Global Silica Analyzer Market Forecast

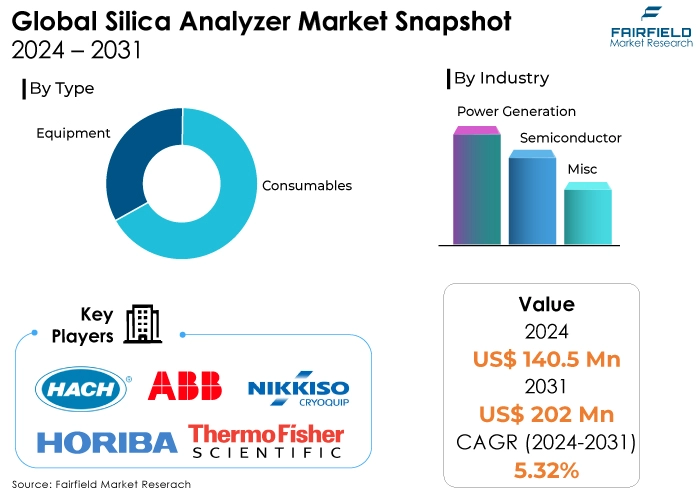

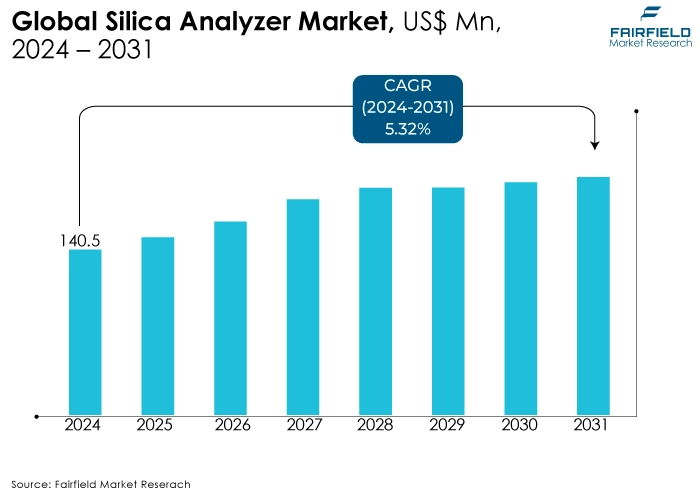

- Global silica analyzer market size to reach US$202 Mn in 2031, up from US$140.5 Mn to be attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 5.32% during 2024 - 2031

Quick Report Digest

- Global silica analyzer market is projected to reach US$202 Mn by 2031, growing from US$140.5 Mn in 2024, with an estimated CAGR of 5.32% during 2024-2031.

- Market growth during 2019-2023 was driven by the electronics industry's demand for high-purity silicon and stricter environmental regulations on industrial emissions, spurring the need for real-time silica monitoring.

- Technological advancements in analyzer design enhanced accuracy, efficiency, and applicability across industries beyond electronics and environmental sectors.

- Key growth determinants include increased demand from the power generation sector, technological advancements, and stringent environmental regulations driving compliance monitoring.

- Major growth barriers include high initial investment and maintenance costs, technical complexities requiring skilled personnel, and market saturation in developed countries.

- Key trends include integration with advanced digital technologies, sustainability focus, expansion into emerging markets, and development of next-generation analyzers.

- Regulatory scenarios shape the industry by driving demand and dictating technical specifications, fostering innovation to meet evolving requirements.

- Top segments include power generation, semiconductor manufacturing, and pharmaceuticals, with Asia Pacific dominating due to industrial growth.

- Leading companies in the global silica analyzer space include Hach, ABB, Thermo Fisher Scientific, and Mettler Toledo, among others.

- Significant company developments include the launch of innovative products, strategic distribution agreements, and advancements in automation and real-time data analysis.

A Look Back and a Look Forward - Comparative Analysis

The silica analyzer market thrived during the historical period 2019-2023, exhibiting steady growth. This upswing can be attributed to a confluence of factors. The electronics industry's insatiable demand for high-purity silicon played a major role. Silicon forms the bedrock of modern electronics, and its purity directly impacts the performance and efficiency of electronic components. Silica analyzers ensure the silicon used meets these stringent purity requirements.

Furthermore, growing environmental concerns spurred stricter regulations on industrial emissions. Silica, a prime component of many industrial processes, can pose health risks if not adequately monitored and controlled. Silica analyzers play a vital role in environmental compliance by enabling real-time monitoring of silica levels in emissions, ensuring adherence to regulations.

Beyond these primary drivers, technological advancements in silica analyzer design played a significant role in market expansion. Manufacturers introduced analyzers boasting enhanced accuracy, efficiency, and faster analysis times. These advancements translated into more efficient production processes and stricter quality control for silicon manufacturers. Additionally, the development of portable and user-friendly analyzers expanded their applicability to various industries beyond electronics production and environmental monitoring.

Looking ahead to the forecast period 2024-2031, the silica analyzer market is expected to maintain its growth trajectory. This bullish outlook can be ascribed to several key trends. The increasing adoption of automation in manufacturing processes across various industries is a significant growth driver. Automation necessitates real-time process monitoring and control, a role that silica analyzers fulfil admirably. Their ability to integrate seamlessly with automated systems makes them an attractive proposition for manufacturers seeking to optimise production efficiency.

The demand for silica-based products across diverse end-use industries is another key driver. Silica finds application in a wide range of products, including pharmaceuticals, chemicals, food & beverages, and construction materials. The growing demand for these products, coupled with the need for stringent quality control, is expected to propel the demand for silica analyzers.

The growing focus on workplace safety and environmental sustainability is another factor influencing market growth. Silica exposure can lead to health complications, and silica analyzers play a crucial role in safeguarding workers by ensuring safe working environments. Additionally, their contribution to emission monitoring aligns with the growing emphasis on sustainable manufacturing practices.

Key Growth Determinants

- Increasing Demand from Power Generation Sector

Silica analyzers are crucial for monitoring silica content in water used in power plants, especially in boiler water and cooling towers. The power generation sector is increasingly focusing on enhancing efficiency and reducing equipment downtime caused by silica scaling and corrosion. This focus is driving the demand for silica analyzers, as they help maintain the integrity of the power generation equipment, thereby ensuring uninterrupted power supply and extending the lifespan of the machinery.

- Advancements in Technology and Integration Capabilities

Recent advancements in silica analyzer technology, including improvements in sensitivity, accuracy, and the ability to integrate with industrial IoT systems, are making these devices more appealing to industries beyond just power generation. These technological enhancements allow for real-time monitoring and predictive maintenance, leading to increased adoption in sectors like semiconductors, pharmaceuticals, and drinking water treatment facilities.

- Stringent Environmental Regulations

Governments and environmental bodies worldwide are implementing stricter regulations regarding water quality standards, including limits on silica content in industrial effluents and drinking water. These regulations necessitate the use of silica analyzers for compliance monitoring, driving the market growth as industries and water treatment facilities invest in these technologies to meet the regulatory standards.

Major Growth Barriers

- High Initial Investments, and Maintenance Costs

The significant initial investment required for purchasing and installing silica analyzers, along with the ongoing maintenance and operational expenses, can deter small and medium-sized enterprises from adopting this technology. This cost barrier limits market penetration primarily to larger companies or sectors with critical needs for silica monitoring.

- Technical Complexities, and Need for Skilled Personnel

The operation and interpretation of data from silica analyzers require specialised knowledge and skills. The shortage of trained professionals can hinder the effective use of these analyzers, affecting market growth. Organisations may find it challenging to recruit or train staff, adding to the operational costs and complexity.

- Market Saturation in Developed Countries

In developed regions, where industrial and environmental regulations have been stringent for years, the market for silica analyzers is approaching saturation. Many facilities have already adopted silica monitoring technologies, limiting new market opportunities. Growth in these regions may rely more on replacement demand and technological upgrades rather than new installations, potentially slowing overall market expansion.

Key Trends and Opportunities to Look at

- Integration with Advanced Digital Technologies

There is a noticeable trend towards integrating silica analyzers with cutting-edge digital technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing. This integration facilitates real-time data monitoring, analysis, and remote access, enhancing operational efficiency and predictive maintenance capabilities. By leveraging AI algorithms, silica analyzers can now predict potential issues before they escalate, allowing for proactive maintenance and minimising downtime. This digital transformation not only improves the accuracy and efficiency of silica monitoring but also opens new avenues for innovation in product development.

- Sustainability and Environmental Compliance

As global emphasis on environmental sustainability intensifies, industries are increasingly seeking eco-friendly and energy-efficient solutions. This trend has spurred the development of silica analyzers that not only ensure compliance with stringent environmental regulations but also contribute to water conservation efforts and reduce the ecological footprint of industrial operations. Manufacturers are focusing on developing analyzers that require fewer reagents, have a longer lifespan, and offer greater precision, aligning with the global push towards sustainability.

- Expansion Across Emerging Markets

Emerging economies present a significant growth opportunity for silica analyzer market players. As these regions focus on industrialisation, particularly in sectors such as power generation, semiconductor manufacturing, and pharmaceuticals, the demand for water quality monitoring solutions, including silica analyzers, is expected to rise. Market players can capitalise on this opportunity by establishing partnerships, local manufacturing, and distribution channels to navigate regulatory landscapes and meet the specific needs of these markets.

- The Rise of Next-Generation Analyzers

Innovating next-generation silica analyzers that offer enhanced functionalities, such as improved accuracy, lower detection limits, and greater ease of use, represents a considerable opportunity. There's a growing demand for devices that can cater to the specific requirements of various industries, including portable models for on-site testing and analyzers capable of handling high-silica samples in geothermal power plants. Investing in R&D to address these niche markets and developing customizable solutions can open new revenue streams and strengthen market positions.

How Does the Regulatory Scenario Shape this Industry?

Regulations act as a double-edged sword for the Silica Analyzer Industry, driving demand while dictating technical specifications. Stringent emission control in industries like construction, glass manufacturing, and foundries mandates real-time monitoring with silica analyzers to ensure compliance. Worker safety regulations, emphasizing protection from silica-related illnesses, fuel the need for portable and user-friendly analyzers for on-site monitoring. However, regulations also set minimum accuracy standards for reliable data collection and may dictate specific reporting formats for silica concentration data. This pushes manufacturers to constantly innovate and develop analyzers that meet these evolving requirements, including data logging and communication capabilities.

While the cost of analyzers can be a hurdle for smaller companies, it creates an opportunity for manufacturers to develop cost-effective solutions. The ever-changing regulatory landscape, driven by environmental and worker safety concerns, presents both challenges and opportunities for the Silica Analyzer Industry. By shaping demand for analyzers and influencing their technical specifications, regulations play a critical role in the industry's growth and technological advancements.

Fairfield’s Ranking Board

Top Segments

- Power Generation Industry Spearheads Adoption

The power generation sector is a leading consumer of silica analyzers due to the critical need for maintaining water purity in steam and cooling systems. Silica contamination can lead to scaling and corrosion, significantly impacting the efficiency and lifespan of turbines and boilers. With the global push towards maximising operational efficiency and reducing downtime, the demand for accurate and reliable silica monitoring solutions in this sector is high.

Additionally, as countries expand and upgrade their power generation capabilities to meet increasing energy demands, new installations of silica analyzers are expected to rise. This segment's growth is further fueled by the rising adoption of renewable energy sources, such as geothermal power, which requires stringent monitoring of silica levels to prevent equipment damage.

- Semiconductor Manufacturing Emerges as a High-Growth Segment

The semiconductor industry is another high-growth segment for silica analyzers. In semiconductor manufacturing, ultra-pure water is essential for cleaning and processing components, and even trace amounts of silica can result in product defects.

As the global semiconductor market continues to expand, driven by increasing demand for electronic devices, IoT applications, and emerging technologies such as 5G, the need for precise water quality monitoring tools, including silica analyzers, is becoming more critical. This industry's stringent cleanliness standards and the continuous push for smaller, more complex chips necessitate advancements in monitoring technologies, making it a lucrative segment for players in the silica analyzer market.

- Application Potential Accelerates as Pharma and Biotech Companies Generate Demand

This segment is increasingly recognising the importance of silica analyzers for ensuring water quality in manufacturing processes. High-purity water is a prerequisite in pharmaceutical production to comply with regulatory standards and ensure product safety and efficacy. As the pharmaceutical and biotechnology industries grow, partly due to rising healthcare demands and the rapid development of new medications and vaccines, the need for effective water quality monitoring solutions, including silica analyzers, is accentuated.

Regional Frontrunners

- Asia Pacific Stands out as the Global Leader

Dominating the scene, Asia Pacific boasts the largest market share fuelled by its booming industrial sector. Extensive infrastructure development and a thriving glass industry further drive demand. China and India, with their heavy reliance on coal-fired power plants and surging electricity needs, are key players. Stringent regulations are less prevalent here compared to other regions, but the sheer scale of industrial activity creates a massive market for silica analyzers.

- Market Growth Accelerates in North America, and Europe

A well-established market, North America benefits from a significant presence of coal-fired power plants and nuclear facilities, all requiring silica monitoring for safe and efficient operation. The US, with its robust environmental regulations, further propels the demand for silica analyzers. Manufacturers here cater to industries seeking not only compliance but also process optimisation through real-time silica level monitoring.

On the other hand, known for its focus on environmental responsibility and industrial efficiency, Europe boasts a mature market for silica analyzers. Stringent environmental regulations across the continent ensure consistent demand. Germany, a manufacturing powerhouse, is a major player due to its emphasis on technological advancements in analyzer design. Manufacturers here cater to industries seeking high-precision and reliable analyzers for various applications.

Fairfield’s Competitive Landscape Analysis

The silica analyzer market boasts a dynamic competitive landscape where established giants battle it out with nimble, emerging players. Leading the charge are companies like Hach Lange, Metrohm International, and Emerson Automation Solutions. These heavyweights leverage their experience and resources to continuously refine their offerings. Their focus lies in developing cutting-edge analyzers with superior accuracy, efficiency, and user-friendliness.

Acquisitions and mergers are another weapon in their arsenal, allowing them to expand their product portfolios and capture new markets. Additionally, strategic collaborations with research institutions fuel the development of next-generation analyzer technologies, keeping them ahead of the curve.

However, established players are not the only game in town. Smaller, agile companies are carving out a niche for themselves. They capitalise on their nimbleness to offer cost-effective solutions that cater to specific industry needs or price points. This injects a dose of healthy competition into the market, forcing established players to constantly adapt and innovate to retain their market share. This dynamic interplay between industry veterans and resourceful newcomers ensures the continuous development of the silica analyzer market.

Who are the Leaders in Global Silica Analyzer Space?

- Hach

- ABB

- HORIBA

- Thermo Fisher Scientific

- Mettler Toledo

- NIKKISO

- Swan Analytical Instruments

- SPX Flow

- DKK TOA

- Waltron Group

- Dr. Thiedig

- Electro to chemical Devices

- Shanghai Boqu Instruments

- KNTEC

- HKY Technology

- Omicron Sensing

Significant Company Developments

- November 2023, a prominent player in the silica analyzer market launched a cutting-edge product equipped with advanced spectroscopic technology. This innovative analyzer boasts enhanced accuracy and sensitivity in detecting silica levels in various industrial processes, catering to the growing demand for precise monitoring solutions. Its user-friendly interface and remote accessibility further streamline operations, ensuring efficient silica management across diverse sectors, including power generation, semiconductor manufacturing, and water treatment.

- August 2023 marked a significant milestone in the silica analyzer market as a leading manufacturer entered a strategic distribution agreement with a renowned global distributor. This collaboration aims to expand the market reach of silica analysis solutions, leveraging the distributor's extensive network and expertise in reaching diverse industries worldwide. With enhanced accessibility and localised support, customers can now procure state-of-the-art silica analyzers more conveniently, accelerating adoption and addressing the evolving regulatory requirements for silica monitoring across different regions.

- January 2024, another major player in the silica analyzer market unveiled a groundbreaking product designed to revolutionise silica measurement in industrial settings. Featuring advanced automation capabilities and real-time data analysis, this innovative analyzer offers unparalleled efficiency and accuracy in monitoring silica concentrations. Its compact design and robust construction make it suitable for a wide range of applications, from wastewater treatment plants to pharmaceutical manufacturing facilities. This new addition to the market promises to elevate silica analysis standards, empowering industries to optimise processes and ensure compliance with stringent quality regulations.

An Expert’s Eye

Rising Awareness and Regulatory Compliance

Increasing awareness about the detrimental effects of high silica levels on industrial processes and environmental sustainability has spurred demand for silica analyzers. Moreover, stringent regulatory frameworks mandating silica monitoring across various sectors such as water treatment, power generation, and semiconductor manufacturing are propelling market growth.

Technological Advancements

Continuous innovation in sensor technologies, automation, and data analytics has resulted in the development of advanced silica analyzers with improved accuracy, sensitivity, and efficiency. These technological advancements are enhancing the capabilities of silica analyzers, making them indispensable tools for quality control and process optimisation in diverse industries.

Expanding Industrial Applications

The growing application of silica analyzers across a wide range of industries, including pharmaceuticals, oil and gas, food and beverage, and construction, is broadening the market's scope. Silica analyzers are increasingly being integrated into production processes to ensure product quality, minimise downtime, and mitigate operational risks, driving market expansion.

Increasing Investments in Infrastructure

With rapid urbanisation and industrialisation in emerging economies, there is a significant increase in investments in infrastructure projects, such as water treatment plants and power generation facilities. These investments are fuelling the demand for silica analyzers to monitor silica levels in water, steam, and other industrial processes, supporting market growth.

Global Silica Analyzer Market is Segmented as Below:

By Type:

- Equipment

- Consumables

By Industry:

- Power Generation

- Semiconductor

- Misc (Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment)

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

1. Executive Summary

1.1. Global Silica Analyzer Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, By Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Key Highlights

3.2. Global Silica Analyzer Production, By Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trends Analysis and Future Projects, 2019 - 2031

4.1. Global Average Price Analysis, By Type

4.2. Prominent Factors Affecting Silica Analyzer Prices

4.3. Global Average Price Analysis, By Region

5. Global Silica Analyzer Market Outlook, 2019 - 2031

5.1. Global Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Equipment

5.1.1.2. Consumables

5.2. Global Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Power Generation

5.2.1.2. Semiconductor

5.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

5.3. Global Silica Analyzer Market Outlook, By Region, Volume (Unit) and Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Silica Analyzer Market Outlook, 2019 - 2031

6.1. North America Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Equipment

6.1.1.2. Consumables

6.2. North America Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Power Generation

6.2.1.2. Semiconductor

6.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

6.3. North America Silica Analyzer Market Outlook, By Country, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.3.1.2. U.S. Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.3.1.3. Canada Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.3.1.4. Canada Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Silica Analyzer Market Outlook, 2019 - 2031

7.1. Europe Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Equipment

7.1.1.2. Consumables

7.2. Europe Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Power Generation

7.2.1.2. Semiconductor

7.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

7.3. Europe Silica Analyzer Market Outlook, By Country, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.2. Germany Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.3. U.K. Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.4. U.K. Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.5. France Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.6. France Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.7. Italy Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.8. Italy Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.9. Russia Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.10. Russia Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.11. Rest of Europe Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.1.12. Rest of Europe Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Silica Analyzer Market Outlook, 2019 - 2031

8.1. Asia Pacific Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Equipment

8.1.1.2. Consumables

8.2. Asia Pacific Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Power Generation

8.2.1.2. Semiconductor

8.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

8.3. Asia Pacific Silica Analyzer Market Outlook, By Country, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.2. China Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.3. Japan Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.4. Japan Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.5. South Korea Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.6. South Korea Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.7. India Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.8. India Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.9. Southeast Asia Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.10. Southeast Asia Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Silica Analyzer Market Outlook, 2019 - 2031

9.1. Latin America Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Equipment

9.1.1.2. Consumables

9.2. Latin America Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Power Generation

9.2.1.2. Semiconductor

9.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

9.3. Latin America Silica Analyzer Market Outlook, By Country, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1.2. Brazil Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1.3. Mexico Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1.4. Mexico Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1.5. Rest of Latin America Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.1.6. Rest of Latin America Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Silica Analyzer Market Outlook, 2019 - 2031

10.1. Middle East & Africa Silica Analyzer Market Outlook, By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Equipment

10.1.1.2. Consumables

10.2. Middle East & Africa Silica Analyzer Market Outlook, By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Power Generation

10.2.1.2. Semiconductor

10.2.1.3. Others to Pharmaceuticals, Food & Beverages, Water & Wastewater Treatment

10.3. Middle East & Africa Silica Analyzer Market Outlook, By Country, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.2. GCC Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.3. South Africa Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.4. South Africa Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.5. Egypt Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.6. Egypt Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.7. Rest of Middle East & Africa Silica Analyzer Market By Type, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.1.8. Rest of Middle East & Africa Silica Analyzer Market By Industry, Volume (Unit) and Value (US$ Mn), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Hach

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. ABB

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Thermo Fisher Scientific

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Mettler Toledo

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. HORIBA

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. NIKKISO

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Swan Analytical Instruments

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. SPX Flow

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Business Strategies and Development

11.5.9. DKK TOA

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Waltron Group

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Dr. Thiedig

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Electro to chemical Devices

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Shanghai Boqu Instruments

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. KNTEC

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. HKY Technology

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. Omicron Sensing

11.5.16.1. Company Overview

11.5.16.2. Product Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million Volume: UNIT |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |