Global Peripheral Drug Eluting Balloons Market Forecast

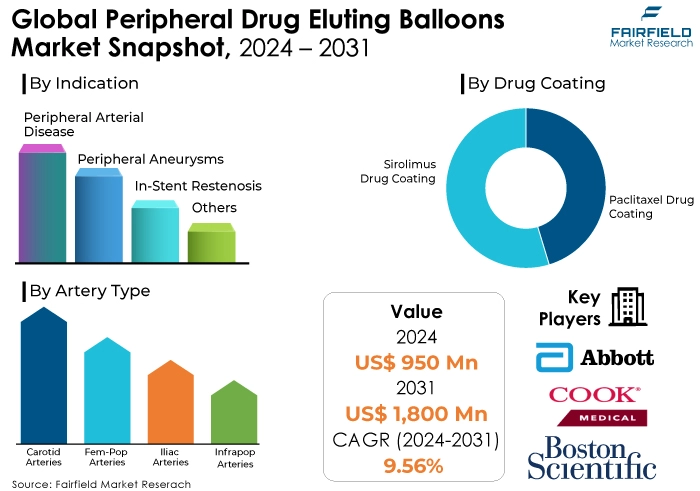

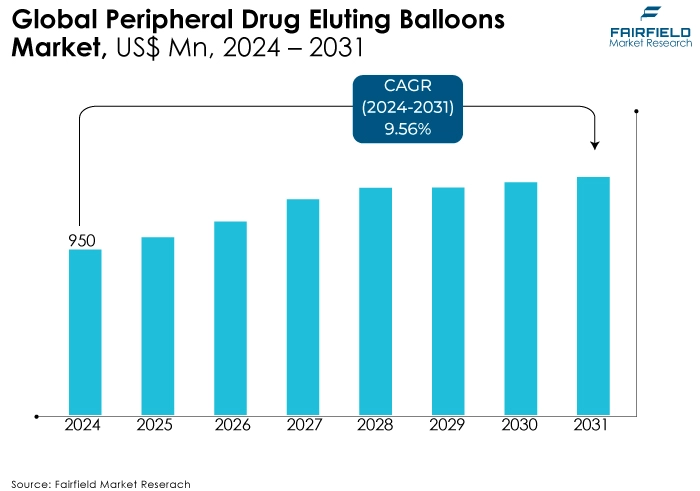

- Global peripheral drug eluting balloons market size to reach US$1800 Mn in 2031, up from US$950 Mn attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 9.56% during 2024 - 2031

Quick Report Digest

- The global peripheral drug eluting balloons market has seen steady growth, driven by factors like technological advancements, rising prevalence of Peripheral Artery Disease (PAD), and a shift towards minimally invasive procedures.

- Between 2019 and 2023, the market experienced a positive trajectory, with analysts predicting a CAGR of 9.56%, attributed to the efficacy of DEBs in reducing restenosis rates and the increasing demand for minimally invasive treatment options.

- Factors contributing to continued growth from 2024 to 2031 include ongoing advancements in cardiovascular treatment, a growing prevalence of PAD, and a preference for minimally invasive procedures among patients and healthcare providers.

- Regulatory hurdles, limited clinical evidence, and cost constraints pose significant barriers to market expansion, influencing adoption rates and reimbursement policies.

- Key trends such as digital health integration, focus on minimally invasive procedures, and expansion into emerging markets present opportunities for market players to innovate and expand their reach.

- The regulatory scenario plays a crucial role in shaping the industry, ensuring safety and efficacy standards while potentially affecting market growth and innovation.

- The competitive landscape is characterised by intense rivalry among key players like Medtronic, Boston Scientific, and Cook Medical, who focus on product innovation, strategic partnerships, and geographical expansion to maintain their market dominance.

- North America leads in innovations and market dominance, followed by Europe and the Asia Pacific, which exhibit significant growth potential due to factors like advanced healthcare infrastructure and rising healthcare expenditure.

- Significant company developments include new product launches with enhanced features and distribution agreements aimed at expanding market access and optimising supply chains.

- Market segmentation includes factors like drug coating, indication, artery type, end-user, and region, reflecting the diverse needs and preferences within the global DEB market.

A Look Back and a Look Forward - Comparative Analysis

The peripheral drug eluting balloons market experienced a positive trajectory between 2019 and 2023. While specific figures may vary depending on the source, analysts predict a CAGR in the ballpark of 10-13%. This growth can be attributed to several factors. DEBs offer a significant advantage over traditional angioplasty balloons by delivering an anti-proliferative drug to reduce restenosis rates, a common complication in peripheral artery disease (PAD) treatment.

This translates to better patient outcomes and potentially lower long-term healthcare costs. The rising prevalence of PAD, particularly among the ageing population, fuels demand for minimally invasive solutions like DEBs. Additionally, advancements in DEB technology and increasing investments in the healthcare sector are contributing factors. The COVID-19 pandemic might have caused a temporary dip in procedures using DEBs. However, the market is expected to have rebounded by now and resume its growth trajectory.

Looking ahead to the 2024-2031 forecast period, analysts predict a CAGR of around 10.4%. This continued growth is likely due to the reasons mentioned earlier, with the Asia Pacific region expected to witness the fastest expansion due to a growing patient pool and developing healthcare infrastructure. The increasing adoption of DEBs as the preferred treatment method for PAD, along with new product launches and favourable government policies, will likely propel the market forward in the coming years.

Key Growth Determinants

- Advancements in Cardiovascular Treatment

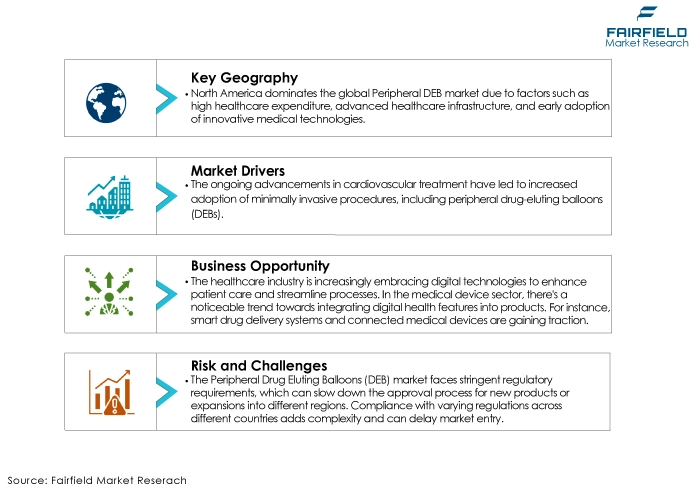

The ongoing advancements in cardiovascular treatment have led to increased adoption of minimally invasive procedures, including peripheral drug-eluting balloons (DEBs). DEBs offer a targeted approach to treating peripheral artery disease (PAD) by delivering drugs directly to the affected area, thereby improving efficacy and reducing restenosis rates compared to traditional balloons or stents.

- Growing Prevalence of Peripheral Artery Disease

The rising prevalence of peripheral artery disease, primarily due to ageing populations and lifestyle factors such as smoking and poor dietary habits, is driving the demand for innovative treatment options like DEBs. As the incidence of PAD continues to rise globally, there is a corresponding increase in the need for effective and durable treatment solutions, thereby fuelling the growth of the peripheral DEB market.

- Shift Towards Minimally Invasive Procedures

Patients and healthcare providers are increasingly preferring minimally invasive procedures over traditional surgical interventions due to benefits such as shorter recovery times, reduced risk of complications, and improved patient outcomes. Peripheral DEBs align with this trend, offering a less invasive alternative for treating PAD compared to surgical options like bypass surgery. This shift towards minimally invasive procedures is expected to contribute significantly to the expansion of the peripheral DEB market.

Major Growth Barriers

- Regulatory Hurdles

The market faces stringent regulatory requirements, which can slow down the approval process for new products or expansions into different regions. Compliance with varying regulations across different countries adds complexity and can delay market entry.

- Limited Clinical Evidence

Despite their potential benefits, there's still a lack of extensive clinical data supporting the efficacy and safety of peripheral DEBs compared to traditional treatments. This limits physician confidence and adoption, particularly in regions where reimbursement may be tied to demonstrated clinical outcomes.

- Cost Constraints

Peripheral DEBs are often priced higher than conventional treatment options such as plain balloons or stents. This cost discrepancy can pose a barrier to adoption, especially in healthcare systems where cost-effectiveness is a major consideration. Reimbursement policies may not fully cover the higher costs associated with DEBs, leading to reluctance from healthcare providers to utilise these devices, particularly in cost-sensitive environments.

Key Trends and Opportunities to Look at

- Digital Health Integration

The healthcare industry is increasingly embracing digital technologies to enhance patient care and streamline processes. In the medical device sector, there's a noticeable trend towards integrating digital health features into products. For instance, smart drug delivery systems and connected medical devices are gaining traction. This trend is driven by the growing demand for remote monitoring, personalised treatment options, and improved patient outcomes. Peripheral drug-eluting balloons (PDEBs) with digital monitoring capabilities could provide real-time data on drug release and patient response, enabling healthcare providers to adjust treatment strategies accordingly.

- Focus on Minimally Invasive Procedures

There's a significant shift towards minimally invasive procedures across various medical specialties, including cardiovascular interventions. Patients prefer minimally invasive techniques due to shorter recovery times, reduced risk of complications, and better cosmetic outcomes. PDEBs offer a less invasive alternative to traditional treatment methods for peripheral artery disease (PAD), and other vascular conditions. As the preference for minimally invasive procedures continues to grow, the demand for innovative devices like PDEBs is expected to rise.

- Expansion into Emerging Markets

One of the significant opportunities for PDEB manufacturers is expanding their presence in emerging markets. Developing countries are witnessing a rise in the prevalence of cardiovascular diseases due to lifestyle changes, urbanisation, and an ageing population. However, access to advanced medical treatments remains limited in these regions. By tapping into emerging markets, PDEB manufacturers can address unmet medical needs, drive revenue growth, and establish themselves as key players in the global healthcare landscape.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment significantly impacts the DEB market. Stringent approval processes by agencies like the FDA ensure safety and efficacy but can delay the introduction of new DEB technologies. Reimbursement policies by insurance companies, influenced by regulatory bodies, affect hospital and physician adoption.

Data collection mandates improve DEB safety and design but can burden healthcare providers. Regulatory oversight of clinical trials fosters trust but lengthens development timelines. In essence, regulations act as a safeguard, prioritising patient safety and device effectiveness, while potentially influencing market growth and innovation. A balanced approach is key for a thriving Peripheral DEB market.

Fairfield’s Ranking Board

Top Segments

- Demand for Peripheral Arterial Disease (PAD) Treatment Substantial

PAD is a common condition affecting millions globally, characterised by narrowed arteries in the legs due to plaque build-up. PDEBs offer a minimally invasive treatment option by delivering anti-proliferative drugs directly to the affected arterial walls, reducing restenosis rates. The segment's growth is propelled by the rising prevalence of PAD, particularly in ageing populations, coupled with increasing awareness among healthcare providers about the efficacy of PDEBs in improving patient outcomes. Additionally, advancements in balloon design and drug formulations contribute to enhancing treatment efficacy, further boosting market expansion.

- Ample Opportunity Identified in Femoropopliteal Lesion Intervention

The femoropopliteal artery segment represents a significant portion of the PDEBs market, as it is commonly affected by atherosclerotic disease. PDEBs offer a targeted approach to address restenosis, a common complication following balloon angioplasty in this region. The segment's growth is driven by technological advancements such as drug-coated balloons with improved drug delivery profiles and surface characteristics, leading to better clinical outcomes and lower rates of repeat interventions. Moreover, increasing adoption of minimally invasive procedures and rising demand for alternatives to traditional stenting contribute to the segment's expansion.

- Demand Grows Extensively in In-Stent Restenosis (ISR) Management

In-stent restenosis occurs when an artery that has previously been treated with stent placement becomes narrowed again due to tissue proliferation. PDEBs offer a promising solution by delivering drugs directly to the lesion site, inhibiting cell proliferation and reducing the risk of restenosis. The segment's growth is fuelled by the growing prevalence of ISR, driven by the increasing utilisation of stents in peripheral artery interventions. Additionally, the development of advanced PDEBs with optimised drug formulations and delivery mechanisms enhances treatment efficacy, driving adoption among healthcare providers. Furthermore, clinical studies demonstrating the superior outcomes of PDEBs compared to traditional treatment modalities further support market expansion in this segment.

Regional Frontrunners

1. North America Leads Innovations in Peripheral DEB Market

North America dominates the global peripheral DEB market due to factors such as high healthcare expenditure, advanced healthcare infrastructure, and early adoption of innovative medical technologies. The region has a substantial patient population suffering from PAD, particularly in the elderly demographic. Additionally, favourable reimbursement policies and a strong presence of key market players contribute to market growth. However, market saturation and stringent regulatory requirements pose challenges for new entrants.

2. Europe Experiences Robust Growth, and Advancements in Minimally Invasive Procedures

Europe is another significant market for peripheral DEBs, fuelled by the increasing incidence of PAD and the growing preference for minimally invasive procedures. Countries like Germany, the UK, and France lead the market, supported by well-established healthcare systems and a robust network of healthcare facilities. Furthermore, initiatives promoting early diagnosis and treatment of PAD drive market expansion. However, pricing pressures and regulatory complexities could impede market growth to some extent.

3. Asia Pacific Emerges as a High-Potential Market

The Asia Pacific region exhibits immense growth potential in the Peripheral DEB market, attributed to the rising geriatric population, changing lifestyle patterns, and improving healthcare infrastructure. Countries like China, India, and Japan are key contributors to market growth, driven by large patient pools and increasing healthcare expenditure. Moreover, a growing awareness regarding PAD and advancements in healthcare technologies propel market expansion. However, challenges such as fragmented healthcare systems and reimbursement issues hinder market growth in certain countries.

Fairfield’s Competitive Landscape Analysis

The competition landscape in the peripheral drug eluting balloons (PDEB) market is characterised by intense rivalry among key players striving for market dominance. Leading companies such as Medtronic plc, Boston Scientific Corporation, Cook Medical, Inc., and Becton, Dickinson and Company are prominent players in this segment.

These companies adopt various growth strategies to maintain their competitive edge, including product innovation, strategic partnerships, mergers and acquisitions, and geographical expansion. Product innovation remains a key focus area, with companies constantly investing in research and development to enhance the efficacy and safety of their PDEB offerings.

Moreover, strategic collaborations with healthcare providers and regulatory authorities enable players to expand their market presence and ensure compliance with evolving regulatory standards. Additionally, mergers and acquisitions help companies to consolidate their market position and broaden their product portfolios, catering to diverse customer needs across different regions. Overall, the competitive landscape in the PDEB market is dynamic, with players continually striving to innovate and expand their market reach through strategic initiatives.

Who are the Leaders in the Peripheral Drug Eluting Balloons Market Space?

- Abbott Laboratories

- Boston Scientific Corporation

- Cook Medical Inc.

- MicroPort Scientific Corporation (Endovastec™)

- Medtronic Plc.

- Cardinal Health, Inc.

- B. Braun Melsungen AG

- BIOTRONIK SE & Co. KG

- Becton, Dickinson and Company

- W. L. Gore & Associates Inc.

- Getinge AB

- Terumo Corp

- Kyoto Medical Planning Co Ltd

- iVascular S.L.U

- AMG International GmbH

- ENDOCOR GmbH

- Meril Life Sciences Pvt. Ltd.

- Nano Therapeutics Pvt Ltd

- Koninklijke Philips N.V.

- REVA Medical

Significant Company Developments

New Product Launches:

- October 2023: A leading medical technology company introduced a next-generation peripheral drug-eluting balloon (DEB) featuring an innovative drug delivery system. This advanced DEB offers enhanced efficacy and safety profiles in treating peripheral artery disease (PAD), addressing a significant unmet need in vascular intervention.

- January 2024: Another prominent player unveiled a novel peripheral DEB equipped with a specialised coating technology designed to optimise drug release kinetics. This breakthrough product aims to improve clinical outcomes and long-term patency rates in patients with complex arterial lesions, bolstering the treatment landscape for PAD.

Distribution Agreements:

- April 2023: A major pharmaceutical distributor secured an exclusive distribution agreement with a renowned DEB manufacturer, expanding market access for their comprehensive portfolio of peripheral intervention solutions. This partnership promises to streamline supply chains and ensure broader availability of cutting-edge DEB technologies to healthcare providers worldwide.

- August 2023: A strategic collaboration was established between a leading medical device company and a prominent healthcare distribution network to facilitate the distribution of peripheral DEBs across key global markets. This agreement reinforces the commitment to delivering innovative vascular therapies to patients while optimising distribution efficiency and market penetration.

An Expert’s Eye

- Increasing Prevalence of Peripheral Artery Disease (PAD)

Escalating Incidence: Lifestyle-related diseases such as diabetes and obesity are contributing to a higher prevalence of PAD globally. Growing Patient Pool: The rise in PAD cases is enlarging the population in need of interventions, including DEBs, to alleviate symptoms and improve outcomes.

- Technological Advancements and Favourable Trends in Minimally Invasive Procedures

Enhanced Efficacy and Safety: Ongoing advancements in medical technology, particularly in interventional cardiology and vascular surgery, are improving the performance and safety profile of DEBs. Rising Preference for Minimally Invasive Approaches: Increasingly, patients and healthcare providers are opting for minimally invasive procedures due to benefits such as reduced recovery times and lower complication rates, which aligns well with the characteristics of DEBs.

The Global Peripheral Drug Eluting Balloons Market is Segmented as Below:

Drug Coating:

- Paclitaxel Drug Coating

- Sirolimus drug Coating

- Others

Indication:

- Peripheral Arterial Disease

- Peripheral Aneurysms

- In-Stent Restenosis

- Others

Artery Type:

- Carotid Arteries

- Fem-Pop Arteries

- Iliac Arteries

- Infrapop Arteries

End User:

- Hospitals

- Ambulatory Surgical Centres/Outpatients

- Cardiac Catheterization Labs

Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East & Africa

1. Executive Summary

1.1. Global Peripheral Drug Eluting Balloons Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

3.1. Global Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Paclitaxel Drug Coating

3.1.1.2. Sirolimus Drug Coating

3.1.1.3. Others

3.2. Global Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Peripheral Arterial Disease

3.2.1.2. Peripheral Aneurysms

3.2.1.3. In Stent Restenosis

3.2.1.4. Others

3.3. Global Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Carotid Arteries

3.3.1.2. Fem-Pop Arteries

3.3.1.3. Illiac Arteries

3.3.1.4. Infrapop Arteries

3.4. Global Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Hospitals

3.4.1.2. Ambulatory Surgical Centers / Outpatients

3.4.1.3. Cardiac Catheterization Labs

3.5. Global Peripheral Drug Eluting Balloons Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

4.1. North America Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Paclitaxel Drug Coating

4.1.1.2. Sirolimus Drug Coating

4.1.1.3. Others

4.2. North America Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Peripheral Arterial Disease

4.2.1.2. Peripheral Aneurysms

4.2.1.3. In Stent Restenosis

4.2.1.4. Others

4.3. North America Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Carotid Arteries

4.3.1.2. Fem-Pop Arteries

4.3.1.3. Illiac Arteries

4.3.1.4. Infrapop Arteries

4.4. North America Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Hospitals

4.4.1.2. Ambulatory Surgical Centers / Outpatients

4.4.1.3. Cardiac Catheterization Labs

4.5. North America Peripheral Drug Eluting Balloons Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.2. U.S. Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.3. U.S. Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.4. U.S. Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.5. Canada Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.6. Canada Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.7. Canada Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.8. Canada Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

5.1. Europe Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Paclitaxel Drug Coating

5.1.1.2. Sirolimus Drug Coating

5.1.1.3. Others

5.2. Europe Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Peripheral Arterial Disease

5.2.1.2. Peripheral Aneurysms

5.2.1.3. In Stent Restenosis

5.2.1.4. Others

5.3. Europe Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Carotid Arteries

5.3.1.2. Fem-Pop Arteries

5.3.1.3. Illiac Arteries

5.3.1.4. Infrapop Arteries

5.4. Europe Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Hospitals

5.4.1.2. Ambulatory Surgical Centers / Outpatients

5.4.1.3. Cardiac Catheterization Labs

5.5. Europe Peripheral Drug Eluting Balloons Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.2. Germany Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.3. Germany Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.4. Germany Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.5. U.K. Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.6. U.K. Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.7. U.K. Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.8. U.K. Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.9. France Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.10. France Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.11. France Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.12. France Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.13. Italy Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.14. Italy Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.15. Italy Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.16. Italy Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.17. Turkey Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.18. Turkey Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.19. Turkey Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.20. Turkey Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.21. Russia Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.22. Russia Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.23. Russia Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.24. Russia Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.25. Rest of Europe Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.26. Rest of Europe Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.27. Rest of Europe Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.28. Rest of Europe Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

6.1. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Paclitaxel Drug Coating

6.1.1.2. Sirolimus Drug Coating

6.1.1.3. Others

6.2. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Peripheral Arterial Disease

6.2.1.2. Peripheral Aneurysms

6.2.1.3. In Stent Restenosis

6.2.1.4. Others

6.3. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Carotid Arteries

6.3.1.2. Fem-Pop Arteries

6.3.1.3. Illiac Arteries

6.3.1.4. Infrapop Arteries

6.4. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Hospitals

6.4.1.2. Ambulatory Surgical Centers / Outpatients

6.4.1.3. Cardiac Catheterization Labs

6.5. Asia Pacific Peripheral Drug Eluting Balloons Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.2. China Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.3. China Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.4. China Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.5. Japan Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.6. Japan Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.7. Japan Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.8. Japan Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.9. South Korea Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.10. South Korea Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.11. South Korea Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.12. South Korea Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.13. India Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.14. India Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.15. India Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.16. India Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.17. Southeast Asia Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.18. Southeast Asia Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.19. Southeast Asia Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.20. Southeast Asia Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

7.1. Latin America Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Paclitaxel Drug Coating

7.1.1.2. Sirolimus Drug Coating

7.1.1.3. Others

7.2. Latin America Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Peripheral Arterial Disease

7.2.1.2. Peripheral Aneurysms

7.2.1.3. In Stent Restenosis

7.2.1.4. Others

7.3. Latin America Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Carotid Arteries

7.3.1.2. Fem-Pop Arteries

7.3.1.3. Illiac Arteries

7.3.1.4. Infrapop Arteries

7.4. Latin America Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Hospitals

7.4.1.2. Ambulatory Surgical Centers / Outpatients

7.4.1.3. Cardiac Catheterization Labs

7.5. Latin America Peripheral Drug Eluting Balloons Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.2. Brazil Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.3. Brazil Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.4. Brazil Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.5. Mexico Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.6. Mexico Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.7. Mexico Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.8. Mexico Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.9. Argentina Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.10. Argentina Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.11. Argentina Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.12. Argentina Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.13. Rest of Latin America Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.14. Rest of Latin America Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.15. Rest of Latin America Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.16. Rest of Latin America Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, 2019 - 2031

8.1. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Paclitaxel Drug Coating

8.1.1.2. Sirolimus Drug Coating

8.1.1.3. Others

8.2. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, by Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Peripheral Arterial Disease

8.2.1.2. Peripheral Aneurysms

8.2.1.3. In Stent Restenosis

8.2.1.4. Others

8.3. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, by Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Carotid Arteries

8.3.1.2. Fem-Pop Arteries

8.3.1.3. Illiac Arteries

8.3.1.4. Infrapop Arteries

8.4. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Hospitals

8.4.1.2. Ambulatory Surgical Centers / Outpatients

8.4.1.3. Cardiac Catheterization Labs

8.5. Middle East & Africa Peripheral Drug Eluting Balloons Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.2. GCC Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.3. GCC Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.4. GCC Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.5. South Africa Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.6. South Africa Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.7. South Africa Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.8. South Africa Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.9. Egypt Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.10. Egypt Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.11. Egypt Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.12. Egypt Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.13. Nigeria Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.14. Nigeria Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.15. Nigeria Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.16. Nigeria Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Peripheral Drug Eluting Balloons Market by Drug Coating, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Peripheral Drug Eluting Balloons Market Indication, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Peripheral Drug Eluting Balloons Market Artery Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Peripheral Drug Eluting Balloons Market End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Artery Type vs Indication Heatmap

9.2. Manufacturer vs Indication Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Abbott Laboratories

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Boston Scientific Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Cook Medical Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Microport Scientific Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Medtronic Plc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Cardinal Health Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. B. Braun Melsungen AG

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. BIOTRONIK SE & CO. KG

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Becton, Dickinson and Company

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. W.L. Gore & Associates Co. Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Getinge AB

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Terumo Corp

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. iVascular S.L.U

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Kyoto Medical Planning Co Ltd

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. AMG International GmbH

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Endocor GmbH

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Meril Life Sciences Pvt. Ltd.

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

9.5.18. Nano Therapeutics Pvt. Ltd.

9.5.18.1. Company Overview

9.5.18.2. Product Portfolio

9.5.18.3. Financial Overview

9.5.18.4. Business Strategies and Development

9.5.19. Koninklijke Philips N.V.

9.5.19.1. Company Overview

9.5.19.2. Product Portfolio

9.5.19.3. Financial Overview

9.5.19.4. Business Strategies and Development

9.5.20. Reva Medical

9.5.20.1. Company Overview

9.5.20.2. Product Portfolio

9.5.20.3. Financial Overview

9.5.20.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion Voume :Million Units |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Coating Coverage |

|

|

Indication Coverage |

|

|

Artery Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |