Global Tunnel Boring Machine Market Forecast

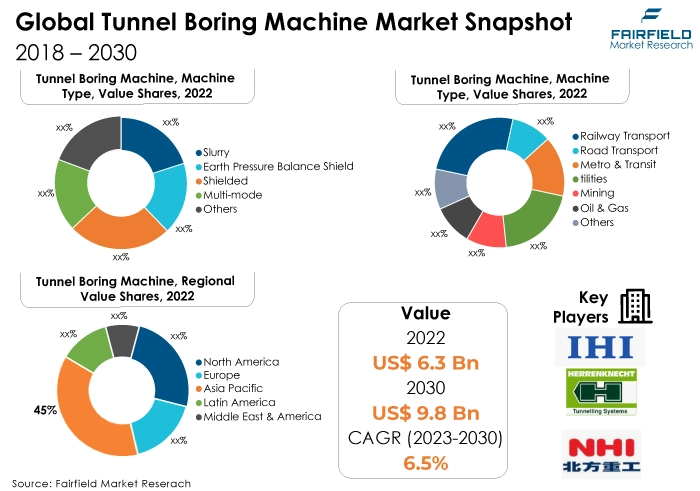

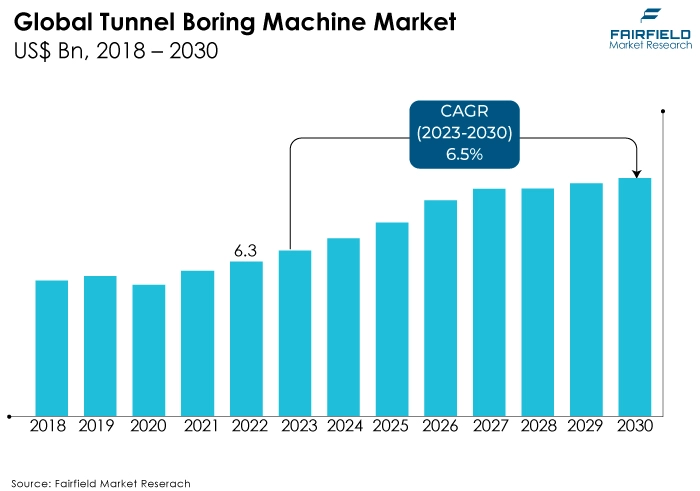

- The approximately US$6.3 Bn tunnel bring machine market (2022) poised to reach US$9.8 Bn in 2030

- Market valuation projected to witness a CAGR of 6.5% during 2023 - 2030

Quick Report Digest

- Ongoing innovations in TBM designs enhance productivity and safety. Automation, precision engineering, and environmentally friendly features characterise the latest trends in tunnel boring machines, ensuring market competitiveness.

- Collaborations between international construction firms and TBM manufacturers are on the rise. Strategic partnerships facilitate knowledge exchange and technology transfer, fostering a competitive global market landscape.

- Slurry-type TBMs lead the market by machine type due to their adaptability and efficiency, catering to both road transport and railway tunneling projects.

- Soft ground conditions dominate geology type segment, ensuring enhanced safety and stability, particularly in railway transport projects, driving market growth in this segment.

- Road transport emerges as the primary end-use sector, demanding customised TBMs. Increasing infrastructural projects worldwide boost the need for efficient tunneling solutions in this sector.

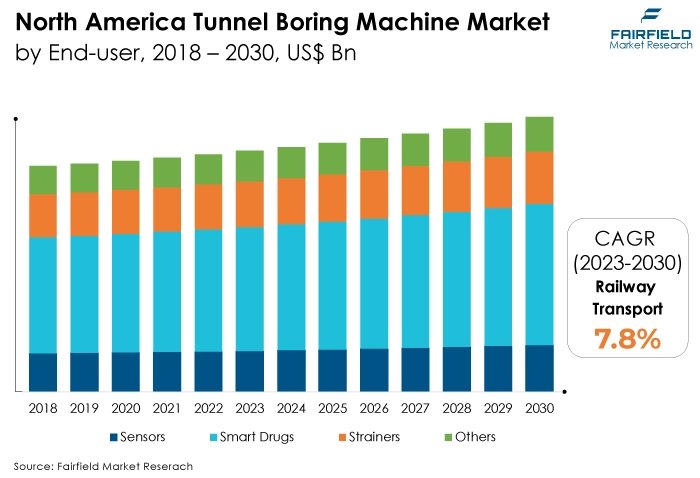

- Railway transport is the fastest category in end-use sectors, focusing on high-speed rail networks. These machines provide stability and safety, aligning with the growing investments in global rail infrastructure projects.

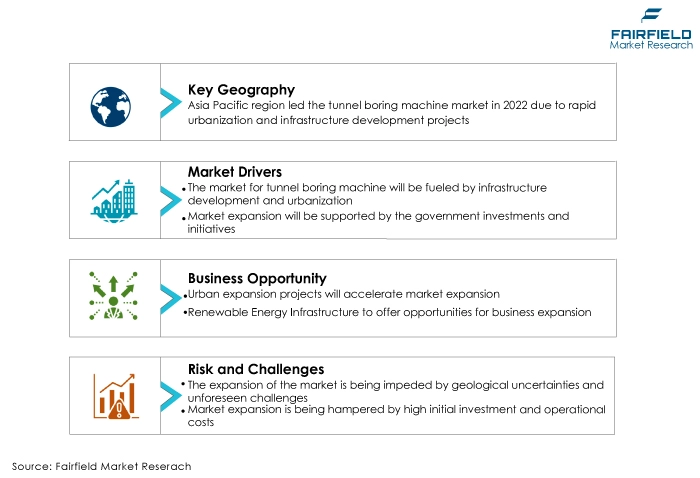

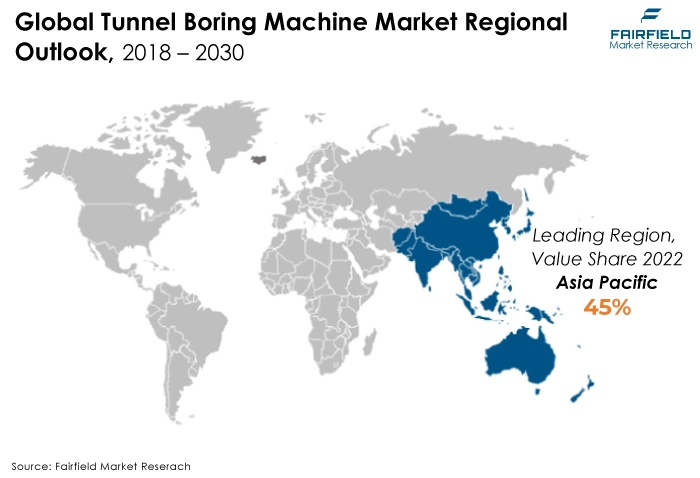

- Asia Pacific stands out as the dominating region. Rapid urbanisation extensive road, and rail projects, coupled with governmental support, make this region the epicenter of TBM market expansion.

- North America witnesses substantial growth, driven by increased demands in road transport infrastructure, particularly in soft ground regions. Investments in modernising ageing tunnels and bridges further boost the market in this region.

A Look Back and a Look Forward - Comparative Analysis

The tunnel boring machine market is currently experiencing robust growth, driven by escalating demands in both road and railway transport sectors. Slurry-type TBMs dominate, offering versatile solutions in soft ground geologies, meeting the requirements of major infrastructure projects globally.

Significant advancements in automation and precision engineering have enhanced TBM performance, ensuring faster and safer tunnel construction. The market is characterised by increasing investments in modern urbanisation projects, boosting the demand for efficient tunneling technologies.

From 2018 to 2022, the TBM market saw remarkable growth. The period witnessed a surge in road and rail projects globally, increasing the adoption of TBMs. Shielded TBMs gained prominence due to their stability in challenging terrains. Technological advancements during these years, such as automated systems and improved cutting tools, significantly enhanced excavation speed and precision.

Technological evolution will continue, focusing on AI-driven automation, green construction techniques, and adaptive designs for various geologies. Increasing urbanisation and environmental concerns will drive the demand for eco-friendly TBMs.

Collaboration between industry leaders and governments will foster research and development, ensuring the market's sustainable expansion. Emerging economies and ongoing mega-infrastructure projects globally will fuel the demand for TBMs, making them pivotal in shaping the future of transportation networks and infrastructure development.

Key Growth Determinants

- Rapid Urbanisation, and Infrastructural Developments

The accelerating pace of urbanisation globally is a significant driver for the tunnel boring machine (TBM) market. As cities expand to accommodate growing populations, the demand for efficient transportation networks, including tunnels for roads and railways, surges. TBMs play a crucial role in these projects, enabling the construction of underground passages swiftly and safely.

This trend is particularly evident in developing economies where new cities are emerging and existing urban centers are undergoing extensive redevelopment. Governments and private investors, recognising the necessity of robust infrastructure, continue to invest substantially in TBMs, ensuring sustained growth for the market.

- Technological Advancements and Automation

Continuous advancements in TBM technology and the integration of Automation are propelling market growth. Modern TBMs are equipped with sophisticated features, such as real-time monitoring systems, precise navigation tools, and automated control mechanisms. These technologies enhance excavation accuracy, reduce human intervention, and ensure worker safety.

Additionally, the implementation of AI and machine learning algorithms optimises tunneling processes, making them more efficient and cost-effective. Construction companies increasingly prefer state-of-the-art TBMs, boosting demand. As technology continues to evolve, TBMs are becoming smarter and more adaptable, driving their adoption in a variety of geological conditions and complex projects.

- Environmental Concerns, and Widening Adoption of Sustainable Construction Practices

Environmental consciousness and sustainable construction practices are compelling factors driving the TBM market. Traditional excavation methods can cause significant environmental disruptions, including soil erosion, habitat destruction, and pollution. TBMs offer a more eco-friendly alternative by minimising surface disturbances, reducing noise pollution, and preserving natural landscapes.

Moreover, the construction industry is witnessing a shift towards green initiatives, emphasizing the importance of environmentally responsible practices. TBMs, with their ability to excavate efficiently while minimising ecological impact, align perfectly with these principles. As environmental regulations become stricter worldwide, the demand for TBMs is expected to rise further, making them a preferred choice for environmentally sensitive projects.

Major Growth Barriers

- Geological Challenges, and Unforeseen Ground Conditions

Unpredictable geological conditions pose a significant challenge for the TBM industry. The variability in rock formations, unforeseen faults, and the potential for water presence can impede TBM operations, resulting in project delays and escalated expenses. Addressing these uncertainties often necessitates expensive modifications to the machines, which can negatively impact project schedules and overall profitability.

- High Initial Investments, and Prohibitive Operational Costs

The substantial initial investment required for acquiring advanced TBMs poses a significant challenge for market players. Additionally, the operational costs associated with maintenance, skilled labour, and energy consumption are considerable.

For smaller construction firms or projects with limited budgets, these high costs can act as a deterrent, limiting their ability to adopt TBMs for tunneling projects. The cost-intensive nature of TBMs can restrain their widespread adoption, especially in regions with budget constraints or limited financial resources.

Key Trends and Opportunities to Look at

- Sustainability in Tunneling Practices

Sustainable tunneling practices are gaining momentum globally, driven by environmental concerns. TBMs that minimise carbon footprint and employ eco-friendly construction methods are increasingly popular. Companies are investing in green technologies, while regions like Europe, and North America lead in their adoption. Brands are leveraging these practices for corporate social responsibility, enhancing their market reputation.

- Advancements in Automation, and Growing AI Integration

Automation and AI integration in TBMs are revolutionising tunnel construction. Enhanced precision, reduced operational errors, and improved safety characterise this trend. This technology is swiftly gaining popularity in Asia Pacific, where rapid urbanisation demands efficient and error-free tunneling. Key industry players are investing heavily in research, driving this transformative trend forward.

- Modular and Customisable TBM Designs

Modular and customisable TBM designs are becoming prevalent, offering adaptability to various geological conditions and project requirements. These versatile machines find favour across regions with diverse terrains. Companies are developing innovative modular components, allowing customisation. Brands are leveraging this trend to cater to niche market demands, ensuring flexibility and competitiveness.

How Does the Regulatory Scenario Shape this Industry?

The tunnel boring machine market is heavily influenced by regulatory frameworks and guidelines that govern construction activities, safety standards, and environmental concerns. Regulatory bodies like OSHA in the US and HSE in the UK enforce stringent safety regulations that impact safety protocols and equipment standards in the industry.

Additionally, environmental protection agencies worldwide set guidelines to minimise the ecological impact of tunneling projects. For example, the European Environmental Agency (EEA) in Europe, and the Environmental Protection Agency (EPA) in the US impose rules to ensure sustainable construction practices, encouraging the adoption of eco-friendly TBMs and construction techniques.

Region-specific changes also play a pivotal role. For instance, in Asia Pacific, governments such as China's Ministry of Transport implement specific guidelines to regulate tunneling activities, ensuring quality and safety standards. These regulations not only enforce industry standards but also stimulate innovation as companies strive to meet and exceed regulatory requirements, shaping a more sustainable and secure future for the TBM market.

Fairfield’s Ranking Board

Top Segments

- Slurry Category Continues to Dominate over Shielded Segments

The slurry segment dominated the market in 2022. due to their adaptability in soft ground conditions. In 2022, slurry TBMs held the largest market share, contributing to 60% of the total sales. Their efficient excavation capabilities and versatility in various geological settings make them the preferred choice, ensuring steady growth.

Furthermore, the shielded category is projected to experience the fastest market growth. Witnessing a growth rate of 8% annually. In 2022, they accounted for 30% of the market share. Their rising popularity is attributed to increased urbanisation, requiring stable tunnels for transportation networks. The demand for shielded TBMs is notably high in densely populated regions, driving their rapid market expansion.

- Soft Ground Segment to Surge Ahead Through 2030

In 2022, the soft ground category dominated the industry. In 2022, it accounted for approximately 70% of the market share. The dominance of soft-ground TBMs can be attributed to the widespread urbanisation and the need for underground infrastructure in densely populated areas.

Soft ground TBMs are highly efficient in excavating through soil, clay, and other less compacted materials, making them indispensable for projects such as subways, sewage systems, and utility tunnels in urban environments.

Additionally, soft-ground projects often require continuous tunneling, leading to a consistent demand for TBMs. Furthermore, this category also represents the fastest-growing segment due to ongoing urban development initiatives, environmental concerns, and the need to optimise space in crowded cities.

- Road Transport Remains the Largest End-use Sector

The road transport segment dominated the market in 2022 constituting approximately 60% of the market share. This is due to the increasing demand for road infrastructure globally, driven by urbanisation and population growth. Road transport projects require extensive tunneling for highways, bridges, and urban road networks, making TBMs indispensable.

The railway transport category is expected to experience the fastest growth within the forecast time frame, with a growth rate of around 8-10% annually. This rapid growth is due to various governments' initiatives to enhance rail connectivity, reduce traffic congestion, and promote eco-friendly modes of transport.

Investments in high-speed rail networks and metro systems across different regions are fuelling the demand for TBMs in railway transport projects, making it the fastest-growing segment in the market.

Regional Frontrunners

Asia Pacific Expects Gains from Rapidly Improving Transportation Networks

Asia Pacific stood as the largest regional market, capturing 45% share of the global market for tunnel boring machines in 2022. Rapid urbanisation in countries like China, and India propelled the demand for TBMs, primarily for metro and road projects.

Technological advancements and increased infrastructure spending contributed to Asia Pacific's dominance, with a diverse range of projects sustaining the market's growth trajectory.

Additionally, the region's favourable government policies and initiatives aimed at improving transportation networks have further fuelled the demand for TBMs. As a result, Asia Pacific is expected to continue leading the global TBM market in the coming years.

North America Emerges Lucrative as Enhanced Commuter Experience Takes Centre Stage

The surge in North America is fuelled by substantial investments in updating ageing transportation networks, including tunnels for roads, and railways. Market growth in North America is further catalysed by a growing emphasis on sustainable practices and a focus on enhancing commuter experiences.

The region's swift adoption of innovative TBMs and a robust consumer base drove this significant expansion. The transportation sector in North America has experienced significant growth due to the implementation of government initiatives aimed at promoting infrastructure development.

Such initiatives have not only attracted domestic and international players to contribute to the modernisation efforts but have also created a favourable investment environment. As a result, North America has witnessed a surge in construction projects and an increased demand for advanced tunneling technologies.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape, innovation becomes a key differentiator. Automation, AI integration, and eco-friendly designs dominate the competition. Additionally, robust supply chain networks are vital. Manufacturers must ensure seamless access to raw materials and efficient distribution channels.

Collaborations across the supply chain enhance adaptability, ensuring TBMs reach construction sites promptly. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Tunnel Boring Machine Space?

- China Railway Construction Heavy Industry Co. Ltd.

- China Railway Engineering Equipment Group Co. Ltd.

- Dalian Huarui Heavy Industry Group Co. Ltd.

- Herrenknecht AG

- Hitachi Zosen Corporation

- IHI Corporation

- Kawasaki Heavy Industries Ltd.

- Komatsu Ltd.

- Northern Heavy Industries Group Co. Ltd.

- Qinhuangdao TianyeTolian Heavy Industry Co. Ltd.

- Robert Bosch GmbH

- Continental AG

- Panasonic Corporation

- Garmin Ltd

- AkkermanInc

Significant Company Developments

New Product Launches

- September 2022: The world's largest diameter hard rock tunnel boring machine, known as the

- "Hongyi," was collaboratively created by China Railway Equipment Engineering Group and Sinohydro Bureau 14.

- July 2019: HS2 has six tunnel boring machines (TBMs) that have begun construction on a more than 26-mile tunnel beneath London. Launched from the west London location on Victoria Road, the fourth of 10 HS2 tunnel boring machines will travel five miles to Greenpark Way in Greenford before being disassembled and hauled from the ground.

Distribution Agreements

- June 2022: Kawasaki Heavy Industries Ltd. has recently delivered an 84,000 m3 LPG carrier named Crystal Oasis to Kumiai Navigation Pte Ltd.

- April 2021: Elon Musk's The Boring Company raised about US$675 million in 'Series C' funding to scale its underground Loop projects and create a next-generation tunneling device.

An Expert’s Eye

Demand and Future Growth

The tunnel boring machine market is witnessing robust demand fuelled by a global surge in infrastructure projects. The growing need for efficient, safe, and environmentally friendly tunneling solutions, especially in urban areas, is driving this demand. Factors such as rapid urbanisation, population growth, and governmental initiatives for extensive transportation networks are propelling the market forward. Technological advancements, particularly in automation, AI, and sustainable practices, will continue to redefine the industry landscape.

Supply Side of the Market

According to our analysis, the supply side of the market is robust and technologically advanced, driven by a network of manufacturers and suppliers operating globally. Asia Pacific-based manufacturers, especially in countries like China, and Japan, leverage their vast production capabilities to meet the growing demand from the region's extensive infrastructure projects.

These regional nuances reflect a dynamic supply side, with manufacturers strategically positioning themselves to cater to the specific needs of their respective markets while driving innovation in the global TBM industry. This dynamic supply side is also influenced by factors such as government policies and regulations, which can vary across different countries in the Asia Pacific region.

Additionally, the presence of strong research and development capabilities in countries like South Korea further contributes to the innovation and technological advancements in the global TBM industry.

Global Tunnel Boring Machine Market is Segmented as Below:

By Machine Type:

- Slurry TBM

- Earth Pressure Balance Shield TBM

- Shielded TBM

- Multi-mode TBM

- Others

By Geology Type:

- Soft Ground

- Hard Ground

- Heterogeneous Ground

- Variable Ground

By End-use Sector:

- Road Transport

- Railway Transport

- Metro & Transit

- Utilities

- Mining

- Oil & Gas

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Tunnel Boring Machine Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Tunnel Boring Machine Outlook, 2018 - 2031

3.1. Global Tunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

3.1.1. Key Highlights

3.1.1.1. Slurry TBM

3.1.1.2. Earth Pressure Balance Shield TBM

3.1.1.3. Shielded TBM

3.1.1.4. Multi-mode TBM

3.1.1.5. Others

3.2. Global Tunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

3.2.1. Key Highlights

3.2.1.1. Soft Ground

3.2.1.2. Hard Ground

3.2.1.3. Heterogeneous Ground

3.2.1.4. Variable Ground

3.3. Global Tunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

3.3.1. Key Highlights

3.3.1.1. Road Transport

3.3.1.2. Railway Transport

3.3.1.3. Metro & Transit

3.3.1.4. Utilities

3.3.1.5. Mining

3.3.1.6. Oil & Gas

3.3.1.7. Others

3.4. Global Tunnel Boring Machine Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

3.5. Global Tunnel Boring Machine Outlook, by Region, Value (US$ Bn), 2018 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Tunnel Boring Machine Outlook, 2018 - 2031

4.1. North America Tunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

4.1.1. Key Highlights

4.1.1.1. Slurry TBM

4.1.1.2. Earth Pressure Balance Shield TBM

4.1.1.3. Shielded TBM

4.1.1.4. Multi-mode TBM

4.1.1.5. Others

4.2. North America Tunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

4.2.1. Key Highlights

4.2.1.1. Soft Ground

4.2.1.2. Hard Ground

4.2.1.3. Heterogeneous Ground

4.2.1.4. Variable Ground

4.3. North AmericaTunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

4.3.1. Key Highlights

4.3.1.1. Road Transport

4.3.1.2. Railway Transport

4.3.1.3. Metro & Transit

4.3.1.4. Utilities

4.3.1.5. Mining

4.3.1.6. Oil & Gas

4.3.1.7. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Tunnel Boring Machine Outlook, by Country, Value (US$ Bn), 2018 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

4.4.1.2. U.S. Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

4.4.1.3. U.S.Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

4.4.1.4. Canada Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

4.4.1.5. Canada Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

4.4.1.6. Canada Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Tunnel Boring Machine Market Outlook, 2018 - 2031

5.1. Europe Tunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Slurry TBM

5.1.1.2. Earth Pressure Balance Shield TBM

5.1.1.3. Shielded TBM

5.1.1.4. Multi-mode TBM

5.1.1.5. Others

5.2. Europe Tunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Soft Ground

5.2.1.2. Hard Ground

5.2.1.3. Heterogeneous Ground

5.2.1.4. Variable Ground

5.3. EuropeTunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. Road Transport

5.3.1.2. Railway Transport

5.3.1.3. Metro & Transit

5.3.1.4. Utilities

5.3.1.5. Mining

5.3.1.6. Oil & Gas

5.3.1.7. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Tunnel Boring Machine Outlook, by Country, Value (US$ Bn), 2018 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.2. Germany Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.3. Germany Tunnel Boring Machine Market End Use, Value (US$ Bn), 2018 - 2031

5.4.1.4. U.K.Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.5. U.K.Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.6. U.K.Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.1.7. France Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.8. France Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.9. France Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.1.10. ItalyTunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.11. ItalyTunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.12. Italy Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.1.13. Italy Tunnel Boring Machine Market End Use, Value (US$ Bn), 2018 - 2031

5.4.1.14. Turkey Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.15. TurkeyTunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.16. Turkey Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.1.17. Russia Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.18. Russia Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.19. Russia Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.1.20. Rest of Europe Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

5.4.1.21. Rest of Europe Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

5.4.1.22. Rest of Europe Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Tunnel Boring Machine Outlook, 2018 - 2031

6.1. Asia PacificTunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Slurry TBM

6.1.1.2. Earth Pressure Balance Shield TBM

6.1.1.3. Shielded TBM

6.1.1.4. Multi-mode TBM

6.1.1.5. Others

6.2. Asia PacificTunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Soft Ground

6.2.1.2. Hard Ground

6.2.1.3. Heterogeneous Ground

6.2.1.4. Variable Ground

6.3. Asia PacificTunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. Road Transport

6.3.1.2. Railway Transport

6.3.1.3. Metro & Transit

6.3.1.4. Utilities

6.3.1.5. Mining

6.3.1.6. Oil & Gas

6.3.1.7. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Tunnel Boring Machine Outlook, by Country, Value (US$ Bn), 2018 - 2031

6.4.1. Key Highlights

6.4.1.1. China Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.2. China Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.3. China Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.1.4. Japan Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.5. Japan Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.6. Japan Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.1.7. South Korea Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.8. South Korea Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.9. South Korea Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.1.10. India Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.11. India Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.12. India Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.1.13. Southeast Asia Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.14. Southeast Asia Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.15. Southeast Asia Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.1.16. Rest of Asia Pacific Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

6.4.1.17. Rest of Asia Pacific Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

6.4.1.18. Rest of Asia Pacific Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Tunnel Boring Machine Outlook, 2018 - 2031

7.1. Latin AmericaTunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Slurry TBM

7.1.1.2. Earth Pressure Balance Shield TBM

7.1.1.3. Shielded TBM

7.1.1.4. Multi-mode TBM

7.1.1.5. Others

7.2. Latin AmericaTunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Soft Ground

7.2.1.2. Hard Ground

7.2.1.3. Heterogeneous Ground

7.2.1.4. Variable Ground

7.3. Latin AmericaTunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. Road Transport

7.3.1.2. Railway Transport

7.3.1.3. Metro & Transit

7.3.1.4. Utilities

7.3.1.5. Mining

7.3.1.6. Oil & Gas

7.3.1.7. Others

7.4. Latin AmericaTunnel Boring Machine Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

7.4.1. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Tunnel Boring Machine Outlook, by Country, Value (US$ Bn), 2018 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

7.5.1.2. Brazil Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

7.5.1.3. Brazil Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

7.5.1.4. Mexico Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

7.5.1.5. Mexico Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

7.5.1.6. Mexico Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

7.5.1.7. Argentina Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

7.5.1.8. Argentina Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

7.5.1.9. Argentina Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

7.5.1.10. Rest of Latin America Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

7.5.1.11. Rest of Latin America Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

7.5.1.12. Rest of Latin America Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & AfricaTunnel Boring Machine Outlook, 2018 - 2031

8.1. Middle East & AfricaTunnel Boring Machine Outlook, by Machine Type, Value (US$ Bn), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Slurry TBM

8.1.1.2. Earth Pressure Balance Shield TBM

8.1.1.3. Shielded TBM

8.1.1.4. Multi-mode TBM

8.1.1.5. Others

8.2. Middle East & Africa Tunnel Boring Machine Outlook, by Geology Type, Value (US$ Bn), 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Soft Ground

8.2.1.2. Hard Ground

8.2.1.3. Heterogeneous Ground

8.2.1.4. Variable Ground

8.3. Middle East & Africa Tunnel Boring Machine Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. Road Transport

8.3.1.2. Railway Transport

8.3.1.3. Metro & Transit

8.3.1.4. Utilities

8.3.1.5. Mining

8.3.1.6. Oil & Gas

8.3.1.7. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & AfricaTunnel Boring Machine Outlook, by Country, Value (US$ Bn), 2018 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

8.4.1.2. GCC Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

8.4.1.3. GCC Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

8.4.1.4. South AfricaTunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

8.4.1.5. South AfricaTunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

8.4.1.6. South Africa Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

8.4.1.7. Egypt Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

8.4.1.8. Egypt Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

8.4.1.9. Egypt Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

8.4.1.10. Nigeria Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

8.4.1.11. Nigeria Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

8.4.1.12. Nigeria Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

8.4.1.13. Rest of Middle East & Africa Tunnel Boring Machine by Machine Type, Value (US$ Bn), 2018 - 2031

8.4.1.14. Rest of Middle East & Africa Tunnel Boring Machine Geology Type, Value (US$ Bn), 2018 - 2031

8.4.1.15. Rest of Middle East & Africa Tunnel Boring Machine Market End-use Sector, Value (US$ Bn), 2018 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use SectorvsApplicationHeatmap

9.2. Manufacturer vsApplicationHeatmap

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. AkkermanInc

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. China Railway Construction Heavy Industry Co. Ltd

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. China Railway Engineering Equipment Group Co. Ltd

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Dalian Huarui Heavy Industry Group Co. Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Herrenknecht AG.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Hitachi Zosen Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. IHI CORPORATION

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Kawasaki Heavy Industries Ltd

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Komatsu Ltd

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Northern Heavy Industries Group Co. Ltd

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Qinhuangdao TianyeTolian Heavy Industry Co. Ltd

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Robert Bosch GmbH

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Continental AG

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. China Railway Construction Heavy Industry Co. Ltd

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. PANASONIC CORPORATION.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Machine Coverage |

|

|

Geology Coverage |

|

|

End-use Sector Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |