Executive Summary & Key Highlights

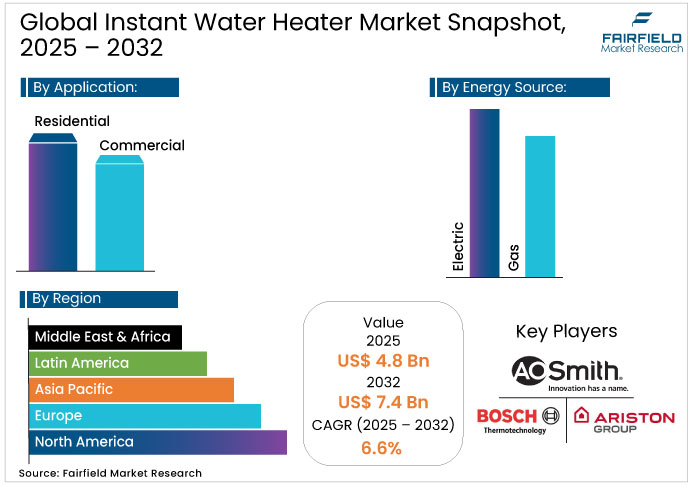

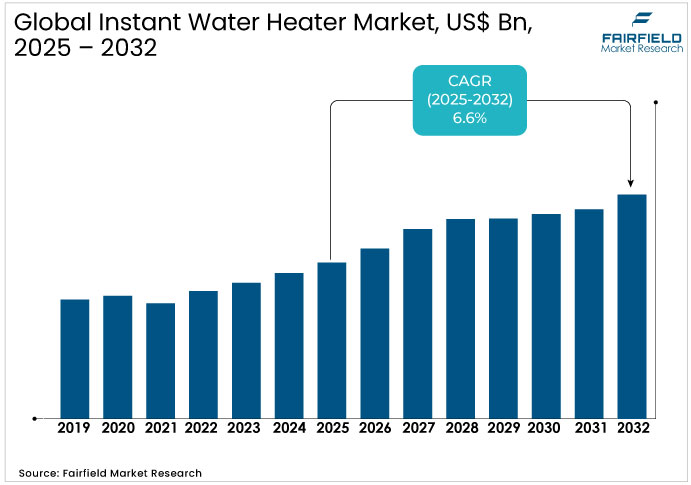

- The global instant water heater market reached approximately USD 4.8 billion in 2025 and is anticipated to expand to USD 7.4 billion by 2032, representing growth within the 6.6 % range-reflecting underlying demand for energy-efficient on-demand heating solutions across residential and commercial segments.

- The Residential segment leads with 55–58% share, driven by strong adoption of compact residential instant water heaters across urbanized global markets.

- Smart Connectivity and IoT-enabled systems are emerging as a key opportunity, particularly as commercial and premium residential users seek integrated, intelligent heating solutions.

- Asia-Pacific holds the highest regional share at 50%, supported by rapid urbanization and strong uptake of both electric and gas-based instant heating solutions.

- Europe maintains a sizable regional share, reinforced by strict Ecodesign and ERP-driven adoption of high-efficiency electric and condensing gas technologies.

Market Dynamics: Drivers, Restraints, and Opportunities Analysis

Market Drivers

- Urbanization and Residential Space Constraints

Rapid urbanization across Asia-Pacific-especially in India, China, and Southeast Asia-is driving strong demand for space-efficient appliances suited for compact urban housing. With apartment-based living now accounting for 35–40% of urban residents in major emerging markets, the shift from standalone homes to high-density residential units is accelerating adoption of compact, wall-mounted instant water heaters.

This trend is set to contribute significantly to growth through 2032, particularly in tier-2 and tier-3 cities experiencing first-time appliance purchases. Companies offering compact, aesthetically integrated designs are positioned to gain, while traditional storage-tank-focused players may face constraints. However, the sustainability of this driver depends on ongoing urbanization momentum and apartment construction rates amid economic cyclicality.

Energy Efficiency Regulatory Mandates and Building Standards

Regulatory frameworks in North America, Europe, and emerging markets are enforcing stricter efficiency standards, accelerating technology transitions and replacement cycles. The U.S. DOE’s December 2024 Final Rule mandates UEF 0.91–0.93 for gas-fired instantaneous heaters by December 26, 2029, effectively eliminating 40% of current non-condensing models, while the EU’s Ecodesign and EPR Directives and emerging requirements in China and India mirror these strict benchmarks.

These mandates create dual impacts: manufacturers must shift to condensing technologies-raising near-term costs but strengthening long-term competitive barriers-while consumers face accelerated replacement decisions. With 60% of North American tankless units already compliant, the transition is partially underway, but removing non-condensing options will raise equipment costs by 15–25%, challenging affordability for price-sensitive and rental markets. Organizations offering cost-efficient condensing units and financing solutions are best positioned to benefit.

Market Restraints

- High Installation Costs and Upfront Capital Requirements

Instant water heaters typically involve noticeably higher upfront expenses than storage systems, with premium residential models and associated installation requirements pushing overall costs well above those of conventional tank-based units. In comparison, traditional storage heaters remain significantly more affordable, both in terms of equipment and setup, making them the lower-cost option for most households. Specialized venting, gas line adjustments, and skilled technician requirements further elevate installation complexity.

These high costs suppress residential growth by 3–5 percentage points, especially among lower-income users and rental markets. Mitigation strategies include utility rebates, lease-based financing, and long-term savings demonstrations showing 15–25% operating cost reductions, supported by incentives in regions such as California and parts of Europe covering 20–40% of installation costs. Organizations with cost-efficient manufacturing, simpler installation, and integrated financing can help ease this restraint.

- Technology Skepticism and Performance Consistency Concerns

Persistent consumer skepticism surrounding temperature stability, water flow performance, and transitional heating issues continues to slow adoption, especially in regions where tankless systems are still relatively unfamiliar. Situations with inconsistent or low hot-water demand can further reduce system efficiency, creating unsatisfactory user experiences that reinforce hesitation within households and communities.

This challenge meaningfully constrains residential adoption by limiting consumer confidence, even when technical capabilities are strong. Addressing these concerns requires broader education efforts, stronger warranty commitments, and certified installation practices that ensure proper system setup. Industry leaders are increasingly incorporating smart controls and remote monitoring features that provide real-time performance visibility and proactive maintenance alerts, helping to build trust through transparent, data-driven assurance of system reliability and efficiency.

Market Opportunities

- Smart Connectivity and IoT-Enabled System Integration

The integration of water-heating systems with smart home platforms, building management software, and IoT infrastructure is becoming a major source of differentiation. Although adoption of smart features is still limited due to platform immaturity and awareness gaps, connected capabilities such as remote control, adaptive scheduling, and predictive maintenance offer clear advantages over traditional systems.

Commercial installations show especially strong potential, as facility managers increasingly demand seamless connectivity with building energy platforms. Companies prioritizing open, interoperable architectures stand to benefit most, though challenges remain around standardization, cybersecurity, and the need for transparent data-privacy frameworks.

- Hybrid Heating System Development Combining Instantaneous and Storage Technologies

Hybrid water-heating systems that combine on-demand operation with thermal storage are emerging as a strong alternative to both traditional and fully instantaneous units. By delivering more stable temperature performance while preserving the efficiency benefits of tankless operation, these systems appeal to customers who remain cautious about pure on-demand technologies.

Their potential spans both new installations and retrofit settings, widening the overall opportunity for adoption. However, uptake is still constrained by early-stage technology maturity, higher upfront costs compared to standard solutions, and the need for clearer consumer education on their distinct value. Companies investing in development, demonstration, and awareness efforts are well positioned to strengthen their competitive edge as understanding and confidence grow.

Segmentation Analysis: Category-Wise Strategic Assessment

Application Segment

- Residential Segment Leadership and Growth Dynamics

The residential segment accounts for 55–58% of global instant water-heater value in 2025, supported by strong adoption in developed markets and rising uptake in urbanizing Asia-Pacific and Europe. Growth is shaped by space-efficient housing, rising energy-efficiency awareness, and tightening appliance-level standards. Performance is further driven by rapid urbanization in emerging markets, steady retrofit cycles in mature regions, and consumer focus on long-term operating-cost savings of 15–25% over the equipment lifetime.

The commercial segment, representing 42–45% of instant water heater market value, is expanding at a significantly faster pace than the residential segment, making it the fastest-growing application area. Demand comes from hospitality, healthcare, and food-service environments requiring high-capacity, multi-point, and temperature-stable hot-water delivery. Growth is reinforced by energy-management priorities, BEMS integration requirements, and higher system throughput (10–20x residential capacity), with lower price sensitivity enabling premium product adoption and long-term service revenue opportunities.

Energy Source Segment

- Electric Heating Technology Market Leadership

The electric instant water heating segment, accounting for 65–68% of global value in 2025, is supported by broad electricity access, electrification policies, and lower upfront costs than gas systems. Growth reflects steady efficiency enhancements and strong adoption in emerging markets where electricity networks outpace natural gas availability. Key challenges include grid limitations in some regions and rising electricity prices influencing operating-cost perceptions.

Gas-fired systems, holding 32–35% of instant water heater market value, are the fastest-growing segment due to natural gas affordability, expanding pipelines, and advances in condensing technology. Regulatory shifts such as U.S. 2029 efficiency standards support widespread adoption, with 15–25% cost premiums balanced by 13% energy savings. Despite higher installation complexity and lingering performance concerns, manufacturers leading in condensing efficiency and smart controls are positioned to gain advantage.

Regional Market Assessment: Strategic Geography Analysis

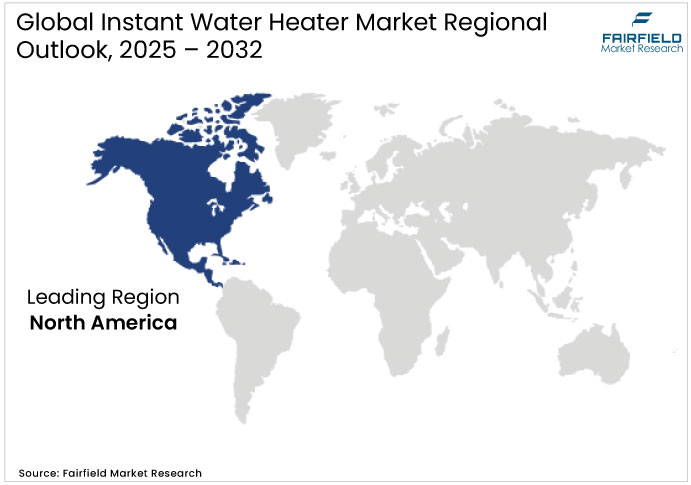

- North America: Technology Transition and Regulatory Compliance Market

The North American instant water heater market is valued at USD 900–1,000 million in 2025, representing 18–21% of global value, with strong influence due to regulatory leadership and a large installed base. Residential adoption is relatively mature, while growth is accelerating across commercial sectors and key submarkets such as Arizona, Nevada, California, and Florida. Canada reflects similar momentum, supported by broader natural-gas utilization and favorable installation environments.

The 2024 DOE Final Rule mandating higher efficiency standards by 2029 will phase out non-condensing gas units, with a substantial portion of systems already aligned and the remainder requiring redesign. This is expected to generate a notable replacement surge ahead of the deadline and increase equipment prices, affecting affordability despite measurable long-term energy and cost benefits.

- Europe: Regulatory Harmonization and Sustainability-Driven Market

The European instant water heater market is valued at USD 1.0–1.2 billion in 2025, representing 20–25% of global value, with Germany holding 20–25% and the U.K. 15–20% of regional share. High residential penetration is driven by apartment-based housing, widespread natural-gas infrastructure, and strict efficiency standards, while countries such as France, Spain, Italy, and Poland show varied growth tied to electrification and renewable-energy policies.

EU-wide regulations under Ecodesign, ERP, and EPBD push the market toward condensing gas systems, advanced electric solutions, and renewable-ready equipment. Decarbonization goals under the Climate Pact and Fit-for-55 further reward systems supporting solar thermal integration, heat-pump optimization, and building-grid connectivity, with investment accelerating in hybrid technologies and microgrid-integrated heating solutions.

- Asia-Pacific: Urbanization-Driven Expansion and Manufacturing Leadership

The Asia-Pacific instant water heater market totals USD 2.2 billion in 2025, representing 50% of global value and benefiting from rapid urbanization and rising appliance penetration in tier-2 and tier-3 cities. China accounts for 48% of regional value, India shows the fastest growth at a higher CAGR, Japan remains stable, and Southeast Asia is shifting from early adoption to mainstream uptake as gas networks and urban housing expand.

Regional growth is driven by apartment-based living, a rising middle class of 400–600 million consumers by 2032 and growing interest in gas or hybrid systems amid electricity price increases. Regulatory frameworks in Japan and South Korea continue tightening efficiency requirements, while China and India push labeling and certification programs that accelerate standardization and create opportunities for hybrid and renewable-integrated systems.

Competitive Landscape: Market Structure and Strategic Positioning

The global instant water heater market shows moderate consolidation, with major players holding 40% of total value and higher concentration in North America and Western Europe. Key global leaders-A.O. Smith, Rinnai, Ariston, Rheem, Bosch, and Noritz-compete through IoT-enabled technology, efficiency enhancements, broad product portfolios, and strong international distribution, while regional brands such as Midea, Haier, Racold, and Havells dominate price-driven emerging markets.

Entry barriers are significant yet gradually declining, shaped by certification requirements, technology licensing, and distributor relationships. While capital needs are moderate, compliance and infrastructure hurdles deter new entrants in developed regions, even as emerging markets attract newer competitors due to lower barriers and strong local demand dynamics.

Key Players

- Smith Corporation

- Ariston Holding N.V.

- Bosch Thermotechnology

- Bradford White Corporation

- GE Appliances

- Rheem Manufacturing Company

- Whirlpool Corporation

- Rinnai Corporation

- FERROLI S.p.A.

- Havells India Ltd.

- Hubbell Heaters

- Vaillant Group

- Navien Inc.

- Haier Inc.

- Jaquar & Company Pvt. Ltd.

Recent Developments

- In September 2024, The new Point-of-Use (POU) Electric Tankless Water Heater offers a compact, vent-free design for easy installation near fixtures in residential and light commercial settings, delivering immediate hot water for sinks, lavatories, emergency fixtures, and boosters. It features continuous dry-fire protection, leak detection with an audible alarm, and integrated scale-detection software that shuts the unit down during buildup to prevent damage and extend system life.

- In May 2025, Lennox and Ariston Group have entered a joint venture to launch a new range of residential water heaters in the U.S. and Canada, combining Lennox’s distribution strength with Ariston’s advanced water heating technology. The partnership aims to expand market presence and accelerate innovation in high-efficiency water heating solutions. Lennox says the collaboration will enhance customer value while creating new growth opportunities for dealers and contractors.

Global Instant Water Heater Market Segmentation-

By Application:

- Residential

- Commercial

By Energy Source:

- Electric

- Gas

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

1. Executive Summary

1.1. Global Instant Water Heater Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Instant Water Heater Market Outlook, 2019 - 2032

3.1. Global Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

3.1.1. Residential

3.1.2. Commercial

3.2. Global Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

3.2.1. Electric

3.2.2. Gas

3.3. Global Instant Water Heater Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Instant Water Heater Market Outlook, 2019 - 2032

4.1. North America Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

4.1.1. Residential

4.1.2. Commercial

4.2. North America Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

4.2.1. Electric

4.2.2. Gas

4.3. North America Instant Water Heater Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.3.1. U.S. Instant Water Heater Market Outlook, by Application, 2019-2032

4.3.2. U.S. Instant Water Heater Market Outlook, by Energy Source, 2019-2032

4.3.3. Canada Instant Water Heater Market Outlook, by Application, 2019-2032

4.3.4. Canada Instant Water Heater Market Outlook, by Energy Source, 2019-2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Instant Water Heater Market Outlook, 2019 - 2032

5.1. Europe Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

5.1.1. Residential

5.1.2. Commercial

5.2. Europe Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

5.2.1. Electric

5.2.2. Gas

5.3. Europe Instant Water Heater Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.3.1. Germany Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.2. Germany Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.3. Italy Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.4. Italy Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.5. France Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.6. France Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.7. U.K. Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.8. U.K. Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.9. Spain Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.10. Spain Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.11. Russia Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.12. Russia Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.3.13. Rest of Europe Instant Water Heater Market Outlook, by Application, 2019-2032

5.3.14. Rest of Europe Instant Water Heater Market Outlook, by Energy Source, 2019-2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Instant Water Heater Market Outlook, 2019 - 2032

6.1. Asia Pacific Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

6.1.1. Residential

6.1.2. Commercial

6.2. Asia Pacific Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

6.2.1. Electric

6.2.2. Gas

6.3. Asia Pacific Instant Water Heater Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.3.1. China Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.2. China Instant Water Heater Market Outlook, by Energy Source, 2019-2032

6.3.3. Japan Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.4. Japan Instant Water Heater Market Outlook, by Energy Source, 2019-2032

6.3.5. South Korea Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.6. South Korea Instant Water Heater Market Outlook, by Energy Source, 2019-2032

6.3.7. India Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.8. India Instant Water Heater Market Outlook, by Energy Source, 2019-2032

6.3.9. Southeast Asia Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.10. Southeast Asia Instant Water Heater Market Outlook, by Energy Source, 2019-2032

6.3.11. Rest of SAO Instant Water Heater Market Outlook, by Application, 2019-2032

6.3.12. Rest of SAO Instant Water Heater Market Outlook, by Energy Source, 2019-2032

7. Latin America Instant Water Heater Market Outlook, 2019 - 2032

7.1. Latin America Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

7.1.1. Residential

7.1.2. Commercial

7.2. Latin America Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

7.2.1. Electric

7.2.2. Gas

7.3. Latin America Instant Water Heater Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.3.1. Brazil Instant Water Heater Market Outlook, by Application, 2019-2032

7.3.2. Brazil Instant Water Heater Market Outlook, by Energy Source, 2019-2032

7.3.3. Mexico Instant Water Heater Market Outlook, by Application, 2019-2032

7.3.4. Mexico Instant Water Heater Market Outlook, by Energy Source, 2019-2032

7.3.5. Argentina Instant Water Heater Market Outlook, by Application, 2019-2032

7.3.6. Argentina Instant Water Heater Market Outlook, by Energy Source, 2019-2032

7.3.7. Rest of LATAM Instant Water Heater Market Outlook, by Application, 2019-2032

7.3.8. Rest of LATAM Instant Water Heater Market Outlook, by Energy Source, 2019-2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Instant Water Heater Market Outlook, 2019 - 2032

8.1. Middle East & Africa Instant Water Heater Market Outlook, by Application, Value (US$ Bn), 2019-2032

8.1.1. Residential

8.1.2. Commercial

8.2. Middle East & Africa Instant Water Heater Market Outlook, by Energy Source, Value (US$ Bn), 2019-2032

8.2.1. Electric

8.2.2. Gas

8.3. Middle East & Africa Instant Water Heater Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.3.1. GCC Instant Water Heater Market Outlook, by Application, 2019-2032

8.3.2. GCC Instant Water Heater Market Outlook, by Energy Source, 2019-2032

8.3.3. South Africa Instant Water Heater Market Outlook, by Application, 2019-2032

8.3.4. South Africa Instant Water Heater Market Outlook, by Energy Source, 2019-2032

8.3.5. Egypt Instant Water Heater Market Outlook, by Application, 2019-2032

8.3.6. Egypt Instant Water Heater Market Outlook, by Energy Source, 2019-2032

8.3.7. Nigeria Instant Water Heater Market Outlook, by Application, 2019-2032

8.3.8. Nigeria Instant Water Heater Market Outlook, by Energy Source, 2019-2032

8.3.9. Rest of Middle East Instant Water Heater Market Outlook, by Application, 2019-2032

8.3.10. Rest of Middle East Instant Water Heater Market Outlook, by Energy Source, 2019-2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. O. Smith Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Ariston Holding N.V.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Bosch Thermotechnology

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Bradford White Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. GE Appliances

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Rheem Manufacturing Company

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Whirlpool Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Rinnai Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. FERROLI S.p.A.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Havells India Ltd.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Application Coverage |

|

|

By Energy Source Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |