Plant-based Milk Market Growth and Industry Forecast

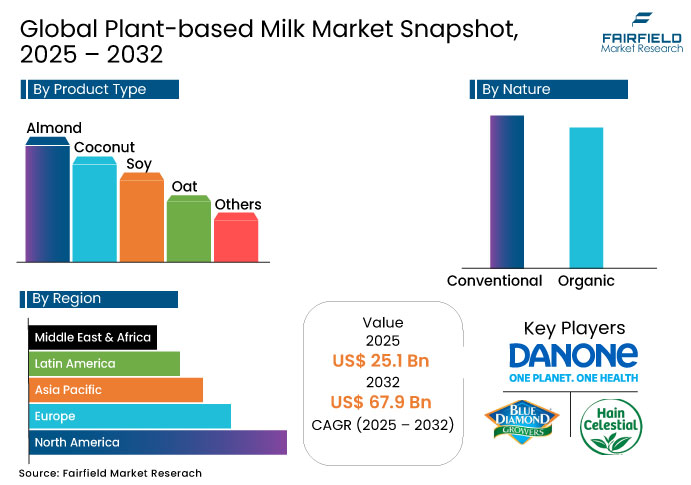

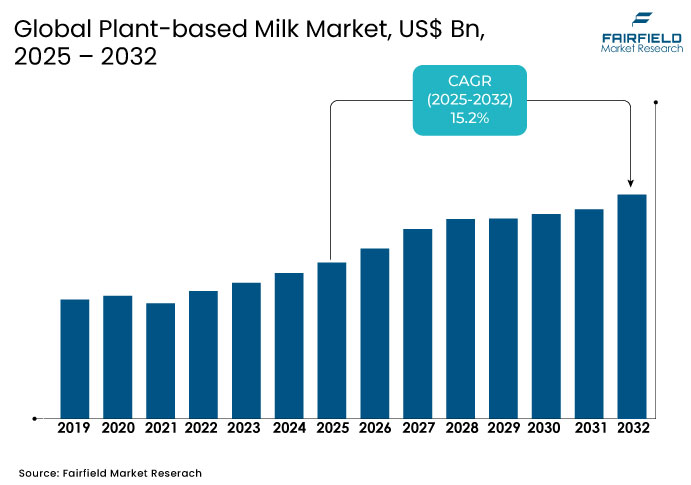

- The global plant-based milk market size is likely to be valued at US$ 25.1 Bn in 2025 and is estimated to reach US$ 67.9 Bn by 2032, growing with a CAGR of 15.2% between 2025 and 2032.

- The market for plant-based milk is driven by rising health consciousness, with consumers seeking lactose-free, low-cholesterol alternatives enriched with vitamins. Increasing vegan and flexitarian populations, coupled with environmental concerns, boost demand for sustainable dairy alternatives.

Plant-based Milk Market Summary Key Insights & Trends

- Oat milk leads the plant-based milk market by product type, holding over 26% share in 2024 due to its taste, texture, and sustainability.

- Pea milk is the fastest-growing product, projected to grow at a CAGR of 17.2% through 2032 as consumers seek nutrient-rich options.

- Conventional plant-based milk dominates the nature segment with approximately 84% share, supported by cost-effectiveness and wide availability.

- The organic segment is gaining strong traction, especially in Europe and North America, due to clean-label demand and increasing consumer health awareness.

- The retail/household end user segment accounts for over 60% of total consumption, driven by the rising use of coconut and soy milk in daily diets.

- Within the food & beverage industry, the bakery and confectionery sub-segment sees rising usage of plant-based milk in vegan and allergen-free recipes.

- Online retail is the fastest-growing business-to-consumer distribution channel, expanding at 15.8% CAGR due to digital convenience and direct-to-consumer brand strategies.

- Asia Pacific leads in growth potential, fueled by high lactose intolerance rates, growing demand for rice milk, and expanding foodservice industry

A Look Back and a Look Forward - Comparative Analysis

The plant-based milk market experienced robust growth from 2019 to 2024, achieving a CAGR of around 11.6%. The COVID-19 pandemic initially disrupted supply chains, impacting raw material availability and production, but heightened health awareness during the crisis accelerated consumer shifts toward plant-based diets. Increased home cooking and e-commerce adoption spurred demand for plant-based milk products such as oat and almond milk. Innovations in fortified formulations and sustainable packaging further supported market resilience, despite economic uncertainties, as consumers prioritized health and ethical consumption.

The plant-Based milk market is poised for exponential growth from 2025 to 2032 at a remarkable CAGR. This growth is fueled by advancements in food technology, such as precision fermentation, enhancing taste and nutrition to rival dairy milk. Rising veganism, urban dietary shifts, and regulatory support for sustainable alternatives will drive demand, particularly in North America and the Asia Pacific. Expanding retail channels, including quick-commerce, and innovative product launches targeting niche consumer needs, such as low-sugar and high-protein options will further propel the market growth.

Key Growth Drivers

- Veganism and Flexitarian Diets Fuel Dairy-Free Milk Demand

The surge in veganism and flexitarian diets is a key driver for the Plant-based Milk Market. According to the USDA Foreign Agricultural Service, approximately 35% of Germans are vegetarians, and 63% aim to reduce meat consumption, reflecting a global shift toward plant-based diets. The rise of ethical consumerism, driven by animal welfare and environmental concerns, boosts demand for dairy alternatives. Plant-based milk, with a lower carbon footprint than dairy, aligns with eco-conscious values. In the U.S., 33% of adults actively reduce meat intake, increasing plant-based milk consumption. Brands such as Oatly capitalize on this trend with barista-quality offerings, enhancing market appeal.

- Food Tech Innovations Enhance Plant-Based Milk Taste and Nutrition

Innovations in food technology are propelling by improving taste, texture, and nutritional profiles. Advances such as precision fermentation and cellular agriculture enable plant-based milk to mimic dairy’s creaminess and mouthfeel, broadening consumer acceptance. For instance, oat milk’s popularity stems from its frothing suitability for coffee, driven by enhanced production techniques. Companies invest heavily in R&D to develop fortified products, such as Vitasoy’s Fresh Plant+ range with oat and almond milk, launched in 2022. These advancements address diverse dietary needs, offering low-calorie almond milk or protein-rich pea milk. Regulatory support, such as the U.S. Dietary Guidelines endorsing plant-based diets, further accelerates market growth through innovation.

Key Growth Restraints

- Traditional Preferences and Flavor Challenges Limit Wider Acceptance

A key restraint in the market is the negative perception among some consumers, particularly in regions such as Asia, where dairy is deeply ingrained in traditional diets. Unfamiliar flavors or textures of plant-based milk, such as soy or rice milk, may deter consumers accustomed to dairy’s taste. Achieving dairy-such as consistency without additives remains challenging, impacting acceptance. In India, despite an 11.5% CAGR, lack of awareness about plant-based milk’s nutritional benefits hinders adoption. Manufacturers must invest in education and product development to overcome these barriers, which increases costs and slows market penetration in traditional dairy markets.

- Premium Pricing Hampers Adoption Among Price-Sensitive Consumers

The plant-based milk market faces challenges due to higher prices compared to conventional dairy. In 2024, plant-based milk prices rose 8% over two years, while dairy milk prices increased only 2%. This price disparity, coupled with consumer price sensitivity post-inflation, limits adoption, with 28% of U.S. shoppers citing budget constraints. Premium production processes, such as fortification and sustainable sourcing, elevate costs, making plant-based milk less appealing to cost-conscious consumers.

Plant-based Milk Market Trends and Opportunities

- Emerging Economies Show Strong Growth with E-commerce Accessibility

The market has significant growth potential in emerging markets such as India and China, driven by high lactose intolerance rates and abundant raw materials. The Asia Pacific region, expected to surpass US$ 19.8 billion by 2031, benefits from rising health awareness and urbanization. Local startups such as Better Bet are launching innovative products, such as sprouted millet-based milk, catering to regional tastes. Government support for sustainable diets and increasing disposable incomes further enhances market potential. E-commerce growth and smartphone penetration enable broader distribution, making plant-based milk accessible to urban and rural consumers. The plant-based milk market can capitalize on these trends by tailoring products to local preferences and leveraging online platforms for market penetration.

- Product Launches Address Niche and Functional Health Demands

The plant-based milk industry offers opportunities through innovative product launches tailored to evolving consumer needs. Brands are introducing fortified and flavored options, such as Silk Kids’ oat and pea-based formula or Vitasoy’s Fresh Plant+ range, to attract diverse demographics. The demand for barista-quality milk, such as Oatly’s offerings, is rising in coffee shops, with the US$ 45 billion coffee shop market increasingly adopting non-dairy options. Functional beverages with added probiotics, collagen, or low-sugar profiles address health-conscious consumers’ needs, such as stress reduction or anti-aging benefits. In 2024, Califia Farms launched Complete Kids, a nutrient-rich milk alternative for children, showcasing market innovation. Expanding product portfolios to include niche varieties such as hemp or pea milk can capture new segments.

Segment-wise Trends & Analysis

- Oat Milk Leads While Pea Milk Gains Ground Fast

Oat milk leads the plant-based milk due to its creamy texture, high fiber content, and suitability for coffee frothing, capturing significant market share. Its sustainability and appeal to vegan consumers drive demand, with a projected CAGR of 14.9% through 2033. Pea milk is the fastest-growing segment, fueled by its high protein content and allergen-free profile, appealing to health-conscious consumers. Innovations such as Califia Farms’ Complete Kids highlight pea milk’s rising popularity, particularly in fortified formulations for children.

- Conventional Remains Dominant, Organic Captures Conscious Consumers

Conventional plant-based milk dominates the market, benefiting from lower production costs and wider availability in retail channels. Its affordability appeals to price-sensitive consumers, holding the largest market share. Organic plant-based milk market is the fastest-growing segment, driven by rising demand for clean-label, sustainably sourced products. With a projected CAGR of 14.4%, organic options align with consumer preferences for ethical and eco-friendly diets, particularly in North America and Europe.

- Food Industry Leads, Foodservice Gains Rapid Momentum

The food & beverage industry leads the plant-based milk market, driven by its use in processed foods, dairy alternatives, and coffee shop applications. Its versatility in formulations ensures dominance. The foodservice industry is the fastest-growing segment, with a rising demand for plant-based milk in cafés and restaurants, fueled by the $45 billion coffee shop market’s shift to non-dairy options. Barista-quality milk, such as Oatly’s, caters to this trend, boosting growth.

- Retail Dominates, B2B Distribution Sees Accelerated Momentum

Business to consumer (B2C) leads the market for plant-based milk, with supermarkets, hypermarkets, and e-commerce platforms ensuring wide accessibility. Strong retail networks in the U.S. and Europe drive this segment’s dominance. Business to business (B2B) is the fastest-growing channel, as manufacturers supply plant-based milk to cafés, restaurants, and food processors. The rise of quick-commerce and online platforms further accelerates B2B growth, supporting the plant-based milk market expansion.

Regional Analysis

- U.S. Market Driven by Innovation and Health-Oriented Consumption

The U.S. dominates the plant-based milk market in North America, valued at US$ 4.5 billion in 2024, with a projected CAGR of 14.8% through 2032. Health trends, lactose intolerance, and strong distribution networks, including e-commerce and supermarkets, drive growth. Innovations such as fortified oat and pea milk, alongside regulatory support for sustainable diets, fuel demand.

- Germany and UK Lead Europe with Ethical Dairy-Free Preferences

Germany leads Europe’s plant-based milk industry, driven by its large vegan and flexitarian population and a projected CAGR of 15.5%. Health consciousness, lactose intolerance concerns, and ethical sourcing preferences boost demand for oat and almond milk. The UK follows, with a growing market for organic and fortified products, supported by innovations and regulatory backing.

- India and China Propel Regional Growth with High Intolerance Rates

India and China drive the plant-based milk market in Asia Pacific, with India’s market at a CAGR of 11.5%. High lactose intolerance rates (61% in India), abundant raw materials such as soy and rice, and rising health awareness fuel growth. Urbanization and e-commerce expansion further accelerate market penetration.

Competitive Landscape

Leading players in the plant-based milk market, such as Danone, Oatly, and Blue Diamond Growers, leverage extensive distribution networks, sustainability initiatives, and R&D to maintain dominance. Danone focuses on mainstream retail with brands such as Silk, while Oatly targets premium barista-quality products. Innovative startups such as Ripple Foods emphasize protein-rich formulations to capture niche markets.

Key Companies

- Danone S.A.

- Oatly Group

- Blue Diamond Growers

- The Hain Celestial Group, Inc.

- SunOpta Inc.

- Daiya Foods Inc.

- Califia Farms

- Lactalis Canada

- Ripple Foods

- Nestlé

- Symrise

- Archer Daniels Midland

- Vitasoy International Holdings Limited

- A&B Ingredients

- Fuji Oil Holdings Inc.

Expert Opinion

- Califia Farms’ Complete Kids Launch (June 2024): Introduced a nutrient-rich pea, chickpea, and fava bean-based milk for children, offering 8g protein and 50% less sugar. Available in U.S. grocery stores and online, targeting health-conscious parents.

- Lactalis Canada’s Enjoy Brand Launch (May 2024): Launched a new plant-based milk brand targeting health-conscious Canadian consumers. The brand focuses on fortified almond and oat milk, expanding retail presence.

- Oatly’s Sponsorship with EF Pro Cycling (June 2024): Entered a multi-year sponsorship to boost brand visibility. This aligns with sustainability goals, promoting oat milk in North America.

- Vitasoy’s Fresh Plant+ Range (September 2022): Launched oat and almond milk products to meet rising demand. Focuses on flavor and nutrition, targeting Asia Pacific markets.

Global Plant-based Milk Market Segmentation

By Product Type

- Almond

- Coconut

- Soy

- Oat

- Rice

- Others

By Nature

- Conventional

- Organic

By End-user

- Retail/Household

- Food & Beverage Industry

- Bakery & Confectionery

- Dairy & Desserts

- Infant Formula

- Foodservice Industry

By Distribution Channel

- Business to Consumer

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

- Business to Business

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Plant-based Milk Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Plant-based Milk Market Outlook, 2019 - 2032

3.1. Global Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

3.1.1. Business to Consumer

3.1.1.1. Hypermarkets/Supermarkets

3.1.1.2. Convenience Stores

3.1.1.3. Specialty Stores

3.1.1.4. Online Retail

3.1.1.5. Others

3.1.2. Business to Business

3.2. Global Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

3.2.1. Retail/Household

3.2.2. Food & Beverage Industry

3.2.2.1. Bakery & Confectionery

3.2.2.2. Dairy & Desserts

3.2.2.3. Infant Formula

3.2.3. Foodservice Industry

3.3. Global Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

3.3.1. Conventional

3.3.2. Organic

3.4. Global Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

3.4.1. Almond

3.4.2. Coconut

3.4.3. Soy

3.4.4. Oat

3.4.5. Rice

3.4.6. Others

3.5. Global Plant-based Milk Market Outlook, by Region, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Latin America

3.5.5. Middle East & Africa

4. North America Plant-based Milk Market Outlook, 2019 - 2032

4.1. North America Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

4.1.1. Business to Consumer

4.1.1.1. Hypermarkets/Supermarkets

4.1.1.2. Convenience Stores

4.1.1.3. Specialty Stores

4.1.1.4. Online Retail

4.1.1.5. Others

4.1.2. Business to Business

4.2. North America Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

4.2.1. Retail/Household

4.2.2. Food & Beverage Industry

4.2.2.1. Bakery & Confectionery

4.2.2.2. Dairy & Desserts

4.2.2.3. Infant Formula

4.2.3. Foodservice Industry

4.3. North America Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

4.3.1. Conventional

4.3.2. Organic

4.4. North America Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

4.4.1. Almond

4.4.2. Coconut

4.4.3. Soy

4.4.4. Oat

4.4.5. Rice

4.4.6. Others

4.5. North America Plant-based Milk Market Outlook, by Country, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

4.5.1. U.S. Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

4.5.2. U.S. Plant-based Milk Market Outlook, by End-user, 2019-2032

4.5.3. U.S. Plant-based Milk Market Outlook, by Nature, 2019-2032

4.5.4. U.S. Plant-based Milk Market Outlook, by Product Type, 2019-2032

4.5.5. Canada Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

4.5.6. Canada Plant-based Milk Market Outlook, by End-user, 2019-2032

4.5.7. Canada Plant-based Milk Market Outlook, by Nature, 2019-2032

4.5.8. Canada Plant-based Milk Market Outlook, by Product Type, 2019-2032

4.6. BPS Analysis/Market Attractiveness Analysis

5. Europe Plant-based Milk Market Outlook, 2019 - 2032

5.1. Europe Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

5.1.1. Business to Consumer

5.1.1.1. Hypermarkets/Supermarkets

5.1.1.2. Convenience Stores

5.1.1.3. Specialty Stores

5.1.1.4. Online Retail

5.1.1.5. Others

5.1.2. Business to Business

5.2. Europe Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

5.2.1. Retail/Household

5.2.2. Food & Beverage Industry

5.2.2.1. Bakery & Confectionery

5.2.2.2. Dairy & Desserts

5.2.2.3. Infant Formula

5.2.3. Foodservice Industry

5.3. Europe Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

5.3.1. Conventional

5.3.2. Organic

5.4. Europe Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

5.4.1. Almond

5.4.2. Coconut

5.4.3. Soy

5.4.4. Oat

5.4.5. Rice

5.4.6. Others

5.5. Europe Plant-based Milk Market Outlook, by Country, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

5.5.1. Germany Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.2. Germany Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.3. Germany Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.4. Germany Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.5. Italy Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.6. Italy Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.7. Italy Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.8. Italy Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.9. France Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.10. France Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.11. France Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.12. France Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.13. U.K. Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.14. U.K. Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.15. U.K. Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.16. U.K. Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.17. Spain Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.18. Spain Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.19. Spain Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.20. Spain Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.21. Russia Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.22. Russia Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.23. Russia Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.24. Russia Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.5.25. Rest of Europe Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

5.5.26. Rest of Europe Plant-based Milk Market Outlook, by End-user, 2019-2032

5.5.27. Rest of Europe Plant-based Milk Market Outlook, by Nature, 2019-2032

5.5.28. Rest of Europe Plant-based Milk Market Outlook, by Product Type, 2019-2032

5.6. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Plant-based Milk Market Outlook, 2019 - 2032

6.1. Asia Pacific Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

6.1.1. Business to Consumer

6.1.1.1. Hypermarkets/Supermarkets

6.1.1.2. Convenience Stores

6.1.1.3. Specialty Stores

6.1.1.4. Online Retail

6.1.1.5. Others

6.1.2. Business to Business

6.2. Asia Pacific Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

6.2.1. Retail/Household

6.2.2. Food & Beverage Industry

6.2.2.1. Bakery & Confectionery

6.2.2.2. Dairy & Desserts

6.2.2.3. Infant Formula

6.2.3. Foodservice Industry

6.3. Asia Pacific Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

6.3.1. Conventional

6.3.2. Organic

6.4. Asia Pacific Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

6.4.1. Almond

6.4.2. Coconut

6.4.3. Soy

6.4.4. Oat

6.4.5. Rice

6.4.6. Others

6.5. Asia Pacific Plant-based Milk Market Outlook, by Country, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

6.5.1. China Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.2. China Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.3. China Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.4. China Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.5.5. Japan Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.6. Japan Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.7. Japan Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.8. Japan Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.5.9. South Korea Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.10. South Korea Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.11. South Korea Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.12. South Korea Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.5.13. India Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.14. India Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.15. India Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.16. India Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.5.17. Southeast Asia Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.18. Southeast Asia Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.19. Southeast Asia Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.20. Southeast Asia Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.5.21. Rest of SAO Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

6.5.22. Rest of SAO Plant-based Milk Market Outlook, by End-user, 2019-2032

6.5.23. Rest of SAO Plant-based Milk Market Outlook, by Nature, 2019-2032

6.5.24. Rest of SAO Plant-based Milk Market Outlook, by Product Type, 2019-2032

6.6. BPS Analysis/Market Attractiveness Analysis

7. Latin America Plant-based Milk Market Outlook, 2019 - 2032

7.1. Latin America Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

7.1.1. Business to Consumer

7.1.1.1. Hypermarkets/Supermarkets

7.1.1.2. Convenience Stores

7.1.1.3. Specialty Stores

7.1.1.4. Online Retail

7.1.1.5. Others

7.1.2. Business to Business

7.2. Latin America Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

7.2.1. Retail/Household

7.2.2. Food & Beverage Industry

7.2.2.1. Bakery & Confectionery

7.2.2.2. Dairy & Desserts

7.2.2.3. Infant Formula

7.2.3. Foodservice Industry

7.3. Latin America Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

7.3.1. Conventional

7.3.2. Organic

7.4. Latin America Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

7.4.1. Almond

7.4.2. Coconut

7.4.3. Soy

7.4.4. Oat

7.4.5. Rice

7.4.6. Others

7.5. Latin America Plant-based Milk Market Outlook, by Country, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

7.5.1. Brazil Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

7.5.2. Brazil Plant-based Milk Market Outlook, by End-user, 2019-2032

7.5.3. Brazil Plant-based Milk Market Outlook, by Nature, 2019-2032

7.5.4. Brazil Plant-based Milk Market Outlook, by Product Type, 2019-2032

7.5.5. Mexico Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

7.5.6. Mexico Plant-based Milk Market Outlook, by End-user, 2019-2032

7.5.7. Mexico Plant-based Milk Market Outlook, by Nature, 2019-2032

7.5.8. Mexico Plant-based Milk Market Outlook, by Product Type, 2019-2032

7.5.9. Argentina Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

7.5.10. Argentina Plant-based Milk Market Outlook, by End-user, 2019-2032

7.5.11. Argentina Plant-based Milk Market Outlook, by Nature, 2019-2032

7.5.12. Argentina Plant-based Milk Market Outlook, by Product Type, 2019-2032

7.5.13. Rest of LATAM Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

7.5.14. Rest of LATAM Plant-based Milk Market Outlook, by End-user, 2019-2032

7.5.15. Rest of LATAM Plant-based Milk Market Outlook, by Nature, 2019-2032

7.5.16. Rest of LATAM Plant-based Milk Market Outlook, by Product Type, 2019-2032

7.6. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Plant-based Milk Market Outlook, 2019 - 2032

8.1. Middle East & Africa Plant-based Milk Market Outlook, by Distribution Channel, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

8.1.1. Business to Consumer

8.1.1.1. Hypermarkets/Supermarkets

8.1.1.2. Convenience Stores

8.1.1.3. Specialty Stores

8.1.1.4. Online Retail

8.1.1.5. Others

8.1.2. Business to Business

8.2. Middle East & Africa Plant-based Milk Market Outlook, by End-user, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

8.2.1. Retail/Household

8.2.2. Food & Beverage Industry

8.2.2.1. Bakery & Confectionery

8.2.2.2. Dairy & Desserts

8.2.2.3. Infant Formula

8.2.3. Foodservice Industry

8.3. Middle East & Africa Plant-based Milk Market Outlook, by Nature, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

8.3.1. Conventional

8.3.2. Organic

8.4. Middle East & Africa Plant-based Milk Market Outlook, by Product Type, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

8.4.1. Almond

8.4.2. Coconut

8.4.3. Soy

8.4.4. Oat

8.4.5. Rice

8.4.6. Others

8.5. Middle East & Africa Plant-based Milk Market Outlook, by Country, Value (US$ Bn) & Volume (Kilolitre), 2019-2032

8.5.1. GCC Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

8.5.2. GCC Plant-based Milk Market Outlook, by End-user, 2019-2032

8.5.3. GCC Plant-based Milk Market Outlook, by Nature, 2019-2032

8.5.4. GCC Plant-based Milk Market Outlook, by Product Type, 2019-2032

8.5.5. South Africa Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

8.5.6. South Africa Plant-based Milk Market Outlook, by End-user, 2019-2032

8.5.7. South Africa Plant-based Milk Market Outlook, by Nature, 2019-2032

8.5.8. South Africa Plant-based Milk Market Outlook, by Product Type, 2019-2032

8.5.9. Egypt Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

8.5.10. Egypt Plant-based Milk Market Outlook, by End-user, 2019-2032

8.5.11. Egypt Plant-based Milk Market Outlook, by Nature, 2019-2032

8.5.12. Egypt Plant-based Milk Market Outlook, by Product Type, 2019-2032

8.5.13. Nigeria Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

8.5.14. Nigeria Plant-based Milk Market Outlook, by End-user, 2019-2032

8.5.15. Nigeria Plant-based Milk Market Outlook, by Nature, 2019-2032

8.5.16. Nigeria Plant-based Milk Market Outlook, by Product Type, 2019-2032

8.5.17. Rest of Middle East Plant-based Milk Market Outlook, by Distribution Channel, 2019-2032

8.5.18. Rest of Middle East Plant-based Milk Market Outlook, by End-user, 2019-2032

8.5.19. Rest of Middle East Plant-based Milk Market Outlook, by Nature, 2019-2032

8.5.20. Rest of Middle East Plant-based Milk Market Outlook, by Product Type, 2019-2032

8.6. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Danone S.A.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Oatly Group

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Blue Diamond Growers

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. The Hain Celestial Group, Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. SunOpta Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Daiya Foods Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Califia Farms

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Lactalis Canada

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Ripple Foods

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Nestlé

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Nature Coverage |

|

|

End User Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |