Lithium Mining Market Growth and Industry Forecast

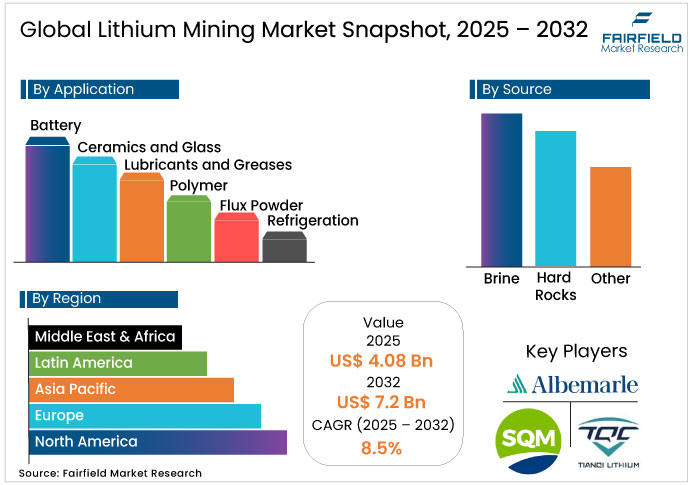

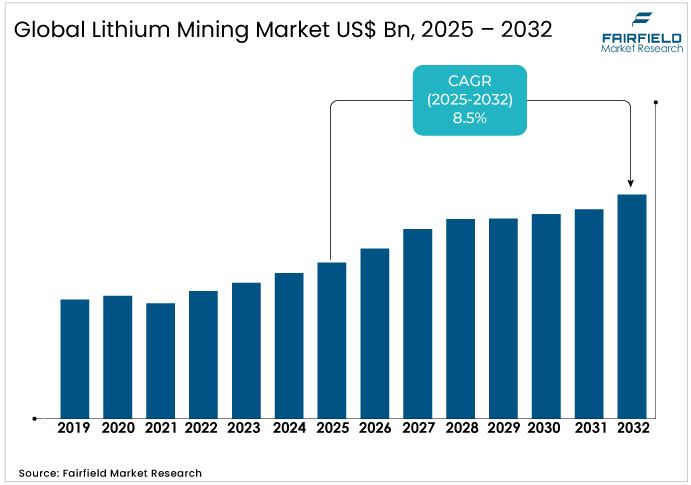

- The global lithium mining market is projected to be valued at US$ 4.08 Bn in 2025.

- It is expected to reach US$ 7.2 Bn by 2032, expanding at a CAGR of 8.5% between 2025 and 2032.

Lithium Mining Market Summary Key Insights & Trends

- Brine remains the leading source with over 60% share in 2025, anchored by South America’s Lithium Triangle operations.

- Hard rock is the fastest growing source, expanding at 10% CAGR with Australia exporting nearly 50% of global supply.

- Lithium carbonate leads by type with 55% share in 2025, valued at US$ 2.2 Bn across batteries, glass, and ceramics.

- Lithium hydroxide is the fastest growing type, rising at 12% CAGR, fueled by demand for high-nickel EV batteries.

- Batteries dominate applications with a 75% share worth US$ 3 Bn in 2025, supported by 30% annual demand growth.

- Direct Lithium Extraction (DLE) offers key opportunity, projected to add 200,000 tons supply by 2030 with 90% less water usage.

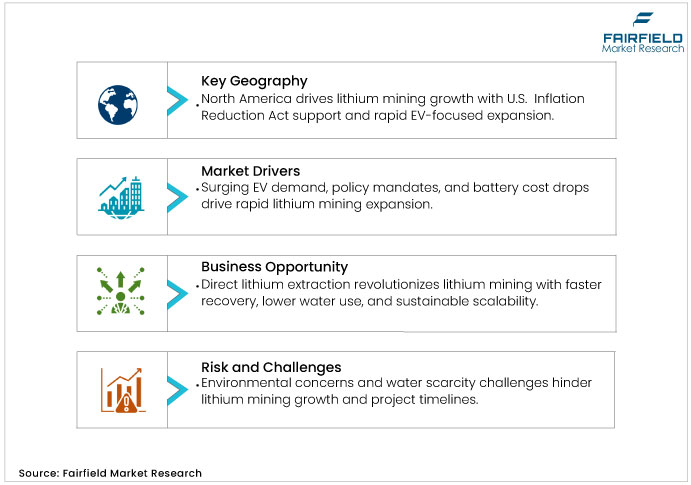

- Asia Pacific leads regionally with 50% share, while North America grows at 9% CAGR, driven by U.S. policy support and mining innovation.

A Look Back and a Look Forward - Comparative Analysis

The lithium mining market witnessed sharp fluctuations from 2019 to 2024, influenced by COVID-19 disruptions and shifting global demand. Production fell during pandemic lockdowns but rebounded strongly with stimulus measures and rapid EV adoption. Despite higher output, falling lithium carbonate prices and oversupply risks pressured profitability. These challenges underscored the sector’s vulnerability to supply chain disruptions, geopolitical uncertainties, and economic volatility during its early growth phase.

From 2025 to 2032, the lithium mining market is expected to expand steadily, driven by accelerating EV battery demand and supportive government policies. Direct lithium extraction (DLE) technologies are anticipated to ease supply bottlenecks, boosting efficiency and output. Leading players such as Albemarle and Ganfeng Lithium are investing in diversified sourcing and recycling, creating a more resilient industry. With net-zero goals advancing, lithium will remain central to the global energy transition.

Key Growth Drivers

- Accelerating EV Adoption Fuels Lithium Demand and Global Mining Expansion

The lithium mining industry is profoundly driven by the burgeoning electric vehicle sector, which accounts for over 70% of global lithium consumption as of 2025. With EV sales expected to hit 20 million units annually by 2027, according to the International Energy Agency (IEA), the need for lithium-ion batteries has skyrocketed, directly boosting mining activities. For instance, lithium hydroxide, a key battery-grade product, saw demand surge by 25% year-over-year in 2024, compelling miners to ramp up production in brine and hard rock deposits. This driver is justified by policy mandates, such as the EU's target for 100% zero-emission vehicle sales by 2035, which incentivizes automakers such as Tesla and Volkswagen to secure long-term lithium supplies. This translates to investments exceeding US$ 10 Bn in new projects across Australia and Chile, ensuring supply chain resilience. Moreover, as battery costs drop below US$ 100 per kWh, affordability enhances EV adoption in emerging markets such as India, further amplifying the market's growth trajectory and solidifying its role in sustainable transportation.

- Renewable Energy Storage Growth Spurs Lithium Demand and Mining Investments

A major driver for lithium demand is the rapid growth of renewable energy storage, where lithium batteries are essential for stabilizing solar and wind power grids. The International Energy Agency (IEA) projects global storage capacity could reach 1,500 GW by 2030, with lithium-based systems accounting for about 60% of installations, supporting an estimated 15% annual rise in demand.

This is evident in large-scale projects such as California’s 1.9 GW battery storage initiative, which depends on lithium sourced from North American mines. Lithium’s high energy density addresses renewable intermittency by reducing curtailment losses of up to 30%. Strategic investments, including Ganfeng Lithium’s multi-billion-dollar supply partnerships and advancements in solid-state batteries, further strengthen the sector. Globally, this trend supports climate goals, energy security, and long-term investment growth.

Key Growth Restraints

- Environmental Challenges and Sustainability Pressures Restrain Industry’s Expansion and Growth

The lithium mining industry faces growing restraints due to its environmental footprint, particularly in water-scarce regions such as South America’s Lithium Triangle. Brine extraction requires up to 500,000 liters of water per ton of lithium, worsening droughts in Chile and Argentina and sparking community protests that, according to the World Bank, have delayed about 20% of projects. Hard rock mining also creates risks, with toxic tailings causing soil and biodiversity damage, as seen at Australia’s Greenbushes mine, which incurred over US$ 100 Mn in remediation costs.

Regulatory pressure is intensifying, with the EU’s Critical Raw Materials Act enforcing stricter sustainability standards that may raise compliance costs by 15–20%. This has slowed expansions and triggered investor caution, underscoring the urgent need for greener technologies such as direct lithium extraction (DLE).

- Price Volatility and Supply Chain Risks Limit Industry Stability and Investments

Price volatility is a significant restraint for the lithium mining market, as lithium carbonate prices dropped sharply from US$ 80,000 per ton in 2022 to below US$ 12,000 in 2024, largely due to oversupply from new projects. This instability has reduced profitability-Pilbara Minerals, for instance, reported a 30% revenue decline-making investors hesitant about long-term commitments. Trade tensions between the U.S. and China further disrupt global flows, inflating costs by 10–15%.

Speculative trading and lingering COVID-19 logistics challenges add to the uncertainty, with forecasts suggesting further dips if EV demand slows. Smaller players face the greatest risks, leading to industry consolidations and reduced exploration budgets. While long-term supply contracts are emerging, persistent unpredictability continues to weigh on market expansion.

Lithium Mining Market Trends and Opportunities

- Adoption of Direct Lithium Extraction (DLE) Technologies in the Lithium Mining Market

Direct lithium extraction (DLE) offers a transformative opportunity for the lithium mining industry by addressing environmental and supply challenges. The method extracts lithium 50% faster with 90% less water than evaporation ponds, easing concerns in arid regions. According to IDTechEx, DLE could contribute 200,000 tons annually by 2030, capturing nearly 25% market share.

Pilot successes, such as Lilac Solutions’ 2025 partnership with Albemarle, demonstrated 95% recovery rates and lower production costs. Supported by government incentives and rising ESG investment, DLE enhances scalability, reduces carbon footprints, and strengthens global supply chains, positioning lithium mining for sustainable, long-term growth.

- Lithium Recycling Boosts Circular Economy While Strengthening Supply Chain Sustainability

Lithium battery recycling presents a major opportunity to reduce dependence on virgin mining while supporting sustainability goals. The IEA projects end-of-life batteries could supply 20% of global lithium needs by 2032, cutting costs by up to 40%. Advanced methods like hydrometallurgical processing achieve 95% purity, with Redwood Materials’ U.S. facility already recycling 50,000 tons in 2024.

Regulatory mandates, including the EU’s Battery Regulation requiring 70% recycling by 2030, are fueling over US$ 4 Bn in global investments. Recycling not only lowers emissions by 50% but also stabilizes supply, diversifies revenues, and strengthens resilience through strategic industry partnerships.

Segment-wise Trends & Analysis

- Brine Segment Leads Global Supply with Strong Production Base

The brine segment leads with over 60% share in 2025, dominated by low-cost operations in South America's Lithium Triangle, where evaporation methods yield high-purity lithium efficiently. Brine extraction, accounting for 58% of global production per USGS data, benefits from established infrastructure, as seen in SQM's Chilean operations producing 40,000 tons annually.

However, the hard rock segment is the fastest growing at a 10% CAGR through 2032, driven by Australia's spodumene-rich deposits and rising demand for hydroxide-grade lithium. Projects such as Greenbushes, with reserves exceeding 200,000 tons, highlight hard rock's scalability amid brine water scarcity issues. The 'others' category, including clay-based sources, remains marginal at 5% but shows potential in innovative DLE pilots. Overall, the lithium mining market's source dynamics reflect a shift toward diversified, sustainable extraction to meet 8.5% overall growth.

- Carbonate Type Dominates Owing to Cost-Effectiveness and High Usage

The lithium mining market's carbonate type holds the leading position with 55% market share in 2025, widely used in traditional batteries and glass applications due to its cost-effectiveness and established supply chains from brine sources. Valued at US$ 2.2 Bn, carbonate benefits from high-volume production in China and Chile, supporting ceramics and lubricants segments.

Conversely, the hydroxide type is the fastest growing at 12% CAGR, fueled by its superior performance in high-nickel EV batteries, with demand projected to double by 2030 per IEA forecasts. Albemarle's expansions underscore this trend, as hydroxide commands 20% higher prices. Chloride and others, at 20% combined, serve niche refrigeration uses but lag in scale.

- Batteries Application Holds Largest Share Driven by EV Demand

Batteries dominate by capturing 75% share in 2025 worth US$ 3 Bn, propelled by EV and storage needs, with lithium demand rising 30% annually. Applications in ceramics and glass follow at 10%, leveraging lithium's flux properties for lightweight materials. The fastest growing is lubricants and greases at 9% CAGR, driven by industrial electrification and high-temperature performance in EVs. Polymers, flux powder, refrigeration, and others contribute 15%, with refrigeration benefiting from chloride variants. The market's application focus highlights batteries' pivotal role in green tech transitions.

Regional Analysis

- North America Leads Growth with U.S. Policy Support and Mining Innovation

North America's market, valued at US$ 0.8 Bn in 2025, is growing at 9% CAGR, led by the U.S., where the Inflation Reduction Act drives US$ 20 Bn in investments for domestic supply. The U.S. market trends toward hard rock mining in Nevada's Thacker Pass, aiming for 40,000 tons annual output by 2027, supported by EV mandates targeting 50% sales by 2030. Drivers include energy security amid China dependencies and tech hubs such as Tesla's Gigafactories boosting battery demand. Sustainability trends favor DLE to minimize water use, with Canada adding clay projects. The lithium mining market here emphasizes innovation and policy alignment.

- Europe Driven by Germany and Sweden Through Policy and Industrial Demand

Europe's lithium mining market reaches US$ 0.6 Bn in 2025 at 8% CAGR, with leading countries Germany and Sweden driven by the Green Deal's 55% emissions cut by 2030. Germany's drivers include auto giants such as BMW securing lithium for 15 million EVs, while Sweden's Northvolt hub spurs recycling-integrated mining. Policy incentives and EU tariffs on imports fuel growth, focusing on ethical sourcing.

- Asia Pacific Led by China and Australia Through Production and Exports

Asia Pacific dominates the global lithium mining market, accounting for nearly 50% share worth about US$ 2 Bn in 2025 and projected to grow at a 9.5% CAGR. China leads with over 60% of global EV sales and 75% of global battery production capacity, supported by state subsidies and major expansions such as Ganfeng Lithium’s additional 100,000 tons of capacity.

Australia contributes nearly 50% of the world’s lithium exports, driven by rich spodumene reserves and strong trade agreements with Asian battery manufacturers. India is emerging through government-backed recycling programs targeting 20% lithium recovery by 2032. The region benefits from integrated manufacturing hubs, rapid EV adoption, and supply diversification strategies, positioning Asia Pacific as the cornerstone of global lithium demand and resource security.

Competitive Landscape

The global lithium mining market is highly competitive, with leading players adopting strategies to secure long-term dominance across the value chain. Albemarle is advancing direct lithium extraction (DLE) technologies and expanding U.S. operations to strengthen domestic supply security. SQM leverages its low-cost brine resources in Chile while forming ESG-focused partnerships to align with tightening regulations.

Ganfeng Lithium pursues acquisitions and joint ventures worldwide, integrating upstream and downstream to control battery supply chains. Tianqi Lithium diversifies through significant stakes in Australian projects, ensuring access to high-grade spodumene. Collectively, these strategies enhance resource security, stabilize pricing, and reinforce leadership amid surging EV-driven demand.

Key Companies:

- Albemarle Corporation

- Sociedad Química y Minera de Chile (SQM)

- Ganfeng Lithium

- Tianqi Lithium

- Mineral Resources (MinRes)

- Pilbara Minerals

- Rio Tinto Lithium

- Lithium Americas Corp.

- Livent Corporation

- Talison Lithium

- American Battery Technology Company (ABTC)

- China Lithium Products Technology Co. Ltd.

- Altmin Private Ltd

- Solvay S.A.

- Zhejiang Huayou Cobalt

Expert Opinion:

- In August 2025, Lithium Argentina and Ganfeng Lithium announced a joint venture (JV) to consolidate lithium assets in Salta, Argentina. The combined Pozuelos-Pastos Grandes project, Pastos Grandes, and Sal de la Puna projects, under the JV “PPG”, aims to gradually reach up to 150,000 tonnes per annum (tpa) of lithium carbonate equivalent in three phases (each 50,000 tpa). Ganfeng acquired the Pozuelos-Pastos Grandes project in 2022 for US$ 1 billion.

- In April 2025, Lithium Americas, in partnership with General Motors, approved the final investment decision (FID) for Phase 1 of the Thacker Pass project, targeting 40,000 tonnes per year of battery-grade lithium carbonate, with production expected to begin in late 2027.

Global Lithium Mining Market Segmentation

By Source

- Brine

- Hard Rocks

- Other

By Type

- Hydroxide

- Carbonate

- Chloride

- Others

By Application

- Battery

- Ceramics and Glass

- Lubricants and Greases

- Polymer

- Flux Powder

- Refrigeration

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Lithium Mining Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Lithium Mining Market Outlook, 2019 - 2032

3.1. Global Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

3.1.1. Brine

3.1.2. Hard Rocks

3.1.3. Other

3.2. Global Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

3.2.1. Hydroxide

3.2.2. Carbonate

3.2.3. Chloride

3.2.4. Others

3.3. Global Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.3.1. Battery

3.3.2. Ceramics and Glass

3.3.3. Lubricants and Greases

3.3.4. Polymer

3.3.5. Flux Powder

3.3.6. Refrigeration

3.3.7. Others

3.4. Global Lithium Mining Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Lithium Mining Market Outlook, 2019 - 2032

4.1. North America Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

4.1.1. Brine

4.1.2. Hard Rocks

4.1.3. Other

4.2. North America Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.2.1. Hydroxide

4.2.2. Carbonate

4.2.3. Chloride

4.2.4. Others

4.3. North America Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.3.1. Battery

4.3.2. Ceramics and Glass

4.3.3. Lubricants and Greases

4.3.4. Polymer

4.3.5. Flux Powder

4.3.6. Refrigeration

4.3.7. Others

4.4. North America Lithium Mining Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. U.S. Lithium Mining Market Outlook, by Source, 2019 - 2032

4.4.2. U.S. Lithium Mining Market Outlook, by Type, 2019 - 2032

4.4.3. U.S. Lithium Mining Market Outlook, by Application, 2019 - 2032

4.4.4. Canada Lithium Mining Market Outlook, by Source, 2019 - 2032

4.4.5. Canada Lithium Mining Market Outlook, by Type, 2019 - 2032

4.4.6. Canada Lithium Mining Market Outlook, by Application, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Lithium Mining Market Outlook, 2019 - 2032

5.1. Europe Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

5.1.1. Brine

5.1.2. Hard Rocks

5.1.3. Other

5.2. Europe Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.2.1. Hydroxide

5.2.2. Carbonate

5.2.3. Chloride

5.2.4. Others

5.3. Europe Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.3.1. Battery

5.3.2. Ceramics and Glass

5.3.3. Lubricants and Greases

5.3.4. Polymer

5.3.5. Flux Powder

5.3.6. Refrigeration

5.3.7. Others

5.4. Europe Lithium Mining Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Germany Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.2. Germany Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.3. Germany Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.4. Italy Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.5. Italy Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.6. Italy Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.7. France Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.8. France Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.9. France Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.10. U.K. Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.11. U.K. Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.12. U.K. Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.13. Spain Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.14. Spain Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.15. Spain Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.16. Russia Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.17. Russia Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.18. Russia Lithium Mining Market Outlook, by Application, 2019 - 2032

5.4.19. Rest of Europe Lithium Mining Market Outlook, by Source, 2019 - 2032

5.4.20. Rest of Europe Lithium Mining Market Outlook, by Type, 2019 - 2032

5.4.21. Rest of Europe Lithium Mining Market Outlook, by Application, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lithium Mining Market Outlook, 2019 - 2032

6.1. Asia Pacific Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

6.1.1. Brine

6.1.2. Hard Rocks

6.1.3. Other

6.2. Asia Pacific Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.2.1. Hydroxide

6.2.2. Carbonate

6.2.3. Chloride

6.2.4. Others

6.3. Asia Pacific Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.3.1. Battery

6.3.2. Ceramics and Glass

6.3.3. Lubricants and Greases

6.3.4. Polymer

6.3.5. Flux Powder

6.3.6. Refrigeration

6.3.7. Others

6.4. Asia Pacific Lithium Mining Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. China Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.2. China Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.3. China Lithium Mining Market Outlook, by Application, 2019 - 2032

6.4.4. Japan Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.5. Japan Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.6. Japan Lithium Mining Market Outlook, by Application, 2019 - 2032

6.4.7. South Korea Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.8. South Korea Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.9. South Korea Lithium Mining Market Outlook, by Application, 2019 - 2032

6.4.10. India Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.11. India Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.12. India Lithium Mining Market Outlook, by Application, 2019 - 2032

6.4.13. Southeast Asia Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.14. Southeast Asia Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.15. Southeast Asia Lithium Mining Market Outlook, by Application, 2019 - 2032

6.4.16. Rest of SAO Lithium Mining Market Outlook, by Source, 2019 - 2032

6.4.17. Rest of SAO Lithium Mining Market Outlook, by Type, 2019 - 2032

6.4.18. Rest of SAO Lithium Mining Market Outlook, by Application, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lithium Mining Market Outlook, 2019 - 2032

7.1. Latin America Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

7.1.1. Brine

7.1.2. Hard Rocks

7.1.3. Other

7.2. Latin America Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.2.1. Hydroxide

7.2.2. Carbonate

7.2.3. Chloride

7.2.4. Others

7.3. Latin America Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.3.1. Battery

7.3.2. Ceramics and Glass

7.3.3. Lubricants and Greases

7.3.4. Polymer

7.3.5. Flux Powder

7.3.6. Refrigeration

7.3.7. Others

7.4. Latin America Lithium Mining Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Brazil Lithium Mining Market Outlook, by Source, 2019 - 2032

7.4.2. Brazil Lithium Mining Market Outlook, by Type, 2019 - 2032

7.4.3. Brazil Lithium Mining Market Outlook, by Application, 2019 - 2032

7.4.4. Mexico Lithium Mining Market Outlook, by Source, 2019 - 2032

7.4.5. Mexico Lithium Mining Market Outlook, by Type, 2019 - 2032

7.4.6. Mexico Lithium Mining Market Outlook, by Application, 2019 - 2032

7.4.7. Argentina Lithium Mining Market Outlook, by Source, 2019 - 2032

7.4.8. Argentina Lithium Mining Market Outlook, by Type, 2019 - 2032

7.4.9. Argentina Lithium Mining Market Outlook, by Application, 2019 - 2032

7.4.10. Rest of LATAM Lithium Mining Market Outlook, by Source, 2019 - 2032

7.4.11. Rest of LATAM Lithium Mining Market Outlook, by Type, 2019 - 2032

7.4.12. Rest of LATAM Lithium Mining Market Outlook, by Application, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lithium Mining Market Outlook, 2019 - 2032

8.1. Middle East & Africa Lithium Mining Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

8.1.1. Brine

8.1.2. Hard Rocks

8.1.3. Other

8.2. Middle East & Africa Lithium Mining Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.2.1. Hydroxide

8.2.2. Carbonate

8.2.3. Chloride

8.2.4. Others

8.3. Middle East & Africa Lithium Mining Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.3.1. Battery

8.3.2. Ceramics and Glass

8.3.3. Lubricants and Greases

8.3.4. Polymer

8.3.5. Flux Powder

8.3.6. Refrigeration

8.3.7. Others

8.4. Middle East & Africa Lithium Mining Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. GCC Lithium Mining Market Outlook, by Source, 2019 - 2032

8.4.2. GCC Lithium Mining Market Outlook, by Type, 2019 - 2032

8.4.3. GCC Lithium Mining Market Outlook, by Application, 2019 - 2032

8.4.4. South Africa Lithium Mining Market Outlook, by Source, 2019 - 2032

8.4.5. South Africa Lithium Mining Market Outlook, by Type, 2019 - 2032

8.4.6. South Africa Lithium Mining Market Outlook, by Application, 2019 - 2032

8.4.7. Egypt Lithium Mining Market Outlook, by Source, 2019 - 2032

8.4.8. Egypt Lithium Mining Market Outlook, by Type, 2019 - 2032

8.4.9. Egypt Lithium Mining Market Outlook, by Application, 2019 - 2032

8.4.10. Nigeria Lithium Mining Market Outlook, by Source, 2019 - 2032

8.4.11. Nigeria Lithium Mining Market Outlook, by Type, 2019 - 2032

8.4.12. Nigeria Lithium Mining Market Outlook, by Application, 2019 - 2032

8.4.13. Rest of Middle East Lithium Mining Market Outlook, by Source, 2019 - 2032

8.4.14. Rest of Middle East Lithium Mining Market Outlook, by Type, 2019 - 2032

8.4.15. Rest of Middle East Lithium Mining Market Outlook, by Application, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Albemarle Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Sociedad Química y Minera de Chile (SQM)

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Ganfeng Lithium

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Tianqi Lithium

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Mineral Resources (MinRes)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Pilbara Minerals

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Rio Tinto Lithium

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Lithium Americas Corp.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Livent Corporation

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Talison Lithium

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |