Global Coconut Oil Market Forecast

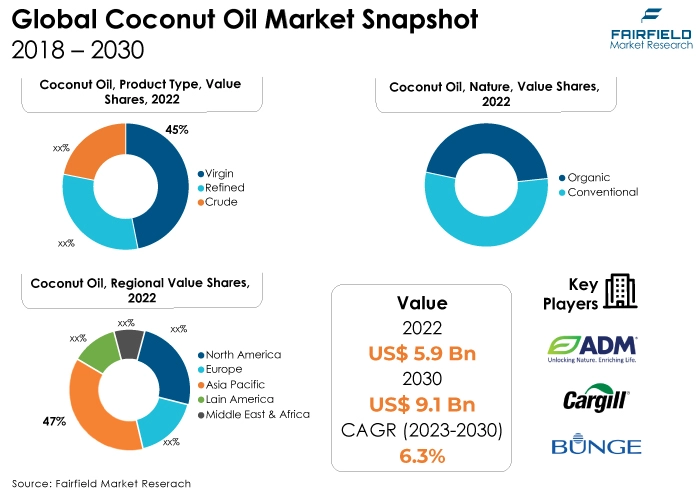

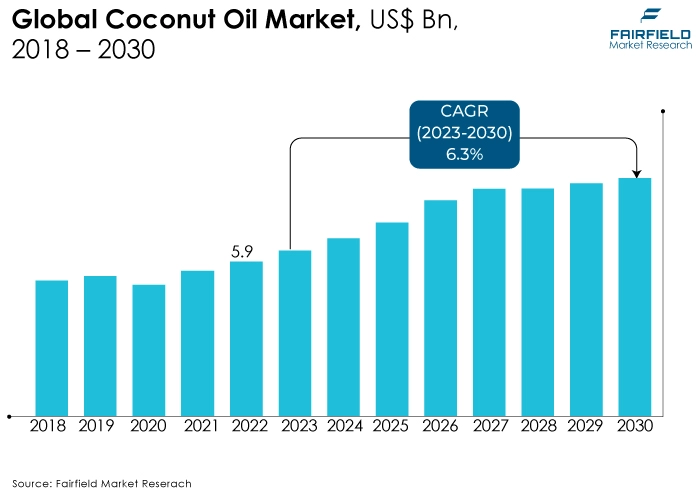

- Global coconut oil market size projected to reach US$9.1 Bn by 2030-end, up from US$5.9 Bn attained in 2023

- Market revenue poised to see healthy expansion at a CAGR of 6.3% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the coconut oil market growth is the changing tastes of consumers and the dominant patterns of society. Similarly, customers' growing health consciousness encourages them to make healthier food choices, propelling the market. In addition, the growing consumer spending on functional foods and drinks has supported the food industry's growth in the coconut oil market.

- Another major market trend expected to fuel the coconut oil market growth is the rapidly expanding population towards the virgin form of coconut oil, which gives better results to the customer.

- In 2023, the conventional category dominated the industry due to its affordability and consumer appeal. People's need for it is growing due to its invaluable nutritional advantages. The increased usage of this kind of oil in the food and beverage and personal care industries is driving the expansion of this market.

- In terms of market share for coconut oil globally, the virgin segment is anticipated to dominate. Its many benefits include the health benefits of the maintained antioxidants and vitamins, the components' antiviral and antibacterial properties, including lauric acid, and its simple digestion.

- In 2023, the food and beverages category controlled the market. Coconut oil enhances the finished food products' nutritional and functional value. Not only does it have a high smoking point, but food product makers prefer it.

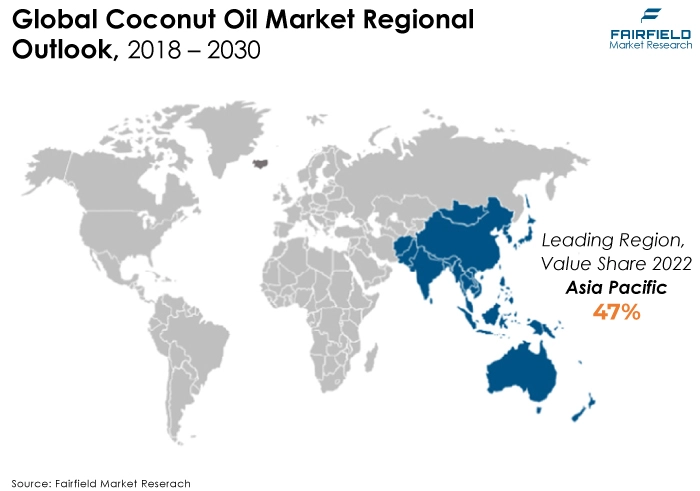

- The Asia Pacific region is anticipated to account for the largest share of the global coconut oil market; growth is being driven by growing knowledge of its possible health advantages. Consistent with the purported health benefits of coconut oil, many Asian Pacific customers place a high value on natural medicines and traditional health practices.

- The market for coconut oil is expanding in Europe due to consumers' rising awareness of healthy eating habits. Additionally, its use is expanding in various industrial items, including food and beverage, pharmaceutical, and cosmetics.

A Look Back and a Look Forward - Comparative Analysis

The market for coconut oil has grown in popularity due to factors such as its organic and antioxidant qualities. Coconut oil is becoming more and more popular among customers. Consumers prefer coconut oil for its ability to effectively nourish skin, care for hair, and improve digestion. Manufacturers are growing the global market through trade agreements, taxes, and rules between different regions. To draw consumers and boost the revenue of the worldwide market, they are concentrating on sustainable methods to enhance the production of coconut oil.

The quality and shelf-life of coconut oil are being enhanced by emerging advanced technologies, such as packaging and processing techniques, which are driving the expansion of the coconut oil market. The market witnessed staggered growth during the historical period 2018 - 2023.

Due to the intricate production process that necessitates additional refining and the separation of coconut milk, premium virgin coconut oil is pricey. In addition, this product has the highest level of saturated fats compared to other cooking oils. The growing popularity of coconut oil, the growing demand for natural and organic products, and expanding knowledge of the health advantages of coconut oil. This substance is a crucial component used in the healthcare and cosmetics industries.

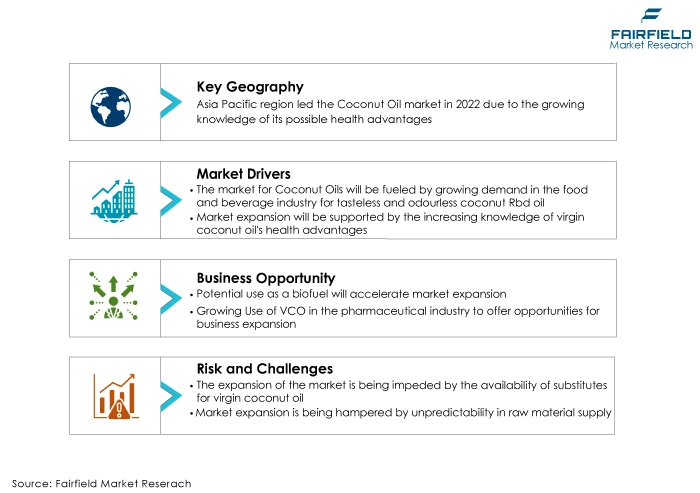

Key Growth Determinants

- Growing Demand in F&B for Tasteless and Odourless Coconut RBD Oil

Medium-chain triglycerides (MCTs) make up a large portion of the fatty acid profile of dried coconut used to make RBD coconut oil. Because of the unique MCTs found in coconut oil, the body absorbs it differently and uses it to produce steady, instantaneous energy directly from the GI tract to the liver.

Because of its high smoke point (450 degrees Fahrenheit), and lack of coconut flavour or perfume, it is great for lengthy frying because the coconut will not overpower other foods' flavours. It is also an excellent option for cooking because of its high quantities of lauric and caprylic acid, which are known to combat inflammation brought on by unstable polyunsaturated fatty acids and make food products healthier when prepared with them. It is also a 1:1 substitute for butter, margarine, and other oils in everyday baking, frying, and cooking.

- Perceived Health Advantages of Virgin Coconut Oil

The rise in the market has been mostly attributed to consumers becoming more health-concerned. Since VCO has so many health advantages, its use in pharmaceutical and medical supplies has expanded to help people stay healthy. Together with vitamins, minerals, and antioxidants, VCO is high in good fats. Worldwide reports indicate that this particular product is becoming increasingly well-liked among people concerned about their health as a nutraceutical ingredient.

- Consumer Spending on Functional F&B

VCO's rich flavour and subtle scent have made it a popular option amid the rising demand for functional foods. It is now common in many diet fads, including paleo and keto. Since choosing a healthy cooking oil can promote extra benefits, consumers' growing understanding of appropriate nutrition and adequate physical exercise has also impacted their food choices. As a result, customers are beginning to recognise this oil as functional. The increased consumer demand for functional food is anticipated to drive the market.

Major Growth Barriers

- Availability of Substitutes for Virgin Coconut Oil

Several alternative oils have comparable nutritional qualities to virgin olive oil (VCO), including canola, sunflower, almond, and virgin olive oil. This is expected to impede the expansion of the market. Customers' interest in alternatives has also changed due to producers fortifying olive and canola oils to maintain their vital elements. Additionally, virgin coconut oil has a higher smoke point than the other oils mentioned, making it a superior option for baking and cooking. Furthermore, Europe's heavy reliance on imports of coconuts and coconut oils is anticipated to impede market expansion.

- Unpredictability in Raw Material Supply

Coconut oil is derived from fresh coconut meat and copra. As a fruit that grows organically on farms, coconut output is susceptible to several events that could reduce it, including illnesses and floods. The availability of fresh coconut meat and copra, needed to make coconut oil, may be adversely affected. One of the world's biggest coconut producers is India.

However, the Union Agriculture Ministry reports that in 2018-19, India's coconut production fell by 10% year over year to its lowest level in the previous four years. Production of coconuts decreased to 21,384 million nuts in 2017-18 from 23,798 million nuts in 2017-18. This decline has been linked to unpredictable weather patterns, including intense rain and drought, and agricultural neglect, particularly in Kerala, India's largest coconut-producing state.

Key Trends and Opportunities to Look at

- Potential Application as a Biofuel

A chemical process known as transesterification, or alcoholysis, produces biofuel. Methanol, alcohol, and vegetable oil react when they are in the presence of sodium or potassium hydroxide, a catalyst. The result of the reaction is a biofuel that shares many characteristics with regular diesel fuel. Blends of coconut oil and regular diesel produce extremely similar energy outputs.

However, compared to traditional diesel exhaust, coconut oil exhaust emits much fewer dangerous pollutants. Because it is less expensive locally, coconut oil is increasingly used in Pacific countries for transportation and electrical generation. Reduced emissions and assistance for regional agro-industries are two other advantages. Numerous opportunities arise when coconut oil is used as biofuel in various nations.

- Growing Use of VCO in Pharma

For a very long time, the personal care and cosmetics industries have used VCO. The pharmaceutical industry has seen increased demand for this oil in recent years due to government-sponsored research and growing public interest. 2020 saw a significant increase in interest in the Philippines as the Department of Science and Technology (DOST) revealed plans to investigate VCO as a potential treatment for COVID-19 symptoms.

By introducing and growing their product lines, the producers are also responding to the increasing use of VCO in a range of pharmaceutical products, which is anticipated to create market opportunities in the coming years. For example, Growrich Manufacturing, a Philippines-based business, increased the market for VCO capsules in March 2021 due to rising customer demand for immune-boosting supplements.

- Widespread Use in Cosmetic and Personal Care Products

A common component of personal care and cosmetic products, coconut oil, is used by manufacturers because it is considered by communities worldwide—especially in coastal and tropical countries—to be a healthy addition to beauty products. Virgin coconut oil is a common ingredient in cosmetics, as consumers increasingly seek vegan and organic skincare and hair care products.

Because coconut oil includes triglycerides, and stable medium-chain fatty acids (C10 capric acid, C8 caprylic acid, and lauric acid), many personal care companies are replacing mineral oil in their personal and cosmetics product lines.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment that applies to coconut oil differs by nation or area. Nonetheless, all coconut oil products must adhere to a few common rules. Coconut oil must adhere to food safety regulations established by regulatory agencies such as the European Food Safety Authority (EFSA) or the US Food and Drug Administration (FDA). These guidelines guarantee that the oil is safe to eat for people.

Furthermore, items containing coconut oil need to have proper labels that provide details about the ingredients, nutritional value, and place of origin. Organic Certification: For coconut oil to have the organic label, it needs to be produced in compliance with the guidelines established by regulatory organisations such as the EU Organic Regulation or the USDA National Organic Programme (NOP). Businesses may struggle to negotiate the complicated regulatory environment surrounding coconut oil. It's critical for companies to adhere to all relevant laws and regulations and to stay current on new ones.

Fairfield’s Ranking Board

Top Segments

- Conventional Coconut Oil Most Favoured

The conventional segment dominated the market in 2023. Due to its affordability and consumer appeal. People's need for it is growing due to its invaluable nutritional advantages. The increased usage of this kind of oil in the food and beverage, and personal care industries is driving the expansion of this market.

Furthermore, the organic category is projected to experience the fastest market growth due to the goodness of coconuts, which are 100% natural. This preserves the nutritious worth of the food because organic oils do not require heat. The demand for organic oils is anticipated to fuel the segment's expansion throughout the projection period due to its healthful qualities, including high dietary fibre, vitamins, and minerals.

- Virgin Oil Represents the Bestseller Category

In 2023, the virgin category dominated the industry. Fresh coconut meat is used to extract virgin coconut oil directly. No bleaching or deodorising is involved because it is done naturally through processes like dry processing, fermentation, churning (centrifugal separation), cold compression, and wet milling. As a result, virgin coconut oil tastes and smells more like coconut than RBD oil. Its various benefits include the health benefits of the maintained antioxidants and vitamins, the lauric acid components' antiviral and antibacterial properties, and the simple digestion brought about by the medium-chain fatty acid content (MCFA).

The refined category is anticipated to grow substantially throughout the projected period. Coconut oil that has undergone processing to eliminate contaminants such as free fatty acids, color, and odor is known as refined coconut oil. This gives it a neutral flavour and scent, and increases its stability and shelf-life compared to unprocessed coconut oil. In addition to being utilised in creating cosmetics and personal hygiene products, refined coconut oil is frequently used in baking, frying, and cooking.

- F&B Emerges as the Leading Consumer Sector

The food and beverages segment dominated the market in 2023. Together with other coconut products, coconut oil is extensively used in the food industry. Coconut products are widely used in the culinary and pastry industries in many Asian, and European countries. Growing knowledge of the advantages and practical qualities of coconut goods, such as coconut oil, is driving up demand for them in the global food sector. Coconut RBD oil is the preferred option among consumers for domestic preparations.

The cosmetics and personal care category is expected to experience the fastest growth within the forecast time frame. VCO hair and skin care products are extensively purchased because of their cleansing, antibacterial, and moisturising qualities, which have helped the market expand. Because of this oil's ability to penetrate the skin completely and its moisturising qualities, it is also becoming increasingly popular in cosmetics as a highlighter, lip gloss, and make-up primer. Because of the oil's previously described qualities, it is a crucial component of many cosmetics, which fuels the market's growth.

Regional Frontrunners

Asia Pacific to be the Primary Regional Market

The rising availability of coconut oil products in countries like China, and India is anticipated to dominate Asia Pacific. Coconut oil is becoming increasingly popular as people become more aware of its possible health advantages. Virgin coconut oil is said to have health benefits, and many consumers in the Asia Pacific area appreciate natural medicines, and traditional health practices.

Furthermore, many Asia Pacific nations' culinary and cultural traditions are strongly rooted in using coconut and its derivatives, particularly coconut oil. Coconut oil is becoming increasingly in demand as people seek ways to reconnect with their traditional ingredients and heritage.

Europe Largely Gains from the Health and Wellness Drive

The region's increased focus on wellness and health is driving expansion in the European coconut oil market. Europe's increased emphasis on health and wellness drives the need for natural and functional ingredients. As a healthier substitute for conventional cooking oils, virgin coconut oil is thought to have various health advantages, including boosting immunity and metabolism. The demand for virgin coconut oil is rising as healthier lives become increasingly important to Europeans.

Fairfield’s Competitive Landscape Analysis

The global coconut oil market is a consolidated market with fewer major players present across the globe. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Coconut Oil Space?

- Archer Daniels Midland Company

- Bunge Limited

- Ruchi Soya Industries

- Adani Wilmar

- Associated British Foods

- Cargill Inc.

- Adams Group Inc

- American Vegetable Oil Inc.

- Phidco

- SC Global

- Oleo-Fats Incorporated

Significant Company Developments

New Product Launch

- February 2020: A new range of goods was introduced by Bunge Limited to help mimic the flavour, texture, and cooking process of meat. This portfolio uses high-stability sunflower, canola, coconut, and palm fruit oils to create specific fat fractions, shortenings, flakes, and emulsifiers.

- In 2022, The recently released virgin coconut oil was revealed by Dabur India Ltd. For health and wellness, this substance is frequently utilised. The corporation expanded its line of business in the international market with the debut of this product.

- In May 2020, GVK Investments, the AVA virgin coconut oil maker, is growing its processing capacity and product line, hiring people, giving smallholder farmers access to markets, and receiving help from HortiFresh through its Innovation fund.

Distribution Agreement

- June 2022: To move forward with new product launches, Cargill Inc., a significant player in the coconut oil market, purchased the Dalmia olive oil company. In addition, Cargill Inc. upgraded the Izegem edible vegetable oil refinery's output capacity by investing about US$17.5 Mn in it.

- August 2020: The Cotabato-based organic product company Treelife has invested in producing virgin coconut oil (VCO) to grow its business.

An Expert’s Eye

Demand and Future Growth

The growing demand for coconut oil in recent years can be attributed to growing awareness of the various benefits of coconut oil over synthetic alternatives. This may be attributed to consumers becoming more aware of the risks associated with products that use harsh chemicals, petrochemicals, and preservatives. It is also used for body massage because of its anti-inflammatory, antibacterial, antioxidant, and anti-aging properties.

Supply Side of the Market

According to our analysis, a few major producers, including Cargill, ADM, and Bunge, control the majority of the supply side of the coconut oil market. These businesses possess the equipment and resources necessary to make coconut oil on a massive scale and ship it to markets worldwide. But there are also a lot of small and medium-sized producers out there, especially in Indonesia, India, and the Philippines. These producers can export their goods to other nations and frequently have a significant role in supplying the local market.

Global Coconut Oil Market is Segmented as Below:

By Nature:

- Conventional

- Organic

By Product Type:

- Virgin

- Refined

- Crude

By End-use Industry:

- Food and Beverages

- Pharmaceutical

- Cosmetics and Personal Care

- Household/Retail

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Coconut Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Coconut Oil Market Outlook, 2018 - 2030

3.1. Global Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Virgin

3.1.1.2. Refined

3.1.1.3. Crude

3.2. Global Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Conventional

3.2.1.2. Organic

3.3. Global Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Food and Beverages

3.3.1.2. Pharmaceutical

3.3.1.3. Cosmetics and Personal Care

3.3.1.4. Household/ Retail

3.3.1.5. Others

3.4. Global Coconut Oil Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Coconut Oil Market Outlook, 2018 - 2030

4.1. North America Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Virgin

4.1.1.2. Refined

4.1.1.3. Crude

4.2. North America Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Conventional

4.2.1.2. Organic

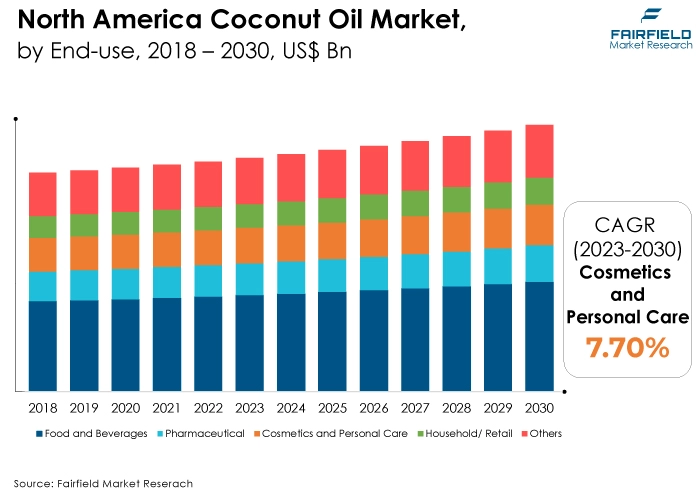

4.3. North America Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Food and Beverages

4.3.1.2. Pharmaceutical

4.3.1.3. Cosmetics and Personal Care

4.3.1.4. Household/ Retail

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Coconut Oil Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Coconut Oil Market Outlook, 2018 - 2030

5.1. Europe Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Virgin

5.1.1.2. Refined

5.1.1.3. Crude

5.2. Europe Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Conventional

5.2.1.2. Organic

5.3. Europe Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Food and Beverages

5.3.1.2. Pharmaceutical

5.3.1.3. Cosmetics and Personal Care

5.3.1.4. Household/ Retail

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Coconut Oil Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Coconut Oil Market Outlook, 2018 - 2030

6.1. Asia Pacific Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Virgin

6.1.1.2. Refined

6.1.1.3. Crude

6.2. Asia Pacific Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Conventional

6.2.1.2. Organic

6.3. Asia Pacific Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Food and Beverages

6.3.1.2. Pharmaceutical

6.3.1.3. Cosmetics and Personal Care

6.3.1.4. Household/ Retail

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Coconut Oil Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Coconut Oil Market Outlook, 2018 - 2030

7.1. Latin America Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Virgin

7.1.1.2. Refined

7.1.1.3. Crude

7.2. Latin America Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.2.1.1. Conventional

7.2.1.2. Organic

7.3. Latin America Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Food and Beverages

7.3.1.2. Pharmaceutical

7.3.1.3. Cosmetics and Personal Care

7.3.1.4. Household/ Retail

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Coconut Oil Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Coconut Oil Market Outlook, 2018 - 2030

8.1. Middle East & Africa Coconut Oil Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Virgin

8.1.1.2. Refined

8.1.1.3. Crude

8.2. Middle East & Africa Coconut Oil Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Conventional

8.2.1.2. Organic

8.3. Middle East & Africa Coconut Oil Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Food and Beverages

8.3.1.2. Pharmaceutical

8.3.1.3. Cosmetics and Personal Care

8.3.1.4. Household/ Retail

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Coconut Oil Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Coconut Oil Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Coconut Oil Market Nature, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Coconut Oil Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use Industry vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Archer Daniels Midland Company

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Bunge Limited

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Ruchi Soya Industries

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Adani Wilmar

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Associated British Foods

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Cargill Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Adams Group Inc

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. American Vegetable Oil Inc

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Phidco

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. SC Global

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Oleo-Fats Incorporated

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Product Type Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |