Global Cocoa Market Forecast

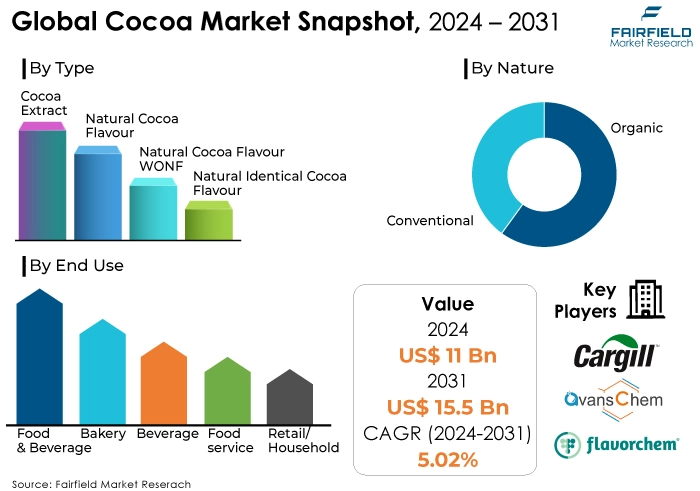

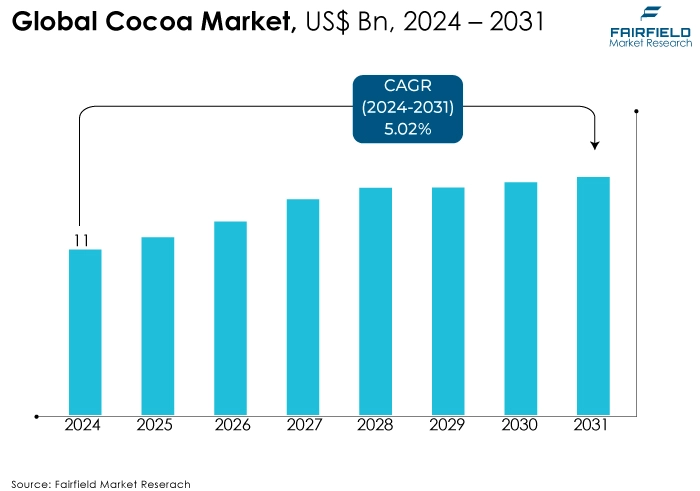

- Global cocoa market size to reach US$15.5 Bn by the end of 2031, up from US$11 Bn to be attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 5.02 % during 2024 - 2031

Quick Report Digest

- Global cocoa market projected to reach US$15.5 Bn by 2031-end at a CAGR of 5.02% from 2024 to 2031.

- Increasing chocolate consumption, demand for natural and premium cocoa products, and expanding applications beyond confectionery will drive market expansion.

- Climate change impacts, price volatility, and income inequality within the cocoa supply chain will be the major growth influencers.

- Recent market trends include the rise in demand for premium and specialty cocoa products, and emergence of functional and health-focused cocoa products.

- A few of the potential growth opportunities are the expansion into emerging markets with growing chocolate consumption, and diversification into cocoa-derived ingredients and applications.

- Stringent regulations ensure product safety and ethical sourcing but can raise production costs and limit innovation.

- The top market segments include dark chocolate, cocoa powder, and cocoa butter that are driven by consumer preferences, and versatile applications.

- Europe dominates the global cocoa market, followed by North America, and Asia Pacific, each with unique market dynamics and growth drivers.

- Leading companies such as Barry Callebaut AG, Cargill, Inc., and Nestlé S.A. dominate through vertical integration, innovation, and strategic partnerships.

- Leaders in Global Cocoa Space: Key players include Olam International Limited, Symrise AG, and Cargill, offering a range of cocoa products catering to various end uses and regions.

A Look Back and a Look Forward - Comparative Analysis

The cocoa market experienced steady growth from 2019 to 2023, with estimates suggesting a CAGR around 4.7%. This expansion is primarily fuelled by the rising popularity of chocolate and cocoa-based products. Consumers are increasingly drawn to the indulgent flavours and potential health benefits of cocoa, particularly dark chocolate with its high antioxidant content. Additionally, the expanding food and beverage industry creates new avenues for cocoa use, such as in bakery products, beverages, and even cosmetics.

The CAGR is predicted to remain stable through the end of forecast year, driven by several key trends. Urbanisation and a growing working population translate to a demand for convenient and shelf-stable ingredients like cocoa powder. The rising disposable income in developing regions like Asia Pacific presents a significant opportunity for market expansion. Consumers in these regions are increasingly indulging in chocolates, and cocoa-based treats.

Furthermore, the growing focus on ethical and sustainable sourcing practices is shaping the cocoa market. Consumers are more willing to pay a premium for cocoa that is ethically sourced and ensures fair treatment for farmers. This trend presents an opportunity for companies that prioritise sustainable practices throughout their supply chain. However, the market faces potential challenges like fluctuations in cocoa bean prices due to weather patterns and political instability in major producing regions. Additionally, rising health concerns regarding sugar content in chocolate could dampen demand for some products.

Key Growth Determinants

- Rising Chocolate Consumption

The increasing consumption of chocolate products worldwide is a significant driver of growth in the cocoa market. Chocolate remains one of the most popular confectionery items globally, with growing demand in emerging markets alongside steady consumption in developed regions. As consumers' disposable incomes rise and chocolate consumption becomes more ingrained in cultural practices, the demand for cocoa as a key ingredient continues to escalate.

- Growing Demand for Natural and Premium Cocoa Products

There is a noticeable shift towards natural and premium cocoa products driven by consumer preferences for high-quality, ethically sourced ingredients. With a heightened focus on health and sustainability, consumers are seeking cocoa products with minimal processing and certifications such as organic and fair trade. This trend is prompting manufacturers to invest in sourcing sustainable cocoa beans and developing premium cocoa products to cater to discerning consumers, thereby stimulating market growth.

- Expanding Applications Beyond Confectionery

The cocoa market is diversifying beyond traditional confectionery applications into various sectors such as cosmetics, pharmaceuticals, and beverages. Cocoa's rich flavour, aroma, and potential health benefits make it an attractive ingredient in skincare products, supplements, and functional beverages. This expanding scope of applications broadens the market's reach and creates new opportunities for cocoa producers and processors to capitalise on the growing demand from non-confectionery industries, thereby driving overall market growth.

Major Growth Barriers

- Climate Change, and Environmental Concerns

Climate change poses a significant threat to cocoa production, impacting both yield and quality. Rising temperatures, irregular rainfall patterns, and increased incidence of pests and diseases are jeopardizing cocoa cultivation in key growing regions such as West Africa. Additionally, deforestation for cocoa farming exacerbates environmental degradation and contributes to habitat loss. These environmental concerns not only constrain cocoa production but also raise ethical and sustainability issues, leading to consumer backlash and market uncertainty.

- Price Volatility, and Income Inequality

Cocoa market dynamics are characterised by price volatility, which can pose challenges for both cocoa farmers and buyers. Fluctuations in cocoa prices, influenced by factors such as weather conditions, geopolitical events, and supply-demand imbalances, impact farmers' livelihoods and investment decisions. Moreover, income inequality within the cocoa supply chain, with farmers typically receiving a small share of the final retail price, exacerbates poverty and limits opportunities for sustainable development in cocoa-producing regions.

- Disease Outbreaks, and Quality Concerns

Cocoa crops are susceptible to various pests and diseases, including fungal infections such as black pod disease and viral diseases like cocoa swollen shoot virus. Outbreaks of these diseases can devastate cocoa plantations, leading to significant yield losses and reduced quality of cocoa beans. Quality concerns arising from disease outbreaks not only affect cocoa production volumes but also diminish the marketability and value of cocoa products, impacting profitability and competitiveness in the cocoa market.

Key Trends and Opportunities to Look at

- Rise in Demand for Premium and Specialty Cocoa Products

One significant recent trend in the cocoa market is the increasing demand for premium and specialty cocoa products. Consumers are showing a growing preference for high-quality, ethically sourced cocoa with unique flavour profiles. This trend is driven by factors such as rising disposable incomes, evolving consumer tastes, and heightened awareness of sustainability and ethical sourcing practices. As a result, there is a growing market for premium cocoa beans, single-origin chocolates, artisanal cocoa products, and specialty cocoa ingredients tailored to meet the demands of discerning consumers. Manufacturers and retailers are capitalising on this trend by offering premium cocoa products that emphasize quality, flavour authenticity, and ethical sourcing practices.

- Emergence of Functional and Health-Focused Cocoa Products

Another notable trend is the emergence of functional and health-focused cocoa products. Consumers are increasingly seeking cocoa products that not only provide indulgence but also offer potential health benefits. Cocoa is rich in antioxidants, flavonoids, and other bioactive compounds associated with various health benefits, including improved cardiovascular health, cognitive function, and mood enhancement. Consequently, there is a growing market for functional cocoa products such as cocoa-infused supplements, beverages, and snacks targeting health-conscious consumers. Manufacturers are innovating to develop cocoa-based products fortified with vitamins, minerals, and other functional ingredients to meet the growing demand for health-focused cocoa offerings.

- Expansion into Emerging Markets

One significant opportunity for cocoa market players is the expansion into emerging markets with growing chocolate consumption and rising disposable incomes. Emerging economies in regions such as Asia Pacific, Latin America, and the Middle East are experiencing increasing urbanisation, changing consumer lifestyles, and a growing appetite for chocolate products. By tapping into these markets, cocoa players can capitalise on the expanding consumer base and drive sales growth. Moreover, investing in marketing, distribution, and product innovation tailored to local preferences can help companies establish a strong presence and capture market share in these high-growth regions.

- Diversification into Cocoa-Derived Ingredients, and Applications

Another promising opportunity lies in diversifying into cocoa-derived ingredients and applications beyond traditional chocolate products. Cocoa offers a versatile ingredient base for a wide range of food, beverage, and non-food applications, including bakery, confectionery, beverages, cosmetics, and pharmaceuticals. By leveraging cocoa's unique flavour, aroma, and functional properties, market players can develop innovative cocoa-based ingredients, flavourings, extracts, and cocoa derivatives to cater to diverse industry sectors. Furthermore, exploring new applications such as cocoa-based skincare products, functional beverages, and cocoa-infused culinary ingredients can open untapped market segments and drive revenue growth for cocoa market players.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a multifaceted role in shaping the cocoa market. Stringent regulations ensure safe, high-quality products by setting standards for contaminants and microbes, but can raise production costs. Regulations are also pushing the industry towards ethical sourcing and fair labour practices, tackling child labour and deforestation concerns. While this might increase costs, it improves the industry's social and environmental footprint.

Transparency is another key area, with regulations mandating clear labelling and product traceability for informed consumer choices and fraud prevention. Standards for processing methods and allowable additives ensure consistency but can limit innovation. Finally, government policies like export duties in producing regions can influence cocoa bean prices, impacting manufacturers who rely on a steady supply. In conclusion, navigating this complex regulatory landscape is essential for companies to ensure consumer safety, ethical practices, and a sustainable cocoa industry.

Fairfield’s Ranking Board

Top Segments

- Dark Chocolate Sales Continue to be Dominant

The dark chocolate segment is one of the top-performing segments in the cocoa market due to increasing consumer preference for its rich flavour profile and perceived health benefits. Dark chocolate contains a higher cocoa content compared to milk chocolate, which contributes to its intense cocoa flavour and potential health-promoting properties, such as antioxidants and flavonoids.

Growing awareness of dark chocolate's health benefits, including its potential to improve heart health, cognitive function, and mood, has driven demand for premium dark chocolate products. This trend is particularly evident among health-conscious consumers seeking indulgent yet nutritious treats. Additionally, the dark chocolate segment benefits from innovation and product diversification, with manufacturers introducing new flavours, textures, and formulations to cater to evolving consumer tastes and preferences, further driving growth in this segment.

- Cocoa Powder Remains Most Favoured

The cocoa powder segment is another top-performing segment in the cocoa market, driven by its versatile applications in various food and beverage products. Cocoa powder is a key ingredient in baking, confectionery, beverages, and culinary preparations, providing rich cocoa flavour, colour, and aroma.

Increasing demand for cocoa powder is fuelled by the growing popularity of homemade baked goods, artisanal chocolates, and gourmet desserts. Additionally, the rise of health-conscious consumers seeking to incorporate cocoa's nutritional benefits into their diets has boosted demand for cocoa powder in smoothies, protein shakes, and other functional beverages.

Furthermore, cocoa powder's long shelf life, ease of storage, and convenient packaging formats make it a preferred choice for both consumers and food manufacturers, driving sustained growth in this segment.

- Cocoa Butter Segment Rises High on the Back of Widening Application in F&B, Cosmetics, and Pharma

The cocoa butter segment is a key performer in the cocoa market, valued for its unique properties, and diverse applications in the food, cosmetics, and pharmaceutical industries. Cocoa butter is the fat extracted from cocoa beans during the chocolate-making process, prized for its smooth texture, pleasant aroma, and melting characteristics.

In the food industry, cocoa butter is used as a key ingredient in chocolate confectionery, providing texture, mouthfeel, and stability to chocolate products. Moreover, cocoa butter's natural moisturising properties make it a sought-after ingredient in skincare products, cosmetics, and personal care formulations.

With the growing demand for premium and natural ingredients, cocoa butter's role in clean label formulations and organic products is driving its market growth. Additionally, technological advancements in cocoa butter processing and extraction techniques are further expanding its applications, fuelling growth in this segment of the cocoa market.

Regional Frontrunners

- Europe - the Pre-eminent Region Consuming Cocoa

Holds the largest market share due to a long history of chocolate consumption and established confectionery industries (Switzerland, Germany, Belgium). High per capita cocoa consumption driven by consumer preference for premium chocolates. Stringent regulations ensure high product quality and focus on ethical sourcing.

- North America, and Asia Pacific All Set for a Sprint Through 2031

Large and established chocolate confectionery industry (Hershey's, Mars, Mondelez). Growing demand for premium and dark chocolates due to health-conscious consumers. Increasing popularity of cocoa-based beverages and bakery applications.On the other hand, rapidly rising disposable income in developing countries like China, and India fuels demand for chocolates, and cocoa products across Asia Pacific. Growing urbanisation, and busy lifestyles create a market for convenient cocoa-based treats. Increasing awareness of chocolate's health benefits fosters market expansion.

Fairfield’s Competitive Landscape Analysis

The competition landscape of the cocoa market is characterised by the presence of several key players competing for market share through various strategies. Leading companies in the industry include Barry Callebaut AG, Cargill, Inc., Olam International, Nestlé S.A., and Mars, Incorporated. These companies dominate the cocoa market due to their extensive global presence, diversified product portfolios, and strong distribution networks. To maintain their competitive positions and drive growth, key players typically adopt several strategic initiatives.

One major growth strategy involves vertical integration, wherein companies engage in cocoa bean sourcing, processing, and manufacturing chocolate products, thereby exerting control over the entire value chain and ensuring product quality and consistency. Additionally, companies invest in research and development to innovate new cocoa-based products, flavours, and formulations that cater to evolving consumer preferences for premium, sustainable, and healthier chocolate options. Furthermore, strategic partnerships, collaborations, and acquisitions are commonly pursued to expand market reach, access new distribution channels, and capitalise on emerging market opportunities, thereby fostering sustainable growth in the competitive landscape of the cocoa market.

Who are the Leaders in Global Cocoa Space?

- Avanschem

- Briofeed Private Limited

- Cargill

- Flavorchem Corp.

- Forbes Chocolate

- Givaduan

- GLCC Co.

- Keliff's

- METAROM Group

- Olam International Limited

- Olivanation

- PROVA

- Sapphire Flavors & Fragrances

- Symrise AG

- Tradin Organics

Significant Company Developments

- April 2024:

In April 2024, a major development rocked the cocoa market with the introduction of a groundbreaking new product. This innovative launch not only signifies a leap forward in cocoa industry standards but also addresses evolving consumer preferences. The product's unique features promise to redefine the cocoa experience, catering to diverse tastes and lifestyles. Its arrival is anticipated to stimulate market growth, drawing attention from both industry players and consumers alike, and setting a new benchmark for quality and innovation in the cocoa sector.

- March 2024:

March 2024 witnessed a significant distribution agreement in the cocoa market, marking a strategic collaboration between key industry stakeholders. This partnership aims to optimize distribution channels, enhance market reach, and streamline supply chain operations. Through this agreement, cocoa products are set to penetrate new territories, catering to a broader consumer base. The synergy between the involved parties promises to unlock untapped opportunities, drive efficiency, and foster sustainable growth in the cocoa market. This development underscores the importance of strategic alliances in navigating the dynamic landscape of the cocoa industry.

- January 2024:

January 2024 witnessed the unveiling of an exciting new product in the cocoa market, signaling a wave of innovation and differentiation. This product launch embodies the latest advancements in cocoa processing technology, delivering superior quality and flavor. Its introduction reflects market responsiveness to shifting consumer preferences, offering a compelling value proposition that resonates with modern lifestyles. Anticipated to captivate discerning consumers, this product promises to carve a distinct niche in the cocoa market landscape, driving sales and redefining industry standards. Its launch heralds a new era of possibilities and opportunities in the cocoa sector.

An Expert’s Eye

The expert analyst's outlook on the global Cocoa Market's growth is cautiously optimistic, underpinned by several key factors. Despite challenges like climate change impacting cocoa production and price volatility, demand for cocoa and cocoa-based products remains robust, especially in emerging markets like Asia. This demand surge is propelled by growing consumer awareness of dark chocolate's health benefits and cocoa's antioxidant properties, driving interest in premium and organic cocoa products. Furthermore, industry innovation, such as reduced sugar content and sustainable sourcing, aligns with shifting consumer preferences, fostering market growth. Efforts to improve the cocoa supply chain, including sustainable farming practices and fair trade initiatives, contribute positively to market expansion. Additionally, globalization and urbanization in developing regions present new opportunities for market penetration, further fueling growth prospects. Despite ongoing challenges, the Cocoa Market appears poised for steady expansion, driven by increasing demand, health-conscious consumer trends, innovation, and sustainability efforts throughout the supply chain.

The Global Cocoa Market is Segmented as Below:

By Nature

- Organic

- Conventional

By Type

- Cocoa Extract

- Natural Cocoa Flavour

- Natural Cocoa Flavour WONF

- Natural Identical Cocoa Flavour

By Form

- Liquid

- Powder

By End Use

- Food and Beverage

- Bakery

- Confectionery

- Beverage

- Foodservice

- Retail/Household

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

1. Executive Summary

1.1. Global Cocoa Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cocoa Market Outlook, 2019 - 2031

3.1. Global Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Organic

3.1.1.2. Conventional

3.2. Global Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Powder

3.2.1.2. Liquid

3.3. Global Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Cocoa Extract

3.3.1.2. Natural Cocoa flavour

3.3.1.3. Natural Cocoa flavour WONF

3.3.1.4. Natural Identical Cocoa flavour

3.4. Global Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Food and Beverages

3.4.1.1.1. Bakery

3.4.1.1.2. Confectionery

3.4.1.1.3. Beverages

3.4.1.2. Foodservice

3.4.1.3. Retail/Household

3.5. Global Cocoa Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Cocoa Market Outlook, 2019 - 2031

4.1. North America Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Organic

4.1.1.2. Conventional

4.2. North America Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Powder

4.2.1.2. Liquid

4.3. North America Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Cocoa Extract

4.3.1.2. Natural Cocoa flavour

4.3.1.3. Natural Cocoa flavour WONF

4.3.1.4. Natural Identical Cocoa flavour

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Food and Beverages

4.4.1.1.1. Bakery

4.4.1.1.2. Confectionery

4.4.1.1.3. Beverages

4.4.1.2. Foodservice

4.4.1.3. Retail/Household

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Cocoa Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

4.5.1.2. U.S. Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

4.5.1.3. U.S. Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

4.5.1.4. U.S. Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

4.5.1.5. Canada Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

4.5.1.6. Canada Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

4.5.1.7. Canada Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

4.5.1.8. Canada Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cocoa Market Outlook, 2019 - 2031

5.1. Europe Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Organic

5.1.1.2. Conventional

5.2. Europe Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Powder

5.2.1.2. Liquid

5.3. Europe Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Cocoa Extract

5.3.1.2. Natural Cocoa flavour

5.3.1.3. Natural Cocoa flavour WONF

5.3.1.4. Natural Identical Cocoa flavour

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Food and Beverages

5.4.1.1.1. Bakery

5.4.1.1.2. Confectionery

5.4.1.1.3. Beverages

5.4.1.2. Foodservice

5.4.1.3. Retail/Household

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Cocoa Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.2. Germany Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.3. Germany Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.4. Germany Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.5. U.K. Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.6. U.K. Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.7. U.K. Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.8. U.K. Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.9. France Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.10. France Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.11. France Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.12. France Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.13. Italy Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.14. Italy Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.15. Italy Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.16. Italy Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.17. Turkey Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.18. Turkey Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.19. Turkey Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.20. Turkey Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.21. Russia Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.22. Russia Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.23. Russia Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.24. Russia Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.25. Rest of Europe Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

5.5.1.26. Rest of Europe Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

5.5.1.27. Rest of Europe Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

5.5.1.28. Rest of Europe Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cocoa Market Outlook, 2019 - 2031

6.1. Asia Pacific Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Organic

6.1.1.2. Conventional

6.2. Asia Pacific Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Powder

6.2.1.2. Liquid

6.3. Asia Pacific Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Cocoa Extract

6.3.1.2. Natural Cocoa flavour

6.3.1.3. Natural Cocoa flavour WONF

6.3.1.4. Natural Identical Cocoa flavour

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Food and Beverages

6.4.1.1.1. Bakery

6.4.1.1.2. Confectionery

6.4.1.1.3. Beverages

6.4.1.2. Foodservice

6.4.1.3. Retail/Household

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Cocoa Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.2. China Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.3. China Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.4. China Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.5. Japan Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.6. Japan Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.7. Japan Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.8. Japan Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.9. South Korea Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.10. South Korea Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.11. South Korea Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.12. South Korea Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.13. India Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.14. India Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.15. India Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.16. India Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.17. Southeast Asia Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.18. Southeast Asia Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.19. Southeast Asia Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.20. Southeast Asia Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cocoa Market Outlook, 2019 - 2031

7.1. Latin America Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Organic

7.1.1.2. Conventional

7.2. Latin America Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Powder

7.2.1.2. Liquid

7.3. Latin America Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Cocoa Extract

7.3.1.2. Natural Cocoa flavour

7.3.1.3. Natural Cocoa flavour WONF

7.3.1.4. Natural Identical Cocoa flavour

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Food and Beverages

7.4.1.1.1. Bakery

7.4.1.1.2. Confectionery

7.4.1.1.3. Beverages

7.4.1.2. Foodservice

7.4.1.3. Retail/Household

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Cocoa Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

7.5.1.2. Brazil Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

7.5.1.3. Brazil Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

7.5.1.4. Brazil Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.5. Mexico Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

7.5.1.6. Mexico Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

7.5.1.7. Mexico Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

7.5.1.8. Mexico Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.9. Argentina Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

7.5.1.10. Argentina Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

7.5.1.11. Argentina Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

7.5.1.12. Argentina Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.13. Rest of Latin America Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

7.5.1.14. Rest of Latin America Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

7.5.1.15. Rest of Latin America Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

7.5.1.16. Rest of Latin America Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cocoa Market Outlook, 2019 - 2031

8.1. Middle East & Africa Cocoa Market Outlook, by Nature, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Organic

8.1.1.2. Conventional

8.2. Middle East & Africa Cocoa Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Powder

8.2.1.2. Liquid

8.3. Middle East & Africa Cocoa Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Cocoa Extract

8.3.1.2. Natural Cocoa flavour

8.3.1.3. Natural Cocoa flavour WONF

8.3.1.4. Natural Identical Cocoa flavour

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Cocoa Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Food and Beverages

8.4.1.1.1. Bakery

8.4.1.1.2. Confectionery

8.4.1.1.3. Beverages

8.4.1.2. Foodservice

8.4.1.3. Retail/Household

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Cocoa Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

8.5.1.2. GCC Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

8.5.1.3. GCC Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

8.5.1.4. GCC Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.5. South Africa Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

8.5.1.6. South Africa Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

8.5.1.7. South Africa Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

8.5.1.8. South Africa Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.9. Egypt Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

8.5.1.10. Egypt Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

8.5.1.11. Egypt Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

8.5.1.12. Egypt Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.13. Nigeria Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

8.5.1.14. Nigeria Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

8.5.1.15. Nigeria Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

8.5.1.16. Nigeria Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Cocoa Market by Nature, Value (US$ Bn), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Cocoa Market by Form, Value (US$ Bn), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Cocoa Market by Type, Value (US$ Bn), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Cocoa Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Type vs by Form Heat map

9.2. Manufacturer vs by Form Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Briofeed Private Limited

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Cargill Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Flavorchem Corp.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Forbes Chocolate

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Givaduan

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Glcc Co.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Keliff's

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Metarom Group

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Olam International Limited

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Olivanation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. PROVA

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Sapphire Flavors & Fragrances

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Symrise Ag

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Tradin Organics

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Type Coverage |

|

|

Form Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |