Global Hydrofluoric Acid Market Forecast

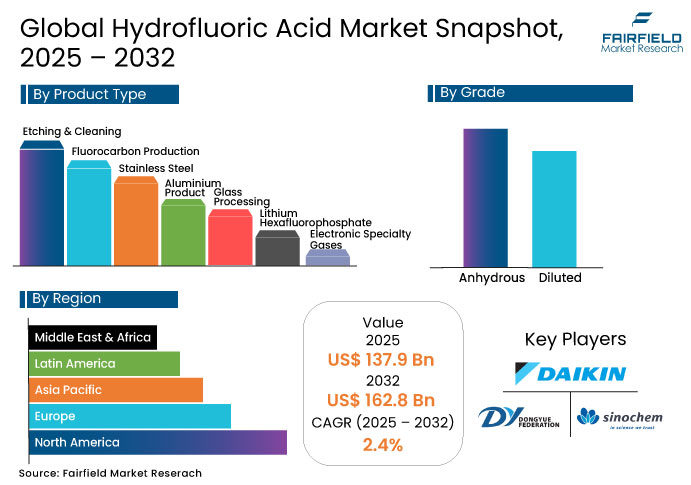

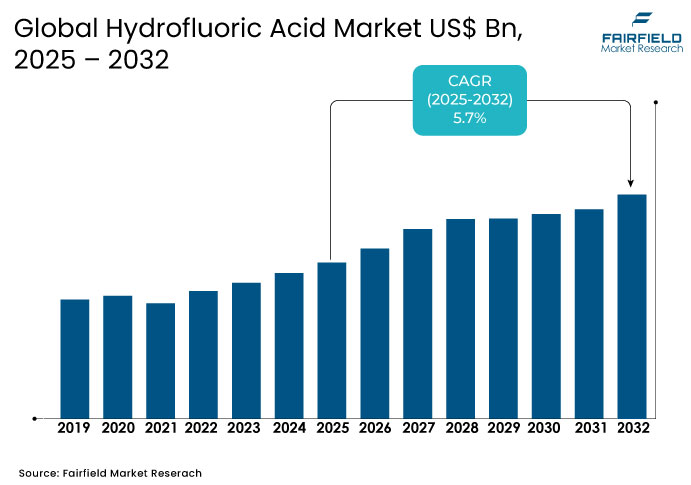

- The global demand for hydrofluoric acid is projected to grow with a CAGR of 5.7% between 2025 to 2032. The hydrofluoric acid market size is likely to be valued at US$2.8 Bn in 2025 and is expected to reach US$4.1 Bn by 2032.

- The rising adoption of lithium-ion batteries, especially in electric vehicles and energy storage systems, is expected to significantly drive hydrofluoric acid demand due to its critical role in producing lithium hexafluorophosphate. This application will remain a key growth engine for the hydrofluoric acid market in the coming years.

Hydrofluoric Acid Insights:

- Anhydrous hydrofluoric acid market is witnessing strong demand growth due to its critical role in fluorocarbon synthesis, which remains essential for refrigerant and fluoropolymer production across industrial applications.

- In the Etching & Cleaning segment, the rapid scale-up of semiconductor manufacturing globally is significantly increasing the need for high-purity hydrofluoric in microchip fabrication processes.

- The lithium hexafluorophosphate production segment is expanding rapidly as the global shift to electric vehicles drives lithium-ion battery manufacturing, where hydrofluoric is a core input in electrolyte salt production.

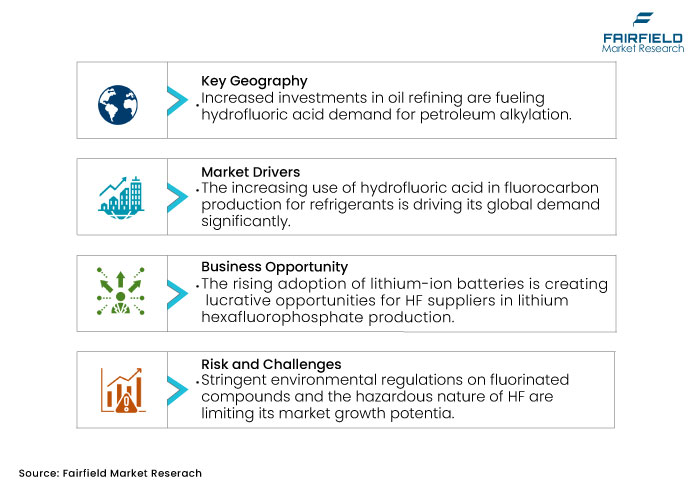

- North America is experiencing sustained demand from petroleum refining, where hydrofluoric-based alkylation remains vital in producing high-octane, low-emission fuels aligned with environmental standards.

- For Asia Pacific, hydrofluoric demand continues to surge in glass processing due to infrastructure growth and increased solar panel production, reinforcing the region’s position as a key market for hydrofluoric suppliers.

A Look Back and a Look Forward - Comparative Analysis

Between 2019 and 2024, the hydrofluoric acid market experienced moderate growth, driven by steady demand from fluorocarbon production and petroleum refining. However, growth was partially constrained by regulatory scrutiny on hydrofluoric handling and supply chain disruptions. China maintained its dominance in production, while key end-use industries such as electronics and aluminum processing showed consistent consumption patterns.

From 2025 to 2032, the market is expected to shift toward high-purity applications, especially in semiconductors and lithium-ion battery materials. Strategic capacity expansions, regional diversification, and environmental compliance will define competitive dynamics. Asia Pacific will remain central to demand growth, while North America and Europe will focus on technological innovation and safer substitutes in response to regulatory challenges.

Key Growth Determinants

The increasing use of hydrofluoric acid in fluorocarbon production for refrigerants is driving its global demand significantly

Hydrofluoric acid is a critical raw material in the production of fluorocarbons, particularly hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs), which are widely used as refrigerants across the HVAC and refrigeration sectors. In 2023, the fluorocarbon segment accounted for over 54.5% of the total hydrofluoric acid demand globally. Fluorocarbon manufacturing consumes approximately 80% of the hydrofluoric acid produced, with annual consumption exceeding one million tonnes in recent years. This dominant end-use application continues to be a key driver of global hydrofluoric acid market demand.

Continued growth in refrigeration and air conditioning demand, particularly in developing economies, is further strengthening the fluorocarbon segment’s position. In 2024, this application remained the largest contributor to hydrofluoric acid revenues, accounting for approximately one-third of the total market. Leading chemical manufacturers have responded to this trend through capacity expansions; for example, Gujarat Fluorochemicals increased hydrofluoric acid production by 25% at its Dahej facility to support rising downstream fluorochemical requirements. These developments underscore the strategic importance of hydrofluoric acid in the global fluorocarbon value chain.

Key Growth Barriers

Stringent environmental regulations on fluorinated compounds and the hazardous nature of hydrofluoric are limiting their market growth potential

Stringent environmental regulations targeting Hydrofluoric Acid mining, especially in ecologically sensitive areas like Madagascar and China, are choking the natural Hydrofluoric Acid supply. Leading producers have reduced mining activities to comply with stricter water-use and tailings disposal laws. For example, China cut natural Hydrofluoric Acid output in recent years to protect ecosystems and simultaneously boosted synthetic Hydrofluoric Acid production in response to stricter environmental controls.

The hazardous nature of hydrofluoric acid further elevates regulatory scrutiny. hydrofluoric can form dense vapor clouds that pose serious health risks, as documented in multiple refinery-related incidents investigated by national safety authorities. As a result, agencies are promoting the use of inherently safer substitutes, thereby intensifying replacement pressure on end users. These regulatory and safety-driven challenges collectively hinder the hydrofluoric acid market's growth trajectory.

Hydrofluoric Acid Market Opportunities

The rising adoption of lithium-ion batteries is creating lucrative opportunities for hydrofluoric suppliers in lithium hexafluorophosphate production

Hydrofluoric acid is a critical raw material for producing lithium hexafluorophosphate (LiPF₆), the primary lithium salt used in lithium-ion battery electrolytes. Global LiPF₆ production capacity exceeded 390,000 tonnes in 2024, with China alone accounting for nearly 371,000 tonnes. The accelerating demand for electric vehicles and energy storage systems continues to drive this expansion, directly increasing the consumption of hydrofluoric acid .

Leading electrolyte manufacturers are significantly increasing LiPF₆ capacity, which directly boosts upstream demand for hydrofluoric acid market. For instance, Tinci Materials has announced annual production targets of approximately 100,000 tonnes of LiPF₆. This expansion reflects a broader trend where hydrofluoric suppliers can secure long-term supply contracts and capitalize on the rapid growth of the lithium-ion battery value chain, particularly in Asia and Europe.

Segment-wise Overview

- The rapid growth of the electronics industry is accelerating demand for hydrofluoric in semiconductor etching and cleaning applications

Hydrofluoric acid plays a critical role in the semiconductor manufacturing process, particularly in the etching and cleaning of silicon wafers. Over 60% of ultra-high-purity hydrofluoric acid consumption is directed toward the electronics sector, with wet etching processes accounting for a substantial share of this demand. The continued expansion of semiconductor fabrication facilities, driven by 5G deployment, AI integration, and increased consumer electronics production, is significantly boosting the requirement for high-purity hydrofluoric.

This growth trajectory is further supported by capacity expansions in electronic-grade hydrofluoric across major manufacturing regions. In 2023, demand for electronic-grade hydrofluoric rose sharply due to increased investments in photovoltaic cells, integrated circuits, and display panels. The semiconductor industry alone accounted for a substantial portion of global hydrofluoric consumption. As chip geometries become more advanced, precision etching requirements intensify, positioning this segment as a major driver of hydrofluoric acid market growth.

- Anhydrous hydrofluoric acid continues to dominate the market due to its high purity and suitability for fluorocarbon synthesis

Anhydrous hydrofluoric acid accounts for a significant share of the global hydrofluoric acid market, owing to its high purity and effectiveness in critical industrial processes. It is the preferred grade for applications such as fluorocarbon and fluoropolymer synthesis, as well as petroleum alkylation. The absence of water ensures higher process efficiency and chemical stability, making it indispensable in high-performance chemical manufacturing environments.

Leading chemical manufacturers are expanding anhydrous hydrofluoric production capacities to meet growing demand across the semiconductor and refrigerant industries. For instance, major infrastructure projects are underway in East Asia to develop large-scale facilities dedicated to high-purity anhydrous hydrofluoric. These investments reflect the segment’s strategic role in high-value downstream applications and confirm its continued dominance in driving hydrofluoric acid market growth globally.

Regional Analysis

- Increased investments in oil refining are fueling hydrofluoric acid demand for petroleum alkylation processes in North America

In North America, increased investment in oil refining infrastructure is significantly contributing to hydrofluoric acid demand. As of 2025, over 40 U.S. refineries continue to utilize hydrofluoric-based alkylation units to produce high-octane, low-emission gasoline. Nearly half of the country’s refining capacity is dependent on hydrofluoric catalysts, highlighting the compound’s critical role in maintaining fuel quality and regulatory compliance.

Recent refinery upgrades have further reinforced this trend. Key operators, including CVR Energy and ExxonMobil, have modernized their alkylation facilities at the Wynnewood and Baytown sites, respectively, incorporating advanced hydrofluoric acid technologies. These strategic improvements reflect sustained industry reliance on hydrofluoric for efficient octane enhancement, ensuring long-term demand stability in the North American hydrofluoric acid market.

- Europe is witnessing rising hydrofluoric demand from aluminum processing industries, driven by lightweight material trends in automotive manufacturing

Europe’s automotive sector is increasingly adopting lightweight materials, with approximately 3.35 million tonnes of aluminum used in passenger vehicle production in 2023—averaging around 219 kilograms per vehicle. This shift, driven by the need to improve fuel efficiency and reduce emissions, has significantly elevated the demand for hydrofluoric acid in aluminum surface treatment, cleaning, and etching processes across the region.

Aluminium processing facilities in Europe are expanding to meet growing demand from the automotive and transportation sectors. Hydrofluoric acid plays a critical role in producing aluminum fluoride and in treating aluminum surfaces to enhance corrosion resistance and bonding quality. With automakers intensifying their use of aluminum in structural and body components, hydrofluoric acid consumption in Europe is expected to remain strong, supporting sustained regional hydrofluoric acid market growth.

- Asia Pacific is experiencing robust hydrofluoric demand growth, particularly in glass processing, due to booming construction and solar panel sectors

Asia Pacific is witnessing a strong increase in hydrofluoric acid demand, largely driven by the expanding glass-processing sector linked to construction and solar energy growth. In 2024, over 310 gigawatts of new solar capacity were installed across the region, with each gigawatt requiring substantial volumes of hydrofluoric acid for glass surface texturing and cleaning. Simultaneously, the construction industry continues to drive demand for architectural and specialty glass products.

The region now accounts for a significant share of global hydrofluoric acid consumption, supported by large-scale production and domestic demand. Rapid urbanization, combined with rising investments in photovoltaic manufacturing and smart building technologies, is pushing the need for high-purity hydrofluoric used in glass etching processes. As both solar energy deployment and infrastructure development accelerate, Asia Pacific remains central to the future growth of the global hydrofluoric acid market.

Competitive Landscape

The global hydrofluoric acid market is marked by strategic competition, with key players such as Honeywell, Daikin, Solvay, Lanxess, and Gujarat Fluorochemicals actively pursuing technological advancements, vertical integration, and purity-focused product development. Companies are differentiating through high-grade hydrofluoric formulations tailored for semiconductors, fluorochemicals, and electronics, while also enhancing supply reliability through backward integration and proprietary production technologies.

Recent strategies include capacity expansions, regional diversification, and alignment with high-growth downstream sectors like batteries and refrigerants. Gujarat Fluorochemicals, for instance, increased hydrofluoric output at its Dahej facility to support new fluoropolymer and LiPF₆ initiatives. Meanwhile, international competitors are strengthening global footprints through joint ventures, long-term supply contracts, and ESG-compliant manufacturing upgrades, reinforcing competitive positioning in a regulatory-sensitive and performance-driven market.

Key Companies

- Daikin

- Dongyue Group

- Sinochem

- Yingpeng Chemical

- Honeywell International Inc.

- Stella Chemifa Corp.

- Koura Global

- Lanxess

- Solvay

- Zhejiang Kaisn Fluorochemical Co., Ltd.

- Do-Fluoride Chemicals Co.,Ltd.

Expert Opinion

- Growing demand for high-purity hydrofluoric acid in semiconductor and electronics manufacturing will be a critical driver, supported by rising investments in advanced chip fabrication and clean energy technologies.

- Regulatory pressure on fluorinated compounds is compelling producers to innovate safer handling processes, while sustaining demand through essential applications in fluorocarbons, alkylation, and lithium battery electrolytes.

- Asia Pacific is expected to remain the demand epicenter due to expanding glass processing, solar manufacturing, and chemical production, with China dominating both consumption and production capacities.

- Future growth will be shaped by vertical integration strategies, wherein key players secure raw materials like fluorspar and establish long-term contracts across refrigerant, electronics, and energy storage sectors.

Global Hydrofluoric Acid Market Segmentation -

By Grade

- Anhydrous

- Diluted

By End-use

- Fluorocarbon Production

- Stainless Steel

- Aluminium Product

- Glass Processing

- Lithium Hexafluorophosphate

- Etching & Cleaning

- Electronic Specialty Gases

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Hydrofluoric Acid Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Hydrofluoric Acid Market Outlook, 2019 - 2032

3.1. Global Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

3.1.1. Anhydrous

3.1.2. Diluted

3.2. Global Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

3.2.1. Fluorocarbon Production

3.2.2. Stainless Steel

3.2.3. Aluminium Product

3.2.4. Glass Processing

3.2.5. Lithium Hexafluorophosphate

3.2.6. Etching & Cleaning

3.2.7. Electronic Specialty Gases

3.2.8. Others

3.3. Global Hydrofluoric Acid Market Outlook, by Region, Value (US$ Bn) & Volume (Tons), 2019 - 2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Hydrofluoric Acid Market Outlook, 2019 - 2032

4.1. North America Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

4.1.1. Anhydrous

4.1.2. Diluted

4.2. North America Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

4.2.1. Fluorocarbon Production

4.2.2. Stainless Steel

4.2.3. Aluminium Product

4.2.4. Glass Processing

4.2.5. Lithium Hexafluorophosphate

4.2.6. Etching & Cleaning

4.2.7. Electronic Specialty Gases

4.2.8. Others

4.3. North America Hydrofluoric Acid Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019 - 2032

4.3.1. U.S. Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

4.3.2. U.S. Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

4.3.3. Canada Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

4.3.4. Canada Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Hydrofluoric Acid Market Outlook, 2019 - 2032

5.1. Europe Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

5.1.1. Anhydrous

5.1.2. Diluted

5.2. Europe Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

5.2.1. Fluorocarbon Production

5.2.2. Stainless Steel

5.2.3. Aluminium Product

5.2.4. Glass Processing

5.2.5. Lithium Hexafluorophosphate

5.2.6. Etching & Cleaning

5.2.7. Electronic Specialty Gases

5.2.8. Others

5.3. Europe Hydrofluoric Acid Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019 - 2032

5.3.1. Germany Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.2. Germany Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.3. Italy Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.4. Italy Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.5. France Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.6. France Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.7. U.K. Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.8. U.K. Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.9. Spain Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.10. Spain Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.11. Russia Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.12. Russia Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.3.13. Rest of Europe Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

5.3.14. Rest of Europe Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Hydrofluoric Acid Market Outlook, 2019 - 2032

6.1. Asia Pacific Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

6.1.1. Anhydrous

6.1.2. Diluted

6.2. Asia Pacific Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

6.2.1. Fluorocarbon Production

6.2.2. Stainless Steel

6.2.3. Aluminium Product

6.2.4. Glass Processing

6.2.5. Lithium Hexafluorophosphate

6.2.6. Etching & Cleaning

6.2.7. Electronic Specialty Gases

6.2.8. Others

6.3. Asia Pacific Hydrofluoric Acid Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019 - 2032

6.3.1. China Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.2. China Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.3.3. Japan Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.4. Japan Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.3.5. South Korea Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.6. South Korea Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.3.7. India Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.8. India Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.3.9. Southeast Asia Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.10. Southeast Asia Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.3.11. Rest of SAO Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

6.3.12. Rest of SAO Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Hydrofluoric Acid Market Outlook, 2019 - 2032

7.1. Latin America Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

7.1.1. Anhydrous

7.1.2. Diluted

7.2. Latin America Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

7.2.1. Fluorocarbon Production

7.2.2. Stainless Steel

7.2.3. Aluminium Product

7.2.4. Glass Processing

7.2.5. Lithium Hexafluorophosphate

7.2.6. Etching & Cleaning

7.2.7. Electronic Specialty Gases

7.2.8. Others

7.3. Latin America Hydrofluoric Acid Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019 - 2032

7.3.1. Brazil Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

7.3.2. Brazil Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

7.3.3. Mexico Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

7.3.4. Mexico Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

7.3.5. Argentina Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

7.3.6. Argentina Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

7.3.7. Rest of LATAM Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

7.3.8. Rest of LATAM Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Hydrofluoric Acid Market Outlook, 2019 - 2032

8.1. Middle East & Africa Hydrofluoric Acid Market Outlook, by Grade, Value (US$ Bn) & Volume (Tons), 2019 - 2032

8.1.1. Anhydrous

8.1.2. Diluted

8.2. Middle East & Africa Hydrofluoric Acid Market Outlook, by End-use, Value (US$ Bn) & Volume (Tons), 2019 - 2032

8.2.1. Fluorocarbon Production

8.2.2. Stainless Steel

8.2.3. Aluminium Product

8.2.4. Glass Processing

8.2.5. Lithium Hexafluorophosphate

8.2.6. Etching & Cleaning

8.2.7. Electronic Specialty Gases

8.2.8. Others

8.3. Middle East & Africa Hydrofluoric Acid Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019 - 2032

8.3.1. GCC Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

8.3.2. GCC Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

8.3.3. South Africa Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

8.3.4. South Africa Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

8.3.5. Egypt Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

8.3.6. Egypt Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

8.3.7. Nigeria Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

8.3.8. Nigeria Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

8.3.9. Rest of Middle East Hydrofluoric Acid Market Outlook, by Grade, 2019 - 2032

8.3.10. Rest of Middle East Hydrofluoric Acid Market Outlook, by End-use, 2019 - 2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Daikin

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Dongyue Group

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Sinochem

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Yingpeng Chemical

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Honeywell International Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Stella Chemifa Corp.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Koura Global

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Lanxess

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Solvay

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Zhejiang Kaisn Fluorochemical Co., Ltd.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Do-Fluoride Chemicals Co.,Ltd.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Grade Coverage |

|

|

Deployment Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |