Industrial Lubricants Market Growth and Industry Forecast

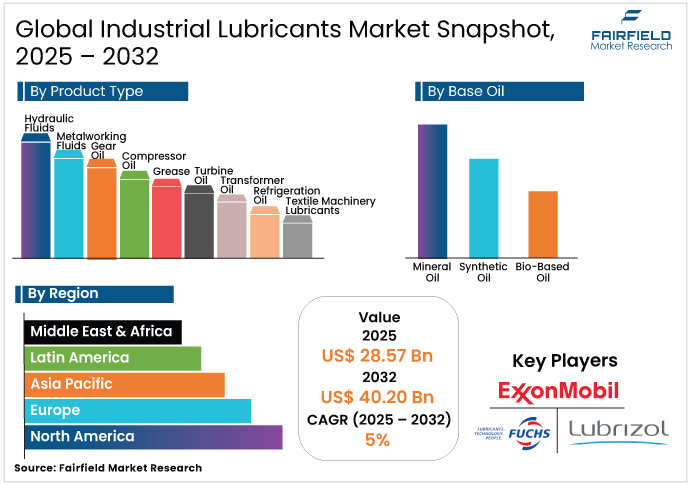

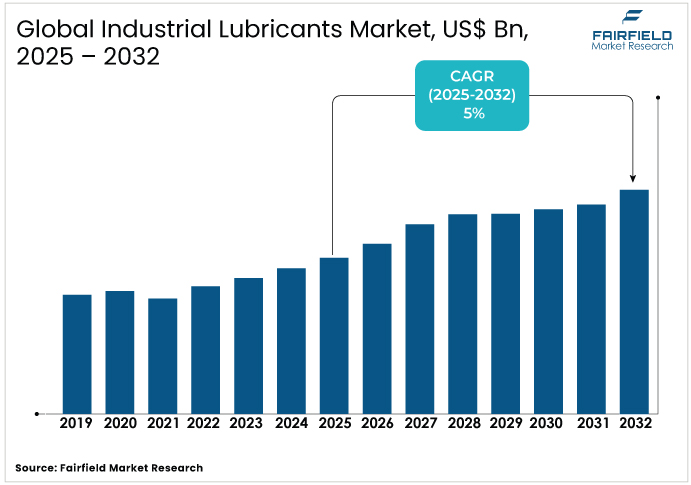

- The global industrial lubricants market is projected to be valued at US$ 28.57 Bn in 2025.

- It is expected to reach US$ 40.20 Bn by 2032, growing at a CAGR of 5% between 2025 and 2032.

Industrial Lubricants Market Summary Key Insights & Trends

- Mineral oil dominates the base oil category with 54.3% of the industrial lubricants market, driven by its cost-effectiveness and use in hydraulic systems and gear lubrication.

- Synthetic oil accounts for 39.8% and is the fastest-growing base oil, boosted by rising demand in power generation and automotive industries.

- Hydraulic fluids hold the top position among product types at 25.9%, essential for construction and manufacturing machinery.

- Compressor oil represents 11.4% and is the fastest-expanding product type, supported by chemical production and power generation needs.

- Power generation leads end-use applications at 22.1%, with strong reliance on turbine and transformer oils for reliable output.

- Automotive stands at 8.6% and records the fastest end-use growth, driven by the surge in electric vehicles.

- Asia Pacific remains the largest regional market, led by East Asia at 30.8% and projected to grow at 4.8% CAGR, supported by China’s industrialization and India’s bio-based adoption.

- Rapid industrialization and infrastructure development, with global construction spending projected at US$15 trillion by 2030, drive lubricant demand in heavy equipment.

- Growing opportunities stem from bio-based lubricants advancing at 8% CAGR and IoT-enabled smart lubricants that can extend equipment life by 20%.

A Look Back and a Look Forward - Comparative Analysis

The industrial lubricants market witnessed moderate growth from 2019 to 2024, showing steady expansion over the period with a consistent growth rate. This period was marked by steady demand from key sectors such as manufacturing and energy, but the COVID-19 pandemic significantly disrupted progress in 2020-2021, causing a sharp decline of up to 15% in global consumption due to lockdowns, reduced industrial activity, and supply chain interruptions. Industries such as automotive and construction saw lubricant demand plummet as factories halted operations and global trade slowed, leading to excess inventories and price volatility.

Recovery began in 2022, driven by resuming industrial activities and investments in automation, though lingering supply issues from raw material shortages persisted. Overall, the industrial lubricants demonstrated resilience, with a shift toward synthetic lubricants gaining traction as companies prioritized efficiency amid economic uncertainties.

Looking ahead to 2025–2032, the industrial lubricants industry is set for steady expansion, driven by technological advancements and sustainability initiatives, with growth momentum expected to accelerate throughout the forecast period. Emerging markets in Asia Pacific will lead expansion, with increased adoption of bio-based and high-performance lubricants to meet stringent environmental regulations and support renewable energy projects.

Sectors such as power generation and oil & gas are expected to drive demand, as digitalization and Industry 4.0 integrations enhance equipment efficiency, reducing maintenance costs. Challenges such as fluctuating raw material prices may arise, but opportunities in electric vehicle-related lubricants and eco-friendly formulations will offset them. The market's forward trajectory emphasizes innovation, with key players investing in R&D to develop lubricants that withstand higher temperatures and extend machinery life, ensuring robust growth through 2032.

Key Growth Drivers

- Rapid Industrialization and Infrastructure Development Driving Global Lubricants Market Demand

The industrial lubricants market is significantly driven by accelerating industrialization in developing regions, where infrastructure projects demand reliable lubricants for heavy machinery. According to the World Economic Forum, infrastructure is the backbone of modern economies, yet a $15 trillion investment gap through 2040 remains, driving higher lubricant demand in excavators, cranes, and related machinery. This growth is justified by the need for reduced friction and wear in high-stress environments, leading to longer equipment life and lower operational costs. Statistics show that proper lubrication can cut maintenance expenses by up to 30%. This driver is amplified by emerging economies such as India and China, where manufacturing output has grown at over 6% annually, necessitating advanced hydraulic and gear oils to support seamless operations.

- Technological Advancements Boosting Adoption of Synthetic and Bio-Based Lubricants

Technological innovations in lubricant formulations are a key driver with synthetic oils offering superior thermal stability and oxidation resistance compared to mineral-based alternatives. Market data indicates that synthetic lubricants can extend drain intervals by 2-3 times, reducing waste and costs global adoption has risen by 15% since 2020 due to environmental regulations pushing for low-emission products. Justification lies in their ability to perform in extreme conditions, such as high temperatures in turbines or low viscosity for energy efficiency, aligning with sustainability goals. The market benefits from this as industries such as power generation invest in these products to comply with emissions standards, driving overall market value growth.

- Rising Energy and Oil & Gas Needs Fueling Lubricants Market Expansion

The booming energy sector is propelled with power generation alone accounting for over 20% of demand due to the need for turbine and transformer oils. Statistics reveal that global energy consumption will increase by over 45% by 2050, justifying higher lubricant usage in turbines and compressors to prevent breakdowns and ensure efficiency. In oil & gas, exploration activities in offshore rigs require specialized greases resistant to corrosion, with market reports showing a 10% annual increase in such applications. This driver strengthens the industrial lubricants by addressing reliability needs in critical infrastructure, where downtime can cost millions, thus encouraging investments in premium lubricants.

Key Growth Restraints

- Volatility of Raw Material Prices to Restrict Market Growth

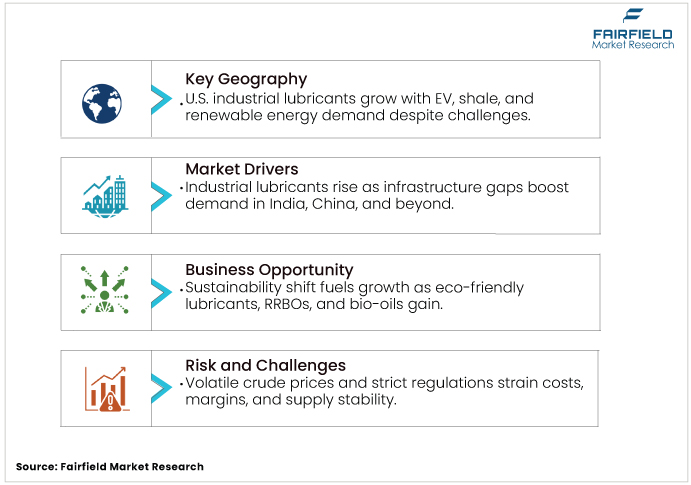

The industrial lubricants market faces significant pressure from volatile crude oil prices, with base oil costs often spiking by 20–30% during periods of geopolitical tension. Since both mineral and synthetic base oils are primarily petroleum-derived, such fluctuations directly raise production costs and undermine pricing stability. For sales teams, this translates into squeezed profit margins, delayed procurement decisions, and more difficult negotiations with cost-sensitive customers. Adding further strain, stringent environmental regulations targeting pollution and carbon emissions are increasing compliance costs, restricting mining activities, and tightening operational standards. Collectively, these challenges not only inflate expenses but also weaken buyer confidence, slowing industrial lubricant sales growth.

- Extended Equipment Life & Synthetic Alternatives

Industrial lubricant sales are increasingly restrained by advances in machinery and lubricant technology. Modern equipment is now designed with higher durability and efficiency, requiring less frequent maintenance and lubrication. At the same time, high-performance synthetic lubricants offer longer service intervals, superior resistance to extreme conditions, and extended protection compared to conventional oils. Furthermore, the adoption of condition monitoring systems allows industries to optimize lubricant usage, minimizing wastage and unnecessary replacements. While these innovations improve operational efficiency, they ultimately reduce lubricant consumption, directly impacting overall market demand.

Industrial Lubricants Market Trends and Opportunities

- Green transition is creating new growth opportunities for key players in the industrial lubricants market through sustainable oils and circular solutions.

The sustainability shift presents a strong growth opportunity for key players in the industrial lubricants market. The transition from conventional Grade I oils to advanced Grade V synthetic esters allows manufacturers to deliver high-performance, durable, and eco-friendly lubricants for emerging applications such as EVs, renewable energy equipment, and cooling technologies. Expanding into bio-lubricants made from algae, plant oils, and waste cooking oils further enables alignment with ESG commitments and premium customer demand. Re-refined base oils (RRBOs) and regenerated oils provide additional opportunities, reducing CO₂ emissions by up to 90% compared to virgin oils while improving cost competitiveness. Global leaders like TotalEnergies, Avista Green, Castrol, and Safety Kleen are already investing in circular lubricant models and large-scale RRBO production. For established players, these trends offer value creation through premium pricing, stronger brand equity, and long-term revenue growth.

- Industry 4.0 and Smart Manufacturing Unlock Opportunities in Advanced Lubricants

Opportunities in the industrial lubricants market arise from smart manufacturing, where IoT-enabled monitoring optimizes lubricant usage and predicts maintenance. With Industry 4.0 investments reaching US$ 200 billion annually, lubricants integrated with sensors can extend equipment life by 20%. This is justified by efficiency gains in sectors such as automotive, where predictive analytics reduce downtime, opening avenues for premium, condition-based lubricants and partnerships with tech firms.

Segment-wise Trends & Analysis

- Mineral Oil Leads Global Base Oil Segment With Strong Market Share

Mineral oil, derived from crude refining, dominates the Industrial Lubricants Market with a 54.3% share. Favoured for cost-effectiveness, availability, and compatibility with legacy equipment, it supports hydraulic systems, gear lubrication, and mining. With lubrication, cooling, corrosion resistance, insulation, and eco-friendly disposal, mineral oil remains indispensable across diverse industrial and consumer applications. However, Synthetic oils, chemically modified with fewer impurities, are the fastest-growing segment at 39.8%, driven by automotive and power generation demand. They offer stable viscosity, superior extreme-temperature performance, fuel efficiency, reduced deposits, less wear, and extended service life. Bio-based oils also show emerging potential as regulations push for sustainable alternatives, though adoption is limited by higher costs. Overall, the shift toward synthetics and bio-based options reflects a balance between affordability and environmental compliance, with synthetics expected to gain further traction through innovations that enhance energy efficiency.

- Hydraulic Fluids Dominate Product Segment Driving Demand Across Key Industries

Hydraulic Fluids lead the market with a 25.9% share, essential for machinery in construction and manufacturing due to their anti-wear properties and fluid power transmission efficiency. The fastest-growing segment is Compressor Oil at 9.2%, propelled by expanding power generation and chemical production needs for high-pressure systems. This highlights a growing preference for specialized products that minimize friction, extend equipment life, and support industrial automation.

- Power Generation Remains Leading End Use Sector Driving Global Consumption

Power Generation leads end-use applications with 22.1% share, requiring turbine and transformer oils for reliable energy production amid global electrification efforts. The fastest-growing segment is Automotive at 8.6%, driven by the transition to electric vehicles that need advanced lubricants for gears and bearings. These dynamics underscore strong opportunities in automotive, while power generation continues to anchor steady demand.

Regional Analysis

- North America Strengthens Market Share With U.S. Manufacturing and Energy Growth

North America holds a 16.5% share with the U.S. dominating due to its robust manufacturing and energy sectors. U.S. trends include a shift toward synthetic lubricants, driven by EPA regulations on emissions and a focus on energy efficiency market data shows a 4% annual growth in bio-based adoption. Key drivers are shale gas exploration boosting oil & gas demand and automotive innovations in EVs requiring specialized oils. Infrastructure investments under the Inflation Reduction Act further propel the industrial lubricants market, emphasizing high-performance products for wind turbines and data centers. Challenges such as raw material volatility persist, but opportunities in renewable energy position the U.S. as a leader in sustainable lubrication solutions.

- Europe Ranks Second with Automotive Prowess and Strict Environmental Sustainability Mandates

Europe commands a 20.2% share, led by Germany, the UK, and France. Germany's automotive and manufacturing prowess drives demand for metalworking fluids, with drivers including EU Green Deal mandates for low-carbon lubricants growth is projected at a 3.5% CAGR. The UK's focus on offshore wind energy boosts turbine oil usage, while France's chemical sector emphasizes eco-friendly options. Key drivers across Europe are stringent environmental regulations and R&D investments in bio-based lubricants, justifying a 20% rise in synthetic adoption. The industrial lubricants benefit from these trends, fostering innovation in high-efficiency products amid energy transitions.

- Asia Pacific Emerges as Largest Regional Market Driven by Industrialization

Asia Pacific is the largest region in the industrial lubricants industry, with East Asia at 30.8%, South Asia Oceania at 17.9%, and Middle East and Africa at 9.6%. China leads East Asia, driven by rapid industrialization and manufacturing exports, with a 6% CAGR fueled by hydraulic fluid demand in construction. India's growth in South Asia is propelled by the agriculture and textile sectors adopting bio-based lubricants under sustainability initiatives. Key drivers include urbanization, foreign investments, and energy expansion in Japan and Australia. The market thrives here due to cost-effective production and rising environmental awareness, positioning the region for dominant growth.

Competitive Landscape

The industrial lubricants market is driven by strategic initiatives such as mergers and acquisitions to strengthen market presence, product innovation through new launches, and capacity expansions to address rising demand. Sustainability remains a core focus, with companies investing in bio-based formulations and forging partnerships with OEMs to deliver customized solutions. These approaches not only enhance competitiveness but also align with global shifts toward efficiency, environmental responsibility, and advanced performance standards, positioning industry leaders for long-term growth and resilience.

Key Companies:

- ExxonMobil Corp.

- Fuchs Petrolub SE

- The Lubrizol Corp.

- Shell Plc

- Phillips 66

- Lucas Oil Products Inc.

- Amsoil, Inc.

- Bel-Ray Co. Inc.

- Total S.A

- Kluber Lubrication

- Valvoline International, Inc.

- Chevron Corp.

- Clariant AG

- Quaker Chemical Corp.

- Zeller+ Gmelin GmbH & Co KG

- Houghton International, Inc.

- Castrol

- Blaser Swisslube, Inc.

- Calumet Specialty Product Partners LP

Recent Industry Developments

- In August 2025, TotalEnergies Marketing India Private Limited (TEMIPL) announces the launch of its new and improved range of Quartz car engine oils in India that meets the latest API SQ and ILSAC GF-7 performance standards, set by the American Petroleum Institute (API) and the International Lubricants Standardization and Approval Committee (ILSAC).

- In May 2025, ExxonMobil announced the startup of its second advanced plastic recycling unit, doubling its existing capacity. The company is pursuing investments in lower-emission solutions, including its Proxxima resin used in wind turbine blades, but did not launch a new line of synthetic turbine oils with a 15% market share target in Q1 2025.

- In April 2025, Fuchs Petrolub acquired US-based lubricant manufacturer IRMCO, strengthening its position in industrial and green lubricants. The move expands Fuchs' industrial offerings, with the company projecting flat sales and EBIT for 2025 due to a muted economic environment.

Global Industrial Lubricants Market Segmentation

Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

Product Type

- Hydraulic Fluids

- Metalworking Fluids

- Gear Oil

- Compressor Oil

- Grease

- Turbine Oil

- Transformer Oil

- Refrigeration Oi

- Textile Machinery Lubricants

- Others

End Use

- Construction

- Metal & Mining

- Cement Production

- Power Generation

- Automotive

- Chemical Production

- Oil & Gas

- Textile Manufacturing

- Food Processing

- Agriculture

- Pulp & Paper

- Marine Applications

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Industrial Lubricants Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Industrial Lubricants Market Outlook, 2019 - 2032

3.1. Global Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

3.1.1. Mineral Oil

3.1.2. Synthetic Oil

3.1.3. Bio-Based Oil

3.2. Global Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

3.2.1. Hydraulic Fluids

3.2.2. Metalworking Fluids

3.2.3. Gear Oil

3.2.4. Compressor Oil

3.2.5. Grease

3.2.6. Turbine Oil

3.2.7. Transformer Oil

3.2.8. Refrigeration Oi

3.2.9. Textile Machinery Lubricants

3.2.10. Others

3.3. Global Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

3.3.1. Construction

3.3.2. Metal & Mining

3.3.3. Cement Production

3.3.4. Power Generation

3.3.5. Automotive

3.3.6. Chemical Production

3.3.7. Oil & Gas

3.3.8. Textile Manufacturing

3.3.9. Food Processing

3.3.10. Agriculture

3.4. Global Industrial Lubricants Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Industrial Lubricants Market Outlook, 2019 - 2032

4.1. North America Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

4.1.1. Mineral Oil

4.1.2. Synthetic Oil

4.1.3. Bio-Based Oil

4.2. North America Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

4.2.1. Hydraulic Fluids

4.2.2. Metalworking Fluids

4.2.3. Gear Oil

4.2.4. Compressor Oil

4.2.5. Grease

4.2.6. Turbine Oil

4.2.7. Transformer Oil

4.2.8. Refrigeration Oi

4.2.9. Textile Machinery Lubricants

4.2.10. Others

4.3. North America Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

4.3.1. Construction

4.3.2. Metal & Mining

4.3.3. Cement Production

4.3.4. Power Generation

4.3.5. Automotive

4.3.6. Chemical Production

4.3.7. Oil & Gas

4.3.8. Textile Manufacturing

4.3.9. Food Processing

4.3.10. Agriculture

4.4. North America Industrial Lubricants Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. U.S. Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

4.4.2. U.S. Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

4.4.3. U.S. Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

4.4.4. Canada Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

4.4.5. Canada Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

4.4.6. Canada Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Industrial Lubricants Market Outlook, 2019 - 2032

5.1. Europe Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

5.1.1. Mineral Oil

5.1.2. Synthetic Oil

5.1.3. Bio-Based Oil

5.2. Europe Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

5.2.1. Hydraulic Fluids

5.2.2. Metalworking Fluids

5.2.3. Gear Oil

5.2.4. Compressor Oil

5.2.5. Grease

5.2.6. Turbine Oil

5.2.7. Transformer Oil

5.2.8. Refrigeration Oi

5.2.9. Textile Machinery Lubricants

5.2.10. Others

5.3. Europe Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

5.3.1. Construction

5.3.2. Metal & Mining

5.3.3. Cement Production

5.3.4. Power Generation

5.3.5. Automotive

5.3.6. Chemical Production

5.3.7. Oil & Gas

5.3.8. Textile Manufacturing

5.3.9. Food Processing

5.3.10. Agriculture

5.4. Europe Industrial Lubricants Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Germany Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.2. Germany Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.3. Germany Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.4. Italy Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.5. Italy Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.6. Italy Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.7. France Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.8. France Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.9. France Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.10. U.K. Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.11. U.K. Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.12. U.K. Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.13. Spain Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.14. Spain Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.15. Spain Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.16. Russia Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.17. Russia Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.18. Russia Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.4.19. Rest of Europe Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

5.4.20. Rest of Europe Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

5.4.21. Rest of Europe Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Industrial Lubricants Market Outlook, 2019 - 2032

6.1. Asia Pacific Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

6.1.1. Mineral Oil

6.1.2. Synthetic Oil

6.1.3. Bio-Based Oil

6.2. Asia Pacific Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

6.2.1. Hydraulic Fluids

6.2.2. Metalworking Fluids

6.2.3. Gear Oil

6.2.4. Compressor Oil

6.2.5. Grease

6.2.6. Turbine Oil

6.2.7. Transformer Oil

6.2.8. Refrigeration Oi

6.2.9. Textile Machinery Lubricants

6.2.10. Others

6.3. Asia Pacific Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

6.3.1. Construction

6.3.2. Metal & Mining

6.3.3. Cement Production

6.3.4. Power Generation

6.3.5. Automotive

6.3.6. Chemical Production

6.3.7. Oil & Gas

6.3.8. Textile Manufacturing

6.3.9. Food Processing

6.3.10. Agriculture

6.4. Asia Pacific Industrial Lubricants Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. China Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.2. China Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.3. China Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.4.4. Japan Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.5. Japan Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.6. Japan Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.4.7. South Korea Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.8. South Korea Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.9. South Korea Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.4.10. India Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.11. India Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.12. India Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.4.13. Southeast Asia Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.14. Southeast Asia Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.15. Southeast Asia Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.4.16. Rest of SAO Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

6.4.17. Rest of SAO Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

6.4.18. Rest of SAO Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Industrial Lubricants Market Outlook, 2019 - 2032

7.1. Latin America Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

7.1.1. Mineral Oil

7.1.2. Synthetic Oil

7.1.3. Bio-Based Oil

7.2. Latin America Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

7.2.1. Hydraulic Fluids

7.2.2. Metalworking Fluids

7.2.3. Gear Oil

7.2.4. Compressor Oil

7.2.5. Grease

7.2.6. Turbine Oil

7.2.7. Transformer Oil

7.2.8. Refrigeration Oi

7.2.9. Textile Machinery Lubricants

7.2.10. Others

7.3. Latin America Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

7.3.1. Construction

7.3.2. Metal & Mining

7.3.3. Cement Production

7.3.4. Power Generation

7.3.5. Automotive

7.3.6. Chemical Production

7.3.7. Oil & Gas

7.3.8. Textile Manufacturing

7.3.9. Food Processing

7.3.10. Agriculture

7.4. Latin America Industrial Lubricants Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Brazil Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

7.4.2. Brazil Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

7.4.3. Brazil Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

7.4.4. Mexico Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

7.4.5. Mexico Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

7.4.6. Mexico Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

7.4.7. Argentina Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

7.4.8. Argentina Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

7.4.9. Argentina Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

7.4.10. Rest of LATAM Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

7.4.11. Rest of LATAM Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

7.4.12. Rest of LATAM Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Industrial Lubricants Market Outlook, 2019 - 2032

8.1. Middle East & Africa Industrial Lubricants Market Outlook, by Base Oil, Value (US$ Bn), 2019 - 2032

8.1.1. Mineral Oil

8.1.2. Synthetic Oil

8.1.3. Bio-Based Oil

8.2. Middle East & Africa Industrial Lubricants Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

8.2.1. Hydraulic Fluids

8.2.2. Metalworking Fluids

8.2.3. Gear Oil

8.2.4. Compressor Oil

8.2.5. Grease

8.2.6. Turbine Oil

8.2.7. Transformer Oil

8.2.8. Refrigeration Oi

8.2.9. Textile Machinery Lubricants

8.2.10. Others

8.3. Middle East & Africa Industrial Lubricants Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

8.3.1. Construction

8.3.2. Metal & Mining

8.3.3. Cement Production

8.3.4. Power Generation

8.3.5. Automotive

8.3.6. Chemical Production

8.3.7. Oil & Gas

8.3.8. Textile Manufacturing

8.3.9. Food Processing

8.3.10. Agriculture

8.4. Middle East & Africa Industrial Lubricants Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. GCC Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

8.4.2. GCC Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

8.4.3. GCC Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

8.4.4. South Africa Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

8.4.5. South Africa Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

8.4.6. South Africa Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

8.4.7. Egypt Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

8.4.8. Egypt Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

8.4.9. Egypt Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

8.4.10. Nigeria Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

8.4.11. Nigeria Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

8.4.12. Nigeria Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

8.4.13. Rest of Middle East Industrial Lubricants Market Outlook, by Base Oil, 2019 - 2032

8.4.14. Rest of Middle East Industrial Lubricants Market Outlook, by Product Type, 2019 - 2032

8.4.15. Rest of Middle East Industrial Lubricants Market Outlook, by End Use, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. ExxonMobil Corp.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Fuchs Petrolub SE

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. The Lubrizol Corp.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Shell Plc

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Phillips 66

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Lucas Oil Products Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Amsoil, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Bel-Ray Co. Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Total S.A

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Kluber Lubrication

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Base Oil Coverage |

|

|

Product Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |