Global Battery Swapping Market Forecast

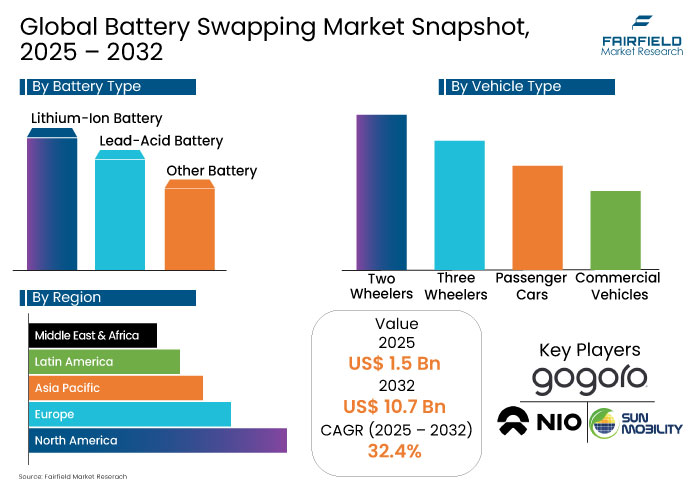

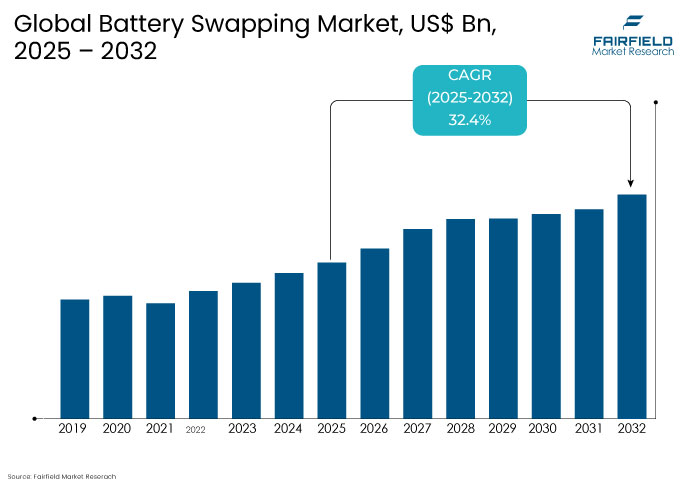

- The Battery Swapping Market is valued at USD 1.6 Bn in 2026 and is projected to reach USD 12.7 Bn, growing at a CAGR of 35% by 2033

Battery Swapping Market Insights

- The increasing adoption of electric vehicles (EVs) is propelling the need for efficient and convenient battery swapping solutions.

- Government initiatives and incentives supporting EV infrastructure development are accelerating the demand for battery swapping stations.

- Expanding fleet operators, especially in e-commerce and ride-hailing services, present a significant opportunity for battery swapping services.

- The rise in demand for EVs in emerging markets offers a potential growth avenue for battery swapping technology adoption.

- The shift towards sustainable, eco-friendly transportation solutions is accelerating the adoption of battery swapping for electric vehicles.

- Technological advancements in battery management and infrastructure are enhancing the efficiency and cost-effectiveness of battery swapping stations.

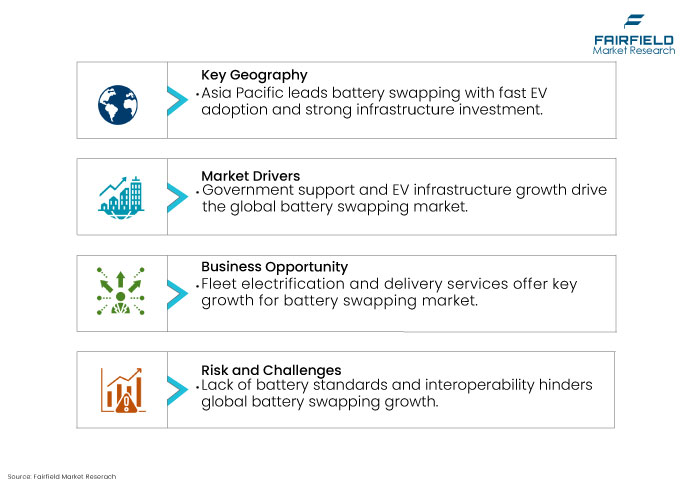

- Asia Pacific, particularly China and India, is the leading region in the adoption of battery swapping technology for electric two-wheelers and commercial vehicles.

- Europe is seeing significant growth in the battery swapping market due to strong government policies and EV adoption rates.

- North America is emerging as a key player with increasing investments in EV infrastructure and battery swapping stations for commercial fleets.

A Look Back and a Look Forward- Comparative Analysis

The Global Battery Swapping Market experienced steady growth in 2019-2024, driven by the rapid adoption of electric vehicles (EVs), government incentives, and the need for efficient, time-saving charging solutions. Key developments included pilot projects by companies like NIO and Gogoro, with China leading the market. While challenges like battery standardization and high infrastructure costs persisted, technological advancements in lithium-ion batteries and automated swapping stations helped shape the market's foundation.

Looking ahead to 2025-2032, the market is poised for exponential growth, fueled by commercial fleet electrification, technological breakthroughs, and cross-border standardization. Emerging markets such as India and North America will see significant uptake, supported by favorable policies and the electrification of public transport and delivery fleets. Europe’s focus on sustainability and the integration of renewable energy into the swapping infrastructure will further accelerate growth. The rise of global partnerships and advancements in battery management will enhance market efficiency, paving the way for a more interoperable, sustainable, and scalable battery swapping ecosystem.

Key Growth Determinants

Government Support and EV Infrastructure Development Propel Growth in the Global Battery Swapping Market

The strong support of governments throughout the world, particularly in China, Europe, and North America, is one of the main factors propelling the global battery swapping market. Government policies, incentives, and regulations aimed at promoting electric vehicles (EVs) have accelerated the growth of charging infrastructure, including battery swapping stations. These initiatives focus on reducing carbon emissions, improving air quality, and supporting the transition to cleaner transportation. With subsidies for EVs and EVs charging infrastructure, governments are playing a vital role in creating an ecosystem that supports battery swapping, making it a more feasible option for EV owners.

As EV adoption rates rise, government-backed battery swapping infrastructure will continue to grow, making it a vital component for the widespread use of electric vehicles. This backing ensures that battery swapping stations will be more accessible, offering convenience and reducing charging times, which significantly contributes to the market’s growth trajectory.

Key Growth Barriers

Lack of Battery Standardization and Interoperability Limits Global Battery Swapping Market Growth

Lack of standardization in infrastructure and battery design is a major obstacle impeding the expansion of the global battery swapping market. Without a universally accepted standard for battery sizes, shapes, or charging protocols, battery swapping stations face compatibility issues. This inconsistency limits the ability to scale the technology across different regions and vehicle manufacturers. Consequently, vehicle owners may struggle to find suitable stations for their specific battery types, impeding widespread adoption of battery swapping as a mainstream solution.

The absence of interoperability between different battery brands and swapping networks creates logistical challenges, slowing down the development of a global battery swapping infrastructure. This restraint hinders market expansion, as it prevents seamless integration between various vehicle types and charging systems, which is crucial for widespread use.

Battery Swapping Market Trends and Opportunities

Electrification of Commercial Fleets and Delivery Services Drives Key Opportunity in Battery Swapping Market

The electrification of commercial fleets, notably in e-commerce and last-mile delivery services, presents a significant opportunity in the global battery swapping market. These sectors require efficient and rapid charging solutions due to the high volume of vehicle usage. Battery swapping offers a viable alternative to traditional charging, providing a quick turnaround for electric vehicles (EVs) and minimizing downtime. With the increasing demand for clean energy solutions in logistics, integrating battery swapping stations into fleet operations offers immense growth potential for the market.

The adoption of battery swapping by fleet operators, including ride-hailing services and delivery companies, is poised to drive significant market expansion. This shift will facilitate the integration of EVs in high-utilization scenarios, accelerating the transition to sustainable transportation across industries.

Renewable Energy Integration with Battery Swapping Stations Fuels Sustainable Market Growth

The growing integration of renewable energy sources, like solar and wind, with battery swapping stations is a significant development in the global battery swapping market. This trend is driven by the growing demand for sustainable energy solutions. By coupling battery swapping infrastructure with renewable power sources, operators can significantly reduce the environmental footprint of EVs and ensure cleaner energy use. This not only supports environmental goals but also contributes to long-term operational cost savings, making the entire process more efficient and eco-friendly.

The synergy between battery swapping and renewable energy will play a critical role in enhancing the attractiveness of EVs and battery swapping stations, further promoting the adoption of sustainable transport solutions worldwide.

Leading Segment Overview

Two-Wheelers Lead Global Battery Swapping Market, With Growing Adoption in Emerging Economies and Strategic Partnerships Boosting Infrastructure

Among the vehicle types in the Global Battery Swapping Market, two-wheelers are leading the segment. This is primarily driven by their growing adoption in regions like Asia-Pacific, particularly in countries like India and China, where electric two-wheelers are becoming a popular solution for urban commuting. Battery swapping stations are particularly suited to the two-wheeler segment due to their smaller battery sizes and shorter charging times, allowing for efficient energy exchange.

Following two-wheelers, three-wheelers also hold a significant share in the market, especially in emerging markets where electric auto-rickshaws are gaining popularity. These vehicles benefit from battery swapping as it allows for quick turnaround times, making them ideal for high-utilization environments. Passenger cars and commercial vehicles are expected to grow in the future but currently represent a smaller segment, as infrastructure is still in development for these larger vehicles.

A recent key development in the industry occurred in March 2024, when Gogoro expanded its collaboration with Delta Electronics to enhance battery swapping infrastructure across Taiwan and Southeast Asia. This partnership aims to increase the efficiency and scalability of battery swapping stations, supporting the growing demand for electric two-wheelers in these regions.

Regional Analysis

- Asia Pacific Leads Global Battery Swapping Market with Rapid EV Adoption and Strategic Infrastructure Growth

Asia Pacific is the leading region in the Global Battery Swapping Market, driven by the rapid adoption of electric vehicles (EVs) in countries like China, India, and Japan. China, in particular, is at the forefront due to strong government support, favorable policies, and extensive EV infrastructure development. The country has seen significant investments in battery swapping networks, making it a key player in driving market growth. With the rise of electric two-wheelers and three-wheelers, the demand for quick and efficient charging solutions like battery swapping is surging, particularly in urban areas with high vehicle density.

India and Southeast Asian countries are also witnessing considerable growth in battery swapping infrastructure, primarily driven by the increasing adoption of electric two-wheelers for urban transportation. The government's push towards clean energy solutions and the need for reducing carbon emissions further contribute to the market’s expansion in the region. As battery swapping stations become more accessible, the adoption rate of EVs in Asia Pacific is set to accelerate, cementing the region's dominance in the global market.

- Europe Drives Growth in Battery Swapping Market with Strong Sustainability Focus and Green Infrastructure Initiatives

Europe stands as a key player in the Global Battery Swapping Market, with countries like Germany, France, and the Netherlands leading the charge in electric vehicle (EV) adoption. The region’s strong regulatory frameworks, such as the European Green Deal and ambitious carbon neutrality goals, have accelerated the push toward clean energy solutions, including the widespread deployment of battery swapping stations. Europe’s focus on sustainability and the transition to low-emission vehicles makes it a vital market for battery swapping, especially as EVs become more mainstream in both urban and commercial sectors.

The European Union’s investments in green infrastructure and its commitment to decarbonizing transport will continue to foster growth in battery swapping adoption. Furthermore, strategic partnerships between automotive manufacturers and energy companies have paved the way for innovative battery swapping solutions. With increased demand for EVs across both private and commercial vehicle segments, Europe’s market for battery swapping is poised for significant growth, especially as nations look to reduce reliance on traditional charging methods and improve EV operational efficiency.

- North America Expands Battery Swapping Market with Robust EV Adoption and Infrastructure Development

North America is emerging as a significant region in the Global Battery Swapping Market, driven by the increasing shift toward electric vehicles (EVs) and growing environmental concerns. The United States, in particular, has seen substantial investments in EV infrastructure, bolstered by federal incentives and state-level policies promoting clean energy. The adoption of battery swapping stations is gaining traction, especially in areas with high EV penetration like California, where regulatory incentives and the growing demand for efficient charging solutions align to support this technology. Battery swapping offers a convenient alternative to traditional charging methods, addressing concerns over long charging times, making it attractive for both consumers and fleet operators.

In Canada, the rise in electric vehicle adoption, coupled with expanding government incentives, has led to the growth of battery swapping infrastructure. Additionally, the increasing interest from commercial fleet operators and logistics companies is pushing demand for quick, cost-effective energy solutions. As more private users, fleet owners, and e-commerce businesses look to improve the efficiency of their electric vehicle fleets, the market for battery swapping in North America is expected to grow at a rapid pace, supported by continued advancements in charging technologies and infrastructure development.

Competitive Landscape

The Global Battery Swapping Market is highly competitive, with major players like Gogoro, NIO, BAIC, Sun Mobility, and Tritium leading the charge. These companies compete based on technological advancements, extensive network development, and partnerships with EV manufacturers. The increasing focus on sustainability and the rapid expansion of the electric vehicle ecosystem intensify the competition, as these players strive to meet the growing demand for efficient energy solutions.

To stay ahead in this competitive market, players are leveraging innovation, forming strategic partnerships, and expanding their battery swapping infrastructure. Companies such as Gogoro and Sun Mobility are collaborating with EV manufacturers to standardize battery swapping technology, while also incorporating renewable energy sources to make operations more eco-friendly and cost-effective, ensuring they meet both customer and environmental demands.

With the increasing adoption of electric vehicles, there are substantial opportunities for growth in this market. Companies can capitalize on the expansion of electric two-wheelers, three-wheelers, and commercial fleets, which rely heavily on efficient energy solutions. Additionally, government incentives for clean energy and the rise of last-mile delivery services open up new avenues for battery swapping providers to grow and reach more customers.

- In March 2025, NIO Power and Zhongan Energy collaborate to construct 1,000 battery swap stations in Anhui province, focusing on creating an open energy network and efficient battery asset management systems.

- In November 2023, NIO and Geely Holding sign a strategic partnership agreement to co-develop battery swapping standards and expand the swapping network for both private and commercial vehicles.

- In March 2024, NIO Power partners with Wuhan Shouyi Scientific Innovation Investment Group to establish 100 battery swap stations in Hubei province, strengthening the energy replenishment network in central China.

Key Companies

- Gogoro Inc.

- NIO Inc.

- Sun Mobility

- BAIC Group

- Tritium

- Nuvve Corporation

- Battery Swapping Technologies Pvt. Ltd.

- Rocky Mountain Institute (RMI)

- Heliox

- Bolloré Group

- Anzhen EV

- Evelozcity

- Automotive Energy Supply Corporation (AESC)

- ChargePoint

- BYD Company Ltd.

Expert Opinion

- The rapid evolution of battery swapping technology is one of the core factors fueling the Global Battery Swapping Market. Innovations in battery design, improved charging speed, and enhanced swapping station infrastructure are key to improving efficiency. Companies are focused on reducing downtime for consumers and optimizing the performance of electric vehicles (EVs) through scalable battery solutions, making battery swapping more viable for a broader range of applications.

- Government incentives and regulations promoting electric vehicles (EVs) are providing significant momentum to the battery swapping market. As the adoption of EVs accelerates, the need for accessible and fast energy solutions, such as battery swapping stations, is becoming more critical. Initiatives like tax rebates, reduced charging fees, and sustainability targets are driving investment in EV infrastructure, contributing to market expansion.

- Battery swapping is a capital-intensive model requiring a robust network of stations. The market is seeing increased collaborations between EV manufacturers, battery companies, and energy providers to develop and scale battery swapping infrastructure. Strategic partnerships, such as those between NIO and CATL, are key to ensuring interoperability, expanding station networks, and offering consumers a seamless and accessible experience.

- Despite its growth potential, the market faces challenges in terms of standardization and fragmentation. Varying battery sizes, designs, and technical standards between manufacturers make it difficult to create a universally compatible swapping network. Companies are working to address this by pushing for standardization, but this remains a critical obstacle to widespread adoption across diverse geographies and vehicle types.

Global Battery Swapping Market Segmentation

By Battery Type

- Lead-Acid Battery

- Lithium-Ion Battery

- Other Battery Types

By Vehicle Type

- Two-Wheelers

- Three-Wheelers

- Passenger Cars

- Commercial Vehicles

By Service Type

- Subscription Model (Monthly/Annual)

- Pay-Per-Use Model

- Rental Model

By End-user

- Private Users

- Fleet Operators

- E-commerce & Delivery Companies

- Taxi Aggregators

- Logistics Companies

- Government/Institutional

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Railway Sleepers Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Railway Sleepers Market Outlook, 2020 - 2033

- Global Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- Global Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- Global Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- Global Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Global Railway Sleepers Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- North America Railway Sleepers Market Outlook, 2020 - 2033

- North America Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- North America Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- North America Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- North America Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- North America Railway Sleepers Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Railway Sleepers Market Outlook, by Material, 2020-2033

- S. Railway Sleepers Market Outlook, by Track Type, 2020-2033

- S. Railway Sleepers Market Outlook, by Line Type, 2020-2033

- S. Railway Sleepers Market Outlook, by Application, 2020-2033

- Canada Railway Sleepers Market Outlook, by Material, 2020-2033

- Canada Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Canada Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Canada Railway Sleepers Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Europe Railway Sleepers Market Outlook, 2020 - 2033

- Europe Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- Europe Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- Europe Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- Europe Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Europe Railway Sleepers Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Railway Sleepers Market Outlook, by Material, 2020-2033

- Germany Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Germany Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Germany Railway Sleepers Market Outlook, by Application, 2020-2033

- Italy Railway Sleepers Market Outlook, by Material, 2020-2033

- Italy Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Italy Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Italy Railway Sleepers Market Outlook, by Application, 2020-2033

- France Railway Sleepers Market Outlook, by Material, 2020-2033

- France Railway Sleepers Market Outlook, by Track Type, 2020-2033

- France Railway Sleepers Market Outlook, by Line Type, 2020-2033

- France Railway Sleepers Market Outlook, by Application, 2020-2033

- K. Railway Sleepers Market Outlook, by Material, 2020-2033

- K. Railway Sleepers Market Outlook, by Track Type, 2020-2033

- K. Railway Sleepers Market Outlook, by Line Type, 2020-2033

- K. Railway Sleepers Market Outlook, by Application, 2020-2033

- Spain Railway Sleepers Market Outlook, by Material, 2020-2033

- Spain Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Spain Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Spain Railway Sleepers Market Outlook, by Application, 2020-2033

- Russia Railway Sleepers Market Outlook, by Material, 2020-2033

- Russia Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Russia Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Russia Railway Sleepers Market Outlook, by Application, 2020-2033

- Rest of Europe Railway Sleepers Market Outlook, by Material, 2020-2033

- Rest of Europe Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Rest of Europe Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Rest of Europe Railway Sleepers Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Asia Pacific Railway Sleepers Market Outlook, 2020 - 2033

- Asia Pacific Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- Asia Pacific Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- Asia Pacific Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- Asia Pacific Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Asia Pacific Railway Sleepers Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Railway Sleepers Market Outlook, by Material, 2020-2033

- China Railway Sleepers Market Outlook, by Track Type, 2020-2033

- China Railway Sleepers Market Outlook, by Line Type, 2020-2033

- China Railway Sleepers Market Outlook, by Application, 2020-2033

- Japan Railway Sleepers Market Outlook, by Material, 2020-2033

- Japan Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Japan Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Japan Railway Sleepers Market Outlook, by Application, 2020-2033

- South Korea Railway Sleepers Market Outlook, by Material, 2020-2033

- South Korea Railway Sleepers Market Outlook, by Track Type, 2020-2033

- South Korea Railway Sleepers Market Outlook, by Line Type, 2020-2033

- South Korea Railway Sleepers Market Outlook, by Application, 2020-2033

- India Railway Sleepers Market Outlook, by Material, 2020-2033

- India Railway Sleepers Market Outlook, by Track Type, 2020-2033

- India Railway Sleepers Market Outlook, by Line Type, 2020-2033

- India Railway Sleepers Market Outlook, by Application, 2020-2033

- Southeast Asia Railway Sleepers Market Outlook, by Material, 2020-2033

- Southeast Asia Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Southeast Asia Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Southeast Asia Railway Sleepers Market Outlook, by Application, 2020-2033

- Rest of SAO Railway Sleepers Market Outlook, by Material, 2020-2033

- Rest of SAO Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Rest of SAO Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Rest of SAO Railway Sleepers Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Latin America Railway Sleepers Market Outlook, 2020 - 2033

- Latin America Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- Latin America Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- Latin America Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- Latin America Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Latin America Railway Sleepers Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Railway Sleepers Market Outlook, by Material, 2020-2033

- Brazil Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Brazil Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Brazil Railway Sleepers Market Outlook, by Application, 2020-2033

- Mexico Railway Sleepers Market Outlook, by Material, 2020-2033

- Mexico Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Mexico Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Mexico Railway Sleepers Market Outlook, by Application, 2020-2033

- Argentina Railway Sleepers Market Outlook, by Material, 2020-2033

- Argentina Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Argentina Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Argentina Railway Sleepers Market Outlook, by Application, 2020-2033

- Rest of LATAM Railway Sleepers Market Outlook, by Material, 2020-2033

- Rest of LATAM Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Rest of LATAM Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Rest of LATAM Railway Sleepers Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Middle East & Africa Railway Sleepers Market Outlook, 2020 - 2033

- Middle East & Africa Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Wood

- Concrete

- Composite

- Steel

- Middle East & Africa Railway Sleepers Market Outlook, by Track Type, Value (US$ Mn), 2020-2033

- Tangents

- Turnouts

- Bridges

- Tunnels

- Middle East & Africa Railway Sleepers Market Outlook, by Line Type, Value (US$ Mn), 2020-2033

- Main Line (Passenger and Freight)

- Transit

- Industrial

- Middle East & Africa Railway Sleepers Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Heavy Haul Railways

- High-Speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Middle East & Africa Railway Sleepers Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Railway Sleepers Market Outlook, by Material, 2020-2033

- GCC Railway Sleepers Market Outlook, by Track Type, 2020-2033

- GCC Railway Sleepers Market Outlook, by Line Type, 2020-2033

- GCC Railway Sleepers Market Outlook, by Application, 2020-2033

- South Africa Railway Sleepers Market Outlook, by Material, 2020-2033

- South Africa Railway Sleepers Market Outlook, by Track Type, 2020-2033

- South Africa Railway Sleepers Market Outlook, by Line Type, 2020-2033

- South Africa Railway Sleepers Market Outlook, by Application, 2020-2033

- Egypt Railway Sleepers Market Outlook, by Material, 2020-2033

- Egypt Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Egypt Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Egypt Railway Sleepers Market Outlook, by Application, 2020-2033

- Nigeria Railway Sleepers Market Outlook, by Material, 2020-2033

- Nigeria Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Nigeria Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Nigeria Railway Sleepers Market Outlook, by Application, 2020-2033

- Rest of Middle East Railway Sleepers Market Outlook, by Material, 2020-2033

- Rest of Middle East Railway Sleepers Market Outlook, by Track Type, 2020-2033

- Rest of Middle East Railway Sleepers Market Outlook, by Line Type, 2020-2033

- Rest of Middle East Railway Sleepers Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Railway Sleepers Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Vossloh AG

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- RailWorks Corporation (NARTSCO)

- Patil Group

- Kirchdorfer Group

- B. Foster Company

- PCM RAIL.ONE AG

- The Indian Hume Pipe

- Wegh Group

- IntegriCo Composites

- CEMEX Rail Products

- Vossloh AG

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Battery Type |

|

|

Vehicle Type |

|

|

Service Type |

|

|

End User |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |