Global Cannabis Concentrate Market Forecast

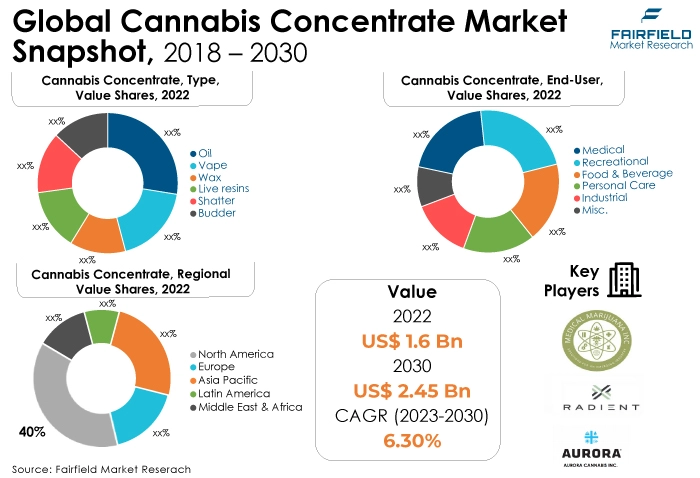

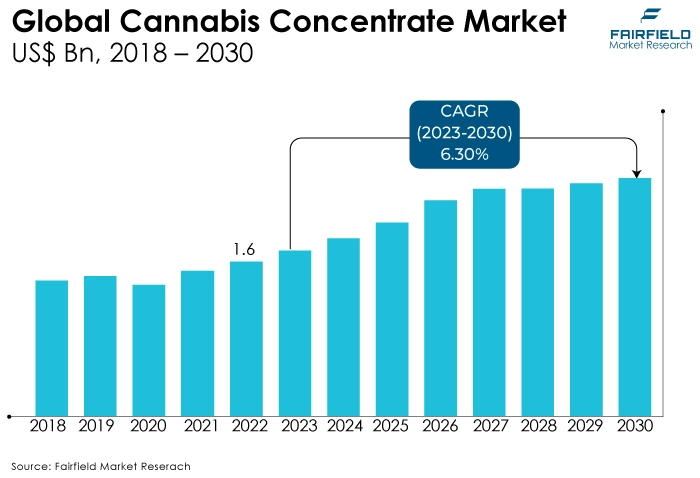

- Cannabis concentrate market revenue poised to jump from US$1.6 Bn recorded in 2022, to US$2.45 Bn in 2030

- Market valuation to see healthy expansion at a CAGR of 6.30% between 2023 and 2030

Quick Report Digest

- As the prevalence of chronic conditions, including diabetes, cancer, and others, rises, the market for cannabis concentrate is anticipated to grow.

- The introduction of a broad range of goods with an emphasis on product advancements and consideration of the expanding demand for cannabis concentrate.

- The wide range of health advantages that cannabis products offer serves as a significant growth driver for the industry. The market is predicted to expand throughout the forecast period.

- The prohibitive cost of using cannabis concentrates and products is a major barrier to the market's growth.

- In 2022, the cannabis oils category dominated the industry. The sector for cannabis oils is expected to expand throughout the projected period as more patients opt for oils rather than flowers.

- In terms of market share for cannabis concentrate globally, the recreational segment is anticipated to dominate. Since numerous governments have made cannabis products legal for recreational use, there has been a significant increase in demand in this market segment.

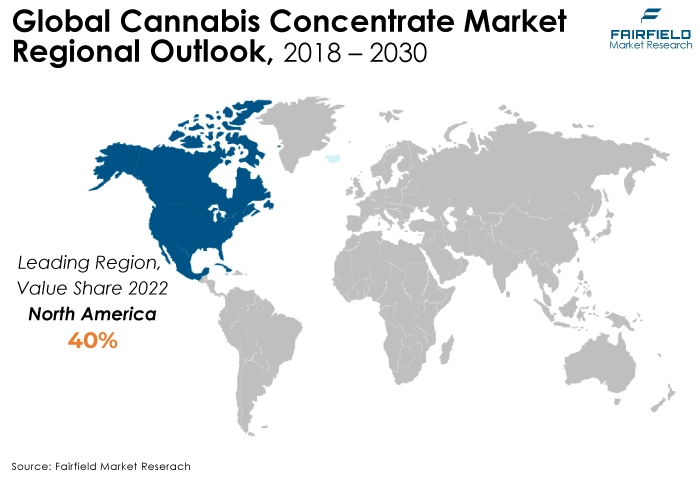

- The North American region is anticipated to account for the largest share of the global cannabis concentrate market due to the massive supply and demand for cannabis products created by the legalization policies that have been implemented governing their usage.

- The market for cannabis concentrate is expanding in Asia-Pacific. The huge increase in consumption rates over the past two years as a result of an increasing number of people turning to cannabis as a medical treatment.

A Look back and a Look Forward - Comparative Analysis

The industry is growing as a result of the growing legalization of marijuana for the treatment of different chronic ailments, such as cancer, arthritis, Alzheimer's disease, and anxiety, as well as the rising demand for cannabis concentrates like oils and tinctures. The cannabis concentrate market is rising as more people become aware of its many medical benefits.

The market witnessed staggered growth during the historical period 2018 – 2022. People chose to purchase medicinal cannabis lawfully, which has led to a decline in the illicit market in several nations where it has been decriminalized and/or legalized.

The legality of medicinal cannabis concentrate is significantly more lax than that of dried buds, which includes smoking, which encourages the growth of the industry. Given that consumer preference is moving in the direction of ethical and sustainable food sources, marketing cannabis concentrate as a sustainable product may be a tactic to expand the customer base.

Numerous countries have legalized the sale and distribution of cannabis products, creating a sizable market opportunity for global corporations. The fierce competition among the major market players to create unique flavors and combinations has shown to be advantageous for recently established companies.

Key Growth Determinants

- Increased Use in Medicines

Cannabis for medical use is derived from cannabis plants and is used to treat both the signs and symptoms of specific medical diseases and the adverse effects of some drugs. The most common use of cannabis for medical purposes is to treat pain. There has been a gradual rise in the acceptance and use of medicinal cannabis as more countries have legalized its use for a number of purposes.

The FDA has approved the use of cannabis concentrate for the treatment of spasticity in Multiple Sclerosis (MS), Lennox-Gastaut syndrome, Dravet syndrome, and uncommon and severe kinds of epilepsy.

Cannabis concentrate uses the marijuana plant or its chemicals in place of prescription drugs to treat certain conditions. Cannabidiol and delta-9-tetrahydrocannabinol are two cannabinoids of considerable importance.

- Increased Adoption for Recreational Purposes

Legalizing cannabis for recreational purposes results in good regulatory control over a substance with minimal danger of negative consequences. Legalizing cannabis would benefit society in a number of ways, including economic expansion without raising taxes, the creation of thousands of new employment, the abolition of discrimination in cannabis enforcement, and the freeing up of scarce police resources.

Legalizing cannabis for recreational use might end the costly enforcement of cannabis laws and diminish the illegal cannabis market. Due to these benefits, cannabis has been legalized and is growing in popularity among individuals of all ages.

A high-quality cannabis concentrate is therefore required for recreational use. As a result, it is projected that producers will have more market opportunities as cannabis use for recreational purposes increases.

- Legalizing Use of Cannabis Both Medically and Recreationally

A significant upheaval in the sector has resulted from the legalization of cannabis for both medical and recreational use in a number of nations. As a result of this transition, a thriving cannabis concentrate sector has arisen, which has had an impact on other industries.

The market for cannabis concentrate is growing to previously unheard-of heights as a result of a number of interrelated variables that this seismic upheaval has triggered. Comprehensive solutions are now more necessary than ever because cannabis products are readily available to customers.

Major Growth Barriers

- Lack of Access to Financial Assistance

Banking is one of the major problems the cannabis concentrate sector has to deal with. Only a small number of nations have legalized cannabis, while it is still prohibited in many others. As a result of the uncertainty this legal division creates, the majority of licensed banks are hesitant to offer banking services to the cannabis concentrate business.

Since banking providers are scarce, cannabis concentrate businesses find it difficult to acquire and keep the same access to financial services as their rivals in traditional retail industries.

- Stringent Standards and Regulations

Regulation and stringent restrictions are significant roadblocks to the market's expansion in terms of income. States in many different nations each have their own rules regarding cannabis concentrate. The rules that apply to cannabis, however, differ depending on where you live.

For instance, the labeling and packaging of cannabis and items associated with cannabis are subject to a number of restrictions under the Canadian Cannabis Regulations and Cannabis Act. Except as expressly provided in the Act, these prohibitions apply to all cannabis concentrate and cannabis-related products.

Key Trends and Opportunities to Look at

- Policy and Regulatory Relaxation

The coronavirus epidemic offered chances to help the sector and loosen rules. On the contrary, an increasing number of jurisdictions have created legal frameworks for adult non-medical use, such as for social, religious, and cultural reasons.

In addition, formalizing operations associated with product production, trade, and cultivation in a (legally regulated) legal cannabis concentrate market will ease consumer access to information and increase consumption, which is anticipated to present opportunities for the market in the years to come.

- Cannabis Infused Edibles

Better development is required due to the cannabis concentrate market's robust growth on a global scale. Due to this demand, numerous businesses have developed research and development programs that thoroughly examine various cannabis genetic enhancement techniques.

One of the biggest opportunities for manufacturers is to make low-dose edible products for people who want medical cannabis without the euphoric effects. Low-dose edibles are the perfect product line to attract new clients into the cannabis concentrate sector because microdosing allows for controlled recreational usage.

- Novel Product Developments with Increasing R&D Activities

One can take cannabis concentrate in a variety of methods, including pills, chewing gum, lotions, crystals, flowers, tablets, oil, and oro-mucosal sprays. Since cannabis has been legalized, there has been an increase in demand for cannabis concentrate, which has prompted the creation of better product strains and delivery systems.

This encouraged many companies to conduct R&D projects to investigate cannabis concentrate advancement strategies.

How Does the Regulatory Scenario Shape this Industry?

The majority of the cannabis concentrate market is dominated by medicinal cannabis. Numerous nations have made the use of cannabis for medical purposes lawful, including Australia, Canada, Chile, Colombia, Germany, Greece, Israel, Italy, the Netherlands, Peru, Poland, Portugal, Thailand, the United Kingdom, and Uruguay.

In June 2022, Cannabis and hemp were decriminalized in Thailand after Food and Drug Administration took them off the list of Category 5 narcotics. The government hopes that by changing the law, Thailand would become a "herbal center" in Southeast Asia, allowing Thais to cultivate and sell cannabis for medical purposes.

Cannabis will be accepted for recreational use in 19 states, two US territories, and the District of Columbia as of 2022. The use of the substance for medicinal purposes has been authorized in 37 states, four US territories, and DC. Given the broad desire for cannabis and its therapeutic benefits, more states are predicted to follow suit during the projection period.

Fairfield’s Ranking Board

Top Segments

- Cannabis Oil Category Surges Ahead

The cannabis oil segment dominated the market in 2022. Cannabis and its derivatives are generally recognized for their benefits. Cannabis oil is used to treat sleep issues as well as stress and anxiety. The market for cannabis oils is expected to expand during the anticipated period as more patients opt for oils rather than flowers.

Furthermore, the vape category is projected to experience the fastest market growth. Customers who want more strong cannabis products in the United States are increasingly turning to vapes. Despite the fact that disposable Vapes are bad for the environment, businesses continue to produce them because of rising consumer demand.

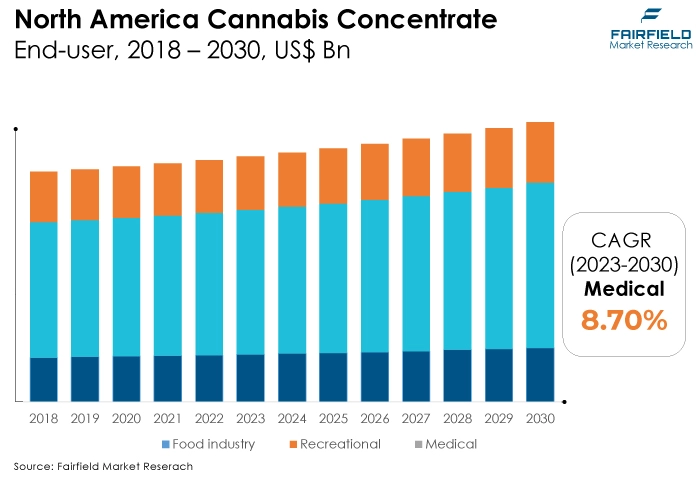

- Recreational Sector Leads Other End-use Industries

In 2022, the recreational category dominated the industry. The need for cannabis concentrate for such services has surged as a result of the American government legalizing the product for recreational use.

Cannabis usage for recreational purposes is defined as cannabis use by an adult for purposes other than medical treatment. The medical use category is anticipated to grow substantially throughout the projected period.

The early legalization of cannabis for medical purposes in significant US states, including California, Colorado, Florida, and Washington, helped to promote the expansion. The FDA has also provided its approval for the use of such drugs to treat conditions of the central nervous system.

Regional Frontrunners

North American Market Strongest

In North America, the US has the biggest cannabis concentrate market. In numerous US states, cannabis has been made legal for both medical and recreational use. By 2022, 21 states would have legalized cannabis use for adults or recreational purposes, while 37 states and the District of Columbia would have permitted the use of medical cannabis.

This is mostly because consumers are becoming more aware of the therapeutic benefits of cannabis and have a general sense that it is safer than alcohol. The growing number of states that have legalized cannabis is opening up a lot of options for industry participants.

The industry keeps evolving as a result of the rise in mega-mergers, high-value investments, and sales.

Asia Pacific’s Cannabis Concentrate Market Expects the Fastest Pace

A significant amount of growth is anticipated in Asia Pacific as a result of the region's fast-evolving political landscape and the legalization of cannabis in various Asian nations. Thailand's legalization of cannabis growing is expected to increase demand for cannabis and hemp, which will benefit the expansion of the regional market.

Additionally, it is predicted that research by the developing pharmaceutical sector will show the potential for cannabis' medical advantages in the region. The demand for the commodity is also expected to rise quickly as a result of changes in government policies. The pertinent law is recent in several nations.

Fairfield’s Competitive Landscape Analysis

There are not many large companies in the worldwide cannabis concentrate market, which is consolidated. To increase their global footprint, the major firms are launching new items and enhancing their distribution networks. In addition, Fairfield Market Research anticipates that during the next few years, there will be further market consolidation.

Who are the Leaders in Global Cannabis Concentrate Space?

- Indiva Limited

- Westleaf Inc.

- Aurora Cannabis Inc.

- Tikun Olam

- Medical Marijuana Inc.

- Canopy Growth Corporation

- MediPharm Labs

- Radient Technologies Inc.

- Neptune Wellness Solutions

- Valens GroWorks Corporation.

- The Cronos Group

- Tilray Brands, Inc.

- Nirvana Group

- PharmaCielo

- BevCanna

Significant Company Developments

New Product Launches

- March 2023: Canopy Growth Corporation, a world-leading diversified cannabis, hemp, and cannabis device company, announced the launch of Deep Space, Canada's first cannabis-infused beverage with naturally occurring caffeine. Canopy is also introducing four new Tweed scents for springtime delight. Deep Space is expanding its cannabis beverage selection with two additional products, making it the first in the Canadian market to blend cannabis and caffeine in a beverage.

- April 2022: Tilray Brands, Inc., a leading global cannabis and consumer packaged goods company, announced the launch of Solei Bites, the Solei brand's first foray into edibles and the first ready-to-eat THC edible available at Quebec's sole legal cannabis retailer, Société Québécoise du Cannabis.

Partnership Agreements

- May 2023: Toast, a multi-state cannabis brand, collaborated with the Nirvana Group, a leading diversified cannabis company. The Nirvana Group's wholesale operation was where the two companies first collaborated in 2021. The Nirvana Group will become Toast's manufacturing partner in Oklahoma and New Mexico as part of their latest cooperation, marking the latter brand's first step into the state's year-old adult-use market.

- April 2023: PharmaCielo, a Canadian cultivator and producer of medicinal-grade cannabis extracts joined forces with CANNPRISMA - PHARMA, a Portuguese Contract Manufacturing Organisation. The agreement was designed to offer high-quality EU-GMP1-certified medicinal cannabis flowers to the European market. PharmaCielo will supply GACP flower to CANNPRISMA, which will convert it to EU-GMP standards and deliver it directly to European consumers from Portugal.

Acquisition Agreement

- January 2022: BevCanna, a Canada-based holistic health and wellness beverage and natural products firm, paid an undisclosed sum for Embark Health Inc. BevCanna will diversify its portfolio of different brands, contribute valuable intellectual property, and increase its inventory of adult-use cannabis products as a result of this transaction. Embark is a Canadian company that produces a wide range of cannabis topicals, edibles, liquid and powder beverage mixes, and concentrates.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the industry is being driven by a rise in the number of cases of chronic disorders. The rising amount of stress and anxiety may result in increased demand for cannabis oil, where cannabis concentrate oil is favored in large quantities, increasing the need for cannabis concentrate.

Furthermore, technological developments have greatly aided the growth and development of various cannabis concentrates. However, the cannabis concentrate market is expected to face considerable challenges because of the side effects of cannabis concentrate on human health.

Supply Side of the Market

According to our analysis, the manufacturers present in the cannabis concentrate market are focusing on enhancing the cannabis concentrate quality and therapeutic value by introducing new cannabis concentrate products in the cannabis concentrate oil category, which will help the end users to utilize the benefits of the product completely.

The majority of cannabis products used for recreational and medical purposes are produced and exported from the United States. According to the analysis, approximately 27 million pounds of legal cannabis would have been grown in the US by 2030. 10.2 million pounds of cannabis were produced at indoor, outdoor, and greenhouse facilities around the country as of 2021.

Additionally, it is anticipated that the United States will be the world's top supplier of cannabis in the years to come. China is also the primary supplier of cannabis to the Asia-Pacific area. Studies suggest that China produces 106,200 t of cannabis annually on 18,560 hm2 of land, expanding quite steadily, making it the second-fastest growing country for the production of cannabis products behind the United States.

Global Cannabis Concentrate Market is Segmented as Below:

By Type:

- Live resins

- Wax

- Oil

- Shatter

- Vape

- Budder

- Miscellaneous

By End-use Sector:

- Medical

- Recreational

- Food & Beverage

- Personal Care

- Industrial

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Cannabis Concentrate Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cannabis Concentrate Market Outlook, 2018 - 2030

3.1. Global Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Live resins

3.1.1.2. Wax

3.1.1.3. Oil

3.1.1.4. Shatter

3.1.1.5. Vape

3.1.1.6. Budder

3.1.1.7. Misc.

3.2. Global Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Medical

3.2.1.2. Recreational

3.2.1.3. Food & Beverage

3.2.1.4. Personal Care

3.2.1.5. Industrial

3.2.1.6. Misc.

3.3. Global Cannabis Concentrate Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Cannabis Concentrate Market Outlook, 2018 - 2030

4.1. North America Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Live resins

4.1.1.2. Wax

4.1.1.3. Oil

4.1.1.4. Shatter

4.1.1.5. Vape

4.1.1.6. Budder

4.1.1.7. Misc.

4.2. North America Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Medical

4.2.1.2. Recreational

4.2.1.3. Food & Beverage

4.2.1.4. Personal Care

4.2.1.5. Industrial

4.2.1.6. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Cannabis Concentrate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cannabis Concentrate Market Outlook, 2018 - 2030

5.1. Europe Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Live resins

5.1.1.2. Wax

5.1.1.3. Oil

5.1.1.4. Shatter

5.1.1.5. Vape

5.1.1.6. Budder

5.1.1.7. Misc.

5.2. Europe Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Medical

5.2.1.2. Recreational

5.2.1.3. Food & Beverage

5.2.1.4. Personal Care

5.2.1.5. Industrial

5.2.1.6. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Cannabis Concentrate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cannabis Concentrate Market Outlook, 2018 - 2030

6.1. Asia Pacific Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Live resins

6.1.1.2. Wax

6.1.1.3. Oil

6.1.1.4. Shatter

6.1.1.5. Vape

6.1.1.6. Budder

6.1.1.7. Misc.

6.2. Asia Pacific Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Medical

6.2.1.2. Recreational

6.2.1.3. Food & Beverage

6.2.1.4. Personal Care

6.2.1.5. Industrial

6.2.1.6. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Cannabis Concentrate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cannabis Concentrate Market Outlook, 2018 - 2030

7.1. Latin America Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Live resins

7.1.1.2. Wax

7.1.1.3. Oil

7.1.1.4. Shatter

7.1.1.5. Vape

7.1.1.6. Budder

7.1.1.7. Misc.

7.2. Latin America Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Medical

7.2.1.2. Recreational

7.2.1.3. Food & Beverage

7.2.1.4. Personal Care

7.2.1.5. Industrial

7.2.1.6. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Cannabis Concentrate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cannabis Concentrate Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cannabis Concentrate Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Live resins

8.1.1.2. Wax

8.1.1.3. Oil

8.1.1.4. Shatter

8.1.1.5. Vape

8.1.1.6. Budder

8.1.1.7. Misc.

8.2. Middle East & Africa Cannabis Concentrate Market Outlook, by End-use Sector, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Medical

8.2.1.2. Recreational

8.2.1.3. Food & Beverage

8.2.1.4. Personal Care

8.2.1.5. Industrial

8.2.1.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Cannabis Concentrate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Cannabis Concentrate Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Cannabis Concentrate Market by End-use Sector, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Indiva Limited

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Westleaf Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Aurora Cannabis Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Tikun Olam

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Medical Marijuana Inc

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Canopy Growth Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. MediPharm Labs

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Radient Technologies Inc

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Neptune Wellness Solutions

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Valens GroWorks Corporation.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. The Cronos Group

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Tilray Brands, Inc.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Nirvana Group

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. PharmaCielo

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. BevCanna

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End-use Sector Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |