Printing Inks Market Growth and Industry Forecast

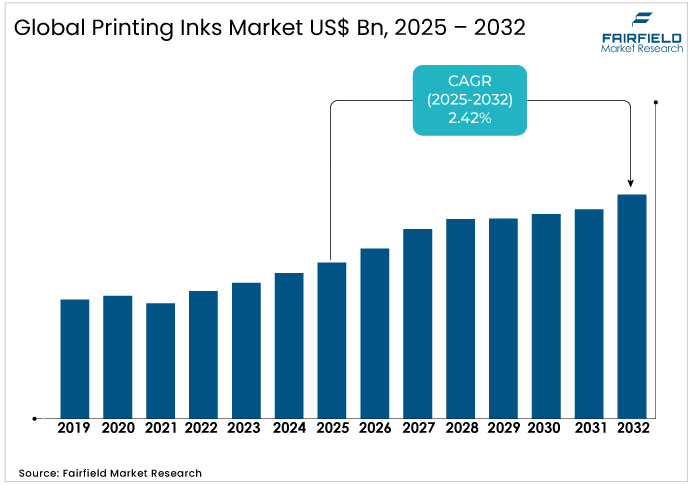

The Printing Inks Market is valued at USD 24.5 Bn in 2026 and is projected to reach USD 31.2 Bn, growing at a CAGR of 4% by 2033.

Printing Inks Market Summary: Key Insights & Trends

- Water-based inks lead with 32% share, supported by low-VOC compliance and flexographic efficiency.

- UV-curable inks gain growing share as instant-drying and energy-efficient solutions expand adoption.

- Flexographic printing dominates with 42% share, powering 60% of global label production.

- Digital printing rises in share, driven by customization and short-run commercial printing demand.

- Packaging & labels hold 48% share, fueled by e-commerce and high-adhesion durability needs.

- Bio-based inks gain momentum as 68% of consumers prefer sustainable packaging solutions.

- Asia Pacific commands 35% share, led by e-commerce growth and green policy support.

- Europe holds 28% share, strengthened by REACH compliance and eco-certified product adoption.

Key Growth Drivers

- Packaging Industry Growth Fuels Rising Global Demand for Printing Inks

The packaging industry drives significant growth with global packaging ink consumption projected to reach USD 17.59 billion by 2032 at a CAGR of 8.1%. According to the International Trade Centre (ITC), packaging exports grew by 12% in 2024, fueled by e-commerce expansion and consumer goods trade. This trend aligns with macroeconomic shifts, including a 5% annual increase in global retail sales as reported by the World Trade Organization (WTO). Technological advancements, such as high-speed flexographic presses, enhance efficiency, reducing production costs by up to 10% per unit. Regulatory changes, such as the EU's Packaging and Packaging Waste Regulation (94/62/EC), mandate sustainable materials, prompting a 20% shift toward recyclable inks. Demographically, urbanization in emerging markets boosts demand for branded packaging, with Asia-Pacific contributing 45% of global volume growth. Overall, these factors strengthen market stability, enabling suppliers to capture 3-5% additional share annually through innovation in pigment stability.

- Sustainability Initiatives Accelerate Adoption of Eco-Friendly Printing Ink Solutions

Sustainability initiatives propel the printing inks market, as water-based and UV-curable inks captured 35% market share in 2024, per the U.S. Environmental Protection Agency (EPA) data on VOC emissions reductions. The EPA reports a 25% decline in solvent-based ink usage since 2020 due to stricter air quality standards under the Clean Air Act. Industry associations such as the National Printing Ink Research Institute (NPIRI) highlight that bio-based resins lowered environmental impact by 18% in tested formulations. Macroeconomic trends, including rising raw material costs from supply chain disruptions, encourage cost-effective green alternatives, saving manufacturers 7-9% on compliance expenses. Demographic shifts, such as millennial-led consumer preferences for eco-labels, drive a 10% yearly uptick in certified product printing, according to a 2024 Nielsen survey. Regulatory bodies such as the European Chemicals Agency (ECHA) enforce REACH compliance, fostering R&D investments exceeding USD 500 million globally in 2024. This driver enhances market resilience, positioning compliant producers for 4% premium pricing advantages.

Key Restraints

- Rising Raw Material Costs Pressure Printing Inks Industry Profit Margins

Fluctuations in pigment and resin costs hinder the printing inks industry, with crude oil-linked prices rising 18% in 2024, according to the U.S. Energy Information Administration (EIA). This increases production expenses by 12-15%, squeezing margins for small-scale suppliers amid supply chain bottlenecks from geopolitical tensions. Competitors face heightened threats as import dependencies exacerbate delays, limiting scalability in high-volume applications.

- Strict Environmental Standards Create Compliance Challenges for Printing Inks Industry

Regulatory hurdles on VOC emissions challenge the printing inks market, with EPA fines totaling USD 50 million in 2024 for non-compliant formulations. Transition costs to low-emission alternatives add 8-10% to operational budgets, creating barriers for legacy manufacturers. Supply chain issues, including scarce bio-resins, further delay compliance, impacting 20% of global output.

Printing Inks Market Trends and Opportunities

- IoT and Policy Support Accelerate UV-Curable Ink Growth in Developing Regions

The adoption of UV-curable inks presents a key opportunity in the printing inks market, with the segment forecasted to grow from USD 2.5 billion in 2025 to USD 4.1 billion by 2032 at a 7.1% CAGR. Developing economies such as India and Brazil show unmet demand, where digital printing penetration remains below 15%, offering USD 1.2 billion in untapped revenue by 2028. Supportive policies, including India's Make in India initiative providing 20% subsidies on green tech imports, accelerate infrastructure upgrades. Emerging technologies such as IoT-integrated curing systems reduce energy use by 25%, addressing customer needs for faster turnaround in packaging. This opportunity enhances market penetration, with potential for 5% share gains in high-growth regions through localized production.

- Sustainable Packaging Demand Boosts Growth of Bio-Based Printing Ink Solutions

Bio-based inks will offer substantial potential, targeting a USD 3.8 billion sub-market by 2030, driven by a 6.5% CAGR as estimated. Unmet demand in Europe and Asia stems from consumer surveys showing 68% preference for sustainable packaging (Nielsen, 2024). Policy changes, such as the EU's Green Deal subsidies worth EUR 1 billion for bio-materials, lower entry barriers. Technological advancements in plant-derived resins improve durability by 15%, filling gaps in flexible packaging. Market sizing indicates USD 800 million in annual opportunities from e-commerce growth, fostering partnerships for scalable supply.

Segment-wise Trends & Analysis

Water-Based Formulations Dominate as UV-Curable Inks Expand Globally

The water-based segment leads the printing inks market by type, holding 32% share and valued at USD 7.06 billion in 2025, driven by regulatory support for low-VOC formulations. Its widespread adoption is supported by flexographic compatibility and cost efficiencies in large-scale production, with emissions 25% lower than solvent-based inks. The UV-curable segment is the fastest-growing, projected at a 6.2% CAGR through 2032, catering to high-speed digital printing and reducing energy use by 30%. Emerging trends include bio-resin integration to boost recyclability by 40%, and a 10% annual shift toward hybrid inks for improved adhesion on plastics, though UV-curable inks face adoption limits in 15% of legacy facilities.

Hybrid Flexo-Digital Printing Systems Unlock Future Growth Opportunities

Flexographic processes hold the leading position in the printing inks market, capturing 42% share valued at USD 9.27 billion in 2025, driven by efficiency in packaging applications. Its high-speed capability supports 60% of label production, while short-run jobs reduce material waste by 20%. Digital printing is the fastest-growing segment, with a 5.9% CAGR, driven by customization demand and a 12% volume increase in 2024 per Technavio. Flexo inks dominate corrugated substrates in North America with 50% volume share, whereas digital adoption is limited to 10% of small printers due to high setup costs. Emerging opportunities in hybrid flexo-digital systems are projected to reach USD 1.5 billion by 2030, complemented by an 8% rise in water-based flexo inks for sustainability compliance.

E-commerce Surge Strengthens Demand for Packaging and Label Printing Inks

Packaging and labels dominate the printing inks market, holding 48% share and reaching USD 10.59 billion in 2025, fueled by the e-commerce boom. High durability demands support high-adhesion formulations, while corrugated cardboard applications are the fastest-growing segment at a 3.8% CAGR, driven by logistics expansion and a 14% increase in ink demand in 2024 according to WTO trade data. Lightweight packaging improves transport efficiency. Packaging inks increasingly integrate anti-counterfeit features, capturing 30% premium segments, while corrugated applications face moisture resistance challenges in 20% of outdoor uses. Opportunities in smart labels add USD 900 million via IoT-enabled tracking, with a 15% uptake of UV variants to extend shelf life.

Regional Trends & Analysis

North America Printing Inks Industry Expands with Digital and Sustainable Trends

North America accounts for 25% of the global printing inks market in 2025, valued at USD 5.52 billion, with trends toward digital integration and sustainability shaping demand. The U.S. leads regional growth at 3.05% CAGR, driven by packaging innovations and regulatory pushes for low-VOC compliance.

U.S. Printing Inks Market - 2025 Snapshot & Outlook

The U.S. market reaches USD 4.65 billion in 2025, growing at 3.05% CAGR to USD 5.41 billion by 2030. Demand surges from e-commerce packaging, up 18% in 2024, enhancing margin advantages through efficient flexo processes that cut costs by 12%. Government policies under the EPA's Clean Air Act provide tax incentives worth USD 100 million annually for green inks, boosting adoption. A key consumer trend shows 62% preference for recyclable packaging, according to a 2024 American Forest & Paper Association survey. Retail shifts to direct-to-consumer models further amplify ink usage in labels. Technological drivers such as UV-LED curing improve print speeds by 25%, supporting commercial sectors. Supportive tariffs on imports maintain domestic capacity at 70% utilization. This positions the market for steady expansion amid demographic growth in urban areas.

Europe Printing Inks Industry Driven by Eco-Certification and Policy Incentives

Europe holds 28% share in 2025, totaling USD 6.18 billion, with emphasis on circular economy trends and REACH compliance influencing ink formulations. Germany and the U.K. drive regional dynamics through advanced manufacturing and export-oriented packaging.

Germany Printing Inks Market - 2025 Snapshot & Outlook

Germany's market is valued at USD 1.82 billion in 2025, with a 2.8% CAGR outlook to 2032. Automotive and pharmaceutical packaging trends boost demand, with exports rising 9% in 2024. Margin advantages stem from efficient lithographic processes, lowering production costs by 11%. The German Federal Environment Agency (Umweltbundesamt) enforces subsidies under the Circular Economy Act, allocating EUR 150 million for bio-inks in 2025. Consumer surveys indicate 70% favor eco-certified products, cited in a 2024 European Commission report. Retail shifts to sustainable supply chains further elevate label printing. Regulatory drivers promote water-based inks, capturing 40% share. Technological advancements in nano-pigments enhance durability by 18%. Demographic stability supports consistent commercial printing volumes.

U.K. Printing Inks Market - 2025 Snapshot & Outlook

The U.K. market stands at USD 1.12 billion in 2025, projecting 3.2% CAGR through 2032. Publication and labels drive growth, with a 10% uptick in digital formats amid post-Brexit trade adjustments. Policy support via the Environment Act 2021 offers tax reliefs totaling GBP 80 million for low-carbon inks, improving margins by 8%. A British Standards Institution survey reveals 65% consumer shift to digital media, impacting print demand positively for personalized goods in 2024. E-commerce expansion reinforces corrugated applications. Trends favor flexographic efficiency, reducing waste by 15%. Government grants for tech upgrades sustain capacity. Urban demographics fuel 6% annual commercial printing rise.

Asia Pacific Printing Inks Industry Dominates Through E-Commerce and Industrial Growth

Asia Pacific commands 35% of the printing inks market in 2025, valued at USD 7.72 billion, characterized by rapid industrialization and e-commerce in Japan, South Korea, China, and India. Trends include tech-driven customization and policy incentives for green manufacturing.

Japan Printing Inks Market - 2025 Snapshot & Outlook

Japan's market totals USD 1.45 billion in 2025, with 2.5% CAGR forecast to 2032. Electronics packaging trends propel demand, growing 8% in 2024. Margin benefits from precision litho processes yield 10% cost reductions. The Ministry of Economy, Trade and Industry (METI) provides JPY 200 billion in subsidies for sustainable inks under the Green Growth Strategy. A 2024 Japan Packaging Institute survey shows 58% consumer preference for recyclable materials. Retail automation increases label needs. Drivers include advanced UV curing, enhancing speed 20%. Regulatory focus on waste reduction maintains 75% capacity utilization. Aging demographics stabilize publication volumes.

India Printing Inks Market - 2025 Snapshot & Outlook

India’s printing inks market is projected at USD 1.98 billion in 2025, growing at a 4.1% CAGR through 2032, driven by FMCG packaging with 16% volume growth in 2024. Government initiatives like the PLI scheme, offering INR 500 crore incentives, enhance margins by 9% through local sourcing, while a 2024 ASSOCHAM survey shows that 72% of urban consumers prefer branded sustainable packaging. The rise of e-retail supports corrugated applications, and flexographic processes improve affordability, saving 13% on production runs. Subsidies bolster supply chain resilience, and the expanding middle class contributes an additional 7% growth in commercial demand, with water-based inks favored by 20% of surveyed consumers.

Competitive Landscape Analysis

The players in the printing inks market are focusing on sustainability strategies to capture eco-conscious segments. This approach addresses regulatory pressures, with 35% of 2024 investments directed toward bio-based R&D. A notable event was the 2024 launch of low-VOC lines, increasing market penetration by 12% in packaging. Expansion into digital inks further supports this, as evidenced by a 15% rise in UV formulations amid e-commerce growth.

M&A activities and new emission rules will impact costs, with consolidations reducing overhead by 8-10% through shared supply chains. Capacity expansions in Asia, backed by USD 300 million investments, counter raw material volatility. Early movers will benefit from premium pricing in green niches, while latecomers may face 5% share erosion from compliance delays.

Key Companies

- DIC Corporation

- Hubergroup

- Flint Group

- Sanchez SA de CV

- Sakata Inx Corporation

- Altana AG

- DEERS I CO., Ltd.

- Sun Chemical Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- T&K TOKA Corporation

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Epple Druckfarben AG

- Toyo Ink SC Holdings Co., Ltd.

- TOKYO PRINTING INK MFG CO., LTD.

- Superior Printing Inks, Inc.

Recent Developments:

- June 2025, hubergroup Print Solutions has opened India’s first dedicated Direct Food Contact (DFC) ink facility in Silvassa, producing globally compliant, food-safe, and sustainable inks. The move reinforces its commitment to innovation, eco-friendly packaging, and stronger international presence.

- July 2025, Flint Group introduced Flexocure LEAP, a next-generation UV ink engineered for high curing speed, strong adhesion, and regulatory compliance. Launched first in Europe, it marks a major step in advancing narrow web printing with safer, high-performance solutions.

- November 2024, DIC India highlighted sustainable innovations at the Elite Plus Packaging conference, unveiling water-based, toluene-free, and PVC-free inks, plus recyclable packaging structures. CTO Utsab Choudhuri stressed food safety, recyclability, and India’s strong growth potential in eco-friendly packaging.

Global Printing Inks Market Segmentation-

By Type

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

By Process

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

By Application

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Printing Inks Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Printing Inks Market Outlook, 2020 - 2033

- Global Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- Global Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- Global Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- Global Printing Inks Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- North America Printing Inks Market Outlook, 2020 - 2033

- North America Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- North America Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- North America Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- North America Printing Inks Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Printing Inks Market Outlook, by Type, 2020-2033

- S. Printing Inks Market Outlook, by Process, 2020-2033

- S. Printing Inks Market Outlook, by Application, 2020-2033

- Canada Printing Inks Market Outlook, by Type, 2020-2033

- Canada Printing Inks Market Outlook, by Process, 2020-2033

- Canada Printing Inks Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Europe Printing Inks Market Outlook, 2020 - 2033

- Europe Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- Europe Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- Europe Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- Europe Printing Inks Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Printing Inks Market Outlook, by Type, 2020-2033

- Germany Printing Inks Market Outlook, by Process, 2020-2033

- Germany Printing Inks Market Outlook, by Application, 2020-2033

- Italy Printing Inks Market Outlook, by Type, 2020-2033

- Italy Printing Inks Market Outlook, by Process, 2020-2033

- Italy Printing Inks Market Outlook, by Application, 2020-2033

- France Printing Inks Market Outlook, by Type, 2020-2033

- France Printing Inks Market Outlook, by Process, 2020-2033

- France Printing Inks Market Outlook, by Application, 2020-2033

- K. Printing Inks Market Outlook, by Type, 2020-2033

- K. Printing Inks Market Outlook, by Process, 2020-2033

- K. Printing Inks Market Outlook, by Application, 2020-2033

- Spain Printing Inks Market Outlook, by Type, 2020-2033

- Spain Printing Inks Market Outlook, by Process, 2020-2033

- Spain Printing Inks Market Outlook, by Application, 2020-2033

- Russia Printing Inks Market Outlook, by Type, 2020-2033

- Russia Printing Inks Market Outlook, by Process, 2020-2033

- Russia Printing Inks Market Outlook, by Application, 2020-2033

- Rest of Europe Printing Inks Market Outlook, by Type, 2020-2033

- Rest of Europe Printing Inks Market Outlook, by Process, 2020-2033

- Rest of Europe Printing Inks Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Asia Pacific Printing Inks Market Outlook, 2020 - 2033

- Asia Pacific Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- Asia Pacific Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- Asia Pacific Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- Asia Pacific Printing Inks Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Printing Inks Market Outlook, by Type, 2020-2033

- China Printing Inks Market Outlook, by Process, 2020-2033

- China Printing Inks Market Outlook, by Application, 2020-2033

- Japan Printing Inks Market Outlook, by Type, 2020-2033

- Japan Printing Inks Market Outlook, by Process, 2020-2033

- Japan Printing Inks Market Outlook, by Application, 2020-2033

- South Korea Printing Inks Market Outlook, by Type, 2020-2033

- South Korea Printing Inks Market Outlook, by Process, 2020-2033

- South Korea Printing Inks Market Outlook, by Application, 2020-2033

- India Printing Inks Market Outlook, by Type, 2020-2033

- India Printing Inks Market Outlook, by Process, 2020-2033

- India Printing Inks Market Outlook, by Application, 2020-2033

- Southeast Asia Printing Inks Market Outlook, by Type, 2020-2033

- Southeast Asia Printing Inks Market Outlook, by Process, 2020-2033

- Southeast Asia Printing Inks Market Outlook, by Application, 2020-2033

- Rest of SAO Printing Inks Market Outlook, by Type, 2020-2033

- Rest of SAO Printing Inks Market Outlook, by Process, 2020-2033

- Rest of SAO Printing Inks Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Latin America Printing Inks Market Outlook, 2020 - 2033

- Latin America Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- Latin America Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- Latin America Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- Latin America Printing Inks Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Printing Inks Market Outlook, by Type, 2020-2033

- Brazil Printing Inks Market Outlook, by Process, 2020-2033

- Brazil Printing Inks Market Outlook, by Application, 2020-2033

- Mexico Printing Inks Market Outlook, by Type, 2020-2033

- Mexico Printing Inks Market Outlook, by Process, 2020-2033

- Mexico Printing Inks Market Outlook, by Application, 2020-2033

- Argentina Printing Inks Market Outlook, by Type, 2020-2033

- Argentina Printing Inks Market Outlook, by Process, 2020-2033

- Argentina Printing Inks Market Outlook, by Application, 2020-2033

- Rest of LATAM Printing Inks Market Outlook, by Type, 2020-2033

- Rest of LATAM Printing Inks Market Outlook, by Process, 2020-2033

- Rest of LATAM Printing Inks Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Printing Inks Market Outlook, 2020 - 2033

- Middle East & Africa Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Modified rosin

- Modified cellulose

- Water based

- UV Curable

- Acrylic

- Polyurethane

- Others

- Middle East & Africa Printing Inks Market Outlook, by Process, Value (US$ Mn), 2020-2033

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

- Middle East & Africa Printing Inks Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Packaging & labels

- Corrugated cardboards

- Publication & Commercial Printing

- Others

- Middle East & Africa Printing Inks Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Printing Inks Market Outlook, by Type, 2020-2033

- GCC Printing Inks Market Outlook, by Process, 2020-2033

- GCC Printing Inks Market Outlook, by Application, 2020-2033

- South Africa Printing Inks Market Outlook, by Type, 2020-2033

- South Africa Printing Inks Market Outlook, by Process, 2020-2033

- South Africa Printing Inks Market Outlook, by Application, 2020-2033

- Egypt Printing Inks Market Outlook, by Type, 2020-2033

- Egypt Printing Inks Market Outlook, by Process, 2020-2033

- Egypt Printing Inks Market Outlook, by Application, 2020-2033

- Nigeria Printing Inks Market Outlook, by Type, 2020-2033

- Nigeria Printing Inks Market Outlook, by Process, 2020-2033

- Nigeria Printing Inks Market Outlook, by Application, 2020-2033

- Rest of Middle East Printing Inks Market Outlook, by Type, 2020-2033

- Rest of Middle East Printing Inks Market Outlook, by Process, 2020-2033

- Rest of Middle East Printing Inks Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Printing Inks Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- DIC Corporation

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Hubergroup

- Flint Group

- Sanchez SA de CV

- Sakata Inx Corporation

- Altana AG

- DEERS I CO., Ltd.

- Sun Chemical Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- T&K TOKA Corporation

- DIC Corporation

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Type Coverage |

|

|

By Process Coverage |

|

|

By Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |