North America Toxicology Laboratories Market Forecast

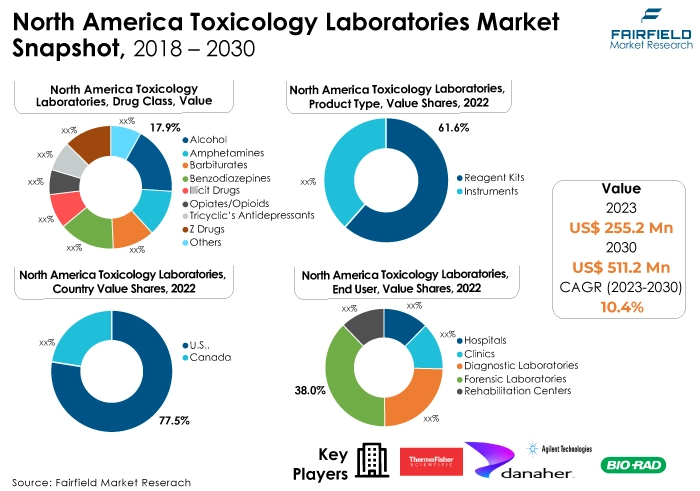

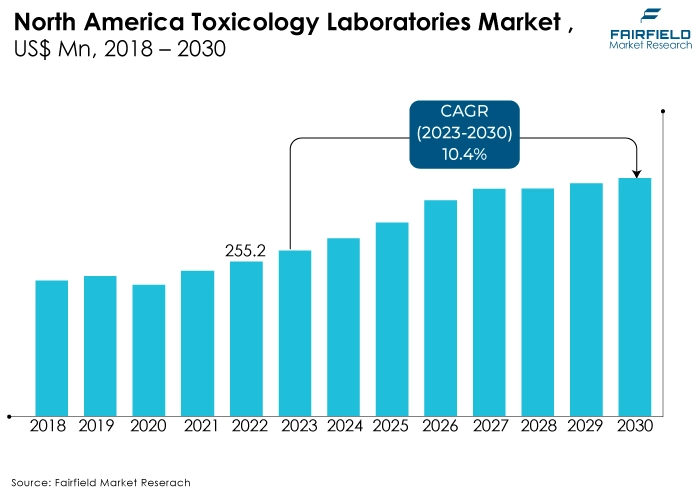

- North America’s toxicology laboratories market all set to witness an impeccable CAGR of 10.4% during the forecast period

- Market size to grow from US$255.2 Mn in 2023 to US$511.2 Mn by 2030-end

Quick Report Findings

- The key trend expected to drive growth in the toxicology laboratory market is increasing significance of rapid screening technologies.

- Another major market trend is the integration of informatics and data solutions. Test results obtained from the collected samples are confidential in nature and such confidential results are stored in a mass spectral database.

- Drug class, amphetamines is the leading segment capturing 17.9%% of the market share. The segment is projected to grow at 11.0% CAGR during the forecast period.

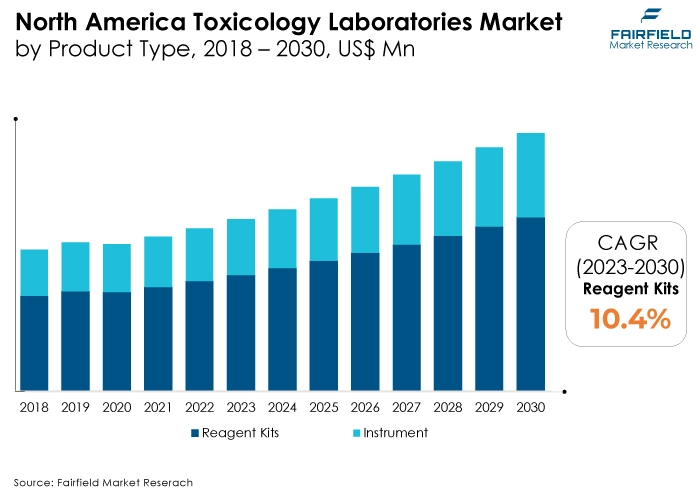

- Product type, reagent and kits is the leading segment capturing 61.6% of the market share. The segment is projected to grow at 9.7% CAGR during the forecast period.

- The market is driven by robust regulatory frameworks in both the US, and Canada, mandating rigorous testing across industries such as pharmaceuticals, cosmetics, food, and chemicals.

A Loom Back and a Look Forward - Comparative Analysis

The North America toxicology laboratories market’s stringent regulations surrounding environmental contaminants, food safety, and pharmaceutical development are increasing the demand for toxicology testing services. Laboratories equipped to handle complex analyses and comply with evolving regulations stand to benefit.

Technological advancements in mass spectrometry, genomics, and bioinformatics enable more sophisticated and precise toxicology testing. This allows for earlier detection of potential hazards and the development of safer products.

North America's thriving pharmaceutical and chemical industries are a significant source of demand for toxicology testing services. These industries require comprehensive safety assessments for new drugs, chemicals, and consumer products.

The growing field of personalised medicine emphasizes individual genetic variations and their impact on drug response and environmental exposures. This necessitates specialised toxicology testing approaches tailored to individual needs. Many companies are opting to outsource their toxicology testing needs to specialised laboratories. This allows them to access expertise and advanced technology without significant in-house investments.

Key Growth Determinants

Elevated Awareness About Conventional Toxicology Testing Devices

Gas chromatography-mass spectrometry (GC-MS) is the favoured approach to toxicological drug screening. General unknown analysis—a broad screening method that screens for over 4,000 substances—is conducted with GC-MS techniques. Because of the high consumption of prohibited chemicals in the US and Canada, the traditional toxicology testing instruments market has a prominent presence in these nations.

Such instruments allow researchers to focus their work on the explicit identification of parent drugs and their corresponding metabolites, which is facilitated by the rapid turnaround time, ease of use, and high sensitivity of innovative GC-MS techniques. Due to the high performance offered by these devices at a minimal cost, they are thus expected to drive the growth of toxicology laboratories market.

Major Growth Barriers

Introduction of Point-of-Care Toxicology Testing Devices

The introduction of point-of-care toxicology testing devices is predicted to stifle the market for toxicology laboratories in North America. The growing abuse of controlled substances has resulted in a significant demand for portable toxicological testing instruments. As a result, companies are concentrating their efforts on developing point-of-care toxicological testing equipment.

The commercialisation of point-of-care toxicological testing equipment could eventually eat into the market share of traditional toxicology laboratories, reducing market growth. For instance, Neogen released a portable version of their Raptor Integrated Analysis Platform in April 2019, allowing testers to undertake mycotoxin testing in the lab – or wherever they want.

Key Trends and Opportunities to Look at

Increasing Government Spending on Toxicity Testing for Reduced Illegal Drug Consumption

The rising government spending on toxicity testing to combat illegal drug consumption is predicted to provide lucrative growth prospects for competitors in the North American toxicology laboratories market. For example, the Florida Department of Health announced in December 2019 that four Florida institutions had been awarded US$ 650,000 in legislatively appropriated funds for a new project to test humans for health concerns from harmful toxicity.

Moreover, the US FDA will continue its long history of supporting collaborations across industries and disciplines on a national and international scale. The FDA views these types of collaborations as critical to identifying needs, maintaining momentum, and developing a community to support the implementation of innovative predictive toxicology procedures.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape plays a pivotal role in shaping the toxicology laboratories market, influencing various aspects of operations, compliance, and strategic decision-making within the industry. The nature of toxicology work, involving the analysis of potentially harmful substances, demands adherence to stringent regulations to ensure public safety, data integrity, and ethical standards.

Regulatory bodies set forth standards and guidelines that toxicology laboratories must follow to ensure the accuracy and reliability of their testing processes. Compliance with these quality assurance measures is a regulatory requirement and a fundamental aspect of delivering trustworthy results.

Many regulatory agencies mandate toxicology laboratories to obtain accreditation or certification from recognised organisations. Meeting these external benchmarks signifies compliance and serves as a market differentiator. Accredited laboratories often have a competitive edge, as clients prefer services that meet or exceed industry-recognised standards.

Fairfield’s Ranking Board

Top Segments

Amphetamines Drug Class Poised for Noteworthy Growth, Demand Driven by Rising Demand and Diverse Applications

The amphetamines drug class, which includes medications such as Adderall, Ritalin, and dexamphetamine, is experiencing a surge in demand due to its diverse applications in various medical conditions. Amphetamines are stimulant drugs that enhance the activity of neurotransmitters such as dopamine and norepinephrine, leading to increased alertness, focus, and energy levels.

One of the most significant applications of amphetamines is in the treatment of attention deficit hyperactivity disorder (ADHD). ADHD is a neurological disorder characterised by symptoms such as impulsivity, hyperactivity, and inattention. Amphetamines help to alleviate these symptoms by improving focus, concentration, and impulse control.

Immunoassay Kits Remain the Most Focused Reagent and Kits Type

Immunoassay kits have become the most focused reagent and kit type in toxicology laboratories due to their high sensitivity, specificity, and convenience. These kits are designed to detect a wide range of toxic substances, including pesticides, heavy metals, drugs of abuse, and environmental pollutants.

Immunoassay kits use antibodies specific to the target substance to bind to it in a sample. The bound antibody is then detected using a labeled secondary antibody, which produces a measurable signal. This signal is then quantified to determine the concentration of the target substance in the sample.

Immunoassay kits in toxicology laboratories have revolutionised the field by providing rapid, accurate, and cost-effective results for a wide range of toxic substances. As technology advances, immunoassay kits will likely play a significant role in toxicology analysis for many years.

Hospitals and Diagnostic Laboratories Continue to Generate the Maximum Demand

The demand for toxicology testing services is increasing in hospitals and diagnostic laboratories due to several reasons, such as the rise in chronic diseases, accidents, and poisoning cases, the increasing prevalence of chronic diseases, the growing awareness about the importance of early diagnosis and treatment, and the need for regular monitoring of drug levels in patients with chronic diseases.

The US Remains the Mainstay of North American Market for Toxicology Laboratories

The US is known for being at the forefront of technological advancements in healthcare, particularly for the toxicology laboratories market. The country has an intense research and development infrastructure, which has led to the development of advanced technologies for toxicology testing.

One of the most notable technological advancements in this market is high-throughput screening (HTS), which enables the rapid screening of large numbers of compounds for toxicity. HTS technology is widely used in the pharmaceutical industry to identify potential drug candidates and reduce the time and cost associated with traditional toxicology testing methods. Technological advancements are driving innovation in the toxicology laboratories market and contributing to the dominance of the US.

Fairfield’s Competitive Landscape Analysis

Prominent organisations, including Bausch & Lomb Incorporated, AJL Ophthalmic S.A., and An-Vision, are at the vanguard of this sector, providing inventive solutions by capitalising on their technological prowess and vast experience in the toxicology laboratories industry. Organisations within this sector prioritise technological advancements, strategic alliances, and user experience improvement.

Companies must prioritise competitive intelligence, and strategic business decisions to remain successful in the highly competitive toxicology laboratories market. Staying informed about the latest trends and developments is essential as the market continues to evolve, driven by technological advancements, regulatory requirements, and significant players.

Additionally, they collaborate with North American toxicology laboratories market manufacturers to seamlessly incorporate their solutions; furthermore, to contend with the increasing market primarily motivated by safety and well-being concerns, they must distinguish their products through implementing user-friendly interfaces and personalised health insights.

Who Are the Leaders in The Global North America Toxicology Laboratories Market Space?

- Thermo Fisher Scientific, Inc.

- Bio Rad Laboratories Inc.

- Neogen Corporation

- Danaher Corporation

- Agilent

- Redwood Toxicology Laboratory

- Abbott (Alere, Inc.)

Significant Company Developments

Launch & Expansion

- In 2022: In 2023, Bio-Rad Laboratories, Inc. announced the launch of its PTC Tempo 48/48 and PTC Tempo 384 Thermal Cyclers, designed to support PCR applications in basic and translational research, process development and quality control.

- In 2022: In 2021, Bio-Rad Laboratories, Inc. expanded diagnostics company partnerships by providing InteliQ products, a range of barcoded, load-and-go quality control tubes that provide efficiencies in workflow, in addition to Bio-Rad’s Unity QC data management solutions, which help improve a laboratory’s analytical performance.

An Expert’s Eye

Demand and Future Growth

As the demand for toxicology testing services continues to grow, the toxicology laboratories market will experience significant growth in the coming years. The increasing prevalence of chronic diseases, environmental pollution, and occupational hazards drives the need for more comprehensive and advanced toxicology testing methods.

The toxicology laboratories market will grow robustly, driven by technological advancements, increasing demand, and emerging healthcare and environmental health trends as healthcare evolves rapidly.

Supply Side of the Market

The development of new technologies, such as high-throughput screening, in vitro toxicology testing, and bioinformatics, has led to new players in the market and increased competition. These technologies are enabling faster and more accurate results, as well as greater efficiency and cost savings, which is driving innovation and growth in the market.

Another factor shaping the supply-side dynamics of this market is regulatory requirements.

The stringent regulatory framework for drug development and approval in the US has led to a high demand for toxicology testing services, which has contributed to the growth of this market. Regulatory requirements also drive investment in research and development as companies seek to develop new technologies and methods that meet the evolving needs of regulatory agencies.

The presence of major players is also a significant factor shaping the supply-side dynamics of this market. Companies such as Thermo Fisher Scientific, Inc., Bio Rad Laboratories Inc., and Neogen Corp have a strong presence in the market. They invest heavily in research and development to stay ahead of the competition. These companies are also expanding their global footprint through strategic acquisitions and partnerships, contributing to the consolidation of the market.

North America Toxicology Laboratories Market is Segmented as Below:

Drug Class:

- Alcohol

- Amphetamines

- Barbiturates

- Benzodiazepines

- Illicit Drugs

- Opiates/Opioids

- Tricyclic’s Antidepressants

- Z Drugs

- Misc

Product Type:

- Reagent Kits

- ELISA

- PCR

- Enzyme Multiplied Immunoassay Technique (EMIT)

- Radio Immuno-sorbent Assay (RIA)

- Instruments

- Immunochemistry Analyzers

- PCR Machine

- Gas Chromatography/Mass Spectrometry (GS/MS)

- High Performance Liquid Chromatography (HPLC)

Sample:

- Urine

- Blood

- Hair

- Oral Fluid

End User:

- Hospitals

- Clinics

- Diagnostic Laboratories

- Forensic Laboratories

- Rehabilitation Centers

By Geographic Coverage:

- North America

- U.S.

- Canada

1. Executive Summary

1.1. North America Toxicology Laboratories Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Overview

2.5.2. Impact By Region

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. North America Toxicology Laboratories Market Outlook, 2018 – 2030

3.1. North America Toxicology Laboratories Market Outlook, by Drug Class, Value (US$ Mn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Alcohol

3.1.1.2. Amphetamines

3.1.1.3. Barbiturates

3.1.1.4. Benzodiazepines

3.1.1.5. Illicit Drugs

3.1.1.6. Opiates/Opioids

3.1.1.7. Tricyclic’s Antidepressants

3.1.1.8. Z Drugs

3.1.1.9. Others

3.2. North America Toxicology Laboratories Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Reagent Kits

3.2.1.1.1. ELISA

3.2.1.1.2. PCR

3.2.1.1.3. Enzyme Multiplied Immunoassay Technique (EMIT)

3.2.1.1.4. Radio Immuno-sorbent Assay (RIA)

3.2.1.2. Instruments

3.2.1.2.1. Immunochemistry Analyzers

3.2.1.2.2. PCR Machine

3.2.1.2.3. Gas Chromatography/Mass Spectrometry (GS/MS)

3.2.1.2.4. High Performance Liquid Chromatography (HPLC)

3.3. North America Toxicology Laboratories Market Outlook, by Sample, Value (US$ Mn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Urine

3.3.1.2. Blood

3.3.1.3. Hair

3.3.1.4. Oral Fluid

3.3.2. Market Attractiveness Analysis

3.4. North America Toxicology Laboratories Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. U.S. Toxicology Laboratories Market by Drug Class, Value (US$ Mn), 2018 – 2030

3.4.1.2. U.S. Toxicology Laboratories Market, by Product Type, Value (US$ Mn), 2018 – 2030

3.4.1.3. U.S. Toxicology Laboratories Market, by Sample, Value (US$ Mn), 2018 – 2030

3.4.1.4. Canada Toxicology Laboratories Market by Drug Class, Value (US$ Mn), 2018 – 2030

3.4.1.5. Canada Toxicology Laboratories Market, by Product Type, Value (US$ Mn), 2018 – 2030

3.4.1.6. Canada Toxicology Laboratories Market, by Sample, Value (US$ Mn), 2018 – 2030

3.4.2. Market Attractiveness Analysis

4. Competitive Landscape

4.1. Company Market Share Analysis, 2022

4.2. Market Concentration by Top Players

4.3. Competitive Dashboard

4.4. Company Profiles

4.4.1. Thermo Fisher Scientific

4.4.1.1. Company Overview

4.4.1.2. Product Portfolio

4.4.1.3. Financial Overview

4.4.1.4. Business Strategies and Development

4.4.2. Bio-Rad Laboratories, Inc.

4.4.2.1. Company Overview

4.4.2.2. Product Portfolio

4.4.2.3. Financial Overview

4.4.2.4. Business Strategies and Development

4.4.3. NEOGEN Corporation

4.4.3.1. Company Overview

4.4.3.2. Product Portfolio

4.4.3.3. Financial Overview

4.4.3.4. Business Strategies and Development

4.4.4. Redwood Toxicology Laboratory, Inc.

4.4.4.1. Company Overview

4.4.4.2. Product Portfolio

4.4.4.3. Financial Overview

4.4.4.4. Business Strategies and Development

4.4.5. Vala Sciences, Inc.

4.4.5.1. Company Overview

4.4.5.2. Product Portfolio

4.4.5.3. Financial Overview

4.4.5.4. Business Strategies and Development

4.4.6. Enzo Life Sciences, Inc.

4.4.6.1. Company Overview

4.4.6.2. Product Portfolio

4.4.6.3. Financial Overview

4.4.6.4. Business Strategies and Development

4.4.7. Alere, Inc.

4.4.7.1. Company Overview

4.4.7.2. Product Portfolio

4.4.7.3. Financial Overview

4.4.7.4. Business Strategies and Development

4.4.8. Agilent Technologies, Inc.

4.4.8.1. Company Overview

4.4.8.2. Product Portfolio

4.4.8.3. Financial Overview

4.4.8.4. Business Strategies and Development

4.4.9. Immunalysis Corporation

4.4.9.1. Company Overview

4.4.9.2. Product Portfolio

4.4.9.3. Financial Overview

4.4.9.4. Business Strategies and Development

4.4.10. Danaher Corporation

4.4.10.1. Company Overview

4.4.10.2. Product Portfolio

4.4.10.3. Financial Overview

4.4.10.4. Business Strategies and Development

4.4.11. Principle Diagnostics Laboratory

4.4.11.1. Company Overview

4.4.11.2. Product Portfolio

4.4.11.3. Financial Overview

4.4.11.4. Business Strategies and Development

4.4.12. Principle Laboratory

4.4.12.1. Company Overview

4.4.12.2. Product Portfolio

4.4.12.3. Financial Overview

4.4.12.4. Business Strategies and Development

4.4.13. Principle Diagnostics Laboratory

4.4.13.1. Company Overview

4.4.13.2. Product Portfolio

4.4.13.3. Financial Overview

4.4.13.4. Business Strategies and Development

4.4.14. Clinical Reference Laboratory, Inc.

4.4.14.1. Company Overview

4.4.14.2. Product Portfolio

4.4.14.3. Financial Overview

4.4.14.4. Business Strategies and Development

4.4.15. Medical Toxicology Laboratory, LLC

4.4.15.1. Company Overview

4.4.15.2. Product Portfolio

4.4.15.3. Financial Overview

4.4.15.4. Business Strategies and Development

4.4.16. NMS Labs

4.4.16.1. Company Overview

4.4.16.2. Product Portfolio

4.4.16.3. Financial Overview

4.4.16.4. Business Strategies and Development

4.4.17. BATTS Laboratories

4.4.17.1. Company Overview

4.4.17.2. Product Portfolio

4.4.17.3. Financial Overview

4.4.17.4. Business Strategies and Development

4.4.18. Total Toxicology

4.4.18.1. Company Overview

4.4.18.2. Product Portfolio

4.4.18.3. Financial Overview

4.4.18.4. Business Strategies and Development

4.4.19. Life Brite Labs.

4.4.19.1. Company Overview

4.4.19.2. Product Portfolio

4.4.19.3. Financial Overview

4.4.19.4. Business Strategies and Development

4.4.20. Product Safety Labs

4.4.20.1. Company Overview

4.4.20.2. Product Portfolio

4.4.20.3. Financial Overview

4.4.20.4. Business Strategies and Development

4.4.21. Lexar Labs

4.4.21.1. Company Overview

4.4.21.2. Product Portfolio

4.4.21.3. Financial Overview

4.4.21.4. Business Strategies and Development

5. Appendix

5.1. Research Methodology

5.2. Report Assumptions

5.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

By Drug Class |

|

|

By Product Type |

|

|

By Sample |

|

|

Geographic Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Market Estimates and Forecast (Value), Market Dynamics, Regulatory Guidelines, Technological Advancements, COVID-19 Impact Analysis, Drug Class Insights, Product Type Insights, Sample Insights, Country Insights, Competitive Landscape, Company Profiles |