Global Catheter Market Forecast

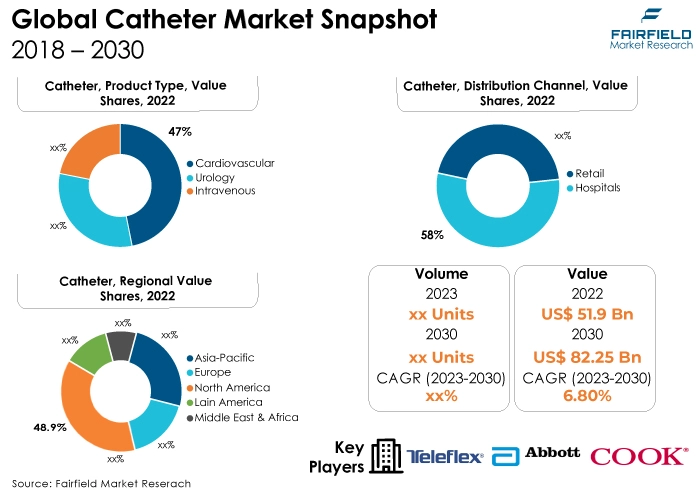

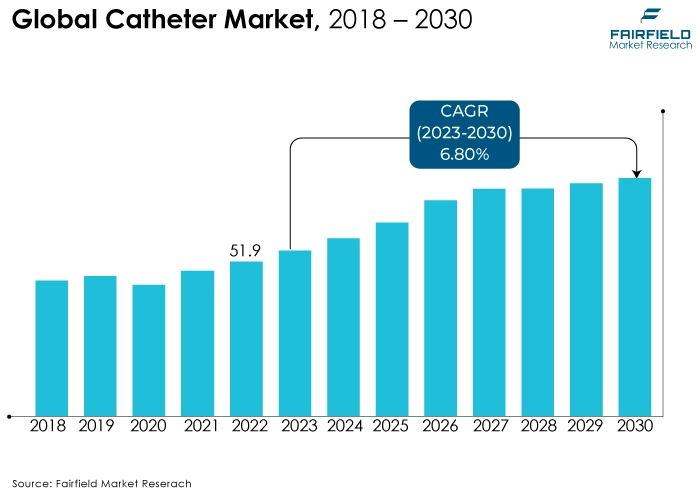

- Global catheter market size poised to reach US$82.2 Bn in 2030, up from US$51.9 Bn attained in 2023

- Catheter market revenue likely to expand at a CAGR of 6.8% between 2023 and 2030

Major Report Findings - Fairfield's Perspective

- The key trend anticipated to fuel the catheter market growth is improvement in patient comfort and safety. Advancements in catheter design and materials have led to smoother insertion processes, reduced discomfort, and minimised tissue damage during placement.

- Throughout the projected period, a rise in the number of product approvals is anticipated to offer a profitable catheter market potential for the expansion of the worldwide catheter market.

- Another major market trend expected to fuel the catheter market is the growing healthcare infrastructure. These essential tools are crucial for various diagnostic and therapeutic procedures, making them indispensable in modern healthcare settings.

- The number of domestic market entries has resulted in a decline in the quality of catheter devices. This is because these producers employ inferior raw materials at low prices, which limits the expansion of the industry.

- In 2022, the cardiovascular category dominated the industry. This category includes a wide range of catheters, such as angioplasty catheters, guiding catheters, electrophysiology catheters, and intravascular ultrasound catheters.

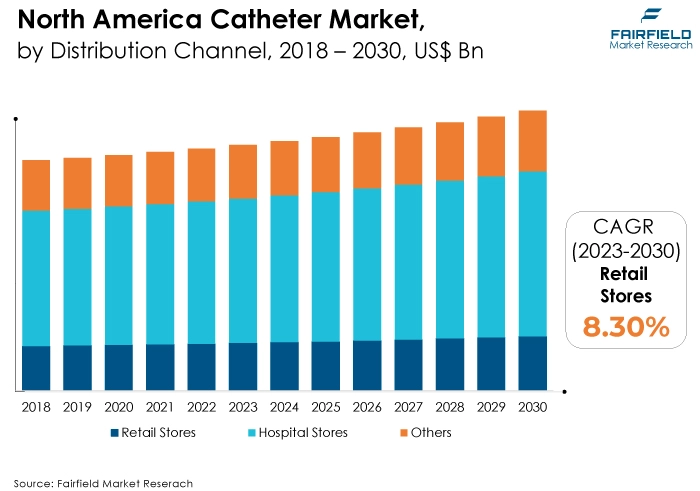

- In terms of market share for catheter globally, the hospital stores segment is anticipated to dominate. They are the primary source of catheter procurement, as they require a steady supply for various medical procedures and patient care.

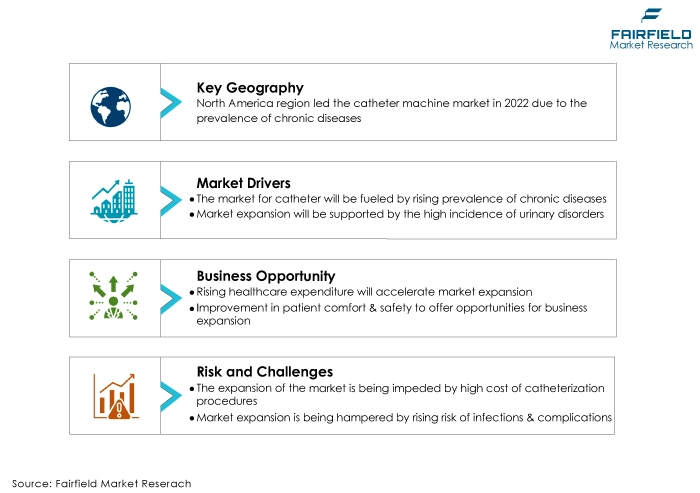

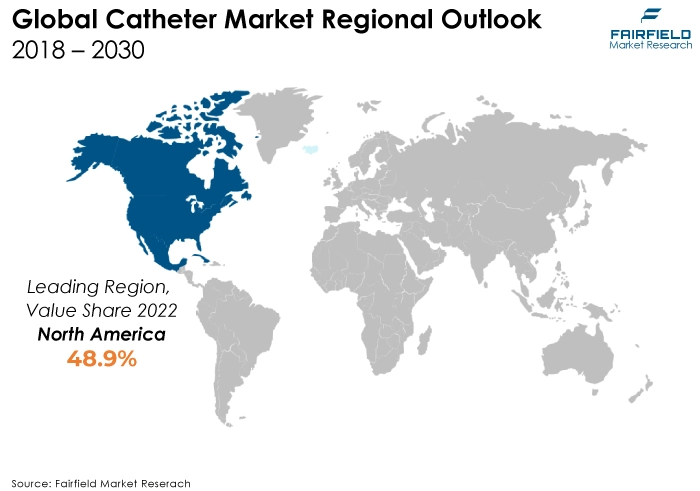

- The North American region is anticipated to account for the largest share of the global catheter market, owing to various factors such as advanced healthcare infrastructure, high healthcare expenditure, prevalence of chronic diseases, ageing population, and a robust healthcare system.

- The market for catheter is expanding in Asia Pacific due to the rising chronic diseases and surgical procedures, increase in healthcare infrastructure, rapid economic growth, and ageing population.

A Look Back and a Look Forward - Comparative Analysis

The market for catheter has grown in popularity because of factors such as an increasing prevalence of cardiovascular and urological disorders, a growing ageing population, and advancements in catheter technology. A competitive landscape with key players like Medtronic, Boston Scientific, and Johnson & Johnson dominating characterised the market.

The market witnessed staggered growth during the historical period 2018 – 2022. It is due to the increasing prevalence of chronic diseases, the increasing geriatric population, and advancements in medical technology. Historically, catheters have evolved from basic rubber tubes to sophisticated, minimally invasive devices for various medical procedures. The market has expanded as a result, with a wide range of catheter types designed for specific applications, such as urinary catheters, cardiac catheters, and vascular catheters.

The rising prevalence of cardiovascular and urological diseases, a growing ageing population, and increasing demand for minimally invasive medical procedures. Technological advancements in catheter design, materials, and functionality are also expected to enhance patient outcomes and expand market opportunities.

Additionally, the spread of healthcare infrastructure in emerging economies and increased healthcare spending further contribute to the market's positive outlook. Overall, the global catheter market is anticipated to exhibit sustained growth and innovation in the foreseeable future.

Key Growth Determinants

- Rising Prevalence of Chronic Diseases

Chronic diseases like cardiovascular diseases, diabetes, and urinary tract disorders have become increasingly common worldwide. Catheters play a crucial role in the diagnosis, treatment, and management of these conditions. The growing ageing population and unhealthy lifestyles contribute to the higher incidence of chronic diseases, necessitating a greater demand for catheters.

Moreover, advancements in catheter technology, including the development of minimally invasive procedures, have made catheterisation safer and more effective, further boosting their usage in chronic disease management.

As the global population continues to age and the prevalence of chronic diseases continues to rise, the demand for catheters is expected to remain strong, driving the growth of the global catheter market.

- Continuous Innovations in Catheter Materials and Procedures

The innovations are driven by a growth in demand for minimally invasive procedures and the need for safer and more efficient catheterisation techniques.

Advancements in materials have led to the development of catheters with improved biocompatibility, flexibility, and durability. These materials reduce the risk of infection and consequences while also improving patient comfort. These advancements have expanded the range of medical applications for catheters, including cardiology, urology, and gastroenterology, driving market growth.

Moreover, ongoing research and development efforts continue to refine catheter technologies, promising even more breakthroughs in the future, which will further boost market expansion.

- High Incidence of Urinary Disorders

Urinary disorders, such as urinary incontinence, urinary retention, and urinary tract infections, are prevalent worldwide, affecting billions of individuals across various age groups.

Factors like ageing, chronic diseases, neurological disorders, and post-surgical complications can cause these conditions. With growth in the aged population and the rising prevalence of chronic diseases, the share of catheters is expected to rise.

Furthermore, the creation of more efficient and pleasant catheter designs has been made possible by technical developments, improving patient comfort and lowering problems. Catheters play a major role in the management and treatment of these urinary disorders.

Major Growth Barriers

- High Cost of Catheterisation Procedures

The expenses encompass healthcare services, such as medical personnel, facility charges, and diagnostic tests. For patients and healthcare systems, the financial burden can be substantial, limiting access to catheterisation procedures and potentially delaying necessary medical interventions.

The cost barrier restricts market growth by reducing patient demand and hindering healthcare providers' ability to invest in advanced catheter technologies, ultimately impeding the market's expansion.

- Potential Risk of Infections, and Complications

Healthcare providers and manufacturers are continually striving to develop infection-resistant catheter materials and improved insertion techniques to mitigate the risks and enhance patient safety in catheterisation procedures.

Prolonged catheterisation can lead to urinary tract infections, bloodstream infections, and other complications, posing a serious threat to patient health. These complications not only result in increased healthcare costs but also diminish the overall effectiveness of catheter-based treatments.

Key Trends and Opportunities to Look at

- Rising Healthcare Expenditure

As countries allocate more resources to their healthcare systems, there is a growth in demand for advanced medical devices like catheters, which are essential for various diagnostic and therapeutic procedures. Higher healthcare spending enables hospitals and healthcare facilities to invest in cutting-edge catheter technologies, improving patient care and outcomes.

- Industry’s Emphasis on Improved Patient Comfort and Safety

Advancements in catheter design and materials have led to smoother insertion processes, reduced discomfort, and minimised tissue damage during placement. These developments not only improve the overall patient experience but also contribute to better healthcare outcomes, making catheters a vital tool in modern medical practice and driving their widespread adoption.

- Sophistication of Healthcare Infrastructure

As healthcare systems expand and improve, there is an increasing demand for medical devices like catheters. These essential tools are crucial for various diagnostic and therapeutic procedures, making them indispensable in modern healthcare settings. The growing healthcare infrastructure fosters accessibility to advanced medical services, which, in turn, drives the adoption of catheters, contributing to market growth.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the regulatory landscape in the catheter industry has aimed to strike a balance between innovation and patient safety, assuring healthcare providers and patients alike that these critical medical devices meet rigorous standards before entering the market.

One of the most influential regulatory bodies is the US FDA, which sets rigorous standards for catheter safety, efficacy, and quality, ensuring that these medical devices meet stringent requirements before they are approved for market entry. This stringent oversight helps enhance patient safety and confidence in catheter-related procedures.

The European Union Medical Device Regulation introduced stricter regulations and increased transparency in the approval process for medical devices, including catheters, within the European Union. It has led to a higher level of scrutiny and standardised evaluation criteria for catheters, fostering innovation and product quality. Complying with these regulations is paramount for catheter manufacturers to succeed in this dynamic and highly regulated industry.

Fairfield’s Ranking Borad

Top Segments

- Cardiovascular Catheters Lead, Specialty Catheters Gain Stronger Traction

The cardiovascular segment dominated the market in 2022. They are specifically designed for procedures related to the heart, and blood vessels. Catheters play a major role in the entire process of diagnosing and treating various cardiovascular conditions.

This category includes a wide range of catheters, such as angioplasty catheters, guiding catheters, electrophysiology catheters, and intravascular ultrasound catheters. These catheters are vital tools in interventions like angiography, angioplasty, and stent placement.

Furthermore, the specialty category is projected to experience the fastest market growth. It covers a diverse range of catheters designed for specific medical applications beyond cardiovascular procedures. This category includes catheters like urinary catheters, neurovascular catheters, and intrathecal catheters. These specialty catheters cater to a wide array of medical needs across various disciplines.

- Hospital Stores Account for Higher Revenue Generation

In 2022, the hospital's stores category dominated the industry. They are the primary source of catheter procurement, as they require a steady supply for various medical procedures and patient care. Catheters are utilised in a wide range of medical settings within hospitals, including surgery, critical care units, and general patient wards. Hospitals often establish long-term contracts with catheter suppliers to ensure reliable supply of these essential medical devices.

The retail stores category is anticipated to grow substantially throughout the projected period. These stores typically cater to individuals who require catheters for personal use at home. Retail outlets offer convenience and accessibility for patients and caregivers, allowing them to purchase catheters over the counter without the need for a prescription in some regions. Retail stores may carry a variety of catheter types and sizes, making them a convenient option for those seeking catheters for intermittent self-catheterisation or other medical needs.

Regional Frontrunners

North America’s Leadership Sustains

In the medical devices industry, catheter adoption is anticipated to dominate in the North American region. The advanced healthcare infrastructure, high healthcare expenditure, prevalence of chronic diseases, ageing population, and robust healthcare system helped drive market expansion in the area.

The US is a dominant market within North America, driven by technological advancements, a growing geriatric population, and a high demand for minimally invasive procedures. Additionally, Canada also contributes to the regional market with its increasing healthcare investments. Overall, North America is expected to continue witnessing steady growth in the catheter market due to these factors.

Major Gains for Asia Pacific from an Expanding Ageing Population

The increase in healthcare infrastructure, rapid economic growth, and an ageing population are driving expansion in the Asia Pacific catheter market. Countries like China, India, and Japan are witnessing substantial growth in the catheter market due to rising chronic diseases and surgical procedures.

Furthermore, favourable government initiatives, and increasing awareness about minimally invasive procedures are driving the adoption of catheters. Asia Pacific is expected to continue its robust growth trajectory in the catheter market, with increasing investments in healthcare, and ongoing technological advancements.

As healthcare standards improve and healthcare expenditure rises, the region is likely to play an increasingly significant role in the global catheter market's expansion.

Fairfield’s Competitive Landscape Analysis

The global catheter market is a consolidated market with fewer major players present across the globe. The key players focus on product innovation, strategic mergers, and geographical spreading to gain a competitive edge. The market also witnesses the emergence of smaller players offering specialised catheter solutions. Regulatory compliance, product quality, and cost-effective manufacturing processes are critical factors influencing competitiveness in this dynamic market.

Who are the Leaders in the Global Catheter Space?

- Medtronic

- Edwards Lifesciences Corporation

- Teleflex Incorporated

- Abbott

- Braun Melsungen AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- ConvaTec Group

- Coloplast

- Johnson & Johnson Services

- Terumo Corporation

- Hollister Incorporated

- Stryker

- Cook Medical

- Merit Medical Systems

- amg International GmbH

- Simeks Tibbi Ürünler

- Alvimedica

- Medinol

- Amsino International

Significant Company Developments

New Product Launches

- December 2022: Medtronic propounded the completion of enrollment in an evaluation trial for a novel pulsed field ablation catheter designed for treating patients with atrial fibrillation. The 'SPHERE Per-AF Trial' is a US FDA Investigational Device Exemption trial for testing the efficacy and safety of the Sphere-9 pulsed field (P.F.) and R.F. ablation and high-density mapping catheter with the Affera cardiac mapping and navigation platform.

- February 2022: Teleflex announced that the company's specialty catheters and coronary guidewires had received approval for expanded indication by the US FDA for use in CTO PCI (crossing chronic total occlusion percutaneous coronary interventions). The devices that received this clearance included TrapLiner Catheter, Teleflex Guide Liner V3 Catheter, Spectre Guidewire, Turnpike Catheters, Bandit Guidewire, Raider Guidewire, R350 Guidewire, and Warrior Guidewire.

- March 2022: Shockwave Medical launched its Shockwave M5+ peripheral intravascular lithotripsy catheter after receiving both the C.E. mark and the United States Food and Drug Administration (FDA) clearance.

Distribution Agreements

- March 2021: Medtronic launched the Chameleon Percutaneous Transluminal Angioplasty (PTA) balloon catheter. The firm launched the Catheter in Germany, Portugal, Italy, South Africa, Turkey, and Spain. The system is approved for use in femoral, iliac, and renal arteries, as well as native and synthetic arteriovenous dialysis fistulas.

- December 2022: Boston Scientific announced a strategic investment for acquiring a majority stake in the Chinese medical technology company Acotec Scientific Holdings Limited. The company is well-known in China for its drug-coated balloons (DCBs), as well as thrombus aspiration catheters and R.F. ablation technologies, among other products. Boston Scientific aims to strengthen its position in the region through this deal.

An Expert’s Eye

Demand and Future Growth

The increasing demand for minimally invasive medical procedures, a growing ageing population, and rising prevalence of chronic diseases are driving the market. Additionally, emerging markets and expanding applications in various medical fields, including cardiology, urology, and neurology are likely to fuel future growth. With the continuous evolution of healthcare practices, the global catheter market is anticipated to experience robust expansion in the foreseeable future.

Supply Side of the Market

According to our analysis, the US is the major manufacturer and adopter of catheter due to technological advancements, growing geriatric population and high demand for minimally invasive procedures. For instance, in April 2021, the Emprint ablation catheter kit achieved "Breakthrough Device Designation" status from the US FDA. It is an innovative device that has not been authorised in the US. The catheter is intended for use with the Emprint microwave generator and the Medtronic lung navigation platform to offer minimally invasive, localised treatment of malignant lung lesions. It can also be used in combination with standard care therapy.

Canada also contributes to the market by making more healthcare investments. Countries such as China, India, and Japan are also the major manufacturers in the catheter market due to the growth in chronic diseases and surgical procedures, increasing investments in healthcare and ongoing technological advancements. As healthcare standards improve and healthcare expenditure rises, the market for catheters also increases globally.

The Global Catheter Market is Segmented as Below:

By Product Type:

- Cardiovascular

- Urology

- Intravenous

- Neurovascular

- Specialty Catheters

By Distribution Channel:

- Hospitals Stores

- Retail Stores

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Catheter Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value/Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Catheter Market Outlook, 2018 - 2030

3.1. Global Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Cardiovascular

3.1.1.2. Urology

3.1.1.3. Intravenous

3.1.1.4. Neurovascular

3.1.1.5. Specialty Catheters

3.2. Global Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Hospital Stores

3.2.1.2. Retail Stores

3.2.1.3. Others

3.3. Global Catheter Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Catheter Market Outlook, 2018 - 2030

4.1. North America Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Cardiovascular

4.1.1.2. Urology

4.1.1.3. Intravenous

4.1.1.4. Neurovascular

4.1.1.5. Specialty Catheters

4.2. North America Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Hospital Stores

4.2.1.2. Retail Stores

4.2.1.3. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Catheter Market Outlook, 2018 - 2030

5.1. Europe Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Cardiovascular

5.1.1.2. Urology

5.1.1.3. Intravenous

5.1.1.4. Neurovascular

5.1.1.5. Specialty Catheters

5.2. Europe Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Hospital Stores

5.2.1.2. Retail Stores

5.2.1.3. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Catheter Market Outlook, 2018 - 2030

6.1. Asia Pacific Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Cardiovascular

6.1.1.2. Urology

6.1.1.3. Intravenous

6.1.1.4. Neurovascular

6.1.1.5. Specialty Catheters

6.2. Asia Pacific Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Hospital Stores

6.2.1.2. Retail Stores

6.2.1.3. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Catheter Market Outlook, 2018 - 2030

7.1. Latin America Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Cardiovascular

7.1.1.2. Urology

7.1.1.3. Intravenous

7.1.1.4. Neurovascular

7.1.1.5. Specialty Catheters

7.2. Latin America Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Hospital Stores

7.2.1.2. Retail Stores

7.2.1.3. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Catheter Market Outlook, 2018 - 2030

8.1. Middle East & Africa Catheter Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Cardiovascular

8.1.1.2. Urology

8.1.1.3. Intravenous

8.1.1.4. Neurovascular

8.1.1.5. Specialty Catheters

8.2. Middle East & Africa Catheter Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Hospital Stores

8.2.1.2. Retail Stores

8.2.1.3. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Catheter Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Catheter Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Product Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Medtronic (Ireland)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Edwards Life sciences Corporation (US)

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Teleflex Incorporated (US)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Abbott (US)

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. B. Barun Melsungen AG (Germany)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Becton, Dickinson, and Company (US)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Boston Scientific Corporation (US)

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Conva Tec Group (UK)

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Coloplast (Denmark)

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Johnson & Johnson Services (US)

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Terumo Corporation (Japan)

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Hollister Incorporated (US)

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Stryker (US)

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Cook Medical (US)

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Merit Medical Systems (US)

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. AMG International GmbH (Germany)

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Simeks Tibbi Urunler (Turkey)

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Alvimedica (Turkey)

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

9.4.19. Medinol (Israel)

9.4.19.1. Company Overview

9.4.19.2. Product Portfolio

9.4.19.3. Financial Overview

9.4.19.4. Business Strategies and Development

9.4.20. Amsino International (US)

9.4.20.1. Company Overview

9.4.20.2. Product Portfolio

9.4.20.3. Financial Overview

9.4.20.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |