Global Fabric Softener Market Forecast

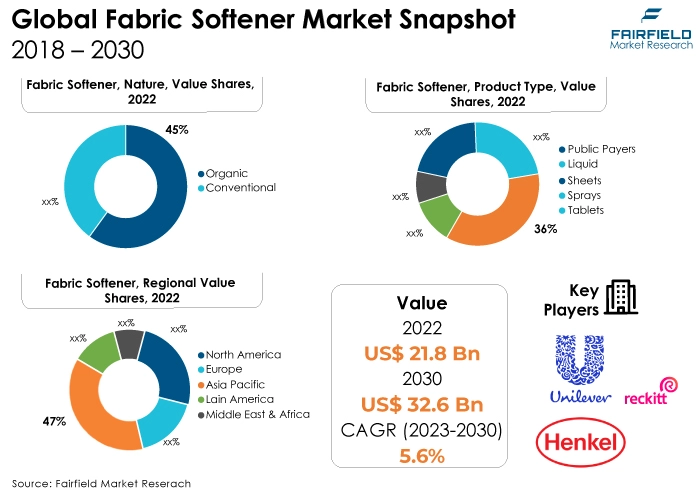

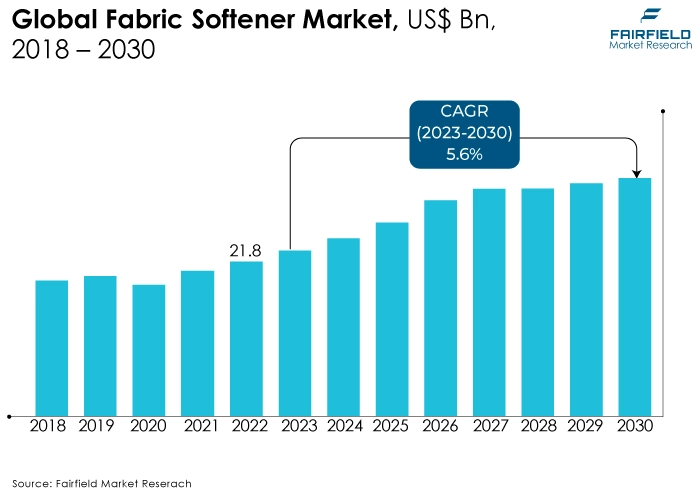

- Global market for fabric softeners worth US$21.8 Bn in 2023 projected to reach US$32 Bn by 2030

- Fabric softener market poised to exhibit a CAGR of 5.6% between 2023 and 2030

Quick Report Digest

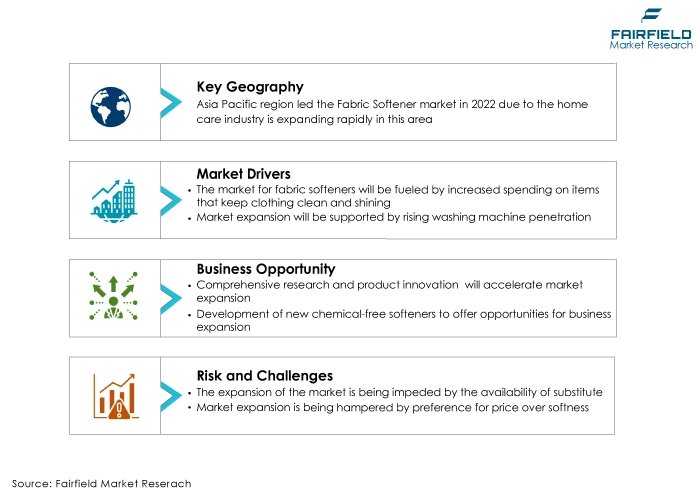

- The key trend anticipated to fuel the fabric softener market growth is increased spending on items that keep clothing clean and shining, which is rising among consumers. In addition, washing machine penetration is rising. Furthermore, customers spend money on high-end goods and select those that best meet their unique needs.

- Another major market trend expected to fuel the fabric softener market growth is that key businesses are boosting their brands to differentiate themselves from the competition while demand for eco-friendly fabric softeners is increasing.

- In 2022, the organic category dominated the industry. Consumers are increasingly more interested in eco-friendly and organic laundry care products, boosting demand for organic fabric softeners and conditioners with a lower environmental effect.

- In terms of market share for fabric softeners globally, the liquid segment is anticipated to dominate due to their potency, simplicity of application, and capacity to provide a longer scent. The liquid form of fabric softeners, made of natural components and safe for sensitive skin, attracts customers who are willing to pay more.

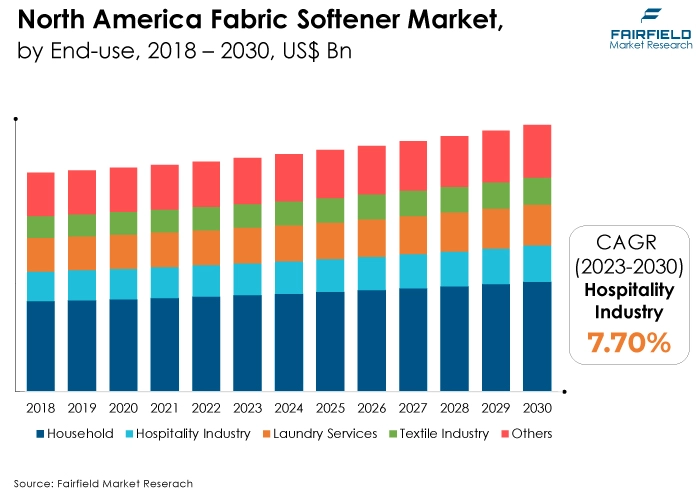

- In 2022, the household category controlled the market. The hospitality sector requires clean, stain-free towels, bed sheets, and other items. These factors are expected to boost industry demand for fabric softener and conditioner.

- The specialty retail store category for fabric softeners is highly prevalent. Consumers seeking a larger selection of specialised fabric softeners or assistance from knowledgeable staff may benefit from visiting specialty retail establishments.

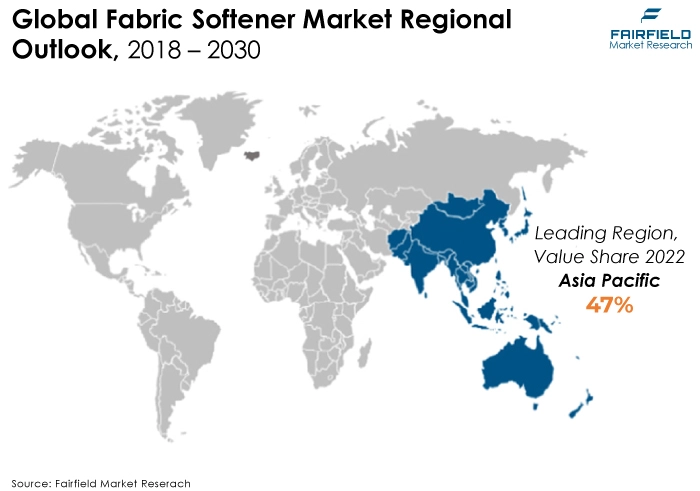

- The Asia Pacific region is anticipated to account for the largest share of the global fabric softener market, and the home care industry is expanding rapidly in this area, which in turn is driving up demand for fabric softeners and conditioners.

- The market for fabric softeners is expanding in North America due to the US, and Canada's large working population concentration and high disposable income. With the help of its two brands, Bounce and Downy, Proctor & Gamble it held a market share of more than 50% in the US.

A Look Back and a Look Forward - Comparative Analysis

The market for fabric softeners has grown in popularity due to factors such as the growing need for biodegradable products due to worries about using chemicals, such as quaternary ammonium compounds, which can cause skin problems. Manufacturers are expected to be encouraged by this factor to spend on R&D and introduce novel products.

The market witnessed staggered growth during the historical period 2018 - 2023. This is because an increasing number of customers are using internet platforms to purchase goods. The high convenience factor of eCommerce channels is driving global sales and distribution of fabric softeners.

The growing emphasis on developing chemical-free softeners that pose no health hazards to humans creates opportunities for established and new market participants. To attract many consumers, fabric softener market participants adopt innovative package styles, contributing to market growth throughout the projection period.

Key Growth Determinants

- Increasing Consumer Preference for Soft, Aromatic, and Well-Kept Apparel

Consumers are becoming more aware of the advantages of fabric softeners, such as reduced fabric wear and tear, wrinkle prevention, and adding a nice aroma to clothing. There is an increasing demand for premium fabric softeners that provide extra benefits, such as being created with natural components, being hypoallergenic, or being developed for specific materials.

Furthermore, people are increasingly seeking products personalised to their specific requirements. This will lead to more personalised fabric softeners, such as those developed for certain materials or skin types.

- Growing Inclination Toward Urban Lifestyle

The use of laundry care products, such as fabric softeners and conditioners, has increased due to the expanding urban population and the increase in dual-income households. People who relocate to cities typically live in smaller apartments with less room for hanging things to dry. This results in a greater need for fabric softeners, which maintain clothes' softness and eliminate static electricity.

Urbanites also tend to frequently have less time to straighten their garments due to their hectic lifestyles. Time and effort can be saved by using fabric softeners to help make clothing wrinkle-free.

- Shifting Standards of Living, and a Growing Preference for Easy Fixes

The demand for washing machines has increased significantly in the global market due to shifting living standards and consumers' growing preference for simple solutions. Due to the expanding middle class, increased disposable incomes, and changing lifestyles, developing nations are especially noticing this trend.

For instance, after lockout limitations were lifted, washing machine sales in India saw a notable surge of more than 24% in units sold through retail stores and online channels. In the upcoming years, the demand for washing machines is anticipated to propel the consumption of related products, such as dryer sheets with fabric softener.

Major Growth Barriers

- Availability of Substitute Products for Fabric Care

The emergence of alternative fabric care products like wool dryer balls, aroma boosters, and dryer sheets reduces the market share of fabric softeners. These solutions frequently provide similar advantages, like softening fabrics and lowering static, but they do not require an extra laundry step.

Eco-friendly and mild substitutes for conventional fabric softeners are becoming increasingly popular among consumers. The market for fabric softeners is anticipated to continue declining as the market for alternative fabric care products grows.

- Sustained Preference for Price over Softness

Cost savings often take precedence over fabric conditioners' advantages in areas with high prices. In order to prolong the product's lifespan, they can decide not to buy these things or only use them occasionally. This limits the size and potential expansion of the market overall by causing low consumption and a slower adoption rate in certain areas.

Key Trends and Opportunities to Look at

- Comprehensive Research, and Product Innovations

New fabric conditioner producers can use several tactics to increase revenue and build a solid brand. By providing distinctive features or formulations that stand out in the market, new competitors might set themselves apart with their products. This could involve eco-friendly and hypoallergenic choices, creative packaging, or specialised fabric conditioners for particular fabrics. Developing a unique selling proposition (USP) can draw customers to search for improved, novel products.

- Development of New Chemical-free Softeners

Cationic surfactants, which coat fabric fibers to make them feel softer and less static clinging, are commonly found in traditional fabric softeners. But these substances may be bad for our health and the environment. They may even interfere with hormone function, irritate skin, and contaminate rivers. This is the reason why interest in natural alternatives is rising.

- Growing Consumer Demand for Upscale and Luxury Fabric Softeners

Mass-market fabric softeners are less beneficial than these and are usually created with higher-quality components. Top-tier fabric softeners are known for having several well-liked properties. These include Good-quality smells that linger for weeks and are frequently used in premium fabric softeners. These perfumes are commonly manufactured with natural ingredients like aloe vera, plant extracts, and essential oils.

How Does the Regulatory Scenario Shape this Industry?

Each country has a different set of regulations governing fabric softeners. The Food and Drug Administration (FDA) is in charge of regulating fabric softeners in the US. The FDA has limited the amounts of specific substances used in fabric softeners. Regulations about fabric softeners are also in place inside the European Union (EU).

The FDA has fewer rules than the EU. The use of some substances considered hazardous to the environment or human health, for instance, is prohibited by EU legislation. The Bureau of Indian Standards (BIS) regulates the regulatory environment for fabric softeners in India. The BIS has established guidelines for the quality and safety of fabric softeners, such as the BIS IS 10479:2013 specification for fabric softeners.

Fairfield’s Ranking Board

Top Segments

- Organic Softeners Dominate as Consumer Show Greater Preference for Eco-friendly Laundry Care Solutions

The organic segment dominated the market in 2022. Customers prefer eco-friendly and organic laundry care solutions since they have a lower environmental impact. Furthermore, numerous industry manufacturers focus more on organic ingredients in products such as coconut oil, olive oil, and others because they are efficient enough not to injure the washer's hands and do not bleach off colors from the cloth.

Furthermore, the conventional category is projected to experience the fastest market growth. These consist of artificial components like silicones and quaternary ammonium compounds. They may contain harsh chemicals that hurt the skin and harm the environment, but they are usually less expensive than organic softeners.

- Demand for Liquid Products Most Widespread

In 2022, the liquid category dominated the industry. Customers prefer softeners to prevent clothing fading, stretching, and gathering fuzz. Moreover, liquid conditioner increases garment durability by slowing down the yarn's strand mobility. Large detergent manufacturers have released machine-safe liquid fabric softeners. These goods are well-liked in the textile, hospitality, and residential sectors, as well as laundry services.

The sheets category is anticipated to grow substantially throughout the projected period. These products soften clothing, offer a calming scent, and help remove creases and static. Major companies in the market concentrate on developing new products to meet the growing demand. Henkel introduced dryer sheets in January 2016 under the New Snuggle Plus SuperFresh brand. The product's proprietary odor-eliminating technology ensures that garments stay soft and fresh for an extended period.

- Demand from Household Laundry Care Maximum

The household segment dominated the market in 2022. The demand for washing machines is greater in cities than in rural areas. Developing countries such as China, and India are expected to have a beneficial impact on market growth. From 2022 to 2029, total home washing machine sales in China are expected to rise 7%. Consumers' preference for fully automatic washing machines over semi-automatic goods increased demand for liquid softeners, and conditioners.

The hospitality industry category is expected to experience the fastest growth within the forecast time frame. This can be ascribed to the global expansion of cleaning services in the textile and hospitality industries. Towels, bed linen, and other supplies must be clean and stain-free in the hospitality sector. This element is expected to drive the industry's need for fabric softeners, and conditioners.

- Specialty Retail Stores Bring in the Highest Revenue

In 2022, the specialty retail stores category led the market growth. These stores specialise in certain goods, such as natural or organic products, or products for a specific consumer, such as babies or pets. They normally have a lesser product range than supermarkets, although they may provide more specialised or specialty items.

Moreover, the online category is expected to grow fastest in the fabric softener machine market during the forecast period. E-commerce has had a tremendous impact on the fabric softener and conditioner sector. Online platforms give consumers ease, a large product range, and the ability to compare costs, causing them to purchase online.

Regional Frontrunners

Asia Pacific Reigns Supreme, Growth of Hospitality Industry Crucial

Asia Pacific is likely to hold a dominant share in the fabric softener industry. Growing discretionary income, especially across the fast-developing nations like China, and India, is anticipated to be a positive aspect. The growing competition between regional and international firms also impacts the industry dynamics.

Strong local manufacturers like Karnataka Soaps & Detergents Ltd., and Jyothi Laboratories Ltd., among others, are expected to compete with Procter & Gamble and other major players in India. These manufacturers have entered the market through their extensive brand campaigns on social and e-media.

Sales Heighten in North America as Convenience Products Gain Momentum

The high percentage of the population in the working age group, and high disposable income is driving expansion in the North American fabric softener market. In the US, and Canada, a high concentration of working-age people, and discretionary money are anticipated to drive growth. Proctor & Gamble's two brands, Bounce, and Downy, allowed it to hold more than 50% of the American market share.

Furthermore, American consumers' fast-paced lifestyle is fueling the fabric conditioner market. Time-conscious American homes find these goods appealing since they reduce the time spent ironing, offering convenience.

Fairfield’s Competitive Landscape Analysis

The global fabric softener market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Fabric Softener Space?

- Procter & Gamble (P&G)

- Unilever

- Henkel

- Reckitt Benckiser Group plc

- C. Johnson & Son, Inc.

- Church & Dwight Co., Inc

- Colgate-Palmolive Company

- Kao Corporation

- Lion Corporation

- The Clorox Company

- Others

Significant Company Developments

New Product Launch

- September 2022: Three innovative "outdoorable" fabric conditioners were launched by Procter & Gamble under the Lenor brand. The company recently presented its revolutionary Solar Dry technology to highlight its dedication to creative solutions and draw a wider customer base for its "outdoorable" product line.

- May 2021: Devan expanded its range of bio-based textile finishes by adding two new items: fast-dry and bio-based fabric softeners. The supplementary items are consistent with the pledge to uphold circularity initiatives.

- July 2023: NEO Corporate Co., Ltd., a well-known Thai company recognised for its personal and household care products, unveiled its most recent goods, Fineline Concentrated Laundry Detergent Natural Origin 98% and Fineline Concentrated Fabric Softener Premium Organic. These solutions harness the power of natural substances by providing a novel and friendly fabric care experience.

Distribution Agreement

- June 2021: AlEn USA LLC expanded its offering with two new products: Ensueno Liquid Laundry Detergent and Ensueno Scent Booster Dryer Sheets. These solutions provide a complete laundry care solution and are available at select shops nationwide.

An Expert’s Eye

Demand and Future Growth

Consumers' increased disposable income and willingness to spend on premium items in developing nations and urbanisation are driving the expansion of several product categories such as fabric, softener, and conditioner.

Because the product matches customer requirements well, developing economies confronting water quality issues are projected to be at the forefront of market growth over the forecast period. An increase in the number of working women, urbanisation, a busy lifestyle, and an increase in e-Commerce activity has also spurred the market's expansion.

In other areas, lifestyles have improved, resulting in stylish lifestyles with rising disposable incomes, a major factor driving the growth of the fabric softener and conditioner market. However, the fabric softener market is expected to face considerable challenges because of other alternatives present in the market.

Supply Side of the Market

According to our analysis, manufacturers in the fabric softener market are focusing on developing fabric softeners for household purposes. For instance, in July 2023, Presenting their newest goods, Fineline Concentrated Fabric Softener Premium Organic, and Fineline Concentrated Laundry Detergent Natural Origin 98%, is NEO Corporate Co., Ltd., a well-known Thai company known for its home and personal care products. These solutions are designed to provide a novel and soothing experience for fabric care by harnessing the power of natural substances.

Global Fabric Softener Market is Segmented as Below:

By Nature:

- Organic

- Conventional

By Product Type:

- Tablets

- Dryer Bars

- Liquid

- Sheets

- Sprays

By End User:

- Household

- Hospitality Industry

- Laundry Services

- Textile Industry

- Others

By Sales Channel:

- Specialty Retail Stores

- Online Sales

- Company Website

- 3rd Party Online Sales

- Independent Retailers

- Hypermarkets

- Multi Brand Stores

- Supermarkets

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Fabric Softener Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Fabric Softener Market Outlook, 2018 - 2030

3.1. Global Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Organic

3.1.1.2. Conventional

3.2. Global Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Tablets

3.2.1.2. Dryer Bars

3.2.1.3. Liquid

3.2.1.4. Sheets

3.2.1.5. Sprays

3.3. Global Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Household

3.3.1.2. Hospitality Industry

3.3.1.3. Laundry Services

3.3.1.4. Textile Industry

3.3.1.5. Others

3.4. Global Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Specialty Retail Stores

3.4.1.2. Online Sales

3.4.1.3. Company Website

3.4.1.4. 3rd Party Online Sales

3.4.1.5. Independent Retailers

3.4.1.6. Hypermarkets

3.4.1.7. Multi Brand Stores

3.4.1.8. Supermarkets

3.5. Global Fabric Softener Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Fabric Softener Market Outlook, 2018 - 2030

4.1. North America Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Organic

4.1.1.2. Conventional

4.2. North America Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Tablets

4.2.1.2. Dryer Bars

4.2.1.3. Liquid

4.2.1.4. Sheets

4.2.1.5. Sprays

4.3. North America Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Household

4.3.1.2. Hospitality Industry

4.3.1.3. Laundry Services

4.3.1.4. Textile Industry

4.3.1.5. Others

4.4. North America Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Specialty Retail Stores

4.4.1.2. Online Sales

4.4.1.3. Company Website

4.4.1.4. 3rd Party Online Sales

4.4.1.5. Independent Retailers

4.4.1.6. Hypermarkets

4.4.1.7. Multi Brand Stores

4.4.1.8. Supermarkets

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Fabric Softener Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Fabric Softener Market Outlook, 2018 - 2030

5.1. Europe Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Organic

5.1.1.2. Conventional

5.2. Europe Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Tablets

5.2.1.2. Dryer Bars

5.2.1.3. Liquid

5.2.1.4. Sheets

5.2.1.5. Sprays

5.3. Europe Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Household

5.3.1.2. Hospitality Industry

5.3.1.3. Laundry Services

5.3.1.4. Textile Industry

5.3.1.5. Others

5.4. Europe Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Specialty Retail Stores

5.4.1.2. Online Sales

5.4.1.3. Company Website

5.4.1.4. 3rd Party Online Sales

5.4.1.5. Independent Retailers

5.4.1.6. Hypermarkets

5.4.1.7. Multi Brand Stores

5.4.1.8. Supermarkets

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Fabric Softener Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Fabric Softener Market Outlook, 2018 - 2030

6.1. Asia Pacific Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Organic

6.1.1.2. Conventional

6.2. Asia Pacific Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Tablets

6.2.1.2. Dryer Bars

6.2.1.3. Liquid

6.2.1.4. Sheets

6.2.1.5. Sprays

6.3. Asia Pacific Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Household

6.3.1.2. Hospitality Industry

6.3.1.3. Laundry Services

6.3.1.4. Textile Industry

6.3.1.5. Others

6.4. Asia Pacific Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Specialty Retail Stores

6.4.1.2. Online Sales

6.4.1.3. Company Website

6.4.1.4. 3rd Party Online Sales

6.4.1.5. Independent Retailers

6.4.1.6. Hypermarkets

6.4.1.7. Multi Brand Stores

6.4.1.8. Supermarkets

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Fabric Softener Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Fabric Softener Market Outlook, 2018 - 2030

7.1. Latin America Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Organic

7.1.1.2. Conventional

7.2. Latin America Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.2.1.1. Tablets

7.2.1.2. Dryer Bars

7.2.1.3. Liquid

7.2.1.4. Sheets

7.2.1.5. Sprays

7.3. Latin America Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Household

7.3.1.2. Hospitality Industry

7.3.1.3. Laundry Services

7.3.1.4. Textile Industry

7.3.1.5. Others

7.4. Latin America Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Specialty Retail Stores

7.4.1.2. Online Sales

7.4.1.3. Company Website

7.4.1.4. 3rd Party Online Sales

7.4.1.5. Independent Retailers

7.4.1.6. Hypermarkets

7.4.1.7. Multi Brand Stores

7.4.1.8. Supermarkets

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Fabric Softener Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Fabric Softener Market Outlook, 2018 - 2030

8.1. Middle East & Africa Fabric Softener Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Organic

8.1.1.2. Conventional

8.2. Middle East & Africa Fabric Softener Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Tablets

8.2.1.2. Dryer Bars

8.2.1.3. Liquid

8.2.1.4. Sheets

8.2.1.5. Sprays

8.3. Middle East & Africa Fabric Softener Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Household

8.3.1.2. Hospitality Industry

8.3.1.3. Laundry Services

8.3.1.4. Textile Industry

8.3.1.5. Others

8.4. Middle East & Africa Fabric Softener Market Outlook, by Sales Channel, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Specialty Retail Stores

8.4.1.2. Online Sales

8.4.1.3. Company Website

8.4.1.4. 3rd Party Online Sales

8.4.1.5. Independent Retailers

8.4.1.6. Hypermarkets

8.4.1.7. Multi Brand Stores

8.4.1.8. Supermarkets

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Fabric Softener Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Fabric Softener Market by Nature, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Fabric Softener Market Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Fabric Softener Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Fabric Softener Market Sales Channel, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Unilever

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Henkel

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Reckitt Benckiser Group plc

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. S.C. Johnson & Son, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Church & Dwight Co., Inc

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Colgate-Palmolive Company

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Lion Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. The Clorox Company

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Product Type Coverage |

|

|

End User Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |