Construction Chemicals Market Growth and Industry Forecast

- The Construction Chemicals Market is valued at USD 61.8 Bn in 2026 and is projected to reach USD 89.9 Bn, growing at a CAGR of 6% by 2033.

Construction Chemicals Market Summary: Key Insights & Trends

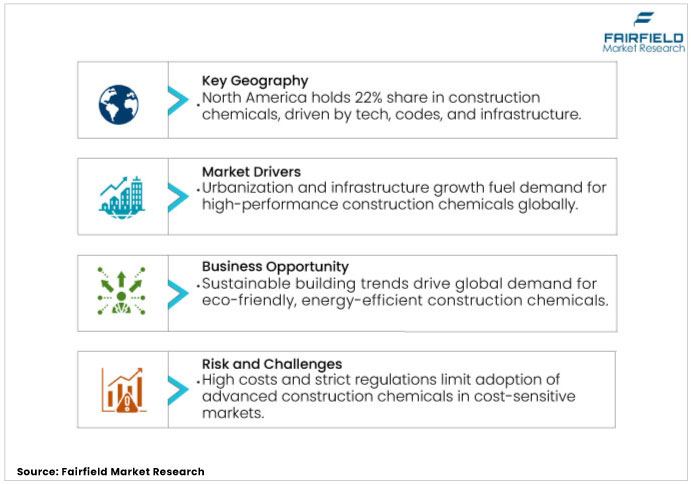

- Rising urbanization and infrastructure development are driving the demand for construction chemicals globally

- Rapid growth of the residential and commercial construction sector is driving demand for construction chemicals

- High costs of advanced chemicals and stringent regulatory compliance are hindering market growth

- Growing focus on sustainable and energy-efficient construction is fuelling demand for construction chemicals

- Adoption of smart construction chemicals with self-healing and sensing capabilities is emerging as a key trend

- Concrete Admixtures account for nearly a 35% share in the global market

- Infrastructure Application leads the market with 26% share in 2025

- North America is expected to account for nearly 22% of the global market in 2025, amid strong infrastructure renewal and sustainable building practices

- Europe presents significant opportunities for growth in the foreseeable future

- Asia Pacific holds nearly 44% share in the global construction chemicals market, driven by rapid urbanization and infrastructure boom

A Look Back and a Look Forward - Comparative Analysis

The global construction chemicals market grew steadily, rising from US$ 43.2 billion in 2019 to an estimated US$ 54.6 billion in 2024, registering a CAGR of 4.8%. This growth was driven by increasing construction activities in emerging economies, particularly in Asia Pacific and the Middle East, alongside greater awareness of the benefits of using construction chemicals improves structural performance and durability. The rise in residential and commercial construction, coupled with infrastructure upgrades in both developed and developing nations, significantly contributed to the market’s momentum during this period.

Looking ahead, the global construction chemicals industry is projected to grow from US$ 61.2 billion in 2025 to US$ 91.4 billion by 2032, reflecting a higher CAGR of 5.9%. This stronger growth trajectory will be supported by rapid urbanization, a surge in smart city and green building initiatives, and stricter regulations emphasizing energy-efficient and sustainable construction practices. Additionally, technological advancements in chemical formulations and rising demand for innovative materials in megaprojects and infrastructure modernization efforts will further accelerate market expansion globally, especially in Asia Pacific, Europe, and North America.

Key Growth Drivers

- Rising urbanization and infrastructure development are driving the demand for construction chemicals globally

The robust growth of urbanization and the expansion of infrastructure projects worldwide are major factors driving the construction chemicals market growth. Governments and private sectors are investing heavily in smart cities, transport systems, residential complexes, and commercial spaces, creating strong demand for high-performance construction materials. Construction chemicals, such as concrete admixtures, waterproofing agents, sealants, and protective coatings, play a vital role in enhancing the durability, strength, and longevity of structures.

The growing emphasis on sustainable construction and adherence to environmental standards is encouraging the adoption of advanced chemical solutions. As urban populations continue to grow, the need for durable, efficient, and eco-friendly construction is expected to further accelerate the demand for construction chemicals globally.

- Rapid growth of the residential and commercial construction sector is driving demand for construction chemicals

The expanding residential and commercial construction sectors are playing a crucial role in driving the market growth. Rising population, urban migration, and increasing disposable incomes, especially in emerging economies, are fuelling the demand for new housing developments, office buildings, shopping complexes, and hospitality infrastructure. To meet this growing demand, construction companies are seeking materials that offer faster application, improved durability, and long-term performance.

The rise in high-rise and complex architectural projects is pushing the need for specialized chemical solutions that can withstand environmental stress and load-bearing requirements. As urban landscapes continue to expand and the need for modern, efficient buildings rises, the demand for advanced construction chemicals is expected to grow steadily, making them an essential part of contemporary building practices.

Key Growth Barriers

High costs of advanced chemicals and stringent regulatory compliance are hindering market growth

The high cost associated with advanced chemical formulations and the complexity of meeting regulatory compliance is one of the key restraints affecting the growth of the global industry. Many high-performance construction chemicals, such as specialty admixtures, eco-friendly coatings, and fire-retardant sealants, come with elevated production and procurement costs, making them less accessible, particularly in cost-sensitive markets. Small- and medium-sized construction firms often find it challenging to invest in these products, especially in regions where budget constraints limit the use of premium materials.

Stringent environmental and safety regulations across regions like North America and Europe require manufacturers to invest heavily in research, testing, and certification processes. Compliance with standards such as REACH, EPA, or VOC limits adds to the overall development cost and time, potentially delaying product launches. These factors create barriers for both manufacturers and end-users, thereby restraining the wider adoption of advanced construction chemicals across various applications.

Construction Chemicals Market Trends and Opportunities

- Growing focus on sustainable and energy-efficient construction is fuelling demand for construction chemicals

The increasing emphasis on sustainable and energy-efficient building practices is significantly boosting the demand for construction chemicals across the globe. As environmental concerns and regulatory pressures intensify, builders and developers are adopting eco-friendly materials that enhance structural performance while reducing the environmental footprint. Construction chemicals such as low-VOC adhesives, insulation-enhancing admixtures, green waterproofing solutions, and energy-efficient coatings are being widely used to meet green building certifications like LEED and BREEAM.

These chemicals help reduce material wastage, lower energy consumption, and extend the life cycle of buildings, aligning with the goals of sustainable development. With consumers, corporations, and governments showing a growing preference for environmentally responsible construction, the market for advanced, sustainable construction chemicals is expected to expand rapidly. This shift toward green construction practices presents significant opportunities for innovation and growth within the construction chemicals industry.

- Adoption of smart construction chemicals with self-healing and sensing capabilities is emerging as a key trend

The development and adoption of smart construction chemicals that offer self-healing and sensing functionalities is a notable trend gaining momentum in the global construction chemicals market. These advanced materials are engineered to automatically repair micro-cracks, detect structural stress, and respond to environmental changes, significantly improving the lifespan and safety of buildings and infrastructure. For instance, self-healing concrete incorporates encapsulated agents that activate upon cracking, sealing the damaged area without external intervention.

Smart coatings and sealants equipped with sensors can monitor humidity, temperature, and corrosion levels, enabling predictive maintenance. These innovations are particularly valuable in critical structures such as bridges, tunnels, and high-rise buildings, where long-term durability and structural health monitoring are essential. As digital transformation and smart infrastructure initiatives continue to expand globally, the integration of intelligent chemical solutions is expected to redefine performance standards and open new growth avenues for the construction chemicals industry.

Segment-wise Trends & Analysis

- Concrete Admixtures account for nearly a 35% share in the global construction chemicals market

Concrete admixtures hold the largest share in the global market, accounting for approximately 35% of total revenue in 2025. Their dominance is attributed to their essential role in improving concrete performance, workability, setting time, and durability across diverse climatic and construction conditions. As urbanization expands and modern construction techniques evolve, the need for customized concrete solutions continues to grow. This trend is especially prominent in developing economies, where infrastructure upgrades and mega-projects are fuelling the adoption of advanced admixture technologies. Additionally, the growing emphasis on sustainable and cost-effective construction practices further supports the widespread use of admixtures in modern concrete formulations.

- Infrastructure Application Leads the Global Construction Chemicals Market with 26% Share in 2025

The infrastructure segment holds the largest share in the global construction chemicals market, accounting for around 26% of total demand in 2025. This dominance is primarily driven by the rising investments in public infrastructure projects such as highways, bridges, railways, airports, and metro systems, especially in developing economies. Governments across Asia, the Middle East, and Africa are prioritizing large-scale infrastructure development to support urbanization, economic growth, and improved connectivity. Construction chemicals such as concrete admixtures, waterproofing agents, and protective coatings are extensively used in these projects to enhance structural durability, reduce maintenance costs, and ensure long-term performance under heavy usage and environmental stress.

Regional Trends & Analysis

- North America to Account for Nearly 22% of the Global Construction Chemicals Market

North America holds a significant position in the global construction chemicals market, contributing approximately 22% of the total market share. This regional growth is supported by a well-established construction industry, ongoing renovation of aging infrastructure, and the adoption of advanced construction technologies. The U.S. and Canada are witnessing steady demand for construction chemicals across residential, commercial, and infrastructure projects. Stringent building codes and increasing emphasis on energy-efficient and sustainable construction practices further drive the use of specialized chemicals such as admixtures, sealants, and waterproofing compounds. The presence of leading manufacturers and a high level of R&D activity contribute to the region's strong market presence.

- Europe presents significant opportunities for growth in the construction chemicals market

Europe is poised to offer substantial growth opportunities for the construction chemicals market, driven by increasing investments in sustainable infrastructure, renovation of aging buildings, and strict environmental regulations. The region is witnessing a growing shift toward energy-efficient construction and the adoption of green building certifications, which is boosting the demand for eco-friendly construction chemicals such as low-VOC adhesives, sealants, and waterproofing systems. Additionally, the European Union’s commitment to carbon neutrality by 2050 and stimulus packages focused on infrastructure development are creating a favourable environment for market expansion. The rising trend of smart cities, coupled with digital construction practices, is also encouraging innovation in chemical formulations tailored for modern construction needs.

- Asia Pacific holds nearly a 44% share in the global construction chemicals market, driven by rapid urbanization and infrastructure boom

Asia Pacific dominates the global construction chemical market with an estimated 44% share in 2025, fuelled by rapid urbanization, industrial expansion, and large-scale infrastructure development across key countries such as China, India, and Southeast Asian nations. The region is experiencing a surge in residential, commercial, and infrastructure projects, supported by favourable government policies, rising foreign investments, and a growing urban population. Mega infrastructure initiatives such as smart cities, metro networks, expressways, and industrial corridors are significantly driving the demand for construction chemicals such as concrete admixtures, grouts, sealants, and waterproofing agents. Additionally, the increasing focus on affordable housing and sustainable construction further supports the market growth in this region.

Competitive Landscape

The construction chemicals market is highly competitive, with key players such as BASF SE, Sika AG, and Dow Chemical focusing on R&D, sustainability, and strategic acquisitions. Companies are expanding in emerging markets through localized production and partnerships while innovating eco-friendly products to meet regulatory and consumer demands.

Key Companies

- Sika AG

- Saint Gobain

- The 3M Company

- MAPEI S.p.A.

- Arkema Group

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Ashland Inc.

- Dow Chemical Company

- Pidilite Industries Limited

- SCG Chemicals

- RPM International Inc.

- Thermax Limited

- Evonik Industries

- LATICRETE International, Inc.

Global Construction Chemicals Market Segmentation-

By Product Type

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Adhesives & Sealants

- Adhesives

- Sealants

- Concrete Repair Mortar

- Cement based

- Epoxy based

- Others

- Plaster

- Cement Based

- Gypsum Based

- Asphalt Additives

By Application

- Commercial

- Residential

- Industrial

- Institutional

- Infrastructure

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Executive Summary

- Global Construction Chemicals Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Construction Chemicals Market Outlook, 2020 - 2033

- Global Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- Global Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- Global Construction Chemicals Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- North America Construction Chemicals Market Outlook, 2020 - 2033

- North America Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- North America Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- North America Construction Chemicals Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Construction Chemicals Market Outlook, by Product Type, 2020-2033

- S. Construction Chemicals Market Outlook, by Application, 2020-2033

- Canada Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Canada Construction Chemicals Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Europe Construction Chemicals Market Outlook, 2020 - 2033

- Europe Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- Europe Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- Europe Construction Chemicals Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Germany Construction Chemicals Market Outlook, by Application, 2020-2033

- Italy Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Italy Construction Chemicals Market Outlook, by Application, 2020-2033

- France Construction Chemicals Market Outlook, by Product Type, 2020-2033

- France Construction Chemicals Market Outlook, by Application, 2020-2033

- K. Construction Chemicals Market Outlook, by Product Type, 2020-2033

- K. Construction Chemicals Market Outlook, by Application, 2020-2033

- Spain Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Spain Construction Chemicals Market Outlook, by Application, 2020-2033

- Russia Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Russia Construction Chemicals Market Outlook, by Application, 2020-2033

- Rest of Europe Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Rest of Europe Construction Chemicals Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Asia Pacific Construction Chemicals Market Outlook, 2020 - 2033

- Asia Pacific Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- Asia Pacific Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- Asia Pacific Construction Chemicals Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Construction Chemicals Market Outlook, by Product Type, 2020-2033

- China Construction Chemicals Market Outlook, by Application, 2020-2033

- Japan Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Japan Construction Chemicals Market Outlook, by Application, 2020-2033

- South Korea Construction Chemicals Market Outlook, by Product Type, 2020-2033

- South Korea Construction Chemicals Market Outlook, by Application, 2020-2033

- India Construction Chemicals Market Outlook, by Product Type, 2020-2033

- India Construction Chemicals Market Outlook, by Application, 2020-2033

- Southeast Asia Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Southeast Asia Construction Chemicals Market Outlook, by Application, 2020-2033

- Rest of SAO Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Rest of SAO Construction Chemicals Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Latin America Construction Chemicals Market Outlook, 2020 - 2033

- Latin America Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- Latin America Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- Latin America Construction Chemicals Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Brazil Construction Chemicals Market Outlook, by Application, 2020-2033

- Mexico Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Mexico Construction Chemicals Market Outlook, by Application, 2020-2033

- Argentina Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Argentina Construction Chemicals Market Outlook, by Application, 2020-2033

- Rest of LATAM Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Construction Chemicals Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Construction Chemicals Market Outlook, 2020 - 2033

- Middle East & Africa Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Concrete Admixture

- Plasticizers

- Accelerators

- Retarders

- Others

- Water Proofing Chemicals

- Bitumen

- Polymers

- SBR - Styrene-butadiene

- Cementitious Membrane

- PU membrane – Liquid applied membrane

- Others

- Protective Coating

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Protective Coating

- Adhesives

- Sealants

- Concrete Repair Mortar

- Plaster

- Asphalt Additives

- Concrete Admixture

- Middle East & Africa Construction Chemicals Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Residential

- Commercial

- Industrial

- Institutional

- Infrastructure

- Middle East & Africa Construction Chemicals Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Construction Chemicals Market Outlook, by Product Type, 2020-2033

- GCC Construction Chemicals Market Outlook, by Application, 2020-2033

- South Africa Construction Chemicals Market Outlook, by Product Type, 2020-2033

- South Africa Construction Chemicals Market Outlook, by Application, 2020-2033

- Egypt Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Egypt Construction Chemicals Market Outlook, by Application, 2020-2033

- Nigeria Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Nigeria Construction Chemicals Market Outlook, by Application, 2020-2033

- Rest of Middle East Construction Chemicals Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Construction Chemicals Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Construction Chemicals Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Sika AG

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Saint Gobain

- The 3M Company

- MAPEI S.p.A.

- Arkema Group

- B. Fuller Company

- Henkel AG & Co. KGaA

- Ashland Inc.

- Dow Chemical Company

- Pidilite Industries Limited

- Sika AG

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |