Global Healthcare Reimbursement Market Forecast

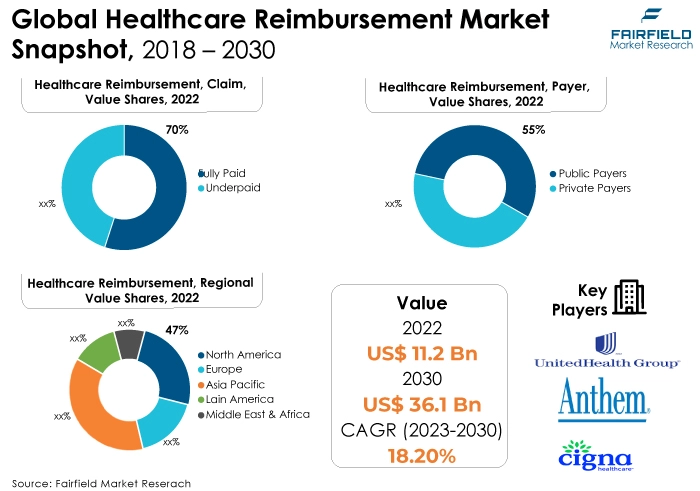

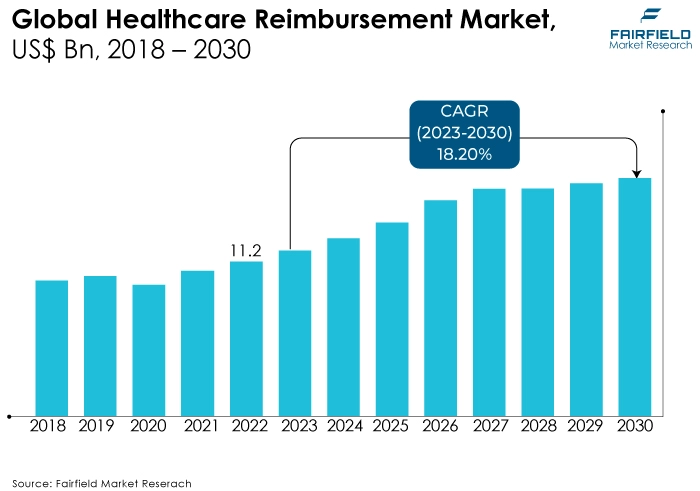

- The approximately US$11.2 Bn healthcare reimbursement market (2022) poised to reach US$36.1 Bn by 2030

- Market size projected to see a staggering CAGR of 18.2% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the global healthcare reimbursement market growth is the increasing popularity of healthcare applications.

- The healthcare reimbursement market is growing due to the increasing complexity of healthcare billing, the rise in healthcare costs, evolving reimbursement models, the need for streamlined claims processing, and advancements in technology that enhance efficiency and accuracy in reimbursement processes.

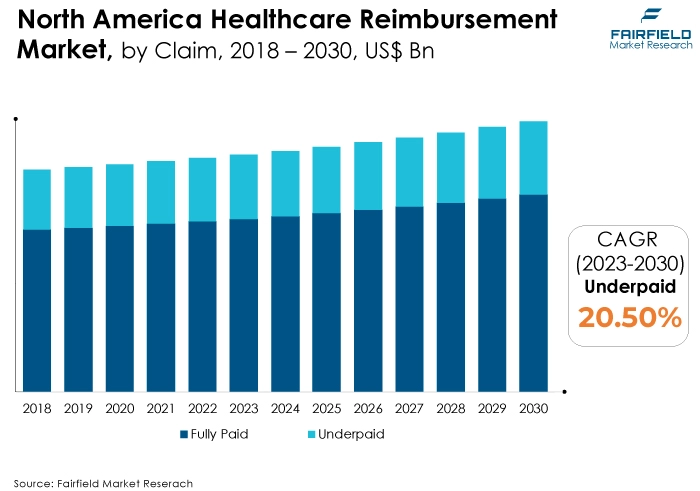

- Fully paid claims have captured the largest market share in the healthcare reimbursement market because they represent successfully processed claims, signifying efficient reimbursement processes and payment completion. Healthcare organisations must ensure consistent revenue streams and reduce administrative efforts.

- Public payers, such as government-funded programs like Medicare, and Medicaid, have secured the largest market share in the healthcare reimbursement market due to their extensive coverage and influence over reimbursement policies, making them a dominant force in the industry.

- Hospital service providers have captured the largest market share in the healthcare reimbursement market due to their comprehensive range of healthcare services and established contracts with payers, allowing them to secure favourable reimbursement rates and efficiently manage diverse reimbursement needs, solidifying their market dominance.

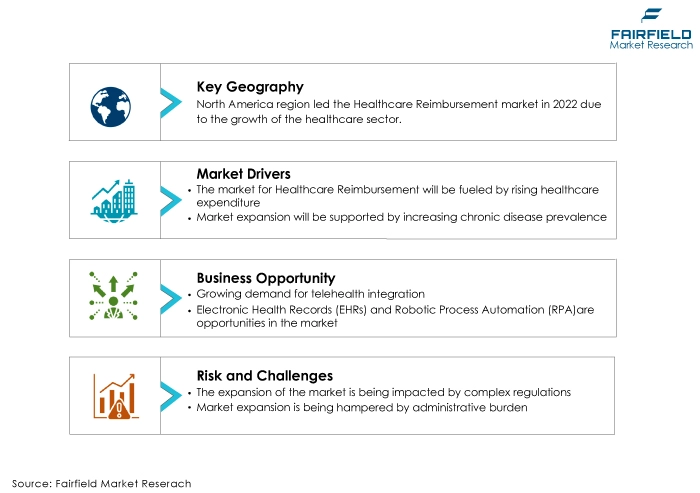

- North America has secured the largest market share in the healthcare reimbursement market due to its advanced healthcare infrastructure, well-established regulatory framework, high healthcare expenditure, and extensive insurance coverage, creating a significant market size with a diverse population and healthcare innovation hub.

- Asia Pacific is experiencing the highest CAGR in the healthcare reimbursement market due to its expanding population, increasing healthcare investments, rising awareness of healthcare services, and the adoption of advanced technologies, aligning with the region's modernisation efforts and evolving reimbursement policies.

- Complex regulations present a challenge in the healthcare reimbursement market as they require significant compliance efforts, lead to administrative burdens, increase operational costs, and introduce potential errors, making it difficult for healthcare organisations to navigate the intricate landscape of healthcare regulations effectively.

A Look Back and a Look Forward - Comparative Analysis

The healthcare reimbursement market is growing due to several factors, including the growing cost of healthcare services, the growing occurrence of chronic diseases, and expanding healthcare coverage. Additionally, regulatory changes, evolving payment models, and the need for efficient claims processing are driving demand for reimbursement solutions. Advancements in technology, data analytics, and the pursuit of cost-effective and value-based healthcare delivery and payment systems also fuel the market growth.

The healthcare reimbursement market is driven by factors such as the growing demand for cost-effective healthcare, the rise in chronic diseases, advancements in healthcare technology, evolving payment models, and regulatory changes. Additionally, the need for accurate claims processing, increased healthcare coverage, and the transition to value-based care are shaping the market's growth as healthcare stakeholders seek efficient and sustainable reimbursement solutions.

The future of the healthcare reimbursement market is likely to be shaped by ongoing healthcare reforms, technological innovations, and a shift towards value-based care models. Increasing focus on cost containment, transparency, and patient-centric approaches will drive changes in reimbursement strategies.

AI, and data analytics will play a significant role in streamlining reimbursement processes. Telehealth adoption and global healthcare trends will also impact the market's evolution, fostering more efficient and patient-centred reimbursement solutions.

Key Growth Determinants

- Rising Healthcare Expenditure

Rising healthcare costs are a significant driver of the healthcare reimbursement market. As healthcare expenses continue to increase, payers, providers, and patients seek efficient and transparent reimbursement processes. This drives the demand for innovative reimbursement solutions that can help manage costs, reduce administrative burdens, and ensure fair compensation for healthcare services. Additionally, the growing financial burden on patients underscores the need for effective reimbursement mechanisms, making cost containment and value-based reimbursement models essential in the evolving healthcare landscape.

- Increasing Chronic Disease Prevalence

The increasing occurrence of chronic diseases is a driving force behind the healthcare reimbursement market. Chronic conditions require ongoing medical care and treatment, leading to a higher demand for reimbursement services.

As the burden of chronic diseases grows, payers and providers seek efficient reimbursement solutions to manage costs while patients receive timely and appropriate care. This trend fuels the development of innovative reimbursement models, data analytics, and value-based care strategies to address the specific needs of patients with chronic conditions, shaping the market's growth.

- Technological Advancements

Technological advancements are driving the healthcare reimbursement market by enabling more efficient and accurate reimbursement processes. Advanced healthcare technology, including electronic health records (EHRs), telemedicine, and data analytics, streamlines claims processing, reduces errors, and enhances transparency. These innovations improve administrative efficiency, reduce costs, and support value-based care models.

Additionally, emerging technologies like blockchain enhance data security and integrity in reimbursement transactions. The industry's adoption of cutting-edge technology ensures the market's growth while adapting to evolving healthcare needs and payment models.

Major Growth Barriers

- Complex Regulations

Complex regulations challenge the healthcare reimbursement market by introducing intricate compliance requirements and frequent policy changes. Payers and providers must navigate a maze of rules, codes, and documentation standards, leading to administrative burdens, increased costs, and potential compliance errors.

Keeping abreast of evolving regulations necessitates continuous training and technology updates. Failure to comply can result in penalties and claim denials, affecting revenue streams. Balancing regulatory adherence with efficient reimbursement practices remains a persistent challenge in the healthcare reimbursement landscape.

- Administrative Burden

Administrative burden presents a significant challenge in the healthcare reimbursement market. The complex and time-consuming nature of reimbursement processes, including coding, claims processing, and documentation requirements, leads to increased administrative workload for both providers and payers. This burden can result in inefficiencies, delays in reimbursement, higher operational costs, and staff burnout.

Streamlining administrative tasks through automation and improved technology is essential to alleviate this challenge and enhance the efficiency and effectiveness of reimbursement procedures in the healthcare industry.

Key Trends and Opportunities to Look at

- Telehealth Integration

Telehealth integration in the healthcare reimbursement market involves incorporating telehealth capabilities into reimbursement systems. This technology streamlines billing and payment processes for virtual healthcare services, ensuring accurate reimbursement for remote consultations and telemedicine visits. It facilitates the verification of eligible services, automates claims submission, and supports transparent billing practices, making it essential for efficient reimbursement in the evolving healthcare landscape.

- Electronic Health Records (EHRs)

Electronic health records (EHR) technology in healthcare reimbursement involves the integration of EHR systems with reimbursement processes. It enhances data accuracy and efficiency by enabling seamless sharing of patient information between healthcare providers and payers. EHRs streamline claims submission, verification of services, and reimbursement tracking, ultimately optimizing reimbursement workflows and reducing administrative burdens for healthcare organisations.

- Robotic Process Automation (RPA)

The robotic process automation (RPA) technology in the healthcare reimbursement market involves the use of software robots to automate repetitive and rule-based tasks in reimbursement processes. RPA enhances efficiency by automating claims processing, eligibility verification, and data entry, reducing errors and administrative workload. It accelerates claims adjudication, accelerates reimbursement, and allows healthcare organisations to reallocate resources to more value-added activities in the reimbursement cycle.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the Healthcare Reimbursement Market. Government policies and regulations influence reimbursement models, eligibility criteria, coding standards, and billing practices. For instance, the transition to value-based care models, prompted by regulatory initiatives, incentivises outcome-based reimbursement.

Compliance with data privacy laws like HIPAA is essential to protect patient information during reimbursement processes. Regulatory changes also impact the adoption of innovative technologies such as telehealth, electronic health records, and blockchain, which are crucial in modernizing reimbursement systems.

Staying compliant with evolving healthcare regulations and ensuring transparency and accuracy in reimbursement practices are imperative for all stakeholders to navigate the complex reimbursement landscape effectively.

Fairfield’s Ranking Board

Top Segments

- Fully Paid Claims Maintain Dominance

Fully paid claims have captured the largest market share in the healthcare reimbursement market because they represent claims for which healthcare providers have received complete and timely reimbursement from payers. These claims are considered successful, indicating efficient reimbursement processes and payment completion.

As a result, healthcare organisations prioritise maximising fully paid claims to ensure consistent revenue streams and reduce administrative efforts related to denied or underpaid claims. Effective management of fully paid claims also fosters positive relationships between providers and payers, reinforcing their dominance in the market.

Underpaid claims are likely to be experiencing the fastest CAGR in the global market, attributing to the increasing complexity in billing and coding, evolving reimbursement policies, and errors in claims processing contribute to underpayments. Healthcare providers are increasingly focused on identifying and appealing underpaid claims to maximise revenue.

Additionally, technological advancements and data analytics are enabling better claim accuracy and identification of underpaid claims, driving their growth in the market as providers seek to optimize their reimbursement processes and revenue recovery efforts.

- Public Payers Take the Lead

Public payers, such as government-funded healthcare programs like Medicare, and Medicaid, have captured the largest market share in the healthcare reimbursement market due to their extensive reach and substantial coverage of the population. These programs cover a significant portion of healthcare services, especially for elderly and low-income individuals.

Additionally, they often set reimbursement standards and rates, making them influential players. The government's commitment to providing healthcare access and its ability to negotiate favourable terms contribute to public payers' dominance in the market.

Private payers on the other hand are expected to see a highest CAGR through the end of forecast year, due to several factors. They offer a diverse range of insurance plans, including employer-sponsored and individual policies, appealing to a broader consumer base.

Private payers often introduce innovative reimbursement models, such as value-based care and bundled payments, driving their growth. Additionally, increasing healthcare costs and demand for personalised coverage options lead individuals and organisations to explore private payer options, further expanding their market presence and influence.

- Hospitals to Surge Ahead Throughout the Forecast Period

Hospitals have captured the largest market share in the Healthcare Reimbursement Market due to their extensive scope of services, which often encompass inpatient, outpatient, and specialised care. They serve as central hubs for a wide range of medical treatments, leading to a high volume of claims and reimbursements.

Hospitals frequently have established contracts and negotiation power with payers, allowing them to secure favourable reimbursement rates. Their prominence in healthcare delivery, combined with their capacity to manage diverse reimbursement needs, solidifies their dominance in the market.

Diagnostic laboratories are however likely to be experiencing the highest rate of growth in the years to come. The increasing demand for diagnostic testing, especially amid the COVID-19 pandemic, has led to a surge in diagnostic laboratory services.

In addition, advancements in medical testing technologies and the trend toward early disease detection have boosted the need for laboratory services. The evolving reimbursement landscape, including policies that support preventive testing, has further contributed to their growth as providers adapt to changing healthcare needs and payment models.

Regional Frontrunners

Government Programs Continue to be the Mainstay of North America’s Leadership

North America has captured the largest market share in the healthcare reimbursement market due to several compelling factors. The region boasts a robust healthcare infrastructure, with highly developed healthcare systems and advanced technologies.

The presence of a well-established regulatory framework, including government programs like Medicare, and Medicaid, influences reimbursement models and standards. A relatively high healthcare expenditure and extensive insurance coverage ensure a substantial market size.

Additionally, North America is a hub for healthcare innovation, with ongoing advancements in technology and reimbursement strategies. The region's large and diverse population, including a significant ageing demographic, drives consistent demand for healthcare services and reimbursement solutions. Collectively, these factors solidify North America's position as the leader in the healthcare reimbursement market.

Growth Prospects Heighten as Asia Pacific Witnesses Rapidly Improving Insurance Coverage Scenario

The region's growing population, increasing healthcare investments, rising awareness of healthcare services, and expanding insurance coverage contribute to greater demand for reimbursement solutions. Additionally, the adoption of advanced healthcare technologies and evolving reimbursement policies align with the region's modernisation efforts. The prevalence of chronic diseases and the need for efficient healthcare delivery further drive the growth of healthcare reimbursement in Asia Pacific, making it a dynamic and rapidly expanding market.

Fairfield’s Competitive Landscape Analysis

The global healthcare reimbursement market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. More consolidation is expected over the coming years.

Who are the Leaders in the Global Healthcare Reimbursement Market space?

- Magellan Health

- UnitedHealth Group

- Anthem, Inc.

- Cigna

- Humana Inc.

- Blue Cross Blue Shield Association

- Centene Corporation

- Molina Healthcare

- Kaiser Permanente

- CVS Health

- Tenet Healthcare

- HCA Healthcare

- Gateway Health

- Universal American

- The Joint Commission

Significant Company Developments

New Product Launch

- March 2022: IMAT Solutions, a prominent provider of real-time healthcare data management and population health reporting solutions, has unveiled a novel offering designed to address healthcare data collection, aggregation, distribution, and reporting. This innovation is set to bring advantages to payers, statewide entities, and Health Information Exchanges (HIEs). The company's new clustering and SaaS-based solutions, coupled with its recently earned Data Aggregator Validation (DAV) recognition from NCQA, underscore its commitment to advancing healthcare data management and quality reporting.

Distribution Agreement

- March 2022: Icertis has introduced Icertis Contract Intelligence (ICI) for Healthcare Providers, a contract lifecycle management (CLM) solution. This CLM solution supports healthcare providers in expediting their digital transformation efforts by modernizing intricate agreements, including payer contracts, supplier agreements, and contract services.

An Expert’s Eye

Demand and Future Growth

The unprecedented growth in the world of healthcare is driving the market. The healthcare reimbursement market is driven by the increasing need for efficient reimbursement solutions to manage rising healthcare costs. Future growth will be shaped by technological innovations, including blockchain and AI, as well as the transition to value-based care models.

The demand for transparent, patient-centric reimbursement practices is also on the rise. Telehealth integration and data analytics will play crucial roles in optimizing reimbursement processes. As healthcare systems evolve, the market will continue to expand to meet the demand for streamlined, cost-effective, and value-driven reimbursement solutions.

Supply Side of the Market

The major countries in the healthcare reimbursement market include the US, Canada, the UK, Germany, France, Japan, China, India, Australia, and Brazil. These countries represent significant market shares due to their well-established healthcare systems, high healthcare expenditure, and evolving reimbursement models.

Additionally, they are often at the forefront of healthcare innovation and technology adoption, driving demand for advanced reimbursement solutions. Emerging markets in Asia, Latin America, and the Middle East are also becoming increasingly important players in the global healthcare reimbursement landscape.

The healthcare reimbursement market primarily relies on software, data processing systems, and secure networking infrastructure for its operations rather than traditional raw materials. Major manufacturers and solution providers in this market include Optum, Inc., Change Healthcare, Cerner Corporation, IBM Corporation, Allscripts Healthcare Solutions, Conifer Health Solutions, and UnitedHealth Group, among others. These companies offer a wide range of reimbursement and healthcare revenue cycle management solutions, leveraging advanced technology and data analytics to streamline the reimbursement process for healthcare providers and payers.

Global Healthcare Reimbursement Market is Segmented as Below:

By Claim:

- Fully Paid

- Underpaid

By Payer:

- Private Payers

- Public Payers

By Service Provider:

- Physician Office

- Hospitals

- Diagnostic Laboratories

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Healthcare Reimbursement Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Healthcare Reimbursement Market Outlook, 2018 - 2030

3.1. Global Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Fully Paid

3.1.1.2. Underpaid

3.2. Global Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Private Payers

3.2.1.2. Public Payers

3.3. Global Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Physician Office

3.3.1.2. Hospitals

3.3.1.3. Diagnostic Laboratories

3.3.1.4. Others

3.4. Global Healthcare Reimbursement Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Healthcare Reimbursement Market Outlook, 2018 - 2030

4.1. North America Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Fully Paid

4.1.1.2. Underpaid

4.2. North America Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Private Payers

4.2.1.2. Public Payers

4.3. North America Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Physician Office

4.3.1.2. Hospitals

4.3.1.3. Diagnostic Laboratories

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Healthcare Reimbursement Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Healthcare Reimbursement Market, by End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Healthcare Reimbursement Market, by End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Healthcare Reimbursement Market Outlook, 2018 - 2030

5.1. Europe Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Fully Paid

5.1.1.2. Underpaid

5.2. Europe Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Private Payers

5.2.1.2. Public Payers

5.3. Europe Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Physician Office

5.3.1.2. Hospitals

5.3.1.3. Diagnostic Laboratories

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Healthcare Reimbursement Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Healthcare Reimbursement Market Outlook, 2018 - 2030

6.1. Asia Pacific Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Fully Paid

6.1.1.2. Underpaid

6.2. Asia Pacific Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Private Payers

6.2.1.2. Public Payers

6.3. Asia Pacific Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Physician Office

6.3.1.2. Hospitals

6.3.1.3. Diagnostic Laboratories

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Healthcare Reimbursement Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Healthcare Reimbursement Market Outlook, 2018 - 2030

7.1. Latin America Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Fully Paid

7.1.1.2. Underpaid

7.2. Latin America Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Private Payers

7.2.1.2. Public Payers

7.3. Latin America Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Physician Office

7.3.1.2. Hospitals

7.3.1.3. Diagnostic Laboratories

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Healthcare Reimbursement Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Healthcare Reimbursement Market Outlook, 2018 - 2030

8.1. Middle East & Africa Healthcare Reimbursement Market Outlook, by Claim, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Fully Paid

8.1.1.2. Underpaid

8.2. Middle East & Africa Healthcare Reimbursement Market Outlook, by Payer, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Private Payers

8.2.1.2. Public Payers

8.3. Middle East & Africa Healthcare Reimbursement Market Outlook, by Service Provider, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Physician Office

8.3.1.2. Hospitals

8.3.1.3. Diagnostic Laboratories

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Healthcare Reimbursement Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Healthcare Reimbursement Market by Claim, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Healthcare Reimbursement Market, by Payer, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Healthcare Reimbursement Market, by Service Provider, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Service Provider vs Claim Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. UnitedHealth Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Anthem, Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Cigna

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Humana Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Blue Cross Blue Shield Association

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Centene Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Molina Healthcare

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Kaiser Permanente

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. CVS Health

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Tenet Healthcare

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. HCA Healthcare

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Magellan Health

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Universal American

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Gateway Health

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. The Joint Commission

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Claim Coverage |

|

|

Payer Coverage |

|

|

Service Provider Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |