Global Coconut Milk Market Forecast

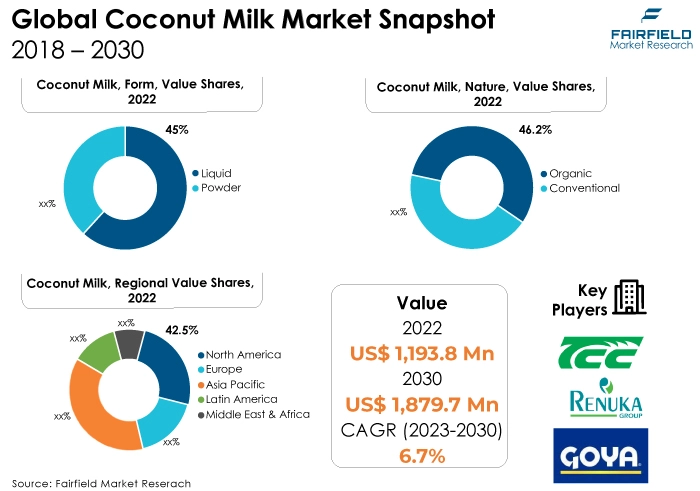

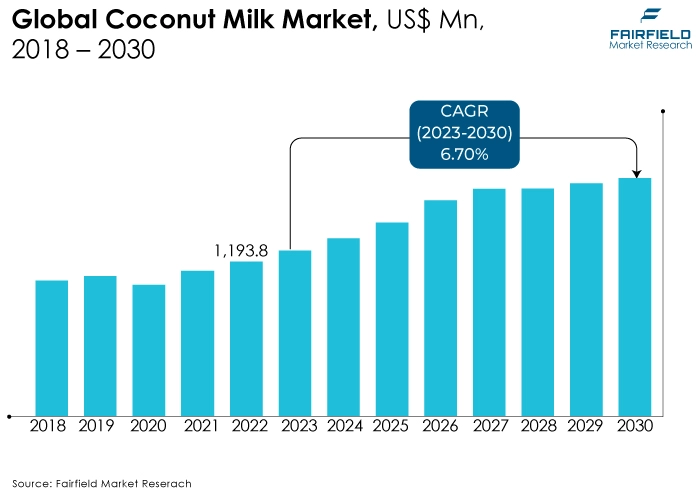

- The approximately US$1.1 Bn market for coconut milk to rise high up to US$1.8 Bn by the end of 2030

- Coconut milk market size all set to expand at a CAGR of 6.7% between forecast years, 2023 - 2030

Quick Report Digest

- The market is expanding as a result of rising consumer awareness of environmental and health issues, which is fueling demand for coconut milk as a dairy substitute.

- The demand for coconut milk as a significant component is being driven by the global trend towards unique and varied flavours, especially in Asian and tropical cuisines, which is driving the market expansion.

- Liquid forms dominate the market because consumers want ready-to-use, convenient items. The commercial domination of liquid coconut milk is largely attributed to its popularity in beverages and its versatility in cookery.

- The organic sector is dominating the market as customers place a higher priority on sustainability and health. Organic coconut milk is growing as more people become aware of eco-friendly production methods and pesticide-free farming.

- The full-fat coconut milk category is dominating the market because of its rich flavour profile and range of culinary uses. The consistent growth of the industry is fueled by consumer taste for rich, creamy textures.

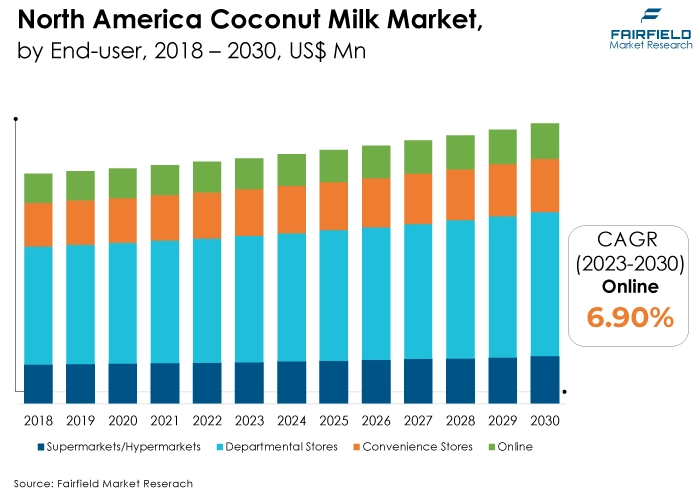

- Online distribution channels are gaining market share due to the ease of e-commerce and consumers' increasing inclination towards online buying. Online segment growth is influenced by doorstep delivery, accessibility, and a wide range of product choices.

- The fastest-growing coconut milk market is in the Asia-Pacific area, where traditional cooking methods and expanding consumer knowledge of health advantages are the main drivers. The extensive coconut farming in the area and the variety of applications in Asian cuisine both greatly aid in the growth of the industry.

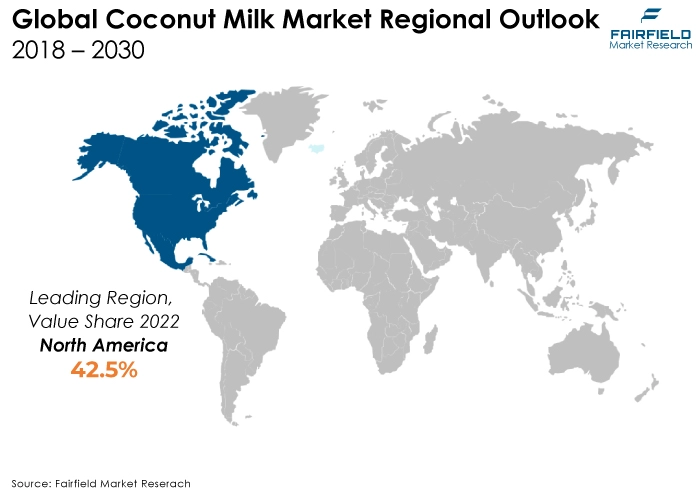

- North America is the largest market for coconut milk, owing to the expanding popularity of coconut-based goods and the increasing adoption of plant-based diets. The region's market supremacy is a result of both creative product offerings and strong customer demand for dairy substitutes.

- Europe is now the second-biggest market due to rising consumer interest in plant-based diets and healthy lifestyles. The region's changing culinary traditions, along with more readily available products and marketing initiatives, have a significant impact on the expansion of the coconut milk industry in Europe.

A Look Back and a Look Forward - Comparative Analysis

The market for coconut milk is currently flourishing due to the notable increase in demand for plant-based substitutes and the rising acceptance of coconut-based goods. The trend toward better living among consumers has led to a desire for coconut milk as a wholesome dairy substitute. The market offers a wide variety of products in different forms, including liquid and powder, with variations according to nature and fat content.

Online distribution platforms are becoming more and more popular since they give customers easy access and a variety of options. The coconut milk market has changed significantly in the last ten years. It has transformed from a specialty item to a popular food and lifestyle option. A steady transition towards more health-conscious eating patterns may be seen in historical trends, with coconut milk emerging as a major participant in the plant-based food revolution.

Another factor contributing to the expansion of market reach has been advancements in packaging and processing methods. The market for coconut milk appears to have a bright future ahead of it, with steady growth predicted. Growing consumer health and environmental consciousness is anticipated to drive up demand for sustainable and organic coconut milk.

Continuous improvements in food technology could result in new product formulations and improved shelf-life. Furthermore, worldwide initiatives to curtail dairy intake and accept a range of dietary choices will probably support the market's continuous growth for coconut milk globally.

Key Growth Determinants

- Rising Health Consciousness, and Mounting Demand for Plant-based Alternatives

The growing global emphasis on wellness and health is one of the main factors driving the coconut milk market expansion. Consumers are gravitating toward plant-based and natural food products as they become more health-conscious. The meat of coconuts is used to make coconut milk, which is thought to be a healthier substitute for conventional dairy products. Rich in minerals, vitamins, and medium-chain triglycerides, it supports the immune system, enhances metabolism, and is good for the heart.

Furthermore, there is a growing need for non-dairy substitutes due to the rise in lactose intolerance and allergies associated with dairy products, with coconut milk emerging as a popular option. Its popularity is partly due to its inherent sweetness and adaptability to savory and sweet recipes. The growing popularity of vegan and vegetarian diets, where coconut milk is welcomed as a basic component for plant-based cookery, is another factor contributing to this health-conscious trend.

- Widely Developing Perceptions About Sustainability, and Ethical Consumption

The increased consciousness of sustainability and ethical consumption behaviour has a major impact on the coconut milk market. When compared to some other crops, coconut production is typically thought to be more environmentally benign because it uses fewer synthetic inputs, and pesticides. Consumers choose products that are ethically and sustainably sourced as they grow more ecologically concerned. The favourable market view of coconut milk is partly attributed to the natural eco-friendliness of coconut production.

Additionally, fair trade methods and community support are important social and ethical components of the coconut industry. Customers are more likely to select goods that reflect their values than those that don't, and the ethical production of coconut milk fits in with the larger worldwide trend toward sustainable and ethical consumption.

- Increasing Culinary Diversity, and Adoption of Exotic Flavours

There is a shift occurring in the worldwide culinary scene as people become more appreciative of unique and unusual flavours. The increasing popularity of Asian, tropical, and Middle Eastern cuisines has led to a surge in demand for coconut milk, an essential ingredient in many of these culinary traditions. Coconut milk is a staple of both traditional and modern cuisines because of its adaptability in savory and sweet recipes, such as soups, curries, desserts, and drinks.

Coconut milk gives food a unique richness and creaminess that encourages people to try new and daring flavours, which has led to its widespread use in mainstream cooking. The rising demand for fusion food, which combines traditional and modern flavour characteristics with coconut milk, is contributing to the trend of culinary diversity. One significant growing driver that is increasing the availability of coconut milk in homes and restaurants across the globe is its incorporation into a wide range of international dishes.

Major Growth Barriers

- Supply Chain Vulnerabilities, and Price Volatility

Due to supply chain weaknesses, such as the reliance on particular regions for coconut cultivation, the coconut milk market needs help with difficulties. The supply chain may be disrupted by natural catastrophes, climate change, and geopolitical events, which could affect coconut prices. The production costs are impacted by these uncertainties, which may affect the marketability and affordability of coconut milk products.

- Limited Product Innovation, and Shelf Stability

The market for coconut milk is significantly constrained by the narrow spectrum of product innovation and issues with shelf stability. To satisfy customer demands for a wider range of products, easy storage, and a longer shelf-life, processing techniques and formulations must be innovative.

The requirement for packaged coconut milk to have a constant quality and flavour presents difficulties for producers trying to keep their products pure without adding chemicals or preservatives. By reducing the opportunity for differentiation and adaptation to changing consumer demands, this restriction may impede market growth.

Key Trends and Opportunities to Look at

- Expanding Product Portfolio with Value-added Variants

Diversifying and increasing the range of coconut milk products is one way to capitalize on market growth opportunities. Producers have the opportunity to leverage consumer preferences for novel and enhanced versions, like flavoured coconut milk, creamers made from coconut, and ready-to-drink coconut drinks.

Products with special dietary requirements, such as fortified or low-sugar variants, can reach a wider audience. This strategic growth boosts total revenue and market competitiveness while also catering to changing consumer tastes.

- Technology Usage for Sustainable Production Practices

The coconut milk business has much potential when it comes to using technology to improve sustainable production methods. Coconut production can be optimised to reduce environmental impact and increase productivity through the use of sustainable farming technologies, precision agriculture, and smart farming approaches.

Adopting these technical innovations guarantees a robust and dependable supply chain in addition to promoting environmentally responsible practices. Businesses may address the growing consumer demand for ethically sourced and ecologically friendly products while gaining a competitive edge in the market by using and promoting sustainable production practices.

- Remarkably Growing Online Retail Channels

The coconut milk market's participants have a profitable chance to increase their customer base and market reach thanks to the exponential rise of e-commerce. By utilising the accessibility and ease of online retail channels, marketers may connect with customers across a wide range of geographic regions. Creating a strong online presence and forming alliances with e-commerce sites can increase exposure and streamline direct-to-consumer transactions.

Online channels also give marketers a place to spread the word about the health advantages and culinary adaptability of coconut milk, which fosters consumer loyalty and expands market share. In the digital age, embracing e-commerce trends is essential to maintaining competitiveness and optimising market potential.

How Does the Regulatory Scenario Shape this Industry?

Regulatory requirements and certifications are applied to the coconut milk market to guarantee the quality and safety of the product. These criteria usually include following food safety laws, adhering to labelling specifications, and obtaining certifications for sustainable or organic farming methods. Regulatory agencies establish guidelines on a national and international scale to ensure the genuineness and quality of coconut milk products.

Market participants must adhere to these norms to gain the trust of consumers, fulfil their legal obligations, and access new markets. Furthermore, certifications like USDA Organic, Fair Trade, and others help differentiate products and denote adherence to sustainable and moral business practices in the coconut milk sector.

Fairfield’s Ranking Board

Top Segments

- Liquid Category Wins Preference over Powder Segment

The market for coconut milk in 2022 is dominated by the liquid form because it is so widely used in cooking, drinks, and culinary applications. Because it is readily available and convenient, liquid coconut milk is a preferred option among consumers who are looking for a product that can be easily and versatilely used in a variety of dishes. Its choice as a dairy substitute in baking and cooking plays a major role in the liquid form's continued dominance of the market.

Coconut milk in powder form is emerging as the segment with the highest rate of growth, propelled by factors including increased shelf-life, simplified storage, and more efficient transportation. The extended shelf-life of powdered coconut milk attracts customers seeking a portable and easy substitute. Powdered coconut milk is expanding quickly in the market due to its increasing use in the food industry, particularly in the creation of instant beverage mixes and as an ingredient in packaged goods.

- An Environmentally Responsible Mindset Drives Dominance of Organic Coconut Milk

In 2022, the coconut milk industry, the organic sector, is in the lead due to rising customer demand for products that are supplied sustainably and with better health. Growing emphasis on pesticide-free farming, moral production methods, and a general dedication to environmental responsibility are what are driving the demand for organic coconut milk. The market share and steady expansion of organic coconut milk are attributed to consumers' willingness to pay a premium for organic products.

The conventional section is expanding quickly, but the organic segment continues to hold a dominant position. The reason for this development is said to be a wider range of consumers who could value affordability more than organic certification. Furthermore, as the industry grows internationally, developing economies may account for a sizable portion of the demand for regular coconut milk. Conventional coconut milk appeals to a wide spectrum of customers due to its affordability, availability, and variety; this helps explain why it is the market sector with the quickest rate of growth.

- Full-fat Coconut Milk Sales Dominate on the Back of a Rich Flavour

In 2022, the market is dominated by full-fat coconut milk, which is favoured for a variety of culinary applications due to its rich and buttery consistency. Full-fat coconut milk is widely used in both traditional and modern cooking because of its rich flavour, which improves the mouthfeel and taste of food. The market's full-fat coconut milk sector continues to dominate due to consumer preferences for rich and tasty options in recipes and beverages.

The market for low-fat coconut milk is expanding quickly due to customers' growing awareness of their health. The demand for low-fat substitutes is growing as dietary habits move in the direction of healthier options. People who are looking for the nutritional advantages of coconut milk with less fat can find it in low-fat coconut milk. Its adaptability in light and health-conscious recipes—such as smoothies and dishes with an emphasis on fitness—helps explain why this market category is now experiencing the strongest rate of growth.

- Supermarkets and Hypermarkets Bring in the Highest Revenue Shares

In 2022, the distribution channels for coconut milk are currently dominated by supermarkets and hypermarkets. This supremacy is largely due to the wide availability of different brands under one roof and the convenience of these large retail facilities for consumers. Supermarkets provide customers with a convenient one-stop shopping experience, allowing them to effortlessly compare and select from an extensive selection of coconut milk products. This has contributed to the continuous dominance of this distribution segment.

With its quick expansion, the online distribution channel is now the coconut milk market category with the quickest rate of growth. This growth is attributed to various factors, including the ease of home delivery, a vast selection of products, and growing digitisation. Customers have the opportunity to research and buy specialist or niche coconut milk goods that are not easily found in nearby stores via online platforms. Online channels' worldwide reach makes it easier to reach a wide range of customers, which is fueling the rapid rise in coconut milk sales via e-commerce platforms.

Regional Frontrunners

Extensive Accessibility Creates Tailwinds for North America’s Leadership

Coconut milk's largest market segment is established in North America, propelled by the increasing prevalence of plant-based diets and the growing appeal of products derived from coconut. North American consumers who are concerned about their health are actively looking for dairy substitutes, and coconut milk, with its many uses and nutritional advantages, meets this need.

The region's well-established retail infrastructure, which consists of specialist shops and supermarkets, makes coconut milk goods easily accessible. In addition, the prevalence of lactose intolerance and the increasing popularity of vegan diets play a major role in the market for coconut milk's continuous growth and domination in North America.

Sales Set to Heighten with Asia Pacific’s Traditional Culinary Culture

The coconut milk market with the quickest rate of growth is, by far, the Asia Pacific region. A combination of cultural factors-coconut milk is a mainstay in many Asian cuisines-and the global trend towards healthier eating choices are driving the region's tremendous growth. Growing disposable incomes in developing nations are a factor in the growing craze for unique and unusual flavours, one of which is coconut milk.

The wide availability of coconut farms in Asia Pacific nations like Thailand, Indonesia, and the Philippines also warrants a steady and affordable supply that fuels the explosive expansion of the market for coconut milk.

Fairfield’s Competitive Landscape Analysis

The coconut milk market is characterised by a dynamic competitive landscape, wherein prominent competitors prioritize product innovation, sustainable sourcing, and expansion of distribution channels. The strong rivalry between national and international businesses spurs constant innovation and guarantees a wide selection of premium coconut milk products to satisfy changing consumer demands.

Who are the Leaders in the Global Coconut Milk Space?

- Theppadungporn Coconut

- Renuka Foods PLC

- Goya Foods Incorporation

- Asiatic Agro-Industry

- The Sambu Group

- Sari Segar Husada

- Thai Agri Foods PLC

- M&S Food Industries

- Primex Coco Products Incorporation

- Santanku Sdn. Bhd

Significant Company Developments

New Product Launch

- January 2023: The Vita Coco Company, Inc. ("Vita Coco" or the "Company"), a prominent high-growth platform of healthier beverage brands, announced today the introduction of Vita Coco Barista MLKTM, available only at Alfred Coffee, a state-of-the-art, design-driven coffee chain. The launch will take place in January 2023.

- May 2021: A new Singaporean company named Only Earth debuted coconut and oat milk in India. Almond milk will soon be added to the lineup, according to the business. Kunal Mutha, who went vegan two years ago, established Only Earth. His worries about the effects of animal agriculture on the environment served as inspiration for the brand.

- June 2020: The first plant-based, totally dairy-free coconut milk yogurt in India will be available, according to Epigamia. These dairy-free, zero-preservative yogurts come in unsweetened and coconut jaggery flavours and are high in probiotics.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the market for coconut milk is expected to develop in the future due to strong demand. The market gains from the nutritious profile and wide range of culinary uses of coconut milk as customer preferences for healthier options increase. Analysts predict further growth due to reasons like growing product portfolios, growing consumer awareness of plant-based diets, and the rise of internet retail.

Additionally, the market is well-positioned for future growth due to its adaptability to changing consumer tastes, innovation in product offerings, and the widespread appeal of cuisines based on coconuts, which appeals to both industry participants and investors.

Supply Side of the Market

According to our analysis, a strong and complex network encompassing coconut agriculture, processing, and distribution characterises the supply side of the coconut milk business. Asia's coconut-producing regions are essential to maintaining a steady supply chain. An ethical and dependable supply of coconuts is made possible by fair trade initiatives, technological breakthroughs in production, and sustainable farming methods.

Coconut milk is extracted using effective techniques by processing facilities, satisfying both demand and quality requirements. Because of the supply side's flexibility in responding to environmental changes and focus on sustainability, the market is well-positioned for long-term growth, guaranteeing a steady and high-quality supply of coconut milk to satisfy demand from consumers throughout the world.

Global Coconut milk Market is Segmented as Below:

By Form:

- Liquid

- Powder

By Nature:

- Organic

- Conventional

By Product Type:

- Full Fat Coconut Milk

- Low Fat Coconut Milk

By Distribution Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Stores

- Online

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East and Africa

1. Executive Summary

1.1. Global Coconut Milk Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Coconut Milk Market Outlook, 2018 - 2030

3.1. Global Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Liquid

3.1.1.2. Powder

3.2. Global Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Organic

3.2.1.2. Conventional

3.3. Global Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Full Fat Coconut Milk

3.3.1.2. Low Fat Coconut Milk

3.4. Global Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Supermarkets/Hypermarkets

3.4.1.2. Departmental Stores

3.4.1.3. Convenience Stores

3.4.1.4. Online

3.5. Global Coconut Milk Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Coconut Milk Market Outlook, 2018 - 2030

4.1. North America Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Liquid

4.1.1.2. Powder

4.2. North America Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Organic

4.2.1.2. Conventional

4.3. North America Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Full Fat Coconut Milk

4.3.1.2. Low Fat Coconut Milk

4.4. North America Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Supermarkets/Hypermarkets

4.4.1.2. Departmental Stores

4.4.1.3. Convenience Stores

4.4.1.4. Online

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Coconut Milk Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Coconut Milk Market Outlook, 2018 - 2030

5.1. Europe Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Liquid

5.1.1.2. Powder

5.2. Europe Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Organic

5.2.1.2. Conventional

5.3. Europe Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Full Fat Coconut Milk

5.3.1.2. Low Fat Coconut Milk

5.4. Europe Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Supermarkets/Hypermarkets

5.4.1.2. Departmental Stores

5.4.1.3. Convenience Stores

5.4.1.4. Online

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Coconut Milk Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Coconut Milk Market Outlook, 2018 - 2030

6.1. Asia Pacific Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Liquid

6.1.1.2. Powder

6.2. Asia Pacific Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Organic

6.2.1.2. Conventional

6.3. Asia Pacific Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Full Fat Coconut Milk

6.3.1.2. Low Fat Coconut Milk

6.4. Asia Pacific Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Supermarkets/Hypermarkets

6.4.1.2. Departmental Stores

6.4.1.3. Convenience Stores

6.4.1.4. Online

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Coconut Milk Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Coconut Milk Market Outlook, 2018 - 2030

7.1. Latin America Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Liquid

7.1.1.2. Powder

7.2. Latin America Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Organic

7.2.1.2. Conventional

7.3. Latin America Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Full Fat Coconut Milk

7.3.1.2. Low Fat Coconut Milk

7.4. Latin America Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Supermarkets/Hypermarkets

7.4.1.2. Departmental Stores

7.4.1.3. Convenience Stores

7.4.1.4. Online

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Coconut Milk Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Coconut Milk Market Outlook, 2018 - 2030

8.1. Middle East & Africa Coconut Milk Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Liquid

8.1.1.2. Powder

8.2. Middle East & Africa Coconut Milk Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Organic

8.2.1.2. Conventional

8.3. Middle East & Africa Coconut Milk Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Full Fat Coconut Milk

8.3.1.2. Low Fat Coconut Milk

8.4. Middle East & Africa Coconut Milk Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Supermarkets/Hypermarkets

8.4.1.2. Departmental Stores

8.4.1.3. Convenience Stores

8.4.1.4. Online

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Coconut Milk Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Coconut Milk Market by Form, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Coconut Milk Market Nature, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Coconut Milk Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Coconut Milk Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Theppadungporn Coconut

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Renuka Foods PLC

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Goya Foods Incorporation.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Asiatic Agro-Industry.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. The Sambu Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. PT. Sari Segar Husada

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Thai Agri Foods PLC

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. M&S Food Industries

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Primex Coco Products Incorporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Santanku Sdn. Bhd

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Form Coverage |

|

|

Nature Coverage |

|

|

Product Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |