Global Vanilla Bean Market Forecast

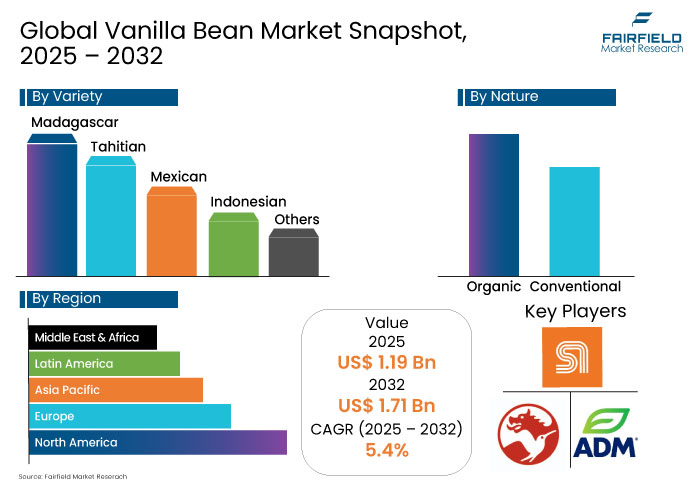

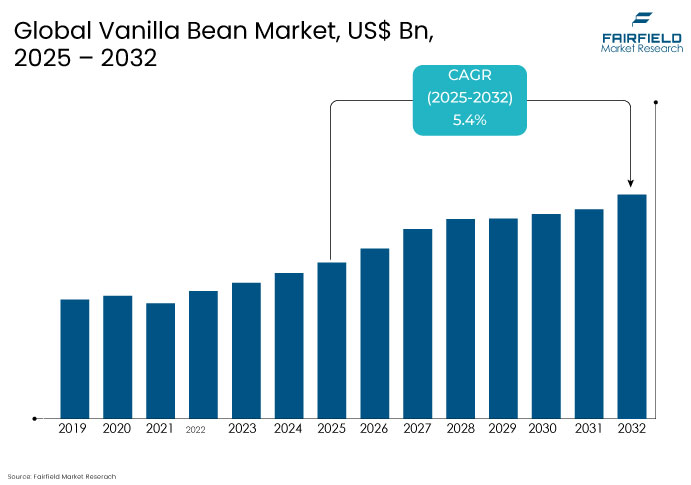

- The Global Vanilla Bean Market is expected to reach a market size of US$ 1.71 Bn by 2032 from its current market size of US$ 1.19 Bn in 2025, resembling strong growth with 5.4% CAGR during this period.

- The future of the vanilla bean market lies in sustainable sourcing, technological innovation, and expanding cultivation beyond traditional regions to stabilize supply and pricing.

Vanilla Bean Market Insights

- Rising demand for natural flavors in the food and beverage sectors is fueling vanilla bean market growth.

- France, Germany, and the Netherlands account for 75% of Europe’s vanilla bean imports.

- North America dominates the market with high imports and broad vanilla use in F&B and personal care.

- Advanced indoor curing and greenhouse farming are enhancing vanilla bean yield and vanillin concentration.

- Premium packaging that blends sustainability and storytelling is reshaping vanilla branding.

- Countries like India, Indonesia, and Japan are emerging as new vanilla cultivation hubs.

A Look Back and a Look Forward- Comparative Analysis

The global vanilla bean market experienced significant turbulence, shaped by cycles of oversupply, inconsistent demand, and geopolitical pressures, especially in Madagascar, the dominant producer. A rigid minimum export price was enforced until 2023, which led to market distortions and stockpiling. Once removed, prices plummeted, with low grades dipping below USD 20/kg, exposing the market’s fragility. Export delays, political distractions, and Cyclone Gamane in 2024 further strained Madagascar’s supply chain, while other origins such as Indonesia, Papua New Guinea, and Uganda faced challenges around traceability, certification, and sustainability.

Looking ahead, the global demand for natural vanilla beans is expected to rise steadily, driven by increasing consumer preference for clean-label and organic products. This shift is encouraging manufacturers in food, beverages, cosmetics, and pharmaceuticals to choose real vanilla over synthetic options. While Madagascar will likely remain the dominant producer, countries such as Indonesia, Uganda, and Mexico are set to expand their market roles. Additionally, innovations in extraction techniques and the adoption of sustainable farming practices are poised to boost production efficiency and quality. These trends will contribute to the vanilla market’s continued resilience and sustained growth in the years ahead.

Key Growth Determinants

Rising demand for natural vanilla in food and beverage applications

The rising demand for natural vanilla in food and beverage applications is driven by consumer preference for clean-label, non-artificial ingredients and strict regulatory standards ensuring product authenticity. Natural vanilla’s premium appeal, emotional resonance, and versatility make it a cornerstone flavor in both traditional and emerging product categories. According to International Flavors & Fragrances Inc., 45% of U.S. consumers associate vanilla with relaxation and comfort, fueling its use in functional foods, plant-based products, and nutraceuticals. In Europe, vanilla appears in nearly 1,800 new food and beverage products annually, making it the fifth most-used flavor in innovation. Regulatory bodies such as the FDA and the EU mandate strict quality and origin requirements, reinforcing consumer trust. As health-conscious and ethical consumption trends grow, demand for traceable, sustainably sourced natural vanilla continues to accelerate.

Key Growth Barriers

Unclear government policies and shifting export regulations

Unclear government policies and shifting export regulations pose a significant restraint to the global vanilla bean market, creating uncertainty for stakeholders across the supply chain. Frequent changes in minimum export prices, unclear timelines for export openings and closings, and a lack of timely communication, such as seen in Madagascar, disrupt planning and investment. These policy fluctuations hinder buyers from making long-term commitments and challenge exporters' ability to manage logistics efficiently. The ambiguity also places undue pressure on farmers, who face unstable income prospects and increased risk. As governments attempt to balance domestic control with international market demands, regulatory unpredictability continues to erode market confidence, encouraging buyers to explore more stable vanilla origins.

Vanilla Bean Market Trends and Opportunities

- Empowering vanilla farmers through sustainable practices

Empowering vanilla farmers through sustainable practices presents a vital opportunity to enhance livelihoods, ensure environmental stewardship, and secure a stable supply of high-quality vanilla. The Sustainable Vanilla Initiative (SVI), representing over 70% of the global vanilla market, plays a pivotal role by promoting traceability, fair labor rights, and grower support. Collaborations with industry leaders like Meiji Holdings showcase commitments to ethical sourcing and compliance with international conservation standards such as CITES. Innovative models like Vanilla Vida’s use precision agriculture and automation to improve bean quality and supply chain stability, setting new industry benchmarks. As per IFF, consumer demand for sustainably sourced vanilla, with 73% of buyers supporting ethical practices, further drives this transformation. Together, initiatives like SVI and national organizations such as VANEX are empowering farmers by integrating sustainable techniques that foster economic resilience, enhance product quality, and build a transparent, responsible vanilla industry benefiting all stakeholders.

- The move toward premium packaging is a major trend in vanilla branding

The move toward premium packaging is emerging as a major trend in vanilla branding, reshaping consumer perceptions and elevating product value. Driven by growing demand for luxury, sustainability, and authenticity, brands are investing in packaging that reflects craftsmanship and quality. Companies like Nielsen-Massey and Heilala Vanilla use apothecary-style glass bottles and minimalist metallic labels to communicate heritage and preserve flavor, appealing to discerning chefs and home bakers. Meanwhile, sustainable packaging innovations from brands like Singing Dog Vanilla and The Vanilla Company integrate compostable and recyclable materials, aligning with eco-conscious consumer values. Customizable, elegant packaging from providers like Rinpac enhances brand identity and product freshness. Even small-batch producers leverage rustic, hand-crafted packaging to emphasize artisanal origins. This fusion of aesthetics, sustainability, and storytelling transforms packaging into a vital brand asset, fostering emotional connection and justifying premium positioning in the global vanilla market.

Leading Segment Overview

- Madagascar vanilla is prized for its rich flavor and high natural vanillin content

Madagascar vanilla is expected to hold approximately 72% share of the Vanilla Bean market in 2025. Madagascar vanilla, known as Bourbon vanilla, is globally prized for its deep, creamy flavor profile and high natural vanillin content, making it the gold standard in culinary and fragrance applications. Grown primarily in the Sava region, Madagascar’s ideal climate and traditional curing methods contribute to beans with rich aroma, thick pods, and complex flavor layers. In contrast, Tahitian vanilla, cultivated in French Polynesia, is favored for its floral, fruity notes and is often used in perfumes and gourmet desserts. Indonesian vanilla beans, though lower in vanillin, offer a smoky, woody flavor due to unique curing techniques and are preferred in chocolate and spice-heavy recipes. Each origin brings distinct sensory profiles, but Madagascar’s superior vanillin yield and flavor depth secure its market leadership.

- Rising consumer preference for clean-label ingredients boosts demand for organic vanilla

Organic vanilla beans are expected to grow at a positive CAGR during the forecast period 2025 to 2032.Today’s consumers are increasingly scrutinizing product labels, favoring natural, minimally processed ingredients free from synthetic additives, GMOs, and artificial flavorings. Organic vanilla fits seamlessly into this clean-label movement, offering transparency, authenticity, and perceived health benefits. Its appeal extends beyond food and beverages into personal care, where organic credentials add value to cosmetics, fragrances, and wellness products. With clean-label products often associated with ethical sourcing and environmental responsibility, organic vanilla gains further traction among eco-conscious consumers. Brands are responding by reformulating products and emphasizing organic certification to align with these preferences.

Regional Analysis

- North America region dominates the Vanilla Bean Market

North America holds a dominant position in the global vanilla bean market, driven by its status as the largest importer of vanilla beans and a highly developed food and beverage industry. The U.S. leads in demand for natural vanilla, with widespread use in premium ice creams, baked goods, and clean-label beverages. Additionally, vanilla’s growing application in cosmetics and personal care products is further propelling regional demand, as consumers seek natural, aromatic ingredients. Canada contributes significantly, with rising demand for organic vanilla beans from artisanal bakeries and patisseries that emphasize quality and sustainability. Collaborations between North American brands and vanilla farmers in Madagascar are fostering traceable and ethical supply chains, reinforcing consumer trust and ensuring long-term supply stability.

- Sustainability and Organic Trends Reshape Europe’s Vanilla Market

Europe plays a vital role in the global vanilla bean market, with France, Germany, and the Netherlands together accounting for nearly 70% of all European import volumes. The region’s strong presence in the global baking industry especially artisanal and premium baked goods drives consistent demand for high-quality vanilla. European consumers increasingly value transparency and ethical sourcing, making sustainable supply chains a critical priority for brands. As a result, many companies are partnering with certified suppliers and investing in traceable, fair-trade vanilla. Organic products are also gaining ground, representing nearly 30% of all vanilla-based product launches in Europe. This growing preference for clean-label, sustainably sourced ingredients continues to shape procurement strategies, positioning Europe as a key market for premium, ethically produced vanilla beans.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the vanilla bean market is marked by strategic collaborations, technological advancements, and geographic expansion. Leading players are partnering with farmers in Madagascar, Papua New Guinea, and Uganda to ensure traceability, fair trade practices, and organic cultivation. These alliances not only stabilize supply but also improve farmers’ livelihoods and bean quality. Companies are investing in advanced curing and processing techniques to enhance flavor profiles and shelf life. Emerging cultivating regions like Japan, India, and Indonesia are gaining traction due to favorable climates and rising local demand. Additionally, regulatory bodies in vanilla-producing countries are playing a critical role in ensuring quality control and stabilizing bean prices, fostering a more sustainable and competitive global vanilla market.

- In January 2025, Israeli startup Vanilla Vida celebrated the world's first large-scale indoor vanilla harvest. Vanilla Vida's innovative indoor farming system, located in the north of Israel, has successfully halved the time required from planting to bloom compared to traditional methods.

- In January 2024, Eurovanille participated in the SIGEP Fair in Rimini, Italy, presenting its 100% vanilla range, including premium vanilla beans, natural extracts, and high-quality powders.

Key Companies

- ADM

- Symrise

- Givaudan

- Sambavanilla

- Pure Vanilla

- Naigai Flavors Co., Ltd.

- Eurovanille

- Nielsen-Massey Vanillas, Inc.

- Sambavanilla

- Vanilla Bean Project

- Kitchodo

- Venui

- Laie Vanilla Company

- Golden Kelly Pat. Flavor Co., Ltd.

- Lochhead Manufacturing Company

- Others

Expert Opinion

- The vanilla supply chain is highly dependent on Madagascar, making it prone to climate disruptions, political instability, and pricing volatility.

- Sustainability has shifted from a value-add to a market expectation, with certification and traceable sourcing now influencing purchasing decisions.

- Governments and trade bodies in producing nations are increasingly involved in setting minimum prices and supporting farmer cooperatives to ensure income stability.

The Global Vanilla Bean Market is Segmented as

By Variety

- Madagascar

- Tahitian

- Mexican

- Indonesian

- Others

By Nature

- Organic

- Conventional

By End-use

- Food & Beverage

- Bakery & Confectionery

- Dairy Products

- Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Vanilla Bean Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-The Netherlands Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Trade Statistics

3.1. List of key importers

3.2. List of key exporters

4. Global Vanilla Bean Market Outlook, 2019 - 2032

4.1. Global Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Madagascar

4.1.1.2. Tahitian

4.1.1.3. Mexican

4.1.1.4. Indonesian

4.1.1.5. Others

4.2. Global Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Organic

4.2.1.2. Conventional

4.3. Global Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Food & Beverage Industry

4.3.1.1.1. Bakery & Confectionery

4.3.1.1.2. Dairy Products

4.3.1.1.3. Beverages

4.3.1.2. Cosmetics and Personal Care

4.3.1.3. Pharmaceuticals

4.4. Global Vanilla Bean Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Vanilla Bean Market Outlook, 2019 - 2032

5.1. North America Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Madagascar

5.1.1.2. Tahitian

5.1.1.3. Mexican

5.1.1.4. Indonesian

5.1.1.5. Others

5.2. North America Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Organic

5.2.1.2. Conventional

5.3. North America Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Food & Beverage Industry

5.3.1.1.1. Bakery & Confectionery

5.3.1.1.2. Dairy Products

5.3.1.1.3. Beverages

5.3.1.2. Cosmetics and Personal Care

5.3.1.3. Pharmaceuticals

5.4. North America Vanilla Bean Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. U.S. Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.2. U.S. Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.3. U.S. Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.4. Canada Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.5. Canada Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.6. Canada Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Vanilla Bean Market Outlook, 2019 - 2032

6.1. Europe Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Madagascar

6.1.1.2. Tahitian

6.1.1.3. Mexican

6.1.1.4. Indonesian

6.1.1.5. Others

6.2. Europe Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Organic

6.2.1.2. Conventional

6.3. Europe Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Food & Beverage Industry

6.3.1.1.1. Bakery & Confectionery

6.3.1.1.2. Dairy Products

6.3.1.1.3. Beverages

6.3.1.2. Cosmetics and Personal Care

6.3.1.3. Pharmaceuticals

6.4. Europe Vanilla Bean Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Germany Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.2. Germany Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.3. Germany Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.4. U.K. Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.5. U.K. Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.6. U.K. Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.7. France Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.8. France Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.9. France Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.10. Italy Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.11. Italy Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.12. Italy Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.13. The Netherlands Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.14. The Netherlands Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.15. The Netherlands Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Europe Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Europe Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Europe Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Vanilla Bean Market Outlook, 2019 - 2032

7.1. Asia Pacific Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Madagascar

7.1.1.2. Tahitian

7.1.1.3. Mexican

7.1.1.4. Indonesian

7.1.1.5. Others

7.2. Asia Pacific Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Organic

7.2.1.2. Conventional

7.3. Asia Pacific Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Food & Beverage Industry

7.3.1.1.1. Bakery & Confectionery

7.3.1.1.2. Dairy Products

7.3.1.1.3. Beverages

7.3.1.2. Cosmetics and Personal Care

7.3.1.3. Pharmaceuticals

7.4. Asia Pacific Vanilla Bean Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. China Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.2. China Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.3. China Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.4. Japan Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.5. Japan Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.6. Japan Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.7. South Korea Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.8. South Korea Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.9. South Korea Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.10. India Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.11. India Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.12. India Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.13. Southeast Asia Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.14. Southeast Asia Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.15. Southeast Asia Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.16. Rest of Asia Pacific Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.17. Rest of Asia Pacific Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.18. Rest of Asia Pacific Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Vanilla Bean Market Outlook, 2019 - 2032

8.1. Latin America Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Madagascar

8.1.1.2. Tahitian

8.1.1.3. Mexican

8.1.1.4. Indonesian

8.1.1.5. Others

8.2. Latin America Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Organic

8.2.1.2. Conventional

8.3. Latin America Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Food & Beverage Industry

8.3.1.1.1. Bakery & Confectionery

8.3.1.1.2. Dairy Products

8.3.1.1.3. Beverages

8.3.1.2. Cosmetics and Personal Care

8.3.1.3. Pharmaceuticals

8.4. Latin America Vanilla Bean Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Brazil Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.2. Brazil Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.3. Brazil Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.4. Mexico Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.5. Mexico Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.6. Mexico Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.7. Argentina Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.8. Argentina Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.9. Argentina Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.10. Rest of Latin America Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.11. Rest of Latin America Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.12. Rest of Latin America Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Vanilla Bean Market Outlook, 2019 - 2032

9.1. Middle East & Africa Vanilla Bean Market Outlook, by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Madagascar

9.1.1.2. Tahitian

9.1.1.3. Mexican

9.1.1.4. Indonesian

9.1.1.5. Others

9.2. Middle East & Africa Vanilla Bean Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Organic

9.2.1.2. Conventional

9.3. Middle East & Africa Vanilla Bean Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Food & Beverage Industry

9.3.1.1.1. Bakery & Confectionery

9.3.1.1.2. Dairy Products

9.3.1.1.3. Beverages

9.3.1.2. Cosmetics and Personal Care

9.3.1.3. Pharmaceuticals

9.4. Middle East & Africa Vanilla Bean Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. GCC Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.2. GCC Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.3. GCC Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.4. South Africa Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.5. South Africa Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.6. South Africa Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.7. Egypt Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.8. Egypt Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.9. Egypt Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.10. Nigeria Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.11. Nigeria Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.12. Nigeria Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.13. Rest of Middle East & Africa Vanilla Bean Market by Variety, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.14. Rest of Middle East & Africa Vanilla Bean Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.1.15. Rest of Middle East & Africa Vanilla Bean Market by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2024

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. ADM

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Symrise

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Givaudan

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Sambavanilla

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Pure Vanilla

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Naigai Flavors Co.,Ltd.

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Eurovanille

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Nielsen-Massey Vanillas, Inc.

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Sambavanilla

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Vanilla Bean Project

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Kitchodo

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

10.3.12. Venui

10.3.12.1. Company Overview

10.3.12.2. Product Portfolio

10.3.12.3. Financial Overview

10.3.12.4. Business Strategies and Development

10.3.13. Laie Vanilla Company

10.3.13.1. Company Overview

10.3.13.2. Product Portfolio

10.3.13.3. Financial Overview

10.3.13.4. Business Strategies and Development

10.3.14. Golden Kelly Pat. Flavor Co., Ltd.

10.3.14.1. Company Overview

10.3.14.2. Product Portfolio

10.3.14.3. Financial Overview

10.3.14.4. Business Strategies and Development

10.3.15. Lochhead Manufacturing Company

10.3.15.1. Company Overview

10.3.15.2. Product Portfolio

10.3.15.3. Financial Overview

10.3.15.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Variety |

|

|

Nature |

|

|

End Use |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |