Global Egg Replacement Ingredients Market Forecast

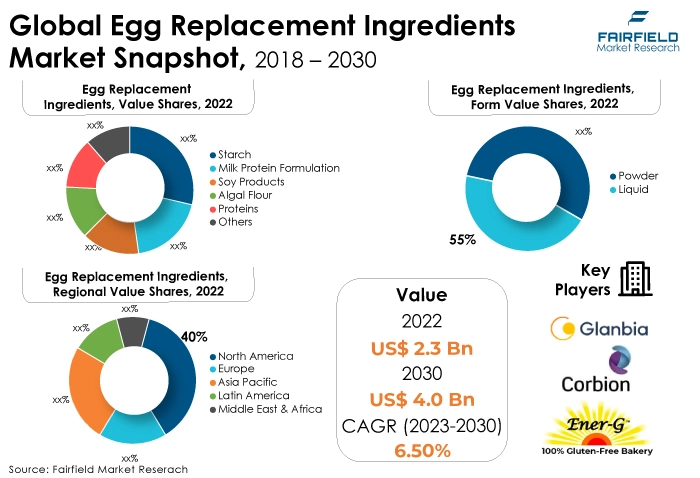

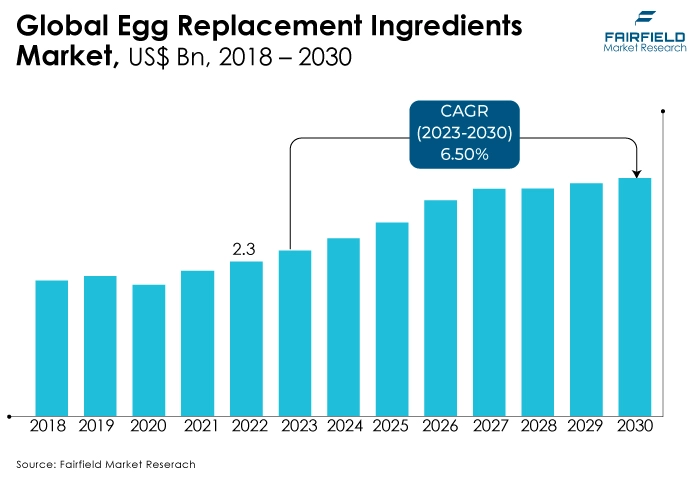

- The approximately US$2.3 Bn market for egg replacement ingredients poised to reach a valuation of US$4 Bn by 2030-end

- Market size slated for a promising CAGR of 6.5% over 2023 - 2030

Quick Report Digest

- The main trend expected to drive the market growth for egg replacement ingredients is increased demand for convenience and ready-to-use products. Furthermore, the cooking and baking procedure is made simpler by egg replacement products that are ready to use. Without the need for additional preparatory processes like breaking and whisking conventional eggs, they can be included in recipes.

- Another major market trend expected to drive the egg replacement ingredients market growth is the rapidly expanding functional egg replacements. To improve the nutritional profile of food products, several available egg replacements are supplemented with vitamins, minerals, and other substances. This appeals to consumers who are looking for nutrient-rich products and are health-conscious.

- In 2022, the starch category dominated the industry. In soups, sauces, and fillings, arrowroot starch, a natural thickening, can be used in substitution for eggs.

- The mayonnaise category dominated the market in 2022. Some vegan mayonnaise recipes use pea protein isolate because of its emulsifying abilities and allergy-friendliness.

- In 2022, the commercial category dominated the industry. Manufacturers of processed meat and seafood use egg substitutes in items like fish sticks, chicken nuggets, and meatballs.

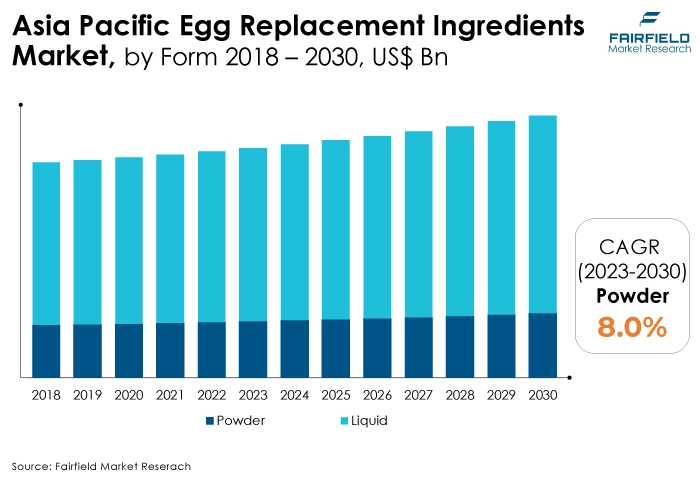

- The powder category is expected to grow the fastest. A versatile powder egg substitute that offers both protein and binding qualities is soy flour. It frequently appears in recipes for muffins, cakes, and cookies.

- In the market for egg replacement ingredients, Asia Pacific is anticipated to grow at the fastest rate. Growing cultural practices, religious convictions, and health considerations are encouraging more people in the Asia Pacific region to adopt vegetarian and plant-based diets.

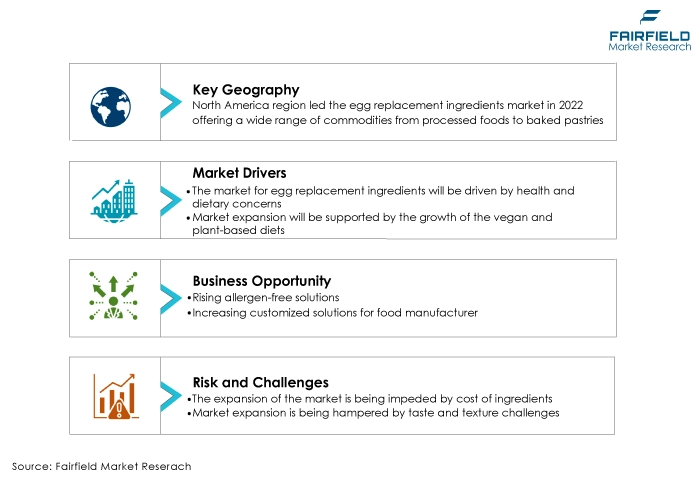

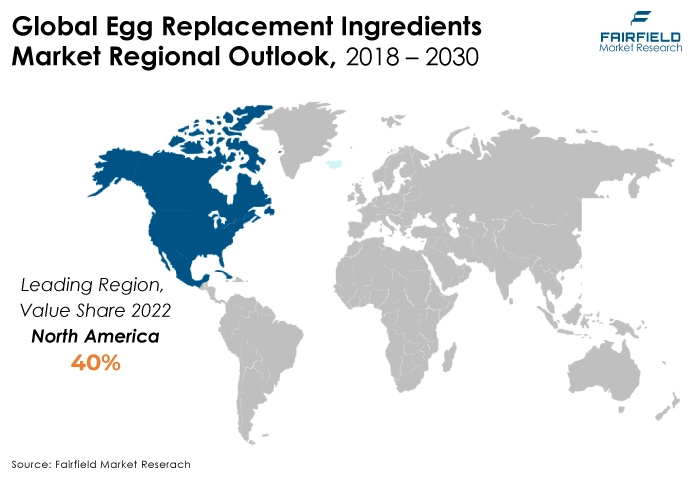

- The North American region will dominate the egg replacement ingredients market throughout the forecast period. The food sector in North America is vibrant and diverse, offering a wide range of commodities from processed foods to baked pastries.

A Look Back and a Look Forward - Comparative Analysis

Ingredients designed to substitute eggs give people a cruelty-free way to enjoy their favourite recipes without putting animals through unnecessary suffering or exploitation. Advocates for animal welfare are campaigning for better conditions for egg-laying hens, including increased production of these animals in the wild rather than in cages.

Ingredients used to substitute eggs offer a solution that addresses these issues. Customers are taking a more active role in supporting businesses and goods that align with their beliefs and animal welfare. Food businesses have responded by providing options that are free of eggs and animal products.

The market witnessed staggered growth during the historical period 2018 - 2022. Research efforts concentrated on creating new and enhanced egg substitutes that were both functional and palatable. As a result of advancements, better alternatives were made that nearly resembled the characteristics of conventional eggs.

Extensive research went into finding plant-based options that could serve as viable egg replacements. Ingredients such as aquafaba, chickpea flour, and flaxseed meal gained popularity due to their excellent binding and emulsifying properties.

Consumers who must avoid particular allergens are kept healthy and safe by expanding options that are allergy friendly. For people who suffer from severe allergies, such as anaphylactic responses to eggs, this is especially crucial in the coming years.

Additionally, many vegan and plant-based egg substitute components are also allergy-friendly. Furthermore, Allergen-friendly products manufactured using egg substitute components are now available at both food service outlets and retailers during the next five years.

Key Growth Determinants

- Growing Health and Dietary Concerns

Many people are moving to vegan and vegetarian diets for reasons related to their health, morals, and the environment. Since eggs are prohibited on these diets, there is a growing need for egg replacement ingredients to create plant-based and vegan-friendly alternatives to eggs in a variety of food products.

Food allergies are a serious health concern, and egg allergies are relatively prevalent. Food producers are introducing egg substitute ingredients into their products to offer allergen-free options to accommodate people with egg allergies.

Eggs are naturally high in fat and cholesterol, which may be a problem for anyone trying to lower their intake of saturated fat or control their cholesterol levels. Ingredients that can be used in place of eggs make it possible to produce lower-fat, cholesterol-free food products.

- Rising Boom Around Vegan and Plant-based Products

The core principle of veganism is avoiding all animal products, including eggs. Similarly, many vegans do not eat eggs. The need for products to replace eggs has increased as more individuals adopt vegan and vegetarian lifestyles.

Several plant-based protein sources, including legumes, soy, and peas, are frequently used in plant-based diets. To produce plant-based food items that are high in protein, components originating from these plant sources, such as soy lecithin and pea protein isolate, are required. The main motivations behind plant-based and vegan diets, in addition to health, are ethical and environmental concerns.

Consumers are increasingly selecting these diets to lessen their impact on the environment and the suffering of animals, which is consistent with the use of substances derived from plants as egg substitutes.

- Rising Demand from Food Industry

Urbanisation and changing lifestyles are driving the demand for processed and convenience foods globally. Numerous processed food items, such as baked goods, sauces, dressings, and prepared meals, all require components that can substitute eggs.

The largest user of ingredients for egg replacements is the bakery and confectionery sector. To produce desirable textures and functionalities while satisfying dietary requirements and consumer preferences, these components are utilised in cakes, cookies, pastries, and other baked foods.

Food producers frequently introduce new products to meet changing consumer preferences. They may make a wide range of goods, from vegan muffins to plant-based ice cream, to meet the demands of a diverse and dynamic market.

Major Growth Barriers

- Prohibitive Costs

Some components used to replace eggs, particularly those made from specialised plant sources or using sophisticated processing techniques, can cost more than regular eggs.

Particularly in product categories where pricing is an issue, the higher cost of these alternatives may prevent food makers from using them. It frequently takes a lot of research and development work to create substances that are useful and successful as egg replacements.

Research, testing, and invention can be expensive, and these expenses might be passed on to consumers or restrict how affordable certain substances might be.

- Taste and Texture Challenges

One of the major challenges is producing products that taste and feel most like ordinary eggs. Customers usually have strong preferences for the recognizable flavour and consistency of real eggs, and any noticeable difference may lead them to refuse or reject products created using egg substitutes.

Different egg substitute ingredients could have other textural characteristics, and these characteristics might not match the desired texture in some applications. For instance, using some egg substitutes can make it difficult to get the right level of fluff or creaminess in cakes or custards.

Key Trends and Opportunities to Look at

- Rising Clean Label and Natural Ingredients

Consumers are becoming more and more concerned about their health and well-being. They actively seek after foods with trustworthy ingredients. This focus is supported by clean label and natural egg replacement ingredients, which are seen as better-for-you replacements for conventional eggs.

The clean label movement emphasizes transparency in food labelling. Modern consumers are more conscious of ingredient labels and want to know what's in their meals. Ingredient lists for clean-label egg replacement products are frequently shorter and easier to recognise, which appeals to consumers looking for openness.

- Rising Allergen-free Solutions

Individuals with food allergies or sensitivities, especially those who are sensitive to eggs, can have their needs met by allergen-free egg replacement ingredients. People can consume a variety of foods without worrying about adverse reactions because of these additives.

A larger consumer base is looking for allergen-free alternatives due to the rise in the prevalence of food allergies and sensitivities. Those who suffer from allergies to common allergens, including eggs, dairy, soy, and nuts, are included in this. Manufacturers can capitalise on this expanding market sector by providing allergen-free alternatives to eggs.

- Customised Solutions for Food Manufacturers

Customised solutions help food producers stand out from the competition in a cutthroat industry. They can develop exclusive formulations that distinguish their goods from those of rivals, potentially boosting market share and patronage.

Collaboration between food makers and suppliers can result in the creation of novel products. Innovative culinary products that meet changing customer preferences and market trends can be made using customised egg substitute components.

How Does the Regulatory Scenario Shape this Industry?

The egg replacement regulatory framework comprises certain common laws and regulatory bodies that govern the safety, labelling, and marketing of these substances. The Food and Drug Administration (FDA) controls food additives, including those used to replace eggs. The Food and Drug Administration (FDA) establishes criteria for the validity of health claims, labelling, and ingredient safety.

To promote and sell egg replacement ingredients in the U.S. market, firms must adhere to Food and Drug Administration (FDA) restrictions. The composition, labelling, and marketing of egg substitute ingredients in the US market are influenced by Food and Drug Administration (FDA) rules.

To guarantee product safety and consumer confidence, manufacturers must abide by FDA regulations. In the European Union (EU), the European Food Safety Authority (EFSA) is the regulatory body in charge of evaluating the efficacy and safety of food components. It assesses the security of innovative food ingredients, particularly those used as egg substitutes.

The evaluations made by the European Food Safety Authority (EFSA) are crucial in deciding whether chemicals used to substitute eggs can be used in the EU. Market access in EU member states depends on European Food Safety Authority (EFSA) approval.

Fairfield’s Ranking Board

Top Segments

- Starch Egg Wins Preference over Milk Protein Formulations

The starch segment dominated the market in 2022. Eggs are frequently substituted with cornstarch in dishes like custards and puddings. It provides a smooth smoothness and thickens things up.

Because starches normally do not contain any allergens, people with allergies or dietary restrictions can consume them. To enhance texture and moisture retention, starch components are frequently utilised in cookies, cakes, muffins, and other baked foods.

Furthermore, the milk protein formulation category is anticipated to grow significantly throughout the forecast period. Ingredients containing milk proteins, such as whey protein and casein, are a good source of high-quality protein and can take the place of eggs in recipes that call for them.

Because eggs usually serve as emulsifiers in products like mayonnaise and salad dressings, milk proteins offer emulsifying qualities that are advantageous in these applications.

- Mayonnaise Leads

In 2022, the mayonnaise segment dominated the industry. Eggs serve as natural emulsifiers in mayonnaise, assisting in the blending of water- and oil-based elements to create a stable, creamy emulsion. To obtain a comparable result, egg replacement ingredients are chosen based on their ability to emulsify.

To prevent changing the flavour of the mayonnaise, egg replacement ingredients are selected for their bland flavour characteristics. This guarantees that the final product keeps its distinctive flavour.

The biscuits & cookies category is expected to grow significantly during the forecast period. Eggs add moisture to biscuit and cookie dough, keeping it from drying out and crumbling. The components used as egg substitutes are selected to add water and aid in creating a soft and chewy texture.

- The Commercial Category Spearheads

The commercial category dominated the industry in 2022. Large-scale bakeries and snack manufacturers use egg substitutes for making bread, cakes, cookies, muffins, pastries, and snack foods. These components contribute to improved product uniformity and quality.

Small-scale manufacturers of jams, jellies, and fruit spreads might substitute eggs with other ingredients to give their recipes more texture and binding power.

The household category is expected to grow the fastest. Eggs are not used in vegan or vegetarian families because they are not allowed. They make vegan pancakes, omelettes, and cookies, as well as other plant-based versions of their favourite foods, using components that function as egg replacements.

- The Liquid Category Maintains a Leading Position

The liquid category dominated the market in 2022. The liquid left behind after cooking legumes, most notably chickpeas, is called aquafaba and is prized for its exceptional foaming and emulsifying abilities. In many recipes, it can be used in place of eggs directly, especially for making meringues, mayonnaise, and baked products like cookies and cakes.

Smoothed-out silken tofu can be substituted for liquid eggs in dishes like quiches, custards, and creamy desserts. Moisture and binding qualities are provided.

The fastest growth is anticipated in the powder category. Baking powder and vinegar used together can act as a powder egg substitute with leavening qualities in recipes for cakes and quick breads.

It is possible to utilise a powdered egg substitute in recipes for muffins, pancakes, and cookies by mixing ground flaxseed meal with water to produce a gel-like solution. Both binding and moisture are provided.

Regional Frontrunners

North America Presents the Largest Market

During the projected period, North America is anticipated to dominate the egg replacement ingredients market. Consumers in North America are becoming more and more health-conscious, with a focus on eating less cholesterol and switching to plant-based diets.

As a result, there is an increasing need for substances that may substitute eggs that are plant-based. In North America, more people are switching to vegan and vegetarian diets. These diets forbid eggs, which significantly increases the need for egg-replacement ingredients in a variety of food products.

The restaurant, fast-food, and cafeteria industries are all prospering in the United States. To satisfy consumer demand, several of these establishments provide vegan and plant-based menu choices.

Asia Pacific Likely to Witness the Significant Growth in Sales During Forecast Period

Asia Pacific is expected to be the fastest-growing egg replacement ingredients market region. Asia Pacific has a significant, diverse population that makes up a substantial customer base. To accommodate various dietary choices and cultural preferences, there is an increasing demand for egg replacement ingredients in this region as dietary tastes change.

Quick-service restaurants and international food chains are expanding across the Asia Pacific region. To ensure product consistency across multiple locations, these businesses frequently need standardised components like egg substitutes.

India has a vast and quickly expanding population, which includes a growing middle-class population. The demand for diversified and cutting-edge food products, especially those containing components for egg replacements, is rising because of this demographic shift.

Fairfield’s Competitive Landscape Analysis

The market for egg replacement ingredients is very competitive and home to several well-known manufacturers. Large corporations are expanding their distribution networks and releasing new products to increase their market share globally. According to Fairfield Market Research, additional market consolidation is also anticipated in the upcoming years.

Who are the Leaders in the Global Egg Replacement Ingredients Space?

- Corbion NV

- Glanbia Plc

- Tate & Lyle Plc

- Ingredion Incorporated

- Ener-G Foods, Inc.

- Natural Products, Inc.

- Orchard Valley Foods

- Puratos Group

- Solazyme, Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- The Scoular Company

- Kerry Group

- Califia Farms

- Sodexo Group

Significant Company Developments

New Product Launches

- November 2021: Piperleaf announced the launch of the egg substitute Eggishh in India. Products made with the pre-mixed plant-based egg substitute have a longer shelf life than those made with liquid plant-based eggs because they are easily accessible. The Piperleaf website currently supports English, but more Indian e-commerce companies will soon help it as well.

- July 2021: The Canadian food technology business Nabati Foods launched ‘The First Canadian-made plant-based eggs substitute’. The soy, gluten, and cholesterol-free liquid egg substitute is offered for sale under the brand name Nabati Plant Eggz. Additionally, it has a lot of protein, fibre, and vitamin B12.

- January 2020: Noblegen launched ‘the egg’, a whole egg powder made from plants, as its first consumer product. It offers the same amount of protein as an egg while being vegan-friendly, cholesterol-free, and low in calories.

Distribution Agreements

- July 2021: Japanese food technology company Next Meats added a new egg replacement called Next Egg 1.0 to its lineup of alternative proteins. The 100% vegan replacement for eggs will soon be available in Japan via B2B channels.

- July 2021: the Canadian plant food manufacturer Nabati Foods created pure vegan eggs using lupin beans, the yellow-coloured legume seeds popular in Latin America as a snack food. Nabati Plant Eggz is the name of the eggs. The business is also submitting patent applications for its recently created product in the US, Canada, and Australia. High levels of protein, fibre, vitamin B12, vitamin E, and vitamin A are also present in the product.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, food manufacturers can enter new market niches and price-sensitive sectors thanks to affordable alternatives. The sales and market share that result from this growth may rise.

Furthermore, Cost-effective egg substitute components can solve issues with the long-term viability of the food industry from both an economic and environmental standpoint. Cost-cutting for ingredients can help provide more consumer-friendly pricing.

However, the egg replacement ingredients market is expected to face considerable challenges because of taste and texture challenges.

Supply Side of the Market

According to our analysis, the main supplier of ingredients for egg substitutes in North America is the United States. There are numerous large food ingredient companies as well as specialty egg replacement ingredient producers with headquarters in the country, including Ingredion, Cargill, Archer Daniels Midland (ADM), Tate & Lyle, Ener-G Foods, Bob's Red Mill, and Just Egg. Compared to the US, Canada is a smaller provider of ingredients for egg substitutes, but its influence is expanding.

ADM, and Tate & Lyle are a few of the key suppliers of egg replacement ingredients in Canada. In North America, the United States consumes more egg replacement ingredients than any other country, with over 50% of the market share in 2022.

The increased popularity of vegan and vegetarian diets, the prevalence of egg allergies, and the growing understanding of the environmental advantages of employing egg replacement ingredients are all factors contributing to the rise of the US market.

In Europe, the United Kingdom consumes more egg replacement ingredients than any other country, with over 25% of the market share in 2022. The UK market is expanding because of rising egg allergies, vegetarian and vegan diet demand, and public awareness of the environmental advantages of utilizing substances that substitute for eggs.

Global Egg Replacement Ingredients Market is Segmented as Below:

By Ingredients:

- Starch

- Milk Protein Formulation

- Soy Products

- Algal Flour

- Proteins

- Others

By Application:

- Chocolates

- Biscuits & Cookies

- Cakes/Pastries/Muffins/Bread

- Mayonnaise

- Noodles & Pasta

- Others

By End User:

- Commercial

- Household

By Form:

- Liquid

- Powder

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Egg Replacement Ingredients Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Egg Replacement Ingredients Market Outlook, 2018 - 2030

3.1. Global Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Starch

3.1.1.2. Milk Protein Formulation

3.1.1.3. Soy Products

3.1.1.4. Algal Flour

3.1.1.5. Proteins

3.1.1.6. Others

3.2. Global Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Chocolates

3.2.1.2. Biscuits & Cookies

3.2.1.3. Cakes/Pastries/Muffins/Bread

3.2.1.4. Mayonnaise

3.2.1.5. Noodles & Pasta

3.2.1.6. Others

3.3. Global Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Commercial

3.3.1.2. Household

3.4. Global Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Liquid

3.4.1.2. Powder

3.5. Global Egg Replacement Ingredients Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Egg Replacement Ingredients Market Outlook, 2018 - 2030

4.1. North America Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Starch

4.1.1.2. Milk Protein Formulation

4.1.1.3. Soy Products

4.1.1.4. Algal Flour

4.1.1.5. Proteins

4.1.1.6. Others

4.2. North America Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Chocolates

4.2.1.2. Biscuits & Cookies

4.2.1.3. Cakes/Pastries/Muffins/Bread

4.2.1.4. Mayonnaise

4.2.1.5. Noodles & Pasta

4.2.1.6. Others

4.3. North America Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Commercial

4.3.1.2. Household

4.4. North America Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Liquid

4.4.1.2. Powder

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Egg Replacement Ingredients Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Egg Replacement Ingredients Market Outlook, 2018 - 2030

5.1. Europe Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Starch

5.1.1.2. Milk Protein Formulation

5.1.1.3. Soy Products

5.1.1.4. Algal Flour

5.1.1.5. Proteins

5.1.1.6. Others

5.2. Europe Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Chocolates

5.2.1.2. Biscuits & Cookies

5.2.1.3. Cakes/Pastries/Muffins/Bread

5.2.1.4. Mayonnaise

5.2.1.5. Noodles & Pasta

5.2.1.6. Others

5.3. Europe Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Commercial

5.3.1.2. Household

5.4. Europe Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Liquid

5.4.1.2. Powder

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Egg Replacement Ingredients Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Egg Replacement Ingredients Market Outlook, 2018 - 2030

6.1. Asia Pacific Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Starch

6.1.1.2. Milk Protein Formulation

6.1.1.3. Soy Products

6.1.1.4. Algal Flour

6.1.1.5. Proteins

6.1.1.6. Others

6.2. Asia Pacific Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Chocolates

6.2.1.2. Biscuits & Cookies

6.2.1.3. Cakes/Pastries/Muffins/Bread

6.2.1.4. Mayonnaise

6.2.1.5. Noodles & Pasta

6.2.1.6. Others

6.3. Asia Pacific Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Commercial

6.3.1.2. Household

6.4. Asia Pacific Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Liquid

6.4.1.2. Powder

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Egg Replacement Ingredients Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Egg Replacement Ingredients Market Outlook, 2018 - 2030

7.1. Latin America Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Starch

7.1.1.2. Milk Protein Formulation

7.1.1.3. Soy Products

7.1.1.4. Algal Flour

7.1.1.5. Proteins

7.1.1.6. Others

7.2. Latin America Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Chocolates

7.2.1.2. Biscuits & Cookies

7.2.1.3. Cakes/Pastries/Muffins/Bread

7.2.1.4. Mayonnaise

7.2.1.5. Noodles & Pasta

7.2.1.6. Others

7.3. Latin America Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Commercial

7.3.1.2. Household

7.4. Latin America Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Liquid

7.4.1.2. Powder

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Egg Replacement Ingredients Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Egg Replacement Ingredients Market Outlook, 2018 - 2030

8.1. Middle East & Africa Egg Replacement Ingredients Market Outlook, by Ingredients, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Starch

8.1.1.2. Milk Protein Formulation

8.1.1.3. Soy Products

8.1.1.4. Algal Flour

8.1.1.5. Proteins

8.1.1.6. Others

8.2. Middle East & Africa Egg Replacement Ingredients Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Chocolates

8.2.1.2. Biscuits & Cookies

8.2.1.3. Cakes/Pastries/Muffins/Bread

8.2.1.4. Mayonnaise

8.2.1.5. Noodles & Pasta

8.2.1.6. Others

8.3. Middle East & Africa Egg Replacement Ingredients Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Commercial

8.3.1.2. Household

8.4. Middle East & Africa Egg Replacement Ingredients Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Liquid

8.4.1.2. Powder

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Egg Replacement Ingredients Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Egg Replacement Ingredients Market by Ingredients, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Egg Replacement Ingredients Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Egg Replacement Ingredients Market, by End User, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Egg Replacement Ingredients Market, by Form, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Ingredient/Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Corbion NV

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Glanbia Plc

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Tate & Lyle Plc

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Ingredion Incorporated

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Ener-G Foods, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Natural Products, Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Orchard Valley Foods

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Puratos Group

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Solazyme, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Archer Daniels Midland Company

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Cargill, Incorporated

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. The Scoular Company

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Kerry Group

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Califia Farms

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Sodexo Group

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Ingredient Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Form Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |