Global Aqua Gym Equipment Market Growth and Industry Forecast

Executive Summary & Key Highlights

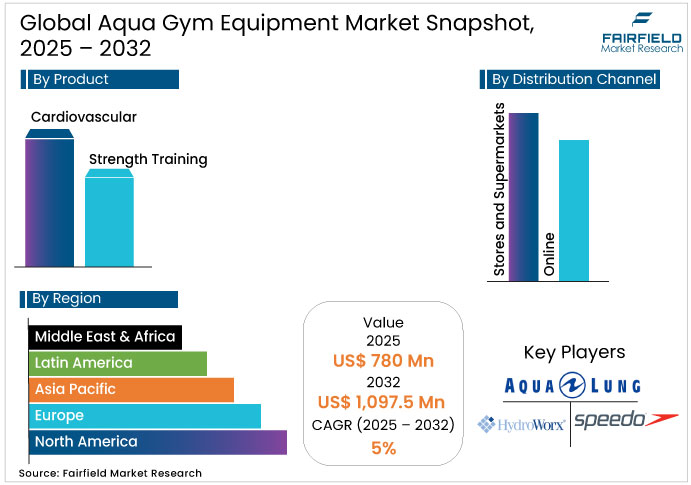

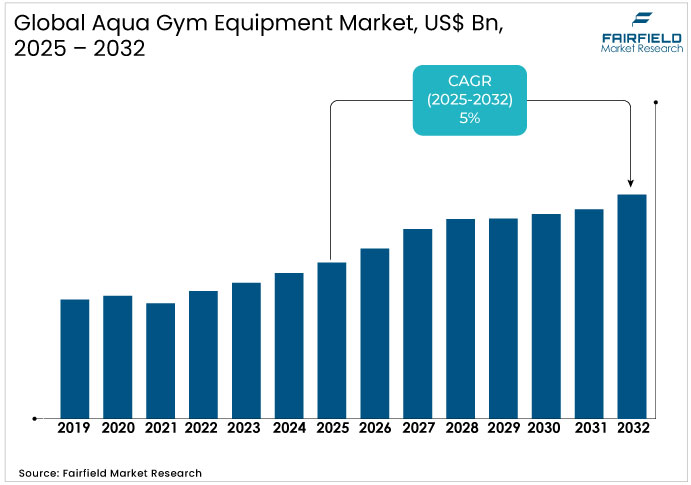

- The global aqua gym equipment market valued at approximately US$ 780 million in 2025 is projected to reach US$ 1,097.5 million by 2032, representing a CAGR of 5%, reflecting sustained expansion driven by demographic shifts and therapeutic adoption patterns.

- Cardiovascular equipment leads the market with around 60% share, driven by strong adoption of aqua bikes and underwater treadmills in fitness and rehabilitation facilities.

- Specialty Stores remain the dominant distribution channel with about 65% share, supported by expert guidance and strong institutional purchasing.

- Online channels, with around 20–25% share, are expanding fastest as consumers increasingly prefer digital purchasing and home-based aqua fitness solutions.

- Health consciousness continues to drive market growth as aquatic training delivers measurable improvements in endurance, strength, and flexibility across user groups.

- Asia Pacific is the fastest-growing region, led by China contributing about 35–40% of regional share and India emerging as the strongest growth engine.

- North America remains the largest market, contributing approximately 40% share supported by mature aquatic therapy infrastructure and high institutional adoption.

Market Dynamics: Drivers, Restraints, and Opportunities Analysis

Market Drivers

- Health Consciousness and Preventative Wellness Paradigm Shifts

Rising consumer awareness of aquatic exercise benefits is a major driver for the Aqua Gym Equipment Market. Industry data shows that 12 weeks of aquatic training improves cardiovascular endurance, muscular strength, and flexibility, while offering safer options for injury-prone users than land-based exercise. Social media trends and influencer-driven fitness culture have further boosted adoption, with boutique aqua cycling and aquatic fitness studios expanding in major cities.

Government wellness initiatives are increasingly incorporating aquatic exercise into public health programs, encouraging facility upgrades and higher participation. This trend drives both household demand for aqua gym equipment and institutional procurement by gyms, community centers, and corporate wellness programs. The longevity of this driver depends on ongoing clinical validation, sustained digital visibility, and the integration of aquatic fitness into mainstream wellness culture.

- Technological Innovation and Smart Equipment Integration

Advances in equipment design featuring digital connectivity, real-time performance monitoring, and personalized analytics are reshaping aqua gym equipment market competition. Smart aqua gym systems with app integration, resistance sensors, and biometric tracking are attracting tech-driven consumers, while AI-based workout programming aligns aquatic fitness with broader digital fitness ecosystems and virtual coaching trends. This innovation lowers entry barriers and enables strong differentiation for established brands.

Growth is fueled by expanded use cases across home fitness, boutique studios, and clinical environments supported by remote health monitoring. Adoption is strongest in North America and Europe due to advanced digital infrastructure, with rapid uptake also visible in urban China and India. Manufacturers prioritizing proprietary software, app compatibility, and data-driven capabilities are well-positioned to capture premium segments.

Market Restraints

- High Equipment Investment Costs and Infrastructure Dependency

High capital requirements for both consumer adoption and commercial facility setup act as major restraints in the Aqua Gym Equipment Market. Commercial-grade aqua equipment priced at US$ 5,000–50,000+ per unit raises inventory costs, while reliance on specialized aquatic facilities with proper treatment, temperature control, and safety systems limits accessibility in developing regions. These barriers significantly hinder penetration, especially in price-sensitive markets.

This challenge is particularly strong in emerging Asia-Pacific regions and lower-income consumer segments, reducing annual market growth by an estimated 2–3 percentage points. Mitigation opportunities include portable, space-efficient designs, financing models that reduce upfront burdens, and innovations enabling use in community centers, schools, and other locations with basic aquatic infrastructure.

- Material Degradation and Maintenance Requirements

Prolonged exposure to chlorinated and saltwater environments creates corrosion and material-degradation challenges, raising maintenance demands and total ownership costs. This increases replacement cycles for home users and intensifies competitive pressure for institutional buyers needing durable, long-life equipment. Regulatory safety and corrosion-resistance standards further elevate manufacturing complexity and production costs.

Mitigation involves adopting marine-grade materials, protective coatings, and structured preventative maintenance programs, supported by warranties for faster replacement. This restraint shows minimal geographic variation, impacting manufacturers and customers uniformly across all operating regions.

Market Opportunities

- Portable and Home-Based Aqua Fitness Equipment Expansion

Portable aqua gym equipment presents strong growth potential as home-based fitness trends accelerate post-pandemic. Products such as resistance bands, adjustable dumbbells, and floating fitness mats expand participation without specialized facilities. Home fitness markets are growing at a sustainable CAGR, with aquatic segments matching or exceeding this rate.

This opportunity is driven by residential users with private or community pool access, forming a larger base than institutional facilities. Success requires affordable, compact designs, digital workout content, and integration with major fitness apps and wearables. The strongest potential lies in North America and Europe, with rising demand in affluent Asia-Pacific aqua gym equipment markets such as urban China and India.

- Emerging Market Expansion in Asia-Pacific and Rising Disposable Income

Rapidly growing middle-class populations in China, India, and ASEAN markets, combined with rising disposable incomes and health consciousness, create strong expansion potential. Asia-Pacific is expected to strengthen its global position by the end of the forecast period, with India and China contributing a significant portion of worldwide physical activity industry expansion. Urbanization, fitness facility expansion, and higher healthcare spending further accelerate adoption.

India is witnessing fast growth in water-aerobics facilities driven by corporate wellness programs and private studio expansion. Success in this opportunity requires localized, price-sensitive products, solutions suited to infrastructure constraints, and partnerships with fitness operators and healthcare providers. Key barriers include infrastructure gaps, varying regulatory frameworks, and the need for tailored marketing and distribution across China, India, and ASEAN countries such as Vietnam, Thailand, and Indonesia.

Regional Market Assessment: Strategic Geography Analysis

- North America: Market Maturity and Therapeutic Leadership

North America accounts for about 40% of global aqua gym equipment market value, with an estimated US$ 320 million in 2025 led by the mature U.S. market. Strong consumer awareness, robust distribution networks, and widespread adoption in community centers, gyms, and aqua studios support regional dominance. Demand is further driven by aging populations and healthcare integration, including growing insurance coverage for aquatic therapy.

The region’s stringent safety standards from the CPSC and ANSI create entry barriers while its innovation ecosystem continues advancing product development. Strategic considerations include premium pricing acceptance, strong institutional procurement, and high home-based adoption potential. Growth remains modest at a sustainable CAGR due to market saturation, though premium and therapeutic segments continue to attract investment.

- Europe: Regulatory Harmonization and Sustainability Emphasis

Europe is projected to reach approximately US$ 384 million by 2032, with Germany contributing about 20–25% and the U.K. around 15–20% of regional market value. Germany benefits from a strong spa and wellness culture, high therapeutic investment, and advanced manufacturing, while the U.K. emphasizes rehabilitation and aging-population wellness programs. EU regulatory frameworks, including CEN standards, impose strict safety and sustainability requirements that favor manufacturers with strong compliance capabilities.

Environmental directives are reshaping competition by encouraging eco-friendly materials and energy-efficient production, aligning with Europe’s preference for durable, sustainable premium products. Aqua gym equipment market growth at a robust CAGR is supported by aging population health needs, well-developed institutional procurement channels, and rising sustainability-driven innovation. Strategic success requires country-specific regulatory alignment, strong distribution partnerships, and sustainability-focused differentiation.

- Asia-Pacific: Rapid Expansion and Emerging Market Dynamics

Asia-Pacific is the fastest-growing region, expanding 150–200 basis points above global growth and projected to exceed US$ 275 million by 2032. China leads with about 35–40% of regional value, driven by rapid fitness facility expansion, rising middle-class health awareness, and growth in premium aquatic studios. India is the region’s fastest-growing aqua gym equipment market, supported by expanding water-aerobics facilities, increasing fitness culture, and wider use of aquatic therapy in rehabilitation centers.

ASEAN countries such as Vietnam, Thailand, and Indonesia show emerging potential driven by tourism-related projects and rising health consciousness, while Japan reflects mature, slower-growth characteristics. Strong regional manufacturing capabilities are reshaping global competitiveness by enabling cost-efficient offerings for price-sensitive markets. Asia-Pacific is expected to grow at a sustainable CAGR through 2032, highlighting significant demographic and economic momentum across diverse national markets.

Segmentation Analysis: Category-Wise Strategic Assessment

- Product Segment Analysis: Cardiovascular vs. Strength Training Equipment

Cardiovascular aqua gym equipment holds about 60% of global aqua gym equipment market value in 2025, valued at approximately US$ 468 million. This segment includes aqua bikes, underwater treadmills, steppers, and ellipticals, supported by strong demand from fitness centers, rehabilitation facilities, and aging populations. Competitive positioning is shaped by digital tracking, adjustable resistance, durability, and user-interface design, with leaders such as HydroWorx International and Aqua Lung International dominating institutional procurement.

Strength training equipment accounts for roughly 40% of the aqua gym equipment market and is expanding faster, growing 100–150 basis points above cardiovascular equipment. This segment, comprising aquatic dumbbells, barbells, belts, and specialized resistance tools, is set for steady expansion throughout the forecast period. Growth is driven by athlete rehabilitation, advanced training methods, and studio adoption, with success hinging on adjustable resistance systems, digital performance integration, and competitive pricing across facility types.

- Distribution Channel Analysis: Specialty Stores and Emerging Online Channels

Specialty stores hold about 65% of aqua gym equipment market value, driven by their expert-led environments that offer personalized guidance, product demonstrations, and strong after-sales service. Their dominance is reinforced by trust from institutional buyers such as fitness centers and rehabilitation facilities. Strategic needs include exclusive product lines, retailer training, and strong partner relationships, though challenges persist in inventory complexity, margin pressure, and limited rural reach.

Online channels represent a steadily expanding share of the industry, supported by strong momentum in e-commerce-driven fitness purchases and rising digital engagement across consumer segments. They attract home users with broad product selection, pricing transparency, and convenient delivery, though institutional adoption remains low. Key opportunities include virtual demos, digital coaching integration, and improved logistics, while challenges involve managing returns and competing with specialty retailers for commercial buyers.

Competitive Landscape: Market Structure and Strategic Positioning

The global aqua gym equipment market is moderately fragmented, with multinational players such as Speedo International Limited, AquaJogger, HydroWorx International, BECO-Beermann GmbH & Co. KG, and Aqua Lung International competing alongside regional Chinese and Indian manufacturers. Larger companies benefit from economies of scale, strong brand recognition, and established distribution networks, while regional firms gain share through cost-competitive products for price-sensitive markets.

Competitive differentiation is driven by smart technology integration, therapeutic application development, niche equipment design, and vertical integration enabling direct digital channels. Entry barriers include safety certification requirements, capital-intensive manufacturing and distribution needs, intellectual property protection, and brand credibility for institutional procurement. Market consolidation remains limited, offering opportunities for specialized competitors in niche segments.

Key Players

- Aqua Lung International

- Speedo International Ltd.

- HydroWorx International, Inc.

- Acquapole S.a.S.

- BECO-Beermann GmbH & Co. KG

- AquaJogger

- Sprint Aquatics

- HYDRO-FIT, Inc.

- Aqua Sphere

- Aqualogix Fitness

- Fluid Running

- Theraquatics

- Aqua Gear Inc.

- N-Fox Sport

- WaterGym LLC

Recent Developments

- In July 2025, HEAD has won the bid to acquire the troubled AQUALUNG Group, securing its continuation with a restructuring plan and over €50 million in rescue funding. The acquisition expands HEAD’s Water Sports portfolio and strengthens its global manufacturing footprint in France, the U.K., and Mexico. The combined group now becomes a leading force in the global Water Sports market, backed by innovation, technical excellence, and strong brand synergies.

- In June 2024, HydroWorx highlights its leadership in aquatic therapy technology, offering advanced underwater treadmills, resistance jets, freestanding units, and customizable therapy pools designed for fast rehabilitation and superior patient outcomes. The company provides versatile hydrotherapy solutions for sports, healthcare, veterinary, and wellness industries. Its state-of-the-art systems leverage water’s therapeutic benefits to improve mobility, strength, flexibility, and recovery efficiency.

Global Aqua Gym Equipment Market Segmentation-

By Product

- Cardiovascular

- Strength Training

By Distribution Channel

- Stores and Supermarkets

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Aqua Gym Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Aqua Gym Equipment Market Outlook, 2019 - 2032

3.1. Global Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

3.1.1. Cardiovascular

3.1.2. Strength Training

3.2. Global Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

3.2.1. Stores and Supermarkets

3.2.2. Online

3.3. Global Aqua Gym Equipment Market Outlook, by Region, Value (US$ Mn), 2019-2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Aqua Gym Equipment Market Outlook, 2019 - 2032

4.1. North America Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

4.1.1. Cardiovascular

4.1.2. Strength Training

4.2. North America Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

4.2.1. Stores and Supermarkets

4.2.2. Online

4.3. North America Aqua Gym Equipment Market Outlook, by Country, Value (US$ Mn), 2019-2032

4.3.1. U.S. Aqua Gym Equipment Market Outlook, by Product, 2019-2032

4.3.2. U.S. Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

4.3.3. Canada Aqua Gym Equipment Market Outlook, by Product, 2019-2032

4.3.4. Canada Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Aqua Gym Equipment Market Outlook, 2019 - 2032

5.1. Europe Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

5.1.1. Cardiovascular

5.1.2. Strength Training

5.2. Europe Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

5.2.1. Stores and Supermarkets

5.2.2. Online

5.3. Europe Aqua Gym Equipment Market Outlook, by Country, Value (US$ Mn), 2019-2032

5.3.1. Germany Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.2. Germany Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.3. Italy Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.4. Italy Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.5. France Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.6. France Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.7. U.K. Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.8. U.K. Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.9. Spain Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.10. Spain Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.11. Russia Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.12. Russia Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.3.13. Rest of Europe Aqua Gym Equipment Market Outlook, by Product, 2019-2032

5.3.14. Rest of Europe Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aqua Gym Equipment Market Outlook, 2019 - 2032

6.1. Asia Pacific Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

6.1.1. Cardiovascular

6.1.2. Strength Training

6.2. Asia Pacific Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

6.2.1. Stores and Supermarkets

6.2.2. Online

6.3. Asia Pacific Aqua Gym Equipment Market Outlook, by Country, Value (US$ Mn), 2019-2032

6.3.1. China Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.2. China Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.3.3. Japan Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.4. Japan Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.3.5. South Korea Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.6. South Korea Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.3.7. India Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.8. India Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.3.9. Southeast Asia Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.10. Southeast Asia Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.3.11. Rest of SAO Aqua Gym Equipment Market Outlook, by Product, 2019-2032

6.3.12. Rest of SAO Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aqua Gym Equipment Market Outlook, 2019 - 2032

7.1. Latin America Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

7.1.1. Cardiovascular

7.1.2. Strength Training

7.2. Latin America Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

7.2.1. Stores and Supermarkets

7.2.2. Online

7.3. Latin America Aqua Gym Equipment Market Outlook, by Country, Value (US$ Mn), 2019-2032

7.3.1. Brazil Aqua Gym Equipment Market Outlook, by Product, 2019-2032

7.3.2. Brazil Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

7.3.3. Mexico Aqua Gym Equipment Market Outlook, by Product, 2019-2032

7.3.4. Mexico Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

7.3.5. Argentina Aqua Gym Equipment Market Outlook, by Product, 2019-2032

7.3.6. Argentina Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

7.3.7. Rest of LATAM Aqua Gym Equipment Market Outlook, by Product, 2019-2032

7.3.8. Rest of LATAM Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aqua Gym Equipment Market Outlook, 2019 - 2032

8.1. Middle East & Africa Aqua Gym Equipment Market Outlook, by Product, Value (US$ Mn), 2019-2032

8.1.1. Cardiovascular

8.1.2. Strength Training

8.2. Middle East & Africa Aqua Gym Equipment Market Outlook, by Distribution Channel, Value (US$ Mn), 2019-2032

8.2.1. Stores and Supermarkets

8.2.2. Online

8.3. Middle East & Africa Aqua Gym Equipment Market Outlook, by Country, Value (US$ Mn), 2019-2032

8.3.1. GCC Aqua Gym Equipment Market Outlook, by Product, 2019-2032

8.3.2. GCC Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

8.3.3. South Africa Aqua Gym Equipment Market Outlook, by Product, 2019-2032

8.3.4. South Africa Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

8.3.5. Egypt Aqua Gym Equipment Market Outlook, by Product, 2019-2032

8.3.6. Egypt Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

8.3.7. Nigeria Aqua Gym Equipment Market Outlook, by Product, 2019-2032

8.3.8. Nigeria Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

8.3.9. Rest of Middle East Aqua Gym Equipment Market Outlook, by Product, 2019-2032

8.3.10. Rest of Middle East Aqua Gym Equipment Market Outlook, by Distribution Channel, 2019-2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Aqua Lung International

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Speedo International Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. HydroWorx International, Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Acquapole S.a.S.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. BECO-Beermann GmbH & Co. KG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. AquaJogger

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Sprint Aquatics

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. HYDRO-FIT, Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Aqua Sphere

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Aqualogix Fitness

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Product Coverage |

|

|

By Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |