Global Digital Therapeutics Market Forecast

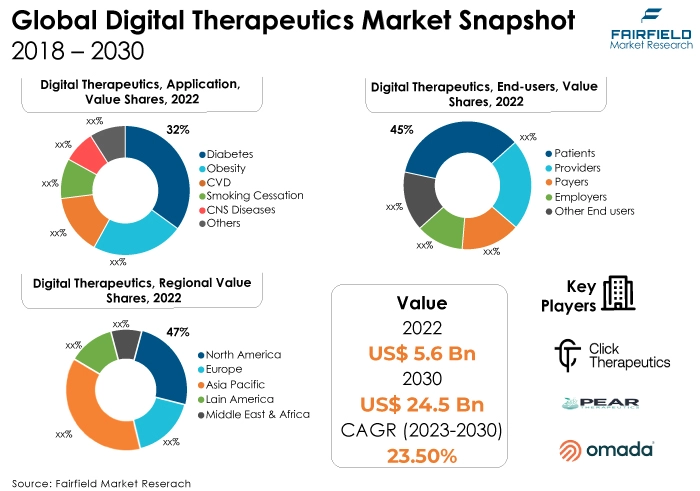

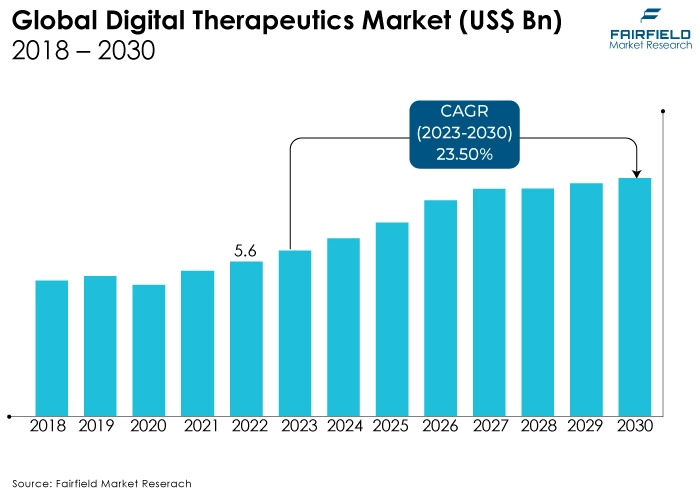

- Global market for digital therapeutics to reach US$24.5 Bn by 2030, up from US$5.6 Bn

- Market size poised to see expansion at a CAGR of 23.5% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the growth of digital therapeutics is the increasing demand from the healthcare industry.

- The digital therapeutics market is growing due to increasing chronic diseases, the need for cost-effective healthcare solutions, rising patient engagement, and technological advancements. These factors drive the adoption of digital therapeutics, offering effective, scalable, and personalised treatments, leading to market growth.

- The rising incidence of preventable chronic diseases is a key driver of the digital therapeutics market. Digital therapeutics offer cost-effective, personalised interventions and tools for managing and preventing conditions like diabetes and heart disease, addressing the urgent need to reduce the burden of these diseases and improve population health.

- Diabetes applications dominate the digital therapeutics market due to the high global prevalence of diabetes. These digital therapeutics provide effective tools for diabetes management, offering personalised interventions, real-time monitoring, and lifestyle guidance, making them the largest segment in the market.

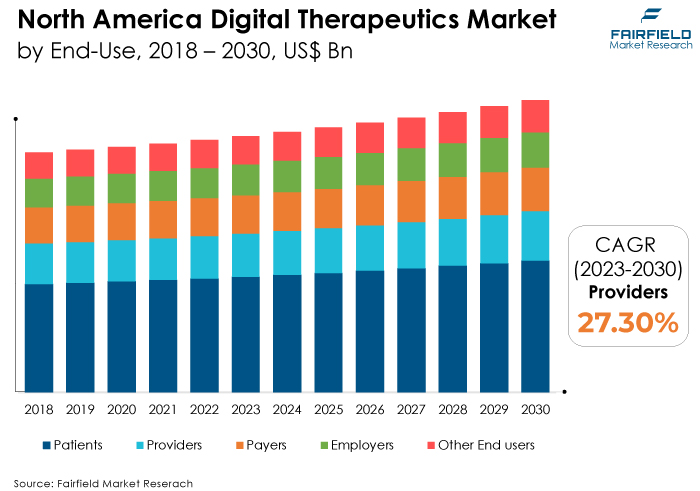

- Patients as end-users have secured the largest market share in the digital therapeutics market due to their increasing involvement in self-managing health and their preference for personalised, convenient, and accessible digital solutions. The shift towards patient-centric care has further solidified their prominence in the market.

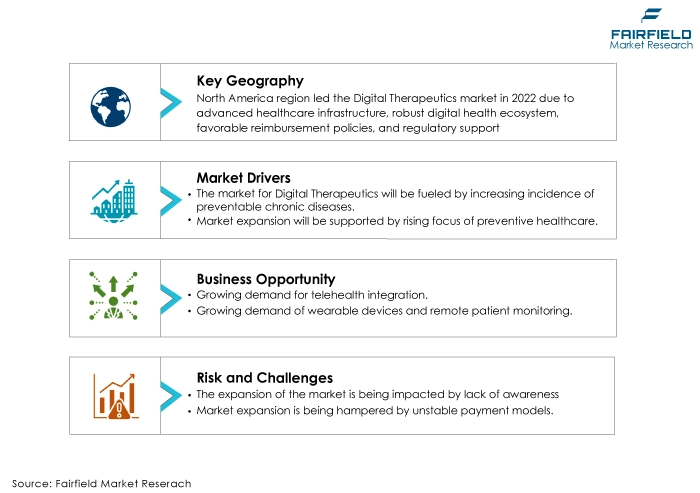

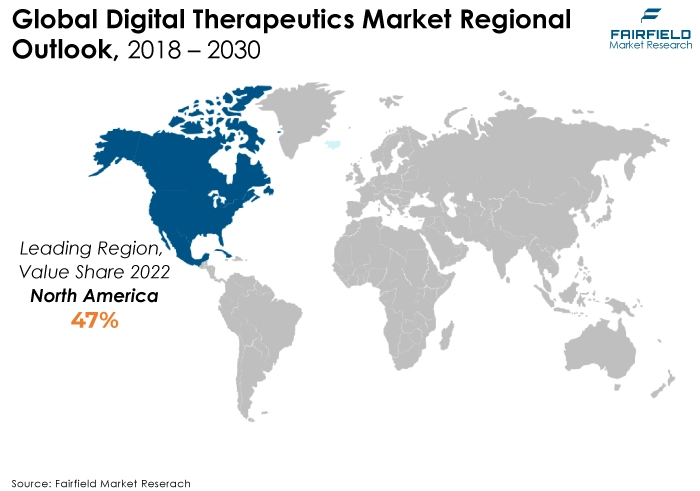

- North America leads the digital therapeutics market due to its advanced healthcare infrastructure, robust digital health ecosystem, favourable reimbursement policies, and regulatory support. The region's high occurrence of chronic diseases and innovation-driven culture contribute to its dominance in the market.

- Asia Pacific is expected to display the fastest pace of growth in the global digital therapeutics market due to rising healthcare expenditure, growing smartphone penetration, increasing awareness of digital health solutions, and expanding middle-class populations, making it a fertile ground for digital therapeutics adoption and market growth.

- The lack of awareness hinders the digital therapeutics market, as potential users are unaware of the benefits and efficacy of these solutions. This results in slower adoption rates among patients and healthcare providers, limiting market growth.

A Look Back and a Look Forward - Comparative Analysis

Digital therapeutics is experiencing rapid growth due to several factors. It offers scalable and accessible solutions for managing and treating various medical conditions using software and digital technologies. This approach appeals to both patients and healthcare providers, as it provides personalised care, improves treatment adherence, reduces healthcare costs, and offers real-time monitoring and feedback. The increasing prevalence of chronic diseases, advancements in technology, and a shift toward value-based care are driving the growth of digital therapeutics.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major end-use application sectors like patients, and payers. The latter as end users are growing in the digital therapeutics market due to their recognition of the cost-effectiveness and potential for improved patient outcomes. Digital therapeutics can help payers reduce healthcare expenses, enhance care management, and promote preventive measures, making them increasingly interested in adopting these solutions.

The digital therapeutics market is poised for robust future growth driven by rising chronic diseases, increased adoption of digital health solutions, and expanding reimbursement policies. Continuous innovations in technology, personalised treatment approaches, and growing patient engagement are expected to fuel market expansion. Additionally, the COVID-19 pandemic has accelerated the acceptance of remote healthcare, further boosting the demand for digital therapeutics in the coming years.

Key Growth Determinants

- Increasing Incidence of Preventable Chronic Diseases

The increasing incidence of preventable chronic diseases is a key driver of the digital therapeutics market. These conditions, such as diabetes, cardiovascular diseases, and obesity, are placing a significant burden on healthcare systems worldwide.

Digital therapeutics offers scalable and cost-effective solutions for managing and preventing these diseases through personalised interventions, real-time monitoring, and behaviour modification.

As the global healthcare landscape shifts towards preventive and value-based care, the demand for digital therapeutics is surging, driven by the urgent need to address the rising prevalence of chronic illnesses.

- Growing Emphasis on Preventive Healthcare

The digital therapeutics market is benefiting from a growing emphasis on preventive healthcare. With healthcare systems worldwide shifting their focus towards disease prevention and early intervention, digital therapeutics are gaining prominence. These solutions enable personalised, data-driven interventions to manage health proactively, reducing the risk of chronic diseases.

In addition, they offer remote monitoring and patient engagement, aligning with the preventive healthcare trend. As individuals and healthcare providers increasingly prioritise prevention, the demand for digital therapeutics is on the rise, driving market growth.

- Critically Growing Need for Controlling Healthcare Costs

As healthcare expenditure continue to escalate globally, digital therapeutics offer a cost-effective alternative to traditional treatments. These solutions reduce the need for expensive interventions and hospitalisations by focusing on prevention, early intervention, and remote monitoring.

By improving patient outcomes and reducing healthcare utilisation, digital therapeutics align with cost-saving objectives, making them a strategic choice for healthcare payers, providers, and stakeholders seeking to manage healthcare expenses more efficiently.

Major Growth Barriers

- Lack of Awareness

The lack of awareness presents a significant challenge in the digital therapeutics market. Many potential users, including patients, healthcare providers, and even payers, may need to be fully informed about the existence, benefits, or efficacy of digital therapeutics. This hampers adoption rates and market growth.

Education and awareness campaigns are crucial to bridge this gap, highlighting the value of digital therapeutics in managing chronic diseases, improving health outcomes, and reducing healthcare costs, ultimately addressing this challenge, and expanding market reach.

- Unstable Payment Models

Unstable payment models present a challenge in the digital therapeutics market. The reimbursement landscape for digital therapeutics is evolving, and uncertainty regarding payment mechanisms and coverage can hinder market growth.

Payers and healthcare systems still need to adapt to incorporate these novel interventions into their reimbursement frameworks, leading to inconsistent and fragmented payment models.

Key Trends and Opportunities to Look at

- Telehealth Integration

Telehealth integration is a vital technology trend in the digital therapeutics market. It involves the seamless integration of digital therapeutics platforms with telehealth services, enabling remote patient monitoring, consultations, and treatment delivery.

This integration enhances accessibility to digital therapeutics, especially during the COVID-19 pandemic, while providing healthcare professionals with real-time data to monitor patient progress and adjust treatment plans, ultimately improving patient outcomes and access to care.

- Wearable Devices

Wearable devices are a pivotal technology trend in the digital therapeutics market. These devices, like smartwatches and fitness trackers, incorporate sensors to monitor vital health metrics such as heart rate, activity levels, and sleep patterns.

These devices facilitate real-time data collection, enabling digital therapeutics platforms to provide personalised interventions and track patient progress. Wearables enhance patient engagement, improve treatment adherence, and offer valuable insights for healthcare providers to tailor treatment plans effectively.

- Remote Patient Monitoring

Remote patient monitoring (RPM) technology is instrumental in the Digital Therapeutics Market. RPM involves the use of IoT devices and sensors to collect real-time health data from patients in their homes. This data is transmitted to healthcare providers, allowing for continuous monitoring and timely interventions.

RPM enhances the effectiveness of digital therapeutics by providing valuable insights, improving patient outcomes, and reducing healthcare costs, particularly in chronic disease management and post-acute care.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the Digital Therapeutics Market. Regulatory bodies like the US FDA have begun recognizing and approving specific digital therapeutics as medical treatments, which bolsters market credibility.

Clear regulatory guidelines provide a framework for companies to develop and market their products, increasing investor confidence and fostering innovation. However, navigating complex and evolving regulations poses challenges.

Companies must demonstrate clinical effectiveness, data security, and patient safety to gain regulatory approval. Additionally, international regulatory harmonisation efforts are crucial for market expansion beyond borders.

Overall, a supportive and well-defined regulatory landscape is essential for the digital therapeutics industry to thrive while ensuring patient safety and treatment efficacy.

Fairfield’s Ranking Board

Top Segments

- Diabetes Application Contributes the Largest Share to Market Value Pie

Diabetes applications have secured the largest market share in the digital therapeutics market due to the sheer prevalence of diabetes worldwide. Digital therapeutics offer effective tools for diabetes management by providing personalised interventions, real-time glucose monitoring, and lifestyle guidance.

Such solutions help patients manage their condition more effectively, reduce complications, and improve their quality of life. As diabetes rates continue to rise globally, the demand for digital therapeutics for diabetes management remains robust, making it the largest segment in the market.

On the other hand, the smoking cessation application is experiencing rapid growth traction over the recent past, attributed to the pressing need to combat the global tobacco epidemic. Smoking cessation digital therapeutics offer evidence-based interventions, behavioural support, and personalised plans to help individuals quit smoking.

As public health initiatives and awareness campaigns intensify, and with the growing understanding of the health risks associated with smoking, there is a significant demand for effective digital solutions to aid in smoking cessation, driving rapid growth in this segment.

- Patients Remain the Largest End Users

Patients as end-users have captured the largest market share in the digital therapeutics market due to their increasingly active role in managing their health. Patients are embracing digital therapeutics for self-care and condition management, seeking personalised, accessible, and convenient solutions.

In addition, the COVID-19 pandemic has accelerated the adoption of remote healthcare, further empowering patients to take control of their health. As patient-centric care becomes a healthcare priority, the demand for digital therapeutics directly serving patients continues to grow, solidifying their position as the largest user group in the market.

Providers, as end users, are slated for the fastest CAGR through 2030 in the market as demand from healthcare professionals continues to heighten. Digital therapeutics are becoming integral tools for physicians, clinicians, and healthcare organisations in delivering personalised, data-driven care. These solutions offer real-time patient monitoring, treatment adjustments, and streamlined care management.

As healthcare providers recognise the value of digital therapeutics in improving patient outcomes, reducing costs, and enhancing the quality of care, their adoption continues to rise, driving the highest CAGR in this user category.

Regional Frontrunners

North America Accelerates to Secure the Top Spot

North America has captured the largest market share in the digital therapeutics market due to several factors. The region boasts a highly developed healthcare infrastructure, advanced technological capabilities, and a robust ecosystem of digital health start-ups.

North America is home to a significant patient population with chronic diseases, creating a substantial demand for digital therapeutics. Favourable reimbursement policies and regulatory frameworks, particularly in the US, support the adoption and integration of digital therapeutics into the healthcare system.

A strong emphasis on research and development, coupled with a culture of innovation and venture capital investment, has accelerated the growth and adoption of digital therapeutics in the North American market.

Penetration will be the Fastest in Asia Pacific

Rising healthcare expenditures, increasing smartphone penetration, and a growing ageing population have created a burgeoning demand for digital health solutions. Governments, and healthcare providers are recognising the potential of digital therapeutics to address the region's healthcare challenges, including the management of chronic diseases.

The region’s expanding middle class and greater awareness of preventive healthcare are driving adoption. These factors, combined with evolving regulatory frameworks, are propelling the rapid growth of digital therapeutics in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The global digital therapeutics market is consolidated, with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Digital Therapeutics space?

- Pear Therapeutics

- Akili Interactive Labs

- Click Therapeutics

- Omada Health

- WellDoc

- Propeller Health

- 2Morrow

- Hinge Health

- Canary Health

- Better Therapeutics

- Kaia Health

- DarioHealth

- Mindstrong Health

- Biofourmis

- Ginger

Recent Company Developments

New Product Launches

- February 2022: DynamiCare Health Inc., a company specializing in digital therapeutics and telehealth, has been granted the Breakthrough Device Designation by the United States Food and Drug Administration (FDA) for its product, DCH-001.

- January 2021: Hydrus 7 Lab has established a strategic partnership with Epillo, a European Digital Health company.

Distribution Agreement

- May 2021: Eli Lilly and Company have entered into strategic international partnerships with four companies to enhance connected solutions and simplify diabetes care management for individuals residing outside of the United States.

An Expert’s Eye

Demand and Future Growth

Growth in the healthcare industry is driving the market. The digital therapeutics market is witnessing strong demand and is poised for substantial future growth. Factors driving this growth include the increasing prevalence of chronic diseases, rising healthcare costs, and the need for cost-effective, scalable treatment options.

The COVID-19 pandemic has accelerated the adoption of remote healthcare solutions, further fuelling the market. Additionally, advancements in technology, regulatory support, and a shift toward value-based care are contributing to the market's expansion.

As patients and healthcare providers increasingly embrace digital interventions, the digital therapeutics market is expected to grow significantly in the coming years.

Supply Side of the Market

Prominent countries in the digital therapeutics market include the US, a pioneer in digital health adoption; Germany, known for its strong healthcare infrastructure; the United Kingdom, with a growing interest in digital therapeutics; China, experiencing rapid growth in telehealth and digital health solutions; and Japan, where healthcare technology innovations are prominent.

Additionally, countries like Australia, Canada, and India are significant players in the digital therapeutics space, with growing adoption and investments in this transformative healthcare sector.

The digital therapeutics market primarily relies on software development, clinical content creation, and data management, making raw materials less relevant in the traditional sense. However, essential components include advanced algorithms, clinical data sets, and user interface design elements.

Manufacturers of these components can range from software development companies and clinical content providers to user experience design firms. Secure cloud storage and computing infrastructure providers play a crucial role in supporting digital therapeutics platforms. These components are sourced from various technology and healthcare companies globally to create and deliver digital therapeutic solutions.

The Global Digital Therapeutics Market is Segmented as Below:

By Application:

- Diabetes

- Obesity

- CVD

- Smoking Cessation

- CNS Diseases

- OTHERS

By End User:

- Providers

- Payers

- Employers

- Other

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Digital Therapeutics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Digital Therapeutics Market Outlook, 2018 - 2030

3.1. Global Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Diabetes

3.1.1.2. Obesity

3.1.1.3. CVD

3.1.1.4. Smoking Cessation

3.1.1.5. CNS Diseases

3.1.1.6. Others

3.2. Global Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Patients

3.2.1.2. Providers

3.2.1.3. Payers

3.2.1.4. Employers

3.2.1.5. Other End users

3.3. Global Digital Therapeutics Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Digital Therapeutics Market Outlook, 2018 - 2030

4.1. North America Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Diabetes

4.1.1.2. Obesity

4.1.1.3. CVD

4.1.1.4. Smoking Cessation

4.1.1.5. CNS Diseases

4.1.1.6. Others

4.2. North America Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Patients

4.2.1.2. Providers

4.2.1.3. Payers

4.2.1.4. Employers

4.2.1.5. Other End users

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Digital Therapeutics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Digital Therapeutics Market Outlook, 2018 - 2030

5.1. Europe Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Diabetes

5.1.1.2. Obesity

5.1.1.3. CVD

5.1.1.4. Smoking Cessation

5.1.1.5. CNS Diseases

5.1.1.6. Others

5.2. Europe Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Patients

5.2.1.2. Providers

5.2.1.3. Payers

5.2.1.4. Employers

5.2.1.5. Other End users

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Digital Therapeutics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Digital Therapeutics Market Outlook, 2018 - 2030

6.1. Asia Pacific Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Diabetes

6.1.1.2. Obesity

6.1.1.3. CVD

6.1.1.4. Smoking Cessation

6.1.1.5. CNS Diseases

6.1.1.6. Others

6.2. Asia Pacific Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Patients

6.2.1.2. Providers

6.2.1.3. Payers

6.2.1.4. Employers

6.2.1.5. Other End users

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Digital Therapeutics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Digital Therapeutics Market by End User, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Digital Therapeutics Market Outlook, 2018 - 2030

7.1. Latin America Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Diabetes

7.1.1.2. Obesity

7.1.1.3. CVD

7.1.1.4. Smoking Cessation

7.1.1.5. CNS Diseases

7.1.1.6. Others

7.2. Latin America Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Patients

7.2.1.2. Providers

7.2.1.3. Payers

7.2.1.4. Employers

7.2.1.5. Other End users

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Digital Therapeutics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Digital Therapeutics Market Outlook, 2018 - 2030

8.1. Middle East & Africa Digital Therapeutics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Diabetes

8.1.1.2. Obesity

8.1.1.3. CVD

8.1.1.4. Smoking Cessation

8.1.1.5. CNS Diseases

8.1.1.6. Others

8.2. Middle East & Africa Digital Therapeutics Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Patients

8.2.1.2. Providers

8.2.1.3. Payers

8.2.1.4. Employers

8.2.1.5. Other End users

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Digital Therapeutics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Digital Therapeutics Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Digital Therapeutics Market, by End User, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs End User Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Pear Therapeutics

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Akili Interactive Labs

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Click Therapeutics

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Omada Health

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. WellDoc

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Propeller Health

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. 2Morrow

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Hinge Health

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Canary Health

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Better Therapeutics

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Kaia Health

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. DarioHealth

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Mindstrong Health

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Biofourmis

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Ginger

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |