Global Breast Reconstruction Market Forecast

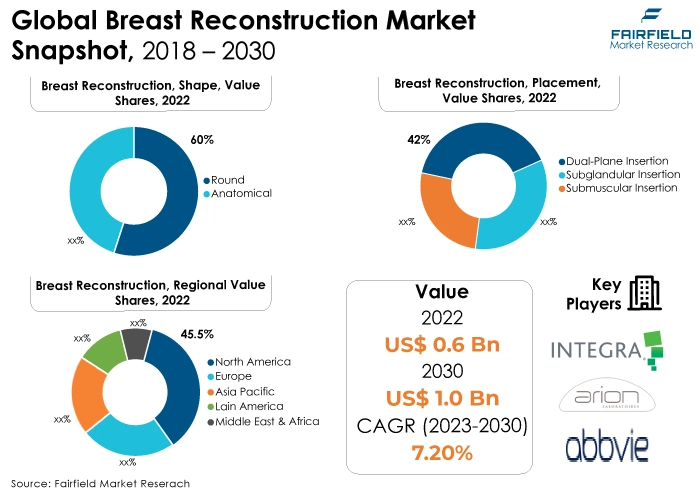

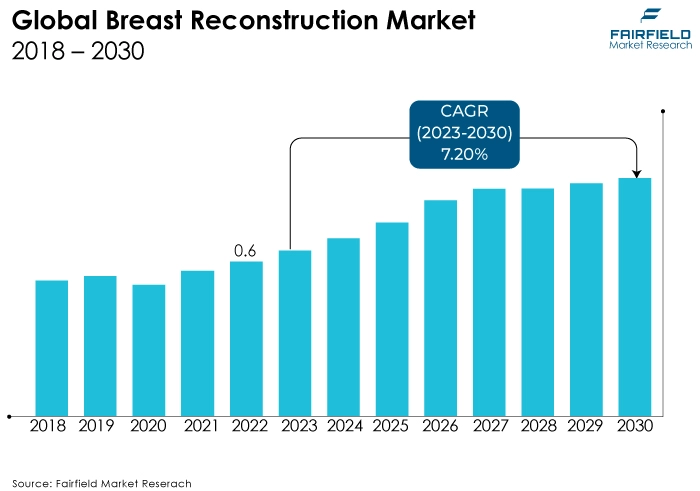

- Breast reconstruction market all set for a sprint at a CAGR of 7.2% during 2023 - 2030

- Market size slated for a leapfrog, up from a mere US$0.6 Bn in 2022 to over US$1 Bn in 2030

Quick Report Digest

- Rising rates of breast cancer, more breast reconstruction surgeries, and a sharp rise in the need for acellular dermal matrix are expected to propel the worldwide breast reconstruction market.

- Rapid technical progress, strong growth potential in emerging economies, and the expansion of 3D-printed implants are all providing the market with considerable growth prospects over the projection period.

- In 2022, the breast implants category held the greatest market share globally. This can be attributed to the growth in breast cancer incidence, breast reconstruction surgeries, and demand for silicone and saline breast implants.

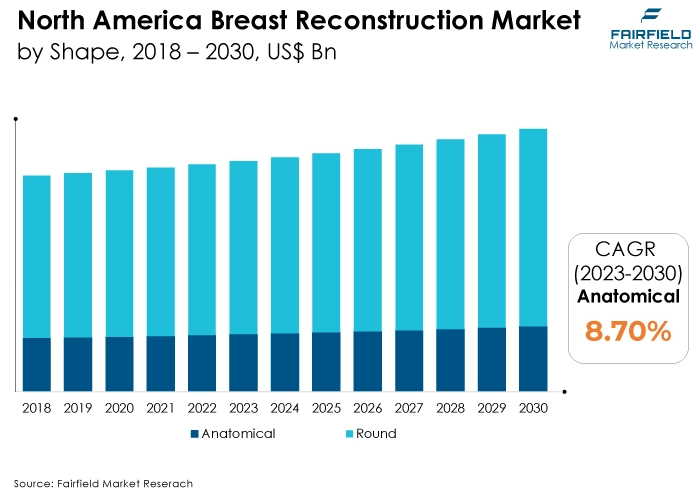

- The round category had the highest revenue share in 2022. The increasing number of product launches, frequent FDA updates on the safety of breast implants, and the execution of several clinical trials can all be attributed for the dominance.

- The category with the largest market share is dual-plane insertion. Using this method, breast implants are adjusted to sit in the most natural position while providing enough soft-tissue coverage.

- In 2022, the hospital segment held the greatest market share worldwide. During the forecast term, it is anticipated that this tendency would persist. The segment is being strengthened by an increase in the number of breast reconstruction surgeries carried out in hospitals.

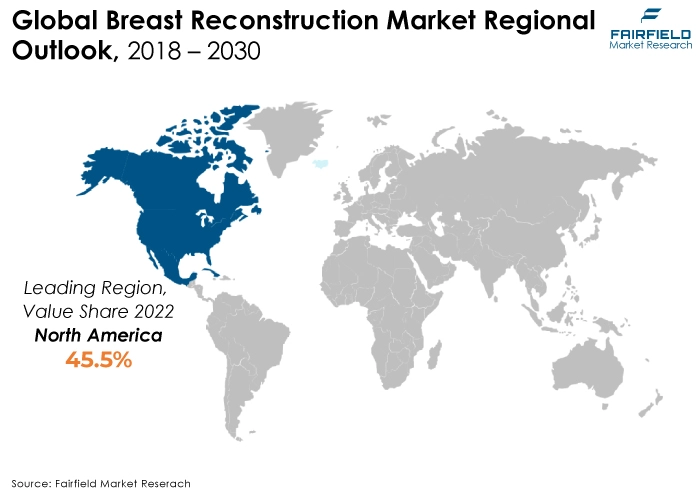

- North America region is anticipated to account for the highest share of the global breast reconstruction market. The highest market share is mostly due to reasons including rising breast augmentation operations, rising breast cancer incidences, and well-established healthcare infrastructure.

- Eurpoe will have the significant rate of growth in the breast reconstruction market during the forecast period. One of the most often performed surgeries in the nation, breast enlargement surgery includes placing implants under the breast tissue to enhance the size or alter the contour of the breasts.

A Look Back and a Look Forward - Comparative Analysis

During the projected period, it is anticipated that rising emphasis on aesthetic appearance would significantly increase demand for the worldwide breast reconstruction market. In addition, it is predicted that rising obesity rates, breast cancer prevalence, and public knowledge of breast reconstruction surgeries would fuel market growth. Another major factors driving the demand for and expansion of breast reconstruction is the substantial reimbursements for the procedure.

Throughout the historical period of 2018-2022, the market had staggered growth. Older women were historically more likely to undergo breast reconstruction surgery. The number of younger women choosing to get breast reconstruction following mastectomy is rising, nevertheless.

The benefits of breast reconstruction, including enhanced quality of life and self-esteem, are probably becoming more widely known. In addition, the breast reconstruction industry is being driven by an increase in breast cancer incidence and the number of breast reconstruction treatments.

In the coming years, the key reasons driving the growth of the breast reconstruction market is the expanding healthcare infrastructure and rising number of mastectomy procedures. A high rate of industrial growth will be ensured over the predicted period by the rapidly rising number of surgical procedures.

Additionally, the market is expected to experience considerable expansion throughout the forecast period as a result of the quickening pace of technical progress, high growth prospects in emerging regions, and growing use of 3D-printed implants.

Key Growth Determinants

- Exploding Prevalence of Breast Cancer

The most common technique of treating breast cancer in women is mastectomy, which involves surgically removing the entire breast. After natural breasts have been removed, breast reconstruction operations are utilised to recreate the breasts. These operations mostly employ implant reconstruction and autologous or flap reconstruction.

As breast cancer rates increase globally, more women are choosing reconstruction operations to restore the natural form of their breasts following a mastectomy.

Furthermore, breast cancer is the type of cancer that affects women the most frequently. For instance, 12% of all new cancer cases worldwide each year as of 2021 were breast cancer instances. It is thus anticipated that the market would rise as a result of the rising incidence of breast cancer and the growing need for breast reconstruction treatments.

- Rising Awareness About Potential Benefits of Breast Reconstruction Surgery

Following a mastectomy, some women elect to have breast reconstruction surgery. It is mostly due to growing concerns about the safety and efficacy of reconstructive surgery. This pattern may be seen in both affluent and developing countries, where people's living standards are rising.

Furthermore, the increase in awareness can be attributed to market actors, stakeholders, and independent bodies such as the American Society of Plastic Surgeons (ASPS).

Breast Reconstruction Awareness was a program launched by the ASPS in cooperation with the Plastic Surgery Foundation to engage and educate women about breast reconstruction following a breast cancer diagnosis.

- Innovations in Surgical Procedures

Breast reconstruction surgeries have evolved, and patients now have more alternatives to choose from. Therefore, there is a greater demand for these procedures to have higher benefits and safety.

Revolutionary gains in terms of better outcomes for breast reconstruction surgery are predicted to occur from technological breakthroughs. The operation is becoming simpler with the introduction of ADMs, and sophisticated imaging technology.

The breast reconstruction market is expected to be impacted by innovations like 3D printing, which is presently used to create soft absorbable shells with silicon filling that are integrated with patients' unique medical needs. In the years to come, it is anticipated that expanding uses of silicone and saline breast implants, ADMs, and tissue expanders will continue to be a major trend in breast reconstruction.

Major Growth Barriers

- Clinical Hazards, and Potential Concerns regarding Breast Reconstruction Surgeries

There are potential risks associated with breast implant reconstruction surgery, including mastectomy or other surgical procedures. Data from Cancer Research UK show that complications that may arise right after surgery include, among other things, blood clots, flap failure, and wound infection.

Additionally, some patients blame their implants for systemic symptoms, often known as breast implant illness (BII), which can include weariness, brain fog, muscle or joint discomfort, and skin rashes. Thus, this is limiting market expansion.

- Increasing Use of Various Non-surgical Methods

Following a mastectomy, some women prefer to have breast reconstruction surgery. Others decide against it because they are ignorant of it or because they suffer from other health issues, such as obesity, skinniness, or modifications in blood flow dynamics. These women can select a customised breast prosthesis, going flat, or other breast reconstruction alternatives.

For those who have just undergone one mastectomy, a personalised breast prosthesis can replicate the woman's exact contour and achieve symmetry with the complete breast.

Key Trends and Opportunities to Look at

- Rising Demand for 3D Breast Reconstruction

A major element fueling market revenue growth is the rising demand for 3D breast reconstruction surgery to achieve improved cosmetic outcomes, greater symmetry and proportion, along with lower surgical risks and shorter operating times.

Companies are actively funding R&D initiatives, focusing on new product releases, and innovating within their current product lines.

- Growing Research Funding

Strong research funding is one of the factors boosting the global market share growth for breast reconstruction. Drug-based therapy are in high demand due to the increasing prevalence of breast cancer.

Vendors and research institutes have created non-therapeutic methods, such as breast reconstruction, and done considerable investigation to treat the indication. Such actions are expected to enhance the growth possibilities of the worldwide breast reconstruction market throughout the course of the projected year.

- Rising Demand for Reconstructive Surgery

The availability of payment for the treatment in various nations is a contributing factor in the increased demand for reconstructive surgery. In contrast to free flaps, which had an average reimbursement rate of USD 4,325.84, pedicled flaps had an average reimbursement rate of USD 5,993.16.

According to another study, reimbursement for breast reconstruction expenses was uniform across countries in Europe. Throughout the forecast period, these elements are fueling revenue growth.

How Does the Regulatory Scenario Shape this Industry?

The market for breast reconstruction may be greatly impacted by the regulatory landscape. Products and devices for breast reconstruction must be approved by regulatory organisations like the FDA in the US, or the European Medicines Agency (EMA) in Europe.

Strict regulatory procedures guarantee the efficacy and safety of these items, which can both delay market introduction and boost consumer confidence if approved.

In addition, regulatory authorities promote innovation by establishing criteria for product safety and development procedures. To satisfy these demands, manufacturers frequently make research and development investments, which results in improvements in breast reconstruction methods and technology.

Fairfield’s Ranking Board

Top Segments

- Breast Implants Favoured More than Tissue Expanders

The breast implants segment dominated the market in 2022. Patients typically choose implants over other breast reconstruction options because of the shorter surgical time and lack of donor sites. Furthermore, many women decide on reconstruction procedures to get their breasts back to how they naturally look.

In fast-developing countries like China, India, and South Africa, breast cancer is more common, which is largely to blame for the rise in the frequency of breast reconstruction surgery. In the upcoming years, this will aid the growth of the implant market.

The tissue expanders category is expected to grow significantly over the forecast period. Tissue expanders are being used for breast reconstruction at a higher rate, which explains the growth rate. For instance, a study by Science Direct found that tissue expander repair accounted for up to 65% of all breast reconstruction procedures.

Additionally, using a tissue expander for breast reconstruction has a number of benefits, including being quicker, easier, and generally less expensive. To further boost their market share, market participants are concentrating on releasing a variety of tissue expanders.

- Round Shape Remains Preferred

In 2022, the round category dominated the market, and it is predicted to grow significantly over the course of the forecast period. The prevalence is explained by the rise in product launches, regular FDA updates on the safety of breast implants, and the execution of numerous clinical studies.

For instance, the US FDA modified its safety standards for breast implants in October 2021 and placed restrictions on the sales and distribution of breast implants to guarantee that patients undergoing breast implant surgery have access to the necessary information. Round-shaped breast implants are therefore anticipated to have significant increase due to the aforementioned considerations.

Furthermore, the anatomical category is expected to expand significantly. Anatomically formed breast implants provide a number of benefits that might be credited for the growth rate. For instance, these breast implants provide a natural form and textured surface, according to the Sayah Institute; as a result, the implant does not shift after implantation. Additionally, because of their texture, women with minimal natural breast tissue might use them for breast augmentation, thereby driving the segment's growth.

- Dual-Plane Insertion Category Holds the Largest Market Share

With regard to market share, dual-plane insertion has the largest share. This technique helps to cover enough soft tissue and adjusts breast implants to the most natural position.

The location is better than a single-pocket site in that it has more benefits and fewer negatives. This permits the new mound the implant has created beneath the muscle to be effectively covered by the breast gland. The procedure is less uncomfortable and calls for a day of rest.

The second-largest market share in 2022 belonged to the subglandular insertion category. This is so that the implant can settle into its final place without interfering with the pectoralis muscle's ability to function or, if the implant is subpectoral, the movement of the breast that happens with arm movement.

- Hospitals Continue to Register the Maximum Adoption

In 2022, the hospitals category’s revenue share was very significant. One of the main drivers of market expansion is the rise in hospitals around the globe. Additionally, the global growth of medical tourism is anticipated to raise the level of treatment provided by hospitals. This will likely cause the hospitals category to expand quickly throughout the course of the projected period.

During the projected period, the segment for ambulatory surgery centres is expected to increase at the quickest CAGR. Ambulatory surgery centres have the capacity to save costs while simultaneously enhancing quality and patient care.

In western nations, the frequency of surgeries performed on the same day has considerably increased during the past few decades. In the US, outpatient facilities perform more than two thirds of all procedures; some of these facilities are operated by hospitals.

Regional Frontrunners

North America Leads Global Market on Account of the Largest Breast Augmentation Industry

The region with the biggest market share for breast reconstruction is expected to be North America during that forecast period. The largest market share is mostly a result of factors such as an expanding breast augmentation industry, an increase in breast cancer cases, and a well-established healthcare system.

Governments are focusing on implementing a variety of programs to increase public awareness of the implant procedure, which in turn is driving up demand for breast reconstruction in North America.

A significant number of implant-related items have received FDA approval in recent years. For instance, the FDA granted Allergan Plc's NATRELLE INSPIRA breast implant, which offers a novel cohesive or medium firmness gel implant alternative for women undergoing breast reconstruction, clearance to go on sale in January 2017.

Government Initiatives Around Breast Health and Care to Drive Europe

The market for breast reconstruction is expanding at the fastest rate in Europe, which presents a significant opportunity for the industry. This is ascribed to an increase in government campaigns for breast health and care, a rise in the demand for cosmetic treatments to achieve aesthetic results, and investments made by both major corporations and government agencies to support R&D in surgical techniques.

For instance, according to information from the Department of Health and Social Care, US$790 Mn was set aside on October 14, 2022, to fund improvements in medical technology, diagnostics, and innovative treatments with the goal of improving patient well-being and the economy. Additionally, the introduction of several products using cutting-edge technology is anticipated to fuel market revenue growth throughout the course of the research year.

Fairfield’s Competitive Landscape Analysis

As per the Fairfields analysis, to strengthen their position in the market, major competitors are using a variety of strategies, including global growth, mergers and acquisitions, collaborations, the launch of new goods, and requesting regulatory permissions. Additionally, major firms are making significant investments in R&D to produce technologically sophisticated products.

Who are the Leaders in Global Breast reconstruction Space?

- Polytech Health & Aesthetics

- GC Aesthetics

- Sebbin

- Integra Lifesciences

- RTI Surgical Holdings

- Establishment Labs S.A.

- Mentor Worldwide LLC (Johnson & Johnson)

- Silimed

- Allergan, Inc. (AbbVie)

- Sientra, Inc.

- Arion Laboratories

- CEREPLAS

- AirXpanders

- KOKEN CO. LTD.

Recent Company Developments

New Product Launches

- June 2022: In response to the needs of breast reconstruction, Coll Plant announced the beginning of a research in large animals for its 3D bioprinted regenerative breast implant program.

- May 2022: Launched by GC Aesthetics is the FixNip NRI Innovative Areola Complex (NAC) reconstruction implant. This medical device fills a well-documented clinical need for thousands of women worldwide.

Mergers & Acquisitions

- December 2022: DuraSorb, a resorbable synthetic matrix for plastic and reconstructive surgery, is developed, marketed, and sold by Surgical Innovation Associates (SIA), which was announced by Integra LifeSciences Holding Corporation as having entered into a formal agreement to be acquired. By increasing ambitions to enter the U.S. market with products particularly FDA-approved for use in Implant-Based Breast Reconstruction (IBBR) surgeries, this acquisition will promote Integra's global strategy in breast reconstruction.

Collaborations

- April 2023: In order to help patients regenerate their natural breast tissue, an Israeli 3D printing business, Stratasys, and an American bioinks startup, CollPlant Technologies, are partnering to develop the technology for 3D-printed breast implants. The implants are designed to restore missing natural breast tissue without provoking an immunological response.

- March 2023: Mia Femtech, a minimally invasive breast aesthetics solution, will be introduced by Establishment Labs in collaboration with businesses in Europe and a secondary partner network in Japan.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, rising demand for breast reconstruction procedures using three-dimensional (3D) printing, encouraging government action by launching specific breast health awareness campaigns, and the launch of insurance plans that cover breast reconstruction surgeries are the main drivers influencing revenue growth.

Another significant element fueling the market's revenue growth is the rising incidence of breast cancer. Additionally, it is anticipated that rapid product approvals from government agencies and ongoing clinical trials would contribute to the market's revenue growth during the projection period.

Supply Side of the Market

According to our analysis, in the market for breast reconstruction, the US was a significant supplier. Many businesses with headquarters in the US produce and supply devices and products for breast reconstruction, thanks to the country's thriving medical device market.

The US is home to a large number of recognised medical equipment producers and businesses that specialise in breast reconstruction devices and technology. This covers businesses that make tissue expanders, surgical tools, and other relevant medical devices in addition to breast implants. Germany, France, the UK, and several Asian nations including South Korea and Japan were among countries with sizable market shares.

Global Breast Reconstruction Market is Segmented as Below:

By Product

- Breast Implants

- Tissue Expanders

- Acellular Dermal Matrix (ADM)

- Others

By Shape

- Anatomical

- Round

By Placement

- Submuscular Insertion

- Subglandular Insertion

- Dual-Plane Insertion

By End User

- Hospitals

- Clinics

- Ambulatory Surgery Centres

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Breast Reconstruction Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Breast Reconstruction Market Outlook, 2018 - 2030

3.1. Global Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Breast Implants

3.1.1.2. Tissue Expanders

3.1.1.3. Acellular Dermal Matrix (ADM)

3.1.1.4. Others

3.2. Global Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Submuscular Insertion

3.2.1.2. Subglandular Insertion

3.2.1.3. Dual-Plane Insertion

3.3. Global Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Clinics

3.3.1.3. Ambulatory Surgery Centers

3.3.1.4. Others

3.4. Global Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Anatomical

3.4.1.2. Round

3.5. Global Breast Reconstruction Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Breast Reconstruction Market Outlook, 2018 - 2030

4.1. North America Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Breast Implants

4.1.1.2. Tissue Expanders

4.1.1.3. Acellular Dermal Matrix (ADM)

4.1.1.4. Others

4.2. North America Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Submuscular Insertion

4.2.1.2. Subglandular Insertion

4.2.1.3. Dual-Plane Insertion

4.3. North America Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Clinics

4.3.1.3. Ambulatory Surgery Centers

4.3.1.4. Others

4.4. North America Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Anatomical

4.4.1.2. Round

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Breast Reconstruction Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Breast Reconstruction Market Outlook, 2018 - 2030

5.1. Europe Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Breast Implants

5.1.1.2. Tissue Expanders

5.1.1.3. Acellular Dermal Matrix (ADM)

5.1.1.4. Others

5.2. Europe Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Submuscular Insertion

5.2.1.2. Subglandular Insertion

5.2.1.3. Dual-Plane Insertion

5.3. Europe Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Clinics

5.3.1.3. Ambulatory Surgery Centers

5.3.1.4. Others

5.4. Europe Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Anatomical

5.4.1.2. Round

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Breast Reconstruction Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Breast Reconstruction Market Outlook, 2018 - 2030

6.1. Asia Pacific Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Breast Implants

6.1.1.2. Tissue Expanders

6.1.1.3. Acellular Dermal Matrix (ADM)

6.1.1.4. Others

6.2. Asia Pacific Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Submuscular Insertion

6.2.1.2. Subglandular Insertion

6.2.1.3. Dual-Plane Insertion

6.3. Asia Pacific Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Clinics

6.3.1.3. Ambulatory Surgery Centers

6.3.1.4. Others

6.4. Asia Pacific Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Anatomical

6.4.1.2. Round

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Breast Reconstruction Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Breast Reconstruction Market Outlook, 2018 - 2030

7.1. Latin America Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Breast Implants

7.1.1.2. Tissue Expanders

7.1.1.3. Acellular Dermal Matrix (ADM)

7.1.1.4. Others

7.2. Latin America Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Submuscular Insertion

7.2.1.2. Subglandular Insertion

7.2.1.3. Dual-Plane Insertion

7.3. Latin America Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Clinics

7.3.1.3. Ambulatory Surgery Centers

7.3.1.4. Others

7.4. Latin America Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Anatomical

7.4.1.2. Round

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Breast Reconstruction Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Breast Reconstruction Market Outlook, 2018 - 2030

8.1. Middle East & Africa Breast Reconstruction Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Breast Implants

8.1.1.2. Tissue Expanders

8.1.1.3. Acellular Dermal Matrix (ADM)

8.1.1.4. Others

8.2. Middle East & Africa Breast Reconstruction Market Outlook, by Placement, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Submuscular Insertion

8.2.1.2. Subglandular Insertion

8.2.1.3. Dual-Plane Insertion

8.3. Middle East & Africa Breast Reconstruction Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Clinics

8.3.1.3. Ambulatory Surgery Centers

8.3.1.4. Others

8.4. Middle East & Africa Breast Reconstruction Market Outlook, by Shape, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Anatomical

8.4.1.2. Round

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Breast Reconstruction Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Breast Reconstruction Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Breast Reconstruction Market, by Placement, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Breast Reconstruction Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Breast Reconstruction Market, by Shape, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Silimed (Brazil)

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Mentor Worldwide LLC (Johnson & Johnson) (US)

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Establishment Labs S.A. (US)

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. RTI Surgical Holdings (US)

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. KOKEN CO. LTD. (Japan)

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Integra Lifesciences (US)

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Sebbin (France)

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. GC Aesthetics (Ireland)

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Polytech Health & Aesthetics (Germany)

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Allergan, Inc. (AbbVie) (Ireland)

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Sientra, Inc. (California)

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Arion Laboratories (France)

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. CEREPLAS (France)

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. AirXpanders (US)

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Shape Coverage |

|

|

Placement Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |