Market Analysis in Brief

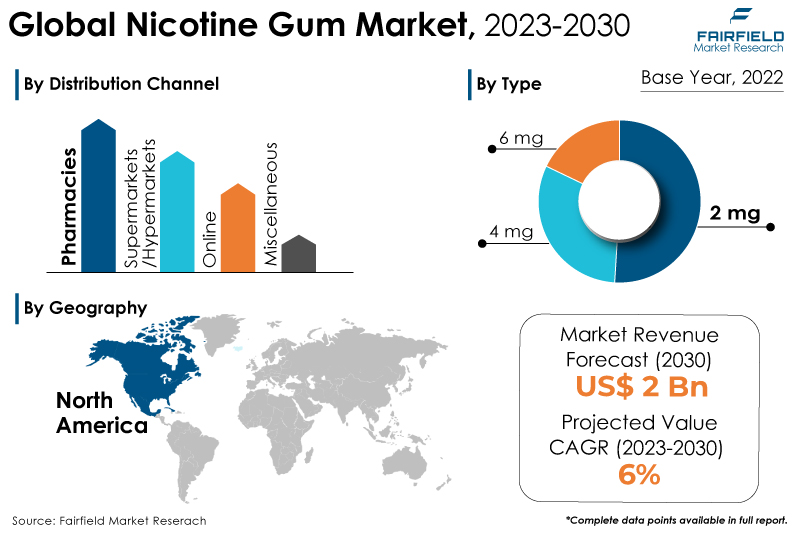

- Global nicotine gum market valuation to experience nearly 6% CAGR during 2023 - 2030

- Market value expected to reach over US$2 Bn by the end of 2030

Market Analysis in Brief

Nicotine gum is an over-the-counter (OTC) product for those who are looking to quitting smoking. It helps tobacco addicts reduce their cigarette intake and finally stop smoking. When the gum is eaten, nicotine is released and absorbed into the bloodstream via the mouth's lining. This helps to progressively lessen nicotine cravings, the impulse to smoke and withdrawal symptoms. According to the nicotine content, it is frequently offered in three different strengths: 2 mg, 4 mg, and 6 mg. Users choose which strength to use according to how many cigarettes they smoke daily. The rise in lung cancer cases and other respiratory disorders is one of the primary drivers of the market's expansion.

Smoking contributes to several chronic conditions, including coronary heart disease (CHD), stroke, oropharyngeal cancer, oesophageal cancer, TB, rheumatoid arthritis, and several immune-related illnesses. Growing health consciousness and increased knowledge of these illnesses expand the market. Another aspect that promotes expansion is the growing use of smoking cessation treatments.

Numerous governments and non-governmental organisations (NGOs) in developed and developing countries are encouraging the use of smoking cessation aids like nicotine gums to help people, especially young people, who are addicted to tobacco. Additional factors are anticipated to fuel the industry, such as numerous product developments like the creation of nicotine lozenges, rising urbanisation, and substantial research and development efforts.

Key Report Findings

- Between 2023 and 2030, the market for nicotine gum will have impressive revenue growth.

- The market for nicotine gums is fuelled by several factors, such as the expanding popularity of smoking cessation aids, governmental efforts to reduce tobacco use, and the rising number of smoking-related fatalities.

- Demand for 2 mg type remains higher in the nicotine gum market.

- The pharmacy sector held the highest nicotine gum market revenue share in 2022.

- North America will continue to lead its way, whereas the Asia Pacific nicotine gum market will experience significant growth till 2030.

Growth Drivers

Increasing Promotion of Anti-smoking Campaigns

A few factors propelling this industry include increasing urbanisation, product advancements, including manufacturing nicotine products (gums), and active research and development activities.

Different government and non-governmental organisations (NGOs) promote using aids for quitting smoking, like nicotine gums and other nicotine replacement goods, to assist individuals, particularly young individuals, who are addicted to tobacco. This is true of both developing and developed countries.

Numerous powerful groups back up anti-smoking campaigns and routinely release items like gum and lozenges to aid in quitting smoking. Combining these items with successful cessation programs increases the likelihood that residents will stop smoking.

Increasing Prevalence of Heart-related and Respiratory Disorders

The primary factor influencing the market growth rate is an increase in the number of people who want to stop smoking due to growing awareness of the dangers of smoking. Additionally, there has been a noticeable increase in demand for nicotine cessation from hospitals and rehab facilities worldwide in developed and poor countries.

Additionally, the market is primarily driven by the rising incidence of ailments like lung cancer, heart conditions, and respiratory problems. It is brought on by rising tobacco usage in distinctive ways that seriously jeopardize global public safety. These factors may encourage the market for nicotine gum to grow.

Faovurable Government Initiatives

Government initiatives to lower smoking rates have greatly increased. Governments worldwide support comprehensive tobacco control plans that include several initiatives like restrictions on tobacco advertising and marketing of cigarettes. Smoking may be prohibited in the workplace and other public places by combining efforts to halt tobacco smuggling with sustainably boosting cigarette taxes.

Strong health warnings on tobacco-based products, support for smoking cessation, tobacco regulation to standards, and promotion of anti-smoking campaigns are additional examples of such measures that have prompted consumers to look for alternatives to reduce their tobacco consumption, fueling demand for market expansion.

Governments and non-governmental organisations (NGOs) from developed and developing nations support nicotine replacement therapies like nicotine gums and other products to help individuals quit smoking, especially young people.

Numerous powerful groups back up anti-smoking campaigns and routinely release items like gum and lozenges to aid in quitting smoking. The possibility that residents will quit smoking increases when these tools are used in conjunction with effective cessation programs. As a result, this element is fueling the market CAGR.

Growth Challenges

Potential Side Effects of Nicotine

Some typical negative effects of nicotine gum products include elevated blood pressure, rapid heartbeat, drowsiness, indigestion, irritability, loss of appetite, heartburn, vomiting, and hiccups. Additionally, if it is chewed frequently and for a prolonged amount of time, it causes nausea and discomfort in the abdomen.

Additionally, it contributes to flatulence and indigestion in certain persons. Even while nicotine gum contains significantly less nicotine than cigarettes, if used for an extended period, it can still become addictive. When nicotine gum is chewed, the nicotine in it enters the bloodstream after being absorbed by the tissues that line the mouth.

According to a recent study by researchers at the University of London, people who use nicotine gum regularly are more likely to experience FOXM1 gene alterations, which increases their risk of developing oral cancer. The body develops accustomed to these intermittent doses of nicotine over time, making it much more difficult to break the addiction. Therefore, these limitations are anticipated to impede market expansion during the anticipated time frame.

Overview of Key Segments

2 mg Type Segment has the Largest Consumer Base

In 2022, the 2 mg category led the market. As part of nicotine replacement therapy (NRT), people chew 2 mg of nicotine gum to help them stop smoking or reduce their cigarette intake. Because more individuals are becoming aware of the negative effects smoking has on their health, more people are looking for strategies to cut back or stop smoking.

Additionally, the ease with which 2 mg nicotine gums in various flavours are accessible attracts new customers, which is expected to support demand throughout the forecast period. Nicorette 2 mg gum lessens, and controls cravings and withdrawal symptoms associated with tobacco dependency. It is advised for smokers and others around them as a safer alternative to smoking.

Additionally, it is suggested to support smokers who want to stop or cut back before stopping. During the projection period, the 4mg sector is anticipated to grow at a significant rate. People who chew nicotine gum containing 4 mg are often heavy smokers, defined as 25 or more cigarettes smoked daily.

Because heavy smokers often need a greater quantity of nicotine to feel relief, the higher dose of nicotine in the 4mg gum is meant to assist smokers in controlling their nicotine cravings and withdrawal symptoms more successfully. For relief, heavy smokers frequently need a higher amount of nicotine.

Pharmacy Distribution Channel Contributes the Highest

The pharmacy industry dominated the market. People purchase nicotine gum from pharmacies for various reasons, including the availability of medical advice and support, the ease of buying it along with other health-related products, the product's availability, quality, and secrecy.

Additionally, pharmacies have educated staff members who may offer guidance and details on nicotine gum and other nicotine replacement medications. Most countries only permit the sale of nicotine gum and other nicotine replacement goods in pharmacies. Sales and marketing of these products are expected to increase in the upcoming years with the presence of general practitioners and knowledgeable chemists in the stores.

Moreover, pharmacies have experienced specialists on staff who may provide advice and details on nicotine gum and other nicotine replacement therapies. During the forecast period, it is predicted that the online distribution channel segment will expand at a rapid rate. The past several years have seen tremendous growth in the popularity of this area.

Because of the channels' conveniences, like substantial savings, the availability of various products on a single platform, door-to-door delivery, simple payment options, and others, consumers are shifting their preference toward online channels.

In addition, compared to traditional brick-and-mortar stores, internet retailers frequently stock a wide choice of nicotine gums with various flavours, strengths, and brands. It enables customers to pick the item that best suits their requirements. The rise is additionally anticipated to be fuelled by the discounts provided by online retail pharmacies.

Growth Opportunities Across Regions

North America’s Primacy Prevails

During the projected period, North America is expected to dominate the global market for nicotine gum. Customers in North America are becoming more health-conscious, due to government initiatives and marketing campaigns boosting the local economy. Additionally, the area is home to large corporations devoted to product development to expand demand and acquire a competitive edge in the market.

Nicorette, for instance, released a nicotine gum product encased in an ice mint lozenge in May 2019. As a result, these factors are anticipated to boost the market share of nicotine gum over the study period. Most of the market for nicotine gum in North America is in the United States.

The proportion of customers in North America concerned about their health has increased due to campaigns and governmental measures encouraging market expansion in the region. Furthermore, the area is home to renowned businesses concentrating on product innovation to meet consumer demand and gain a competitive advantage, including Philip Morris, Cipla Health Limited, and Johnson & Johnson.

Asia Pacific Gains Largely from Novel Products

The CAGR for the Asia Pacific area will increase at the fastest rate during the projection period. This expansion results from greater consumer demand for unique products, stiffer rivalry among major cigarette companies, and more market opportunities, particularly in Japan.

Market potential development, particularly in Japan, the rising desire for novel products, and the escalating rivalry among the main tobacco corporations are also to blame for the growth. The market for nicotine gum is also expected to rise due to China's, and India's strict anti-smoking laws.

In addition, strong anti-smoking laws in China, and India are anticipated to increase demand for nicotine replacement products like gums. Therefore, these factors are projected to increase the market share of nicotine gum throughout the study. The companies' primary strategies in the market include partnerships, new product development, expansions, mergers, and acquisitions.

Nicotine Gum Market: Competitive Landscape

Some of the leading players at the forefront in the nicotine gum market space include British American Tobacco plc, Johnson & Johnson, Novartis AG, ITC Limited, Cipla Health Limited, Perrigo Company Plc, Teva Canada, Philip Morris International, Inc., Revolymer, and Enorama Pharma AB.

Recent Notable Developments

In July 2023, Haleon, the world's biggest standalone consumer health business, is exploring the sale of its nicotine gum business as it aims to streamline its business.

In February 2022, Enorama Pharma's business partner, betapharm Arzneimittel GmbH, introduced generic nicotine chewing gum under the trademark Nicotine Beta in Germany. Betapharm has chosen to provide pharmacists with an attractive sell-in discount on Nicotin beta®, giving consumers a financial advantage. Nicotine beta will provide a generic medication highlighting the benefits of nicotine replacement therapy (NRT). Brand awareness will emerge because of the planned digital abstinence program.

In July 2021, Philip Morris International Inc. purchased Fertin Pharma, a maker of nicotine gum, for USD 813.1 million. Fertin Pharma products include chewing gums, tablets, and powders for pharmaceutical and nutraceutical applications, as well as aids in the cessation of dangerous cigarette smoking. Over the years, Philip Morris has committed more than $8.1 billion to the development of smoke-free goods, which it believes "will one day replace cigarettes."

Global Nicotine Gum Market is Segmented as Below:

By Type

- 2 mg

- 4 mg

- 6 mg

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Online

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Nicotine Gum Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Global Nicotine Gum Production, 2018 - 2022

3.2. Import & Export Statistics, 2018-2022

4. Price Trends Analysis and Future Projects, 2018 - 2030

4.1. Global Average Price Analysis, by Region, US$ per Kg

4.2. Prominent Factors Affecting Nicotine Gum Prices

5. Global Nicotine Gum Market Outlook, 2018 - 2030

5.1. Global Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. 2mg

5.1.1.2. 4mg

5.1.1.3. 6 mg

5.2. Global Nicotine Gum Market Outlook, by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Supermarkets/Hypermarkets

5.2.1.2. Pharmacies

5.2.1.3. Online

5.2.1.4. Misc.

5.3. Global Nicotine Gum Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Nicotine Gum Market Outlook, 2018 - 2030

6.1. North America Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. 2mg

6.1.1.2. 4mg

6.1.1.3. 6 mg

6.2. North America Nicotine Gum Market Outlook, by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Supermarkets/Hypermarkets

6.2.1.2. Pharmacies

6.2.1.3. Online

6.2.1.4. Misc.

6.2.2. Market Attractiveness Analysis

6.3. North America Nicotine Gum Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. U.S. Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.1.2. U.S. Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.1.3. Canada Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.1.4. Canada Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Nicotine Gum Market Outlook, 2018 - 2030

7.1. Europe Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. 2mg

7.1.1.2. 4mg

7.1.1.3. 6 mg

7.2. Europe Nicotine Gum Market Outlook, by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Supermarkets/Hypermarkets

7.2.1.2. Pharmacies

7.2.1.3. Online

7.2.1.4. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Nicotine Gum Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Germany Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.2. Germany Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.3. U.K. Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.4. U.K. Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.5. France Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.6. France Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.7. Italy Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.8. Italy Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.9. Turkey Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.10. Turkey Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.11. Russia Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.12. Russia Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.13. Rest of Europe Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1.14. Rest of Europe Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Nicotine Gum Market Outlook, 2018 - 2030

8.1. Asia Pacific Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. 2mg

8.1.1.2. 4mg

8.1.1.3. 6 mg

8.2. Asia Pacific Nicotine Gum Market Outlook, by by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Supermarkets/Hypermarkets

8.2.1.2. Pharmacies

8.2.1.3. Online

8.2.1.4. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Nicotine Gum Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. China Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.2. China Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.3. Japan Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.4. Japan Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.5. South Korea Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.6. South Korea Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.7. India Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.8. India Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.9. Southeast Asia Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.10. Southeast Asia Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.11. Rest of Asia Pacific Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1.12. Rest of Asia Pacific Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Nicotine Gum Market Outlook, 2018 - 2030

9.1. Latin America Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. 2mg

9.1.1.2. 4mg

9.1.1.3. 6 mg

9.2. Latin America Nicotine Gum Market Outlook, by by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Supermarkets/Hypermarkets

9.2.1.2. Convenience Stores

9.2.1.3. Pharmacies

9.2.1.4. Online

9.2.1.5. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Nicotine Gum Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Brazil Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.2. Brazil Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.3. Mexico Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.4. Mexico Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.5. Argentina Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.6. Argentina Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.7. Rest of Latin America Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1.8. Rest of Latin America Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Nicotine Gum Market Outlook, 2018 - 2030

10.1. Middle East & Africa Nicotine Gum Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. 2mg

10.1.1.2. 4mg

10.1.1.3. 6 mg

10.2. Middle East & Africa Nicotine Gum Market Outlook, by by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Supermarkets/Hypermarkets

10.2.1.2. Pharmacies

10.2.1.3. Online

10.2.1.4. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Nicotine Gum Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. GCC Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.2. GCC Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.3. South Africa Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.4. South Africa Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.5. Egypt Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.6. Egypt Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.7. Nigeria Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.8. Nigeria Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.9. Rest of Middle East & Africa Nicotine Gum Market by Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1.10. Rest of Middle East & Africa Nicotine Gum Market by Distribution Channel, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Manufacturer vs Type Heatmap

11.2. Company Market Share Analysis, 2022

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. British American Tobacco PLC

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Novartis AG

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Enorama Pharma AB

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. ITC Limited

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Alkalon A/S

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Cipla Health Limited

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Perrigo Company Plc

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Teva Canada

11.4.8.1. Company Overview

11.4.8.2. Product Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. Philip Morris International, Inc.

11.4.9.1. Company Overview

11.4.9.2. Product Portfolio

11.4.9.3. Financial Overview

11.4.9.4. Business Strategies and Development

11.4.10. Johnson & Johnson

11.4.10.1. Company Overview

11.4.10.2. Product Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |