Building Insulation Market Growth and Industry Forecast

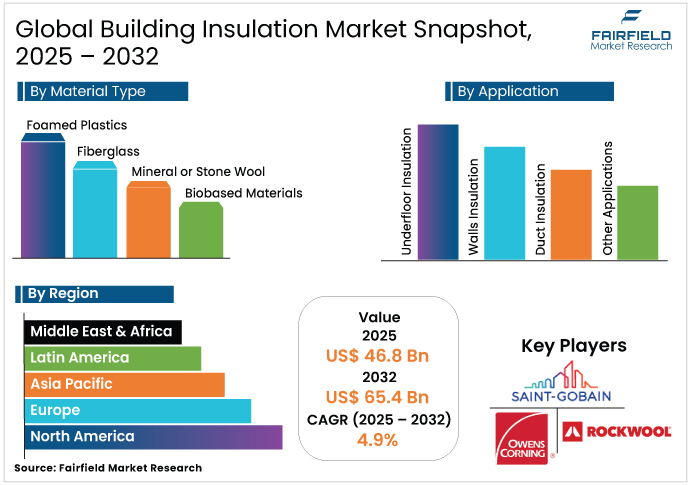

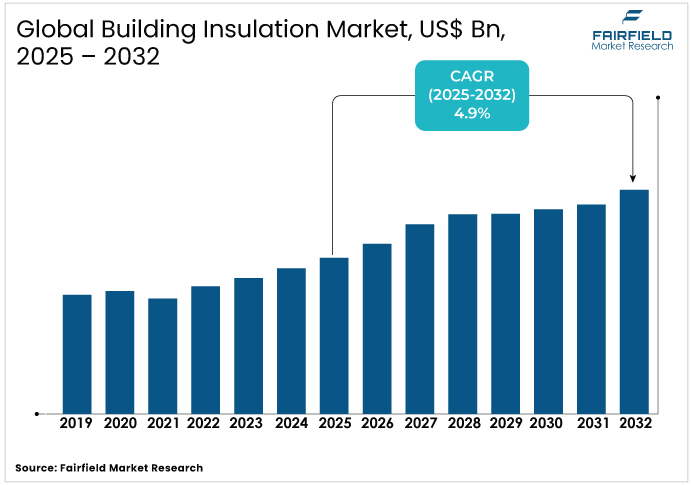

- The global building insulation market is projected to be valued at US$ 8 Bn in 2025 and reach US$ 65.4 Bn by 2032.

- The market is expected to grow at a CAGR of 4.9% during the forecast period 2025-2032.

Building Insulation Market Summary Key Insights & Trends

- Foamed plastics remain the largest material segment, holding around 27% share in 2025, with demand supported by superior thermal resistance, cost efficiency, and adaptability across residential and commercial buildings.

- The residential sector dominates end-use applications with nearly 55% market share, as stricter building codes and rising consumer awareness of energy savings drive insulation demand in housing projects worldwide.

- Asia Pacific leads the global building insulation market with close to 48% share, propelled by rapid urbanization in China and India, where government policies and construction booms reinforce insulation adoption.

- Europe follows with around 27% share, reflecting strong regulatory enforcement on energy efficiency and an accelerated transition toward low-carbon, eco-friendly insulation materials.

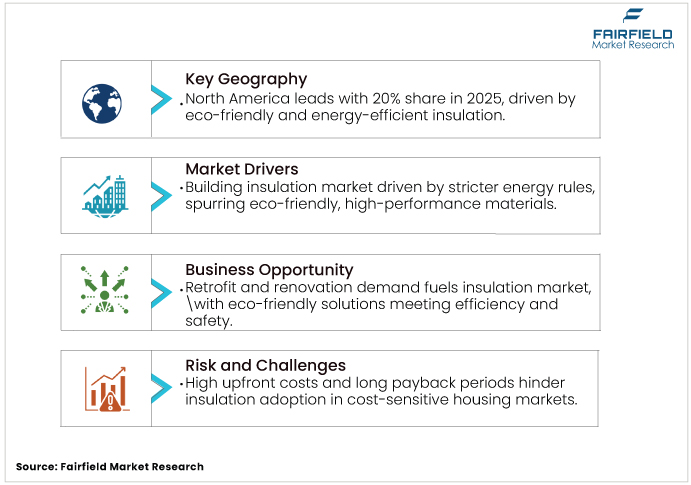

- North America accounts for nearly a 20% share, supported by retrofit activity and increasing focus on healthier indoor environments through advanced insulation products.

A Look Back and a Look Forward - Comparative Analysis

The building insulation market experienced steady growth from 2019 to 2024, driven by the rising need for energy efficiency, sustainability goals, and regulatory measures promoting green construction. Growing awareness of reducing energy costs and emissions also played a vital role in shaping demand across residential and commercial sectors.

The sector is set for strong expansion from 2025 to 2032, driven by consistent demand, technological advancements, and stricter building energy codes. Increasing adoption of eco-friendly materials and the focus on sustainable infrastructure will further support growth, positioning the market for long-term resilience and innovation.

Key Growth Drivers

- Strict Energy Regulations Driving Adoption of Advanced Materials

The building insulation market is being shaped by increasingly strict energy efficiency requirements, pushing developers, architects, and manufacturers to prioritize materials that deliver superior thermal performance and environmental benefits. Industry leaders are answering this demand with innovative solutions, polyurethane systems infused with low-carbon and circular ingredients, fiberglass insulation certified for healthier indoor air, and recycled PET based structural insulation that meets both mechanical and fire safety standards.

Low-carbon technologies such as Neopor® BMB are also enabling insulation products that cut emissions while boosting energy savings in buildings. These advancements demonstrate how energy efficiency has become a core driver for insulation product innovation, turning it into both a regulatory necessity and a competitive advantage in sustainable construction.

- Urbanization and Construction Boom Accelerating Demand for Thermal Insulation Solutions

Urbanization and rapid infrastructure growth are directly accelerating demand for advanced building insulation solutions in both residential and commercial sectors. As cities expand, companies such as Saint-Gobain are scaling up sustainable insulation portfolios through partnerships such as its collaboration with TimberHP, ensuring eco-friendly options are available to meet the rising need for energy-efficient construction. At the same time, manufacturers such as Knauf Insulation are investing heavily, such as the USD 130 million expansion in Croatia with electric melting technology to double production capacity and address surging requirements across urban projects.

Major players, including Owens Corning, are also strengthening their presence by acquiring complementary businesses, creating broader platforms in the building materials market that can support large-scale infrastructure development. This combination of urban growth, sustainability focus, and strategic expansion is making insulation materials indispensable, positioning building insulation as a cornerstone of modern construction worldwide.

- Sustainability and Low-Carbon Construction Supporting the Shift to Eco-Friendly Insulation Materials

The building insulation market is increasingly driven by the global shift toward sustainability and low-carbon construction. Companies like KORE are introducing low-carbon EPS insulation using BASF’s Neopor® BMB technology, which not only improves thermal efficiency but also reduces the carbon footprint of housing projects. BASF has further strengthened this trend by developing Elastopor®, Elastopir®, and Elastospray® systems with recycled plastics, reinforcing the link between high-performance insulation and circular economy practices. Covestro is also pushing insulation material forward by partnering with major Chinese developers to integrate polyurethane-based insulation that addresses more than half of the country’s building-related carbon emissions.

These developments reflect how energy-efficient, eco-friendly insulation materials are becoming central to modern construction, positioning sustainability as a long-term growth pillar for the global market.

Key Growth Restraints

- High Initial Capital Requirement Restricts Adoption in Cost-Sensitive Projects

The building insulation market faces a major restraint as high initial capital requirements restrict adoption in cost-sensitive residential and commercial projects. Recent U.S. regulations mandating compliance with the 2021 IECC standard can add up to US$31,000 per new home, making insulation upgrades financially challenging for first-time buyers and affordable housing developers.

While insulation enhances thermal efficiency and long-term energy savings, the extended payback period, sometimes estimated at 90 years, creates a barrier for cost-sensitive markets. This issue becomes more pressing in regions with affordable housing shortages, where stricter building codes can discourage new construction and shift demand toward older, less efficient buildings. For the building insulation market, the financial burden of upfront installation costs continues to limit wider adoption, especially in entry-level housing and budget-constrained projects.

- Volatility in Raw Material Prices Affecting Market Stability

Volatility in raw material prices poses a significant restraint on the building insulation market. Materials such as polyurethane and polystyrene rely on petroleum-based inputs, which are subject to price fluctuations due to geopolitical tensions and supply chain disruptions. For example, crude oil prices rose by 8% in 2024, impacting insulation production costs. These fluctuations increase manufacturing expenses, squeezing profit margins for key players such as Owens Corning and BASF SE. The building insulation industry struggles to maintain affordability, particularly for large-scale projects, limiting growth in price-sensitive regions.

Building Insulation Market Trends and Opportunities

- Advancement in High-Performance and Smart Insulation Technologies

Growing retrofit and renovation projects in aging buildings present a strong opportunity for the building insulation market. Renovations increasingly demand solutions that improve energy efficiency, reduce carbon footprint, and ensure structural stability while complying with regulatory and preservation standards.

Advanced materials like silica aerogel-based plasters showcase how thermal performance can improve without compromising historic façades, making them suitable for heritage and commercial buildings. Similarly, recycled polymeric solutions such as ArmaPET Eco50 offer mechanical stability, fire compliance, and low maintenance, meeting the evolving needs of modern construction and renovation projects.

By focusing on energy-efficient, sustainable, and high-performance insulation solutions, manufacturers can capture market growth driven by retrofitting initiatives. Integrating eco-friendly and structurally robust materials in renovation projects ensures long-term benefits for building owners while enhancing the overall market adoption.

- Strategic Expansions Drive Sustainable Growth in the Market

The building insulation market is witnessing a strong shift toward sustainability, where manufacturers are pushing innovations in eco-friendly and high-performance insulation solutions. BASF, for instance, integrates recycled plastics into products like Elastopor® and Elastopir®, reflecting how energy-efficient and green materials are becoming a primary growth driver. Recticel strengthens this direction by expanding its insulation panel business while exiting non-core operations, showing a clear industry-wide focus on portfolio optimization.

These moves highlight how key players are aligning strategies with the rising demand for sustainable construction, ensuring that innovation, efficiency, and environmental responsibility move hand in hand. This trend underlines the future of the insulation market as being shaped not just by product performance, but by how effectively companies embed sustainability into their growth strategies.

Segment-wise Trends & Analysis

- Dominance of Foamed Plastic in Insulation

The foamed plastic segment holds the highest market share in the building insulation material market, driven by holding around 27% share in 2025. Its dominance comes from superior thermal insulation, lightweight nature, and adaptability across residential, commercial, and industrial buildings.

Polyurethane and polystyrene foams are widely adopted as they deliver strong energy efficiency while resisting moisture, which makes them attractive for sustainable construction practices. With stricter building energy codes and the rising demand for eco-friendly solutions, manufacturers are also focusing on recyclable and low emission foamed plastic insulation.

These innovations, combined with cost-effectiveness and ease of installation, keep foamed plastics at the center of the building insulation market, reinforcing their long-term relevance in meeting global sustainability and efficiency goals.

- Residential Sector Leads While Commercial Applications Expand Rapidly

The residential segment holds the highest market share in the building insulation market, accounting for around 55% by end use, driven by rising demand for energy-efficient and sustainable housing solutions. In Europe alone, residential buildings consume nearly 40% of total energy, making insulation a critical factor for reducing costs and carbon emissions.

Global players such as Kingspan, Rockwool, and Saint-Gobain are actively innovating in thermal insulation systems, with acquisitions like Saint-Gobain’s purchase of Building Products of Canada Corp. reinforcing leadership in sustainable construction.

Huntsman has strengthened its presence in spray polyurethane foam insulation through acquisitions, expanding its global reach in residential markets. Growing homeowner awareness, coupled with regulatory pushes for climate action, ensures that the residential segment will continue to anchor the future growth for insulation material.

Regional Analysis

- North America Driven by U.S. Investments and Energy Efficiency Initiatives

North America segment holds the highest market share in the building insulation material market, accounting for nearly 20% in 2025, supported by strong demand for energy-efficient and sustainable construction.

The region benefits from innovations such as Armacell’s ultra-low smoke elastomeric insulation and Knauf’s formaldehyde-free Performance+ fiberglass solutions, both of which address safety, indoor air quality, and long-term thermal performance.

Saint-Gobain’s CarbonLow™ wallboard and PIMA’s industry collaborations further reinforce the shift toward low-carbon, eco-friendly building materials. With rising construction activity, strict energy codes, and a growing preference for healthier indoor environments, North America continues to lead advancements in insulation technologies. This regional momentum positions insulation solutions to play a defining role in shaping the global transition to sustainable and resilient building practices.

- Strong Sustainability Push Positions Europe at the Forefront of Building Insulation

Europe segment holds a significant market share in the building insulation market, accounting for nearly 27% in 2025, driven by stringent energy efficiency regulations and a strong shift toward sustainable construction.

Companies such as HIRSCH Isolation are pioneering circular economy practices with EPS insulation products made without virgin material, significantly reducing carbon footprints and aligning with Europe’s decarbonization goals. Kingspan’s strategic acquisitions, including its majority stake in Steico and its partnership with LONGi for solar-integrated building materials, further strengthen the region’s leadership in high-performance insulation solutions. Cabot Corporation’s aerogel application in Germany’s UNESCO World Heritage site highlights Europe’s balance between heritage preservation and modern energy efficiency.

With growing adoption of eco-friendly insulation technologies, Europe continues to set global benchmarks for innovation, sustainability, and regulatory compliance in the market.

- Strong Construction and Sustainability Push Drives Asia Pacific Market

Asia Pacific segment holds the highest market share in the building insulation materials market, accounting for around 48% in 2025. China and India drive this dominance as both countries lead global mineral wool insulation gains, fueled by rapid urban construction, stricter building codes, and rising demand for acoustic and thermal insulation.

China strengthens its position with new residential standards and partnerships from players like Covestro and AkzoNobel, advancing polyurethane and aerogel-based sustainable solutions that align with carbon-reduction goals.

In India, innovations such as Nuvoco’s Ecodure Thermal Insulated Concrete and Saint-Gobain’s mineral wool expansion in Chennai highlight how local manufacturing supports energy efficiency and cost-effective building practices.

Across the region, a surge in HVAC equipment and advanced coatings is accelerating the adoption of insulation technologies. These factors position the Asia Pacific as a leading contributor to the global market, setting benchmarks for sustainable construction practices.

Competitive Landscape

The competitive landscape of the building insulation market reflects a moderately consolidated structure, where a mix of global leaders and regional players actively shape the industry. Multinational companies dominate through technological innovation, product diversification, and sustainability-driven solutions, while local manufacturers strengthen their positions with cost-effective offerings in price-sensitive markets. With strong demand from the construction and real estate sectors, the competition is influenced by energy efficiency regulations and the rising need for eco-friendly insulation materials.

Players in this market compete not only on product quality and thermal performance but also on expanding geographic reach and forming partnerships to enhance production capacity. Strategic investments in advanced insulation solutions, such as eco-conscious foams and high-performance panels, highlight the industry’s shift toward sustainable growth.

Key Companies

- Saint‑Gobain S.A.

- Owens Corning

- Knauf Insulation (Knauf Gips KG)

- Rockwool International A/S

- BASF SE

- Dow Inc.

- Johns Manville Corporation

- GAF Materials Corporation

- CNBM Group Co., Ltd.

- Aspen Aerogels, Inc.

- Covestro AG

- Huntsman Corporation

- DuPont de Nemours, Inc.

- Paroc Group Oy

- Evonik Industries AG

Key Development

- In May 2024, Saint-Gobain, through CertainTeed, partnered with TimberHP to distribute wood fiber insulation across North America, with exclusive rights in Canada. This move significantly strengthens Saint-Gobain’s sustainable product portfolio and aligns with rising demand for eco-friendly building solutions. The collaboration reflects a broader industry trend toward renewable and low-carbon insulation materials.

- In Sept 2024, Knauf Insulation unveiled its Performance+™ range of fiberglass insulation, certified for healthier indoor air quality and high energy efficiency. This portfolio marks a step forward in combining thermal performance with occupant well-being, meeting stricter building standards. The launch underscores the market shift toward next-generation insulation products with enhanced sustainability and health benefits.

Expert Opinion

- The building insulation market is currently expanding steadily, fueled by rising construction activities and strict regulations around energy efficiency and thermal performance of buildings.

- Demand is shifting toward advanced and sustainable insulation solutions, with recyclable, low-carbon, and eco-friendly materials gaining traction in response to green building certifications and environmental policies.

- Despite challenges from raw material price fluctuations, the market remains resilient due to strong government incentives, urbanization, and retrofitting projects in both developed and emerging economies.

- In the future, technological innovation and smart insulation systems are expected to shape market growth, as integration with energy-efficient building technologies becomes a priority.

Global Building Insulation Market Segmentation

By Material Type

- Foamed Plastics

- Polyurethane and Polyisocyanurate

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Other Foamed Plastics

- Fiberglass

- Loose Fill

- Batts and Blankets

- Roof Deck Board

- Pipe and Duct Wrap

- Mineral or Stone Wool

- Board

- Batts and Blankets

- Loose Fill

- Biobased Materials

- Denim

- Wood

- Sheep Wool

- Hemp

- Straw

- Miscellaneous

By Application

- Underfloor Insulation

- Walls Insulation

- Attic/Roof Insulation

- Duct Insulation

- Other Applications

By End Use

- Commercial

- Residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Building Insulation Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Building Insulation Market Outlook, 2019 - 2032

3.1. Global Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

3.1.1. Foamed Plastics

3.1.1.1. Polyurethane and Polyisocyanurate

3.1.1.2. Expanded Polystyrene (EPS)

3.1.1.3. Extruded Polystyrene (XPS)

3.1.1.4. Other Foamed Plastics

3.1.2. Fiberglass

3.1.2.1. Loose Fill

3.1.2.2. Batts and Blankets

3.1.2.3. Roof Deck Board

3.1.2.4. Pipe and Duct Wrap

3.1.3. Mineral or Stone Wool

3.1.3.1. Board

3.1.3.2. Batts and Blankets

3.1.3.3. Loose Fill

3.1.4. Biobased Materials

3.1.4.1. Denim

3.1.4.2. Wood

3.1.4.3. Sheep Wool

3.1.4.4. Hemp

3.1.4.5. Straw

3.1.5. Miscellaneous

3.2. Global Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

3.2.1. Underfloor Insulation

3.2.2. Walls Insulation

3.2.3. Attic/Roof Insulation

3.2.4. Duct Insulation

3.2.5. Other Applications

3.3. Global Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

3.3.1. Commercial

3.3.2. Residential

3.4. Global Building Insulation Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Building Insulation Market Outlook, 2019 - 2032

4.1. North America Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

4.1.1. Foamed Plastics

4.1.1.1. Polyurethane and Polyisocyanurate

4.1.1.2. Expanded Polystyrene (EPS)

4.1.1.3. Extruded Polystyrene (XPS)

4.1.1.4. Other Foamed Plastics

4.1.2. Fiberglass

4.1.2.1. Loose Fill

4.1.2.2. Batts and Blankets

4.1.2.3. Roof Deck Board

4.1.2.4. Pipe and Duct Wrap

4.1.3. Mineral or Stone Wool

4.1.3.1. Board

4.1.3.2. Batts and Blankets

4.1.3.3. Loose Fill

4.1.4. Biobased Materials

4.1.4.1. Denim

4.1.4.2. Wood

4.1.4.3. Sheep Wool

4.1.4.4. Hemp

4.1.4.5. Straw

4.1.5. Miscellaneous

4.2. North America Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

4.2.1. Underfloor Insulation

4.2.2. Walls Insulation

4.2.3. Attic/Roof Insulation

4.2.4. Duct Insulation

4.2.5. Other Applications

4.3. North America Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

4.3.1. Commercial

4.3.2. Residential

4.4. North America Building Insulation Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.4.1. U.S. Building Insulation Market Outlook, by Material Type, 2019-2032

4.4.2. U.S. Building Insulation Market Outlook, by Application, 2019-2032

4.4.3. U.S. Building Insulation Market Outlook, by End Use, 2019-2032

4.4.4. Canada Building Insulation Market Outlook, by Material Type, 2019-2032

4.4.5. Canada Building Insulation Market Outlook, by Application, 2019-2032

4.4.6. Canada Building Insulation Market Outlook, by End Use, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Building Insulation Market Outlook, 2019 - 2032

5.1. Europe Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

5.1.1. Foamed Plastics

5.1.1.1. Polyurethane and Polyisocyanurate

5.1.1.2. Expanded Polystyrene (EPS)

5.1.1.3. Extruded Polystyrene (XPS)

5.1.1.4. Other Foamed Plastics

5.1.2. Fiberglass

5.1.2.1. Loose Fill

5.1.2.2. Batts and Blankets

5.1.2.3. Roof Deck Board

5.1.2.4. Pipe and Duct Wrap

5.1.3. Mineral or Stone Wool

5.1.3.1. Board

5.1.3.2. Batts and Blankets

5.1.3.3. Loose Fill

5.1.4. Biobased Materials

5.1.4.1. Denim

5.1.4.2. Wood

5.1.4.3. Sheep Wool

5.1.4.4. Hemp

5.1.4.5. Straw

5.1.5. Miscellaneous

5.2. Europe Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

5.2.1. Underfloor Insulation

5.2.2. Walls Insulation

5.2.3. Attic/Roof Insulation

5.2.4. Duct Insulation

5.2.5. Other Applications

5.3. Europe Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

5.3.1. Commercial

5.3.2. Residential

5.4. Europe Building Insulation Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.4.1. Germany Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.2. Germany Building Insulation Market Outlook, by Application, 2019-2032

5.4.3. Germany Building Insulation Market Outlook, by End Use, 2019-2032

5.4.4. Italy Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.5. Italy Building Insulation Market Outlook, by Application, 2019-2032

5.4.6. Italy Building Insulation Market Outlook, by End Use, 2019-2032

5.4.7. France Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.8. France Building Insulation Market Outlook, by Application, 2019-2032

5.4.9. France Building Insulation Market Outlook, by End Use, 2019-2032

5.4.10. U.K. Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.11. U.K. Building Insulation Market Outlook, by Application, 2019-2032

5.4.12. U.K. Building Insulation Market Outlook, by End Use, 2019-2032

5.4.13. Spain Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.14. Spain Building Insulation Market Outlook, by Application, 2019-2032

5.4.15. Spain Building Insulation Market Outlook, by End Use, 2019-2032

5.4.16. Russia Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.17. Russia Building Insulation Market Outlook, by Application, 2019-2032

5.4.18. Russia Building Insulation Market Outlook, by End Use, 2019-2032

5.4.19. Rest of Europe Building Insulation Market Outlook, by Material Type, 2019-2032

5.4.20. Rest of Europe Building Insulation Market Outlook, by Application, 2019-2032

5.4.21. Rest of Europe Building Insulation Market Outlook, by End Use, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Building Insulation Market Outlook, 2019 - 2032

6.1. Asia Pacific Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

6.1.1. Foamed Plastics

6.1.1.1. Polyurethane and Polyisocyanurate

6.1.1.2. Expanded Polystyrene (EPS)

6.1.1.3. Extruded Polystyrene (XPS)

6.1.1.4. Other Foamed Plastics

6.1.2. Fiberglass

6.1.2.1. Loose Fill

6.1.2.2. Batts and Blankets

6.1.2.3. Roof Deck Board

6.1.2.4. Pipe and Duct Wrap

6.1.3. Mineral or Stone Wool

6.1.3.1. Board

6.1.3.2. Batts and Blankets

6.1.3.3. Loose Fill

6.1.4. Biobased Materials

6.1.4.1. Denim

6.1.4.2. Wood

6.1.4.3. Sheep Wool

6.1.4.4. Hemp

6.1.4.5. Straw

6.1.5. Miscellaneous

6.2. Asia Pacific Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

6.2.1. Underfloor Insulation

6.2.2. Walls Insulation

6.2.3. Attic/Roof Insulation

6.2.4. Duct Insulation

6.2.5. Other Applications

6.3. Asia Pacific Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

6.3.1. Commercial

6.3.2. Residential

6.4. Asia Pacific Building Insulation Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.4.1. China Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.2. China Building Insulation Market Outlook, by Application, 2019-2032

6.4.3. China Building Insulation Market Outlook, by End Use, 2019-2032

6.4.4. Japan Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.5. Japan Building Insulation Market Outlook, by Application, 2019-2032

6.4.6. Japan Building Insulation Market Outlook, by End Use, 2019-2032

6.4.7. South Korea Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.8. South Korea Building Insulation Market Outlook, by Application, 2019-2032

6.4.9. South Korea Building Insulation Market Outlook, by End Use, 2019-2032

6.4.10. India Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.11. India Building Insulation Market Outlook, by Application, 2019-2032

6.4.12. India Building Insulation Market Outlook, by End Use, 2019-2032

6.4.13. Southeast Asia Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.14. Southeast Asia Building Insulation Market Outlook, by Application, 2019-2032

6.4.15. Southeast Asia Building Insulation Market Outlook, by End Use, 2019-2032

6.4.16. Rest of SAO Building Insulation Market Outlook, by Material Type, 2019-2032

6.4.17. Rest of SAO Building Insulation Market Outlook, by Application, 2019-2032

6.4.18. Rest of SAO Building Insulation Market Outlook, by End Use, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Building Insulation Market Outlook, 2019 - 2032

7.1. Latin America Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

7.1.1. Foamed Plastics

7.1.1.1. Polyurethane and Polyisocyanurate

7.1.1.2. Expanded Polystyrene (EPS)

7.1.1.3. Extruded Polystyrene (XPS)

7.1.1.4. Other Foamed Plastics

7.1.2. Fiberglass

7.1.2.1. Loose Fill

7.1.2.2. Batts and Blankets

7.1.2.3. Roof Deck Board

7.1.2.4. Pipe and Duct Wrap

7.1.3. Mineral or Stone Wool

7.1.3.1. Board

7.1.3.2. Batts and Blankets

7.1.3.3. Loose Fill

7.1.4. Biobased Materials

7.1.4.1. Denim

7.1.4.2. Wood

7.1.4.3. Sheep Wool

7.1.4.4. Hemp

7.1.4.5. Straw

7.1.5. Miscellaneous

7.2. Latin America Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

7.2.1. Underfloor Insulation

7.2.2. Walls Insulation

7.2.3. Attic/Roof Insulation

7.2.4. Duct Insulation

7.2.5. Other Applications

7.3. Latin America Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

7.3.1. Commercial

7.3.2. Residential

7.4. Latin America Building Insulation Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.4.1. Brazil Building Insulation Market Outlook, by Material Type, 2019-2032

7.4.2. Brazil Building Insulation Market Outlook, by Application, 2019-2032

7.4.3. Brazil Building Insulation Market Outlook, by End Use, 2019-2032

7.4.4. Mexico Building Insulation Market Outlook, by Material Type, 2019-2032

7.4.5. Mexico Building Insulation Market Outlook, by Application, 2019-2032

7.4.6. Mexico Building Insulation Market Outlook, by End Use, 2019-2032

7.4.7. Argentina Building Insulation Market Outlook, by Material Type, 2019-2032

7.4.8. Argentina Building Insulation Market Outlook, by Application, 2019-2032

7.4.9. Argentina Building Insulation Market Outlook, by End Use, 2019-2032

7.4.10. Rest of LATAM Building Insulation Market Outlook, by Material Type, 2019-2032

7.4.11. Rest of LATAM Building Insulation Market Outlook, by Application, 2019-2032

7.4.12. Rest of LATAM Building Insulation Market Outlook, by End Use, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Building Insulation Market Outlook, 2019 - 2032

8.1. Middle East & Africa Building Insulation Market Outlook, by Material Type, Value (US$ Bn), 2019-2032

8.1.1. Foamed Plastics

8.1.1.1. Polyurethane and Polyisocyanurate

8.1.1.2. Expanded Polystyrene (EPS)

8.1.1.3. Extruded Polystyrene (XPS)

8.1.1.4. Other Foamed Plastics

8.1.2. Fiberglass

8.1.2.1. Loose Fill

8.1.2.2. Batts and Blankets

8.1.2.3. Roof Deck Board

8.1.2.4. Pipe and Duct Wrap

8.1.3. Mineral or Stone Wool

8.1.3.1. Board

8.1.3.2. Batts and Blankets

8.1.3.3. Loose Fill

8.1.4. Biobased Materials

8.1.4.1. Denim

8.1.4.2. Wood

8.1.4.3. Sheep Wool

8.1.4.4. Hemp

8.1.4.5. Straw

8.1.5. Miscellaneous

8.2. Middle East & Africa Building Insulation Market Outlook, by Application, Value (US$ Bn), 2019-2032

8.2.1. Underfloor Insulation

8.2.2. Walls Insulation

8.2.3. Attic/Roof Insulation

8.2.4. Duct Insulation

8.2.5. Other Applications

8.3. Middle East & Africa Building Insulation Market Outlook, by End Use, Value (US$ Bn), 2019-2032

8.3.1. Commercial

8.3.2. Residential

8.4. Middle East & Africa Building Insulation Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.4.1. GCC Building Insulation Market Outlook, by Material Type, 2019-2032

8.4.2. GCC Building Insulation Market Outlook, by Application, 2019-2032

8.4.3. GCC Building Insulation Market Outlook, by End Use, 2019-2032

8.4.4. South Africa Building Insulation Market Outlook, by Material Type, 2019-2032

8.4.5. South Africa Building Insulation Market Outlook, by Application, 2019-2032

8.4.6. South Africa Building Insulation Market Outlook, by End Use, 2019-2032

8.4.7. Egypt Building Insulation Market Outlook, by Material Type, 2019-2032

8.4.8. Egypt Building Insulation Market Outlook, by Application, 2019-2032

8.4.9. Egypt Building Insulation Market Outlook, by End Use, 2019-2032

8.4.10. Nigeria Building Insulation Market Outlook, by Material Type, 2019-2032

8.4.11. Nigeria Building Insulation Market Outlook, by Application, 2019-2032

8.4.12. Nigeria Building Insulation Market Outlook, by End Use, 2019-2032

8.4.13. Rest of Middle East Building Insulation Market Outlook, by Material Type, 2019-2032

8.4.14. Rest of Middle East Building Insulation Market Outlook, by Application, 2019-2032

8.4.15. Rest of Middle East Building Insulation Market Outlook, by End Use, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Saint‑Gobain S.A.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Owens Corning

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Knauf Insulation (Knauf Gips KG)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Rockwool International A/S

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. BASF SE

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Dow Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Johns Manville Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. GAF Materials Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. CNBM Group Co., Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Aspen Aerogels, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |