Smart Cities Market Growth and Industry Forecast

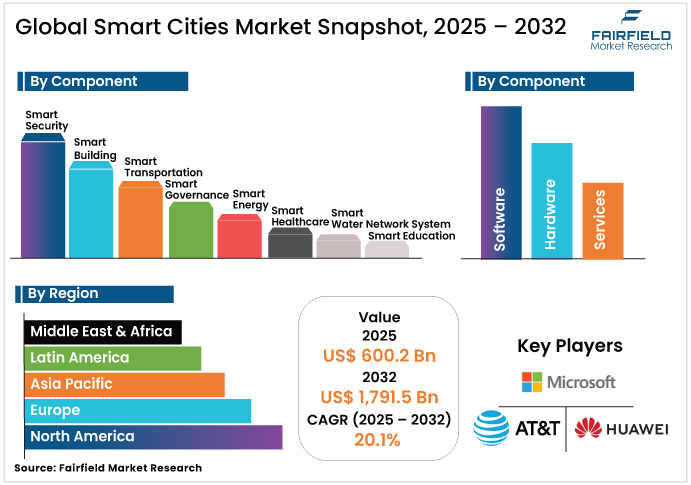

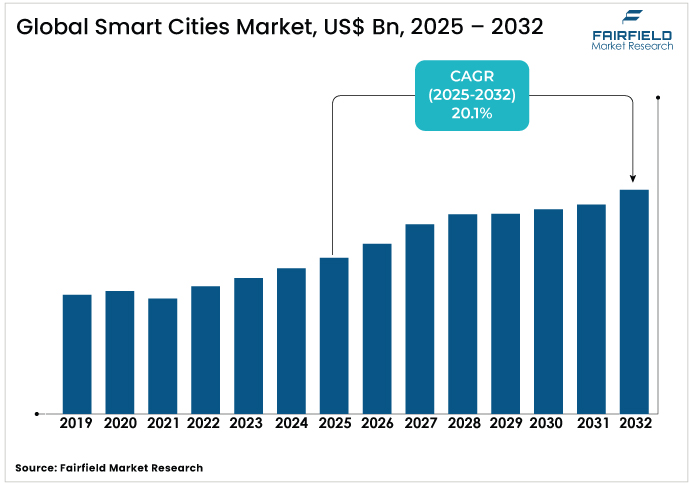

- The global smart cities market is projected to grow from US$ 600.2 billion in 2025 to US$ 1,791.5 billion by 2032.

- This expansion is set to register a CAGR of 20.1% over the 2025-2032 period.

Smart Cities Market Summary Key Insights & Trends

- Services lead the market with over 40% share in 2024, driven by IoT and AI deployment.

- Software is the fastest-growing segment, projected to grow at a 21.1% CAGR from 2025 to 2032.

- Rapid urbanization, with 68% global urban population by 2050, fuels demand for smart infrastructure.

- Sustainability efforts such as Europe’s 100 Positive Energy Districts by 2025 create major growth opportunities.

- Asia Pacific is the fastest-growing region, expected to expand at a 29.2% CAGR through 2032.

- North America benefits from U.S. government funding of US$100 million annually for smart city projects.

- High implementation costs and cybersecurity concerns remain key challenges restraining market growth globally.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the market grew by around US$ 200 Bn, driven by the increasing adoption of IoT and AI technologies in urban planning. The COVID-19 pandemic initially disrupted supply chains and delayed smart city projects due to budget constraints, but it also accelerated digital transformation as cities prioritized smart healthcare and remote governance solutions. For instance, AI-driven traffic management systems in cities such as Singapore reduced congestion by 15-20%, while investments in smart grids grew to enhance energy efficiency. Government stimulus packages post-2024, such as Europe’s recovery funds, further boosted market recovery and growth, setting a strong foundation for future expansion.

The smart cities market is driven by advancements in 5G, AI, and IoT integration. Rapid urbanization in Asia-Pacific, particularly in China and India, will fuel demand for smart transportation and infrastructure solutions. Sustainability initiatives, such as Europe’s 100 Positive Energy Districts by 2025, will drive investments in smart energy and buildings. The rise of autonomous vehicles, expected to reach 20 million by 2032, will transform urban mobility. Collaborative efforts between governments and tech giants such as Cisco and IBM will further accelerate the deployment of scalable smart city platforms, ensuring sustained market growth.

Key Growth Drivers

- Urbanization Trends and Population Data Driving Demand for Smart City Infrastructure Solutions

The smart cities market is propelled by rapid urbanization, with the United Nations projecting that 68% of the global population will reside in urban areas by 2050. This surge increases pressure on infrastructure, necessitating smart solutions for efficient resource management. For example, cities such as Singapore and Tokyo leverage IoT-enabled systems to monitor traffic and energy use, reducing congestion by up to 25%. Governments are investing heavily, with China’s “Smart Cities Development Plan” under Made in China 2025 allocating over US$ 1.2 trillion for urban tech by 2032. These investments support the integration of AI and IoT for real-time data analytics, enhancing urban planning and sustainability.

- Government Funding and Policy Data Accelerating Smart Cities Development Worldwide

Government policies are a key driver with significant funding allocated globally. The U.S. Infrastructure Investment and Jobs Act provides US$100 million annually through 2026 for smart community technologies, attracting 392 municipal applications in its first call. In Asia, South Korea’s K-City Network 2025 initiative promotes smart city expansion, while India’s Smart Cities Mission targets 100 cities with a US$ 12 billion budget. These programs incentivize public-private partnerships (PPPs), enabling tech firms such as Siemens and Cisco to deploy smart grids and transportation systems. For instance, Singapore’s smart mobility solutions increased public transport usage by 15-20%. Such initiatives are driven by fostering innovation and ensuring financial support for scalable urban solutions.

- Technological Data Insights on IoT, AI, and 5G Advancements in Smart Cities

The smart cities market is fueled by advancements in IoT, AI, and 5G, enabling seamless connectivity and data-driven urban management. AI-powered systems, such as those in Barcelona, reduced traffic by 25% through predictive analytics. 5G networks, covering one-third of the world’s population by 2025, enhance low-latency applications such as autonomous vehicle coordination. Companies such as Huawei and IBM integrate these technologies into smart city platforms, optimizing energy and transportation systems.

Key Growth Restraints

High Costs Data Highlighting Financial Barriers to Smart Cities Technology Implementation

The smart cities market faces significant challenges due to high initial costs of deploying advanced technologies such as IoT, AI, and 5G infrastructure. For instance, developing a single smart city project can cost upwards, deterring budget-constrained municipalities, especially in developing economies. The integration of smart grids or intelligent transportation systems requires substantial investments in hardware, software, and skilled labor. For example, retrofitting existing infrastructure with IoT sensors can account for 30-40% of project costs. These financial barriers limit adoption in regions such as Latin America, where tight budgets restrict smart city initiatives.

Data Privacy and Cybersecurity Risks Impacting Smart Cities Adoption and Infrastructure Security

The smart cities market is hindered by data privacy and cybersecurity risks associated with extensive IoT and AI integration. The deployment of 27 billion IoT devices by 2025 increases vulnerability to cyberattacks, potentially compromising citizen data. For instance, smart city systems collecting real-time data on traffic or energy usage face risks of breaches, as seen in past municipal data leaks. Stringent regulations such as Europe’s GDPR impose compliance costs, slowing adoption. In 2025, a US$100 million Series E round for Nozomi Networks highlighted the focus on cyber-resilience in smart cities. These concerns restrict cities from prioritizing secure systems to protect infrastructure and citizen privacy.

Smart Cities Market Trends and Opportunities

- Sustainability Data and Green Infrastructure Trends Driving Smart Cities Market Growth

The smart cities industry presents significant opportunities through the growing emphasis on sustainability and green infrastructure. As cities aim to reduce carbon footprints, smart grids and renewable energy integration are gaining traction. For example, Europe’s goal of 100 Positive Energy Districts by 2025 encourages investments in energy-efficient buildings and smart lighting, projected to grow. Globally, smart waste management systems, equipped with IoT sensors, reduce operational costs by 15%, as seen in New York’s route optimization initiatives. The rise of green building technologies, supported by companies such as Schneider Electric, enhances resource efficiency and urban liveability. Governments are incentivizing eco-friendly solutions, with the U.S. allocating for sustainable urban projects. The Smart Cities Market can capitalize on these trends by developing scalable, energy-efficient solutions that align with global sustainability goals, fostering long-term growth and environmental benefits.

- Data on Autonomous Vehicles and Smart Mobility Shaping Urban Transportation Innovations

The smart cities market is poised for growth with the rise of autonomous vehicles and smart mobility solutions. By 2032, autonomous vehicle will transform urban transportation, reducing congestion and emissions. Cities such as London tested robotaxis in 2025, showcasing scalability. Intelligent transportation systems (ITS), holding a 47% market share in 2024, leverage AI and IoT for traffic management, as seen in Singapore’s 15-20% increase in public transport usage. Companies such as Cisco and Huawei are investing in smart roads and charging infrastructure for electric vehicles (EVs), with the EV market expected to grow alongside smart city initiatives. The market benefits from these innovations, as governments prioritize integrated mobility solutions to enhance urban accessibility and sustainability, creating opportunities for tech providers to develop advanced transportation ecosystems.

Segment-wise Trends & Analysis

- Component-wise Market Data Highlighting Leading Services and Fastest-Growing Software Segments

The smart cities market by components is led by services, accounting for over 40% of the market share in 2024, driven by deployment and integration services for smart infrastructure. These services, offered by companies such as IBM and Accenture, ensure seamless implementation of IoT and AI systems, critical for urban efficiency. The software segment is the fastest-growing, projected to grow at a CAGR, fueled by demand for cloud-based platforms and data analytics tools. Software solutions enable real-time monitoring and predictive analytics, as seen in smart grid applications, reducing energy waste by 20%.

- Application-based Market Data Featuring Leading Smart Transportation and Fastest-Growing Smart Healthcare

Smart transportation leads, holding a 29.6% share in 2024, driven by intelligent transportation systems (ITS) that reduce congestion and emissions. Cities such as Singapore and New York report 15-20% improvements in public transport efficiency. Smart healthcare is the fastest-growing segment, projected to grow from 2025-2032, fueled by IoT-enabled medical devices and AI-driven health monitoring systems. For example, smart healthcare systems in Tokyo enhance patient outcomes through real-time diagnostics, reducing hospital burdens.

Regional Analysis

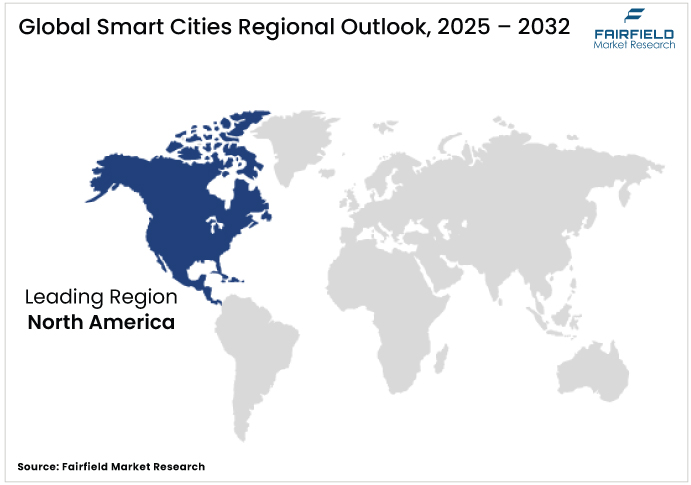

- North America, U.S. Leadership and Funding Driving Market Growth

North America dominates, with the U.S. holding a 35% share in 2024, driven by advanced technology adoption and government funding. The U.S. Infrastructure Investment and Jobs Act allocates US$ 100 million annually for smart city projects, fostering innovations such as Las Vegas’ data-driven policing, which reduced wrong-way driving by 85%. IoT and 5G integration enhance urban mobility and energy efficiency, with smart grids saving 15% in energy costs. The market in the U.S. grows through public-private partnerships and a focus on sustainability.

- Europe Key Countries Driving Growth through Sustainability Initiatives

Europe’s smart cities market is led by Germany and the UK, driven by sustainability policies and EU funding for 100 Positive Energy Districts by 2025. Germany invests over EUR 1 billion in urban technologies, focusing on smart grids and renewable integration. The UK leverages AI-driven traffic systems, reducing congestion by 22.5% in cities such as London. Stringent privacy laws such as GDPR ensure secure data management, boosting adoption. In Europe grows through innovation and regulatory support for green infrastructure.

- Asia Pacific Rapid Growth Fueled by Urbanization and Government Plans

Asia Pacific is the fastest-growing region, with a projected CAGR of 29.2% from 2025-2032, led by China and India. China’s Made in China 2025 plan invests US$ 1 trillion in smart city projects, focusing on IoT and 5G for urban management. India’s Smart Cities Mission targets 100 cities, driving smart transportation and e-governance. Rapid urbanization, with 404 million new urban residents in India by 2050, fuels demand.

Competitive Landscape

The Smart Cities Market is moderately fragmented, with no single vendor exceeding 10% market share. Leading players such as Cisco Systems, Siemens AG, and IBM Corporation focus on interoperability, forming consortia to deliver turnkey platforms. Microsoft and Intel provide cloud and AI solutions, while Huawei emphasizes 5G infrastructure. Strategies include R&D investments, partnerships with governments, and modular IoT deployments to enhance scalability and cyber-resilience.

Key Companies:

- Microsoft Corp.

- AT&T Inc.

- Huawei Technologies Co. Ltd.

- Hitachi Ltd.

- Siemens AG

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- ABB Ltd.

- Accenture plc

- General Electric Company

- Intel Corporation

- Itron, Inc.

- Ericsson

- SAP SE

Expert Opinion

- In April 2025, UAE’s du signed a US$ 544.54 million deal with Microsoft for a hyperscale data center, enhancing regional smart city workloads. This strengthens cloud-based smart city platforms.

- In November 2024, INWIT acquired Smart City Roma for EUR 97 million, expanding 5G connectivity across Rome’s metro lines. This boosts urban mobility solutions.

- In 2025, Nozomi Networks secured a US$ 100 million Series E round, backed by Mitsubishi Electric, enhancing cybersecurity for smart city systems. This addresses critical IoT security needs

Global Smart Cities Market Segmentation

By Component

- Software

- Smart sensors

- Smart Cameras

- Smart Meters

- Network Devices

- Others

- Hardware

- Smart Metering Software

- Smart Lighting Software

- Data Management Software

- Other

- Services

- Consulting Service

- Support& Maintenance

- Integration& Deployment

- Security Services

By Application

- Smart Security

- Smart Building

- Smart Transportation

- Smart Governance

- Smart Energy

- Smart Healthcare

- Smart Water Network System

- Smart Education

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Smart Cities Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Smart Cities Market Outlook, 2019 - 2032

3.1. Global Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

3.1.1. Software

3.1.1.1. Smart sensors

3.1.1.2. Smart Cameras

3.1.1.3. Smart Meters

3.1.1.4. Network Devices

3.1.1.5. Others

3.1.2. Hardware

3.1.2.1. Smart Metering Software

3.1.2.2. Smart Lighting Software

3.1.2.3. Data Management Software

3.1.2.4. Other

3.1.3. Services

3.1.3.1. Consulting Service

3.1.3.2. Support& Maintenance

3.1.3.3. Integration& Deployment

3.1.3.4. Security Services

3.2. Global Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

3.2.1. Smart Security

3.2.2. Smart Building

3.2.3. Smart Transportation

3.2.4. Smart Governance

3.2.5. Smart Energy

3.2.6. Smart Healthcare

3.2.7. Smart Water Network System

3.2.8. Smart Education

3.2.9. Others

3.3. Global Smart Cities Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Smart Cities Market Outlook, 2019 - 2032

4.1. North America Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

4.1.1. Software

4.1.1.1. Smart sensors

4.1.1.2. Smart Cameras

4.1.1.3. Smart Meters

4.1.1.4. Network Devices

4.1.1.5. Others

4.1.2. Hardware

4.1.2.1. Smart Metering Software

4.1.2.2. Smart Lighting Software

4.1.2.3. Data Management Software

4.1.2.4. Other

4.1.3. Services

4.1.3.1. Consulting Service

4.1.3.2. Support& Maintenance

4.1.3.3. Integration& Deployment

4.1.3.4. Security Services

4.2. North America Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

4.2.1. Smart Security

4.2.2. Smart Building

4.2.3. Smart Transportation

4.2.4. Smart Governance

4.2.5. Smart Energy

4.2.6. Smart Healthcare

4.2.7. Smart Water Network System

4.2.8. Smart Education

4.2.9. Others

4.3. North America Smart Cities Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.3.1. U.S. Smart Cities Market Outlook, by By Components, 2019-2032

4.3.2. U.S. Smart Cities Market Outlook, by By Application, 2019-2032

4.3.3. Canada Smart Cities Market Outlook, by By Components, 2019-2032

4.3.4. Canada Smart Cities Market Outlook, by By Application, 2019-2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Smart Cities Market Outlook, 2019 - 2032

5.1. Europe Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

5.1.1. Software

5.1.1.1. Smart sensors

5.1.1.2. Smart Cameras

5.1.1.3. Smart Meters

5.1.1.4. Network Devices

5.1.1.5. Others

5.1.2. Hardware

5.1.2.1. Smart Metering Software

5.1.2.2. Smart Lighting Software

5.1.2.3. Data Management Software

5.1.2.4. Other

5.1.3. Services

5.1.3.1. Consulting Service

5.1.3.2. Support& Maintenance

5.1.3.3. Integration& Deployment

5.1.3.4. Security Services

5.2. Europe Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

5.2.1. Smart Security

5.2.2. Smart Building

5.2.3. Smart Transportation

5.2.4. Smart Governance

5.2.5. Smart Energy

5.2.6. Smart Healthcare

5.2.7. Smart Water Network System

5.2.8. Smart Education

5.2.9. Others

5.3. Europe Smart Cities Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.3.1. Germany Smart Cities Market Outlook, by By Components, 2019-2032

5.3.2. Germany Smart Cities Market Outlook, by By Application, 2019-2032

5.3.3. Italy Smart Cities Market Outlook, by By Components, 2019-2032

5.3.4. Italy Smart Cities Market Outlook, by By Application, 2019-2032

5.3.5. France Smart Cities Market Outlook, by By Components, 2019-2032

5.3.6. France Smart Cities Market Outlook, by By Application, 2019-2032

5.3.7. U.K. Smart Cities Market Outlook, by By Components, 2019-2032

5.3.8. U.K. Smart Cities Market Outlook, by By Application, 2019-2032

5.3.9. Spain Smart Cities Market Outlook, by By Components, 2019-2032

5.3.10. Spain Smart Cities Market Outlook, by By Application, 2019-2032

5.3.11. Russia Smart Cities Market Outlook, by By Components, 2019-2032

5.3.12. Russia Smart Cities Market Outlook, by By Application, 2019-2032

5.3.13. Rest of Europe Smart Cities Market Outlook, by By Components, 2019-2032

5.3.14. Rest of Europe Smart Cities Market Outlook, by By Application, 2019-2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Smart Cities Market Outlook, 2019 - 2032

6.1. Asia Pacific Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

6.1.1. Software

6.1.1.1. Smart sensors

6.1.1.2. Smart Cameras

6.1.1.3. Smart Meters

6.1.1.4. Network Devices

6.1.1.5. Others

6.1.2. Hardware

6.1.2.1. Smart Metering Software

6.1.2.2. Smart Lighting Software

6.1.2.3. Data Management Software

6.1.2.4. Other

6.1.3. Services

6.1.3.1. Consulting Service

6.1.3.2. Support& Maintenance

6.1.3.3. Integration& Deployment

6.1.3.4. Security Services

6.2. Asia Pacific Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

6.2.1. Smart Security

6.2.2. Smart Building

6.2.3. Smart Transportation

6.2.4. Smart Governance

6.2.5. Smart Energy

6.2.6. Smart Healthcare

6.2.7. Smart Water Network System

6.2.8. Smart Education

6.2.9. Others

6.3. Asia Pacific Smart Cities Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.3.1. China Smart Cities Market Outlook, by By Components, 2019-2032

6.3.2. China Smart Cities Market Outlook, by By Application, 2019-2032

6.3.3. Japan Smart Cities Market Outlook, by By Components, 2019-2032

6.3.4. Japan Smart Cities Market Outlook, by By Application, 2019-2032

6.3.5. South Korea Smart Cities Market Outlook, by By Components, 2019-2032

6.3.6. South Korea Smart Cities Market Outlook, by By Application, 2019-2032

6.3.7. India Smart Cities Market Outlook, by By Components, 2019-2032

6.3.8. India Smart Cities Market Outlook, by By Application, 2019-2032

6.3.9. Southeast Asia Smart Cities Market Outlook, by By Components, 2019-2032

6.3.10. Southeast Asia Smart Cities Market Outlook, by By Application, 2019-2032

6.3.11. Rest of SAO Smart Cities Market Outlook, by By Components, 2019-2032

6.3.12. Rest of SAO Smart Cities Market Outlook, by By Application, 2019-2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Smart Cities Market Outlook, 2019 - 2032

7.1. Latin America Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

7.1.1. Software

7.1.1.1. Smart sensors

7.1.1.2. Smart Cameras

7.1.1.3. Smart Meters

7.1.1.4. Network Devices

7.1.1.5. Others

7.1.2. Hardware

7.1.2.1. Smart Metering Software

7.1.2.2. Smart Lighting Software

7.1.2.3. Data Management Software

7.1.2.4. Other

7.1.3. Services

7.1.3.1. Consulting Service

7.1.3.2. Support& Maintenance

7.1.3.3. Integration& Deployment

7.1.3.4. Security Services

7.2. Latin America Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

7.2.1. Smart Security

7.2.2. Smart Building

7.2.3. Smart Transportation

7.2.4. Smart Governance

7.2.5. Smart Energy

7.2.6. Smart Healthcare

7.2.7. Smart Water Network System

7.2.8. Smart Education

7.2.9. Others

7.3. Latin America Smart Cities Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.3.1. Brazil Smart Cities Market Outlook, by By Components, 2019-2032

7.3.2. Brazil Smart Cities Market Outlook, by By Application, 2019-2032

7.3.3. Mexico Smart Cities Market Outlook, by By Components, 2019-2032

7.3.4. Mexico Smart Cities Market Outlook, by By Application, 2019-2032

7.3.5. Argentina Smart Cities Market Outlook, by By Components, 2019-2032

7.3.6. Argentina Smart Cities Market Outlook, by By Application, 2019-2032

7.3.7. Rest of LATAM Smart Cities Market Outlook, by By Components, 2019-2032

7.3.8. Rest of LATAM Smart Cities Market Outlook, by By Application, 2019-2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Smart Cities Market Outlook, 2019 - 2032

8.1. Middle East & Africa Smart Cities Market Outlook, by By Components, Value (US$ Bn), 2019-2032

8.1.1. Software

8.1.1.1. Smart sensors

8.1.1.2. Smart Cameras

8.1.1.3. Smart Meters

8.1.1.4. Network Devices

8.1.1.5. Others

8.1.2. Hardware

8.1.2.1. Smart Metering Software

8.1.2.2. Smart Lighting Software

8.1.2.3. Data Management Software

8.1.2.4. Other

8.1.3. Services

8.1.3.1. Consulting Service

8.1.3.2. Support& Maintenance

8.1.3.3. Integration& Deployment

8.1.3.4. Security Services

8.2. Middle East & Africa Smart Cities Market Outlook, by By Application, Value (US$ Bn), 2019-2032

8.2.1. Smart Security

8.2.2. Smart Building

8.2.3. Smart Transportation

8.2.4. Smart Governance

8.2.5. Smart Energy

8.2.6. Smart Healthcare

8.2.7. Smart Water Network System

8.2.8. Smart Education

8.2.9. Others

8.3. Middle East & Africa Smart Cities Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.3.1. GCC Smart Cities Market Outlook, by By Components, 2019-2032

8.3.2. GCC Smart Cities Market Outlook, by By Application, 2019-2032

8.3.3. South Africa Smart Cities Market Outlook, by By Components, 2019-2032

8.3.4. South Africa Smart Cities Market Outlook, by By Application, 2019-2032

8.3.5. Egypt Smart Cities Market Outlook, by By Components, 2019-2032

8.3.6. Egypt Smart Cities Market Outlook, by By Application, 2019-2032

8.3.7. Nigeria Smart Cities Market Outlook, by By Components, 2019-2032

8.3.8. Nigeria Smart Cities Market Outlook, by By Application, 2019-2032

8.3.9. Rest of Middle East Smart Cities Market Outlook, by By Components, 2019-2032

8.3.10. Rest of Middle East Smart Cities Market Outlook, by By Application, 2019-2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Microsoft Corp.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. AT&T Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Huawei Technologies Co. Ltd.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Hitachi Ltd.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Siemens AG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Schneider Electric SE

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. IBM Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Cisco Systems, Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. ABB Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Accenture plc

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Components Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |