Global Strapping Machine Market Forecast

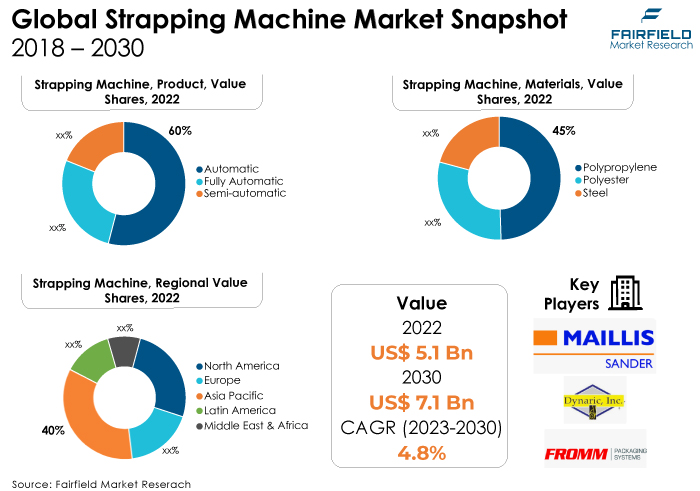

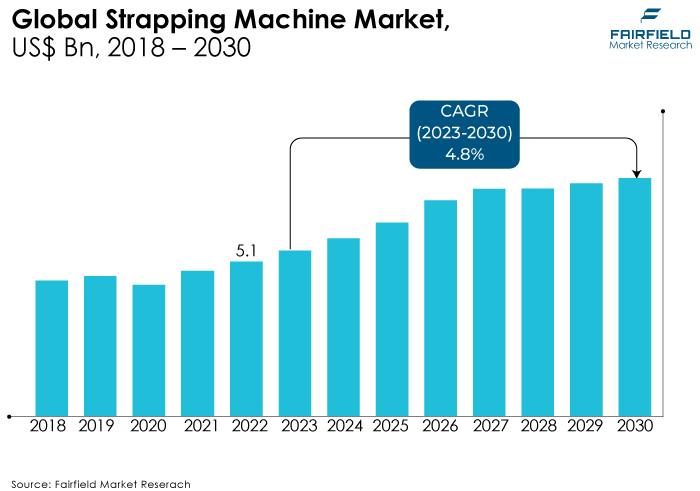

- Global strapping machine market size to reach US$7.1 Bn by 2030, up from US$5.1 Bn attained in 2022

- Market for strapping machines poised to witness a CAGR of 4.8% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the strapping machine market growth is growing demand for automated packaging solutions in various industries is driving the strapping machine market. Automated machines increase efficiency and reduce labour costs.

- Another major market trend expected to fuel the rise of eCommerce has led to increased packaging needs, boosting the demand for strapping machines, especially in sectors like consumer electronics and household appliances.

- The shift towards eco-friendly materials has driven innovation in strapping machines, promoting the use of recyclable and sustainable strapping materials.

- In 2022, semi-automatic strapping machines are popular in smaller businesses due to their cost-effectiveness, while fully automatic machines are favoured by large-scale industries for their speed and efficiency.

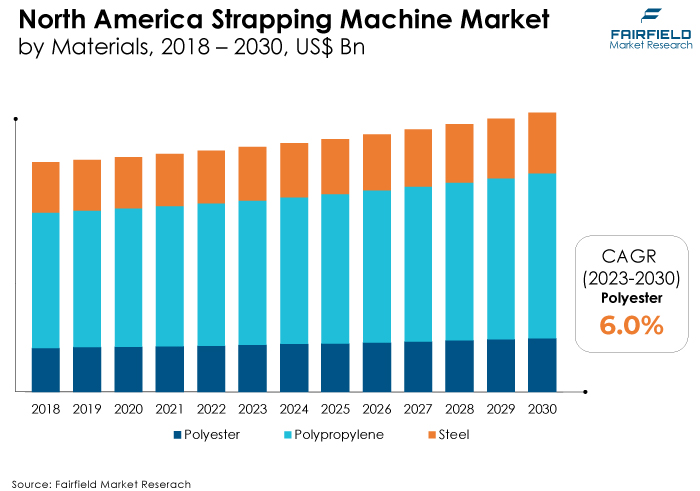

- Steel strapping is widely used in heavy-duty applications, especially in the metal and construction industries, while polypropylene and polyester find extensive use in lighter applications due to their flexibility, and cost effectiveness.

- In 2022, the food & beverages segment is often the dominant market for strapping machines due to the continuous demand for packaged food products. Strapping machines are extensively used in food processing and packaging units to ensure secure packaging and prevent damage during transit.

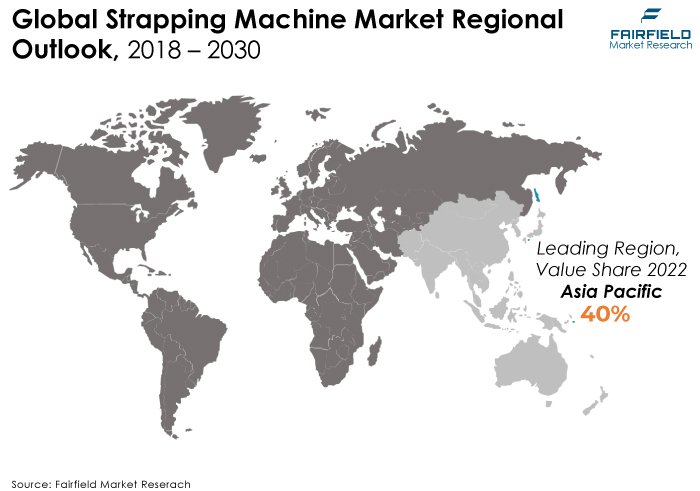

- Asia Pacific leads the market due to rapid industrialisation, especially in countries like China, and India, driving the demand for strapping machines across various sectors. The region's status as a global manufacturing hub increases the need for efficient packaging, boosting the adoption of strapping machines.

- North America experiences rapid technological adoption, leading to a high demand for advanced strapping solutions in industries like eCommerce, driving the market's growth. Strict packaging standards and regulations in North America fuel the demand for high-quality strapping machines, making it a swiftly growing market.

A Look Back and a Look Forward - Comparative Analysis

The strapping machine market is currently experiencing robust growth, driven by the increasing demand for efficient packaging solutions across various industries. With the rise in eCommerce activities, there is a growing need for secure and automated strapping machines to handle the packaging demands of online retail. Moreover, industries such as food & beverages, consumer electronics, and logistics are adopting strapping machines to streamline their packaging processes, enhance efficiency, and reduce operational costs.

The market witnessed staggered growth during the historical period 2018 - 2022. The strapping machine market witnessed steady growth. The period saw increased industrialisation, globalisation of trade, and the rise of eCommerce, all contributing to the demand for efficient strapping solutions. Manufacturers focused on innovations, introducing user-friendly, energy-efficient, and versatile strapping machines to cater to diverse industry needs. The market also experienced a shift towards eco-friendly materials, aligning with global sustainability goals.

The strapping machine market is poised for substantial growth. Anticipated technological advancements, including the integration of artificial intelligence and machine learning, will lead to the development of smarter, more automated strapping solutions. The market is expected to witness a surge in demand from emerging economies due to increased industrialisation and a growing focus on efficient packaging methods. Additionally, the eCommerce sector's continual expansion will remain a key driver, necessitating the implementation of advanced strapping technologies.

Key Growth Determinants

- eCommerce Boom, and Increased Online Retail Activity

The booming eCommerce industry has been a significant driver for the strapping machine market. With the rise in online retail activities, there is an escalating demand for efficient and secure packaging solutions. Strapping machines play a pivotal role in ensuring that packages are securely bundled and ready for shipping.

The need for quick, reliable, and automated strapping solutions in eCommerce warehouses and distribution centres has driven the adoption of strapping machines. This trend is expected to continue as the eCommerce market expands globally, thereby fuelling the demand for advanced strapping technologies.

- Industrial Automation, and Streamlined Packaging Processes

Industrial automation has become a cornerstone in modern manufacturing facilities. Strapping machines, being an integral part of the automated packaging process, have experienced increased adoption. These machines offer higher efficiency, reduced labour costs, and enhanced operational speed.

Manufacturers across various industries, including food and beverages, consumer electronics, and logistics, are integrating strapping machines into their production lines to streamline packaging processes. As industries continue to emphasize automation to improve productivity and reduce errors, the demand for advanced strapping solutions is set to grow, driving the market forward.

- Focus on Sustainable and Eco-friendly Packaging Solutions

There has been a growing emphasis on sustainable packaging practices. Strapping machines manufacturers are responding to this demand by developing eco-friendly strapping materials and energy-efficient machines. Companies are increasingly adopting strapping solutions that utilise biodegradable and recyclable strapping materials.

The eco-conscious approach not only aligns with corporate sustainability goals but also meets the evolving preferences of environmentally conscious consumers. As environmental concerns continue to shape the packaging industry, the market for sustainable strapping solutions is expected to witness significant growth, driving innovation and market expansion.

Major Growth Barriers

- High Initial Investment and Maintenance Costs

The strapping machine market is the high initial investment required for advanced strapping technologies. Fully automated and technologically sophisticated strapping machines often come with a significant upfront cost, making them inaccessible for small and medium-sized enterprises (SMEs) with limited budgets.

Additionally, the maintenance and repair costs associated with these machines can be substantial. This financial barrier hampers the adoption of cutting-edge strapping solutions, particularly among smaller businesses, limiting market growth.

- Limited Flexibility and Adaptability

The strapping machine market is the limited flexibility and adaptability of certain strapping technologies. Some machines are specifically designed for specific types or sizes of packages, making them less versatile for businesses dealing with diverse products.

Companies that frequently change their packaging requirements or handle a wide range of products may find it challenging to invest in strapping machines that lack adaptability. The inability to cater to varied packaging needs restricts the market potential of such machines, hindering their widespread adoption across different industries.

Key Trends and Opportunities to Look at

- Automation and Industry 4.0 Integration

Strapping machines are increasingly integrating with Industry 4.0 concepts, enabling automation, remote monitoring, and predictive maintenance. This trend, popular worldwide, enhances operational efficiency. Companies like Signode and Mosca are developing smart strapping solutions, leveraging IoT and AI, offering real-time insights into strapping operations.

- Sustainable Strapping Solutions

With a global focus on sustainability, there's a growing demand for eco-friendly strapping materials. Biodegradable and recyclable straps made from materials like PET and PLA are gaining popularity. Key players like FROMM and Dynaric are investing in research, developing sustainable strapping solutions, aligning with eco-conscious market demands.

- Customisation and Diverse Applications

Strapping machines are being customised to cater to diverse industry needs. Different sectors, such as food & beverages, construction, and logistics, have unique strapping requirements. Companies like StraPack, and Samuel Strapping Systems are developing specialised strapping solutions tailored to these sectors, expanding their market presence through customised offerings.

How Does the Regulatory Scenario Shape this Industry?

The strapping machine market is significantly influenced by various regulatory bodies and standards, ensuring product safety, quality, and environmental compliance. In the US, the Occupational Safety and Health Administration (OSHA) regulates workplace safety, impacting the design and usage of strapping machines.

Additionally, the European Machinery Directive (2006/42/EC) and CE marking are crucial for strapping equipment sold in the European Union, ensuring conformity to safety standards. Region-specific regulations such as China Compulsory Certification (CCC) in China, and International Organization for Standardization (ISO) certifications globally, further shape the industry landscape.

Adherence to these regulations is imperative for market players to maintain product quality and access international markets. Moreover, environmental standards, like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), impact the materials used in strapping machines, driving the industry towards sustainable and eco-friendly solutions to align with global environmental guidelines.

Fairfield’s Ranking Board

Top Segments

- Automatic Category Maintains Dominance

Automatic strapping machines have dominated the industry with a share of approximately 60%, due to their efficiency, speed, and reduced labour requirements. Automatic strapping machines, encompassing both fully automatic and semi-automatic variants, have gained prominence across various sectors, including manufacturing, logistics, and packaging industries. Their ability to handle high volumes of strapping operations with minimal human intervention has led to widespread adoption.

Furthermore, the fastest-growing segment is the fully automatic strapping machines category, with a market share increase of approximately 15%. The demand for fully automatic strapping machines has been surging due to their advanced features, such as high-speed strapping, adjustable tension settings, and integration capabilities with conveyor systems.

- Polypropylene Strapping Marches Ahead with 50% Market Share

In 2022, polypropylene strapping has dominated the industry landscape approximately 50% of the total market. Polypropylene strapping is widely preferred due to its excellent balance between strength, flexibility, and cost-effectiveness. It is commonly used in various industries, including logistics, food and beverage, and consumer goods packaging.

The fastest-growing segment, polyester strapping has been experiencing significant growth with approximately 20% market share. Polyester strapping offers superior strength and durability, making it suitable for heavy-duty applications in industries like metal and construction. Its ability to withstand high tension and provide secure packaging solutions has propelled its demand. Driven by the rising demand for robust and reliable strapping materials in industrial sectors.

- Food & Beverages Captures 35% of Total Demand Generation

The dominant application segment is F&B. The food and beverage industry extensively utilises strapping machines for securing packages and pallets, ensuring the safe transport of products. This segment holds a substantial market share, accounting for approximately 35% of the total market. The dominance of the food and beverages sector is due to the stringent packaging requirements, especially for perishable goods, where secure strapping is essential for maintaining product integrity during transportation.

The fastest-growing application segment is eCommerce. With the booming online retail industry, there has been a significant surge in the demand for strapping machines for packaging goods in eCommerce warehouses. This segment has witnessed rapid growth, increasing its market share by approximately 25% in recent years. The trend is driven by the escalating need for efficient and automated packaging solutions in eCommerce logistics, where strapping machines play a vital role in ensuring that parcels are securely bundled and ready for delivery.

Regional Frontrunners

Asia Pacific Stands out, eCommerce Boom Drives Growth

Asia Pacific continues to be the largest revenue-contributing region in the global strapping machine market, holding a significant market share of approximately 40%. The dominance of Asia Pacific can be attributed to several factors.

One key factor is the region's robust manufacturing sector, especially in countries like China, Japan, and South Korea. These countries have extensive manufacturing industries that require efficient packaging solutions, driving the demand for strapping machines.

Additionally, the booming eCommerce industry in countries like China, and India has significantly increased the need for strapping machines in packaging and logistics operations. Furthermore, government initiatives in various Asian countries to promote industrial automation and enhance packaging standards have further fueled the adoption of strapping machines, contributing to the region's market leadership.

North America Continues to Gain Significant Profits in Manufacturing Sector

North America is poised to witness significant growth in strapping machine sales during the forecast period, and it is expected to capture a notable market share of approximately 35%. Several factors contribute to this growth.

The region's well-established manufacturing sector, especially in industries like automotive, electronics, and food processing, drives the demand for efficient packaging solutions, including strapping machines. The rise in eCommerce activities and the subsequent demand for robust packaging solutions in the US, and Canada further boost the market.

Moreover, the increasing focus on sustainability and eco-friendly packaging materials in North America has led to the adoption of innovative strapping solutions, enhancing the market growth. Additionally, the presence of key market players, technological advancements, and continuous research and development activities in the region contribute to the robust growth of the strapping machine market in North America.

Fairfield’s Competitive Landscape Analysis

The strapping machine market is witnessing intense rivalry among key players striving for innovation and market dominance. Companies are investing significantly in research and development to introduce cutting-edge technologies like automation, robotics, and machine learning algorithms into their products. This not only enhances operational efficiency but also addresses the growing demand for customised solutions.

Who are the Leaders in Global Strapping Machine Space?

- Dynaric Inc.

- Fromm Holdings AG

- Messersi Packaging S.r.l

- MJ Maillis S.A

- Mosca GmbH

- Polychem Corporation

- Samuel Strapping Systems

- StraPack Inc.

- Strapex Group

- Transpak Equipment Corp.

- Signode Packaging Systems Corporation

- Polychem Corporation

- Cyklop

- Venus Packaging

- Vinayak Packaging Industries

Significant Company Developments

New Product Launch

- February 2017: Kite Packaging launched a range of machines to cater to the growing requirements of its consumers. The company redesigned its strapping achiness to offer high-quality and affordable packaging solutions in the industry. Kite’s semi-automatic system is developed for small and medium-sized items and requires manual feeding of strapping into it.

- February 2022: Signode Industrial Group LLC introduced new strapping equipment in the market. It is a BPT steel strapping hand tool that is light in weight and has balanced features. It is used for heavy-duty stationary and mobile applications which require high-tension force.

- May 2021: Fromm Holding AG has developed a machine that automatically scans the product and fills it in the carton.

Distribution Agreement

- May 2022: Signode Corporation, a leading global provider of industrial packaging products and solutions, announced a strategic partnership with StrapRex Inc., a leading provider of innovative strapping machine solutions.

- January 2023: Mosca, a leading manufacturer of strapping machines, and Towa Corporation, a leading manufacturer of strapping materials, announced a strategic alliance.

An Expert’s Eye

Demand and Future Growth

The strapping machine market is poised for significant growth in the long term due to several key factors. One of the primary drivers is the rising demand for efficient and automated packaging solutions across various industries. As eCommerce continues to flourish globally, the need for secure, reliable, and high-speed strapping machines becomes paramount. Additionally, industries such as food and beverages, consumer electronics, and logistics are increasingly relying on strapping machines to streamline their packaging processes.

Supply Side of the Market

According to our analysis, the challenge lies in meeting the evolving demands of diverse industries. Manufacturers are tasked with developing strapping machines that are not only efficient and durable but also adaptable to different packaging needs. Technological advancements, such as IoT integration for real-time monitoring and predictive maintenance, are becoming industry norms.

Additionally, suppliers are focusing on sustainable practices, including the use of recyclable materials and energy-efficient production processes, to align with the global shift towards environmental consciousness. Striking a balance between innovation, sustainability, and cost-effectiveness will be crucial for market players to maintain a competitive edge in the long run.

To stay ahead, companies must also prioritise cybersecurity measures to protect sensitive data and ensure the integrity of their systems. Furthermore, investing in research and development to continuously improve product offerings and meet evolving customer demands will be essential for sustained success in the market.

Global Strapping Machine Market is Segmented as Below:

By Product:

- Semi-automatic

- Automatic

- Fully Automatic

By Materials:

- Steel

- Polypropylene

- Polyester

By Application:

- Food & Beverages

- Consumer Electronics

- Household Appliances

- Newspaper & Graphics

- Metal

- Building & Construction

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Strapping Machine Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Strapping Machine Market Outlook, 2018 - 2030

3.1. Global Strapping Machine Market Outlook, by Product ,Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Semi-automatic

3.1.1.2. Automatic

3.1.1.3. Fully Automatic

3.2. Global Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Steel

3.2.1.2. Polypropylene

3.2.1.3. Polyester

3.3. Global Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Food & Beverages

3.3.1.2. Consumer Electronics

3.3.1.3. Household Appliances

3.3.1.4. Newspaper & Graphics

3.3.1.5. Metal

3.3.1.6. Building & Construction,

3.3.1.7. Others

3.4. Global Strapping Machine Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Strapping Machine Market Outlook, 2018 - 2030

4.1. North America Strapping Machine Market Outlook, by Product , Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Semi-automatic

4.1.1.2. Automatic

4.1.1.3. Fully Automatic

4.2. North America Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Steel

4.2.1.2. Polypropylene

4.2.1.3. Polyester

4.3. North America Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Food & Beverages

4.3.1.2. Consumer Electronics

4.3.1.3. Household Appliances

4.3.1.4. Newspaper & Graphics

4.3.1.5. Metal

4.3.1.6. Building & Construction,

4.3.1.7. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Strapping Machine Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Strapping Machine Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Strapping Machine Market Outlook, 2018 - 2030

5.1. Europe Strapping Machine Market Outlook, by Product , Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Semi-automatic

5.1.1.2. Automatic

5.1.1.3. Fully Automatic

5.2. Europe Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Steel

5.2.1.2. Polypropylene

5.2.1.3. Polyester

5.3. Europe Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Food & Beverages

5.3.1.2. Consumer Electronics

5.3.1.3. Household Appliances

5.3.1.4. Newspaper & Graphics

5.3.1.5. Metal

5.3.1.6. Building & Construction,

5.3.1.7. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Strapping Machine Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K .Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.7. France Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.8. France Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.9. France Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Strapping Machine Market Outlook, 2018 - 2030

6.1. Asia Pacific Strapping Machine Market Outlook, by Product , Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Semi-automatic

6.1.1.2. Automatic

6.1.1.3. Fully Automatic

6.2. Asia Pacific Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Steel

6.2.1.2. Polypropylene

6.2.1.3. Polyester

6.3. Asia Pacific Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Food & Beverages

6.3.1.2. Consumer Electronics

6.3.1.3. Household Appliances

6.3.1.4. Newspaper & Graphics

6.3.1.5. Metal

6.3.1.6. Building & Construction,

6.3.1.7. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Strapping Machine Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.2. China Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.3. China Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.1.10. India Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.11. India Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.12. India Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Strapping Machine Market Outlook, 2018 - 2030

7.1. Latin America Strapping Machine Market Outlook, by Product , Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Semi-automatic

7.1.1.2. Automatic

7.1.1.3. Fully Automatic

7.2. Latin America Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.2.1.1. Steel

7.2.1.2. Polypropylene

7.2.1.3. Polyester

7.3. Latin America Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Food & Beverages

7.3.1.2. Consumer Electronics

7.3.1.3. Household Appliances

7.3.1.4. Newspaper & Graphics

7.3.1.5. Metal

7.3.1.6. Building & Construction,

7.3.1.7. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Strapping Machine Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Strapping Machine Market Outlook, 2018 - 2030

8.1. Middle East & Africa Strapping Machine Market Outlook, by Product , Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Semi-automatic

8.1.1.2. Automatic

8.1.1.3. Fully Automatic

8.2. Middle East & Africa Strapping Machine Market Outlook, by Materials , Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Steel

8.2.1.2. Polypropylene

8.2.1.3. Polyester

8.3. Middle East & Africa Strapping Machine Market Outlook, by Application , Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Food & Beverages

8.3.1.2. Consumer Electronics

8.3.1.3. Household Appliances

8.3.1.4. Newspaper & Graphics

8.3.1.5. Metal

8.3.1.6. Building & Construction,

8.3.1.7. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Strapping Machine Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Strapping Machine Market by Product , Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Strapping Machine Market Materials , Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Strapping Machine Market Application , Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs ApplicationHeatmap

9.2. Manufacturer vsApplicationHeatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Dynaric Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Fromm Holdings AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Messersi Packaging S.r.l

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. MJ Maillis S.A

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Mosca GmbH

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Polychem Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Samuel Strapping Systems

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. StraPack Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Strapex Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Transpak Equipment Corp.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Signode Packaging Systems Corporation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Polychem Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Cyklop

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Venus Packaging

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.14.5. Vinayak Packaging Industries

9.5.14.6. Company Overview

9.5.14.7. Product Portfolio

9.5.14.8. Financial Overview

9.5.14.9. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Material Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |