India Two-Wheeler Engine Oil Market

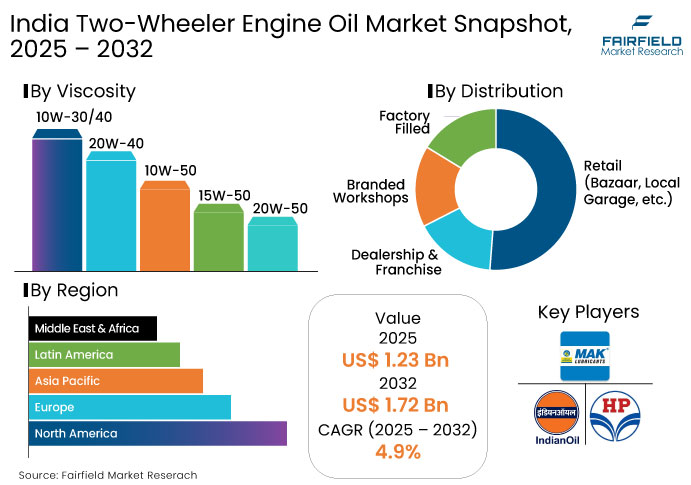

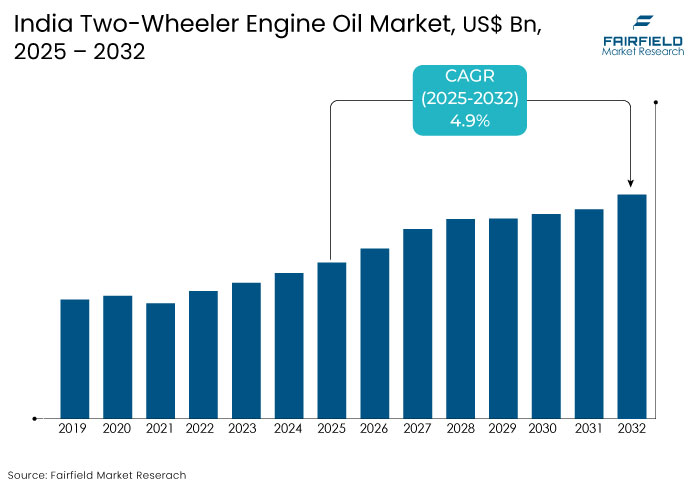

- The India Two Wheeler Engine Oil Market is valued at USD 1.2 Bn in 2026 and is projected to reach USD 1.5 Bn, growing at a CAGR of 4% by 2033

India Two Wheeler Engine Oil Market Insights

- Evolving rider preferences in India are driving demand for high-performance and premium two-wheelers, creating a need for advanced engine oils.

- Declining production of mopeds and sub-250cc motorcycles indicates a clear shift toward mid-range (250–500cc) and premium (500cc+) bikes.

- Local engine oil brands dominate the price-sensitive segments, especially in mopeds and commuter bikes, through cost-effective mineral oils and strong bazaar networks.

- Rising popularity of synthetic and semi-synthetic lubricants highlights a performance-driven trend, especially among mid and premium bike users.

- Bazaar sales channels hold 60.9% market share in 2024, powered by local distribution networks and demand for affordable oil options.

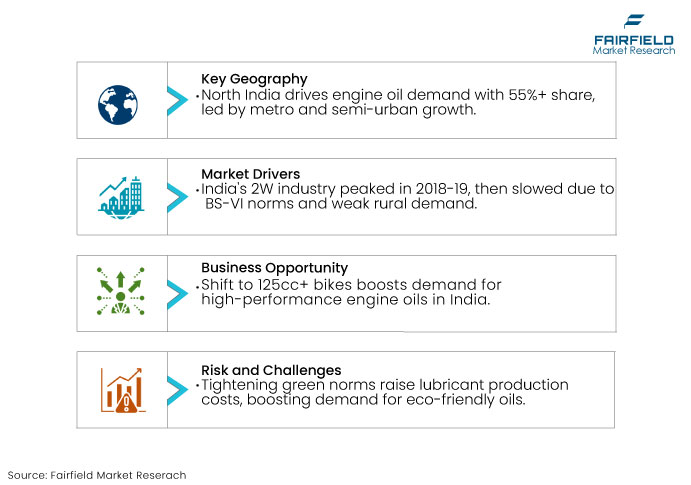

- South India leads regional demand with a 31% market share, driven by high two-wheeler penetration and frequent oil change habits.

- North India follows closely, supported by dense urban clusters and diverse consumer segments ranging from cost-conscious to brand-loyal buyers.

- Organized players hold 55–60% market share, while the unorganized segment caters to mass markets with aggressive pricing and localized strategies.

A Look Back and a Look Forward: Tracking the Two-Wheeler Market Through India’s Economic Lens

India’s automotive industry moved through a dynamic phase over the past decade, marked by economic shifts, regulatory reforms, and evolving consumption patterns.

From FY16 to FY20, manufacturers increased domestic output at a 2.3% CAGR while vehicle sales, although slower, still registered a 1.2% CAGR. The pandemic interrupted this progress, yet production rebounded by FY21 with over 22 million vehicles built and nearly two million units turned out in August 2021 alone. Automakers ramped up investments across operations to match demand, supported by US$ 30.51 billion in foreign direct investment inflows from April 2000 to June 2021.

Accelerated vaccination efforts and an uptick in consumer activity revived industrial momentum, while growing urbanization, infrastructure upgrades, and booming e-commerce created fresh mobility needs.

With GDP projected to grow between 6.0% and 7.0% in FY2023–24 and reach 6.5% in FY2024–25, backed by strong performance in the services and manufacturing sectors, the outlook for the two-wheeler segment appears promising. Rising income levels and the expanding middle class continue to drive personal vehicle purchases, and this segment remains essential for affordable and efficient transport across diverse geographies.

Key Growth Determinants

- Evolving Demand Patterns and Export Volatility Reshape India’s Mobility Sector

From 2017-18 to 2023-24, India’s two-wheeler industry witnessed a significant transformation driven by shifting consumer behavior and changing international trade dynamics. After reaching a production and sales peak in 2018-19, the sector faced consistent challenges, including higher vehicle prices due to BS-VI regulations, rural income stagnation, and pandemic-induced disruptions, collectively suppressing domestic demand.

Buyers, especially in entry-level segments, prioritized affordability and delayed purchases, leading to a sharp dip in sales by 2022-23. Manufacturers focused on global markets, where rising demand from Africa and Latin America supported export growth, peaking in 2021-22. This external momentum lost pace as economic instability and currency fluctuations in key import regions caused a decline in outbound shipments in 2023-24.

With recent signs of recovery in local demand and the need to counter international uncertainties, companies began adapting product strategies by emphasizing value-driven models and preparing for a gradual shift toward electric mobility.

This evolving landscape reflects a broader realignment in India's mobility ecosystem, where internal consumption trends and global dependencies continue to reshape market priorities and growth avenues.

Key Growth Barriers

- Fluctuating Prices and Declining Utilization of Regasification Terminals

As green regulations tighten across the globe, the cost of producing conventional lubricants in India is set to rise. Eco-friendly requirements, such as stricter emission standards, push manufacturers to adopt cleaner but more expensive base oils and additives. These changes come with added costs, especially with the increasing pressure to comply with waste management regulations, all of which contribute to a surge in production expenses.

Alongside this, there's a growing preference for synthetic and semi-synthetic oils driven by the demand for better efficiency and reduced emissions. This shift requires manufacturers to heavily invest in research and development to meet eco-friendly standards, creating a challenge for smaller players who may lack the necessary resources. While India's market is highly price-sensitive, the push for more sustainable options complicates the balance between adhering to environmental laws and keeping prices affordable.

The unorganized sector, which makes up a large portion of oil sales, may struggle to comply with these new regulations, potentially flooding the market with substandard products that bypass eco-friendly standards. This creates a complex and competitive landscape for manufacturers and consumers alike.

Market Opportunity

- India's Expanding Energy Landscape Creates a Strategic Growth Avenue

As India’s two-wheeler market shifts gears toward higher-capacity motorcycles, the engine oil market has a prime opportunity to accelerate growth. With smaller engine bikes (

Oil manufacturers can tap into this growing trend by developing premium lubricants that offer superior protection, fuel efficiency, and engine longevity. As more consumers look for smoother, high-performance rides, they will seek oils that cater to these evolving needs, opening the door for innovation in the engine oil market.

The rise of electric and hybrid two-wheelers further broadens the horizon for the engine oil sector. While electric vehicles may not rely on traditional engine oils, hybrid models that combine internal combustion engines with electric powertrains still need specialized lubrication. This offers engine oil companies the chance to diversify their product lines to accommodate these emerging vehicles.

As the demand for larger, more powerful motorcycles (180cc and above) continues to grow, manufacturers have a golden opportunity to develop oils that can withstand the higher performance demands of these engines. Whether it’s enhancing protection for high-stress riding or ensuring peak performance in premium motorcycles, the engine oil market stands ready for a high-octane boost.

Market Trend

- Domination of cheap local engine oil brand in bazaar and aftermarket for Mopeds and Regular Bikes category

Cost-conscious riders are flocking to local oil brands in India’s bustling bazaars, driving a clear trend in the mopeds and regular bikes segment. Local players leverage their mineral-oil formulations to undercut both semi-synthetic and fully synthetic alternatives, delivering acceptable protection at a fraction of the cost.

As moped production plunged from 10.48 lakh units in 2018 to 3.24 lakh in 2023 and regular bikes dipped from 1.95 crore to 1.09 crore over the same period, affordability has become king. Manufacturers like Velvex, Waxity, VIP and Mangalam have tapped into this opportunity by offering pocket-friendly lubricants that match the maintenance budgets of entry-level riders, effectively turning price sensitivity into market share.

Beyond competitive pricing, these brands excel through razor-sharp distribution strategies. By streamlining supply chains and partnering with neighborhood garages and aftermarket outlets, they achieve penetration that multinational firms struggle to match. Shorter logistics routes let them stock shelves faster and respond to demand spikes in tier-II and tier-III towns. As a result, the India two wheeler engine oil market sees local labels dominate sales for sub-250cc bikes, establishing brand loyalty through convenience and consistent availability.

Major oil companies now face the challenge of reinventing their go-to-market approaches or risk ceding further ground to these nimble, locally entrenched rivals.

- Evolving Consumer Demands in India’s Two-Wheeler Market: The Shift Toward Performance and Premium Segments

India's two-wheeler market is shifting gears, with consumer preferences rapidly moving toward more powerful and performance-driven motorcycles. The decline in moped production, from 10,48,255 units in 2018 to just 3,24,683 units in 2023, highlights a preference for higher-capacity bikes. Similarly, regular bikes under 250cc have seen a notable drop in production, from 1.94 crore units in 2018 to 1.09 crore units in 2023.

This decline reflects a broader trend where riders are seeking motorcycles that offer better utility and performance, driving the demand for oils capable of supporting more sophisticated, high-performance engines. The rise of mid-segment bikes (250cc-500cc), with production peaking at 8,25,171 units in 2022, further emphasizes this shift. These motorcycles require oils designed to enhance power, reduce wear, and maximize engine efficiency.

The growing interest in premium motorcycles (500cc and above), with production increasing from 11,605 units in 2018 to 24,055 units in 2023, signals a demand for lubricants that can handle the higher stress and performance expectations of these high-end models. As more consumers opt for luxury and advanced technological features in their motorcycles, oils formulated for larger engines are becoming a necessity. The performance-focused segment demands products with superior heat resistance, enhanced wear protection, and smoother operation to ensure optimal engine life.

With these evolving preferences, manufacturers are innovating to create solutions that cater to the growing need for high-performance lubrication, positioning themselves to meet the demands of a dynamic and shifting market.

Segments Covered in the Report

- Mineral Oil Continues to Dominate, But Synthetic Options Are Gaining Ground

In 2024, mineral oil holds a strong 70.1% share of the Indian two-wheeler engine oil market, driven by its appeal to the massive population of budget-focused riders. Regular bikes accounting for nearly 90% of the two-wheeler category mostly operate with engines under 200cc, where performance demands are modest, but cost sensitivity is high. Riders in this segment consistently choose mineral oils for their affordability and adequate protection. However, the tide is slowly shifting.

Riders of performance-oriented and premium bikes have begun favoring semi-synthetic and fully synthetic oils, thanks to their enhanced efficiency, engine life, and cleaner performance. While mineral oil isn’t disappearing anytime soon, especially in the commuter category, the rise of synthetic blends is undeniable, driven by aspirational buyers and newer engine technologies.

- Bazaar Sales Channels Rule, Powered by Local Brands and Price Appeal

In terms of distribution, bazaar channels command a dominant 60.9% market share in 2024, riding on the back of India’s vast aftermarket and informal retail system.

Local lubricant brands such as Velvex, Waxity, VIP Lubricants, and Mangalam thrive in this segment by offering low-cost mineral oils that resonate with moped and regular bike owners. These brands know their audience riders looking for quick, inexpensive refills, often outside dealership networks.

By leveraging short distribution chains and maintaining strong presence in local shops and service outlets, these players meet demand across urban and rural markets. While dealerships, franchises, and branded workshops cater to the premium and performance segments, the bazaar continues to drive volume, and shows no signs of slowing down especially as price pressures and fuel costs keep consumers looking for value..

Regional Analysis

- North India Keeps Pace, Backed by Dense Urban Clusters

North India continues to hold a major stake in the market, contributing significantly to the over 55% combined share with West India in 2024. Metro cities like Delhi, Lucknow, and Jaipur act as demand hubs, driven by high population density and increasing two-wheeler ownership across urban and semi-urban areas.

Consumers here rely heavily on bikes for both commuting and business mobility, which keeps the aftermarket engine oil segment highly active. Unlike South India’s preference for frequent oil changes, North India sees a mix of price-sensitive and brand-loyal consumers, creating strong opportunities for both local and premium lubricant brands. This dual-market dynamic gives North India a resilient edge in engine oil demand, with steady growth visible in both volume and value segments.

- South India Shifts into Top Gear with 31% Market Share

South India takes the lead in the India two-wheeler engine oil market, commanding a 31% share in 2024. This region stays ahead thanks to its high penetration of two-wheelers, especially in cities like Bangalore, Chennai, and Hyderabad, where bikes dominate daily commuting. Riders in South India often face longer rides and warmer climates, leading to more frequent oil changes and higher lubricant consumption.

A well-established network of workshops and service stations across urban and rural belts keeps product availability strong. The combination of strong aftermarket infrastructure, consumer awareness, and regular maintenance habits ensures that South India holds its pole position and the gap with other regions isn’t closing anytime soon.

Fairfield’s Competitive Landscape Analysis

India’s two-wheeler engine oil market features a competitive landscape shaped by both B2B and B2C operations. Organized players such as Indian Oil Corporation Ltd. (Servo), BPCL (Mak Lubricants), HPCL (HP Lubricants), Castrol India Ltd., and Veedol International Limited (Tide Water) dominate with their strong brand presence, extensive distribution networks, and compliance with evolving technical and environmental standards.

These companies cater to OEMs, authorized service centers, and retail networks, ensuring consistent demand across channels.

Alongside them, a significant unorganized segment including tier-2, tier-3 suppliers, and local manufacturers targets the price-sensitive mass market. These players typically lack large-scale distribution or advanced product development but compete aggressively on pricing.

The market remains fragmented, with organized players holding around 55%–60% of the share, while unorganized contributors make up the remaining 40%–45%, reflecting a diverse and dynamic environment where brand trust, pricing, and regulatory readiness drive competition.

Key Market Companies

- Indian Oil Corporation Ltd. (Servo)

- BPCL (Mak Lubricants)

- HPCL (HP Lubricants)

- Castrol India Ltd.

- Veedol International Limited (Tide Water)

- Gulf Oil Lubricants India Ltd.

- Shell India

- Motul.

Recent Industry Developments

- On April 12, 2024, Shell Lubricants India unveiled its upgraded Shell Advance motorcycle oil portfolio featuring enhanced technologies like Flexi Molecule and Active Cleansing, launched in limited-edition packs with brand ambassador Shahid Kapoor under the ongoing "Rukna Mushkil Hai" campaign.

- On Mar 31, 2023, ExxonMobil, a prominent player in the oil and gas industry, has revealed plans to invest approximately $110 million (equivalent to around Rs 900 crore) in constructing a new lubricant manufacturing facility at the Maharashtra Industrial Development Corporation's Isambe Industrial Area.

- On June 8, 2023, IndianOil Corporation, a leading oil marketing company, has introduced Servo Hypersport F5, a fully synthetic 4T engine oil for motorcycles. This new-generation lubricant is designed for all bike types, including the latest models compliant with BS VI-2 (OBD) regulations, and is suitable for mid-to-high displacement bikes.

An Expert’s Eye

- Local brands have captured price-sensitive segments, but they must now focus on brand trust and consistent quality to retain long-term loyalty.

- Mineral oils continue to dominate, but rising demand for synthetic oils indicates a clear shift toward performance-based offerings brands must capitalize on this.

- Bazaar channels drive volume today, yet expanding structured retail and D2C strategies will future-proof distribution.

- South and North India lead the demand, but untapped growth lies in East India, where rising infrastructure needs better aftermarket servicing support.

- Companies must invest in consumer education about oil grades and engine compatibility to boost synthetic and semi-synthetic adoption..

India Two Wheeler Engine Oil Market is Segmented as-

By Product Type

- Mineral

- Synthetic Blend

- Fully Synthetic

By Vehicle Type

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- High Performance and Premium Bikes (500 CC and above)

By Distribution Channel

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

By Sales Channel

- B2B

- B2C

By Viscosity

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

By Region

- North India

- South India

- East India

- West India

- Executive Summary

- Global India Two Wheeler Engine Oil Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- Global India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- Global India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Global India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- Global India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- Global India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- Global India Two Wheeler Engine Oil Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- North America India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- North America India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- North America India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- North America India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- North America India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- North America India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- North America India Two Wheeler Engine Oil Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- S. India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- S. India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- S. India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- S. India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Canada India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Canada India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Canada India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Canada India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Canada India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Europe India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- Europe India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- Europe India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Europe India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- Europe India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- Europe India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- Europe India Two Wheeler Engine Oil Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Germany India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Germany India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Germany India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Germany India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Italy India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Italy India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Italy India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Italy India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Italy India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- France India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- France India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- France India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- France India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- France India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- K. India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- K. India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- K. India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- K. India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- K. India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Spain India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Spain India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Spain India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Spain India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Spain India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Russia India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Russia India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Russia India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Russia India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Russia India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Rest of Europe India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Rest of Europe India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Rest of Europe India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Rest of Europe India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- China India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- China India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- China India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- China India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Japan India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Japan India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Japan India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Japan India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Japan India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- South Korea India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- South Korea India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- South Korea India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- South Korea India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- South Korea India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- India India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- India India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- India India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- India India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- India India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Southeast Asia India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Southeast Asia India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Southeast Asia India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Southeast Asia India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Rest of SAO India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Rest of SAO India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Rest of SAO India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Rest of SAO India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Latin America India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- Latin America India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- Latin America India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Latin America India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- Latin America India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- Latin America India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- Latin America India Two Wheeler Engine Oil Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Brazil India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Brazil India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Brazil India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Brazil India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Mexico India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Mexico India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Mexico India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Mexico India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Mexico India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Argentina India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Argentina India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Argentina India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Argentina India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Argentina India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Rest of LATAM India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Rest of LATAM India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Rest of LATAM India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Rest of LATAM India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, 2020 - 2033

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Mineral

- Synthetic Blend

- Fully Synthetic

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Moped

- Regular Bikes (below 250 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Sports and Cruiser Bikes (250 – 500 CC)

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, Value (US$ Mn), 2020-2033

- Retail (Bazaar, Local Garage, etc.)

- Dealership and Franchise

- Branded Workshops

- Factory Filled

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- B2B

- B2C

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Viscosity, Value (US$ Mn), 2020-2033

- 10W-30/40

- 20W-40

- 10W-50

- 15W-50

- 20W-50

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- GCC India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- GCC India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- GCC India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- GCC India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- South Africa India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- South Africa India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- South Africa India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- South Africa India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- South Africa India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Egypt India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Egypt India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Egypt India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Egypt India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Egypt India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Nigeria India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Nigeria India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Nigeria India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Nigeria India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Nigeria India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- Rest of Middle East India Two Wheeler Engine Oil Market Outlook, by Product Type, 2020-2033

- Rest of Middle East India Two Wheeler Engine Oil Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East India Two Wheeler Engine Oil Market Outlook, by Distribution Channel, 2020-2033

- Rest of Middle East India Two Wheeler Engine Oil Market Outlook, by Sales Channel, 2020-2033

- Rest of Middle East India Two Wheeler Engine Oil Market Outlook, by Viscosity, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa India Two Wheeler Engine Oil Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Indian Oil Corporation Ltd. (Servo)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- BPCL (Mak Lubricants)

- HPCL (HP Lubricants)

- Castrol India Ltd.

- Veedol International Limited (Tide Water)

- Gulf Oil Lubricants India Ltd.

- Shell India

- Motul

- Indian Oil Corporation Ltd. (Servo)

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Sales Channel Coverage |

|

|

Viscosity Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |