Market Growth Forecast

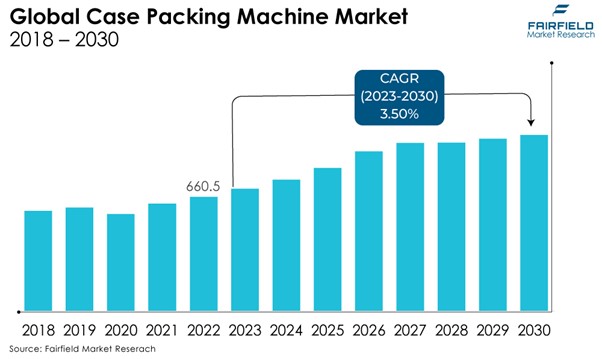

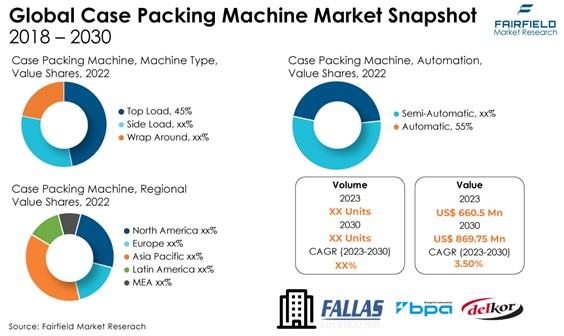

- In 2022, the case packing machine market was estimated to be worth US$660.5 Mn, and by 2030, it is expected to increase to US$869.75 Mn.

- Between 2023 and 2030, the market for case packing machines is anticipated to expand at a CAGR of 3.5%.

Quick Report Digest

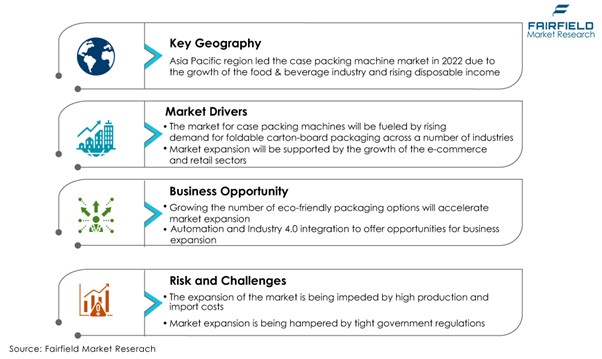

- The key trend anticipated to fuel the case packing machine market growth is an increase in the demand for folding carton-board packaging across numerous industries and manufacturer upgrades. Furthermore, due to its total biodegradability, carton-board packaging is often favored over all other alternatives for secondary packaging.

- Another major market trend expected to fuel the case packing machine market growth is the rapidly expanding global FMCG industry. The market is also predicted to profit from the expanding worldwide pharmaceutical and food and beverage industries.

- In 2022, the side load category dominated the industry. Utilising side load case packing machines may enable food businesses to enhance packaging output. They are categorised into groups depending on how the cases are handled and where the substance is injected.

- In terms of market share for case packing machines globally, the automatic segment is anticipated to dominate. Automatic packaging machines' advantages, such as better productivity, lower costs, and enhanced product quality and safety, are responsible for this segment's significant market share.

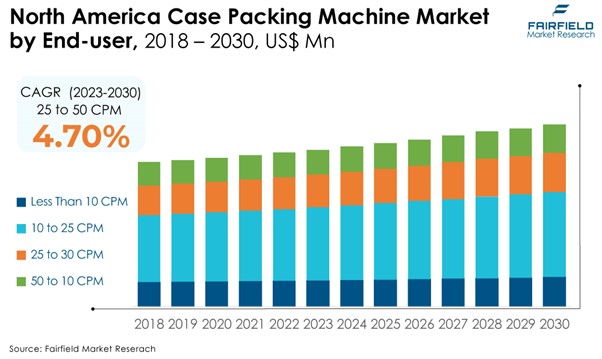

- In 2022, the 10 to 25 CPM category controlled the market. This capacity range is appropriate for industries with moderate production quantities that need effective case packing while balancing speed and precision. When choosing a case packing machine within this capacity range, it's necessary to consider the unique product and operating requirements.

- The confectionery category is highly prevalent in the market for case packing machines. These devices ensure packaging effectiveness and uniformity by automating the packaging of confectionery products. The market for case packing machines that serve this industry is anticipated to increase along with the demand for packaged confectionery products.

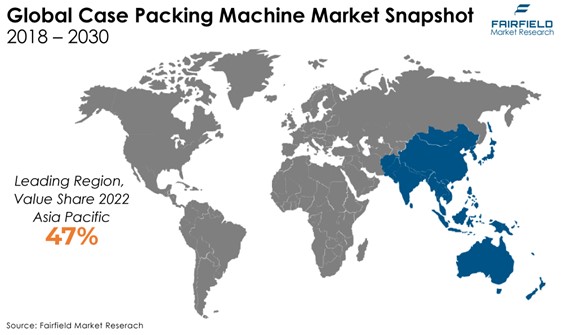

- The Asia Pacific region is anticipated to account for the largest share of the global case packing machine market, owing to various factors such as expansion in the food industry, government initiatives to encourage environmentally sustainable packaging use, and consistent packaging technology advancements by industry leaders.

- The market for case packing machines is expanding in North America due to the rise in packaging needs in the food and beverage, pharmaceutical, and cosmetics industries. Additionally, consumers of packaged goods prioritised convenience and packaging that complemented their lifestyles and provided value.

A Look Back and a Look Forward - Comparative Analysis

The market for case packing machines has grown in popularity as a result of factors such as an increase in its applications across a variety of industries, including the food and beverage, cosmetics, healthcare, and other consumer goods industries, as well as a range of industrial sectors where packaging has become essential, with an increase in usage generally in line with the global economy.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as snacks, confectionary items, cereals, chocolates, and others. However, in some applications, the demand for case packing machines has increased, including frozen food, pet food, and packaged dairy products.

The increased need for quick delivery and high consumer expectations have motivated e-retailers to implement operational innovations for speedy order fulfilment and to stay competitive in the market. This offers a significant chance for the case packing machines to experience quick acceptance in the e-commerce sector in the coming years.

Additionally, technological developments in factory automation have substantially contributed to the growth and development of various case packing machines. Furthermore, various conventional case packing machines are anticipated to lose ground to robotic packaging during the next five years due to its rising popularity.

Major Growth Determinants

- Increased Demand for Foldable Carton-board Packaging

Cardboard-based secondary packaging is generally preferred to all other types of packaging due to its complete biodegradability. An empty carton can be folded to maximise storage space. It's not always required to use glue for sealing. The box will be effectively sealed if the flaps are tucked within. It provides a sizable, easily-printable surface for product information and brand promotion. As a result, carton-board packaging is in greater demand globally as a result of this.

However, the labour pool has shrunk since case packing machines produce more effective results than human labour. Due to an increase in carton-board packaging in most industries, a greater requirement for packaging more cartons in a shorter time is emerging. Thus, the market for case packing machines is growing due to increased demand for carton-board packing.

- E-commerce and Retail Expansion

The retail and e-commerce industries have used packaging equipment to outperform the competition. High consumer expectations and the spike in demand for quick delivery have given e-retailers the push to innovate to fulfill orders on time and stay competitive in the market. This creates a significant possibility for packing equipment to experience quick acceptance in the e-commerce sector.

For instance, Kiva Systems' packaging automation solutions may pick items off the shelf and deliver them to workers. As a result, to handle high-volume and high-value orders, e-commerce and retailing enterprises are currently investing in integrating robotics.

- Severing Skilled Labour Shortage

Many firms, including packing and manufacturing, worry about finding qualified people to do tasks requiring precision and understanding. Repeated case packing tasks include assembly, filling, and sealing packages. Additionally, inconsistencies, errors, or even a lower standard of the finished product may occur due to a lack of trained staff with the required knowledge. This consistency yields an improved product as well as a stronger brand reputation.

Furthermore, labour-intensive tasks like manual packaging may have high turnover rates because of their repetitive nature and physical demands. Frequent turnover increases the cost of training new staff, reducing productivity. Thus, this is anticipated to boost market expansion.

Major Growth Barriers

- High Production and Import Expenses

Leading market players strongly emphasize case packing machines, increasing efficiency by speeding up operations. The cost of production as a whole is raised, nevertheless. Furthermore, the export industry is badly impacted since small and medium-sized businesses find it difficult to purchase these devices. Additionally, because of the charges levied by customs duty, developing nations encounter difficulties importing machinery, which hinders the global case packing machine market.

- Government-imposed Restrictions

In the majority of manufacturing sectors, case packing machines are used. The industry that manufactures food and beverages is the largest portion of users, followed by the pharmaceutical sector. The Health and Safety Executive (HSE) has concluded from an analysis of packing machinery accidents examined in the food and beverages industry that injuries resulting from using, maintaining, or removing blockages at packaging machines can be severe or even dangerous (as with palletizers). These laws may prevent the market from expanding.

Key Trends and Opportunities to Look at

- Integration of Industry 4.0 and Automation

Case packing machines were increasingly incorporated into smart manufacturing settings, which was a big trend. Data analytics and other Industry 4.0 principles were used to track and improve equipment performance, preventive maintenance, and production efficiency. As a result, this is boosting the market for case packing machines.

- Boom Around Eco-friendly Packaging

Eco-friendly packaging options are created to reduce the environmental effects of packaging components and operations during their useful lives. These solutions seek to decrease resource consumption, encourage sustainability, and reduce waste. Using packaging materials effectively and streamlining the packaging procedure to meet environmental objectives are the main concerns when discussing case packing machines.

- Surging Popularity of Robotics and Collaborative Robots (Cobots)

In many areas, including manufacturing and packaging, robotics and collabourative robots, sometimes called "cobots," are game-changing technology. They significantly improve the automation, productivity, and safety of case packing machines and other systems. Increased production efficiency is also a result of robots' ability to work continuously at a fast pace without becoming weary. In some circumstances, they are faster at completing tasks than manual labour, particularly useful in high-volume production settings.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, sustainable packaging standards have mostly focused on plastic case packing. Eighty-three percent of the legal measures linked to sustainable packaging worldwide, with 147 measures found, focus on plastics. The European Union and Asia have the most plastic rules, with France and India ranking first and second, respectively. Although it has changed over the years in response to some lessons learned, the system in the United States for regulating food contact materials and food packaging is pretty well established.

All compounds that are intended to become parts of food must acquire premarket approval from the Food and Drug Administration (FDA), unless they are covered by a particular exemption, according to the Federal Food, Drug, and Cosmetic Act (the Act), which was amended to include food additives in 1958.

Furthermore, the Federal Food, Drug, and Cosmetic Act was amended in 1998 to allow food contact notifications (FCNs) to be submitted instead of food additive petitions for compounds that come into contact with food. The FDA supported this amendment.

The Top Segments on Ranking Board

- Side Load Category Continues to Dominate

The side load segment dominated the market in 2022. Food enterprises may be able to increase packaging output by utilising side load case packing machines. In contrast to other loading techniques like top or bottom loading, this case packing machine feeds goods into a packaging case from the side. Products best put into the case horizontally from one of its sides should be handled by a side load case packing machine.

Furthermore, the top load category is projected to experience the fastest market growth. Industries prioritising product security, aesthetics, and efficiency in their packaging processes can benefit from top load case packing machines. They are a significant resource for producers looking for dependable and adaptable packaging solutions due to their versatility and compatibility with numerous product types.

- Automatic Case Packers Surge Ahead

In 2022, the automatic category dominated the industry. The automatic case packers are designed to process a greater volume of goods significantly faster. Larger throughput allows for a significantly faster output rate, making it more appropriate for industrial operations on a grand scale. Additionally, they use exact robotic or mechanical techniques to pack goods consistently and accurately, reducing the likelihood of errors and anomalies.

The semi-automatic category is anticipated to grow substantially throughout the projected period. Between entirely manual and fully automated packaging operations is a transitional stage represented by the semi-automatic category of case packing machines. It offers the right amount of productivity, adaptability, and human control, making it an excellent option for various sectors with varying packaging requirements and production volumes.

- 10 to 25 CPM Capacity Most Sought-after

The 10 to 25 CPM segment dominated the market in 2022. This capacity range is suitable for businesses with a moderate volume of production which requires efficient case packing while juggling speed and accuracy. The distinct product needs and operating requirements must be considered when selecting a case packing machine within this capacity range.

The 25 to 50 CPM category is expected to experience the fastest growth within the forecast time frame. The 25 to 50 CPM capacity category of case packing machines provides a balanced packaging solution for enterprises with medium-scale production needs. These machines offer an effective packaging process without the difficulty and expense associated with high-speed machines, making them an advantageous option for various applications.

- Confectionary Industry Registers Maximum Demand

In 2022, the confectionary category led the market growth. The confectionery industry is well-represented in the market for case packing machines. These gadgets guarantee uniformity and efficiency in packing by automating the packaging of confectionery products. Along with the demand for packaged confectionery products, case packing machines that cater to this industry are predicted to see a rise in demand.

Moreover, the frozen food category is expected to grow fastest in the case packing machine market during the forecast period. The convenience and adaptability of frozen foods have helped them become more popular. The category of frozen foods is always evolving and providing new goods to satisfy consumer expectations for time-saving solutions and a larger variety of meal options.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Contributor

In the packaging industries, case packing machine adoption is anticipated to dominate in the Asia-Pacific region. The rise of the food and beverage industry, rising disposable income, and a growing population helped drive market expansion in the area. Recent shifts in developing economies like China, and India have also helped the region's business expand.

The expansion of the market in China, and India is driven by an increase in demand for medicines, food, and beverage products and by the entry of several domestic and foreign case packing machine manufacturers. Moreover, the demand for case packing machines in the Asia Pacific region is projected to increase due to a growing professional base.

North America to Witness Significant Growth in Sales

The increase in packaging applications in the food and beverage, pharmaceutical, and cosmetics industries is driving expansion in the North American case packing machine market. Consumers of packaged goods in North America primarily focused on convenience and packaging that complemented their lifestyles and provided value.

Furthermore, the adoption rate of packaging equipment in the North American region has increased due to the growth of industrial automation and technological developments in manufacturing facilities. The need for environmentally friendly packaging has significantly increased, promoting the usage and creation of green materials.

Along with rising consumer awareness and rules about food cleanliness, certain other factors driving the growth of the North American case packing machine market include rising demand for packaged foods.

Who are the Leaders in Global Case Packing Machines Space?

- BluePrint Automation

- Mpack Group

- Douglas Machine Inc.

- Delkor Systems, Inc.

- IMA Group

- FOCKE & CO

- Ishida Europe Ltd

- Somic Packaging

- Case Packing Systems BV (Xano Group)

- Brenton, LLC

- ABRIGO SPA.

- Cama Group

- Fallas Automation

- Clearpack

- Aagard Group

Fairfield’s Competitive Landscape Analysis

The global case packing machine market is a consolidated market with less major players present across the globe. The key players are introducing new products as well as working on the distriubution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Significant Company Developments

New Product Launch

- July 2022: SEA Vision developed the whole Track & Trace software system, the BL-A525 CW high-speed labeler, and the INTEGRA 720V robotised blister line. The Marchesini Group and SEA Vision Group will release them for the first time. It consists of a broad range of technologies that are all integrated into a 4.0 environment to print, check, and pack serialised blisters as well as carry out aggregation with cartons. It is a fresh approach to the aggregation and serialisation of primary packs.

- July 2021: A Florida-based company called EndFlex, which makes secondary and end-of-line automatic packaging systems, including case erecting, has introduced the PKR modular pick and place cell with delta robot to its collection of case and tray packing equipment. The PKR Delta is a pick-and-place packaging option for flexible bags and packages, complementing the PKR Gantry, which is made to pack more rigid cans, cartons, jars, bottles, and similarly packaged goods.

- November 2020: The upgraded CONE platform was introduced by Douglas. Case packing is quick and easy, packaging 5 to 45 cases in a minute while requiring 40% fewer components and changeover points. CpONE is easy to use and maintain because of its appealing, intelligent design.

Distribution Agreement

- May 2021: For the markets in Australia, New Zealand, and the Pacific Islands, a collabouration between J.L. Lennard and Cama Group was established. J.L. Lennard is an exclusive distributor of tools, accessories, and life cycle services.

- February 2020: CT Pack grew its market share in Latin America. It has also developed solid client relationships and a potent sales team. Customers' ideal solutions have been its complete packaging systems for the food industry.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, an increase in consumer demand for food and beverages is driving the market. The rising demand for beverages may result in a growth in secondary packaging, where case packaging is favored in large quantities, increasing the need for case packing machines.

Furthermore, technological developments have greatly aided the growth and development of various case packing machines in factory automation. However, the case packing machine market is expected to face considerable challenges because of high initial expenses.

Supply Side Uncovered

According to our analysis, the manufacturers present in the case packaging machine market are focusing on enhancing the machine capacities and competences by introducing new models in the 25 to 50 CPM category which will help the end users to work more effectively and efficiently. For instance, in September 2022, in order to satisfy CPQ clients' requests for packing between 30 and 50 cases per minute, Brenton announced a new continuous motion side-load case packer.

Case packing machine makers are working on technological advanced versions which requires integrating automation, robotics, and AI in order to increase production, accuracy, and adaptability. Intelligent features, preemptive maintenance, and real-time monitoring are becoming more prevalent.

In addition, a number of firms are creating case packing equipment to assist eco-friendly packaging techniques in response to rising environmental concerns. This can mean implementing energy-saving technologies, utilising environmentally friendly materials, and optimising package designs to save waste. These might make the machine's environmental impact even smaller.

Global Case Packing Machine Market is Segmented as Below:

By Machine Type

- Top Load

- Side Load

- Wrap Around

By Automation

- Semi-automatic

- Automatic

By Capacity

- Less than 10 CPM

- 10 to 25 CPM

- 25 to 50 PM

- 50 to 100 CPM

By End Use

- Snacks

- Potato Chips

- Tortilla Chips

- Extruded Snacks

- Nuts & Seeds

- Dried Fruits

- Miscellaneous

- Frozen Food

- Potato Product IQF

- Fruit and Vegetables IQF

- Meat and Protein IQF

- Fresh & Chilled Food

- Leaf Salad

- Confectionery

- Jelly

- Wrapped Confectionery

- Miscellaneous Confectionary

- Chocolate & Bars

- Chocolate Lentils

- Wrapped Chocolate

- Cereals

- Extruded Cereals

- Flakes

- Muesli

- Bakery

- Cake

- Bread

- Frozen Bakery

- Cookies

- Biscuits

- Crackers

- Powder

- Infant Nutrition

- Instant Drinks

- Food Powder

- Coffee & Tea

- Ground Coffee

- Whole Bean Coffee

- Coffee Pods

- Pet Food

- Dry Pet Food

- Wet Pet Food

- Dairy Products

- Cheese

- Yogurt

- Puddings

- Misc. food

- Pasta

- Rice

- Beans and Lentils

- Salt

- Sugar

- Herbs & Spices

- Pharmaceuticals

- Personal Care and Cosmetics

- Household Care

By Geography

- North America

- United States

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Case Packing Machine Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Case Packing Machine Market Outlook, 2018 - 2030

3.1. Global Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Top Load

3.1.1.2. Side Load

3.1.1.3. Wrap Around

3.2. Global Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Semi-automatic

3.2.1.2. Automatic

3.3. Global Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Less than 10 CPM

3.3.1.2. 10 to 25 CPM

3.3.1.3. 25 to 50 CPM

3.3.1.4. 50 to 100 CPM

3.4. Global Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Snacks

3.4.1.1.1. Potato Chips

3.4.1.1.2. Tortilla Chips

3.4.1.1.3. Extruded Snacks

3.4.1.1.4. Nuts & Seeds

3.4.1.1.5. Dried Fruits

3.4.1.1.6. Misc.

3.4.1.2. Frozen Food

3.4.1.2.1. Potato Product IQF

3.4.1.2.2. Fruit and Vegetables IQF

3.4.1.2.3. Meat and Protein IQF

3.4.1.2.4. Fresh & Chilled Food

3.4.1.2.5. Leaf Salad

3.4.1.3. Confectionery

3.4.1.3.1. Jelly

3.4.1.3.2. Wrapped Confectionery

3.4.1.3.3. Misc. Confectionary

3.4.1.4. Chocolate & Bars

3.4.1.4.1. Chocolate Lentils

3.4.1.4.2. Wrapped Chocolate

3.4.1.5. Cereals

3.4.1.5.1. Extruded Cereals

3.4.1.5.2. Flakes

3.4.1.5.3. Muesli

3.4.1.6. Bakery

3.4.1.6.1. Cake

3.4.1.6.2. Bread

3.4.1.6.3. Frozen Bakery

3.4.1.6.4. Cookies

3.4.1.6.5. Biscuits

3.4.1.6.6. Crackers

3.4.1.7. Powder

3.4.1.7.1. Infant Nutrition

3.4.1.7.2. Instant Drinks

3.4.1.7.3. Misc. Food Powder

3.4.1.8. Coffee & Tea

3.4.1.8.1. Ground Coffee

3.4.1.8.2. Whole Bean Coffee

3.4.1.8.3. Coffee Pods

3.4.1.9. Pet Food

3.4.1.9.1. Dry Pet Food

3.4.1.9.2. Wet Pet Food

3.4.1.10. Dairy Products

3.4.1.10.1. Cheese

3.4.1.10.2. Yogurt

3.4.1.10.3. Puddings

3.4.1.11. Misc. food

3.4.1.11.1. Pasta

3.4.1.11.2. Rice

3.4.1.11.3. Beans and Lentils

3.4.1.11.4. Salt

3.4.1.11.5. Sugar

3.4.1.11.6. Herbs & Spices

3.4.1.12. Pharmaceuticals

3.4.1.13. Personal Care and Cosmetics

3.4.1.14. Household Care

3.5. Global Case Packing Machine Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Case Packing Machine Market Outlook, 2018 - 2030

4.1. North America Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Top Load

4.1.1.2. Side Load

4.1.1.3. Wrap Around

4.2. North America Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Semi-automatic

4.2.1.2. Automatic

4.3. North America Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Less than 10 CPM

4.3.1.2. 10 to 25 CPM

4.3.1.3. 25 to 50 CPM

4.3.1.4. 50 to 100 CPM

4.4. North America Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Snacks

4.4.1.2. Frozen Food

4.4.1.3. Confectionery

4.4.1.4. Chocolate & Bars

4.4.1.5. Cereals

4.4.1.6. Bakery

4.4.1.7. Powder

4.4.1.8. Coffee & Tea

4.4.1.9. Pet Food

4.4.1.10. Dairy Products

4.4.1.11. Misc. food

4.4.1.12. Pharmaceuticals

4.4.1.13. Personal Care and Cosmetics

4.4.1.14. Household Care

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Case Packing Machine Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Case Packing Machine Market Outlook, 2018 - 2030

5.1. Europe Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Top Load

5.1.1.2. Side Load

5.1.1.3. Wrap Around

5.2. Europe Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Semi-automatic

5.2.1.2. Automatic

5.3. Europe Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Less than 10 CPM

5.3.1.2. 10 to 25 CPM

5.3.1.3. 25 to 50 CPM

5.3.1.4. 50 to 100 CPM

5.4. Europe Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Snacks

5.4.1.2. Frozen Food

5.4.1.3. Confectionery

5.4.1.4. Chocolate & Bars

5.4.1.5. Cereals

5.4.1.6. Bakery

5.4.1.7. Powder

5.4.1.8. Coffee & Tea

5.4.1.9. Pet Food

5.4.1.10. Dairy Products

5.4.1.11. Misc. food

5.4.1.12. Pharmaceuticals

5.4.1.13. Personal Care and Cosmetics

5.4.1.14. Household Care

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Case Packing Machine Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Case Packing Machine Market Outlook, 2018 - 2030

6.1. Asia Pacific Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Top Load

6.1.1.2. Side Load

6.1.1.3. Wrap Around

6.2. Asia Pacific Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Semi-automatic

6.2.1.2. Automatic

6.3. Asia Pacific Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Less than 10 CPM

6.3.1.2. 10 to 25 CPM

6.3.1.3. 25 to 50 CPM

6.3.1.4. 50 to 100 CPM

6.4. Asia Pacific Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Snacks

6.4.1.2. Frozen Food

6.4.1.3. Confectionery

6.4.1.4. Chocolate & Bars

6.4.1.5. Cereals

6.4.1.6. Bakery

6.4.1.7. Powder

6.4.1.8. Coffee & Tea

6.4.1.9. Pet Food

6.4.1.10. Dairy Products

6.4.1.11. Misc. food

6.4.1.12. Pharmaceuticals

6.4.1.13. Personal Care and Cosmetics

6.4.1.14. Household Care

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Case Packing Machine Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Case Packing Machine Market Outlook, 2018 - 2030

7.1. Latin America Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Top Load

7.1.1.2. Side Load

7.1.1.3. Wrap Around

7.2. Latin America Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Semi-automatic

7.2.1.2. Automatic

7.3. Latin America Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Less than 10 CPM

7.3.1.2. 10 to 25 CPM

7.3.1.3. 25 to 50 CPM

7.3.1.4. 50 to 100 CPM

7.4. Latin America Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Snacks

7.4.1.2. Frozen Food

7.4.1.3. Confectionery

7.4.1.4. Chocolate & Bars

7.4.1.5. Cereals

7.4.1.6. Bakery

7.4.1.7. Powder

7.4.1.8. Coffee & Tea

7.4.1.9. Pet Food

7.4.1.10. Dairy Products

7.4.1.11. Misc. food

7.4.1.12. Pharmaceuticals

7.4.1.13. Personal Care and Cosmetics

7.4.1.14. Household Care

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Case Packing Machine Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Case Packing Machine Market Outlook, 2018 - 2030

8.1. Middle East & Africa Case Packing Machine Market Outlook, by Machine Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Top Load

8.1.1.2. Side Load

8.1.1.3. Wrap Around

8.2. Middle East & Africa Case Packing Machine Market Outlook, by Automation, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Semi-automatic

8.2.1.2. Automatic

8.3. Middle East & Africa Case Packing Machine Market Outlook, by Capacity, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Less than 10 CPM

8.3.1.2. 10 to 25 CPM

8.3.1.3. 25 to 50 CPM

8.3.1.4. 50 to 100 CPM

8.4. Middle East & Africa Case Packing Machine Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Snacks

8.4.1.2. Frozen Food

8.4.1.3. Confectionery

8.4.1.4. Chocolate & Bars

8.4.1.5. Cereals

8.4.1.6. Bakery

8.4.1.7. Powder

8.4.1.8. Coffee & Tea

8.4.1.9. Pet Food

8.4.1.10. Dairy Products

8.4.1.11. Misc. food

8.4.1.12. Pharmaceuticals

8.4.1.13. Personal Care and Cosmetics

8.4.1.14. Household Care

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Case Packing Machine Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Case Packing Machine Market by Machine Type, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Case Packing Machine Market Automation, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Case Packing Machine Market Capacity, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Case Packing Machine Market End Use, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. BluePrint Automation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Clearpack

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Mpack Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Douglas Machine Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Delkor Systems, Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. IMA Group

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. FOCKE & CO

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Ishida Europe Ltd

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Somic Packaging

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Case Packing Systems BV (Xano Group)

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Fallas Automation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Brenton, LLC

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Cama Group

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Clearpack

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. ABRIGO SPA.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. SERPA PACKAGIG SOLUTIONS (ProMach)

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. A+F Automation + Fördertechnik GmbH - EOL Group

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

9.5.18. Aagard Group

9.5.18.1. Company Overview

9.5.18.2. Product Portfolio

9.5.18.3. Financial Overview

9.5.18.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Machine Type Coverage |

|

|

Capacity Coverage |

|

|

Automation Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |