Global Fish Oil Market Forecast

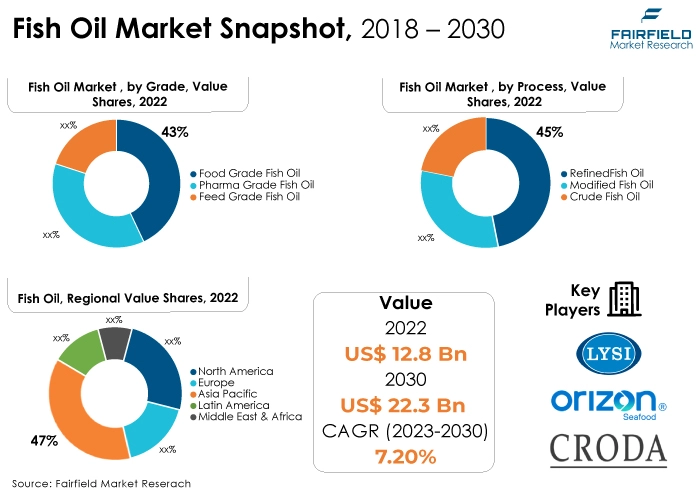

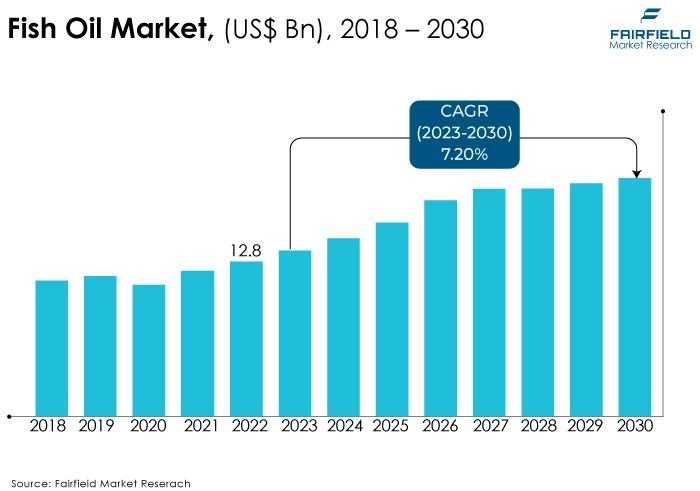

- The approximately US$12.8 Bn market for fish oil slated to reach a valuation of US$22.3 Bn by 2030

- Fish oil market valuation likely to observe a robust CAGR of 7.2% between 2023 and 2030

Quick Report Digest

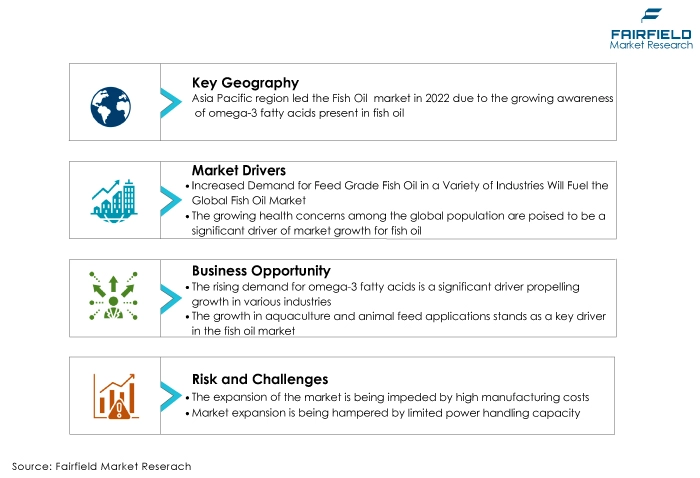

- The key trend anticipated to fuel the fish oil market growth is that consumer awareness about the health benefits of omega-3 fatty acids found in fish oil has significantly boosted demand. Omega-3 fatty acids are associated with heart health, brain function, and reducing inflammation, driving a growing consumer base seeking these health benefits.

- Another major market trend expected to fuel the fish oil market growth is the rising concerns about lifestyle diseases such as cardiovascular disorders, diabetes, and obesity have led to an increased focus on preventive healthcare. Fish oil is viewed as a natural and effective supplement to mitigate these health issues, thereby driving market growth.

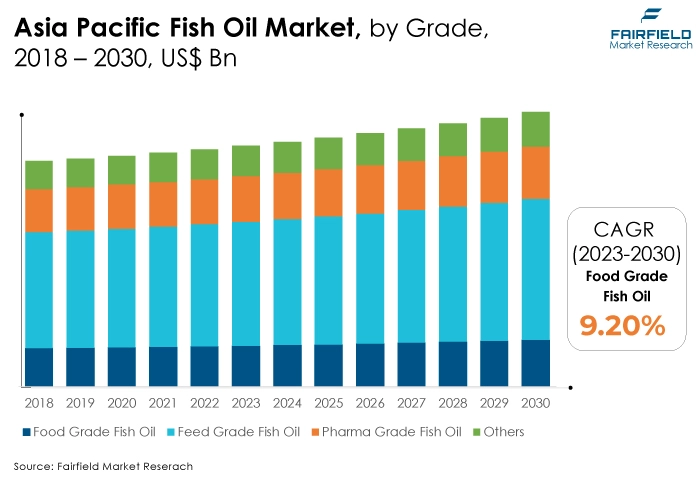

- In 2022, the feed-grade fish oil category dominated the industry. The aquaculture and animal feed sectors are major consumers of feed-grade fish oil, utilizing it as a key ingredient in aquafeed to support the growth and health of farmed aquatic animals.

- In terms of market share for fish oil globally, the refined fish oil segment is anticipated to dominate. Refined fish oil undergoes extensive purification processes, resulting in a high-quality product that meets rigorous industry standards for purity and composition. This refined form of fish oil is widely sought after across various industries, including nutraceuticals, pharmaceuticals, food and beverages, and cosmetics.

- In 2022, the salmon oil category controlled the market. Salmon oil has historically been a significant and influential category within the fish oil market. Salmon oil is highly regarded for its rich content of omega-3 fatty acids, specifically eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), which offer numerous health benefits. The oil is primarily sourced from salmon, a species of fish widely known for its nutritional value and omega-3 content.

- The aqua feed category is highly prevalent in the market for fish oil market. Aqua feed, especially for marine and freshwater species in aquaculture, is a significant consumer of fish oil. The aquaculture industry has experienced remarkable growth to meet the rising global demand for seafood.

- The Asia Pacific region is anticipated to account for the largest share of the global fish oil market, owing to various technological factors such as economic conditions. The region is a hub for aquaculture, experiencing significant growth due to the rising demand for seafood driven by its large and growing population.

- The market for fish oil is expanding in North America due to rapid economic growth, and technological advancements. The region's robust economic development has increased disposable incomes and improved living standards, enabling more consumers to afford health supplements and nutritional products, whereas fish oil holds a significant position due to its recognized health benefits.

A Look Back and a Look Forward - Comparative Analysis

The fish oil market is experiencing significant growth driven by several factors. Historically, the market has seen substantial growth, primarily fuelled by the increasing awareness of the health benefits associated with omega-3 fatty acids. Omega-3s are recognized for their positive impacts on heart health, brain function, and overall well-being. This awareness drove the demand for fish oil in dietary supplements, pharmaceuticals, functional foods, and the aquaculture industry.

The market witnessed staggered growth during the historical period 2018 - 2022. Historically, the fish oil market has seen substantial growth, primarily fuelled by the increasing awareness of the health benefits associated with omega-3 fatty acids. Omega-3s are recognized for their positive impacts on heart health, brain function, and overall well-being. This awareness drove the demand for fish oil in dietary supplements, pharmaceuticals, functional foods, and the aquaculture industry.

The fish oil market is poised for substantial growth with a strong focus on sustainability, performance, and versatility. Sustainability will remain a key focus, with increased adoption of responsible fishing practices and certifications like MSC. The trend toward plant-based and alternative sources of omega-3s will likely continue, aligning with the growing interest in vegetarian and vegan diets.

Technological advancements may lead to improved extraction processes and higher-quality fish oil products. Additionally, personalized nutrition and the development of tailor-made fish oil products to suit individual health needs may become more prevalent.

Key Growth Determinants

- Mounting Demand for Feed Grade Fish Oil from Various End Users

The global fish oil market is set to experience a surge in growth, propelled by the heightened demand for advanced fish oil products across a diverse range of industries. Several key factors drive this demand.

Industries such as healthcare, pharmaceuticals, sports and athletics, military and defense, and veterinary care are increasingly recognizing the crucial role of advanced fish oil in facilitating quicker healing and minimizing complications.

The healthcare sector is especially witnessing a significant rise in surgical procedures and chronic wound cases due to a growing aging population and a rise in lifestyle-related diseases like diabetes and obesity.

- Food & Beverages will Spur Market Expansion

The food and beverages sector is positioned to drive the expansion of the fish oil market significantly. Fish oil, rich in omega-3 fatty acids, has gained prominence as a functional ingredient in a variety of food and beverage products. Consumer awareness of the health benefits associated with omega-3s, including heart health and cognitive development, is fueling the demand for products enriched with fish oil.

In the food industry, fish oil is incorporated into products such as functional foods, dairy products, infant formulas, and baked goods, providing a convenient way for consumers to meet their omega-3 intake. Additionally, the trend toward healthy and nutritious eating is amplifying the use of fish oil in food products, aligning with consumer preferences for natural, health-boosting ingredients.

- Increasing Health Concerns

The growing health concerns among the global population are poised to be a significant driver of market growth for fish oil. Omega-3 fatty acids, a key component of fish oil, are widely recognized for their various health benefits, including heart health, brain function, and anti-inflammatory properties.

As health issues such as cardiovascular diseases, obesity, diabetes, and cognitive disorders become prevalent, individuals are seeking ways to improve their overall well-being and mitigate health risks.

Major Growth Barriers

- Overfishing and Depletion of Fish Stocks

Overfishing occurs when fish are captured from the oceans or freshwater bodies at a rate faster than they can reproduce and replenish their populations naturally. This unsustainable practice threatens the balance of marine ecosystems and depletes the availability of fish species rich in oil, which are crucial for fish oil production.

Overfishing directly impacts the supply of fish, leading to a reduction in the availability of raw materials needed for fish oil production. As fish stocks decline, sourcing sufficient fish for fish oil becomes a challenge, limiting the market's ability to expand and meet the increasing demand for fish oil and its derivatives.

- Health Concerns and Misinformation

Health concerns and misinformation present significant hurdles to the expansion of the fish oil market. While fish oil is widely acknowledged for its numerous health benefits, there are apprehensions regarding potential contaminants like heavy metals and environmental pollutants present in fish and, consequently, in fish oil.

Consumers concerned about the purity and safety of fish oil, may hesitate to incorporate it into their diets, leading to reduced consumption.

Key Trends and Opportunities to Look at

- Rising Demand for Omega-3 Fatty Acids

The rising demand for omega-3 fatty acids is a significant driver propelling growth in various industries, particularly the health and wellness sector. Omega-3 fatty acids are essential polyunsaturated fats critical for human health, especially eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA). They play a vital role in supporting heart health brain function and reducing inflammation within the body.

Consumers are becoming increasingly health-conscious and are actively seeking products that offer health benefits. Omega-3 fatty acids, often sourced from fish oil, have gained immense popularity due to their proven advantages in maintaining cardiovascular health and cognitive well-being.

- Growth in Aquaculture and Animal Feed Applications

The growth in aquaculture and animal feed applications stands as a key driver in the fish oil market. The burgeoning global demand for seafood, driven by an increasing population and a growing preference for protein-rich diets, has significantly propelled the aquaculture industry.

Fish oil, known for its rich content of essential omega-3 fatty acids crucial for the growth and health of aquatic animals, particularly in early stages, has become a fundamental ingredient in aquafeed.

- Diversification of Omega-3 Sources

The diversification of omega-3 sources represents a notable trend in the fish oil market. Traditionally sourced from marine fish, particularly oily fish like salmon, sardines, and mackerel, omega-3 fatty acids are now being diversified to alternative sources to cater to various consumer preferences and sustainability concerns.

Algal oil, derived from microalgae, has emerged as a popular and sustainable source of omega-3s, particularly DHA. Algal oil not only addresses concerns related to overfishing and oceanic sustainability but also provides a vegetarian and vegan-friendly option for obtaining essential omega-3 fatty acids.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the regulatory environment has had a significant impact on how the fish oil market develops. The regulatory landscape significantly shapes the fish oil industry, dictating product quality, sustainability, and consumer safety. Regulations encompass stringent standards for purity, contaminants, and labeling accuracy to ensure that fish oil products meet established safety thresholds.

Moreover, there is a growing emphasis on sustainability and responsible sourcing, with many regions requiring adherence to eco-friendly fishing practices and certifications like the Marine Stewardship Council (MSC). Compliance with sustainability measures not only satisfies legal requirements but also aligns with consumer preferences for ethically sourced and environmentally friendly products.

As the industry advances, staying updated with evolving regulations and proactively aligning with sustainability standards is vital for market players to maintain compliance, gain consumer trust, and ensure a sustainable future for the fish oil market.

Fairfield’s Ranking Board

Top Segments

- Demand for Feed Grade Fish Oil Most Prominent

In the fish oil market, the feed-grade fish oil category continues to dominate over the traditional fish oil products category. The feed-grade fish oil category maintains its dominant position over the food-grade fish oil segment in the fish oil market. This dominance can be attributed to the significant demand for feed-grade fish oil in the aquaculture and animal feed industries.

Aquaculture, a rapidly growing sector, relies heavily on feed-grade fish oil due to its rich omega-3 fatty acid content, which is vital for the growth and health of farmed aquatic species.

Furthermore, the food-grade fish oil category is projected to experience the fastest market growth. This projection is substantiated by the increasing consumer awareness of the health benefits associated with omega-3 fatty acids found abundantly in fish oil.

Consumers are increasingly seeking healthier dietary options, leading to a surge in the demand for functional and fortified food products. Food-grade fish oil, with its rich omega-3 content, has become a crucial ingredient in a wide array of food and beverage products.

- Refined Fish Oil Sales Climb up

In 2022, the refined fish oil category dominated the industry. Refined fish oil, a high-quality and purified form of fish oil, is gaining traction due to its superior purity, reduced levels of contaminants, and better stability compared to crude fish oil. The refinement process involves rigorous purification, molecular distillation, and deodorization, resulting in a premium product that meets stringent industry standards and consumer expectations.

Consumers and industries are placing an increasing emphasis on the quality and safety of fish oil products, and refined fish oil perfectly aligns with these requirements.

The crude fish oil category is anticipated to grow substantially throughout the projected period. Crude fish oil, in its raw and unrefined state, serves as a valuable initial material in the production of various fish oil derivatives. Its significance lies in being a primary source of omega-3 fatty acids, viz., EPA and DHA, which are renowned for their health benefits.

Crude fish oil is typically obtained through the initial pressing or extraction of fish, containing essential nutrients that are further refined for various applications. One of the driving factors for the growth of the crude fish oil category is its extensive use in the aquaculture and animal feed sectors.

- Salmon Oil Segment Leads

The salmon oil segment dominated the market in 2022. Salmon oil, derived from salmon, is particularly sought after due to its high concentration of omega-3 fatty acids, including EPA and DHA. These essential fatty acids offer various health benefits, promoting heart health cognitive function, and reducing inflammation.

The increasing consumer awareness of the health advantages of omega-3s and the preference for natural and holistic healthcare solutions are driving the demand for salmon oil. It is widely used in dietary supplements, nutraceuticals, pharmaceuticals, and functional foods, contributing to its prominence in the fish oil market.

The krill oil category is expected to experience the fastest growth within the forecast time frame. Krill oil is derived from tiny crustaceans called krill, which are abundant in omega-3 fatty acids, primarily EPA and DHA. Krill oil has gained popularity due to its high bioavailability, powerful antioxidant properties, and its potential benefits for heart health, joint health, and brain function.

Consumers are increasingly attracted to krill oil as an alternative to traditional fish oil supplements due to its smaller dosage requirements and reduced risk of fishy aftertaste. The sustainable and eco-friendly aspect of krill harvesting also appeals to environmentally conscious consumers, aligning with their preferences for responsible sourcing and sustainability.

Regional Outlook

Asia Pacific Brings in the Maximum Revenue

Asia Pacific indeed continues to be a dominant and largest revenue-contributing region in the global fish oil market. The Asia Pacific region has witnessed a surge in health consciousness and a growing awareness of the nutritional benefits of omega-3 fatty acids present in fish oil. This has propelled the demand for fish oil not only in the traditional forms of seafood but also as supplements and additives in various food and beverage products.

The expanding aquaculture industry, driven by the rising demand for seafood, particularly in populous countries, further boosts the utilization of fish oil in aquafeed, solidifying the region's revenue contribution.

As sustainability practices gain traction and responsible sourcing becomes a priority, Asia Pacific is focusing on maintaining a steady and reliable supply of high-quality fish oil to meet the demands of both domestic and international markets.

North America All Set for Significant Growth

North America is anticipated to witness significant growth in the advanced fish oil products category during the forecast period in the fish oil market. The region is experiencing a surge in demand for high-quality feed-grade fish oil, primarily driven by the expanding aquaculture industry.

As the popularity of seafood consumption rises in North America, there is an increasing need to sustainably produce high-quality aquafeed to support the growth of farmed fish and other aquatic species.

Feed-grade fish oil, rich in omega-3 fatty acids, is a critical component of aquafeed, enhancing the overall nutritional profile and promoting healthy growth in farmed aquatic animals.

Furthermore, the growing awareness of the health benefits associated with omega-3 fatty acids among consumers is contributing to the demand for fish oil in animal nutrition. Not only is feed-grade fish oil essential for the aquaculture sector, but it is also gaining traction in poultry and swine feed, further fuelling its growth in North America.

F

F

Fairfield’s Competitive Landscape Analysis

The global fish oil market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Fish Oil Space?

- DSM Nutritional Products

- Croda International Plc

- Omega Protein Corporation (Now a subsidiary of Cooke Inc.)

- GC Rieber Oils

- Corpesca SA

- FMC Corporation

- Maruha Nichiro Corporation

- Orizon SA

- TripleNine Group A/S

- OLVEA Fish Oils

- Pelagia AS

- Complex International

- Arbee Biomarine Extracts Pvt. Ltd.

- BASF SE

- LYSI hf

Significant Company Developments

New Product Launches

- June 2022: DSM launched "Romega," a high-purity omega-3 fatty acid product. This product is designed to cater to the growing demand for omega-3 supplements.

- November 2023: Grøntvedt Biotech launches CETO3 for omega 3 and cetoleic acid products.

- June 2023: Nuseed Nutritional US Inc., a wholly-owned subsidiary of Nufarm Limited (ASX:NUF), welcomes the Norwegian Food Safety Authority's (NFSA) decision to grant the approval of Aquaterra® Omega-3 oil for use in fish feed applications.

Distribution Agreements

- May 2021: Organic Technologies Enters Distribution Agreement with Bioriginal for AlaskOmega Products In Europe.

- February 2020: Organic Technologies announces exclusive distribution agreement for alaskomega® omega-3 fish oil products in Europe with original europe / asia b.v.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the market demand for fish oil is expected to expand significantly. Rising consumer awareness of the health benefits associated with omega-3 fatty acids, such as supporting heart health and cognitive function, is a key driver propelling market demand.

Moreover, the expanding nutraceutical and functional food sectors, along with the burgeoning aquaculture industry's need for aquafeed, contribute significantly to this demand. Sustainability and responsible sourcing are becoming pivotal factors, steering consumers towards products derived from eco-friendly and ethically sourced fish oil.

Additionally, as research continues to unveil the diverse health benefits and applications of omega-3s, the market is likely to witness further growth, with an increasing focus on alternative sources like krill oil and algae-based supplements to meet evolving consumer preferences. Overall, the fish oil market is poised for promising growth, propelled by the intersection of health consciousness, sustainability, and advancements in nutritional science.

Supply Side of the Market

According to our analysis, the supply side of the fish oil market reflects a dynamic landscape characterized by fierce competition and rapid technological advancements. Firstly, the supply of fish oil is heavily dependent on the global catch and availability of fish species rich in oil, such as anchovy, mackerel, and salmon. Sustainable fishing practices and responsible sourcing play a pivotal role in ensuring a steady and reliable supply.

Additionally, advancements in processing technologies and extraction methods have enhanced production efficiency, enabling higher yields of fish oil from the raw material. The growth of the aquaculture industry has significantly impacted the supply side, as aquaculture operations require substantial amounts of fish oil for use in aquafeed to support the growth and health of farmed fish.

Furthermore, regulatory frameworks regarding fishing quotas, environmental policies, and quality standards also dictate the supply dynamics, ensuring that the fish oil available in the market meets required quality and safety standards. Overall, a balanced interplay of responsible sourcing, technological advancements, and regulatory compliance shapes the supply side of the fish oil market.

Global Fish Oil Market is Segmented as Below:

By Grade:

- Feed Grade Fish Oil

- Food Grade Fish Oil

- Pharma Grade Fish Oil

By Process:

- Crude Fish Oil

- Refined Fish Oil

- Modified Fish Oil

By Product:

- Salmon Oil

- Tuna Oil

- Cod Liver Oil

- Sardine Oil

- Squalene Oil

- Krill Oil

- Anchovy Oil

- Menhaden Oil

- Others

By End User:

- Aqua Feed

- Food & Beverages

- Dietary Supplements

- Cosmetics & Beauty Products

By Sales Channel:

- Offline Sales Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Store

- Other Sales Channel

- Online Sales Channel

- Company Website

- E-commerce Platform

- By Geographic Coverage:

- North America

- The U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Fish Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global In Fish Oil Market Outlook, 2018 - 2030

3.1. Global In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Feed Grade Fish Oil

3.1.1.2. Food Grade Fish Oil

3.1.1.3. Pharma Grade Fish Oil

3.2. Global In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Crude Fish Oil

3.2.1.2. Refined Fish Oil

3.2.1.3. Modified Fish Oil

3.3. Global In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Salmon Oil

3.3.1.2. Tuna Oil

3.3.1.3. Cod Liver Oil

3.3.1.4. Sardine Oil

3.3.1.5. Squalene Oil

3.3.1.6. Krill Oil

3.3.1.7. Anchovy Oil

3.3.1.8. Menhaden Oil

3.3.1.9. Others

3.4. Global In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. Aqua feed

3.4.1.2. Food & Beverages

3.4.1.3. Dietary Supplements

3.4.1.4. Cosmetics & Beauty Products

3.5. Global In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. Offline Sales Channel

3.5.1.1.1. Supermarkets/Hypermarkets

3.5.1.1.2. Departmental Stores

3.5.1.1.3. Convenience Store

3.5.1.1.4. Other Sales channel

3.5.1.2. Online Sales Channel

3.5.1.2.1. Company Website

3.5.1.2.2. E-commerce Platform

3.6. Global In Fish Oil Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America In Fish Oil Market Outlook, 2018 - 2030

4.1. North America In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Feed Grade Fish Oil

4.1.1.2. Food Grade Fish Oil

4.1.1.3. Pharma Grade Fish Oil

4.2. North America In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Crude Fish Oil

4.2.1.2. Refined Fish Oil

4.2.1.3. Modified Fish Oil

4.3. North America In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Salmon Oil

4.3.1.2. Tuna Oil

4.3.1.3. Cod Liver Oil

4.3.1.4. Sardine Oil

4.3.1.5. Squalene Oil

4.3.1.6. Krill Oil

4.3.1.7. Anchovy Oil

4.3.1.8. Menhaden Oil

4.3.1.9. Others

4.4. North America In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Aqua feed

4.4.1.2. Food & Beverages

4.4.1.3. Dietary Supplements

4.5. North America In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. Offline Sales Channel

4.5.1.1.1. Supermarkets/Hypermarkets

4.5.1.1.2. Departmental Stores

4.5.1.1.3. Convenience Store

4.5.1.1.4. Other Sales channel

4.5.1.2. Online Sales Channel

4.5.1.2.1. Company Website

4.5.1.2.2. E-commerce Platform

4.6. North America In Fish Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.6.1. Key Highlights

4.6.1.1. U.S. In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

4.6.1.2. U.S. In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

4.6.1.3. U.S. In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

4.6.1.4. U.S. In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

4.6.1.5. Canada In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

4.6.1.6. Canada In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

4.6.1.7. Canada In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

4.6.1.8. Canada In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe In Fish Oil Market Outlook, 2018 - 2030

5.1. Europe In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Feed Grade Fish Oil

5.1.1.2. Food Grade Fish Oil

5.1.1.3. Pharma Grade Fish Oil

5.2. Europe In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Crude Fish Oil

5.2.1.2. Refined Fish Oil

5.2.1.3. Modified Fish Oil

5.3. Europe In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Salmon Oil

5.3.1.2. Tuna Oil

5.3.1.3. Cod Liver Oil

5.3.1.4. Sardine Oil

5.3.1.5. Squalene Oil

5.3.1.6. Krill Oil

5.3.1.7. Anchovy Oil

5.3.1.8. Menhaden Oil

5.3.1.9. Others

5.4. Europe In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Aqua feed

5.4.1.2. Food & Beverages

5.4.1.3. Dietary Supplements

5.4.1.4. Cosmetics & Beauty Products

5.5. Europe In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Offline Sales Channel

5.5.1.1.1. Supermarkets/Hypermarkets

5.5.1.1.2. Departmental Stores

5.5.1.1.3. Convenience Store

5.5.1.1.4. Other Sales channel

5.5.1.2. Online Sales Channel

5.5.1.2.1. Company Website

5.5.1.2.2. E-commerce Platform

5.6. Europe In Fish Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.6.1. Key Highlights

5.6.1.1. Germany In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.2. Germany In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.3. Germany In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.4. Germany In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.5. U.K. In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.6. U.K. In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.7. U.K. In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.8. U.K. In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.9. France In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.10. France In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.11. France In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.12. France In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.13. Italy In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.14. Italy In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.15. Italy In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.16. Italy In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.17. Turkey In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.18. Turkey In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.19. Turkey In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.20. Turkey In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.21. Russia In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.22. Russia In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.23. Russia In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.24. Russia In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.1.25. Rest of Europe In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

5.6.1.26. Rest of Europe In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

5.6.1.27. Rest of Europe In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

5.6.1.28. Rest of Europe In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific In Fish Oil Market Outlook, 2018 - 2030

6.1. Asia Pacific In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Feed Grade Fish Oil

6.1.1.2. Food Grade Fish Oil

6.1.1.3. Pharma Grade Fish Oil

6.2. Asia Pacific In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Crude Fish Oil

6.2.1.2. Refined Fish Oil

6.2.1.3. Modified Fish Oil

6.3. Asia Pacific In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Salmon Oil

6.3.1.2. Tuna Oil

6.3.1.3. Cod Liver Oil

6.3.1.4. Sardine Oil

6.3.1.5. Squalene Oil

6.3.1.6. Krill Oil

6.3.1.7. Anchovy Oil

6.3.1.8. Menhaden Oil

6.3.1.9. Others

6.4. Asia Pacific In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Aqua feed

6.4.1.2. Food & Beverages

6.4.1.3. Dietary Supplements

6.4.1.4. Cosmetics & Beauty Products

6.5. Asia Pacific In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. Offline Sales Channel

6.5.1.1.1. Supermarkets/Hypermarkets

6.5.1.1.2. Departmental Stores

6.5.1.1.3. Convenience Store

6.5.1.1.4. Other Sales channel

6.5.1.2. Online Sales Channel

6.5.1.2.1. Company Website

6.5.1.2.2. E-commerce Platform

6.6. Asia Pacific In Fish Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.6.1. Key Highlights

6.6.1.1. China In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.2. China In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.3. China In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.4. China In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.1.5. Japan In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.6. Japan In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.7. Japan In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.8. Japan In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.1.9. South Korea In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.10. South Korea In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.11. South Korea In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.12. South Korea In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.1.13. India In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.14. India In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.15. India In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.16. India In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.1.17. Southeast Asia In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.18. Southeast Asia In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.19. Southeast Asia In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.20. Southeast Asia In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.1.21. Rest of Asia Pacific In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

6.6.1.22. Rest of Asia Pacific In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

6.6.1.23. Rest of Asia Pacific In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

6.6.1.24. Rest of Asia Pacific In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America In Fish Oil Market Outlook, 2018 - 2030

7.1. Latin America In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Feed Grade Fish Oil

7.1.1.2. Food Grade Fish Oil

7.1.1.3. Pharma Grade Fish Oil

7.2. Latin America In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Crude Fish Oil

7.2.1.2. Refined Fish Oil

7.2.1.3. Modified Fish Oil

7.3. Latin America In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Salmon Oil

7.3.1.2. Tuna Oil

7.3.1.3. Cod Liver Oil

7.3.1.4. Sardine Oil

7.3.1.5. Squalene Oil

7.3.1.6. Krill Oil

7.3.1.7. Anchovy Oil

7.3.1.8. Menhaden Oil

7.3.1.9. Others

7.4. Latin America In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Aqua feed

7.4.1.2. Food & Beverages

7.4.1.3. Dietary Supplements

7.4.1.4. Cosmetics & Beauty Products

7.5. Latin America In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Offline Sales Channel

7.5.1.1.1. Supermarkets/Hypermarkets

7.5.1.1.2. Departmental Stores

7.5.1.1.3. Convenience Store

7.5.1.1.4. Other Sales channel

7.5.1.2. Online Sales Channel

7.5.1.2.1. Company Website

7.5.1.2.2. E-commerce Platform

7.6. Latin America In Fish Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.6.1. Key Highlights

7.6.1.1. Brazil In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

7.6.1.2. Brazil In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

7.6.1.3. Brazil In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

7.6.1.4. Brazil In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

7.6.1.5. Mexico In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

7.6.1.6. Mexico In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

7.6.1.7. Mexico In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

7.6.1.8. Mexico In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

7.6.1.9. Argentina In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

7.6.1.10. Argentina In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

7.6.1.11. Argentina In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

7.6.1.12. Argentina In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

7.6.1.13. Rest of Latin America In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

7.6.1.14. Rest of Latin America In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

7.6.1.15. Rest of Latin America In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

7.6.1.16. Rest of Latin America In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa In Fish Oil Market Outlook, 2018 - 2030

8.1. Middle East & Africa In Fish Oil Market Outlook, by Grade, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Feed Grade Fish Oil

8.1.1.2. Food Grade Fish Oil

8.1.1.3. Pharma Grade Fish Oil

8.2. Middle East & Africa In Fish Oil Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Crude Fish Oil

8.2.1.2. Refined Fish Oil

8.2.1.3. Modified Fish Oil

8.3. Middle East & Africa In Fish Oil Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Salmon Oil

8.3.1.2. Tuna Oil

8.3.1.3. Cod Liver Oil

8.3.1.4. Sardine Oil

8.3.1.5. Squalene Oil

8.3.1.6. Krill Oil

8.3.1.7. Anchovy Oil

8.3.1.8. Menhaden Oil

8.3.1.9. Others

8.4. Middle East & Africa In Fish Oil Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Aqua feed

8.4.1.2. Food & Beverages

8.4.1.3. Dietary Supplements

8.4.1.4. Cosmetics & Beauty Products

8.5. Middle East & Africa In Fish Oil Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. Offline Sales Channel

8.5.1.1.1. Supermarkets/Hypermarkets

8.5.1.1.2. Departmental Stores

8.5.1.1.3. Convenience Store

8.5.1.1.4. Other Sales channel

8.5.1.2. Online Sales Channel

8.5.1.2.1. Company Website

8.5.1.2.2. E-commerce Platform

8.6. Middle East & Africa In Fish Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.6.1. Key Highlights

8.6.1.1. GCC In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

8.6.1.2. GCC In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

8.6.1.3. GCC In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

8.6.1.4. GCC In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

8.6.1.5. South Africa In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

8.6.1.6. South Africa In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

8.6.1.7. South Africa In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

8.6.1.8. South Africa In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

8.6.1.9. Egypt In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

8.6.1.10. Egypt In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

8.6.1.11. Egypt In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

8.6.1.12. Egypt In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

8.6.1.13. Nigeria In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

8.6.1.14. Nigeria In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

8.6.1.15. Nigeria In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

8.6.1.16. Nigeria In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

8.6.1.17. Rest of Middle East & Africa In Fish Oil Market by Grade, Value (US$ Bn), 2018 - 2030

8.6.1.18. Rest of Middle East & Africa In Fish Oil Market Process, Value (US$ Bn), 2018 - 2030

8.6.1.19. Rest of Middle East & Africa In Fish Oil Market Product, Value (US$ Bn), 2018 - 2030

8.6.1.20. Rest of Middle East & Africa In Fish Oil Market End User, Value (US$ Bn), 2018 - 2030

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Product Heatmap

9.2. Process vs Product Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. DSM Nutritional Products

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Croda International Plc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Omega Protein Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. GC Rieber Oils

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Corpesca SA

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. FMC Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Maruha Nichiro Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Orizon SA

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. TripleNine Group A/S

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. OLVEA Fish Oils

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Pelagia AS

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Colpex International

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Arbee Biomarine Extracts Pvt. Ltd.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. BASF SE

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. LYSI hf

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Grade Coverage |

|

|

Process Coverage |

|

|

Product Coverage |

|

|

End User Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |