Construction Adhesives Market Growth and Industry Forecast

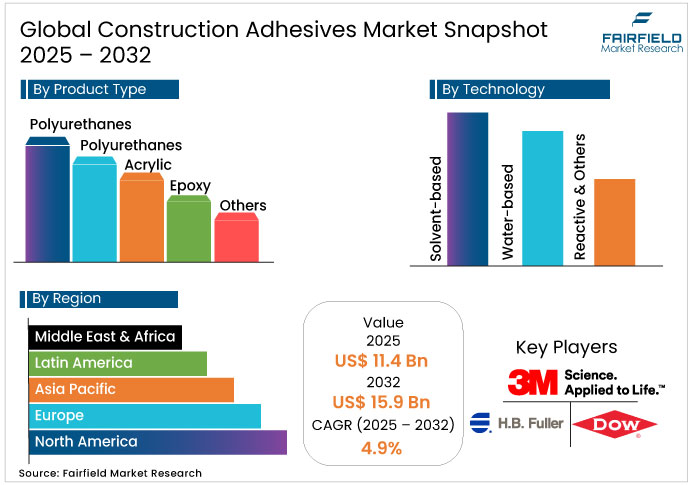

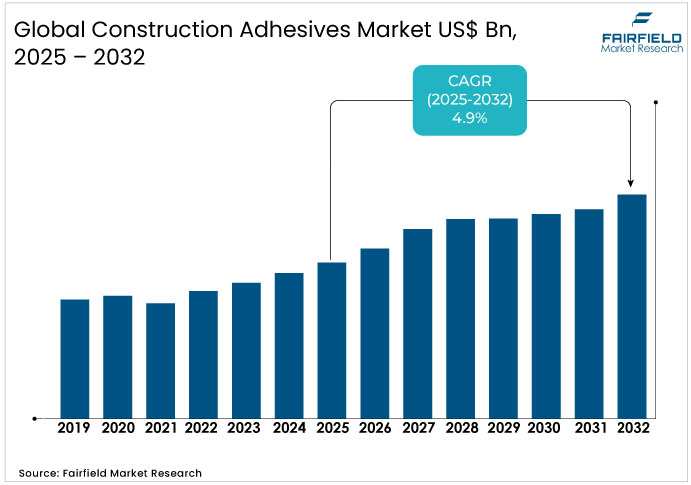

The construction adhesives market is valued at USD 11.4 billion in 2025 and is projected to reach USD 15.9 billion by 2032, growing at a CAGR of 4.9%.

Construction Adhesives Market Summary: Key Insights & Trends

- Polyurethane leads the resin segment with over 25% share, favored for strength and flexibility in structural applications.

- Acrylic is the fastest-growing resin type, gaining traction with water-based, eco-friendly formulations.

- Solvent-based adhesives dominate with over 35% share, widely used in industrial and infrastructure projects.

- Water-based adhesives show the fastest growth, supported by global low-VOC and green building mandates.

- Infrastructure expansion and urbanization, with Asia Pacific reaching 60% urban population by 2030, drive rising demand.

- Bio-based adhesives present strong opportunities, as over 40% of EU buildings built before 1990 require sustainable retrofits.

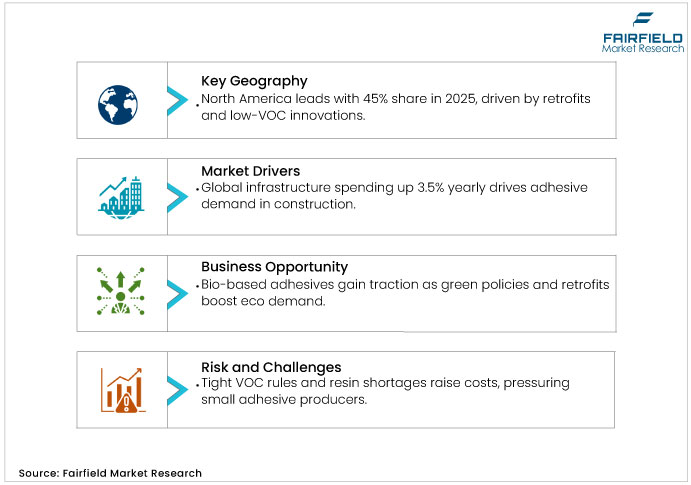

- North America leads globally with over 45% share, supported by infrastructure spending and low-VOC adoption.

- Asia Pacific holds over 30% share and grows fastest, fuelled by affordable housing, localization, and urban migration.

Key Growth Drivers

- Global Infrastructure Spending and Urban Growth Drive Adhesives Demand in Construction

Governments worldwide channel funds into public works, with global infrastructure outlays projected to rise 3.5% annually through 2030, according to the Asian Development Bank. In the U.S., the Bipartisan Infrastructure Law allocates USD 550 billion for new projects, directly boosting adhesive use in concrete bonding and structural assembly. This driver enhances market stability by linking construction volume to economic recovery cycles. Urbanization in Asia Pacific, where 60% of the population will live in cities by 2030 per United Nations data, accelerates demand for high-durability adhesives in high-rise developments. Macroeconomic trends, including GDP growth averaging 2.8% globally from the World Bank, amplify these effects, as higher disposable incomes support commercial expansions.

- Sustainability Regulations and Innovation Boost Demand for Advanced Adhesive Solutions

Environmental regulations from the European Union's REACH framework enforce low-VOC limits, cutting volatile emissions by 50% in compliant products, as reported by the European Chemicals Agency. Construction firms adopt these adhesives to meet LEED standards, with certified green buildings increasing 12% yearly per the U.S. Green Building Council. Technological progress in reactive chemistries improves bond strength by 30%, enabling lighter structures that save 15% on material costs. Demographic shifts toward eco-conscious millennials, comprising 40% of homebuyers by 2025 according to the National Association of Realtors, drive residential applications. This convergence of policy and consumer preference fosters long-term growth, as manufacturers invest in R&D to align with circular economy principles, ultimately enhancing product lifecycle efficiency.

Key Restraints

- Tight Environmental Rules and VOC Compliance Drive Adhesive Production Challenges

Regulations such as the U.S. EPA's low-VOC standards increase formulation expenses by 15-20%, straining smaller manufacturers, according to the American Chemistry Council. Transitioning to water-based alternatives raises R&D budgets, delaying market entry for 6-12 months. Competitive pressures from established players exacerbate margins, with import tariffs on raw materials adding 5-10% to costs in Europe per the European Commission. Supply chain bottlenecks, including resin shortages from petrochemical volatility, compound these issues, potentially slowing growth by 1-2% annually.

- Rising Raw Material Costs and Supply Chain Risks Restrain Adhesives Market

Fluctuations in crude oil prices, up 10% in 2024 per the U.S. Energy Information Administration, elevate polyurethane costs by 8-12%. Geopolitical tensions disrupt imports, with 30% of global resins sourced from Asia, as per the International Trade Centre. This restraint heightens risks for just-in-time models, increasing inventory buffers by 20% and eroding profitability. Competitors with diversified sourcing gain edge, while bottlenecks delay projects, contributing to 5% overruns in construction timelines.

Construction Adhesives Market Trends and Opportunities

- Green Building Mandates Fuel Adhesive Demand in Renovation and Retrofit Projects

Sustainability mandates are opening a significant niche for bio-based adhesives by 2030, per the Global Alliance for Buildings and Construction. Developing economies such as India, with USD 1.4 trillion infrastructure pipeline from the National Infrastructure Pipeline, prioritize low-emission products, sizing the opportunity at USD 800 million annually. Policy subsidies, such as the EU's Green Deal funding EUR 1 trillion, support retrofits reducing energy use by 30%. Unmet customer needs for durable, recyclable bonds in aging structures-over 40% of EU buildings pre-1990 per Eurostat-drive innovation. Manufacturers targeting this segment can capture 15% premium pricing through certifications, fostering loyalty in a market where 65% of contractors seek eco-solutions, as surveyed by the Construction Industry Institute.

- Asia Pacific Urbanization and Localization Drive Adhesives Growth Opportunities

Rapid urbanization in India and Southeast Asia, adding 400 million urban dwellers by 2030 per UN Habitat, opens a USD 3 billion opportunity in affordable housing adhesives. Supportive policies such as India's Production Linked Incentive scheme allocate INR 1.97 trillion for chemicals, enabling local production to cut costs 20%. Emerging technologies in hybrid reactive adhesives address unmet demand for seismic-resistant bonds in earthquake-prone zones, with Japan investing JPY 10 trillion in resilience per its Ministry of Economy. Subsidies for imported tech transfer lower entry barriers, allowing firms to scale capacity 25% faster.

Segment-wise Trends & Analysis

Polyurethane Dominates Resin Segment While Acrylic Drives Fast-Growth Opportunities

In 2025, polyurethane dominates the resin segment of the construction adhesives market, capturing over 25% share and valued at USD 2.85 billion, thanks to its superior flexibility and adhesion for demanding applications. Acrylic emerges as the fastest-growing resin type due to cost-effectiveness and versatility in water-based formulations. Theoretical frameworks such as Porter’s Five Forces indicate that polyurethane’s high R&D barriers protect incumbents, while acrylic’s low switching costs attract new entrants, highlighting the need for suppliers to maintain a balanced portfolio strategy.

Solvent-Based Leads Technology Segment as Water-Based Gains Sustainable Momentum

Solvent-based adhesives lead the technology segment in 2025 with over 35% market share, valued at USD 4 billion, favored for robust bonding in industrial applications. Water-based adhesives are the fastest-growing, driven by regulatory support for low-emission products. Game theory suggests solvent-based adhesives benefit from a first-mover advantage in performance-critical sectors, while water-based adhesives leverage cooperative standards like ISO 14001 to enable broader adoption, requiring suppliers to manage dual production lines to balance performance and sustainability.

Industrial Applications Lead Adhesives Demand While Residential Sector Expands Rapidly

In 2025, industrial applications dominate adhesives demand, accounting for over 40% share and USD 4.56 billion, fueled by manufacturing expansion. The residential sector is rapidly growing, driven by housing booms and urbanization. Value chain analysis shows industrial applications benefit from upstream integration, delivering approximately 12% efficiency gains, whereas residential demand is shaped by downstream consumer preferences. This segmentation informs strategic R&D allocation, enabling suppliers to optimize product development for performance-driven industrial clients and preference-sensitive residential consumers.

Regional Trends & Analysis

North America Leads Global Adhesives Market with Infrastructure and Green Innovation

North America holds over 45% global share in 2025, valued at $5.13 billion, leading via robust infrastructure spending and innovation in low-VOC technologies. Trends emphasize retrofitting for energy efficiency, with U.S. projects incorporating adhesives in 70% of upgrades.

U.S. Construction Adhesives Market – 2025 Snapshot & Outlook

The U.S. market is projected to expand steadily from 2025, supported by ongoing growth and long-term momentum through 2035, propelled by residential remodeling amid 1.5% annual housing starts growth. Low-VOC mandates under EPA rules cut emissions 30%, granting 10% margin advantages for compliant producers. Government policies such as 30% tax credits for green materials boost adoption in commercial retrofits. A 2024 National Association of Home Builders survey reveals 65% consumers prioritize eco-adhesives for health. Infrastructure bills accelerate industrial use, where adhesives replace welds for 20% cost reductions.

Prefabricated housing trends, comprising 5% of builds, favor reactive technologies for seamless joints. Retail shifts to e-commerce platforms increase DIY adhesive sales by 12%, per U.S. Department of Commerce. Margin edges persist in specialized formulations, with supportive tariffs shielding domestic production.

Europe Advances Adhesives Market with Automation, Renovation, and Green Policies

Europe captures 25% share of construction adhesives market, focusing on automation and green building codes that mandate 50% emission reductions by 2030. Trends highlight renovation, with adhesives in 60% of energy-efficient projects.

Germany Construction Adhesives Market – 2025 Snapshot & Outlook

In 2025, Germany’s construction market reaches US$ 0.8 billion, expanding at a 5.3% CAGR, driven by energy renovations under the Energy Efficiency Act. Stringent building codes favor high-performance insulation adhesives, enabling a 12% margin uplift through premium pricing. Government policies provide €50 billion in subsidies for HVAC upgrades, affecting 25% of commercial demand. A 2024 Federal Environment Agency study reports 70% of builders choose low-VOC products for compliance. Urban density increases panel bonding demand, while modular construction rises 8%, using epoxies for facade stability. Tax incentives enhance sustainable material adoption by 15%, and consumer preference for certified products lifts residential tiling demand by 10%.

U.K. Construction Adhesives Market – 2025 Snapshot & Outlook

In 2025, the U.K. construction market demonstrates resilience with steady growth, driven by infrastructure projects such as HS2 rail, which increase demand for moisture-resistant bonds. Policies under the Green Homes Grant offer 15% cost rebates, providing approximately 8% margins in retrofit projects. Modular housing accounts for 20% of new builds, according to government data. A 2024 Building Research Establishment survey shows 55% of developers prefer quick-dry adhesives, while flood-prone areas prioritize sealants. Commercial projects adopt water-based solutions for 18% faster installations, and retail digitalization boosts DIY sales by 14%, with favorable duties supporting domestic formulations.

Asia Pacific Adhesives Growth Driven by Urbanization and Affordable Housing Needs

Asia Pacific commands over 30% share of construction adhesives market, propelled by urbanization in China and India, where adhesives support 40% of prefabricated volumes. Trends focus on affordable, durable solutions amid 6% annual GDP growth in construction.

Japan Construction Adhesives Market – 2025 Snapshot & Outlook

In 2025, Japan’s construction market shows stable growth, largely driven by regulatory initiatives for seismic retrofitting. Government policies subsidize 20% of earthquake-resistant bonds, resulting in approximately 10% margin gains for developers. Aging infrastructure fuels a 15% increase in maintenance demand, while a 2024 Japan Housing Corporation report highlights that 60% of projects are shifting to flexible urethanes. Urban renewal projects prioritize lightweight materials, and prefabricated buildings, accounting for 15% of construction, use reactive resins for precision. Tax incentives on imports support product diversification, and consumers increasingly prefer durable, low-odor materials.

India Construction Adhesives Market – 2025 Snapshot & Outlook

India’s construction market is growing steadily, driven by the PMAY scheme targeting millions of affordable housing units. Localized production cuts costs by 15%, boosting margins, while subsidies reduce duties on green imports by 10%, encouraging sustainable products. A 2024 CREDAI survey shows 75% of developers adopting water-based tiling. Rising urban migration increases roofing demand, and commercial malls drive panel adhesive growth by 22%. E-retail expansion improves access, supporting an 18% sales increase, with policies favoring domestic blends.

Competitive Landscape Analysis

The players in the Construction Adhesives Market focus on sustainability innovations to capture 20% additional share in green segments by 2030. Henkel's low-VOC launches reduced emissions 25%, per company filings, while Sika's bio-based patents grew revenues 12% in 2024. M&A activity, such as Avery Dennison's USD 150 million flooring acquisition in August 2025, consolidates supply chains amid 10% raw material volatility. Regulatory changes, including EPA VOC caps, compel capacity shifts to water-based lines, costing USD 50-100 million per facility. Early movers secure 15% cost advantages through scale, while latecomers grapple with 8-10% premium pricing pressures.

Key Companies

- 3M

- Dow Inc.

- B. Fuller Company

- Sika AG

- Henkel AG & Co. KGaA

- Bostik (Arkema Group)

- DAP Products Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- Franklin International, Inc.

Recent Developments:

- April 2025, Dow announced it will delay construction of its Path2Zero net-zero ethylene cracker project in Fort Saskatchewan due to weak market conditions, cutting 2025 CapEx plans by $1 billion. The company reaffirmed commitment to the project’s long-term growth potential while emphasizing ongoing cost-reduction and cash-flow support measures.

- July 2025, H.B. Fuller has launched Millennium PG-1 EF ECO₂, the first commercial roofing adhesive with patented ECO₂ Driven™ technology, using natural atmospheric gases instead of harmful HFCs or HFOs. The equipment-free system offers faster application, broad substrate compatibility, reduced environmental impact, and compliance with strict VOC and sustainability standards.

- July 2025, Henkel has introduced Loctite Liofol LA 7837/LA 6265, a solvent-free adhesive system designed for high-heat applications such as retort packaging. The innovation boosts food safety, cuts CO₂ emissions by eliminating solvent drying, enhances efficiency with low application weight, and ensures strong performance across pet food, ready meals, and pharmaceutical packaging.

Global Construction Adhesives Market Segmentation-

By Resin Type

- Polyurethanes

- Polyvinyl Acetate

- Acrylic

- Epoxy

- Others

By Technology

- Solvent-based

- Water-based

- Reactive & Others

By Application

- Industrial

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Construction Adhesives Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024 - 2032

2.9.2. Price Impact Factors

3. Global Construction Adhesives Market Outlook, 2019 - 2032

3.1. Global Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

3.1.1. Polyurethanes

3.1.2. Polyvinyl Acetate

3.1.3. Acrylic

3.1.4. Epoxy

3.1.5. Others

3.2. Global Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

3.2.1. Solvent-based

3.2.2. Water-based

3.2.3. Reactive & Others

3.3. Global Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.3.1. Industrial

3.3.2. Residential

3.3.3. Commercial

3.4. Global Construction Adhesives Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Construction Adhesives Market Outlook, 2019 - 2032

4.1. North America Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

4.1.1. Polyurethanes

4.1.2. Polyvinyl Acetate

4.1.3. Acrylic

4.1.4. Epoxy

4.1.5. Others

4.2. North America Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

4.2.1. Solvent-based

4.2.2. Water-based

4.2.3. Reactive & Others

4.3. North America Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.3.1. Industrial

4.3.2. Residential

4.3.3. Commercial

4.4. North America Construction Adhesives Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. U.S. Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

4.4.2. U.S. Construction Adhesives Market Outlook, by Technology, 2019 - 2032

4.4.3. U.S. Construction Adhesives Market Outlook, by Application, 2019 - 2032

4.4.4. Canada Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

4.4.5. Canada Construction Adhesives Market Outlook, by Technology, 2019 - 2032

4.4.6. Canada Construction Adhesives Market Outlook, by Application, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Construction Adhesives Market Outlook, 2019 - 2032

5.1. Europe Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

5.1.1. Polyurethanes

5.1.2. Polyvinyl Acetate

5.1.3. Acrylic

5.1.4. Epoxy

5.1.5. Others

5.2. Europe Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

5.2.1. Solvent-based

5.2.2. Water-based

5.2.3. Reactive & Others

5.3. Europe Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.3.1. Industrial

5.3.2. Residential

5.3.3. Commercial

5.4. Europe Construction Adhesives Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Germany Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.2. Germany Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.3. Germany Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.4. Italy Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.5. Italy Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.6. Italy Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.7. France Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.8. France Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.9. France Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.10. U.K. Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.11. U.K. Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.12. U.K. Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.13. Spain Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.14. Spain Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.15. Spain Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.16. Russia Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.17. Russia Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.18. Russia Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.4.19. Rest of Europe Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

5.4.20. Rest of Europe Construction Adhesives Market Outlook, by Technology, 2019 - 2032

5.4.21. Rest of Europe Construction Adhesives Market Outlook, by Application, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Construction Adhesives Market Outlook, 2019 - 2032

6.1. Asia Pacific Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

6.1.1. Polyurethanes

6.1.2. Polyvinyl Acetate

6.1.3. Acrylic

6.1.4. Epoxy

6.1.5. Others

6.2. Asia Pacific Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

6.2.1. Solvent-based

6.2.2. Water-based

6.2.3. Reactive & Others

6.3. Asia Pacific Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.3.1. Industrial

6.3.2. Residential

6.3.3. Commercial

6.4. Asia Pacific Construction Adhesives Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. China Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.2. China Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.3. China Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.4.4. Japan Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.5. Japan Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.6. Japan Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.4.7. South Korea Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.8. South Korea Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.9. South Korea Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.4.10. India Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.11. India Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.12. India Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.4.13. Southeast Asia Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.14. Southeast Asia Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.15. Southeast Asia Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.4.16. Rest of SAO Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

6.4.17. Rest of SAO Construction Adhesives Market Outlook, by Technology, 2019 - 2032

6.4.18. Rest of SAO Construction Adhesives Market Outlook, by Application, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Construction Adhesives Market Outlook, 2019 - 2032

7.1. Latin America Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

7.1.1. Polyurethanes

7.1.2. Polyvinyl Acetate

7.1.3. Acrylic

7.1.4. Epoxy

7.1.5. Others

7.2. Latin America Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

7.2.1. Solvent-based

7.2.2. Water-based

7.2.3. Reactive & Others

7.3. Latin America Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.3.1. Industrial

7.3.2. Residential

7.3.3. Commercial

7.4. Latin America Construction Adhesives Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Brazil Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

7.4.2. Brazil Construction Adhesives Market Outlook, by Technology, 2019 - 2032

7.4.3. Brazil Construction Adhesives Market Outlook, by Application, 2019 - 2032

7.4.4. Mexico Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

7.4.5. Mexico Construction Adhesives Market Outlook, by Technology, 2019 - 2032

7.4.6. Mexico Construction Adhesives Market Outlook, by Application, 2019 - 2032

7.4.7. Argentina Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

7.4.8. Argentina Construction Adhesives Market Outlook, by Technology, 2019 - 2032

7.4.9. Argentina Construction Adhesives Market Outlook, by Application, 2019 - 2032

7.4.10. Rest of LATAM Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

7.4.11. Rest of LATAM Construction Adhesives Market Outlook, by Technology, 2019 - 2032

7.4.12. Rest of LATAM Construction Adhesives Market Outlook, by Application, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Construction Adhesives Market Outlook, 2019 - 2032

8.1. Middle East & Africa Construction Adhesives Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2032

8.1.1. Polyurethanes

8.1.2. Polyvinyl Acetate

8.1.3. Acrylic

8.1.4. Epoxy

8.1.5. Others

8.2. Middle East & Africa Construction Adhesives Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

8.2.1. Solvent-based

8.2.2. Water-based

8.2.3. Reactive & Others

8.3. Middle East & Africa Construction Adhesives Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.3.1. Industrial

8.3.2. Residential

8.3.3. Commercial

8.4. Middle East & Africa Construction Adhesives Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. GCC Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

8.4.2. GCC Construction Adhesives Market Outlook, by Technology, 2019 - 2032

8.4.3. GCC Construction Adhesives Market Outlook, by Application, 2019 - 2032

8.4.4. South Africa Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

8.4.5. South Africa Construction Adhesives Market Outlook, by Technology, 2019 - 2032

8.4.6. South Africa Construction Adhesives Market Outlook, by Application, 2019 - 2032

8.4.7. Egypt Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

8.4.8. Egypt Construction Adhesives Market Outlook, by Technology, 2019 - 2032

8.4.9. Egypt Construction Adhesives Market Outlook, by Application, 2019 - 2032

8.4.10. Nigeria Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

8.4.11. Nigeria Construction Adhesives Market Outlook, by Technology, 2019 - 2032

8.4.12. Nigeria Construction Adhesives Market Outlook, by Application, 2019 - 2032

8.4.13. Rest of Middle East Construction Adhesives Market Outlook, by Resin Type, 2019 - 2032

8.4.14. Rest of Middle East Construction Adhesives Market Outlook, by Technology, 2019 - 2032

8.4.15. Rest of Middle East Construction Adhesives Market Outlook, by Application, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. 3M

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Dow Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. H.B. Fuller Company

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Sika AG

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Henkel AG & Co. KGaA

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Bostik (Arkema Group)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. DAP Products Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Avery Dennison Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Illinois Tool Works Incorporation

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Franklin International, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Resin Type Coverage |

|

|

Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |