Recycled Plastics Market Outlook

Recycled Plastics Market: A Solution to Tackle Waste Issues to Achieve Circular Economy for Plastics

The Recycled Plastics Market is valued at USD 67.3 Bn in 2026 and is projected to reach USD 127 Bn, growing at a CAGR of 10% by 2033.Each year, more than 300 million tons of plastic is consumed worldwide with more than 50% of it meant for a single-use purpose. The ever-increasing ubiquity of plastics has not been without consequences. Majority of this single-use plastic (SUPs) ends up either in landfills, incinerators, or oceans. It is estimated that around 10-12 million tons of plastic is thrown into oceans every year, destroying as many as 1 million sea creatures. Ineffective management of plastics and the take-make-waste model has put an immense burden on ecosystems resulting in releasing harmful chemicals into the environment, thus polluting soil, underground water, and air. This repeatedly highlights the critical need to prioritize investments in global recycled plastics market.

In recent times, the recycled plastics market has been on the rise with burgeoning demand from a variety range of end-users. Their cost-competitiveness against virgin counterparts in the past has finally helped to unlock its huge market potential worldwide. This commoditization of plastic waste streams seems to be an effective way to deal with plastic waste pollution and ultimately become a part of the system required to create a circular economy for plastics. With the help of plastic recycling, scrap or waste plastic can be recovered and reprocessed as a material for functional and useful products.

Polyethylene Terephthalate (PET), and High-density Polyethylene (HDPE) to Lead Recycled Plastics Market

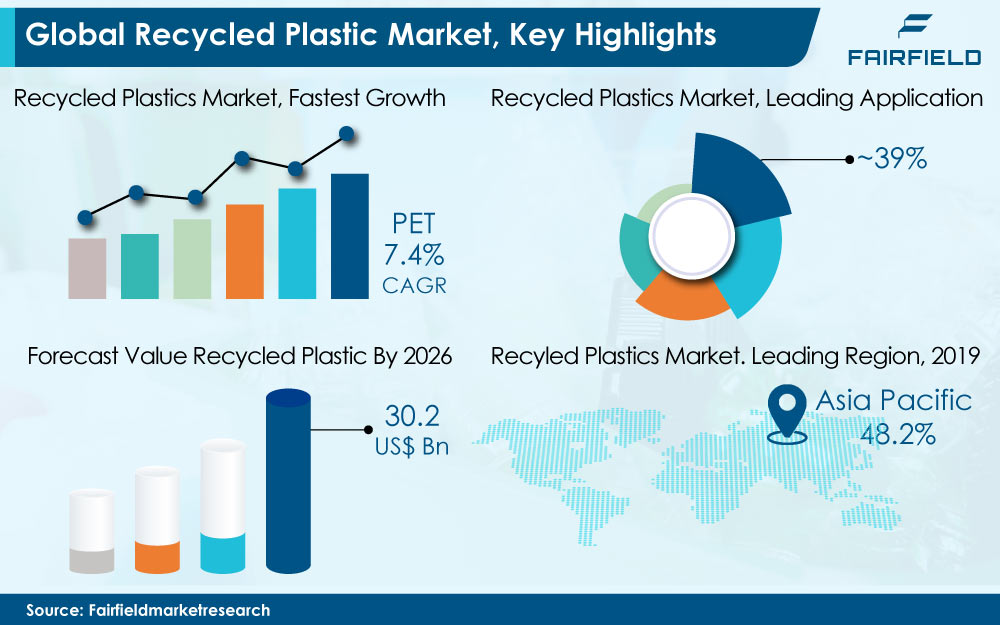

Consumer awareness is pushing brand companies and governments to restrict usage of single-use plastics in packaging applications. This has forced consumer packaged goods (CPGs) owners to incorporate a high level of recycled PET content in packaging. Recycled PET is largely sourced from post-consumer waste, the majority belonging to packaging items such as bottles and trays. Demand for recycled PET is anticipated to grow with a CAGR of 7.4% between 2022 and 2026 owing to the huge demand for sustainable packaging materials. The recycled plastics market has seen upsurge in demand from PET bottles and thermoformed containers, trays, and sheets. PET and HDPE together accounted for more than 3/4th of the total recycled plastics market in 2019.

Major consumer brands such as Coca-Cola, PepsiCo, Unilever, and Nestlé have pledged the integration of recycled plastics into their product packaging to achieve sustainable packaging goals. Sharp growth in demand from the packaging industry to prioritize environmental sustainability commitments and ensure long-term cost savings is expected to drive the market for recycled high-density polyethylene (HDPE) and polyethylene (PP). PP and PE waste for the recycled plastics market is largely sourced from post-industrial waste streams with a certain percentage from post-consumer waste as well. The production of engineered plastics recyclate such as ABS, nylon, and polystyrene is likely to grow with better collection & sorting systems along with advancements in recycling technologies.

Non-food Packaging to Remain the Largest Consumer Segment in Recycled Plastics Market

Annually, an estimated 170 million tons of plastic waste is generated by the packaging industry alone. The industry is accountable for creating an extraordinary amount of plastic waste. Non-food packaging accounted for more than 39% of the total recycled plastics market in 2019. Non-food packaging applications such as containers for pharmaceuticals, cleaning chemicals, automotive fluids, and personal care products. is anticipated to drive the demand for recycled plastics over the coming years. On the other hand, food packaging is forecast to be the fastest-growing application segment in the recycled plastics market. Many companies in this segment are focused on limiting the usage of virgin plastics in their product packaging. These companies are investing in creating circular economies for plastics, thus promoting food-grade recycled plastics. In value terms, the recycled plastics market in food packaging is forecasted to grow by 8.9% between 2022 and 2026.

In recent years, the construction sector too has been changing its perception towards the consumption of recycled plastics, paving the way to a more conscious decision. Recycled plastics can be incorporated into construction materials such as polymeric timbers. They can also be used for a wide range of applications such as flooring tiles, indoor insulation, carpeting, roofing tiles, fences, and bricks. These materials can be used in residential as well as commercial construction owing to their durability, lighter weight, and high strength in case mix-compound recycled plastics. This will largely bode well for the growth of recycled plastics market.

Supportive Government Policies, and Soaring Need of Resource Sustainability to Drive Recycled Plastics Market in Europe

In 2021, the EU introduced a new ‘plastics tax’, with each country contributing ~US$950/ton on nonrecycled plastic packaging waste. This scheme is expected to generate between US$7.2 Bn and US$9.7 Bn annually till 2027. This new tax policy is expected to boost the growth of recycled plastics market in the region. In the past few years, the EU has proposed various plans aiming towards a circular economy and a green deal. These policies are expected to improve the margins for recycled plastics companies in the region, significantly improving the recycling rates.

In 2019, Asia Pacific accounted for more than half of the recycled plastic demand. The region is also one of the largest consumers of virgin plastic. Governments in countries such as India, Southeast Asia, and China are emphasizing more on the consumption of recycled plastics intending to boost the domestic recycled plastics market. These governments are also aiming to improve the recycling rates and collection systems by offering economic incentives.

In the past, the U.S. used to ship much of its plastic waste to China for recycling. However, China’s ban on plastic waste import through its ‘National Sword’ policy in 2018 has created major recycling opportunities for the entire region in the past couple of years. The U.S. will invest in collection and recycling capabilities to secure the supply of recycled plastics in the coming years. Industry association, sustainability targets of brand owners, and consumers awareness towards sustainable packaging solutions are driving factors behind the growth of recycled plastics market in the region.

Key Companies in Recycled Plastics Market Emphasize New Capacities

The recycled plastics market is highly fragmented with small and medium enterprises dominating the regional and domestic scenario. COVID-19 pandemic has badly impacted the profit margins of companies operating in the recycled plastics market, with packaging companies opting for virgin plastics as prices of crude oil hitting an all-time low in the H2 of 2020. However, there has been ample encouragement in the recycled plastics market with various companies setting goals for a circular economy and adding new production capacities to meet their sustainability targets. A Few of the major players operating in the recycled plastics market include Indorama Ventures Public Company Limited, Borealis AG, ALPLA Group, LyondellBasell Industries N.V., and KW Plastics.

Prominent companies in global recycled plastics market are also focusing on establishing vertically integrated systems to ensure a consistent flow of feedstock. JEPLAN, a Japan-based depolymerization technology company, developed the BRING™ system, enabling the company to collect large quantities of discarded clothing, including polyester waste. This waste can be fed into their molecular recycling technology process. This helped the company to have better control over feedstock flow during turbulent times.

The Global Recycled Plastics Market is Segmented as Below:

Product Coverage

- PET

- HDPE

- PP

- LDPE

- Misc. (PVC, PS, PUR, etc.)

Application Coverage

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- Misc. (Electronics, Agriculture, etc.)

Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Leading Companies

- Indorama Ventures Public Company Limited

- Covestro AG

- Borealis AG

- LyondellBasell Industries N.V.

- Phoenix Technologies International, LLC

- UltrePET, LLC.

- Extrupet Group (Pty) Ltd

- KW Plastics

- Envision Plastics

- ALPLA Group

- Executive Summary

- Global Recycled Plastics Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Recycled Plastics Market Outlook, 2020 - 2033

- Global Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- Global Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- Global Recycled Plastics Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- North America Recycled Plastics Market Outlook, 2020 - 2033

- North America Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- North America Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- North America Recycled Plastics Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- S. Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Canada Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Canada Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- Europe Recycled Plastics Market Outlook, 2020 - 2033

- Europe Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- Europe Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- Europe Recycled Plastics Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Germany Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Italy Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Italy Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- France Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- France Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- K. Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- K. Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Spain Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Spain Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Russia Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Russia Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Rest of Europe Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Rest of Europe Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- Asia Pacific Recycled Plastics Market Outlook, 2020 - 2033

- Asia Pacific Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- Asia Pacific Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- Asia Pacific Recycled Plastics Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- China Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Japan Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Japan Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- South Korea Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- South Korea Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- India Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- India Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Southeast Asia Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Southeast Asia Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Rest of SAO Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Rest of SAO Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- Latin America Recycled Plastics Market Outlook, 2020 - 2033

- Latin America Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- Latin America Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- Latin America Recycled Plastics Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Brazil Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Mexico Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Mexico Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Argentina Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Argentina Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Rest of LATAM Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Rest of LATAM Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- Middle East & Africa Recycled Plastics Market Outlook, 2020 - 2033

- Middle East & Africa Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- PET

- HDPE

- PP

- LDPE

- (PVC, PS, PUR, etc.)

- Middle East & Africa Recycled Plastics Market Outlook, by Application Coverage, Value (US$ Mn), 2020-2033

- Food Packaging

- Non-food Packaging

- Construction

- Automotive

- Textile

- (Electronics, Agriculture, etc.)

- Middle East & Africa Recycled Plastics Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- GCC Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- South Africa Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- South Africa Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Egypt Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Egypt Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Nigeria Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Nigeria Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- Rest of Middle East Recycled Plastics Market Outlook, by Product Coverage, 2020-2033

- Rest of Middle East Recycled Plastics Market Outlook, by Application Coverage, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Recycled Plastics Market Outlook, by Product Coverage, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Indorama Ventures Public Company Limited

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Covestro AG

- Borealis AG

- LyondellBasell Industries N.V.

- Phoenix Technologies International, LLC

- UltrePET, LLC.

- Extrupet Group (Pty) Ltd

- KW Plastics

- Envision Plastics

- ALPLA Group

- Indorama Ventures Public Company Limited

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Product-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain), Key Trends |