Clear Aligners Market Growth and Industry Forecast

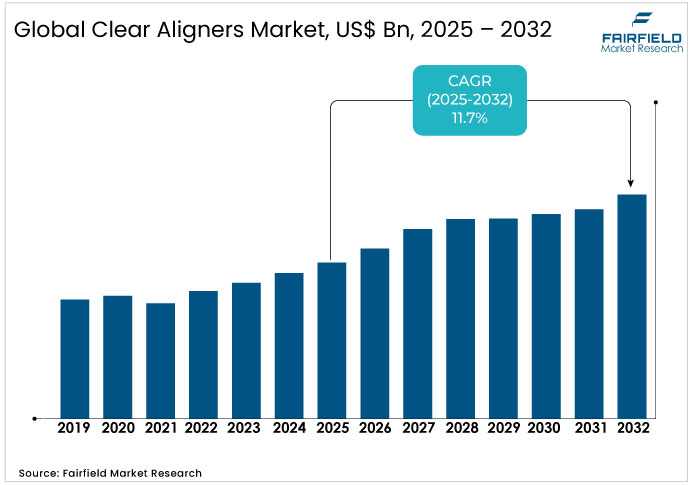

The Clear Aligners Market is valued at USD 5.4 Bn in 2026 and is projected to reach USD 14.9 Bn, growing at a CAGR of 16% by 2033.

Clear Aligners Market Summary: Key Insights & Trends

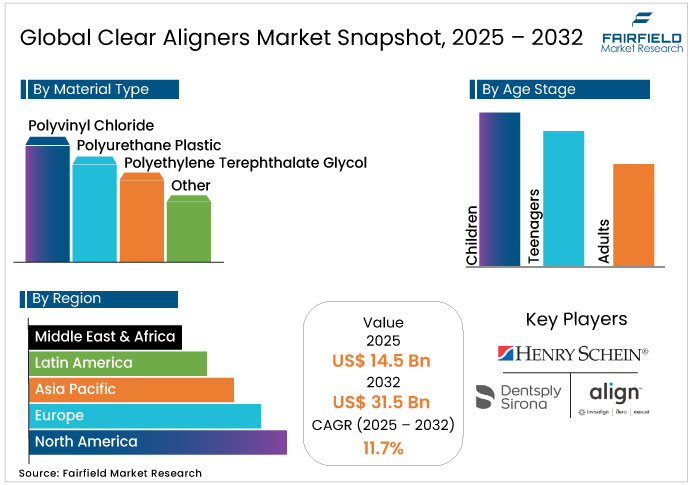

- Adults dominate with over 70% share, making them the leading age group for clear aligners.

- Teenagers are the fastest-growing segment, steadily gaining share through early screenings and social media influence.

- Polyurethane Plastic leads with over 75% share, remaining the preferred material for durability and comfort.

- PETG is expanding its share, boosted by sustainability-focused and recyclable aligner materials.

- Dental & Orthodontic Clinics hold over 60% share, maintaining their dominance as the key end-user group.

- Standalone & Group Practices are expected to witness a growth in their market share, driven by suburban reach and tele-dentistry adoption.

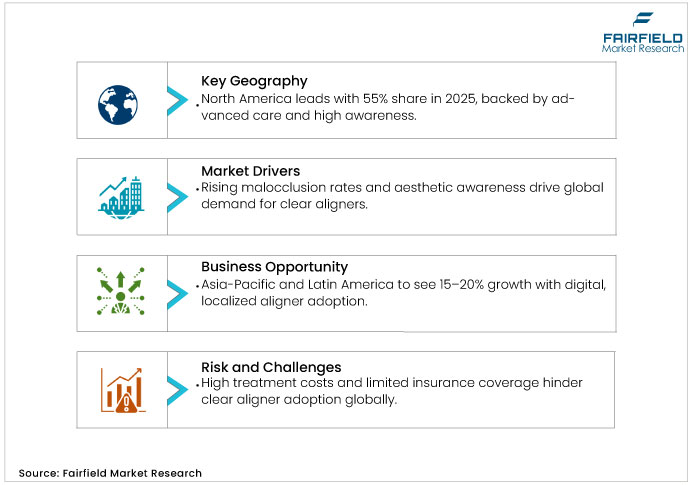

- North America accounts for a large share, supported by advanced healthcare and awareness about teeth misalignment.

- Europe secures the second-largest share, while Latin America shows the fastest share expansion with dental tourism and middle-class growth.

Key Growth Drivers

- Rising prevalence of malocclusion drives clear aligners demand with an aesthetic focus

Orthodontic misalignments affect a substantial portion of the global population, with malocclusion rates ranging from 39% to 93% among children and adolescents, according to the World Health Organization data. Demand for non-invasive alternatives to traditional braces by patients is further propelling the clear aligners market. Adults prioritize aesthetics, viewing aligned teeth as a marker of professional success and social confidence. Economic analyses from industry associations indicate that cosmetic dentistry investments yield high returns on personal branding, with surveys showing 66% of adults reporting incisor irregularities yet opting for clear aligners over visible appliances. This shift not only boosts adoption but also encourages preventive care, reducing long-term dental expenditures. Providers leverage this by integrating patient education campaigns, fostering a virtuous cycle of awareness and utilization.

- Growing disposable incomes and direct-to-consumer access expand clear aligners adoption

As global middle classes expand, disposable incomes enable elective procedures such as clear aligners, with per capita spending on oral health rising 15% annually in developing regions per International Labour Organization metrics. In the clear aligners market, this manifests through direct-to-consumer models that bypass high clinic overheads, reducing costs drastically. Lower price points correlate with 20% higher adoption rates among urban professionals. Providers respond by partnering with e-commerce platforms, democratizing access and capturing untapped segments. This dynamic not only sustains volume growth but also diversifies revenue streams, ensuring resilience against economic fluctuations.

Key Restraints

- High treatment costs restrict clear aligner adoption in price-sensitive markets

Elevated upfront expenses for clear aligners, often exceeding USD 3,000 per case, deter adoption among lower-income groups in the clear aligners industry. Insurance coverage remains inconsistent, with only 20% of plans fully reimbursing, exacerbating affordability gaps. This restraint particularly impacts emerging economies, where out-of-pocket spending dominates healthcare budgets.

- Market saturation and rising competition challenge clear aligner growth in developed regions

Developed markets such as North America host over 10,500 orthodontists, leading to price wars and diluted margins in the clear aligners market. New entrants fragment shares, while brand loyalty wanes amid commoditization. This dynamic curbs organic growth, forcing incumbents to pivot toward differentiation strategies.

Clear Aligners Market Trends and Opportunities

- Direct-to-consumer models expand clear aligner accessibility in emerging markets

The clear aligners market holds promise in Asia-Pacific and Latin America, where rising middle classes projected to add 1.5 billion consumers by 2030, seek affordable aesthetics. Diffusion theory posits that DTC platforms, bypassing clinics, lower entry barriers through at-home kits and virtual consults, mirroring e-commerce disruptions. In India and Brazil, smartphone penetration (over 70%) enables app-based tracking, fostering trust and compliance. This opportunity leverages glocalization adapting aligner designs to local bite patterns while scaling via partnerships with e-pharmacies. Business implications include margin expansion through reduced overheads, positioning the market for 15-20% regional CAGR, with investments in localized R&D yielding first-mover advantages.

- AI and tele-dentistry integration transform clear aligner treatments with personalization

Advancements in predictive analytics offer a pathway to hyper-personalization, using machine learning to forecast treatment paths with 90% accuracy. Opportunities arise in underserved areas such as rural Mexico, where bandwidth improvements enable equitable access. Strategically, this fosters ecosystem lock-in data-rich platforms enhance retention, while regulatory nods for AI diagnostics seen in FDA pilots de-risk scaling. For stakeholders, it signals a 25% efficiency gain, transforming the clear aligners market into a tech-enabled service sector.

Segment-wise Trends & Analysis

- Adults dominate clear aligners market while teenagers emerge as fastest growing segment

The adults segment commands over 70% market share in 2025, valued at approximately USD 10.15 billion, driven by career-oriented professionals prioritizing subtle corrections. This leadership stems from higher disposable incomes and delayed orthodontic interventions, aligning with lifecycle theories where mid-life aesthetics investments peak. Competitors such as Align Technology dominate via tailored adult protocols, outpacing rivals through superior brand recall.

Teenagers emerge as the fast-growing segment, with projections for 15-20% annual gains, fuelled by peer-driven social media trends and parental awareness of early alignment benefits. Underlying drivers include school-based screenings revealing 50% malocclusion rates. Positioning-wise, entrants such as Byte leverage DTC affordability, challenging incumbents by capturing Gen Z's digital natives, reshaping competitive dynamics in the clear aligners industry.

- Polyurethane plastic leads the material segment while PETG gains through eco-friendly growth

Polyurethane plastic leads the market with over 75% share in 2025, equating to USD 10.88 billion, owing to its durability and biocompatibility that support extended wear. Game theory in supply chains explains this hegemony: established manufacturers lock in economies of scale, deterring switches via consistent performance metrics.

Polyethylene terephthalate glycol (PETG) emerges rapidly, with 10-12% growth trajectory, propelled by eco-conscious formulations reducing plastic waste by 20%. Drivers include sustainability mandates from EU regulations, enabling niche players such as Argen to differentiate via green certifications, intensifying rivalry.

- Clinics lead clear aligners adoption while standalone practices expand through tele-integration

Dental & orthodontic clinics hold over 60% of the 2025 clear aligners market, at USD 8.7 billion, as hubs for expert-led fittings that build trust through hands-on diagnostics. Porter's five forces illustrate their bargaining power over suppliers, sustaining margins via volume prescriptions.

Standalone & group practices grow fast at a sustainable CAGR, driven by franchise models expanding to suburbs where 40% of demand originates. This shift, rooted in decentralization theories, empowers independents with tele-integration, eroding clinic monopolies and diversifying the market landscape.

Regional Trends & Analysis

North America maintains leadership supported by advanced healthcare and an aesthetic focus

North America dominates with over 55% market share in 2025, driven by advanced healthcare infrastructure, high aesthetic consciousness, and established orthodontic care frameworks. The region houses approximately 19,000 orthodontists with substantial target patient populations, though increasing market saturation creates competitive pressures among practitioners. Strong disposable incomes, favorable insurance coverage, and widespread awareness of orthodontic treatment options support continued market leadership despite emerging competition from other regions.

U.S. Clear Aligners Market - 2025 Snapshot & Outlook

The U.S. maintains market leadership through robust demand for cosmetic dental solutions and technological advancement adoption in orthodontic practices. Nearly 65% of the U.S. population experiences some form of malocclusion, creating substantial treatment demand. The market benefits from 11,000 active orthodontists, with high concentrations in California, New York, and Texas, providing accessible care networks. Consumer spending on aesthetic dentistry continues to rise, supported by social media influence and professional appearance requirements.

Government healthcare initiatives and favorable reimbursement policies enhance market accessibility, while ongoing product launches from established manufacturers maintain innovation momentum. The U.S. market demonstrates a strong preference for premium clear aligner solutions, with Invisalign maintaining a significant market share through brand recognition and clinical effectiveness. Direct-to-consumer models gain traction, offering cost-effective alternatives while maintaining professional oversight through teledentistry platforms.

Latin America shows fastest growth driven by expanding middle class and tourism

Latin America emerges as a high-growth region with a projected CAGR, driven by expanding middle-class populations and increasing aesthetic awareness. The region benefits from dental tourism growth, offering cosmetic procedures at competitive costs compared to North America and Europe. Brazil leads regional expansion, while Mexico and other key markets demonstrate strong adoption of clear aligner technologies.

Brazil Clear Aligners Market - 2025 Snapshot & Outlook

Brazil benefits from rise in disposable income, urbanization trends, and increasing awareness of dental aesthetics among younger populations. Government healthcare initiatives and expanding dental infrastructure support market growth, while local partnerships with international manufacturers enhance product accessibility.

The adult segment maintains dominance, though teenage adoption accelerates as parental awareness increases and treatment costs become more accessible. Brazil's position as a dental tourism destination attracts international patients seeking cost-effective clear aligner treatments, contributing to market expansion. Local manufacturing capabilities and distribution networks continue to develop, supporting long-term growth and sustainability.

Mexico Clear Aligners Market - 2025 Snapshot & Outlook

Mexico demonstrates substantial growth potential driven by expanding middle-class demographics and rising orthodontic supply awareness. The market benefits from geographic proximity to the U.S., facilitating technology transfer and clinical expertise sharing. Urban centers particularly drive adoption, with advanced dental services becoming increasingly available and social media influence raising treatment awareness.

Consumer health consciousness and image awareness contribute to clear aligner preference over traditional orthodontic solutions. The availability of technologically advanced dental services in metropolitan areas supports market development, while digital marketing and social media education enhance treatment benefit awareness among target demographics.

Europe holds second second-largest share with expanding access to orthodontic care

Europe holds the second-largest market position with 23.1% global share in 2024, supported by established healthcare systems and growing aesthetic dentistry acceptance. The region demonstrates notable growth potential through increasing awareness of dental treatment options and market player efforts to enhance orthodontic treatment accessibility.

Germany Clear Aligners Market - 2025 Snapshot & Outlook

Germany maintains the largest European market, projected to reach USD 0.39 billion in 2025. The market benefits from advanced healthcare infrastructure, high disposable incomes, and strong awareness of preventive dental care. German consumers demonstrate willingness to invest in premium orthodontic solutions, supporting clear aligner adoption among adult professionals seeking discreet treatment options.

The market exhibits steady growth supported by technological advancement adoption and expanding practitioner networks offering clear aligner services. Government healthcare policies and insurance coverage considerations influence market accessibility, while research collaborations between academic institutions and industry players drive innovation in treatment approaches.

U.K. Clear Aligners Market - 2025 Snapshot & Outlook

The U.K. market demonstrates strong growth potential, estimated to reach USD 0.26 billion in 2025. Market development benefits from NHS awareness initiatives and private dental practice expansion offering cosmetic orthodontic services. British consumers increasingly prioritize dental aesthetics, supporting clear aligner adoption among working professionals and young adults.

Regulatory framework developments and safety standard improvements enhance consumer confidence in clear aligner treatments. The market benefits from established dental tourism networks and international practitioner exchanges, facilitating clinical expertise sharing and treatment protocol standardization across European markets.

Competitive Landscape Analysis

The players in the clear aligners market focus on innovation and partnerships to capture untapped segments. This strategy addresses fragmentation by integrating AI and 3D tech, as evidenced by a 25% rise in FDA approvals since 2020, enabling faster market entry. Collaborations with dental chains, such as those expanding telehealth, have boosted treatment volumes by 18% in key regions, per association filings, countering cost pressures.

Mergers and acquisitions will reshape costs by consolidating supply chains, potentially reducing material expenses by 15%, while new EU sustainability rules may hike compliance outlays by 10%. Early movers will benefit from first-mover advantages in emerging markets, while latecomers may face intensified pricing wars.

Key Companies

- Align Technology, Inc.

- Dentsply Sirona

- Henry Schein, Inc.

- Institut Straumann AG

- The 3M Company

- 32 Watts (Renderwise Solutions Pvt Ltd.)

- Alignerco

- K Line Europe GmbH

- Others

Recent Developments:

- July 2025, Align Technology has introduced the Invisalign System with mandibular advancement featuring occlusal blocks, a new solution for treating Class II malocclusions in growing patients (ages 10-16). The innovation allows simultaneous jaw correction and teeth alignment with improved efficiency, comfort, and predictable outcomes, positioning Invisalign as a comprehensive alternative to traditional functional appliances.

- May 2025, ALIGNERCO has partnered with scan centers across the U.S. to introduce in-person 3D dental scans, giving customers a faster, more convenient alternative to at-home impression kits. This expansion supports ALIGNERCO’s mission to make teeth straightening more simple, affordable, and accessible, offering greater flexibility and personalized options for starting aligner treatment.

- November 2024, Solventum (formerly 3M Health Care) has launched 3M™ Clarity™ Precision Grip Attachments, available exclusively with Clarity Aligners. These 3D-printed, stain-resistant attachments address one of aligner treatment’s biggest challenges by ensuring accurate shape, durability, and precise placement—reducing variability, improving efficiency, and enhancing treatment outcomes for orthodontists and patients.

- June 2024, Henry Schein Orthodontics unveiled its Smilers Expert advanced aligner system, powered by Nemotec’s NemoCast software. The system enhances treatment planning with CBCT-based root visibility, multiple setup comparisons, customizable aligner thickness options, and advanced visualization tools, improving predictability and personalized orthodontic care.

Global Clear Aligners Market Segmentation-

By Age Stage

- Children

- Teenagers

- Adults

By Material Type

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

By End-users

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Clear Aligners Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Clear Aligners Market Outlook, 2020 - 2033

- Global Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- Global Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- Global Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- Global Clear Aligners Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- North America Clear Aligners Market Outlook, 2020 - 2033

- North America Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- North America Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- North America Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- North America Clear Aligners Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Clear Aligners Market Outlook, by Age Stage, 2020-2033

- S. Clear Aligners Market Outlook, by Material Type, 2020-2033

- S. Clear Aligners Market Outlook, by End-users, 2020-2033

- Canada Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Canada Clear Aligners Market Outlook, by Material Type, 2020-2033

- Canada Clear Aligners Market Outlook, by End-users, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Europe Clear Aligners Market Outlook, 2020 - 2033

- Europe Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- Europe Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- Europe Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- Europe Clear Aligners Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Germany Clear Aligners Market Outlook, by Material Type, 2020-2033

- Germany Clear Aligners Market Outlook, by End-users, 2020-2033

- Italy Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Italy Clear Aligners Market Outlook, by Material Type, 2020-2033

- Italy Clear Aligners Market Outlook, by End-users, 2020-2033

- France Clear Aligners Market Outlook, by Age Stage, 2020-2033

- France Clear Aligners Market Outlook, by Material Type, 2020-2033

- France Clear Aligners Market Outlook, by End-users, 2020-2033

- K. Clear Aligners Market Outlook, by Age Stage, 2020-2033

- K. Clear Aligners Market Outlook, by Material Type, 2020-2033

- K. Clear Aligners Market Outlook, by End-users, 2020-2033

- Spain Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Spain Clear Aligners Market Outlook, by Material Type, 2020-2033

- Spain Clear Aligners Market Outlook, by End-users, 2020-2033

- Russia Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Russia Clear Aligners Market Outlook, by Material Type, 2020-2033

- Russia Clear Aligners Market Outlook, by End-users, 2020-2033

- Rest of Europe Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Rest of Europe Clear Aligners Market Outlook, by Material Type, 2020-2033

- Rest of Europe Clear Aligners Market Outlook, by End-users, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Asia Pacific Clear Aligners Market Outlook, 2020 - 2033

- Asia Pacific Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- Asia Pacific Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- Asia Pacific Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- Asia Pacific Clear Aligners Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Clear Aligners Market Outlook, by Age Stage, 2020-2033

- China Clear Aligners Market Outlook, by Material Type, 2020-2033

- China Clear Aligners Market Outlook, by End-users, 2020-2033

- Japan Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Japan Clear Aligners Market Outlook, by Material Type, 2020-2033

- Japan Clear Aligners Market Outlook, by End-users, 2020-2033

- South Korea Clear Aligners Market Outlook, by Age Stage, 2020-2033

- South Korea Clear Aligners Market Outlook, by Material Type, 2020-2033

- South Korea Clear Aligners Market Outlook, by End-users, 2020-2033

- India Clear Aligners Market Outlook, by Age Stage, 2020-2033

- India Clear Aligners Market Outlook, by Material Type, 2020-2033

- India Clear Aligners Market Outlook, by End-users, 2020-2033

- Southeast Asia Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Southeast Asia Clear Aligners Market Outlook, by Material Type, 2020-2033

- Southeast Asia Clear Aligners Market Outlook, by End-users, 2020-2033

- Rest of SAO Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Rest of SAO Clear Aligners Market Outlook, by Material Type, 2020-2033

- Rest of SAO Clear Aligners Market Outlook, by End-users, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Latin America Clear Aligners Market Outlook, 2020 - 2033

- Latin America Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- Latin America Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- Latin America Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- Latin America Clear Aligners Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Brazil Clear Aligners Market Outlook, by Material Type, 2020-2033

- Brazil Clear Aligners Market Outlook, by End-users, 2020-2033

- Mexico Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Mexico Clear Aligners Market Outlook, by Material Type, 2020-2033

- Mexico Clear Aligners Market Outlook, by End-users, 2020-2033

- Argentina Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Argentina Clear Aligners Market Outlook, by Material Type, 2020-2033

- Argentina Clear Aligners Market Outlook, by End-users, 2020-2033

- Rest of LATAM Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Rest of LATAM Clear Aligners Market Outlook, by Material Type, 2020-2033

- Rest of LATAM Clear Aligners Market Outlook, by End-users, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Middle East & Africa Clear Aligners Market Outlook, 2020 - 2033

- Middle East & Africa Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Children

- Teenagers

- Adults

- Middle East & Africa Clear Aligners Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyvinyl Chloride

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Other

- Middle East & Africa Clear Aligners Market Outlook, by End-users, Value (US$ Mn), 2020-2033

- Hospitals

- Dental & Orthodontic Clinics

- Standalone & Group Practices

- Research Institutes

- Other

- Middle East & Africa Clear Aligners Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Clear Aligners Market Outlook, by Age Stage, 2020-2033

- GCC Clear Aligners Market Outlook, by Material Type, 2020-2033

- GCC Clear Aligners Market Outlook, by End-users, 2020-2033

- South Africa Clear Aligners Market Outlook, by Age Stage, 2020-2033

- South Africa Clear Aligners Market Outlook, by Material Type, 2020-2033

- South Africa Clear Aligners Market Outlook, by End-users, 2020-2033

- Egypt Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Egypt Clear Aligners Market Outlook, by Material Type, 2020-2033

- Egypt Clear Aligners Market Outlook, by End-users, 2020-2033

- Nigeria Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Nigeria Clear Aligners Market Outlook, by Material Type, 2020-2033

- Nigeria Clear Aligners Market Outlook, by End-users, 2020-2033

- Rest of Middle East Clear Aligners Market Outlook, by Age Stage, 2020-2033

- Rest of Middle East Clear Aligners Market Outlook, by Material Type, 2020-2033

- Rest of Middle East Clear Aligners Market Outlook, by End-users, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Clear Aligners Market Outlook, by Age Stage, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Align Technology, Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Dentsply Sirona

- Henry Schein, Inc.

- Institut Straumann AG

- The 3M Company

- 32 Watts (Renderwise Solutions Pvt Ltd.)

- Alignerco

- K Line Europe GmbH

- Others

- Align Technology, Inc.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2025 |

|

2019 - 2024 |

|

2026 - 2033 |

Value: US$ Billion |

|

REPORT FEATURES |

DETAILS |

|

Age Stage |

|

|

Material Type |

|

|

End Users |

|

|

Geographic Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Market Estimates and Forecast Value, Market Dynamics, Regulatory Guidelines, COVID-19 Impact Analysis, Regional and Country Insights, Competitive Landscape, Company Profiles |