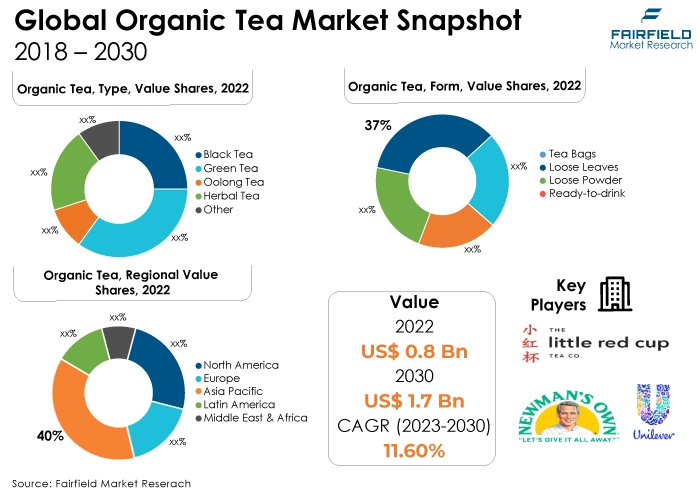

Global Organic Tea Market Forecast

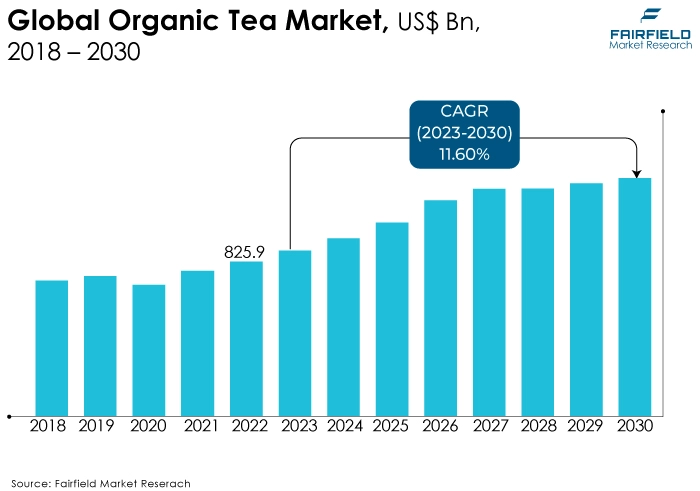

- Organic tea sales that reached US$0.8 Bn in 2022 likely to reach US$1.7 Bn by 2030-end

- Market valuation poised to witness a CAGR of 11.6% between 2023 and 2030

Quick Report Digest

- Growing consumer knowledge of the possible health benefits of ingesting organic products and the desire to support environmentally friendly and sustainable agricultural techniques have contributed to the growth of the organic tea market.

- Organic tea has bioactive components, including caffeine and polyphenols, that help break down fat cells and release them into the circulatory system, which leads to weight loss. As a result of consumers' growing propensity to spend money on weight-reduction goods, the demand is rising globally.

- The market for organic tea is primarily constrained by rising coffee consumption trends and variable raw material costs brought on by unpredictably changing weather circumstances. Additionally, the major players in the market have implemented a marginal pricing approach, which is predicted to restrain market expansion overall.

- In 2022, green tea has the greatest market share due to its expanding consumer popularity and its numerous health benefits. Due to its greater flavonoid and antioxidant content, green tea is becoming more popular.

- The market for organic tea bags has expanded rapidly worldwide as convenience and portable food and beverages become increasingly popular. Due to its simple preparation, organic tea in teabags has the biggest market share.

- The supermarket/hypermarket category is exhibiting the most growth due to the wide range of products these outlets carry. Owing to advancements in storage methods, these businesses may now offer comfort to patrons, facilitating an easy shopping experience.

- The Asia Pacific region is anticipated to account for the largest global organic tea market share because consumers in this area have more disposable income. Compared to regular green tea, organic tea is considered healthier. This region's market revenue growth is driven by the rising popularity of herbal and organic tea for enhancing health and skin.

- North America will have the quickest growth rate in the organic tea market during the forecast period driven by the rising popularity of natural and organic products and the rising acceptance of healthy lifestyles. Furthermore, the rise in obese patients is a key factor boosting North America's organic tea market.

A Look Back and a Look Forward - Comparative Analysis

The global market for organic tea is anticipated to develop because of the growing usage of green tea as a natural component in the personal care sector. Additionally, it is projected that rising levels of disposable income, rising food and beverage prices, and a rise in consumer awareness of healthy lifestyles would all impact the growth of the organic tea market.

In the historical period of 2018 to 2022, the market had inconsistent growth. With customers becoming more health-conscious and gravitating toward natural and organic goods, the market for organic tea started to take off in the late 20th century. Despite being modest initially, this growth signalled the start of a pattern.

Additionally, there was a noticeable increase in customer interest in beverages seen as healthier substitutes for sugary drinks, reflecting a rise in health consciousness in the market. Industry participants should benefit greatly from the rising global demand for organic products in the upcoming years.

The market is continuously seeing the introduction of brand-new, cutting-edge products from producers because of the great demand for the therapeutic benefits of organic tea. In addition, the growing R&D in this area to introduce new, innovative products and the medical advantages of organic tea will further provide a variety of new chances for the industry.

Key Growth Determinants

- Improved Understanding of Consumers

The global clean-label food industry is expanding mostly due to consumer awareness of products free of pesticides. Due to the perception that green tea grown organically has a superior quality and has advantages for both the environment and human health, the production of organic tea has significantly increased over the past few years.

Additionally, it is anticipated that sales of green tea grown organically will result in greater price realisation and improve the socioeconomic standing of green tea growers. Organic farming has advanced worldwide due to increased consumer knowledge of food safety issues and rising demand for organic food and drinks worldwide.

- Perceived Health Advantages

Caffeine, and polyphenols in organic tea are bioactive substances that aid in breaking fat cells and releasing their contents into the bloodstream, resulting in weight loss. As consumers' willingness to spend money on weight loss goods increases, there is a growing need for organic tea on a global scale.

Additionally, organic tea helps lower triglyceride and cholesterol levels and prevents heart attacks. It also lowers saliva acidity, slows the development of plaque, and stops oral bacteria from creating acids that erode tooth enamel, all of which help to prevent cavities and other oral health issues. Thus, several health advantages of drinking organic tea are anticipated to spur market expansion for organic tea during the projected time.

- Increasing Consumer Access to Organic Tea Products

One of the main factors fuelling the growth of the organic tea market is the expanding availability of organic tea products through organised retailing. As manufacturers in the market who largely distribute their products through them, major and organised retailers predominately sell convenience goods like RTD organic tea powders and mixes.

Additionally, one of the main distribution routes for supplying wholesome, practical, and reasonably priced food and drink items is supermarkets. The growing number of people with disposable income also significantly contributes to increased supermarket demand. As a result, the growth of the organic tea market will be fuelled by these expanding merchants over the forecast period.

Major Growth Barriers

- Limitations in the Production of Organic Tea

The lack of understanding regarding correct agricultural techniques to produce organic tea significantly constrains the market's expansion. Most green tea farmers lack the knowledge necessary to transform their traditional cultivation practices into more efficient and sustainable ones.

- High Cost of Organic Tea

Due to their great nutritional value and manufacturers' thorough processing of organic tea leaves, organic tea s are pricey beverage goods. As a result, not many individuals in underdeveloped nations can afford it. This aspect is anticipated to slow the market expansion for organic tea during the anticipated time frame.

Key Trends and Opportunities to Look at

- Increasing Concerns Related to Environment and Sustainability

Consumers are increasingly choosing goods that are made with eco-friendly practices due to worries about the environment and sustainability. These environmental considerations are in line with the organic agricultural methods utilised in the production of green tea.

- Increasing Desire for Specialty Teas

Specialty teas like organic tea are becoming more popular as people get pickier about the teas they buy. These teas appeal to many consumers thanks to their distinctive flavours, smells, and potential health advantages.

- Rising Marketing and Consumer Education Efforts

The expansion of organic tea has been aided by marketing initiatives and educational campaigns emphasizing its advantages, its production processes, and its potential effects on health and the environment.

How Does the Regulatory Scenario Shape this Industry?

While certification guarantees that a product is organic, the certification would need its own guarantee. To achieve this, a global system for ensuring organic certification was established. This system is known as the International Federation of Organic Agriculture Movements (IFOAM), which unites over a hundred countries and numerous member organisations within those nations.

A green tea grower can market, label, and advertise his products as organic due to organisations like INDOCERT, IMO Control, ECOCERT SA, Naturland-India, SGS India Private Limited, Onecert Asia Agri Certification Private Limited, SKAL International Ltd., and others. Furthermore, India's first organic certification body, INDOCERT, upholds the National Standards for Organic Products.

The certification is offered by testing facilities approved by the Agricultural and Processed Food Products Export Development Authority (APEDA) as a component of the National Program for Organic Production of the Government of India.

Fairfield’s Ranking Board

Top Segments

- Green Tea Wins Preference over Black Tea

The green tea segment dominated the market in 2022. Due to its antioxidant characteristics, green tea is one of the healthiest drinks and is popular among older adults, pregnant women, and health-conscious people. It can enhance cognitive performance, boost fat burning, and lower the risk of several cancers, including colorectal, breast, and prostate. Cardiovascular disease and type 2 diabetes are also prevented by it.

Since more black tea is produced than any other form of tea, it is commonly consumed. Asian nations, including China, India, and Japan have the greatest rates. Black tea has historically been eaten more due to its well-known health benefits, including more antioxidants. Additionally, customers prefer black organic tea more frequently due to expanding knowledge about safer alternatives to teas cultivated organically.

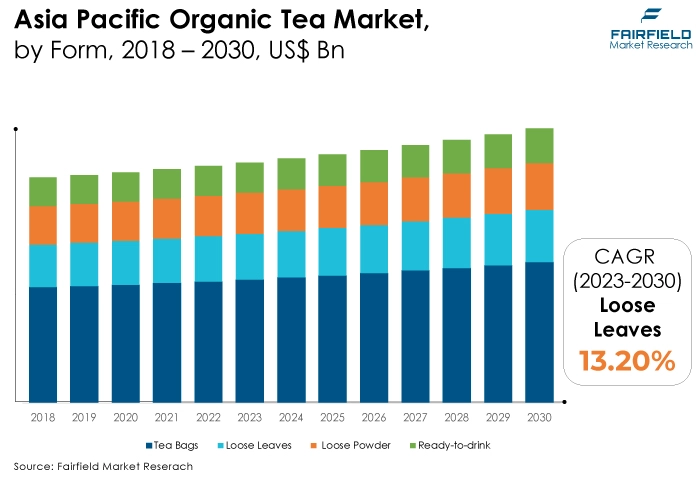

- Sales of Tea Bags Surge Ahead

In 2022, due to its extraordinary advantages and simplicity, organic tea bags have experienced a substantial rise in popularity over the past several years. Because they are portable and simple to dispose of, the tea bags and their handy attached thread are seen to be convenient. Using tea bags to prepare organic tea simplifies and expedites the tea-brewing process because no additional tools, such as a tea infuser or strainer, are needed.

Furthermore, the loose leaves category is expected to expand significantly. This is explained by the fact that leaf varieties have a first-mover advantage. In addition, these items give customers the option to choose between strong and moderate organic tea flavours, giving them more control over the taste of their beverage.

- Supermarkets/Hypermarkets Remain the Prime Distribution Channels

In 2022, supermarkets/hypermarkets held most of the market share. Finding a certain product that suits one's tastes might be challenging given the wide range of goods on the market. As a result, it can be said that shopping for these goods is best done in supermarkets/hypermarkets that provide a wide range of options, which promotes the expansion of the channel.

During the forecasted years, online retail is anticipated to increase fastest. Leading and small organic tea brewers have a chance to connect with consumers through online channels. Online shopping is a good option for some manufacturers because the order triggers a speedy item creation.

Regional Frontrunners

Asia Pacific Stands the Tallest

During that forecast period, Asia Pacific is anticipated to hold the largest market share for organic tea. The world's top organic tea producers, including China, Pakistan, India, and Sri Lanka, are thought to be responsible for the growth. Many nations, like China and India, have concentrated on growing tea on large tracts of land since the area's climate, humidity, and soil texture are suitable for the crop.

Furthermore, China and Japan consume the most functional drinks, including matcha tea, specialty teas, and organic tea, all of which are excellent sources of nutrients. Further predictions indicate that these variables will accelerate market expansion in the area. Additionally, numerous firms are expected to strengthen and invest in their market presence across Asia Pacific soon due to the good chances in the region.

North America’s Proclivity for Organic Tea will Grow at the Fastest Pace

With the fastest-growing market share for organic tea, North America has a huge potential for the tea business. The region's expanding knowledge of the health advantages of organic tea is primarily responsible for the market's expansion. Consumers are now more likely to have lifestyle-related health concerns like obesity, diabetes, and cardiovascular illnesses thanks to the fast-paced modern way of life.

Furthermore, the demand for organic tea to lower the risk of certain illnesses has grown. The demand for organic tea among millennials in the area has surged as functional beverages become increasingly popular. Moreover, with customers looking for products that align with health trends and ethical considerations, the US, and Canada are important markets for organic tea.

Fairfield’s Competitive Landscape Analysis

Although there are many companies in the organic tea market, there is fierce competition among them because tea already has a sizable portion of the global market as per the Fairfield’s analysis.

A brand might become the market leader with the help of marketing strategies and fundamental processing enhancements. Furthermore, the foundation for innovation for the participants is the addition of an organic tag along with several flavours.

Additionally, to increase their market share and global presence, organic tea producers are implementing various methods, including new product innovations, mergers and acquisitions, and plant capacity enhancement.

Who are the Leaders in Global Organic tea Space?

- Associated British Foods plc

- Unilever plc

- Tata Consumer Products Limited

- The Bigelow Tea Company

- The Republic of Tea, Inc.

- The Stash Tea Company

- Tazo Tea Company

- Shangri La Tea Company

- Newman’s Own, Inc.

- Organic India Pvt. Ltd.

- Compass Tea Company

- Davidson’s Organics

- Little Red Cup Tea Co.

- Numi Inc.

- Frontier Natural Products

Significant Company Developments

New Product Launches

- December 2020: Care Tea Basket is a brand-new organic tea from Ban Labs. It is free of artificial flavours and preservatives. It was first introduced in India and comes in 5 packs with unique flavours.

- June 2019: Unilever-owned Sariwangi, an Indonesian tea brand, revealed a cutting-edge addition to its line of goods. Two appealing flavours of powdered milk tea were added to this new line of 3-in-1 organic tea products: caramel, and Teh Tarik.

- May 2019: A noteworthy statement was made as part of the centennial celebrations of Gujarat, India-based Wagh Bakri Tea Group, a well-known premium tea producer. To demonstrate its dedication to quality and creativity, the company offered new packaging options for its selection of organic teas.

Distribution Agreements

- January 2022: WeWork, one of the top global providers of flexible space, and Numi Organic Tea, known for its selection of organic & fair-trade certified teas, partnered to become each other's exclusive tea partners. Through this collaboration, Numi will make its tea products available to WeWork members in more than 275 locations and more than 1,000 food banks across the US and Canada.

- November 2019: Ajinomoto General Foods Inc., a significant player in the organic tea market, partnered with Accenture plc. as part of a strategic drive to leverage technology and increase market presence. This joint company, which was born in Japan, is the result of combining resources to take advantage of prospects in the organic tea market.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, one of the main drivers of market expansion is consumers' increased preference for safe, chemical-free, and healthy consumable products.

Additionally, quick progress in tea packaging has increased shelf-life, export, and availability of new organic tea brands, all fuelling the market's revenue growth.

Furthermore, they are spending money on cutting-edge marketing techniques and celebrity endorsements, expected to boost organic tea market expansion.

Supply Side of the Market

According to our study, the rising customer preference for secure, chemical-free, and nutritious consumables is one of the main causes pushing organic tea market producers to concentrate on organic tea cultivation.

To reduce their carbon footprint, several companies are also making tea bags with compostable and biodegradable outer packaging. They also provide ready-to-drink variations to diversify their product offering and increase total sales.

Additionally, they are spending money on cutting-edge marketing plans and celebrity endorsements, predicted to accelerate market growth in the upcoming years.

Global Organic Tea Market is Segmented as Below:

By Type

- Black Tea

- Green Tea

- Oolong Tea

- Herbal Tea

- Others

By Form

- Tea Bags

- Loose Leaves

- Loose Powder

- Ready-to-Drink

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Organic Tea Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value/Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Organic Tea Market Outlook, 2018 - 2030

3.1. Global Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Black Tea

3.1.1.2. Green Tea

3.1.1.3. Oolong Tea

3.1.1.4. Herbal Tea

3.1.1.5. Others

3.2. Global Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Tea Bags

3.2.1.2. Loose Leaves

3.2.1.3. Loose Powder

3.2.1.4. Ready-to-drink

3.3. Global Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Supermarkets/Hypermarkets

3.3.1.2. Convenience Stores

3.3.1.3. Specialty Stores

3.3.1.4. Online Retail

3.4. Global Organic Tea Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Organic Tea Market Outlook, 2018 - 2030

4.1. North America Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Black Tea

4.1.1.2. Green Tea

4.1.1.3. Oolong Tea

4.1.1.4. Herbal Tea

4.1.1.5. Others

4.2. North America Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Tea Bags

4.2.1.2. Loose Leaves

4.2.1.3. Loose Powder

4.2.1.4. Ready-to-drink

4.3. North America Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Supermarkets/Hypermarkets

4.3.1.2. Convenience Stores

4.3.1.3. Specialty Stores

4.3.1.4. Online Retail

4.3.2. Market Attractiveness Analysis

4.4. North America Organic Tea Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Organic Tea Market Outlook, 2018 - 2030

5.1. Europe Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Black Tea

5.1.1.2. Green Tea

5.1.1.3. Oolong Tea

5.1.1.4. Herbal Tea

5.1.1.5. Others

5.2. Europe Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Tea Bags

5.2.1.2. Loose Leaves

5.2.1.3. Loose Powder

5.2.1.4. Ready-to-drink

5.3. Europe Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Supermarkets/Hypermarkets

5.3.1.2. Convenience Stores

5.3.1.3. Specialty Stores

5.3.1.4. Online Retail

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Organic Tea Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Organic Tea Market Outlook, 2018 - 2030

6.1. Asia Pacific Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Black Tea

6.1.1.2. Green Tea

6.1.1.3. Oolong Tea

6.1.1.4. Herbal Tea

6.1.1.5. Others

6.2. Asia Pacific Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Tea Bags

6.2.1.2. Loose Leaves

6.2.1.3. Loose Powder

6.2.1.4. Ready-to-drink

6.3. Asia Pacific Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Supermarkets/Hypermarkets

6.3.1.2. Convenience Stores

6.3.1.3. Specialty Stores

6.3.1.4. Online Retail

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Organic Tea Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Organic Tea Market, by Form, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Organic Tea Market, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Organic Tea Market Outlook, 2018 - 2030

7.1. Latin America Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Black Tea

7.1.1.2. Green Tea

7.1.1.3. Oolong Tea

7.1.1.4. Herbal Tea

7.1.1.5. Others

7.2. Latin America Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Tea Bags

7.2.1.2. Loose Leaves

7.2.1.3. Loose Powder

7.2.1.4. Ready-to-drink

7.3. Latin America Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Supermarkets/Hypermarkets

7.3.1.2. Convenience Stores

7.3.1.3. Specialty Stores

7.3.1.4. Online Retail

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Organic Tea Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Organic Tea Market Outlook, 2018 - 2030

8.1. Middle East & Africa Organic Tea Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Black Tea

8.1.1.2. Green Tea

8.1.1.3. Oolong Tea

8.1.1.4. Herbal Tea

8.1.1.5. Others

8.2. Middle East & Africa Organic Tea Market Outlook, by Form, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Tea Bags

8.2.1.2. Loose Leaves

8.2.1.3. Loose Powder

8.2.1.4. Ready-to-drink

8.3. Middle East & Africa Organic Tea Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Supermarkets/Hypermarkets

8.3.1.2. Convenience Stores

8.3.1.3. Specialty Stores

8.3.1.4. Online Retail

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Organic Tea Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Organic Tea Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Organic Tea Market by Form, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Organic Tea Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Form/Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Associated British Foods plc (London, U.K.)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Unilever plc (London, U.K.)

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Tata Consumer Products Limited (Mumbai, India)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. The Bigelow Tea Company (Connecticut, U.S.)

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. The Republic of Tea, Inc. (California, U.S.)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. The Stash Tea Company (Oregon, U.S.)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Tazo Tea Company (Washington, U.S.)

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Shangri La Tea Company (Nevada, U.S.)

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Newman’s Own, Inc. (Connecticut, U.S.)

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Organic India Pvt. Ltd. (Lucknow, India)

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Compass Tea Company (Virginia, U.S.)

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Davidson’s Organics (India)

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Little Red Cup Tea Co. (Brunswick, U.S.)

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Numi Inc. (California, U.S.)

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Frontier Natural Products (Norway, U.S.)

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Form Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |