Global Pressure Relief Valve Market Forecast

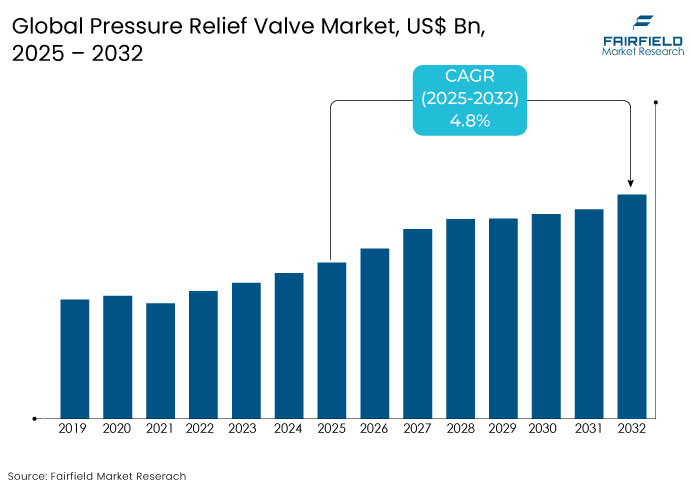

- The global Pressure Relief Valve Market is projected to reach a valuation of US$ 5,061.1 million and is expected to expand at a CAGR of 4.8% from 2025 to 2032.

- This growth trajectory is anticipated to drive the market valuation to US$ 7,027.1 million by 2032.

Pressure Relief Valve Market Insights

- The pressure relief valve market rebounded strongly in 2021, stabilizing by 2022-2023 with balanced growth in production and consumption.

- Increased electricity demand and renewable energy expansion drive the need for advanced pressure relief systems.

- The oil and gas sector remains the largest market for pressure relief valves, driven by growing exploration and refining activities.

- Upfront and ongoing maintenance costs limit broader adoption of advanced pressure relief systems, particularly in smaller firms.

- Significant infrastructure investments in emerging economies, especially in hydrocarbon projects, fuel demand for pressure management systems.

- The shift towards smart valves with real-time monitoring and predictive analytics enhances system reliability and efficiency.

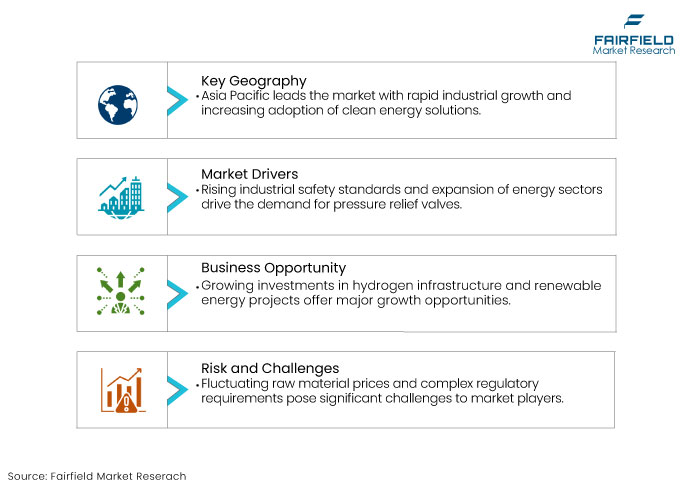

- Asia Pacific is set to lead market growth, driven by industrial expansion and rising energy demands in China and India.

- North America maintains a strong market presence, spurred by innovation in high-performance pressure relief systems and the transition to cleaner energy sources.

A Look Back and a Look Forward- Comparative Analysis

Looking back from 2019 to 2024, the pressure relief valve market witnessed notable fluctuations due to economic, geopolitical, and technological factors. The COVID-19 pandemic in 2020 led to a decline in production and consumption, but the market rebounded strongly in 2021. Key players focused on introducing advanced technologies and smarter valve solutions, improving performance and reliability. The market stabilized in 2022-2023, with production and consumption growth aligning, signaling a balanced recovery.

Looking ahead from 2025 to 2032, the market will continue evolving with increasing demand for high-performance and sustainable valve solutions. Manufacturers will focus on innovations such as smart valves and leak detection technologies.

The growing energy transition and stricter environmental regulations has pushed the market toward eco-friendly solutions. Technological advancements and market expansion into sectors like hydrogen and renewable energy will drive product development and new applications.

Key Growth Determinants

- Rising electricity demand and renewable energy expansion fuels growth

The increasing global electricity demand, especially in emerging markets, drives the growth of safety valves. Countries such as India are focusing on expanding their renewable energy capacity, aiming for 500,000 MW by 2031-32. This surge in energy infrastructure creates a need for reliable safety systems to prevent overpressure ensuring efficient and safe operation.

The expansion of renewable energy sources, such as solar, wind, and battery storage, also plays a key role in increasing the need for pressure regulation systems. As these projects scale up, they require robust safety measures to protect against system failures and ensure smooth integration into the national grid. The growing complexity of renewable energy infrastructure directly contributes to the demand for advanced pressure relief solutions across the energy sector.

- Oil and gas industry demand surge drives expansion of safety valve applications

The oil and gas industry remains the largest sector utilizing pressure relief systems, driven by rising global demand for oil. World oil consumption is expected to increase to 103.9 mb/d by 2025, with demand for petrochemical feedstocks leading the surge.

As production ramps up in major non-OPEC+ countries such as the U.S., Brazil, and Guyana, the need for reliable Pressure Relief Valves becomes critical to managing the growing volumes of crude oil and ensuring safe operations in exploration, production, and refining processes.

Refinery throughputs are also expected to rise, reaching an annual peak of 84.3 mb/d in December 2024, further amplifying the demand for pressure relief solutions. As global oil inventories fluctuate and geopolitical tensions continue, maintaining the safety and reliability of oil infrastructure becomes paramount.

Safety valves are crucial for protecting equipment from overpressure, minimizing risk during the extraction and refining stages. Consequently, the demand for these systems is tightly linked to the increasing scale and complexity of oil production operations worldwide.

Key Growth Barriers

- High installation and maintenance costs

The high costs of installation and maintenance restrict market growth. Industries, particularly in sectors like oil and gas, face significant upfront expenses when setting up these systems. The equipment's purchase price, along with the cost of installation, can be a financial burden for smaller firms.

Beyond the initial investment, ongoing maintenance demands add to the operational costs, requiring periodic inspections, calibration, and replacement of parts, which discourages some companies from adopting these solutions.

Downtime for maintenance can disrupt operations, especially in critical industries where continuous production is vital. The need for consistent servicing and the associated costs can lead to reluctance in choosing advanced systems. As a result, companies might opt for more cost-effective alternatives, limiting the broader market adoption of advanced pressure regulation technologies.

Market Opportunity

- Growing investments in infrastructure and hydrocarbon projects drive demand for pressure management systems

The rapid industrialization and infrastructure development in emerging economies are significantly influencing the demand for pressure management solutions. Countries such as India, China, and Egypt are making substantial investments in infrastructure, particularly in the oil and gas sector, which is boosting the need for advanced safety and efficiency measures.

For instance, China’s major investment in the Guangdong refinery and Egypt’s $2.5 billion commitment to a new oil refinery demonstrate the scale of such initiatives. As these large-scale projects progress, the demand for pressure relief systems to manage and regulate pressure within complex networks, such as pipelines, refineries, and power plants, is expected to rise substantially.

This expansion is in direct response to increasing hydrocarbon processing needs, which require reliable and efficient pressure control to prevent safety hazards and ensure optimal system performance.

Market Trend

- Shift towards smart technologies and sustainable practices in valve design

Innovation and sustainability are transforming the valve manufacturing landscape. With the growing focus on environmental responsibility, manufacturers are developing next-generation pressure relief systems that are not only more efficient but also eco-friendly.

Companies such as Emerson Electric and Parker Hannifin are leading the charge with advanced products that integrate smart technologies such as real-time monitoring, remote diagnostics, and predictive analytics, which are enhancing the reliability and longevity of the valves.

The shift towards recyclable materials, improved sealing mechanisms, and longer operational lifespans is aligning industry practices with global sustainability goals. These innovations are helping companies reduce their environmental footprint while also increasing the performance of their systems, providing a competitive edge in a rapidly evolving market.

Segments Covered in the Report

- Spring-loaded pressure relief valves accounts for the leading market share

Spring-loaded valves will hold the highest market share of 42.4% in 2024 due to their simplicity, reliability, and cost-effectiveness. These valves are widely used across industries, including oil and gas, chemicals, and pharmaceuticals, thanks to their straightforward design and long-lasting performance.

The growing demand for safety and reliability in pressure systems strengthens the market for spring-loaded valves.

The adoption of new technologies, such as the Crosby™ Balanced Diaphragm, which enhances backpressure resistance and reduces maintenance costs, will further bolster their demand. The flexibility and robustness of spring-loaded valves continue to make them a preferred choice in critical applications, ensuring their position as a leading product type in the Pressure Relief Valve market.

- Oil & gas sector dominates pressure relief valve market

The oil and gas sector is projected to account for a 33.8% market share in 2024 driven by ongoing exploration and increasing demand for safety solutions. This sector’s growth is fueled by new projects in offshore and onshore oil fields, as well as the requirement for efficient and safe pressure management systems in high-risk environments.

Companies like Baker Hughes, Emerson, and Parker Hannifin are advancing with products specifically designed to meet the needs of the oil and gas industry, such as high-pressure relief valves for offshore platforms. As energy demands rise globally and exploration activities intensify, the need for reliable pressure relief solutions will continue to expand positioning the oil and gas sector as a key driver for the market growth.

Regional Analysis

- North America strengthens market position with focus on safety, innovation, and clean energy transition

North America is expected to maintain a strong market presence with a 25.3% share of the market in 2024. The region’s well-established oil and gas industry, along with its focus on industrial safety and technological innovation, drives the demand for high-performance pressure relief solutions.

Major players such as Emerson and Parker Hannifin continue to introduce advanced technologies, like the Fisher™ 63EGLP-16 valve for liquid propane and anhydrous ammonia storage, which enhance both safety and reliability.

North America’s efforts to transition to cleaner energy sources, such as hydrogen, are further contributing to the region’s growth. The ongoing development of hydrogen infrastructure and renewable energy projects will increase the need for advanced Pressure Relief Valves, solidifying North America's significant role in the market.

- Asia Pacific leads pressure relief valve market amid industrial growth and clean energy initiatives

Asia Pacific is projected to hold the largest share of 47.3% in the Pressure Relief Valve market by 2024, driven by significant industrial expansion and rising safety standards across the region.

Countries such as China and India, with their rapidly growing industrial sectors, are contributing to the increasing demand for pressure relief valves. In addition to traditional industries such as oil and gas, the growing adoption of renewable energy and the hydrogen economy are accelerating the need for advanced pressure management solutions.

Innovations, such as those introduced by companies such as CIRCOR International for hydrogen applications, align with the region’s shift toward cleaner energy solutions. The combination of industrial growth, energy sector developments, and technological advancements positions Asia Pacific as a dominant force in the global Pressure Relief Valve market.

Competitive Landscape

The pressure relief valve market is highly competitive, with leading companies such as Emerson, Parker Hannifin, and Curtiss-Wright driving innovation through new product launches and technological advancements. These companies focus on improving valve performance by using better materials and designs to handle high pressure and temperature. Mergers and acquisitions help these players expand their product portfolios and enter new markets.

Collaboration and joint ventures are common in the market, especially between companies like CIRCOR and Baker Hughes, which work together to develop customized solutions for industries such as hydrogen, oil & gas, and pharmaceuticals. Technological progress, such as the development of smart valves with automated features and leak detection is intensifying competition and fragmentation while addressing the specific needs of these specialized industries.

Key Companies

- Emerson Electric

- IMI plc

- LESER GmbH & Co. KG

- Curtiss-Wright Corp.

- GE Baker Hughes

- Mercer Valve Co., Inc.

- Parker Hannifin

- CIRCOR International

- Alfa Level

Recent Industry Developments

- In Feb 2025, Emerson introduced the Anderson Greenwood Type 84 Valve, specifically designed for hydrogen and high-pressure gas applications. With advanced materials like Arlon® 3000XT thermoplastic seating and high-strength stainless steel, the valve offers superior leak-tight performance and resistance to embrittlement, capable of handling pressures from 6,000 to 20,000 psig, ideal for tanks and vessels handling hydrogen and other gases.

- In May 2024, Curtiss-Wright Corporation received contracts worth over $130 million to provide advanced valves, pumps, and instrumentation for the U.S. Navy’s Virginia-class, Columbia-class submarines, and Ford-class aircraft carriers. This contract reinforces Curtiss-Wright's long-standing relationship with the U.S. Navy and positions the company to deliver critical valve technologies for important naval defense platforms.

Expert Opinions

- Pressure Relief Valves are integrating real-time monitoring and predictive analytics, enhancing performance and safety.

- Rising demand for valves in renewable energy and hydrogen sectors, driving new market opportunities.

- The oil and gas sector continues to be a dominant driver, but the demand for pressure relief systems is now expanding into emerging markets like India, China, and Africa, where significant industrial and infrastructure development is underway. This shift is not only creating new market opportunities but also highlighting the growing need for region-specific, reliable pressure management solutions to ensure safety in both traditional and emerging energy sectors.

- Despite the market’s positive outlook, the high installation and maintenance costs remain a significant barrier to growth, particularly in industries such as oil and gas.

- For companies operating in more budget-constrained environments, the financial burden of adopting advanced pressure relief systems can delay or even hinder decision-making, particularly in regions with less economic stability.

Global Pressure Relief Valve Market is Segmented as-

By Product Type

- Spring Loaded

- Pilot operated

- Dead Weight

- P&T Actuated

By Set Pressure

- Low Pressure

- Medium Pressure

- High Pressure

By End-use

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Chemical Processing

- Power Generation

- Paper & Pulp

- Food & Beverages

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Pressure Relief Valve Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024 - 2032

2.9.2. Price Impact Factors

3. Global Pressure Relief Valve Market Outlook, 2019 - 2032

3.1. Global Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.1.1. Spring Loaded

3.1.2. Pilot Operated

3.1.3. Dead Weight

3.1.4. P&T Actuated

3.2. Global Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.2.1. Low Pressure

3.2.2. Medium Pressure

3.2.3. High Pressure

3.3. Global Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.3.1. Oil & Gas

3.3.2. Chemical Processing

3.3.3. Power Generation

3.3.4. Food & Beverages

3.4. Global Pressure Relief Valve Market Outlook, by Region, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Pressure Relief Valve Market Outlook, 2019 - 2032

4.1. North America Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.1.1. Spring Loaded

4.1.2. Pilot Operated

4.1.3. Dead Weight

4.1.4. P&T Actuated

4.2. North America Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.2.1. Low Pressure

4.2.2. Medium Pressure

4.2.3. High Pressure

4.3. North America Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.3.1. Oil & Gas

4.3.2. Chemical Processing

4.3.3. Power Generation

4.3.4. Food & Beverages

4.4. North America Pressure Relief Valve Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.4.1. U.S. Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

4.4.2. U.S. Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

4.4.3. U.S. Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

4.4.4. Canada Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

4.4.5. Canada Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

4.4.6. Canada Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Pressure Relief Valve Market Outlook, 2019 - 2032

5.1. Europe Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.1.1. Spring Loaded

5.1.2. Pilot Operated

5.1.3. Dead Weight

5.1.4. P&T Actuated

5.2. Europe Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.2.1. Low Pressure

5.2.2. Medium Pressure

5.2.3. High Pressure

5.3. Europe Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.3.1. Oil & Gas

5.3.2. Chemical Processing

5.3.3. Power Generation

5.3.4. Food & Beverages

5.4. Europe Pressure Relief Valve Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.4.1. Germany Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.2. Germany Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.3. Germany Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.4. Italy Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.5. Italy Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.6. Italy Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.7. France Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.8. France Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.9. France Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.10. U.K. Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.11. U.K. Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.12. U.K. Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.13. Spain Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.14. Spain Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.15. Spain Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.16. Russia Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.17. Russia Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.18. Russia Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.4.19. Rest of Europe Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

5.4.20. Rest of Europe Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

5.4.21. Rest of Europe Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pressure Relief Valve Market Outlook, 2019 - 2032

6.1. Asia Pacific Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.1.1. Spring Loaded

6.1.2. Pilot Operated

6.1.3. Dead Weight

6.1.4. P&T Actuated

6.2. Asia Pacific Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.2.1. Low Pressure

6.2.2. Medium Pressure

6.2.3. High Pressure

6.3. Asia Pacific Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.3.1. Oil & Gas

6.3.2. Chemical Processing

6.3.3. Power Generation

6.3.4. Food & Beverages

6.4. Asia Pacific Pressure Relief Valve Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.4.1. China Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.2. China Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.3. China Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.4.4. Japan Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.5. Japan Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.6. Japan Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.4.7. South Korea Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.8. South Korea Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.9. South Korea Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.4.10. India Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.11. India Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.12. India Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.4.13. Southeast Asia Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.14. Southeast Asia Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.15. Southeast Asia Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.4.16. Rest of SAO Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

6.4.17. Rest of SAO Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

6.4.18. Rest of SAO Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pressure Relief Valve Market Outlook, 2019 - 2032

7.1. Latin America Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.1.1. Spring Loaded

7.1.2. Pilot Operated

7.1.3. Dead Weight

7.1.4. P&T Actuated

7.2. Latin America Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.2.1. Low Pressure

7.2.2. Medium Pressure

7.2.3. High Pressure

7.3. Latin America Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.3.1. Oil & Gas

7.3.2. Chemical Processing

7.3.3. Power Generation

7.3.4. Food & Beverages

7.4. Latin America Pressure Relief Valve Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.4.1. Brazil Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

7.4.2. Brazil Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

7.4.3. Brazil Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

7.4.4. Mexico Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

7.4.5. Mexico Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

7.4.6. Mexico Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

7.4.7. Argentina Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

7.4.8. Argentina Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

7.4.9. Argentina Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

7.4.10. Rest of LATAM Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

7.4.11. Rest of LATAM Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

7.4.12. Rest of LATAM Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pressure Relief Valve Market Outlook, 2019 - 2032

8.1. Middle East & Africa Pressure Relief Valve Market Outlook, by Product Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.1.1. Spring Loaded

8.1.2. Pilot Operated

8.1.3. Dead Weight

8.1.4. P&T Actuated

8.2. Middle East & Africa Pressure Relief Valve Market Outlook, by Set Pressure, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.2.1. Low Pressure

8.2.2. Medium Pressure

8.2.3. High Pressure

8.3. Middle East & Africa Pressure Relief Valve Market Outlook, by End User, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.3.1. Oil & Gas

8.3.2. Chemical Processing

8.3.3. Power Generation

8.3.4. Food & Beverages

8.4. Middle East & Africa Pressure Relief Valve Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.4.1. GCC Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

8.4.2. GCC Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

8.4.3. GCC Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

8.4.4. South Africa Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

8.4.5. South Africa Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

8.4.6. South Africa Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

8.4.7. Egypt Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

8.4.8. Egypt Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

8.4.9. Egypt Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

8.4.10. Nigeria Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

8.4.11. Nigeria Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

8.4.12. Nigeria Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

8.4.13. Rest of Middle East Pressure Relief Valve Market Outlook, by Product Type, 2019 - 2032

8.4.14. Rest of Middle East Pressure Relief Valve Market Outlook, by Set Pressure, 2019 - 2032

8.4.15. Rest of Middle East Pressure Relief Valve Market Outlook, by End User, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Emerson Electric Co.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Parker Hannifin Corp.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Watts

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Baker Hughes

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Rexnord Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Curtiss-Wright Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. The Weir Group plc

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. ALFA Laval AB

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. CIRCOR International, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. IMI PLC

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Mercer Valve Co., Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Oil Type Coverage |

|

|

Application Coverage |

|

|

End Use method |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |

|

Customization and Pricing |

Available upon request |