Global Dairy Nutrition and Nutraceuticals Market Forecast

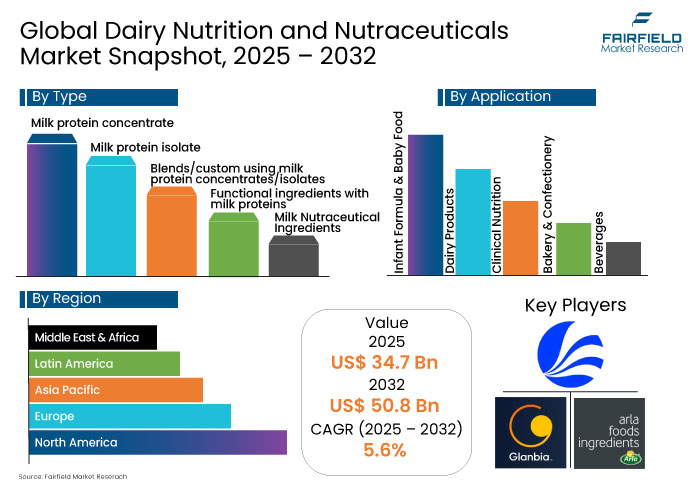

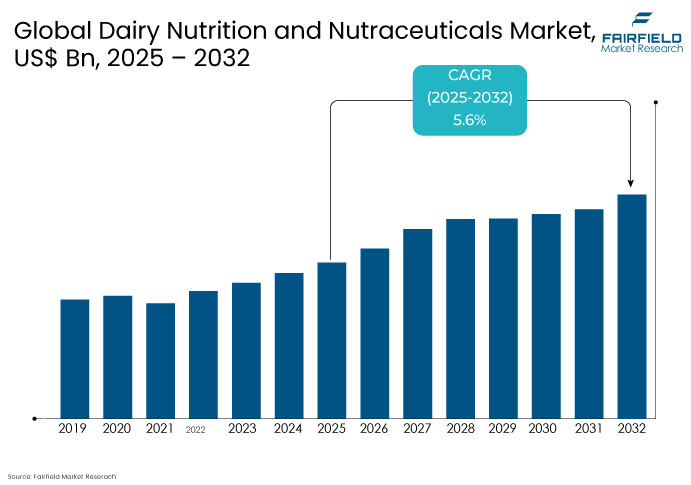

The Global Dairy Nutrition and Nutraceuticals Market is expected to reach a market size of US$ 50.8 Bn by 2032 from its current market size of US$ 34.7 Bn in 2025, resembling strong growth with 5.6% CAGR during this period.

Dairy Nutrition and Nutraceuticals Market Insights

- The dairy nutrition and nutraceuticals market is rapidly evolving through innovations in protein extraction and personalized nutrition.

- Regulatory approvals are encouraging the use of milk proteins in high-protein dairy products.

- Sustainable sourcing and regenerative agriculture are becoming central to dairy ingredient supply chains.

- Milk-based nutraceutical ingredients maintain a leading position due to their versatility and consumer trust.

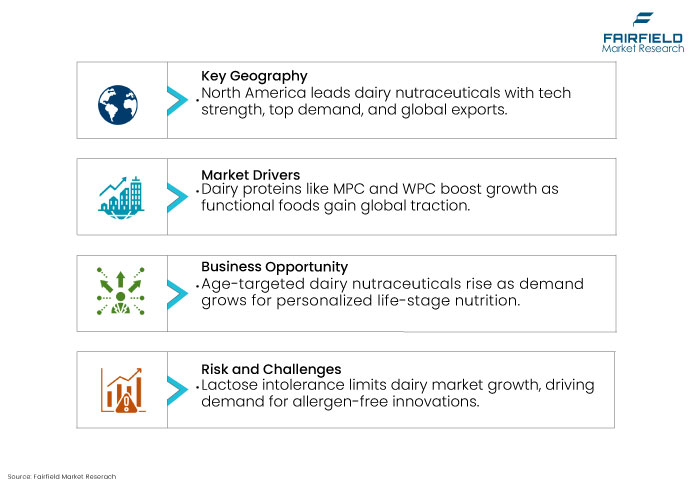

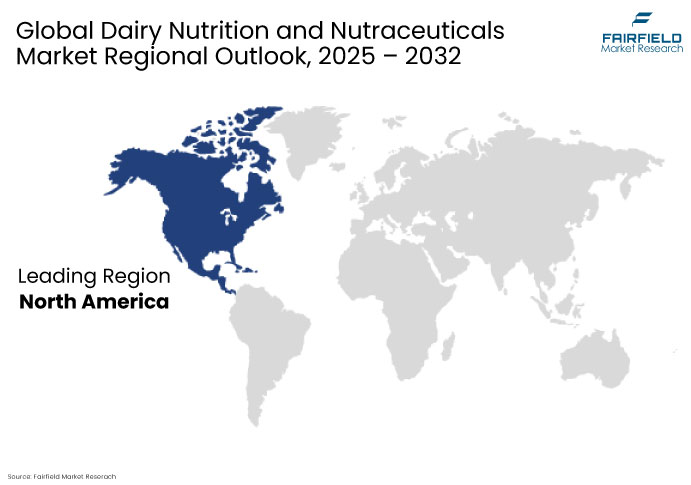

- North America remains a leader due to its advanced dairy processing infrastructure.

- Partnerships with farmers, research bodies, and tech firms enhance innovation and market agility.

A Look Back and a Look Forward - Comparative Analysis

Between 2019 and 2024, the global dairy nutrition and nutraceuticals market witnessed steady growth, driven by rising health awareness, functional food trends, and increased consumption of protein-rich diets. Demand surged for ingredients such as milk protein concentrates, isolates, and bioactive peptides, as consumers turned to dairy for muscle recovery, gut health, and immunity. The COVID-19 pandemic further accelerated demand for immunity-boosting and digestive health products, while manufacturers adapted by developing clean-label, fortified, and lactose-free formulations. However, inflation, supply chain volatility, and shifting dairy preferences in certain regions slightly tempered growth toward 2024.

Looking ahead to 2025–2032, the market is poised for accelerated expansion, fueled by innovations in protein extraction, bioavailability enhancement, and personalized nutrition. Functional dairy ingredients are expected to gain broader application across sports nutrition, infant formula, clinical nutrition, and elderly care. Additionally, regulatory support for clean labels and sustainable sourcing will play a pivotal role. Emerging markets in Asia-Pacific and Latin America will further drive growth, supported by rising urbanization, middle-class expansion, and dietary diversification.

Key Growth Determinants

Increasing adoption of dairy ingredients in functional foods and beverages

The increasing adoption of dairy ingredients in functional foods and beverages is driving significant growth in the global dairy nutrition market. Dairy proteins such as milk protein concentrate (MPC), milk protein isolate (MPI), and whey protein concentrate (WPC) are valued for their high-quality amino acid profiles and functional benefits, including muscle support and improved satiety. Supporting this trend, the U.S. Food and Drug Administration (FDA) has approved the use of MPC, MPI, and WPC in products labeled as high protein milk, encouraging innovation and consumer trust in functional dairy offerings. This regulatory endorsement enables manufacturers to create nutrient-dense, protein-rich products that cater to health-conscious consumers seeking enhanced nutrition through everyday foods and beverages. Consequently, the integration of dairy ingredients in functional formulations continues to expand, fueling market growth and diversification.

Key Growth Barriers

Growing cases of intolerance and allergies

Growing cases of lactose intolerance and milk protein allergies present a notable restraint for the dairy nutrition and nutraceuticals market. As per the U.S. Department of Health and Human Services, about 68 percent of the world’s population has lactose malabsorption, limiting their ability to benefit from dairy-based products. This has led many consumers to seek alternative sources of protein and nutrition, such as plant-based or hypoallergenic options. While dairy remains a key ingredient in functional foods, manufacturers must carefully address these concerns through product innovation, including lactose-free or reduced-allergen formulations. Balancing these challenges with the market’s growth potential is crucial for companies aiming to meet diverse consumer needs without compromising inclusivity.

Dairy Nutrition and Nutraceuticals Market Trends and Opportunities

- Developing customized dairy nutraceuticals targeting age-specific nutrition needs

Developing customized dairy nutraceuticals targeting age-specific nutrition needs presents a significant opportunity in the global market. As consumer awareness around life-stage nutrition grows, there is increasing demand for products tailored to the nutritional requirements of infants, children, adults, and the elderly. Dairy-based formulations offer a natural and highly bioavailable source of essential nutrients like calcium, protein, and vitamins, which can be optimized for different age groups. For instance, fortifying milk powders with DHA for cognitive development in children or with collagen and protein for muscle retention in seniors is gaining popularity. This personalized approach enhances efficacy and consumer appeal, also allowing brands to differentiate in a competitive landscape, fostering brand loyalty and long-term market growth.

- Companies are prioritizing sustainable sourcing practices for dairy ingredients

Companies in the dairy, nutritional, and nutraceuticals market are increasingly prioritizing sustainable sourcing practices to align with environmental goals and meet evolving consumer expectations. This trend reflects a growing commitment to reducing greenhouse gas emissions, ensuring animal welfare, and promoting regenerative agriculture. Leading firms are investing in cleaner supply chains and traceable dairy sourcing to reinforce brand integrity and environmental responsibility. For instance, Danone has implemented its "Regenerative Agriculture Program," which supports dairy farmers in reducing carbon emissions, preserving biodiversity, and improving soil health across its European milk supply. Such initiatives contribute to sustainability and enhance long-term supply stability and brand value.

Leading Segment Overview

Milk nutraceutical ingredients dominate the market due to a broad application spectrum

The milk nutraceutical ingredients segment holds approximately 54% share in the global dairy nutrition and nutraceuticals market, owing to their broad application spectrum and high consumer trust. These ingredients, including whey protein, casein, milk protein concentrates, etc, are increasingly incorporated into sports nutrition, infant formulas, elderly nutrition, clinical diets, and functional beverages. Their excellent amino acid profile, digestibility, and scientifically validated health benefits, such as muscle maintenance, satiety enhancement, and immune support, make them highly versatile. Moreover, innovation in dairy protein extraction and formulation is expanding their use in ready-to-drink beverages, protein bars, and specialized dietary supplements. As health and wellness trends intensify globally, demand for multifunctional, natural, and efficacious ingredients such as milk nutraceuticals continues to rise, reinforcing their dominance across clinical, fitness, and mainstream nutrition channels.

Rising consumer demand for high-protein drinks fuels the popularity of dairy-based nutritional beverages

Beverages are expected to show a lucrative growth of 6.7% CAGR during the forecast period from 2025 to 2032, driven largely by rising consumer demand for high-protein drinks. Dairy-based nutritional beverages are gaining popularity among health-conscious individuals seeking functional benefits such as muscle recovery, satiety, and weight management. With busy lifestyles fueling demand for convenient nutrition, these beverages offer a portable, palatable source of complete proteins. The inclusion of milk protein concentrate, whey protein, and casein in ready-to-drink (RTD) formats has made dairy-based options particularly appealing in the sports and wellness segments. Additionally, brands are innovating with flavored, lactose-free, and fortified dairy drinks to target broader demographics.

Regional Analysis

- North America dominates the dairy nutrition and nutraceuticals market

North America dominates the dairy nutrition and nutraceuticals market due to its robust infrastructure, advanced technology, and strong consumer demand. The U.S. boasts one of the most developed dairy processing industries globally, with high adoption of dairy-derived supplements in clinical nutrition, infant formula, and baby food. Technological advancements in protein isolation and formulation have further fueled innovation and efficiency. Meanwhile, Canada’s dairy sector plays a vital role, with 549 milk processing plants supporting both domestic needs and export demands. Canadian whey products are exported to key markets like the U.S., Australia, the Netherlands, and France, reflecting the region’s international reach. This combination of production strength and diversified demand continues to position North America as a global leader in the dairy nutraceutical space.

- Europe is becoming a nutritional powerhouse, adapting to health-conscious consumers

The European dairy nutrition and nutraceuticals market presents a dynamic landscape, influenced by increasing health consciousness and the rising prevalence of chronic diseases across the continent. In the U.K., government data from 2022-2023 indicated a focus on the nutrient composition of milk, highlighting the importance of dairy as a source of riboflavin, vitamin B12, and iodine. Germany, as Europe's largest dairy producer, showcases a market driven by health and wellness trends. France demonstrates a growing nutraceutical market, where dairy-fortified products are in high demand, aligning with increased consumer awareness regarding preventive health measures. Overall, the European market signifies a trend towards functional foods and beverages, where dairy plays a crucial role in delivering essential nutrients and health benefits.

Competitive Landscape

The competitive nature of the dairy nutrition and nutraceuticals market drives companies to innovate and adopt sustainable practices across their operations and value chains. Manufacturers are increasingly implementing emission reduction initiatives to lower carbon intensity, aligning with global sustainability goals while strengthening market positioning. Simultaneously, firms prioritize tailored ingredients that enhance taste and functionality, leveraging advanced R&D and processing technologies to produce specialty proteins with varying degrees of hydrolysis.

Customization extends to delivery formats, meeting diverse customer needs. Additionally, strategic partnerships and collaborations with dairy farmers, research institutions, and industry stakeholders enable access to cutting-edge technologies, research insights, and market trends. These efforts collectively enhance competitiveness by fostering innovation, sustainability, and responsiveness to evolving consumer and industry demands.

- In May 2025, Arla Foods Ingredients introduced the Nutrilac® HighYield range of milk proteins, a zero-waste innovation that eliminates acid whey separation, enabling 100% milk yield and streamlined dairy processing.

- In April 2025, Actus Nutrition completed the acquisition of a 99,000 sq. ft. processing facility from Foremost Farms USA, enhancing its manufacturing capabilities and expanding its footprint in the dairy nutraceuticals sector.

- In August 2024, Idaho Milk Products announced a $200 million investment to build a dual ice cream and powder blending facility at its Jerome, Idaho campus, signaling major expansion and increased production of dairy-based functional ingredients.

Key Market Companies

- Glanbia plc

- Arla Foods Ingredients Group P/S

- Actus Nutrition

- Idaho Milk Products

- Kerry Group plc.

- Lactalis Ingredients

- FrieslandCampina Ingredients

- Gay Lea Foods Co-operative Ltd

- Fonterra Co-Operative Group Limited

- BioCorp Nutrition Labs

- Leprino Nutrition

- Agropur

- AMCO Proteins

- Synlait Ltd

- Saputo Inc.

- Others

Expert Opinion

- Emission reduction initiatives along the entire dairy supply chain are becoming a key competitive differentiator, with companies adopting carbon footprint labeling to meet growing consumer demand for climate-conscious products.

- Emerging dairy nutraceuticals are increasingly focusing on gut health and immune support, leveraging bioactive peptides derived from milk proteins that offer targeted health benefits beyond basic nutrition.

- Strategic partnerships between dairy ingredient manufacturers and tech startups are accelerating innovation in sustainable packaging and delivery systems, enhancing product shelf life while minimizing environmental impact.

Global Dairy Nutrition and Nutraceuticals Market is Segmented as

By Type

- Milk protein concentrate

- Milk protein isolate

- Blends/custom using milk protein concentrates/isolates

- Functional ingredients with milk proteins

- Milk Nutraceutical Ingredients

By Application

- Infant Formula and Baby Food

- Dairy Products

- Clinical Nutrition

- Bakery and Confectionery

- Beverages

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Dairy Nutrition and Nutraceuticals Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Trade Statistics

3.1. List of key importers

3.2. List of key exporters

4. Global Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

4.1. Global Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Milk protein concentrate

4.1.1.2. Milk protein isolate

4.1.1.3. Blends/custom using milk protein concentrates/isolates

4.1.1.4. Functional ingredients with milk proteins

4.1.1.5. Milk Nutraceutical Ingredients

4.1.1.6. Others

4.2. Global Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Infant Formula and Baby Food

4.2.1.2. Dairy Products

4.2.1.3. Clinical Nutrition

4.2.1.4. Bakery and Confectionery

4.2.1.5. Beverages

4.3. Global Dairy Nutrition and Nutraceuticals Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

5. North America Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

5.1. North America Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Milk protein concentrate

5.1.1.2. Milk protein isolate

5.1.1.3. Blends/custom using milk protein concentrates/isolates

5.1.1.4. Functional ingredients with milk proteins

5.1.1.5. Milk Nutraceutical Ingredients

5.1.1.6. Others

5.2. North America Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Infant Formula and Baby Food

5.2.1.2. Dairy Products

5.2.1.3. Clinical Nutrition

5.2.1.4. Bakery and Confectionery

5.2.1.5. Beverages

5.3. North America Dairy Nutrition and Nutraceuticals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. U.S. Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1.2. U.S. Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1.3. Canada Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1.4. Canada Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

6.1. Europe Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Milk protein concentrate

6.1.1.2. Milk protein isolate

6.1.1.3. Blends/custom using milk protein concentrates/isolates

6.1.1.4. Functional ingredients with milk proteins

6.1.1.5. Milk Nutraceutical Ingredients

6.1.1.6. Others

6.2. Europe Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Infant Formula and Baby Food

6.2.1.2. Dairy Products

6.2.1.3. Clinical Nutrition

6.2.1.4. Bakery and Confectionery

6.2.1.5. Beverages

6.3. Europe Dairy Nutrition and Nutraceuticals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Germany Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.2. Germany Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.3. U.K. Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.4. U.K. Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.5. France Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.6. France Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.7. Italy Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.8. Italy Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.9. Russia Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.10. Russia Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.11. Rest of Europe Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1.12. Rest of Europe Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

7.1. Asia Pacific Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Milk protein concentrate

7.1.1.2. Milk protein isolate

7.1.1.3. Blends/custom using milk protein concentrates/isolates

7.1.1.4. Functional ingredients with milk proteins

7.1.1.5. Milk Nutraceutical Ingredients

7.1.1.6. Others

7.2. Asia Pacific Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Infant Formula and Baby Food

7.2.1.2. Dairy Products

7.2.1.3. Clinical Nutrition

7.2.1.4. Bakery and Confectionery

7.2.1.5. Beverages

7.3. Asia Pacific Dairy Nutrition and Nutraceuticals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. China Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.2. China Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.3. Japan Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.4. Japan Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.5. South Korea Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.6. South Korea Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.7. India Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.8. India Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.9. Southeast Asia Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.10. Southeast Asia Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.11. Rest of Asia Pacific Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1.12. Rest of Asia Pacific Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

8.1. Latin America Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Milk protein concentrate

8.1.1.2. Milk protein isolate

8.1.1.3. Blends/custom using milk protein concentrates/isolates

8.1.1.4. Functional ingredients with milk proteins

8.1.1.5. Milk Nutraceutical Ingredients

8.1.1.6. Others

8.2. Latin America Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Infant Formula and Baby Food

8.2.1.2. Dairy Products

8.2.1.3. Clinical Nutrition

8.2.1.4. Bakery and Confectionery

8.2.1.5. Beverages

8.3. Latin America Dairy Nutrition and Nutraceuticals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Brazil Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.2. Brazil Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.3. Mexico Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.4. Mexico Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.5. Argentina Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.6. Argentina Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.7. Rest of Latin America Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1.8. Rest of Latin America Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Dairy Nutrition and Nutraceuticals Market Outlook, 2019 - 2032

9.1. Middle East & Africa Dairy Nutrition and Nutraceuticals Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Milk protein concentrate

9.1.1.2. Milk protein isolate

9.1.1.3. Blends/custom using milk protein concentrates/isolates

9.1.1.4. Functional ingredients with milk proteins

9.1.1.5. Milk Nutraceutical Ingredients

9.1.1.6. Others

9.2. Middle East & Africa Dairy Nutrition and Nutraceuticals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Infant Formula and Baby Food

9.2.1.2. Dairy Products

9.2.1.3. Clinical Nutrition

9.2.1.4. Bakery and Confectionery

9.2.1.5. Beverages

9.3. Middle East & Africa Dairy Nutrition and Nutraceuticals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. GCC Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.2. GCC Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.3. South Africa Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.4. South Africa Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.5. Egypt Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.6. Egypt Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.7. Nigeria Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.8. Nigeria Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.9. Rest of Middle East & Africa Dairy Nutrition and Nutraceuticals Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.1.10. Rest of Middle East & Africa Dairy Nutrition and Nutraceuticals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2024

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. ADM

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Glanbia plc

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Arla Foods Ingredients Group P/S

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Actus Nutrition

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Idaho Milk Products

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Kerry Group plc.

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Lactalis Ingredients

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. FrieslandCampina Ingredients

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Gay Lea Foods Co-operative Ltd

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Fonterra Co-Operative Group Limited

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. BioCorp Nutrition Labs

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

10.3.12. Leprino Nutrition

10.3.12.1. Company Overview

10.3.12.2. Product Portfolio

10.3.12.3. Financial Overview

10.3.12.4. Business Strategies and Development

10.3.13. Agropur

10.3.13.1. Company Overview

10.3.13.2. Product Portfolio

10.3.13.3. Financial Overview

10.3.13.4. Business Strategies and Development

10.3.14. AMCO Proteins

10.3.14.1. Company Overview

10.3.14.2. Product Portfolio

10.3.14.3. Financial Overview

10.3.14.4. Business Strategies and Development

10.3.15. Synlait Ltd

10.3.15.1. Company Overview

10.3.15.2. Product Portfolio

10.3.15.3. Financial Overview

10.3.15.4. Business Strategies and Development

10.3.16. Saputo Inc.

10.3.16.1. Company Overview

10.3.16.2. Product Portfolio

10.3.16.3. Financial Overview

10.3.16.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type |

|

|

Application |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |