Global Welding Consumables Market Forecast

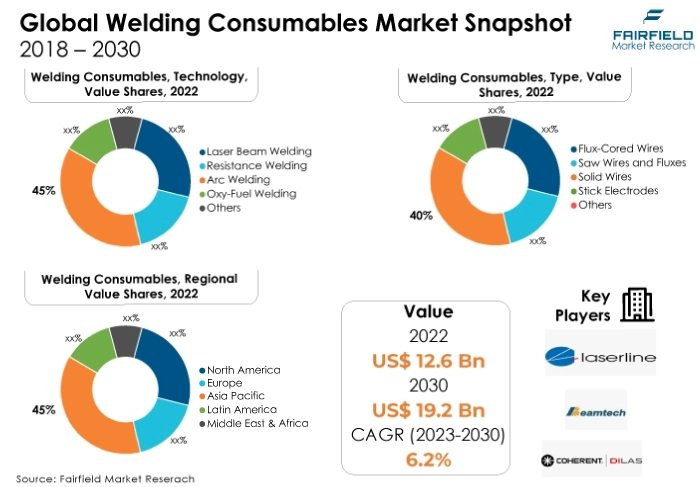

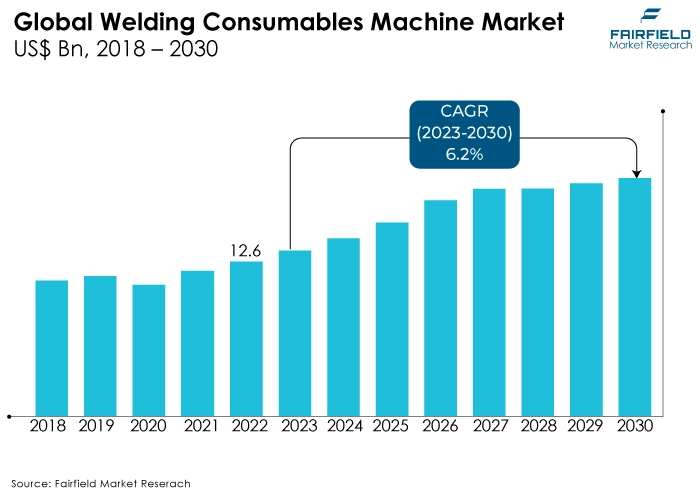

- Welding consumables market size poised to reach US$19.2 Bn in 2030, up from US$12.6 Bn attained in 2022

- Global market for welding consumables projected to see a CAGR of 6.2% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the welding consumables market growth is growing demand from construction and automotive industries, coupled with technological advancements, propels the welding consumables market.

- Rising infrastructure projects, especially in developing economies, and the expanding aerospace industry offer lucrative opportunities for welding consumables.

- Innovations in welding technologies, such as automation, robotics, and the development of advanced materials, have significantly improved the efficiency, precision, and quality of welding processes.

- In 2022, arc welding dominates due to its versatility and applicability across various materials and industries, followed closely by resistance welding, indicating a strong market hold.

- In terms of market share for Welding Consumables globally, laser beam welding showcases rapid growth, driven by its precision and applications in high-tech industries, indicating a shifting market trend.

- In 2022, flux-cored wires are experiencing exponential growth due to their enhanced efficiency and ability to weld in challenging conditions, making them the fastest-growing welding consumable type.

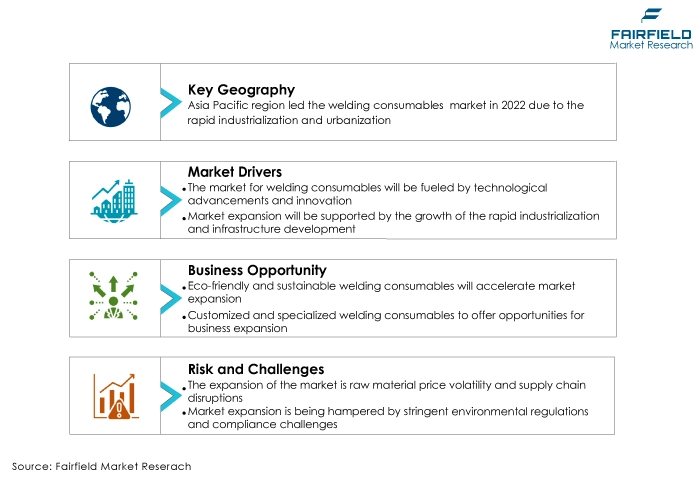

- Asia Pacific emerges as the dominant market, fueled by rapid industrialisation, increased construction activities, and the booming automotive sector, establishing it as a stronghold for welding consumables.

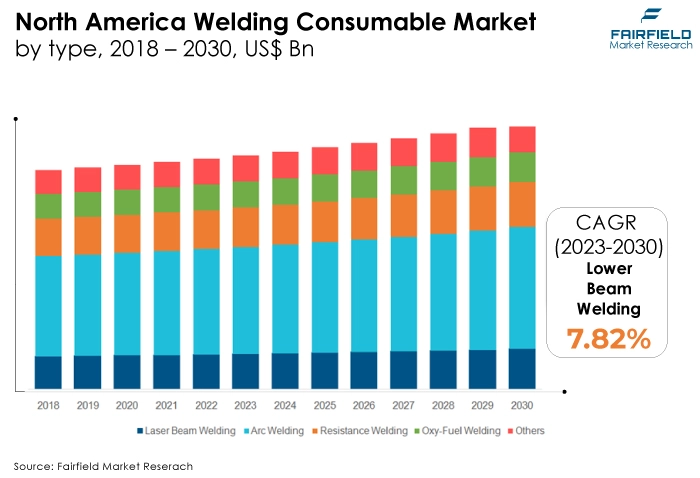

- North America takes the lead as the fastest-growing region, driven by heavy industrialisation, infrastructural developments, and the presence of key market players, signifying a significant shift in the global market focus.

A Look Back and a Look Forward - Comparative Analysis

The welding consumables market is witnessing robust growth due to the increasing demand from key industries such as construction, automotive, and manufacturing. Rapid urbanisation, infrastructural developments, and a surge in industrial activities are driving the need for welding consumables globally. Moreover, the market is benefiting from technological advancements, including the development of innovative welding techniques and materials, enhancing the overall efficiency and effectiveness of welding processes.

The market witnessed staggered growth during the historical period 2018 – 2022. The industry saw a rise in research and development activities, leading to the introduction of innovative consumables with superior strength and durability. The period witnessed increased demand in emerging economies due to rapid industrialisation and infrastructure projects. Furthermore, manufacturers focused on developing specialised consumables to cater to diverse applications, fostering market stability and expansion.

The welding consumables market is poised for continued growth. Anticipated to be driven by the global shift towards renewable energy sources and the ongoing trend of automation in manufacturing, the market will experience heightened demand for high-performance consumables. Additionally, the rise in electric vehicle production and advancements in aerospace technologies will further boost the market. Eco-friendly welding consumables and the integration of IoT technology for real-time monitoring and quality control are expected to shape the future landscape, ensuring sustainable growth in the welding consumables market.

Key Growth Determinants

- Technological Advancements Driving Innovation

Technological advancements stand as a pivotal driver in the welding consumables market. Continuous innovation in welding technologies, such as the development of advanced materials and techniques, has significantly enhanced the efficiency, precision, and safety of welding processes. The integration of automation, robotics, and Artificial Intelligence (AI) in welding systems has streamlined operations, reducing human error and increasing productivity.

Furthermore, the introduction of smart welding consumables equipped with sensors and IoT capabilities allows real-time monitoring of weld quality, ensuring adherence to stringent industry standards.As industries increasingly adopt these cutting-edge solutions, the demand for technologically advanced welding consumables is poised to grow, fueling market expansion in the coming years.

- Pacing Infrastructural Development

The global focus on infrastructural development and rapid urbanisation is a key driver propelling the welding consumables market. As countries invest significantly in building bridges, highways, railways, and commercial and residential spaces, the demand for welding consumables, particularly in construction and infrastructure projects, experiences a substantial upswing.

Welding is essential in the fabrication and assembly of structural components, making it a critical process in the construction sector. Additionally, urbanisation leads to increased demand for automobiles, requiring welding in both manufacturing and repair processes.

- Growing Emphasis on Sustainable Practices

The growing emphasis on sustainability and environmentally friendly practices is reshaping the welding consumables market. Environmental regulations and concerns about the ecological impact of welding processes have led to the development of eco-friendly welding consumables.

Manufacturers are investing in research and development to create consumables with reduced emissions, minimal hazardous by-products, and lower energy consumption. These green alternatives not only comply with stringent environmental standards but also appeal to eco-conscious industries and consumers.

As sustainability becomes a central focus for businesses worldwide, the demand for these eco-friendly welding consumables is on the rise, driving market growth and encouraging further innovation in the sector.

Major Growth Barriers

- High Raw Material Costs, and Price Volatility

The welding consumables market faces a significant restraint in the form of high raw material costs and price volatility. Fluctuations in the prices of metals, fluxes, and gases, essential components of welding consumables, directly impact manufacturing costs.

Economic uncertainties and geopolitical factors often lead to abrupt changes in these raw material prices, challenging the market players to maintain stable pricing for their products. Consequently, this volatility can impact profit margins, limiting the market's overall growth potential.

- Stringent Regulatory Compliance

Stringent regulatory compliance and adherence to industry standards pose a considerable challenge for the welding consumables market. Welding processes generate emissions and by-products that are subject to strict environmental regulations. Meeting these regulations requires significant investments in research and development to develop eco-friendly consumables.

Additionally, varying standards across different regions and industries necessitate continuous adjustments and certifications, adding complexity and costs to manufacturers. Complying with these standards is crucial, but it also acts as a restraint, constraining market players and potentially affecting their competitiveness.

Key Trends and Opportunities to Look at

- Rapid Adoption of Automation and Robotics

The welding consumables market witnesses a growing trend in the adoption of automation and robotics. Industries globally are integrating robotic welding systems for higher precision and efficiency. This trend is particularly popular in North America, and Europe, with companies like Lincoln Electric and ESAB investing in robotic technology.

Brands are likely to leverage this trend by offering compatible consumables and specialised training, capitalizing on the demand for robotic welding solutions.

- Focus on Environmentally Friendly Consumables

The shift towards environmentally friendly welding consumables is on the rise. With stringent environmental regulations worldwide, there's a growing demand for low-emission and eco-friendly consumables. This trend is prominent in developed regions like Europe, and Asia Pacific.

Companies like ITW Welding, and voestalpine Böhler Welding are developing green consumables. Brands will focus on sustainable products, catering to environmentally conscious consumers and complying with regulations.

- Digitalisation, and IoT Integration

Digitalisation and IoT integration are transforming the welding consumables market. Smart welding consumables embedded with sensors and IoT capabilities enable real-time monitoring and data analysis. This trend is gaining momentum globally, especially in industries like aerospace and automotive.

Companies like Fronius International, and Kemppi are leading in IoT-enabled welding solutions. Brands are likely to leverage this trend by investing in research for advanced IoT integration, offering predictive maintenance services, and enhancing customer experiences through data-driven insights.

How Does the Regulatory Scenario Shape this Industry?

The welding consumables market is significantly influenced by regulatory frameworks and guidelines that vary across regions and countries. Standards for workplace safety, particularly those pertaining to welding fumes and emissions, are developed by regulatory organisations such as the European Committee for Standardisation (CEN) in Europe, and the Occupational Safety and Health Administration (OSHA) in the United States.

The permissible exposure limits (PELs) set by OSHA for welding fumes, for example, have an effect on consumable selection and production procedures. Furthermore, environmental laws are very important. Organisations like the European Chemicals Agency (ECHA) in Europe and the Environmental Protection Agency (EPA) in the United States control emissions and the disposal of welding byproducts.

Region-specific changes further shape the industry; for example, the RoHS (Restriction of Hazardous Substances) directive in Europe restricts the use of certain hazardous materials in electronic products, influencing the choice of welding consumables in the manufacturing of electronics.

Fairfield’s Ranking Board

Top Segments

- Arc Welding Category Continues to Dominate over Laser Beam Welding Segments

Arc welding holds the dominant position in the Welding Consumables Market in 2022, commanding a substantial 45% market share. Its versatility across industries, including automotive, construction, and shipbuilding, solidifies its status as the preferred choice.

Continuous advancements in consumable materials and equipment have further propelled its market stronghold, making it a go-to method for a wide range of welding applications globally.

Furthermore, the fastest-growing category, Laser Beam Welding, holds approximately 15% of the market share and experiences a remarkable annual growth rate of approximately 8%. This growth is fueled by the demand for high-precision welding in industries such as aerospace, electronics, and medical devices.

Laser Beam Welding's unparalleled accuracy and efficiency make it ideal for intricate and delicate welding tasks, contributing to its significant market share and continuous growth in the welding consumables market.

- Solid Wires to Surge Ahead Through 2030

In 2022, solid wires dominate the welding consumables market, accounting for a substantial 40% market share. Their popularity stems from their ease of use, versatility across applications, and consistent welding performance. Industries such as automotive, construction, and manufacturing widely employ solid wires due to their reliability and straightforward welding process.

Continuous innovations and improvements in their composition have reinforced their dominance, making them the preferred choice for many welding professionals. Flux-cored wires represent the fastest-growing category in the welding consumables market, commanding approximately 10% of the market share with a notable annual growth rate of 6%.

The demand for flux-cored wires is surging due to their suitability for heavy-duty welding tasks and their ability to provide high-quality welds even in challenging environments. Industries like shipbuilding, oil and gas, and heavy machinery manufacturing are increasingly adopting flux-cored wires for their superior performance and efficiency.

Regional Outlook

Asia Pacific Tops with Unprecedented Infratsructural Growth

Asia Pacific remains the largest revenue contributing region in the global welding consumables market due to its robust industrial growth, particularly in countries like China, Japan, India, and South Korea.

The region's dominance is attributed to the flourishing manufacturing sectors, rapid urbanisation, and extensive infrastructural developments. With manufacturing hubs for automotive, electronics, construction, and shipbuilding, the demand for welding consumables in Asia Pacific is consistently high.

Additionally, the region's large-scale construction projects, especially in emerging economies, further drive the need for welding consumables. Asia Pacific's market share in the global welding consumables market stands at approximately 45%, emphasizing its significant contribution to the industry's overall revenue.

North America to Maintain 25% Share Through

North America is poised to witness significant growth in sales during the forecast period due to several factors. One major reason is the region's technological advancements and innovation in welding processes and consumables. The presence of a highly developed industrial sector, particularly in the US, and Canada, fuels the demand for high-quality welding consumables. Additionally, the growing emphasis on automation, precision welding, and eco-friendly consumables in industries such as automotive, aerospace, and energy further boosts the market in North America.

Moreover, the region's focus on infrastructure development, including commercial and residential construction projects, contributes to the increased demand for welding consumables. The adoption of advanced welding technologies and materials in the construction industry enhances the overall market growth. North America's market share in the global welding consumables market is approximately 25%, indicating its substantial impact on the industry's sales and revenue during the forecast period.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape, differentiation through product innovation and quality becomes pivotal. Manufacturers are investing heavily in research and development to create cutting-edge welding consumables that offer superior performance and durability.

Additionally, companies are leveraging data analytics, and IoT technology to enhance their products. Smart welding consumables embedded with sensors offer real-time monitoring capabilities, enabling businesses to optimise welding processes and improve efficiency. Brand reputation and customer service also play a significant role.

Who are the Leaders in Global Welding Consumables Space?

- Bavaria Schweisstechnik Gmbh

- Carboweld Schweissmaterialien Gmbh

- Colfax Corporation

- Corodur Verschleiss-Schutz Gmbh

- Daiko Welding Consumables

- Dim Schweissmaterial Manfred Schuermann

- Drahpo Gmbh

- Drahtwerk Elisental W. Erdmann Gmbh & Co.

- Durum Verschleissschutz Gmbh

- Elbor Spa

- Fidat Srl

- Fronius International Gmbh

- Gedik Welding

- Hermann Fliess & Co. Gmbh

- Voestalpine Ag

Significant Company Developments

New Product Launch

- February 2023: Miller Electric Mfg. LLC, which is considered as one of the prominent manufacturers of welding equipment and consumable products, has recently unveiled its Copilot collaborative welding system. This system will enable welders to achieve better quality of welding and optimise the use of consumables enabling the users to meet with augmented demand.

- February 2022: Miller Electric Mfg., which offers arc welding equipment under its brand name Miller, has recently announced that the company is venturing into a collaboration with NCCER (National Center for Construction Education & Research). The collaboration efforts will provide NCCER welding level 1 and 2 to integrate its augmented reality welding system.

- May 2022: Lincoln Electric, which is engaged in development, manufacturing, and supply of welding equipment and consumables across diverse geographies, has increased diversity in its existing product portfolio by offering hyperfill solutions into its Flux-Cored wire applications.

Distribution Agreement

- Oct 2021: The EM 210 MIG/Flux Cored welder and the EMP 210 MIG/Stick/TIG welder are new offerings from ESAB Welding and Cutting Products. Although these inverter-based power sources are compact, they provide professional-caliber power and performance for the majority of vehicle and truck maintenance, light fabrication and construction, and HVAC operations.

- August 2020:New Europian Union welding regulations that come into effect from 1 January 2021 set out ecodesign requirements for welding equipment. The definition of welding equipment includes products that are used for manual, automated or semi-automated welding, brazing, soldering or cutting.

An Expert’s Eye

Demand and Future Growth

The market is set to be driven by a growing demand for precision and efficiency across various industries. Industries like automotive, aerospace, and electronics are increasingly relying on advanced welding technologies to ensure superior quality and reliability. This demand, coupled with the expanding construction and infrastructure projects worldwide, will continue to fuel the market's growth in the long term. Moreover, the global push towards sustainable practices is steering the market towards eco-friendly welding consumables.

Supply Side of the Market

According to our analysis, the welding consumables market faces a dual challenge, ensuring a stable supply of raw materials and optimizing production processes for efficiency. Raw materials like metals, fluxes, and gases are the lifeblood of the industry.

Sudden disruptions in supply chains, whether due to geopolitical tensions or environmental factors, can significantly impact production. Companies are thus investing in diversified sourcing strategies and building strategic reserves to mitigate such risks.

Furthermore, advancements in sustainable sourcing, such as recycled metals and eco-friendly fluxes, are becoming increasingly prominent. Integrating these materials into the supply chain not only ensures a stable supply but also aligns with environmental goals, meeting the growing demand for eco-conscious products.

Global Welding Consumables Market is Segmented as Below:

By Technology:

- Resistance Welding

- Laser Beam Welding

- Arc Welding

- Oxy-Fuel Welding

- Others

By Type:

- Solid Wires

- Saw Wires and Fluxes

- Stick Electrodes

- Flux-Cored Wires

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Welding Consumables Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Welding Consumables Market Outlook, 2018 - 2030

3.1. Global Welding Consumables Market Outlook, by Technology ,Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Resistance Welding

3.1.1.2. Laser Beam Welding

3.1.1.3. Arc Welding

3.1.1.4. Oxy-Fuel Welding

3.1.1.5. Others

3.2. Global Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Solid Wires

3.2.1.2. Saw Wires and Fluxes

3.2.1.3. Stick Electrodes,

3.2.1.4. Flux-Cored Wires

3.2.1.5. Others

3.3. Global Welding Consumables Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Welding Consumables Market Outlook, 2018 - 2030

4.1. North America Welding Consumables Market Outlook, by Technology , Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Resistance Welding

4.1.1.2. Laser Beam Welding

4.1.1.3. Arc Welding

4.1.1.4. Oxy-Fuel Welding

4.1.1.5. Others

4.2. North America Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Solid Wires

4.2.1.2. Saw Wires and Fluxes

4.2.1.3. Stick Electrodes

4.2.1.4. Flux-Cored Wires

4.2.1.5. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Welding Consumables Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Welding Consumables Market Outlook, 2018 - 2030

5.1. Europe Welding Consumables Market Outlook, by Technology , Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Resistance Welding

5.1.1.2. Laser Beam Welding

5.1.1.3. Arc Welding

5.1.1.4. Oxy-Fuel Welding

5.1.1.5. Others

5.2. Europe Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Solid Wires

5.2.1.2. Saw Wires and Fluxes

5.2.1.3. Stick Electrodes

5.2.1.4. Flux-Cored Wires

5.2.1.5. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Welding Consumables Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.5. France Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.6. France Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Welding Consumables Market Outlook, 2018 - 2030

6.1. Asia Pacific Welding Consumables Market Outlook, by Technology , Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Resistance Welding

6.1.1.2. Laser Beam Welding

6.1.1.3. Arc Welding

6.1.1.4. Oxy-Fuel Welding

6.1.1.5. Others

6.2. Asia Pacific Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Solid Wires

6.2.1.2. Saw Wires and Fluxes

6.2.1.3. Stick Electrodes

6.2.1.4. Flux-Cored Wires

6.2.1.5. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Welding Consumables Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.2. China Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.1.7. South Korea Welding Consumables Market Capacity, Value (US$ Mn), 2018 - 2030

6.3.1.8. South Korea Welding Consumables Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.9. India Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.10. India Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.1.11. Southeast Asia Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.12. Southeast Asia Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.1.13. Rest of Asia Pacific Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

6.3.1.14. Rest of Asia Pacific Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Welding Consumables Market Outlook, 2018 - 2030

7.1. Latin America Welding Consumables Market Outlook, by Technology , Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Resistance Welding

7.1.1.2. Laser Beam Welding

7.1.1.3. Arc Welding

7.1.1.4. Oxy-Fuel Welding

7.1.1.5. Others

7.2. Latin America Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Solid Wires

7.2.1.2. Saw Wires and Fluxes

7.2.1.3. Stick Electrodes

7.2.1.4. Flux-Cored Wires

7.2.1.5. Others

7.2.2. Analysis

7.3. Latin America Welding Consumables Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Welding Consumables Market Outlook, 2018 - 2030

8.1. Middle East & Africa Welding Consumables Market Outlook, by Technology , Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Resistance Welding

8.1.1.2. Laser Beam Welding

8.1.1.3. Arc Welding

8.1.1.4. Oxy-Fuel Welding

8.1.1.5. Others

8.2. Middle East & Africa Welding Consumables Market Outlook, by Type , Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Solid Wires

8.2.1.2. Saw Wires and Fluxes

8.2.1.3. Stick Electrodes

8.2.1.4. Flux-Cored Wires

8.2.1.5. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Welding Consumables Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Welding Consumables Market by Technology , Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Welding Consumables Market Type , Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vsApplication Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Fronius International Gmbh

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Carboweld Schweissmaterialien Gmbh

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Colfax Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Voestalpine Ag

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Corodur Verschleiss-Schutz Gmbh

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. DAIKO WELDING CONSUMABLES

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Dim Schweissmaterial Manfred Schuermann

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Drahpo Gmbh

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Drahtwerk Elisental W. Erdmann Gmbh & Co.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Durum Verschleissschutz Gmbh

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Elbor Spa

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Fidat Srl

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Fronius International Gmbh

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. GEDIK WELDING

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Hermann Fliess & Co. Gmbh

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |