Global Sports Analytics Market Forecast

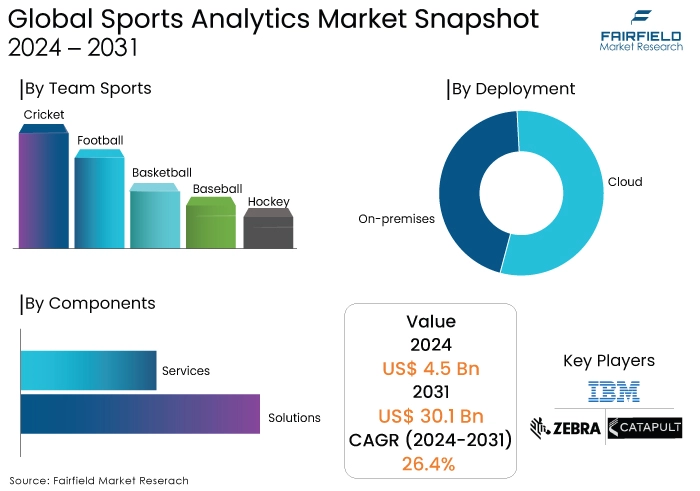

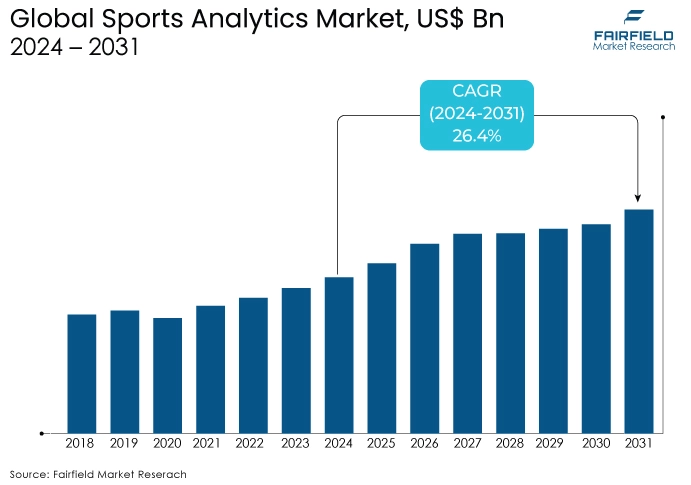

- The approximately US$4.5 Bn market for sports analytics (2024) poised to reach a valuation of US$30.1 Bn (2031)

- Global sports analytics market size to experience a CAGR of 26.4% over 2024-2031

Quick Report Digest

- The sports analytics market is expected to reach US$30.1 Bn by 2031, growing at a CAGR of 26.4%.

- AI adoption in sports analytics is rising due to the pandemic and its potential for insights.

- Cloud-based solutions are preferred for scalability, affordability, and ease of access.

- Limited regulations allow innovation but raise data privacy concerns.

- Changing sports dynamics and Big Data adoption are driving market growth.

- Sports organizations leverage analytics for performance improvement and revenue generation.

- Traditional methods and limited technology access hinder growth in some regions.

- Data privacy, skilled personnel, and implementation costs are challenges.

- Cloud, on-field applications, and smart wearables are leading segments.

- North America dominates, with Asia Pacific showing high potential.

A Look Back and a Look Forward - Comparative Analysis

The pandemic significantly impacted operations, forcing sports organizations to adopt online solutions. AI-powered solutions are being implemented by many companies to enhance the athlete experience, gain unique insights, and improve fan engagement. This increased market readiness for AI-based software could accelerate AI adoption in core sports analytics beyond initial projections. Furthermore, incorporating AI and machine learning into sports analytics unlocks lucrative opportunities for market growth.

Unpredictable market conditions and advancements in technology are fueling the global adoption of these solutions. As companies strive to reduce upgrade and maintenance costs, the demand for cloud-based software is surging. Cloud solutions offer rapid scalability, affordability, easy access, and uninterrupted service. Moreover, the fiercely competitive landscape, the need for better decision-making for a competitive edge, and the influence of social media have exponentially propelled the acceptance of analytics.

The growing trend of clubs and teams partnering with analytics organizations is another noteworthy development. For instance, numerous football clubs and leagues have partnered with Opta, a provider of football sports data. Opta's analytics can predict specific actions of a player in a precise area on the field, regardless of ball possession.

Key Growth Determinants

Evolving Dynamics of Sports Industry

The intensely competitive environment, the demand for improved decision-making for an advantage, the need for strategic execution during matches, and the influence of social media are all expected to drive analytics adoption. Consequently, the changing dynamics of sports, and the rising adoption of technology are likely to propel the sports analytics market share in the coming years.

Rising Adoption of Big Data Analytics

The growing adoption of Big Data analytics is another key factor driving market growth. The use of innovative technologies like Big Data, IoT, cloud, analytics, mobility, and social media has transformed and driven innovation in the business world. This demand for in-depth knowledge has fueled the acceptance of Big Data and related technologies.

The ever-increasing data volume due to business growth across the globe necessitates a continuous rise in data sources. Industry experts estimate that roughly 55% of sports organizations leverage Big Data to monitor and improve performance.

Growing Inclination Towards Embracing Analytics Solutions

Increasing demand for sports analytics solutions for valued game insights to coaches, managers, and athletes, enhancing their skills, strategies, and overall performance. By crunching numbers, these solutions predict win-loss records and offer a data-driven edge. Additionally, sports organizations are increasingly showing their willingness to leverage analytics to boost athlete performance, team quality, revenue generation, and injury prevention. This is also expected to push the prospects of the sports analytics market growth in upcoming years.

Sports companies are embracing analytics to develop data-driven decisions and enhance individual and team performance. Cost-effective solutions can benefit smaller sports organizations, improve their team's position in competitions, and unlock new growth opportunities. Advancements in Machine Learning (ML), Artificial Intelligence (AI), and Big Data have transformed the sports industry, creating significant growth prospects for the market.

Key Growth Barriers

Prevalent Dependency on Traditional Analysis Methods, and Limited Technology Access

Stringent regulations, and lower technology penetration in certain regions can hinder market growth. While North America, and Europe witness a rising demand for Big Data analytics, AI, and ML to enhance performance, companies in other regions lag due to these factors.

Additionally, sports organizations in many regions rely on traditional analysis methods, employing retired athletes or sportspersons as trainers to coach their sports physiotherapists, and teams in athlete health assessment.

Extracting value from data is crucial for businesses to target valuable customers, mitigate risks, and estimate business performance. Monetizing these data assets requires sufficient information. However, merging data from various sources into meaningful information can pose significant challenges, especially for centralized enterprises. These factors could potentially impede market growth.

Data Privacy Concerns, Lack of Skilled Personnel, and Cost of Implementation

As the collection and use of athlete and fan data increase, data privacy concerns need to be addressed effectively to maintain trust and transparency. The growing demand for skilled data scientists and analysts specializing in sports analytics necessitates the development of educational programs to fill this gap. Moreover, implementing and maintaining sophisticated sports analytics solutions can be expensive, particularly for smaller organizations.

How is Regulatory Scenario Shaping this Industry?

The sports analytics market faces limited regulations compared to other data-driven industries. This fosters innovation but also raises privacy concerns. While there are no specific regulations for sports analytics data, general data privacy laws like GDPR (Europe), and CCPA (California) can impact how athlete and fan data is collected, stored, and used. These regulations can increase compliance costs and limit the type of data collected, potentially hindering the effectiveness of analytics solutions.

The lack of specific regulations can be a double-edged sword. It allows for faster development of new technologies, but also raises concerns about data misuse. As the market matures, stricter regulations around data privacy could emerge, impacting how sports organizations and analytics companies handle athlete and fan data.

Fairfield’s Ranking Board

Top Segments

Cloud Services Take the Lead in Global Market for Sports Analytics

The cloud segment is anticipated to dominate the market driven by the rapid digital transformation. The growing demand for structured and visualized data is expected to propel the demand for cloud-based deployment models. Furthermore, the growing demand for cost-effective, secure, and scalable solutions will boost private cloud adoption among large enterprises.

Cloud services are likely to lead the market share during the forecast period due to the increased penetration of digital transformation, connected devices, and growing automation across small and medium-sized businesses. The cloud deployment model empowers organizations and clubs to digitally transform their sports performance and enable athletes to analyze themselves more effectively by providing secure and sustainable data.

On-field Application to be the Largest Category

The on-field segment is expected to hold the largest revenue share due to the increasing use of on-field analytical data, such as player and team analysis, health assessment, and video analysis. Implementing on-field data analysis solutions in cricket, football, rugby, and swimming has recently improved performance. Data metrics help teams determine how to improve on-field strategies, nutrition plans, and other methods to enhance athlete performance.

Data analytics in on-field games helps gather valuable insights such as passing trends, acceleration, player performance, and the number of touchdown passes. The exclusive benefits offered by these tools in football, coupled with high investments by football teams in acquiring a data analytics edge, are expected to accelerate segment growth.

Off-field analytics primarily focus on improving the operational and business efficiency of sports teams. Stakeholders, fantasy gaming, and betting applications utilize off-field analytics to make better decisions and boost productivity. The growing trend among sports fans to understand sports dynamics is expected to propel the CAGR during the forecast period.

Smart Wearables Steal the Spotlight

Smart wearable technology is expected to generate the maximum revenue share due to the rapid rise in real-time monitoring. Sports analytics encompass vast datasets from teams and athletes that calculate competition and training efforts. Wearable technology gadgets worn by players daily offer significant opportunities for an in-depth view of player recovery and stress levels.

Market players are collaborating to launch new software platforms for analyzing this data, further accelerating segment growth. For instance, the Association of Tennis Professionals (ATP) partnered with Tennis Data Innovations to launch Tennis IQ, a new performance analysis platform in September 2023. This platform grants ATP players access to cutting-edge information and data. Additionally, video analytics is expected to grow at the highest CAGR due to its numerous applications in sports and science. Athletes and coaches leverage video analytics to analyze individual and team performances. Video analytics tools can be used for biomechanics research, gait analysis, and injury rehabilitation.

Big Data Technology Remains Highly Sought-After

Big Data is anticipated to hold the maximum share due to the need for teams to develop unique strategies. Specialized athletes and teams rely on Big Data technology to gain a competitive advantage. Modern coaching utilizes Big Data to build winning strategies that support individual players and the entire team.

Data science empowers trainers to create customized athlete matchups and other strategies for each match, making the team's strategies unpredictable yet productive, ultimately propelling the sports analytics market forward. For instance, Liverpool FC's trainers leverage data science to analyze Premier League and Champions League competitors.

Moreover, AI is expected to grow at the highest CAGR owing to the advantages it offers in analyzing and improving athlete performance. AI-based solutions help understand these crucial parameters. For instance, NEX Technology utilizes machine learning and computer vision to assess the talent of basketball athletes. It calculates performance metrics such as ball handling, release time, speed, progress over time, vertical jump, and shot accuracy.

Adoption to be Higher Across Teams than Among Individuals

The teams segment holds the largest revenue share due to its consistent growth fueled by the rising popularity of sports. Football is one of the most popular sports played and watched globally, and this is likely to propel the teams segment in the forecast period. According to FIFA, roughly 265 million people, including men and women, play football worldwide, with a fan base exceeding 3.5 billion. These figures are constantly rising as football gains international popularity.

The individuals segment is projected to witness the highest CAGR. Sports analytics empower individuals to achieve their goals, whether it's analyzing player performance or identifying new business opportunities. In fantasy game applications, people use statistical data to gain insights about players and select those predicted to win.

Regional Frontrunners

North America Extends the Largest Revenue Contribution

North America is expected to account for the highest market share. The growing demand for AI technology and video analysis in sports, fueled by increasing investments in cutting-edge technologies by companies like Major League Baseball (MLB), National Football League (NFL), and National Basketball Association (NBA), is anticipated to propel the North American market.

Leading market organizations, including SAP SE, Tableau Software, LLC, and IBM Corporation, are investing heavily in research and development to address client needs and secure a competitive edge.

Europe Follows, Asia Pacific Set for Notable Growth

Europe holds the second-largest market share. The growing need to leverage advanced technologies and the increasing number of companies are likely to drive market growth here. Additionally, the escalating demand for advanced management communication solutions to improve employee retention and organizational evaluation of employee work will further contribute to market growth.

The Asia Pacific region is projected to experience significant growth. Countries like China, Japan, and India are expected to witness strong demand due to their robustly developing sports cultures. Factors like rising investments in sports, the launch of numerous sporting leagues, and digitalization are expected to play a vital role in market growth in this region.

South America, the Middle East, and Africa are expected to experience rapid growth. This growth can be attributed to increasing government investments in emerging technologies like 5G, Machine Learning (ML), Artificial Intelligence (AI), cloud, Big Data, and others in Brazil, Israel, and Mexico.

Fairfield’s Competitive Landscape Analysis

The sports analytics market boasts a vibrant startup ecosystem. Over 100 start-ups are expected to develop sports analytics solutions. Such a competitive market is likely to generate intense competition, forcing existing companies to continuously implement and update new advancements in their product offerings. Consequently, increased competition is likely to expand the market size and create more opportunities for market participants.

Who are the Leading Companies in Sports Analytics Space?

- IBM

- Zebra Technologies

- Catapult

- EXL

- SAS Institute

- HCL

- Salesforce

- Sportradar

- Whoop

- Trumedia Networks

Recent Industry Developments

- In October 2023, Zelus Analytics, a company revolutionizing player evaluations and in-game decision-making with their platform, secured funding in the first tranche of their Series A round. This funding will be used to fuel their business expansion.

- In March 2023, Alteryx, Inc. launched Alteryx Fanalytics, showcasing how analytics impact decisions across professional sports. This includes players using data to enhance their game and enthusiasts exploring insights on their favorite teams. Alteryx has partnered with major sports organizations like the NBA, F1, Premier League, NFL, and PGA Tour.

- In March 2023, Relo Metrics, a sponsorship analytics platform, offered free social media intelligence services to European soccer clubs to capitalize on the momentum of the women's game.

- In March 2023, Memryx Inc. partnered with Cachengo to provide modular computing and storage services with AI processors. This collaboration offers a unique solution for edge-based data-intensive applications that support various sectors, including sports analytics, retail analytics, and healthcare monitoring.

- In March 2022, nVenue secured US$3.5 Mn in seed funding to expand its real-time B2B sports prediction platform to broadcasters and sportsbooks.

Global Sports Analytics Market is Segmented as Below-

By Components

- Solutions

- Services

By Deployment

- Cloud

- On-premises

By Team Sports

- Cricket

- Football

- Basketball

- Baseball

- Hockey

- Other Team Sports

By Application

- Performance Analysis

- Player and Team Valuation

- Player Fitness and Safety

- Fan Engagement

- Broadcast Management

- Other Applications

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Turkey

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- Egypt

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Sports Analytics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions

2.2. Market Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Value Chain Analysis

2.5. Porter’s Five Forces Analysis

2.6. COVID-19 Impact Analysis

2.7. Key Patents

3. Global Sports Analytics Market Outlook, 2019 - 2031

3.1. Global Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Solutions

3.1.1.2. Services

3.1.2. BPS Analysis/Market Attractiveness Analysis

3.2. Global Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Performance Analysis

3.2.1.2. Player and Team Valuation

3.2.1.3. Player Fitness and Safety

3.2.1.4. Fan Engagement

3.2.1.5. Broadcast Management

3.2.1.6. Other Applications

3.2.2. BPS Analysis/Market Attractiveness Analysis

3.3. Global Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Cloud

3.3.1.2. On-premises

3.3.2. BPS Analysis/Market Attractiveness Analysis

3.4. Global Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Cricket

3.4.1.2. Football

3.4.1.3. Basketball

3.4.1.4. Baseball

3.4.1.5. Hockey

3.4.1.6. Other Team Sports

3.4.2. BPS Analysis/Market Attractiveness Analysis

3.5. Global Sports Analytics Market Outlook, by Region, Value (US$ ‘000), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

3.5.2. BPS Analysis/Market Attractiveness Analysis

4. North America Sports Analytics Market Outlook, 2019 - 2031

4.1. North America Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Solutions

4.1.1.2. Services

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. North America Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Performance Analysis

4.2.1.2. Player and Team Valuation

4.2.1.3. Player Fitness and Safety

4.2.1.4. Fan Engagement

4.2.1.5. Broadcast Management

4.2.1.6. Other Applications

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Cloud

4.3.1.2. On-premises

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Cricket

4.4.1.2. Football

4.4.1.3. Basketball

4.4.1.4. Baseball

4.4.1.5. Hockey

4.4.1.6. Other Team Sports

4.4.1.7. BPS Analysis/Market Attractiveness Analysis

4.5. North America Sports Analytics Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

4.5.1.2. Canada Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Sports Analytics Market Outlook, 2019 - 2031

5.1. Europe Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Solutions

5.1.1.2. Services

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Europe Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Performance Analysis

5.2.1.2. Player and Team Valuation

5.2.1.3. Player Fitness and Safety

5.2.1.4. Fan Engagement

5.2.1.5. Broadcast Management

5.2.1.6. Other Applications

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Cloud

5.3.1.2. On-premises

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Cricket

5.4.1.2. Football

5.4.1.3. Basketball

5.4.1.4. Baseball

5.4.1.5. Hockey

5.4.1.6. Other Team Sports

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Sports Analytics Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

5.5.1.2. France Sports Analytics Market by Product, Value (US$ ‘000), 2019 - 2031

5.5.1.3. U.K. Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

5.5.1.4. Italy Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

5.5.1.5. Spain Sports Analytics Market by Product, Value (US$ ‘000), 2019 - 2031

5.5.1.6. Rest of Europe Sports Analytics Market Value (US$ ‘000), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Sports Analytics Market Outlook, 2019 - 2031

6.1. Asia Pacific Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Solutions

6.1.1.2. Services

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Asia Pacific Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Performance Analysis

6.2.1.2. Player and Team Valuation

6.2.1.3. Player Fitness and Safety

6.2.1.4. Fan Engagement

6.2.1.5. Broadcast Management

6.2.1.6. Other Applications

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Cloud

6.3.1.2. On-premises

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Cricket

6.4.1.2. Football

6.4.1.3. Basketball

6.4.1.4. Baseball

6.4.1.5. Hockey

6.4.1.6. Other Team Sports

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Sports Analytics Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. India Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.5.1.2. China Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.5.1.3. Japan Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.5.1.4. Australia & New Zealand Sports Analytics Market Value (US$ ‘000), 2019 - 2031

6.5.1.5. Rest of Asia Pacific Market by Value (US$ ‘000), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Latin America Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

6.7. Latin America Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

6.7.1. Key Highlights

6.7.1.1. Solutions

6.7.1.2. Services

6.7.2. BPS Analysis/Market Attractiveness Analysis

6.8. Latin America Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

6.8.1. Key Highlights

6.8.1.1. Performance Analysis

6.8.1.2. Player and Team Valuation

6.8.1.3. Player Fitness and Safety

6.8.1.4. Fan Engagement

6.8.1.5. Broadcast Management

6.8.1.6. Other Applications

6.8.2. BPS Analysis/Market Attractiveness Analysis

6.9. Latin America Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

6.9.1. Key Highlights

6.9.1.1. Cloud

6.9.1.2. On-premises

6.9.2. BPS Analysis/Market Attractiveness Analysis

6.10. Latin America Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

6.10.1. Key Highlights

6.10.1.1. Cricket

6.10.1.2. Football

6.10.1.3. Basketball

6.10.1.4. Baseball

6.10.1.5. Hockey

6.10.1.6. Other Team Sports

6.10.2. BPS Analysis/Market Attractiveness Analysis

6.11. Latin America Sports Analytics Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

6.11.1. Key Highlights

6.11.1.1. Brazil Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.11.1.2. Mexico Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.11.1.3. Rest of Latin America Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

6.11.2. BPS Analysis/Market Attractiveness Analysis

7. Middle East & Africa Sports Analytics Market Outlook, 2019 - 2031

7.1. Middle East & Africa Sports Analytics Market Outlook, by Components (US$ ‘000), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Solutions

7.1.1.2. Services

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Middle East & Africa Sports Analytics Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Performance Analysis

7.2.1.2. Player and Team Valuation

7.2.1.3. Player Fitness and Safety

7.2.1.4. Fan Engagement

7.2.1.5. Broadcast Management

7.2.1.6. Other Applications

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Middle East & Africa Sports Analytics Market Outlook, by Deployment, Value (US$ ‘000), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Cloud

7.3.1.2. On-premises

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Middle East & Africa Sports Analytics Market Outlook, by Team Sports, Value (US$ ‘000), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Cricket

7.4.1.2. Football

7.4.1.3. Basketball

7.4.1.4. Baseball

7.4.1.5. Hockey

7.4.1.6. Other Team Sports

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Middle East & Africa Sports Analytics Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. GCC Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

7.5.1.2. South Africa Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

7.5.1.3. Rest of Middle East & Africa Sports Analytics Market by Value (US$ ‘000), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Competitive Landscape

8.1. Company Market Share Analysis, 2019

8.2. Company Profiles

8.2.1. IBM

8.2.1.1. Company Overview

8.2.1.2. Key Retailing Partners

8.2.1.3. Business Segment Revenue

8.2.1.4. Ingredient Overview

8.2.1.5. Product Offering & its Presence

8.2.1.6. Certifications & Claims

8.2.2. Zebra Technologies

8.2.3. Catapult

8.2.4. EXL

8.2.5. SAS Institute

8.2.6. HCL

8.2.7. Salesforce

8.2.8. Sportradar

8.2.9. Whoop

8.2.10. Trumedia Networks

9. Appendix

9.1. Research Methodology

9.2. Report Assumptions

9.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2020 |

2021 - 2027 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Components Coverage |

|

|

Deployment Coverage |

|

|

Team Sports Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |