Global Sustainable Alternative Fuels Market Forecast

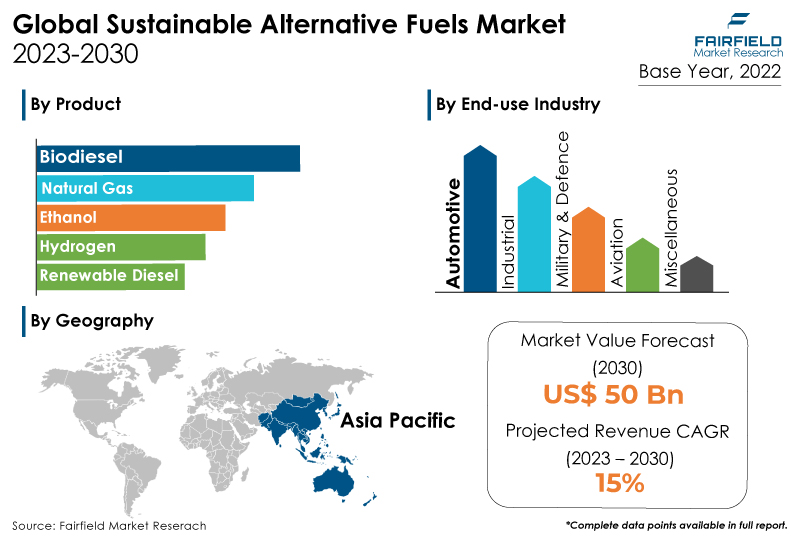

- Global sustainable alternative fuels market valuation will reach approximately US$50 Bn by 2030

- Market size poised to expand at a CAGR of 15% between 2023 and 2030

Market Analysis in Brief

The various alternative fuels offered on the market include natural gas, biodiesel, ethanol, and hydrogen. Natural gas currently maintains the largest revenue share in the market and is anticipated to do so during the analysis period due to its extensive availability and widespread use in automobiles, notably the use of LPG in light commercial vehicles. Most businesses consider them environmentally beneficial since they don't produce any pollution. Various aviation sector stakeholders are implementing alternative solutions like redesigning aero-engines to increase efficiency, using hybrid and all-electric aircraft, using renewable jet fuels, etc.

2021: The hydrogen fuel cell electric vehicle (FCEV) prototype is being built, according to the UK-based automaker Jaguar Land Rover Automotive PLC. By 2039, activities, goods, and supply chains should be free of carbon emissions, and there should be no tailpipe emissions by 2036, according to the FCEV concept. FCEVs' electric motors are driven by hydrogen-produced energy, which helps BEVs achieve their aim of zero-emission transportation. Additionally, the growing usage of alternative fuels is a result of the rising price of petrol and diesel and the quick depletion of non-renewable resources.

Key Report Findings

- The market for sustainable alternative fuels will demonstrate huge expansion in revenue over the decade, i.e., between 2023 and 2030

- The increasing need for GHG emission reduction in the aviation sector, rising air passenger traffic, and the high fuel economy of sustainable aviation fuel are some of the major drivers propelling the market's expansion.

- Demand for biofuel remains higher in the sustainable alternative fuels market.

- The automotive category held the highest sustainable alternative fuels market revenue share in 2022.

- Asia Pacific will continue to lead its way, whereas the North American sustainable alternative fuels market will experience the strongest growth till 2030.

Growth Drivers

Aviation Industry’s Growing Emphasis on Reduced GHG Emissions

In order to fulfill the aviation industry's promises to uncouple rising carbon emissions from increasing traffic, sustainable aviation fuels are a crucial component. Depending on the sustainable feedstock utilised, the production process, and the supply chain to the airport, SAF offers a remarkable decrease in CO2 emissions of up to 80% over the fuel's lifecycle compared to fossil jet fuel.

According to the Iata Fact Sheet, the SAF will be a viable option for aircraft operators to fulfill their obligations under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). A Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) was approved by the UN's International Civil Aviation Organisation (ICAO) in 2016 to reduce CO2 emissions.

In addition, sustainable aviation fuel is a fully fungible drop-in fuel when combined with petroleum-based fuel. Depending on the methods, technological frameworks, and raw materials employed in their manufacture, these fuels are sometimes referred to as synthetic fuels, renewable jet fuels, e-fuels, green fuels, conventional jet fuels, and alternative jet fuels.

Since these fuels can utilise the airport's fuel storage and water hydrant systems, infrastructure expenses are reduced and they are handled the same as current petroleum-based fuels. Co-processing with other streams or making ongoing attempts to utilise depreciated infrastructure and equipment could be strategies for lowering capital expenditures. A drop-in fuel can be utilised in existing engines and infrastructure without needing to be modified and is thought to be equivalent to regular jet fuel.

Huge Demand for Cleaner, Low-carbon Fuels

The adoption of various alternative fuel vehicles is being sped up by alternative fuel vehicles expanding popularity among people all over the world. Electric vehicles are becoming increasingly popular across all worldwide markets due to increased reliance on biofuels and growing air pollution levels brought on by carbon emissions. Huge concerns about the depletion of non-renewable energy sources have been raised as a result of the significant population adoption of vehicles in the automotive sector.

The cost of biofuels has increased, and they have significantly contributed to the decline in the quality of the environment. The expansion of the electric vehicle has been aided by government programmes to minimise carbon footprint and increased investments in the study and development of renewable and eco-friendly energy sources. The global market for alternative fuel vehicles is predicted to develop as a result of the a notable increase in the appeal of electric vehicles among consumers worldwide.

Additionally, the majority of daily used goods and services increase in price due to inflation brought on by rising gasoline prices. Demand for alternative fuel vehicles is rising worldwide due to the growing need for affordable, sustainable fuel sources. Additionally, the proliferation of alternative fuel cars for commercial and passenger use has been aided by the development of fuel-efficient automobiles. The increased government investments in creating alternative fuel vehicles, such as public buses and other public transit vehicles, are boosting market growth.

It is projected that the widespread adoption of alternative fuel vehicles will increase due to the government's strict laws governing vehicle emissions, which already have a favourable market impact. Further, the market is expanding due to increasing corporate investments in constructing BEV manufacturing facilities.

Growth Challenges

Fluctuating Raw Material Supply

The raw materials that play a significant part in the entire production chain of alternative aviation biofuels and fuels like synthetic fuels, e-fuels, and bio-jet fuels, include biological and non-biological resources, include oil crops, sugar crops, algae, and waste oil. The insufficient supply of raw materials needed for its manufacture can cause the demand for sustainable aviation fuel to stop growing.

The total process of producing SAF is also delayed due to refineries' restrictions, which are crucial to effectively utilising these feedstocks. The low fuel availability creates a barrier to the fuel's ability to blend, decreasing efficiency.

Airlines require SAF if they are to achieve their own GHG emission reduction goals, which they cannot do with only improved engines, and flights. Among operating expenses, fuel expenditures make up a sizable portion. SAF requires sophisticated and expensive technological processes, even though it is created from waste and feedstocks that are easily accessible and inexpensive.

Due to the requirement to deploy new manufacturing capacity, SAF is more expensive than petro-jet. Because manufacturing capacity will be developed in response to contracts rather than as a commodity, SAF will not be broadly accessible for at least the first ten to fifteen years.

Because constructing new biofuel facilities costs money and time, their capacity to achieve the critical mass of profitability is hampered. As a result, the offtake price once the factories are operational increases.

Overview of Key Segments

Biodiesel to Capture the Largest Market Pie

The biodiesel category will dominate the sustainable alternative fuels market over the forecast period. The SAF types are biofuel, hydrogen fuel, and power-to-liquid biofuel. The biofuel segment of the market for sustainable aviation fuel is expected to hold the biggest share over the course of the forecast period. As technology approaches to commercialise the use of alternative jet fuel quickly advances, bio-jet fuel production is anticipated to scale up significantly over the next ten years. By providing money for bio jet fuel infrastructure, nations like Norway, the Netherlands, and the UK are making a big contribution to long-term sustainability objectives.

Automotive Industry Records Maximum Fuel Consumption

The automotive industry segment will dominate the sustainable alternative fuels market over the forecast period. The automobile industry currently holds the largest revenue share in the market as a result of the substantial role that petrol plays in an engine's operation, and it is projected that this share will rise over the course of the analysis.

Alternative fuels also have a bright future in this industry because of multiple developments and the depletion of non-renewable resources. The aviation industry is predicted to expand throughout the course of the analysis period as the need for alternative fuels increases in this region.

Growth Opportunities Across Regions

Asia Pacific Spearheads

The sustainable alternative fuels market will continue to dominate Asia Pacific due to several factors that fueled its expansion, mostly due to the enormous popularity of employing renewable resources among the local population. Governments are also actively encouraging the use of alternative fuels on a large scale in a number of Asian Pacific nations. The alternative fuels industry may experience fresh growth due to this factor.

Furthermore, in essence, non-renewable fuels are replaced by alternative fuels. These have lower levels of hazardous pollutants as versus conventional fuels like petrol, and diesel. Additionally, two important advantages associated with alternative fuels are domestic accessibility and job generation. Therefore, the market for alternative fuels is predicted to grow due to these considerations. Some alternative fuels include hydrogen, biodiesel, natural gas, and others that can be used in various businesses.

North America Emerges Lucrative

The market for sustainable alternative fuels across North America will display a significant CAGR over the forecast period because of the high demand for these fuels in these areas as a result of growing sensitivity to climate change. The market in those regions is also driven by the populace's high-income levels and the depletion of non-renewable fuels. The significance of safeguarding the environment grows along with the need for alternative fuels.

One of the main factors driving the growth of the alternate fuels industry is environmental concerns, which restrict the use of non-renewable fuels like petrol and diesel. Demand is anticipated to increase dramatically due to government organisations in many nations encouraging the use of alternative fuels. These developments raise public knowledge of alternative fuels, which increases the industry's potential for growth on a global scale.

Sustainable Alternative Fuels Market: Competitive Landscape

Some leading players at the forefront in the sustainable alternative fuels market space include Renewable Energy Group, Cosan, Australian Renewable Fuels Limited, BlueFire Ethanol Fuels, Inc., and Coskata, Inc.

Recent Notable Developments

In August 2020, Gevo, Inc. and Trafigura Trading LLC, a fully-owned subsidiary of Trafigura Group Pte Ltd, entered into a legally binding agreement to acquire and sell renewable hydrocarbons. The agreement will allow Trafigura to provide SAF to US and abroad customers whose demand for low-carbon jet fuel is growing.

Similarly, in June 2020, Urban Aeronautics, Inc., a pioneer in VTOL aircraft, contracted with Hypoint, Inc. to supply zero-carbon hydrogen fuel cell technology for the CityHawk eVTOL aircraft.

Global Sustainable Alternative Fuels Market is Segmented as Below:

By Product

- Natural Gas

- Biodiesel

- Ethanol

- Hydrogen

- Renewable Diesel

- Miscellaneous

By End-use Industry

- Automotive

- Industrial

- Military & Defence

- Aviation

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Sustainable Alternative Fuels Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Global Sustainable Alternative Fuels Production, 2018 - 2022

3.2. Sustainable Alternative Fuels Import Statistics, 2018 - 2022

3.3. Sustainable Alternative Fuels Export Statistics, 2018 - 2022

4. Price Trends Analysis and Future Projects, 2018 - 2030

4.1. Global Average Price Analysis, by Service, US$ per Kg

4.2. Prominent Factors Affecting Sustainable Alternative Fuels Prices

4.3. Global Average Price Analysis, by Region, US$ per Kg

5. Global Sustainable Alternative Fuels Market Outlook, 2018 - 2030

5.1. Global Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Natural Gas

5.1.1.2. Biodiesel

5.1.1.3. Ethanol

5.1.1.4. Hydrogen

5.1.1.5. Renewable Diesel

5.1.1.6. Misc.

5.2. Global Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Automotive

5.2.1.2. Industrial

5.2.1.3. Military & Defence

5.2.1.4. Aviation

5.2.1.5. Misc.

5.3. Global Sustainable Alternative Fuels Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Sustainable Alternative Fuels Market Outlook, 2018 - 2030

6.1. North America Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Natural Gas

6.1.1.2. Biodiesel

6.1.1.3. Ethanol

6.1.1.4. Hydrogen

6.1.1.5. Renewable Diesel

6.1.1.6. Misc.

6.2. North America Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Automotive

6.2.1.2. Industrial

6.2.1.3. Military & Defence

6.2.1.4. Aviation

6.2.1.5. Misc.

6.2.2. Market Attractiveness Analysis

6.3. North America Sustainable Alternative Fuels Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. U.S. Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.1.2. U.S. Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.1.3. Canada Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.1.4. Canada Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Sustainable Alternative Fuels Market Outlook, 2018 - 2030

7.1. Europe Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Natural Gas

7.1.1.2. Biodiesel

7.1.1.3. Ethanol

7.1.1.4. Hydrogen

7.1.1.5. Renewable Diesel

7.1.1.6. Misc.

7.2. Europe Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Automotive

7.2.1.2. Industrial

7.2.1.3. Military & Defence

7.2.1.4. Aviation

7.2.1.5. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Sustainable Alternative Fuels Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Germany Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.2. Germany Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.3. U.K. Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.4. U.K. Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.5. France Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.6. France Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.7. Italy Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.8. Italy Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.9. Russia Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.10. Russia Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.11. Rest of Europe Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1.12. Rest of Europe Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Sustainable Alternative Fuels Market Outlook, 2018 - 2030

8.1. Asia Pacific Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Natural Gas

8.1.1.2. Biodiesel

8.1.1.3. Ethanol

8.1.1.4. Hydrogen

8.1.1.5. Renewable Diesel

8.1.1.6. Misc.

8.2. Asia Pacific Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Automotive

8.2.1.2. Industrial

8.2.1.3. Military & Defence

8.2.1.4. Aviation

8.2.1.5. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Sustainable Alternative Fuels Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. China Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.2. China Sustainable Alternative Fuels Market End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.3. Japan Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.4. Japan Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.5. South Korea Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.6. South Korea Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.7. India Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.8. India Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.9. Southeast Asia Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.10. Southeast Asia Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.11. Rest of Asia Pacific Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1.12. Rest of Asia Pacific Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Sustainable Alternative Fuels Market Outlook, 2018 - 2030

9.1. Latin America Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. Natural Gas

9.1.1.2. Biodiesel

9.1.1.3. Ethanol

9.1.1.4. Hydrogen

9.1.1.5. Renewable Diesel

9.1.1.6. Misc.

9.2. Latin America Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Automotive

9.2.1.2. Industrial

9.2.1.3. Military & Defence

9.2.1.4. Aviation

9.2.1.5. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Sustainable Alternative Fuels Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Brazil Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1.2. Brazil Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1.3. Mexico Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1.4. Mexico Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1.5. Rest of Latin America Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1.6. Rest of Latin America Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Sustainable Alternative Fuels Market Outlook, 2018 - 2030

10.1. Middle East & Africa Sustainable Alternative Fuels Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. Natural Gas

10.1.1.2. Biodiesel

10.1.1.3. Ethanol

10.1.1.4. Hydrogen

10.1.1.5. Renewable Diesel

10.1.1.6. Misc.

10.2. Middle East & Africa Sustainable Alternative Fuels Market Outlook, by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Automotive

10.2.1.2. Industrial

10.2.1.3. Military & Defence

10.2.1.4. Aviation

10.2.1.5. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Sustainable Alternative Fuels Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. GCC Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1.2. GCC Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1.3. South Africa Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1.4. South Africa Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1.5. Rest of Middle East & Africa Sustainable Alternative Fuels Market by Product, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1.6. Rest of Middle East & Africa Sustainable Alternative Fuels Market by End-use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs End-use Industry Heatmap

11.2. Manufacturer vs Product Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Fulcrum BioEnergy Inc.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Eni S.p.A.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Renewable Energy Group

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Cosan

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Australian Renewable Fuels Limited

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. BlueFire Ethanol Fuels, Inc.

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Coskata, Inc.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Sapphire Energy

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. POET LLC

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Valero Energy Corporation

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |