Global Food Anti-Caking Agents Market Forecast

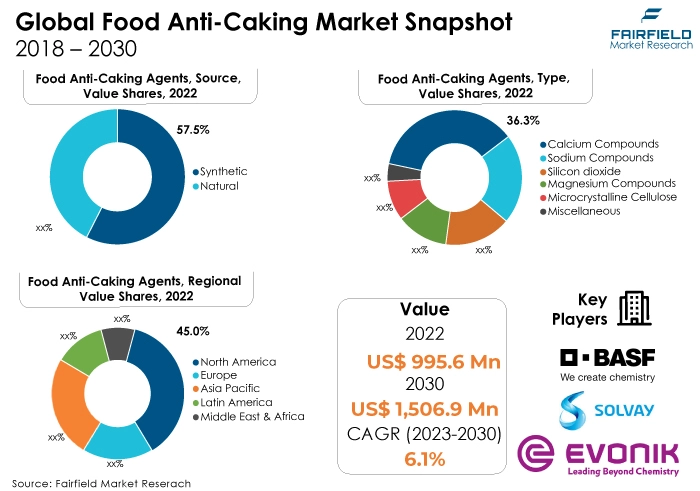

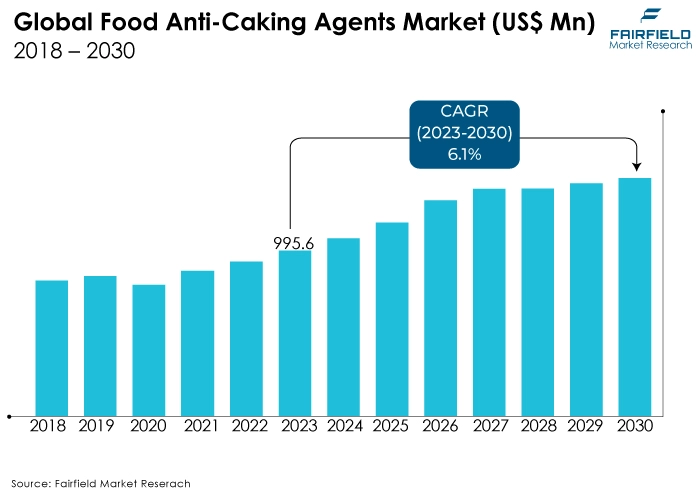

- Global food anti-caking agents market worth US$995.6 Mn in 2022 to reach US$1,506.9 Mn by 2030

- Market size likely to witness a CAGR of 6.1% over 2023 - 2030

Quick Report Digest

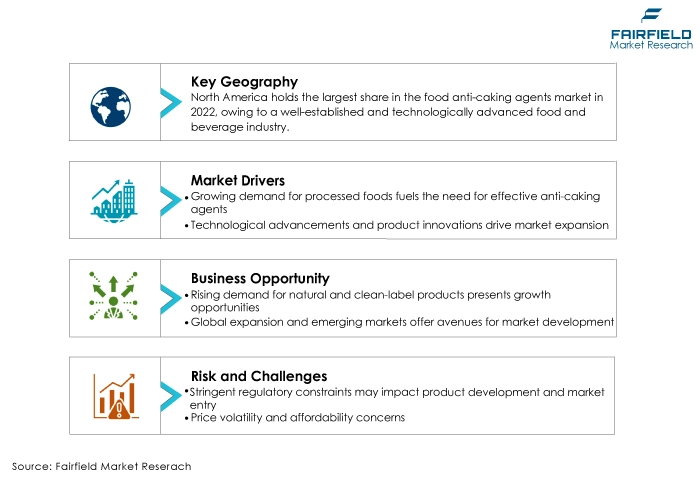

- The market for food anti-caking agents is being driven by consumers' growing inclination for processed foods and convenience. In order to fulfill the demands of the fast-paced modern lifestyle, these agents prevent clumping, ensuring the quality and flowability of powdered and granulated food products.

- Manufacturers are adding anti-caking agents to improve food formulas as public health awareness grows. By addressing nutritional concerns, these additives enable the decrease of salt and sugar content in products, in line with the trend of health-conscious consumers and supporting the expansion of the industry.

- The synthetic segment now dominates the market for food anti-caking agents due to its affordability, reliability, and increased availability. Because they provide dependable quality control, synthetic agents greatly aid in the expansion of the industry.

- Calcium compounds dominate the market for food anti-caking agents due to their broad applicability and adaptability to a wide range of food applications. Their affordability, efficacy, and regulatory approval all play a major role in the market dominance of this industry.

- Seasonings and condiments now dominate the market for food anti-caking agents because of their widespread usage in maintaining the flavour and consistency of spice mixes. The market is helped by the rising demand for tasty, quick food options throughout the world.

- The food anti-caking agents market is expanding at the quickest rate in the Asia Pacific area due to factors such as increasing urbanisation, shifting consumer preferences, and a rise in the demand for processed foods. The region's markets are expanding due in large part to rising disposable incomes and growing populations.

- In terms of market share for food anti-caking agents, North America dominates. The region's dominance is ascribed to strict quality requirements, a well-established food and beverage industry, and a significant demand for convenience meals. Sustaining market leadership also comes from a focus on food safety and ongoing product improvements.

- In terms of food anti-caking agents, Europe is the second-largest market. The area gains from a robust food processing industry, a diverse culinary culture, and an increased consciousness of food quality. Expanding consumer demand for natural and clean-label products combined with strict restrictions is driving the European market's steady expansion.

A Look Back and a Look Forward - Comparative Analysis

The market for food anti-caking agents is now expanding rapidly on a global scale due to rising consumer demand for convenience and processed foods. Synthetic anti-caking agents dominate the market because of their reliable and affordable performance. In particular, calcium compounds account for a sizable portion due to their adaptability and extensive use in a wide range of food products.

The top application segment is seasoning and condiments, which reflects the widespread tendency of culinary products to be enhanced in flavour. Asia Pacific is the market with the quickest rate of growth in terms of regional dynamics, driven by rising urbanisation and changing consumer tastes.

The market for food anti-caking agents has grown steadily over the last ten years, growing in tandem with the rise in the consumption of processed foods. The benefits in manufacturing and the cost-effectiveness of synthetic agents led to their rise in popularity. The type segmentation revealed a preponderance of calcium and salt compounds, indicating the industry's dependence on these useful additives.

With an increasing emphasis on maintaining the integrity of spice blends and boosting flavours in processed foods, the application landscape has changed. Due in large part to their established food processing industries and strict quality standards, North America, and Europe have become important marketplaces.

In the future, the market for food anti-caking agents is expected to expand due to the ongoing need for processed foods and changing customer tastes. The market is anticipated to be impacted by the move toward natural and clean-label products, with a greater emphasis on natural anti-caking ingredients. Technological and sustainable innovations will reshape the industry.

It is expected that Asia Pacific will continue to be the fastest-growing area, with North America and Europe playing crucial roles and placing more attention on product quality, safety, and regulatory compliance. The market's future course will be determined by striking a balance between customer demands, technical improvements, and sustainable food production methods.

Key Growth Determinants

- Expanding Market of Processed Foods

The market for food anti-caking agents is expanding due in large part to the growing preference for processed and convenience foods around the world. With the increasing trend of urbanisation and hectic lifestyles, customers are looking for quick and easy meal options. The demand for processed foods, such as packaged goods, snacks, and ready-to-eat meals, has increased.

Anti-caking agents are used by food manufacturers to keep powdered and granulated ingredients from clumping and to guarantee that they flow smoothly when employed in processed foods. These compounds help the finished products match consumer expectations for texture, flavour, and convenience while also improving their overall quality and appearance. Food anti-caking agents are anticipated to become more in demand as the processed food sector grows.

- Technological Advancements, and Product Innovations

Continuous product developments and ongoing technological advancements are major factors propelling the expansion of the food anti-caking agents market. In order to produce innovative formulations that specifically address issues in a variety of culinary applications, manufacturers are investing in research and development.

Creating anti-caking agents with greater solubility, increased functionality, and compatibility with a larger variety of components is one way to do this. Furthermore, developments in processing technology make it possible to produce anti-caking agents that satisfy clean-label and natural product specifications, in line with the changing demands of health-conscious consumers.

Companies are at the forefront of the market when they can customise anti-caking solutions to match unique industry needs and consumer requests. This promotes growth through product performance enhancement and differentiation.

- Growing Health Consciousness, and Clean-Label Trends

The need for clean-label products and healthy lifestyles around the globe is a major factor driving the food anti-caking agent market. Customers are looking for items with fewer agents and identifiable ingredients as they become more health-conscious. Manufacturers are reacting to this trend by creating natural anti-caking agents or changing current formulations to meet clean-label requirements.

Natural anti-caking compounds are becoming more and more popular as substitutes for their synthetic counterparts. Examples of these include extracts from plants or minerals. A demand for more healthy and natural products, as well as openness in food labeling, are the driving forces behind the trend toward clean-label solutions. The market's trajectory is anticipated to be shaped by the growing demand for food anti-caking agents that help create clearer labels as customers continue to place a premium on health and wellness.

Major Growth Barriers

- Regulatory Constraints, and Stringent Standards

The market for food anti-caking agents is significantly constrained by the existence of strict regulatory standards and changing compliance requirements. The use of food additives is coming under increased regulatory scrutiny, which forces businesses to traverse challenging clearance procedures.

Complying with these rules, which impose restrictions on additive concentrations and safety evaluations, complicates the process of developing new products and might restrict the application of specific anti-caking agents.

- Consumer Perception, and Negative Health Concerns

A major barrier to the market is consumer perception and worries about the possible health effects of food additives. Certain customers have raised concerns over the long-term health effects and safety of synthetic anti-caking agents. Purchase decisions may be influenced by false information or unfavourable opinions, which may cause a change in favour of natural and clean-label products.

To adapt to consumers' shifting desires for healthier and more transparent food options, manufacturers must address customer concerns through open communication, transparent labeling, and the development of natural anti-caking methods.

Key Trends and Opportunities to Look at

- Growing Demand for Natural and Clean-Label Products

The market for food anti-caking agents has much potential due to consumers' growing desire for natural and clean-label products. Growing consumer consciousness about health and well-being has led to a need for foods with few agents and identifiable ingredients.

By creating and marketing anti-caking products made from natural sources like plant extracts, minerals, or other clean-label substitutes, manufacturers can profit from this trend. Providing natural solutions gives market participants a way to stand out from the competition and capitalise on the growing market for health-conscious consumers. It also complies with consumer expectations for transparency and clean labels.

- Technological Advancements in Anti-Caking Solutions

Innovation in the creation of anti-caking Agents is made possible by the ongoing advancement of technology. The creation of anti-caking products with greater functionality and improved performance is made possible by advancements in formulation techniques, processing technologies, and component compatibility.

Possibilities include creating agents that solve particular problems in diverse food applications, like enhanced solubility, stability in a variety of settings, and compatibility with a wider range of ingredients. By allocating resources towards research and development, companies can generate cutting-edge anti-caking agents that fulfill the varied needs of the food sector and provide them a competitive advantage in the market.

- Emerging Markets

There are chances in the food anti-caking agents market due to the global food industry's expansion and the creation of new markets. The need for anti-caking compounds is rising as food processing activities expand internationally in order to preserve the quality of processed meals.

Manufacturers should look for prospects in developing nations where the food sector is expanding rapidly. Businesses may position themselves strategically to satisfy the growing need for anti-caking products and take advantage of the growing opportunities in the global food market by establishing a presence in these locations and learning about distinctive preferences and laws.

How Does the Regulatory Scenario Shape this Industry?

The market for food anti-caking agents is governed by strict regulations that control the use of additives in food items. Authorities that regulate, like the US to protect consumer health, the US FDA, and the European Food Safety Authority (EFSA) carry out safety evaluations and establish allowable limits for anti-caking agent use.

Manufacturers must abide by these standards, which call for careful recordkeeping, safety assessments, and adherence to predetermined concentration limits. Strict regulatory control works to ensure the quality and safety of food products by influencing the development and usage of food anti-caking agents and industry practices to fulfill safety and quality standards.

Fairfield’s Ranking Board

Top Segments

- Prominence of Synthetic Anti-Caking Agents Prevails

The synthetic segment dominates the market for food anti-caking agents because of its affordability, reliability, and accessibility. Artificial anti-caking agents provide dependable quality control by guaranteeing consistency and flowability in a range of food items. Producers choose synthetic alternatives due to their cost-effectiveness and adaptability, satisfying the needs of an expanding food sector that prioritises production and efficiency.

The natural segment of the food anti-caking agents market is expanding at the quickest rate as consumer preferences for clean-label and natural products continue to rise. Growing health consciousness has forced manufacturers to look into and invest in natural alternatives as consumers move away from synthetic additives.

The natural market responds to consumer demand for label transparency by providing anti-caking agents made from plant extracts, minerals, or other natural sources. The market's natural sector is expanding at a quick rate due to the desire for clean-label solutions.

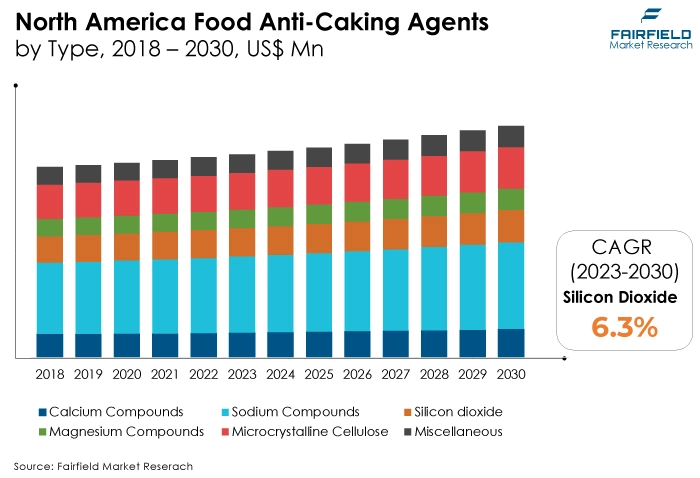

- Calcium Compounds Remain Most Reliable

Calcium compounds dominate the market for food anti-caking agents, owing to their versatility and broad use in a variety of food applications. Their dominance in the industry is largely due to their ability to prevent clumping and maintain product quality. Calcium compounds are preferred by businesses looking for dependable anti-caking solutions because of their versatility in meeting the needs of various industries, from dairy products to baked goods.

Silicon dioxide is the fastest-growing segment of the market for food anti-caking agents. This is primarily due to its expanding applications in the food industry and its multifunctional properties. Customers looking for clean-label options appreciate silicon dioxide because it is a natural anti-caking agent.

The capability of silicon dioxide to improve texture and inhibit clumping—especially in items that are powdered or granulated—makes it an advantageous option. The food and beverage industry's growing inclination toward using natural and minimally processed products is driving demand for silicon dioxide and facilitating its explosive rise in the market.

- Seasonings and Condiments Spearhead

Seasonings and condiments dominate the market for food anti-caking agents because of their widespread usage in maintaining the flavour and consistency of spice mixes. The global consumer demand for tasty and diverse culinary experiences is driving up demand for anti-caking agents in seasonings and condiments.

Producers depend on these ingredients to guarantee that spice blends flow freely, improving the products' overall sensory appeal and shelf-life and helping to maintain this application segment's supremacy in the market.

The market for food anti-caking agents is expanding at the quickest rate in the bakery segment, driven by the rising demand for baked goods worldwide. For dry components like flour and powdered additions used in bakery goods, anti-caking agents are essential to preserving their quality and homogeneity.

The necessity for efficient anti-caking solutions rises along with the expansion and diversification of the bread industry, propelling the explosive growth of this application segment. The bakery category is leading the way in market expansion due to the adaptability of anti-caking agents in meeting the unique needs of different baked items.

Regional Frontrunners

North America Eats up the Largest Revenue Share of Market Pie

North America dominates the market for food anti-caking agents due to its technologically advanced and firmly established food and beverage sector. The region's prominence is ascribed to a significant demand for processed foods, the preservation of which depends heavily on anti-caking agents.

Strict quality regulations and an emphasis on food safety in North America fuel the use of these compounds. Furthermore, the region's market has been growing steadily thanks to ongoing product advancements and a strong focus on convenience, which has made North America a significant player and contributor to the market's overall size.

Asian Markets Receive Tailwinds from Mounting Popularity of Convenience Foods

The market for food anti-caking agents is expanding at the quickest rate in the Asia Pacific area. The dynamic growth of the region is driven by various causes, including a surge in demand for processed and convenience foods, rising urbanisation, and altering consumer preferences.

Asia Pacific is becoming a major food product market due to rising disposable incomes and population growth, which is boosting the need for efficient anti-caking products. The growing food processing sector in the area also increases the need for these agents, establishing Asia Pacific as a major driver of the market's overall expansion.

Fairfield’s Competitive Landscape Analysis

The food anti-caking agents market is characterised by a dynamic competitive landscape that includes both established firms and innovative entrants. To obtain a competitive edge, major corporations prioritise technology innovations, product diversification, and strategic alliances. The environment is shaped by strict quality standards and a commitment to changing consumer demands, which promotes ongoing innovation and growth.

Who are the Leaders in the Global Food Anti-Caking Agents Space?

- Evonik Industries

- BASF SE

- Solvay SA

- PPG Industries

- Arkema

- Cabot Corporation

- Agropur Ingredients

- EP Minerals

- PQ Corporation

- Kemin Industries, Inc.

Significant Company Developments

Product launch

- December 2021: The Swiss ingredient manufacturer Omya developed Omyafood 120, an anti-caking agent to aid in the handling and processing of powders. Omyafood 120 is a non-nano anti-caking solution that offers a nano-free substitute for conventional flow aids like silica. It has high porosity, strong moisture-binding properties, and decreased mechanical interlocking.

- October 2021: Asiros Nordic, a European distributor of liquid extracts and powdered berry juice concentrates, has introduced a full range of BerryShield Juice Powders. The prebiotic component Sunfiber from Taiyo GmbH is used in the berry powders, completely replacing the need for maltodextrin.

Acquisition

- Nov 2023: Perfect Day, a provider of precision fermentation ingredients, successfully acquired Sterling Biotech Limited, an Indian company that is the sixth-largest gelatin manufacturer globally. Perfect Day will increase the number of goods in its portfolio in addition to its presence with the acquisition of additional properties in India. Pharmaceutical-grade gelatin, which is used to make capsules, and dicalcium phosphate, a calcium supplement that is also used in time-release pills and as an anti-caking ingredient in food, are both produced by Sterling Biotech. Perfect Day intends to retain all of the Sterling Biotech staff members and go on providing services to its current clientele.

Showcase

- August 2019: Omya will be exhibiting its mineral varieties at SupplySide West and CPhI Worldwide. During Vitafoods Asia 2019, KappaBioscience will present its 344-page LookBook. ACG Capsules has responded to consumer demand for clean labels by introducing a new line of HPMC capsules. Lastly, a US$10 million grant for cardiovascular health research from the NSW government has been awarded to academics at the University of Sydney.

An Expert’s Eye

Demand and Future Growth

The market for food anti-caking agents is expected to develop in the future due to consistent demand. The market for efficient anti-caking technologies is driven by consumers' growing preference for processed foods and the industry's adaptability to clean-label trends. Experts predict that the market will continue to grow due to advancements in both natural and technologically complex formulations.

The market is expected to grow as dietary trends and urbanisation of the world's population change, with Asia Pacific playing a key role. The emphasis on making healthier decisions and the pursuit of higher-quality products place food anti-caking agents in a position of significant influence in the dynamic and changing food sector.

Supply Side of the Market

According to our analysis, the food anti-caking agents industry is characterised by a strong network of manufacturers and suppliers on the supply side. Many businesses throughout the world are involved in the manufacturing and marketing of these agents, providing a variety of formulas to meet the demands of different industries.

A blend of well-established firms and up-and-coming creatives characterise the supply chain, creating rivalry and encouraging ongoing improvements in product offerings. Suppliers' primary areas of interest are procuring raw materials, production efficiency, and adherence to strict quality requirements. A growing need for specialist anti-caking technologies combined with changing market dynamics presents both possibilities and problems for the various supply-side players.

Global Food Anti-Caking Agents Market is Segmented as Below:

By Source:

- Synthetic

- Natural

By Type:

- Calcium Compounds

- Sodium Compounds

- Silicon dioxide

- Magnesium Compounds

- Microcrystalline Cellulose

- Miscellaneous

By Application:

- Seasoning & Condiments

- Dairy Products

- Bakery

- Soups & Sauces

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Food Anti-Caking Agents Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Food Anti-Caking Agents Market Outlook, 2018 - 2030

3.1. Global Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Synthetic

3.1.1.2. Natural

3.2. Global Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Calcium Compounds

3.2.1.2. Sodium Compounds

3.2.1.3. Silicon dioxide

3.2.1.4. Magnesium Compounds

3.2.1.5. Microcrystalline Cellulose

3.2.1.6. Miscellaneous

3.3. Global Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Seasoning & Condiments

3.3.1.2. Dairy Products

3.3.1.3. Bakery

3.3.1.4. Soups & Sauces

3.3.1.5. Miscellaneous

3.4. Global Food Anti-Caking Agents Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Food Anti-Caking Agents Market Outlook, 2018 - 2030

4.1. North America Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Synthetic

4.1.1.2. Natural

4.2. North America Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Calcium Compounds

4.2.1.2. Sodium Compounds

4.2.1.3. Silicon dioxide

4.2.1.4. Magnesium Compounds

4.2.1.5. Microcrystalline Cellulose

4.2.1.6. Miscellaneous

4.3. North America Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Seasoning & Condiments

4.3.1.2. Dairy Products

4.3.1.3. Bakery

4.3.1.4. Soups & Sauces

4.3.1.5. Miscellaneous

4.4. North America Food Anti-Caking Agents Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Food Anti-Caking Agents Market Outlook, 2018 - 2030

5.1. Europe Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Synthetic

5.1.1.2. Natural

5.2. Europe Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Calcium Compounds

5.2.1.2. Sodium Compounds

5.2.1.3. Silicon dioxide

5.2.1.4. Magnesium Compounds

5.2.1.5. Microcrystalline Cellulose

5.2.1.6. Miscellaneous

5.3. Europe Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Seasoning & Condiments

5.3.1.2. Dairy Products

5.3.1.3. Bakery

5.3.1.4. Soups & Sauces

5.3.1.5. Miscellaneous

5.4. Europe Food Anti-Caking Agents Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Food Anti-Caking Agents Market Outlook, 2018 - 2030

6.1. Asia Pacific Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Synthetic

6.1.1.2. Natural

6.2. Asia Pacific Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Calcium Compounds

6.2.1.2. Sodium Compounds

6.2.1.3. Silicon dioxide

6.2.1.4. Magnesium Compounds

6.2.1.5. Microcrystalline Cellulose

6.2.1.6. Miscellaneous

6.3. Asia Pacific Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Seasoning & Condiments

6.3.1.2. Dairy Products

6.3.1.3. Bakery

6.3.1.4. Soups & Sauces

6.3.1.5. Miscellaneous

6.4. Asia Pacific Food Anti-Caking Agents Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Food Anti-Caking Agents Market Outlook, 2018 - 2030

7.1. Latin America Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Synthetic

7.1.1.2. Natural

7.2. Latin America Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030 7.2.1. Key Highlights

7.2.1.1. Calcium Compounds

7.2.1.2. Sodium Compounds

7.2.1.3. Silicon dioxide

7.2.1.4. Magnesium Compounds

7.2.1.5. Microcrystalline Cellulose

7.2.1.6. Miscellaneous

7.3. Latin America Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Seasoning & Condiments

7.3.1.2. Dairy Products

7.3.1.3. Bakery

7.3.1.4. Soups & Sauces

7.3.1.5. Miscellaneous

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Food Anti-Caking Agents Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Food Anti-Caking Agents Market Outlook, 2018 - 2030

8.1. Middle East & Africa Food Anti-Caking Agents Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Synthetic

8.1.1.2. Natural

8.2. Middle East & Africa Food Anti-Caking Agents Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Calcium Compounds

8.2.1.2. Sodium Compounds

8.2.1.3. Silicon dioxide

8.2.1.4. Magnesium Compounds

8.2.1.5. Microcrystalline Cellulose

8.2.1.6. Miscellaneous

8.3. Middle East & Africa Food Anti-Caking Agents Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Seasoning & Condiments

8.3.1.2. Dairy Products

8.3.1.3. Bakery

8.3.1.4. Soups & Sauces

8.3.1.5. Miscellaneous

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Food Anti-Caking Agents Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Food Anti-Caking Agents Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Food Anti-Caking Agents Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Food Anti-Caking Agents Market Application, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Evonik Industries

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. BASF SE

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Solvay SA.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. PPG Industries.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Arkema.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Cabot Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Agropur Ingredients

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. EP Minerals

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. PQ Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Kemin Industries, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |