Global Parcel Sortation Systems Market Forecast

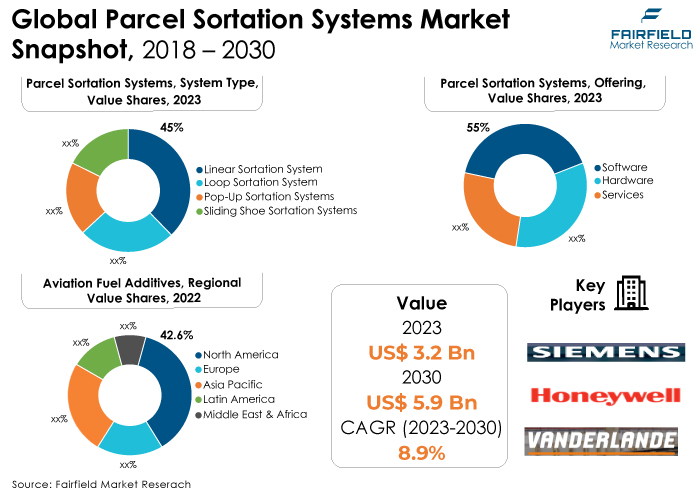

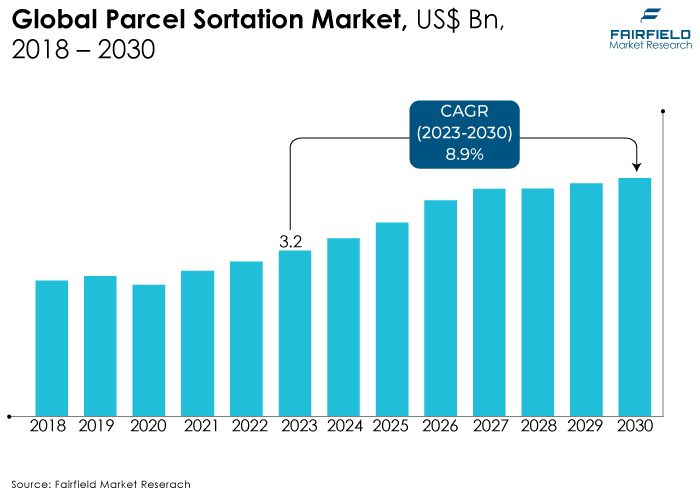

- Parcel sortation systems market revenue worth US$3.2 Bn (2023) projected to reach US$5.9 Bn by the end of 2030

- Market size expected to witness a robust CAGR of 8.9% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the parcel sortation systems market growth is increased demand for advanced sensor technologies. Furthermore, advanced sensors like barcode scanners and high-resolution cameras make precise parcel identification possible. This reduces the possibility of mistakes during the sorting process by guaranteeing that each package is appropriately identified.

- Another major market trend expected to fuel the parcel sortation systems market growth is the rapidly expanding real-time data analytics. Real-time data analytics makes dynamic route optimisation based on the sorting system's present state possible. The system can modify sorting routes in real-time to maximise productivity and guarantee on-time delivery.

- In 2023, the linear sortation systems category dominated the industry. High-order precision in these systems results from their accurate diverters and linear movement. Sorting accuracy is essential to guarantee that every package arrives at its destination without any mistakes.

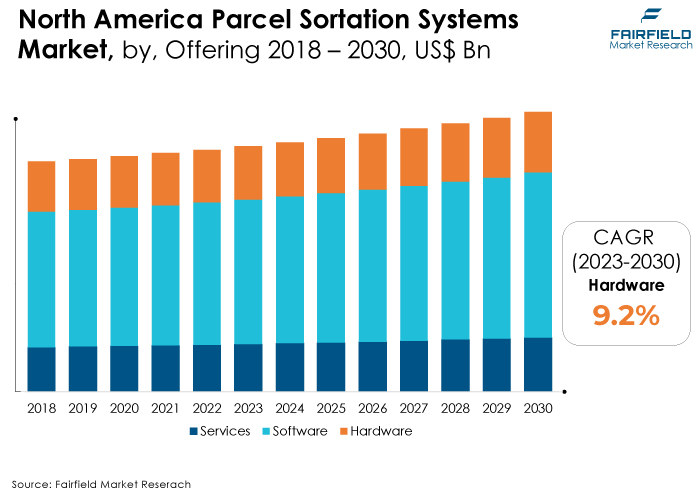

- Regarding market share for parcel sortation systems globally, the software segment is anticipated to dominate. The software makes it possible to scan barcodes and recognise images, which improves parcel identification accuracy. Error-free sorting, fewer misplacements, and increased order correctness depend on this.

- In 2023, the logistics and transportation category controlled the market. Parcel sortation systems are used by national postal services to handle the distribution and sorting of mail and packages. Postal services can manage a variety of parcel sizes and types more effectively due to these solutions.

- The food and beverage category is anticipated to be the fastest-growing market for parcel sortation systems. Some products related to food and beverages must be handled carefully because they are sensitive or fragile. Parcel sortation systems come with features that ensure these kinds of products are moved and sorted gently, reducing the risk of damage.

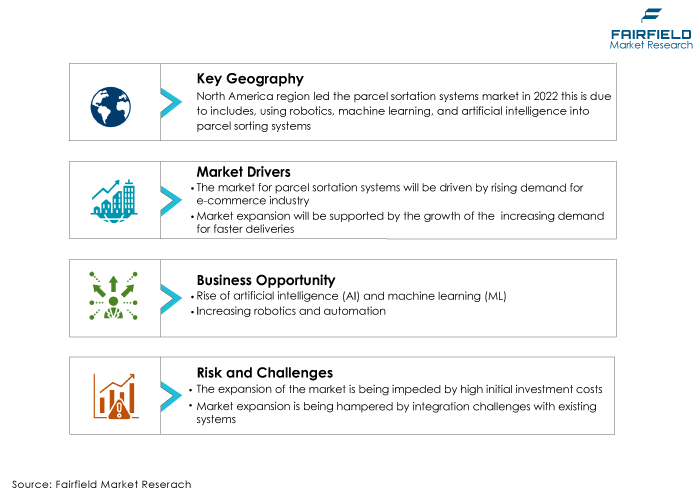

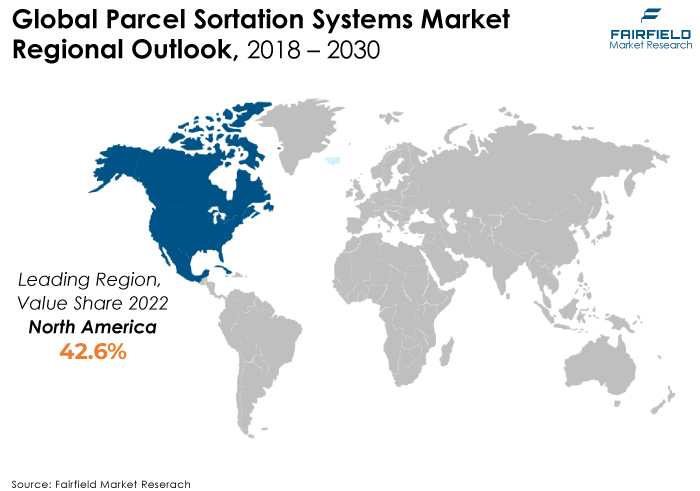

- The North American region is anticipated to account for the largest share of the global parcel sortation systems market, owing to the region being a centre for technical innovation because companies there are always looking to improve their operations by implementing new technologies. This includes using robotics, machine learning (ML), and Artificial Intelligence (AI) in parcel sorting systems.

- The market for parcel sortation systems is expanding in the Asia Pacific due to the governments of the region frequently launching programs to encourage the uptake of cutting-edge technologies and optimise logistics procedures. Businesses are encouraged to invest in parcel sorting systems by regulatory frameworks that provide support.

A Look Back and a Look Forward - Comparative Analysis

Processing returns is streamlined with integration. WMS can interface with the parcel sortation system to guarantee effective processing of returned items, update inventory records, and start the required procedures for restocking or inspection. The ability to adjust to changing circumstances, including variations in order volume or seasonal demand, is made possible via WMS integration. Based on the real-time data provided by the WMS, parcel sortation systems can modify their sorting algorithms dynamically.

The market witnessed staggered growth during the historical period 2018 - 2023. This is due to the substantial growth of the major end-use application sectors such as e-commerce and retail, logistics and transportation, and others. However, in some applications, the demand for parcel sortation systems has increased, including food and beverage, pharmaceuticals and healthcare, and misc.

Implementing IoT connectivity is a necessary component of Industry 4.0 integration. Incorporating Internet of Things (IoT) sensors and devices into parcel sorting systems allows for real-time data collecting, monitoring, and communication, which improves overall system intelligence in the coming years.

Additionally, Cloud computing is frequently used in Industry 4.0 integration. By utilising cloud infrastructure, parcel sorting systems may expand operations, manage substantial data amounts, and offer adaptability in response to evolving company needs.

Furthermore, cyber-physical systems where digital and physical components are closely interconnected are an idea involved in integrating with Industry 4.0. During the next five years, smarter and more coordinated sorting activities can be made possible by integrating parcel sortation systems into a larger CPS framework.

Key Growth Determinants

- Remarkable Growth Pace of eCommerce

An increase in online orders can be attributed to the growth of eCommerce. Parcel sortation technologies are crucial in efficiently handling growing shipments and ensuring prompt and precise sorting for on-time deliveries. eCommerce clients have high standards for prompt and dependable delivery. The speed and efficiency are thus essential.

Warehouses and distribution centres can match customer expectations and expedite order processing by implementing parcel sortation systems, which provide efficient sorting. Shipping various goods in varying sizes and forms is a part of eCommerce.

Packages of different sizes can be effectively sorted and routed thanks to parcel sorting systems' ability to handle this diversity. Optimising last-mile delivery, the last leg of the delivery process requires efficient sorting. Parcel sortation systems help save delivery times and costs by grouping goods according to delivery routes.

- Rising Demand for Faster Deliveries

Delivery centres can handle orders faster thanks to parcel sortation systems, which automate the sorting process. This efficiency is necessary for orders to be fulfilled more quickly and deliveries to be made on time. With the expansion of eCommerce, consumer expectations for dependable and quick deliveries have increased. Businesses can satisfy these higher expectations by using parcel sorting technologies, which increase consumer satisfaction and loyalty.

eCommerce businesses have a competitive edge in the market if they can provide options for faster delivery. Systems for sorting parcels are crucial in reaching the speed needed to offer same-day or next-day delivery services.

- Growing Demand for Customisation, and Sorting Flexibility

Systems for customisable sorting parcels can effectively manage a broad variety of package dimensions, weights, and forms. This adaptability is essential for companies with various product lines and packaging specifications. Every industry has its criteria when it comes to sorting.

Systems for parcel sorting that allow for customisation can be made to specifically fit the requirements of various industries, including electronics, medicines, and retail. Demand varies seasonally, which is common for businesses. Scalable and adaptable parcel sorting systems enable businesses to modify their sorting capacities in response to fluctuating order quantities during peak seasons.

Major Growth Barriers

- High Initial Investments

Implementing parcel sortation systems necessitates a significant initial capital outlay for acquiring related technologies, software, and hardware. It might be difficult for many businesses, particularly smaller ones, to commit such large resources. The large initial investment costs can negatively impact SMEs, as they often have more constrained budgets. These companies might be discouraged from implementing automated solutions because of the cost of purchasing and setting up parcel sorting equipment.

- Integration Challenges with Existing Systems

Warehouse management systems (WMS), legacy systems, and other technologies can be found in many enterprises' complex and varied IT infrastructures. Integrating parcel sorting systems with such diverse surroundings can be challenging technologically. To guarantee efficient operations, parcel sorting systems must be able to interact with current technology easily. Workflow disruptions might occur from incompatibility between automated sorting solutions and older or proprietary systems.

Key Trends and Opportunities to Look at

- Rise of AI and ML

Large-scale data analysis can be performed using AI and ML systems to improve package sorting accuracy. Package placement errors can be minimised by using these technologies to help systems learn from past data, spot trends, and improve sorting procedures. Real-time data, traffic patterns, and delivery priority can all be used to optimise sorting routes dynamically using AI and ML algorithms. This improves operational efficiency overall by guaranteeing that packages are processed and sent out effectively.

- Increasing Robotics and Automation

Parcel sorting processes may be performed at much higher speeds and throughput because of robotics, and automated technologies. In particular, during peak seasons or times of strong demand, enterprises can efficiently handle more parcels. Continuous 24/7 sorting activities are made possible by automation. Firms must maintain a consistent and effective workflow to satisfy the expectations of a globalised market where deliveries are anticipated at all hours.

- Sustainable and Eco-friendly Solutions

Companies have an opportunity to develop and market environmentally friendly and sustainable package sorting systems due to growing environmental consciousness. Environmentally minded firms could be drawn to systems that prioritise energy efficiency and minimise the environmental effects.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, standards that affect package sorting systems have been developed by groups such as the International Electrotechnical Commission (IEC) and the International Organisation for Standardisation (ISO). Safety, performance, and interoperability standards may impact how these systems are designed and operated.

Parcel sorting systems may be required to go by certain safety and compliance criteria in each country. National regulatory organisations or authorities in charge of product safety often set these requirements. OSHA is a significant regulatory agency in the US that manages worker safety. Producers, operators, and consumers of parcel sorting systems must adhere to OSHA requirements to protect worker safety.

Federal Communications Commission (FCC) regulations for radiofrequency device use may apply if parcel sorting systems use wireless communication technology. For these kinds of systems, FCC compliance is mandatory. Systems for sorting parcels, particularly those used in cross-border logistics, might be impacted by regulations governing international shipping and customs processes. Systems utilised in international shipment must adhere to CBP requirements.

Fairfield’s Ranking Board

Top Segments

- Linear Sortation Systems Maintain Dominance over Loop Counterparts

The linear sortation systems segment dominated the market in 2023. The tremendous throughput and speed of sorting processes achieved by linear sortation systems are well recognised. Demand for linear systems that can swiftly process huge volumes is growing along with the need for parcel sorting to become faster and more efficient.

Conveyor systems and current warehouse layouts are typically easier to implement linear sortation systems into. This simplicity of connection is a critical component for companies trying to improve their sorting capabilities without experiencing major disruptions.

Furthermore, the loop sortation systems category is projected to experience the fastest market growth. Systems for loop sorting provide a variety of sorting choices. Depending on each packet's destination or features, parcels can be routed at different places along the loop to alternative chutes or destinations, enabling a variable sorting process.

- Software Continues to Surge Ahead

In 2023, the software category dominated the industry. The software manages conveyor belts, diverters, and other equipment in parcel sorting systems, controlling the automation features of these devices. Achieving great productivity, minimising manual involvement, and guaranteeing the seamless flow of packages all depend on this automation control.

The hardware category is anticipated to grow substantially throughout the projected period. Devices like tilt tray sorters, cross-belt sorters, and push tray sorters are examples of sorting equipment. The particular needs of the sorting process, such as throughput, package sizes, and sorting accuracy, determine the demand for various hardware components.

- Logistics and Transportation Consume the Largest Share of Market Pie, F&B Accelerates

The logistics and transportation segment dominated the market in 2023. Large warehouses and distribution centres run by logistics corporations house most of the sorting operations. These facilities need parcel sortation systems to sort incoming and outgoing goods efficiently.

Fulfilment centres have become an essential component of the logistics landscape due to the expansion of eCommerce. These centres can manage many individual orders due to parcel sortation technologies, which precisely sort the orders for prompt delivery.

The food and beverages category is expected to experience the fastest growth within the forecast time frame. Many foods and beverages must be kept at a specific temperature while transported and stored. To ensure the correct handling of perishable items, parcel sortation systems in this business may have features that consider temperature needs into consideration.

Regional Frontrunners

North America Holds the Lion’s Share

North America is expected to dominate the market. Consumers are increasingly choosing to shop online, and e-commerce activity has significantly increased in the US. Due to this trend, there is a growing need for effective parcel sorting systems to handle the increasing number of parcels. North America has an advanced logistics infrastructure that is well-developed and offers a favourable environment for implementing cutting-edge parcel sorting technologies.

Sophisticated sorting systems can be implemented with contemporary distribution centres, transportation networks, and warehouses. North American consumers have high standards for dependable and timely delivery. E-commerce and logistics firms invest in package sortation systems that streamline the delivery and sorting procedures to match these expectations.

Asian Markets Gain from Unprecedented Proliferation of eCommerce

Asia Pacific is expected to be the fastest-growing region. Growing middle-class populations in nations like China, and India are a factor in the rise in consumer expenditure, which includes internet shopping. This change in the population is driving the need for quicker and more dependable parcel sorting systems. The area has led the way in integrating robots, AI, and ML.

Advanced package sorting systems are a reflection of this technical advancement. Many cross-border eCommerce transactions occur in the Asia Pacific, where many countries import and export commodities. Systems for sorting parcels are essential for handling the intricacies of international shipping and guaranteeing on-time delivery.

Fairfield’s Competitive Landscape Analysis

The market for parcel sorting systems worldwide is consolidated, with few large competitors operating globally. The major players are improving their distribution networks and launching new items to increase global reach. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Parcel sortation systems Space?

- Siemens AG

- Honeywell Intelligrated

- Vanderlande Industries

- Beumer Group

- Fives Intralogistics

- Daifuku Co., Ltd.

- Bastian Solutions

- Interroll Group

- Murata Machinery, Ltd.

- Swisslog Holding AG

- Tompkins International

- OKURA YUSOKI CO., LTD.

- Dematic

- Toshiba Corporation

- Hyster-Yale Group

Significant Company Developments

New Product Launch

- March 2022: Vanderlande has announced a new automatic piece-picking robot as an addition to its smart item robotics (SIR) technology portfolio. This technology aligns with Vanderlande's aim of advancing the usage of robotics in warehouse operations.

- December 2021: A brand-new system for sorting small and medium-sized products has been introduced to service by Beumer Group.

- May 2021: Fives launched their Smart Automation Solution website. The Division's ability to provide a comprehensive service for all markets is highlighted on the new website, which takes the place of the prior Automation and Intralogistics sections.

Distribution Agreement

- March 2023: Demantic announced that it would be distributing KION Group with the newest technologies in warehouse automation. This facility will support KION's efficient European spare part delivery network.

- February 2021: Daifuku Co Ltd and AFT Industries AG signed an agreement. The company, headquartered in Germany, produces and sells parcel sorting and material handling solutions. Utilising package sorting systems for the automotive industry was the partnership's goal.

An Expert’s Eye

Demand and Future Growth

Parcel sorting systems are becoming more accurate and efficient due to developments in sorting technology, such as robotics, AI, and ML. Businesses are using these technologies to stay competitive.

Furthermore, parcel sorting systems can expand their customer base by collaborating with third-party logistics (3PL) companies. 3PLs aiming to improve their sorting capabilities could look for cutting-edge solutions to satisfy customer demands. However, the parcel sortation systems market is expected to face considerable challenges because of high initial investment costs.

Supply Side of the Market

According to our analysis, Germany, well-known for its engineering skills, is home to businesses like Siemens Logistics and BEHN + MATE, which are global leaders in high-tech, high-capacity package sorting systems. They supply huge logistical firms and international postal services. Leading Japanese companies in automation and robotics, such as Toshiba and Daifuku, have created advanced sorting systems renowned for their accuracy, speed, and space efficiency. They serve both local and foreign customers.

Some US companies like Honeywell Intelligrated, and Vanderlande Industries make a major market contribution with their creative sorter designs and software solutions. They concentrate on catering to the sizable domestic e-commerce and logistics market. The US has the largest consumer of the e-commerce market in the world and an extensive network of logistics centres with advanced sorting technologies.

Automation is widely invested in by businesses like UPS, FedEx, and Amazon, which increases demand for effective and high-capacity sorters. The rise of eCommerce in China has accelerated the use of sophisticated sorting technologies. Automation plays a major role in how Alibaba, JD.com, and SF Express manage their enormous numbers of packages.

Global Parcel Sortation Systems Market is Segmented as Below:

By System Type:

- Linear Sortation Systems

- Loop Sortation Systems

- Pop-up Sortation Systems

- Sliding Shoe Sortation Systems

By Offering:

- Hardware

- Software

- Services

By End-use Industry:

- eCommerce and Retail

- Logistics and Transportation

- Food and Beverage

- Pharmaceuticals and Healthcare

- Misc

By Geographic Coverage:

- North America

- S.

- Canada

- Europe

- Germany

- K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Parcel Sortation Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Parcel Sortation Systems Market Outlook, 2018 - 2030

3.1. Global Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Linear Sortation Systems

3.1.1.2. Loop Sortation Systems

3.1.1.3. Pop-Up Sortation Systems

3.1.1.4. Sliding Shoe Sortation Systems

3.2. Global Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Hardware

3.2.1.2. Software

3.2.1.3. Services

3.3. Global Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. E-commerce and Retail

3.3.1.2. Logistics and Transportation

3.3.1.3. Food and Beverage

3.3.1.4. Pharmaceuticals and Healthcare

3.3.1.5. Misc

3.4. Global Parcel Sortation Systems Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Parcel Sortation Systems Market Outlook, 2018 - 2030

4.1. North America Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Linear Sortation Systems

4.1.1.2. Loop Sortation Systems

4.1.1.3. Pop-Up Sortation Systems

4.1.1.4. Sliding Shoe Sortation Systems

4.2. North America Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Hardware

4.2.1.2. Software

4.2.1.3. Services

4.3. North America Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. E-commerce and Retail

4.3.1.2. Logistics and Transportation

4.3.1.3. Food and Beverage

4.3.1.4. Pharmaceuticals and Healthcare

4.3.1.5. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Parcel Sortation Systems Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Parcel Sortation Systems Market Outlook, 2018 - 2030

5.1. Europe Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Linear Sortation Systems

5.1.1.2. Loop Sortation Systems

5.1.1.3. Pop-Up Sortation Systems

5.1.1.4. Sliding Shoe Sortation Systems

5.2. Europe Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Hardware

5.2.1.2. Software

5.2.1.3. Services

5.3. Europe Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. E-commerce and Retail

5.3.1.2. Logistics and Transportation

5.3.1.3. Food and Beverage

5.3.1.4. Pharmaceuticals and Healthcare

5.3.1.5. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Parcel Sortation Systems Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Parcel Sortation Systems Market Outlook, 2018 - 2030

6.1. Asia Pacific Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Linear Sortation Systems

6.1.1.2. Loop Sortation Systems

6.1.1.3. Pop-Up Sortation Systems

6.1.1.4. Sliding Shoe Sortation Systems

6.2. Asia Pacific Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Hardware

6.2.1.2. Software

6.2.1.3. Services

6.3. Asia Pacific Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. E-commerce and Retail

6.3.1.2. Logistics and Transportation

6.3.1.3. Food and Beverage

6.3.1.4. Pharmaceuticals and Healthcare

6.3.1.5. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Parcel Sortation Systems Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Parcel Sortation Systems Market Outlook, 2018 - 2030

7.1. Latin America Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Linear Sortation Systems

7.1.1.2. Loop Sortation Systems

7.1.1.3. Pop-Up Sortation Systems

7.1.1.4. Sliding Shoe Sortation Systems

7.2. Latin America Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Hardware

7.2.1.2. Software

7.2.1.3. Services

7.3. Latin America Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. E-commerce and Retail

7.3.1.2. Logistics and Transportation

7.3.1.3. Food and Beverage

7.3.1.4. Pharmaceuticals and Healthcare

7.3.1.5. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Parcel Sortation Systems Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Parcel Sortation Systems Market Outlook, 2018 - 2030

8.1. Middle East & Africa Parcel Sortation Systems Market Outlook, by System Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Linear Sortation Systems

8.1.1.2. Loop Sortation Systems

8.1.1.3. Pop-Up Sortation Systems

8.1.1.4. Sliding Shoe Sortation Systems

8.2. Middle East & Africa Parcel Sortation Systems Market Outlook, by Offering, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Hardware

8.2.1.2. Software

8.2.1.3. Services

8.3. Middle East & Africa Parcel Sortation Systems Market Outlook, by End-User Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. E-commerce and Retail

8.3.1.2. Logistics and Transportation

8.3.1.3. Food and Beverage

8.3.1.4. Pharmaceuticals and Healthcare

8.3.1.5. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Parcel Sortation Systems Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Parcel Sortation Systems Market by System Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Parcel Sortation Systems Market Offering, Value (US$ Bn), 2018 - 2030

v8.4.1.15. Rest of Middle East & Africa Parcel Sortation Systems Market End-User Industry, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-User Industry vs End-User Industry Heatmap

9.2. Manufacturer vs End-User Industry Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Siemens AG

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Honeywell Intelligrated

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Vanderlande Industries

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Beumer Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Fives Intralogistics

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Daifuku Co., Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Bastian Solutions

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Interroll Group

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Murata Machinery, Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Swisslog Holding AG

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Tompkins International

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. OKURA YUSOKI CO., LTD.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Dematic

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Toshiba Corporation

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Hyster-Yale Group

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

System Type Coverage |

|

|

Offering Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |