E-cigarette Market Growth and Industry Forecast

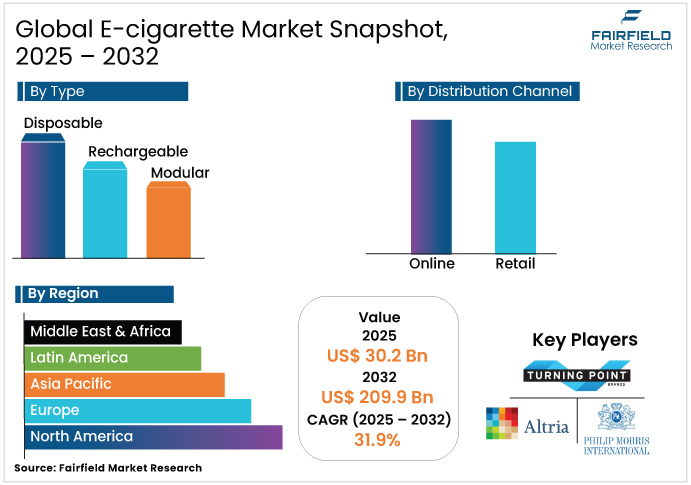

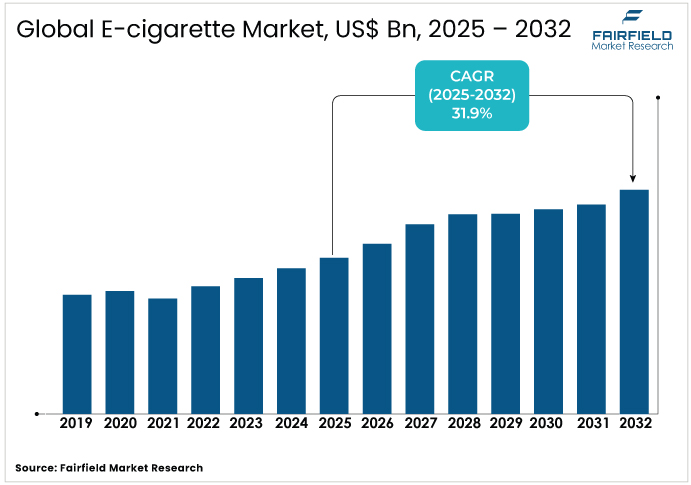

- The global e-cigarette market is projected to value at US$ 30.2 Bn in 2025.

- It is expected to expand to US$ 209.9 Bn by 2032, registering a strong CAGR of 31.9% between 2025 and 2032.

E-cigarette Market Summary: Key Insights & Trends

- Rechargeable devices lead the E-cigarette market with over 40% share in 2024, driven by cost-effectiveness and reusability.

- Disposables are the fastest-growing type, expanding at a CAGR of 35% through 2032 due to affordability and convenience.

- Retail dominates distribution with more than 80% share, supported by vape shops and convenience store availability.

- Online sales are the fastest-growing channel, projected at a 36% CAGR, contributing 20–30% of revenue by 2024.

- Health perceptions and smoking cessation trends remain the strongest driver, boosting adoption by 25–30% in key regions.

- Emerging markets in Asia Pacific and Latin America offer vast opportunities, with potential to add US$ 50 billion by 2032.

- North America leads with over 40% share, Europe follows with 30%, while Asia Pacific records the fastest CAGR of 35%.

A Look Back and a Look Forward - Comparative Analysis

The E-cigarette Market experienced significant fluctuations from 2019 to 2024, marked by rapid initial growth followed by challenges during the COVID-19 pandemic. In 2019, the E-cigarettes were valued at approximately USD 18-20 billion, driven by rising awareness of smoking cessation aids and the popularity of brands such as JUUL in the U.S., which captured a large youth segment through flavored pods. However, by 2020, the COVID-19 outbreak disrupted supply chains, particularly from China, the manufacturing hub for e-cigarettes, leading to shortages and a temporary dip in sales.

Health concerns linking vaping to respiratory vulnerabilities amplified during the pandemic, with studies showing mixed outcomes. Some indicated e-cigarette users had lower odds of severe COVID-19, while others highlighted increased risks, causing a 10-15% market contraction in 2020-2021. Regulatory crackdowns, such as the U.S. FDA's flavor bans in 2020, further restrained growth, but the E-cigarette industry rebounded by 2022-2024 as remote work trends boosted home-based consumption and online sales surged by 20-30%. Overall, the period saw a CAGR of around 15-20%, with the market reaching USD 37-41 billion by 2024, resilient despite external shocks.

Looking ahead to 2025-2032, the industry is poised for exponential growth, projected to expand at a remarkable CAGR through 2032, fueled by technological innovations and shifting consumer behaviors. Advancements in battery life, customizable modular devices, and nicotine salt formulations will enhance user experience, driving adoption in emerging markets such as Asia Pacific. Sustainability trends, such as eco-friendly disposables, and regulatory harmonization in Europe and the U.S. will mitigate past restraints, while digital marketing and e-commerce expansions are expected to increase accessibility. Health-focused campaigns positioning e-cigarettes as harm-reduction tools will attract more adult smokers, potentially reducing traditional tobacco use by 20-30% in key regions.

Key Growth Drivers

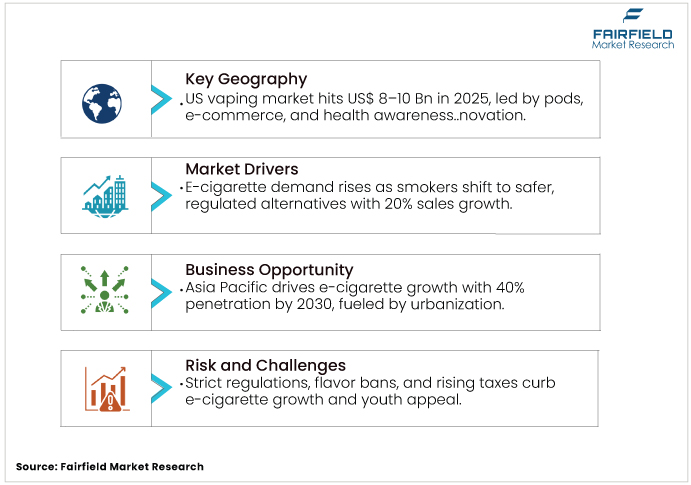

- Health perceptions and smoking cessation trends fueling strong global adoption rates

The E-cigarette market is significantly driven by the growing perception of e-cigarettes as a safer alternative to traditional smoking, with users believing they reduce exposure to harmful chemicals such as tar and carbon monoxide. The benefits from a rise in anti-smoking regulations, pushing consumers toward vaping; for instance, in the U.S., where smoking rates dropped from 14% in 2019 to 11.5% in 2023, e-cigarette sales surged by 20% annually.

- Innovations in technology, flavor diversity, and sustainable products are driving rapid consumer market growth

Product Innovation and Flavor Variety Innovation remains a core driver with advancements in device technology such as longer battery life, leak-proof designs, and smart connectivity features attracting tech-savvy consumers.Statistics indicate that modular and rechargeable devices, offering customization, hold over 40% market share, with new launches incorporating AI for usage tracking boosting sales by 15-20% yearly. Justification lies in consumer demand for variety; over 15,000 flavors available globally appeal to diverse tastes, driving a 35% growth in flavored product segments despite some bans. In Asia Pacific, where youth preferences fuel the E-cigarette, innovations such as disposable pods with exotic flavors have led to a 40% market expansion in countries such as China. This driver is further supported by R&D investments exceeding USD 5 billion annually from top players, ensuring competitive edges and sustaining the E-cigarette Market's high CAGR.

- E-commerce expansion and retail presence are boosting accessibility and global sales

Expanding Distribution Channels and E-commerce Growth, the E-cigarettes thrive on enhanced accessibility through diverse distribution, with online channels growing at 25% CAGR due to convenience and discreet purchasing. Data shows online sales accounting for 20-30% of the market, justified by platforms such as Amazon and dedicated vape sites offering global reach, especially during post-COVID shifts where e-commerce vaping sales rose 30%. Retail expansions in convenience stores and specialty shops provide hands-on experiences, driving 80% of sales in mature markets such as the U.S. This driver's impact is evident in emerging regions, where partnerships with retailers have increased penetration by 40%, supporting the overall Market's projected valuation.

Key Growth Restraints

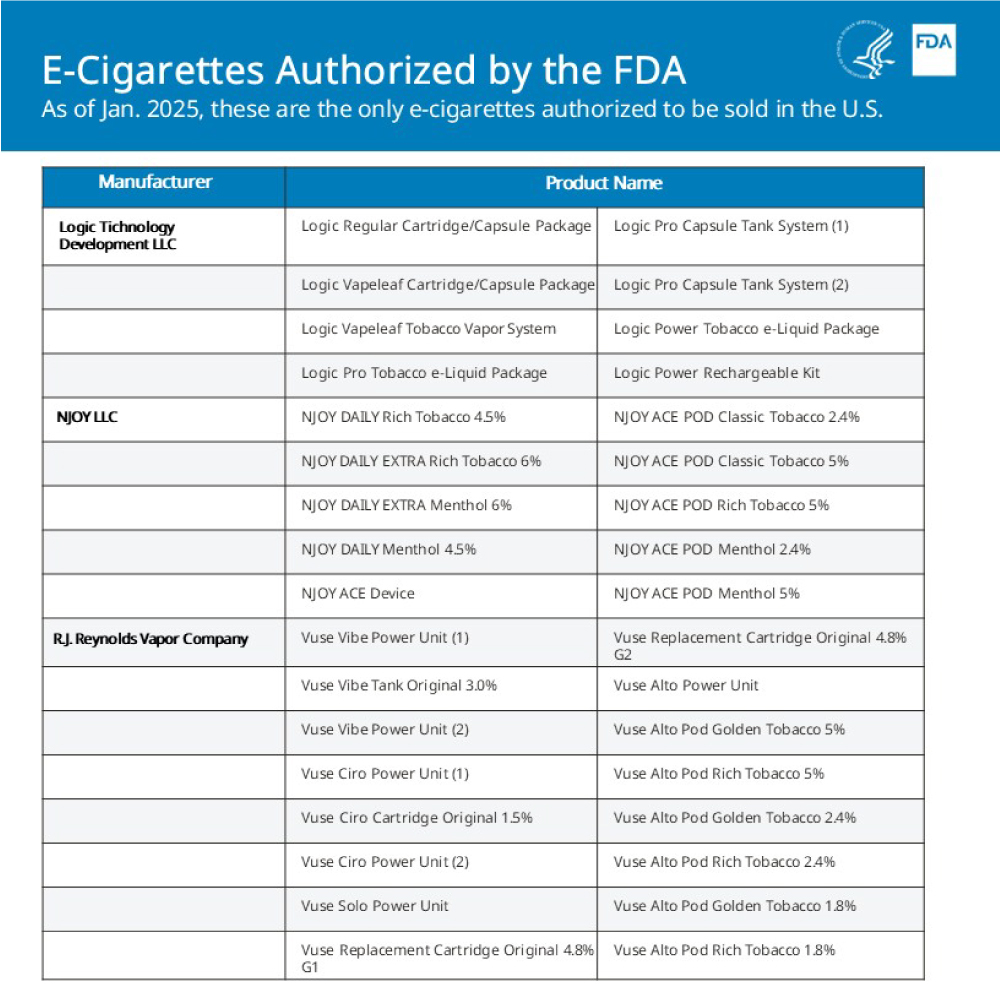

- Stringent global regulations and flavor bans restricting consumer choice and growth

Government regulations represent one of the most significant barriers to industry growth, as authorities worldwide continue tightening rules to limit youth usage. Policies include stricter age verification, advertising restrictions, and outright bans on flavored products, which are particularly popular among younger demographics. In the U.S., the FDA’s flavor ban on pod-based devices disrupted sales, demonstrating how regulatory measures can quickly alter demand patterns. Globally, rising excise taxes on e-liquids have further increased product costs, discouraging consumers and limiting accessibility in price-sensitive markets. These measures are often justified by concerns over youth addiction and underage use, backed by studies showing a high prevalence of daily vaping among teenagers.

According to a 2023 World Health Organization (WHO) report, nearly 40 percent (74 countries) still have not regulated e-cigarettes. Of the countries that regulate them, 28 percent (34 countries) ban them while 72 percent (87 countries) impose regulations. While intended to protect public health, such restrictions reduce consumer choice and constrain innovation, forcing companies to adjust portfolios. Collectively, these regulatory hurdles place downward pressure on market expansion, challenging the industry’s ability to sustain high growth momentum.

- Health risks and negative perceptions undermining adoption and slowing industry expansion

Despite being marketed as a safer alternative to traditional smoking, health concerns continue to weigh heavily on the industry. Incidents such as the 2019 EVALI outbreak, linked to illicit vaping products, damaged consumer trust and created long-lasting skepticism. Studies associating vaping with potential respiratory problems and cardiovascular risks have gained significant media attention, reinforcing public fear. The World Health Organization and national health bodies frequently issue warnings, adding pressure to governments and regulators to limit adoption. As a result, health-conscious consumers remain cautious, with many reconsidering or abandoning usage. Negative publicity also complicates industry marketing, as companies struggle to position products within harm-reduction frameworks without drawing criticism. This perception challenge slows adoption, particularly in developed markets where public health campaigns are highly influential. Unless supported by stronger scientific evidence and transparent regulations, these ongoing health debates are such asly to remain a key restraint on future growth.

E-cigarette Market Trends and Opportunities

- Emerging markets in Asia Pacific and Latin America driving future growth potential

The market has vast opportunities in underserved regions such as Asia Pacific, where urbanization and a growing middle class of over 1.5 billion people drive demand for affordable nicotine alternatives, with projections of 40% market penetration by 2030 per industry reports. Drivers include rising disposable incomes in countries such as India and Indonesia, where traditional smoking rates exceed 30%, justifying targeted product launches with localized flavors; this opportunity is amplified by easing regulations in some areas, enabling companies to capture 25% annual growth through partnerships with local distributors. Innovations tailored to cultural preferences, such as compact devices for on-the-go use, position the E-cigarette Market for exponential expansion, potentially adding US$ 50 billion in revenue from these regions alone.

- Eco-friendly innovations are unlocking a green growth opportunity in the e-cigarette market.

An emerging opportunity in the e-cigarette market lies in sustainability and eco-friendly innovations, which are becoming increasingly important as environmental concerns rise. With nearly 1.3 billion disposable vapes discarded annually, the issue of plastic and electronic waste has drawn attention from both regulators and consumers. This challenge is creating space for market players to differentiate themselves through the development of recyclable, biodegradable, and low-carbon devices. Consumer surveys reveal that 60% of users are willing to pay up to 20% more for sustainable products, highlighting strong demand potential.

British American Tobacco is piloting green initiatives that could enhance brand loyalty by up to 30%. Industry pioneers like Riot Labs introduced the QBAR in 2022, the world’s first carbon-negative disposable e-cigarette made from bioplastics with all components fully recyclable. The momentum continued in 2024 with Riot Labs’ launch of the Connex sustainable e-cigarette, alongside INNOKIN’s “Vape For The Planet” campaign promoting responsible vaping practices. Collectively, these developments demonstrate how eco-friendly innovation not only addresses environmental challenges but also opens significant opportunities for market expansion, premium positioning, and long-term brand value creation.

Segment-wise Trends & Analysis

- Rechargeable devices dominate while disposable and modular products show strong growth

In the E-cigarette Market, the rechargeable segment holds the leading position with over 40% share, driven by its cost-effectiveness and reusability, appealing to long-term users who prefer customizable nicotine levels and flavors without frequent repurchases. Rechargeable devices, such as pod systems from brands such as JUUL, offer superior battery life and vapor quality, contributing to higher user retention rates of 70% as per industry data; this dominance is justified by lower per-use costs, averaging 50% less than disposables over time, making them ideal for adult smokers transitioning from tobacco. However, the disposable segment is the fastest-growing, expanding at a CAGR of over 35%, fueled by convenience and no-maintenance appeal for beginners and occasional users, with sales surging 25% in 2024 amid flavored options despite regulatory pressures.

The modular segment, while smaller at 20-25% share, shows steady growth through advanced customization features such as variable wattage and coil options, attracting enthusiasts who represent 15% but drive premium pricing. Leading rechargeable products benefit from technological integrations, such as app-controlled settings, enhancing the Market's appeal in mature regions such as North America. Fastest-growing disposables thrive in emerging markets due to affordability, with global shipments exceeding 2 billion units annually, though environmental concerns prompt innovations in biodegradable variants.

- Retail leads distribution as online platforms emerge as fastest growing channel

Retail channels dominate with over 80% share, led by convenience stores and vape shops that provide hands-on experiences and expert advice, fostering trust and impulse buys among 60% of consumers who prefer in-person trials. This leadership is justified by widespread availability in chains such as 7-Eleven, where point-of-sale displays boost visibility and sales by 20%; retail's tactile advantage supports education on device usage, crucial for new adopters. Conversely, online channels are the fastest-growing segment with a CAGR exceeding 35%, driven by e-commerce giants offering discreet shipping, vast selections, and competitive pricing that attract 30% of millennials.

Online platforms such as Amazon and brand sites enable subscription models, reducing costs by 15% for repeat buyers and expanding the market's reach to remote areas. Leading retail benefits from partnerships with manufacturers for exclusive launches, while fastest-growing online leverages digital marketing, with social media influencing 40% of purchases. The E-cigarette Market's channel evolution includes hybrid models, such as click-and-collect, blending convenience; however, regulations on online age verification pose challenges, yet opportunities in AI-driven recommendations propel growth.

Regional Trends & Analysis

- Europe driven by harm-reduction policies, customization demand, and cultural shifts

Europe holds 30%, led by the UK, Germany, and France, where the UK market exceeds US$ 3 billion in 2025, driven by NHS endorsements as harm reduction tools, achieving 25% higher quit rates than patches. Germany's market grows via strict EU TPD compliance, with drivers such as flavor diversity and modular devices appealing to 40% of users seeking customization; France emphasizes premium botanicals, fueled by anti-smoking laws reducing traditional consumption by 15%. Overall, regulatory support and cultural shifts toward wellness propel Europe's E-cigarette Market.

- North America led by U.S. cessation trends, regulations, and technology adoption

North America commands over 40%, with the U.S. leading at US$ 8-10 billion in 2025 revenue, driven by high smoking cessation rates where 50% of vapers use devices to quit traditional cigarettes per CDC surveys. U.S. trends include a surge in pod systems and nicotine salts for smoother hits, amid FDA regulations curbing flavored disposables to combat youth usage, which dropped 20% post-2020 bans; this has shifted focus to adult-oriented products, boosting rechargeable segments by 15%. Key drivers in the U.S. Market encompass health awareness campaigns and tech innovations such as JUUL's device-locking features for age control, while e-commerce growth at 30% annually enhances accessibility despite retail dominance.

- Asia Pacific fastest growth fueled by manufacturing strength and rising demand

Asia Pacific is the fastest-growing region at 35% CAGR, led by China (manufacturing hub with US$ 10 billion exports), Japan (heated tobacco such as IQOS driving 20% adoption), and India (emerging despite bans, via online channels). China's drivers include low-cost production and domestic demand from 300 million smokers; Japan's market thrives on tech-savvy consumers and regulatory allowances for non-combustible products; India's growth stems from urbanization and youth appeal, though restrictions challenge formal markets.

Competitive Landscape Analysis

The E-cigarette Market is highly competitive, dominated by multinational tobacco firms and specialized vape companies focusing on innovation, regulatory compliance, and market expansion. Key players such as Philip Morris International Inc. (PMI) and British American Tobacco PLC (BAT) employ strategies such as product diversification into heated tobacco and acquisitions to consolidate share. Altria Group Inc. invests in R&D for reduced-risk products, while JUUL Labs, Inc. emphasizes digital marketing despite regulatory scrutiny. Strategies in the E-cigarette industry include sustainability initiatives, such as eco-friendly packaging by Imperial Brands PLC, and partnerships for distribution. Emerging players such as Shenzhen IVPS Technology Co., Ltd. (SMOK) focus on affordable modular devices for APAC growth.

Key Market Companies

- Philip Morris International Inc. (PMI)

- Turning Point Brands, Inc.

- Altria Group Inc.

- British American Tobacco PLC (BAT)

- SMOK

- Elf Bar

- Japan Tobacco Inc. (JTI)

- Imperial Brands PLC

- Logic Technology Development LLC

- JUUL Labs, Inc.

- International Vapor Group (IVG)

- NJOY, LLC

- J. Reynolds Vapor Company (Vuse)

- NicQuid

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

- ASPIRE

- Innokin Technology

- J Well France

Recent Development

- In August 2025, Turning Point Brands unveiled its second-quarter results, reporting a strong year-over-year increase in net sales and setting a new record for Modern Oral segment performance. The company also raised its guidance for the year in both profitability and Modern Oral outlook.

- In May 2025, Japan Tobacco Inc. introduced its next-generation heated tobacco device, Ploom AURA, in Japan via Ploom stores and its online CLUB JT platform, alongside the exclusive EVO heated tobacco sticks

Global E-cigarette Market Segmentation-

By Type

- Disposable

- Rechargeable

- Modular

By Distribution Channel

- Online

- Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global E-cigarette Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global E-cigarette Market Outlook, 2019 - 2032

3.1. Global E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

3.1.1. Disposable

3.1.2. Rechargeable

3.1.3. Modular

3.2. Global E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

3.2.1. Online

3.2.2. Retail

3.3. Global E-cigarette Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America E-cigarette Market Outlook, 2019 - 2032

4.1. North America E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.1.1. Disposable

4.1.2. Rechargeable

4.1.3. Modular

4.2. North America E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.2.1. Online

4.2.2. Retail

4.3. North America E-cigarette Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. U.S. E-cigarette Market Outlook, by Type, 2019 - 2032

4.3.2. U.S. E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

4.3.3. Canada E-cigarette Market Outlook, by Type, 2019 - 2032

4.3.4. Canada E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe E-cigarette Market Outlook, 2019 - 2032

5.1. Europe E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.1.1. Disposable

5.1.2. Rechargeable

5.1.3. Modular

5.2. Europe E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.2.1. Online

5.2.2. Retail

5.3. Europe E-cigarette Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Germany E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.2. Germany E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.3. Italy E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.4. Italy E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.5. France E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.6. France E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.7. U.K. E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.8. U.K. E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.9. Spain E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.10. Spain E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.11. Russia E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.12. Russia E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.3.13. Rest of Europe E-cigarette Market Outlook, by Type, 2019 - 2032

5.3.14. Rest of Europe E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific E-cigarette Market Outlook, 2019 - 2032

6.1. Asia Pacific E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.1.1. Disposable

6.1.2. Rechargeable

6.1.3. Modular

6.2. Asia Pacific E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.2.1. Online

6.2.2. Retail

6.3. Asia Pacific E-cigarette Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. China E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.2. China E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.3.3. Japan E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.4. Japan E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.3.5. South Korea E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.6. South Korea E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.3.7. India E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.8. India E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.3.9. Southeast Asia E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.10. Southeast Asia E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.3.11. Rest of SAO E-cigarette Market Outlook, by Type, 2019 - 2032

6.3.12. Rest of SAO E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America E-cigarette Market Outlook, 2019 - 2032

7.1. Latin America E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.1.1. Disposable

7.1.2. Rechargeable

7.1.3. Modular

7.2. Latin America E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.2.1. Online

7.2.2. Retail

7.3. Latin America E-cigarette Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Brazil E-cigarette Market Outlook, by Type, 2019 - 2032

7.3.2. Brazil E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

7.3.3. Mexico E-cigarette Market Outlook, by Type, 2019 - 2032

7.3.4. Mexico E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

7.3.5. Argentina E-cigarette Market Outlook, by Type, 2019 - 2032

7.3.6. Argentina E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

7.3.7. Rest of LATAM E-cigarette Market Outlook, by Type, 2019 - 2032

7.3.8. Rest of LATAM E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa E-cigarette Market Outlook, 2019 - 2032

8.1. Middle East & Africa E-cigarette Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.1.1. Disposable

8.1.2. Rechargeable

8.1.3. Modular

8.2. Middle East & Africa E-cigarette Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.2.1. Online

8.2.2. Retail

8.3. Middle East & Africa E-cigarette Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. GCC E-cigarette Market Outlook, by Type, 2019 - 2032

8.3.2. GCC E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

8.3.3. South Africa E-cigarette Market Outlook, by Type, 2019 - 2032

8.3.4. South Africa E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

8.3.5. Egypt E-cigarette Market Outlook, by Type, 2019 - 2032

8.3.6. Egypt E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

8.3.7. Nigeria E-cigarette Market Outlook, by Type, 2019 - 2032

8.3.8. Nigeria E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

8.3.9. Rest of Middle East E-cigarette Market Outlook, by Type, 2019 - 2032

8.3.10. Rest of Middle East E-cigarette Market Outlook, by Distribution Channel, 2019 - 2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Philip Morris International Inc. (PMI)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Turning Point Brands, Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Altria Group Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. British American Tobacco PLC (BAT)

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. SMOK

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Elf Bar

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Japan Tobacco Inc. (JTI)

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Imperial Brands PLC

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Logic Technology Development LLC

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. JUUL Labs, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |