Global Pharmaceutical Glass Ampoules Market Forecast

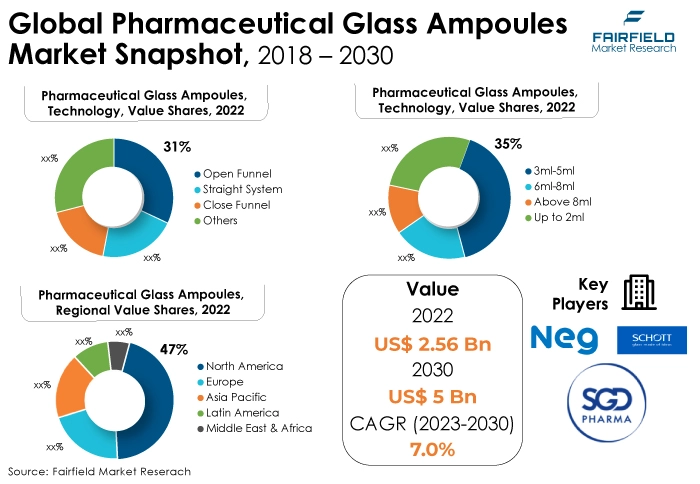

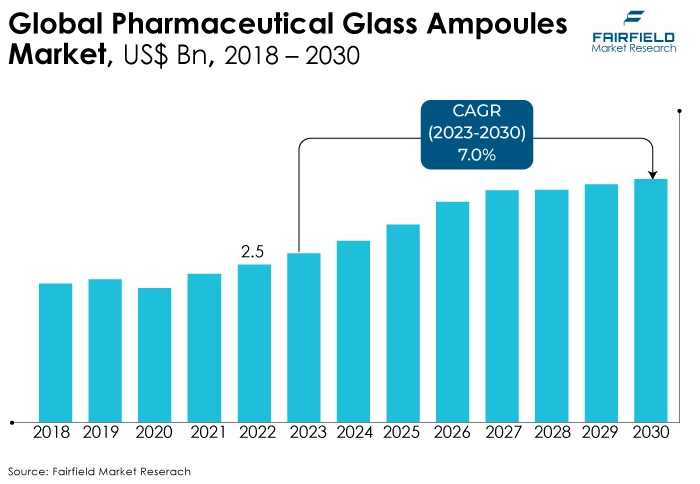

- The approximately US$2.5 Bn market for pharmaceutical glass ampoules (as of 2022) to witness 2x growth, reaching US$5 Bn in 2030

- Market valuation likely to experience around 7% CAGR during 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the growth of pharmaceutical glass ampoules market is the increasing demand of biopharmaceuticals and pharmaceuticals.

- Raw material availability and price fluctuations are challenges in the pharmaceutical glass ampoules market, impacting cost predictability and supply chain stability, hindering market growth and profitability.

- The open funnel product type is expected to hold the largest market share in the pharmaceutical glass ampoules market because it allows for easy and controlled filling of liquid medications, reducing contamination risks and ensuring precise dosage, which is crucial in pharmaceutical applications, thus driving its market dominance.

- The 3 ml to 5 ml capacity range is expected to hold the largest market share in the pharmaceutical glass ampoules market because it aligns with the most common dosage requirements for a wide range of pharmaceutical products, making it versatile and widely adopted by the industry.

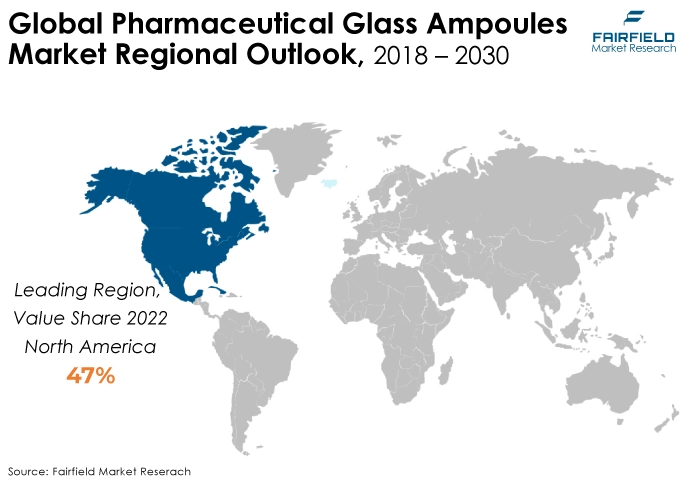

- North America captured the largest market share in the pharmaceutical glass ampoules market due to its well-established pharmaceutical industry, stringent quality standards, and high demand for reliable and safe drug packaging as well as awareness about vaccination. Additionally, robust healthcare infrastructure and research activities further drive market dominance in the region.

- Asia Pacific is the fastest-growing region in the pharmaceutical glass ampoules market due to expanding pharmaceutical manufacturing, rising healthcare expenditure, and a growing population. The region's increasing focus on pharmaceutical production and export contributes to its rapid market growth.

- The stringent requirements demanded by finished products to be filled in glass ampoules can lead to increased product prices, affecting affordability and potentially limiting market growth, especially in regions with budget constraints and cost-sensitive healthcare systems.

A Look Back and a Look Forward - Comparative Analysis

The pharmaceutical glass ampoules market is experiencing steady growth, driven by the expanding pharmaceutical industry's demand for reliable drug and formulation packaging. Stringent quality standards and patient safety concerns have elevated the use of glass ampoules.

Additionally, the increasing cases of chronic diseases and the surge in healthcare advancements worldwide contribute to sustained market growth, especially in regions with robust pharmaceutical manufacturing.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as pharmaceuticals. The pharmaceutical application in the pharmaceutical glass ampoules market is growing due to the critical need for safe and efficient drug packaging.

Glass ampoules offer excellent compatibility with a wide range of pharmaceutical compounds, ensuring drug stability and minimising the risk of contamination. As the pharmaceutical industry expands and emphasizes product quality, the demand for glass ampoules as a reliable packaging solution continues to increase.

The pharmaceutical glass ampoules market is growing due to several factors. Firstly, the global pharmaceutical industry's continuous expansion drives the demand for reliable and safe drug packaging. Secondly, increasing emphasis on quality and patient safety has led to the preference for glass ampoules, known for their inertness and protection against contamination.

Additionally, the rise in chronic diseases and healthcare advancements worldwide fuels the need for pharmaceuticals, further propelling the demand for glass ampoules in drug storage and delivery.

Key Growth Determinants

- Rising Demand from Pharmaceutical Industry

The burgeoning pharmaceutical industry is a significant driver propelling the pharmaceutical glass ampoules market forward. This growth is primarily due to several factors. Firstly, the pharmaceutical sector continues to expand globally, driven by population growth, increased healthcare access, and advancements in medical science.

As pharmaceutical companies develop and manufacture an ever-increasing array of medications, the demand for reliable and safe packaging solutions like glass ampoules rises in tandem.

Moreover, glass ampoules are a preferred choice for pharmaceutical packaging due to their inert nature, which ensures the stability and integrity of sensitive medications. This aligns with the industry's stringent quality standards and regulatory requirements.

As the pharmaceutical industry grows, so does the demand for high-quality packaging that can protect the efficacy and safety of these life-saving drugs, making pharmaceutical glass ampoules a critical component of the supply chain.

- Growing Demand of Specialised Drug Delivery

Specialised drug delivery systems, such as autoinjectors and pre-filled syringes, are driving the pharmaceutical glass ampoules market by necessitating tailored packaging solutions. These systems require precision and compatibility in packaging to ensure accurate dosing and drug stability.

Glass ampoules are an ideal choice due to their inert properties, which safeguard sensitive drug formulations. The growing demand for these innovative drug delivery methods, particularly in the case of biologics and complex therapies, is bolstering the need for glass ampoules, making them an essential component of the pharmaceutical packaging landscape.

- Growing Demand for Packaging Innovations

As it continually changes to satisfy the shifting demands of the pharmaceutical sector, packaging innovation is a crucial market driver for pharmaceutical glass ampoules.

Advanced glass manufacturing techniques, precision forming, and coating technologies have led to glass ampoules with improved drug stability, longer shelf-life, and enhanced user-friendliness.

Innovations in sealing mechanisms, tamper-evident features, and serialisation have also contributed to the appeal of glass ampoules.

As pharmaceutical packaging evolves to meet stringent regulations and consumer demands, glass ampoules remain at the forefront, driven by their adaptability to these innovations and their ability to ensure the integrity of pharmaceutical products.

Major Growth Barriers

- High Cost

The high cost of producing pharmaceutical glass ampoules poses a significant challenge for the market. Precision manufacturing and rigorous quality control processes required for glass ampoules contribute to elevated production expenses.

Pharmaceutical companies, facing cost pressures and seeking cost-effective alternatives, may be hesitant to invest in premium glass packaging. This challenge can lead to increased competition from lower-cost alternatives like plastic ampoules and vials.

Striking a balance between maintaining quality standards and managing production costs remains a persistent challenge in the pharmaceutical glass ampoules market.

- Customisation Challenges

Customisation challenges present a hurdle for the pharmaceutical glass ampoules market. Pharmaceutical companies often require tailored packaging solutions to accommodate diverse drug formulations and delivery methods. Meeting these varied demands can complicate manufacturing processes, lead to higher production costs, and require extensive logistical coordination.

Striking the right balance between standardisation & customisation while ensuring timely delivery and cost-effectiveness poses a significant challenge for glass ampoule manufacturers. Adapting to the ever-changing needs of pharmaceutical clients while maintaining efficiency is essential to remain competitive in the market.

Key Trends and Opportunities to Look at

- Smart Packaging Specialisation

Smart packaging and serialisation technologies in the pharmaceutical glass ampoules market involve incorporating unique codes like QR or RFID tags on ampoules. This enables real-time tracking, authentication, and anti-counterfeiting measures. It enhances supply chain transparency, safeguards patient safety, and ensures regulatory compliance.

- Improved Drug Delivery Systems

Improved drug delivery systems in the pharmaceutical glass ampoules market entail integrating specialised mechanisms within ampoules, like autoinjectors or pre-filled syringes. These systems enhance the precision and convenience of drug administration, making it easier for patients to self-administer medications.

It caters to the growing demand for user-friendly and efficient drug delivery methods, particularly in the case of biologics and complex therapies, thereby improving patient outcomes and adherence.

- Tamper-evident Technology

Tamper-evident and child-resistant packaging technology in the pharmaceutical glass ampoules market focuses on safeguarding medications.

It includes innovative opening mechanisms and materials that deter tampering and protect children from accessing harmful substances. These safety features are vital for regulatory compliance and ensuring the well-being of patients, making them an integral part of pharmaceutical glass ampoule design and production.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the pharmaceutical glass ampoules market. To guarantee the safety, effectiveness, and quality of medicines, regulatory authorities like the European Medicines Agency (EMA), and the US Food and Drug Administration (FDA) have strict criteria for pharmaceutical packaging. These guidelines necessitate the use of high-quality, inert, and tamper-evident materials, which align perfectly with glass ampoules.

As a result, manufacturers and pharmaceutical companies prioritise glass ampoules to comply with these regulations, driving the growth of the market. Moreover, the emphasis on patient safety and drug integrity further underscores the significance of glass ampoules in pharmaceutical packaging.

Glass is impermeable to oxygen and moisture, preserving the stability and shelf life of sensitive drug formulations, which is essential for regulatory compliance.

Additionally, the recyclable and environmentally friendly nature of glass aligns with global sustainability initiatives, making it a preferred choice in regions with stringent environmental regulations.

Furthermore, the pharmaceutical industry's increasing focus on biologics and complex drug formulations requires packaging solutions that can maintain the integrity of these delicate substances.

Glass ampoules are known for their compatibility with a wide range of drug types, including biologics, which makes them compliant with evolving regulatory demands in the pharmaceutical sector.

In conclusion, the regulatory landscape reinforces the demand for pharmaceutical glass ampoules as a trusted and compliant packaging solution in the pharmaceutical market.

Fairfield’s Ranking Board

Top Segments

- Open Funnel Product Type Continues to Dominate

The open funnel product type has captured the largest market share in the pharmaceutical glass ampoules market primarily due to its user-friendly and versatile design.

Open funnel ampoules are easy to fill with medications, making them a preferred choice for pharmaceutical manufacturers. They offer convenience, accuracy, and reduced risk of contamination during the filling process.

Additionally, open-funnel ampoules are suitable for a wide range of drug formulations, including liquid and lyophilised products, making them highly adaptable to various pharmaceutical applications. These advantages have propelled their popularity, leading to a dominant market share.

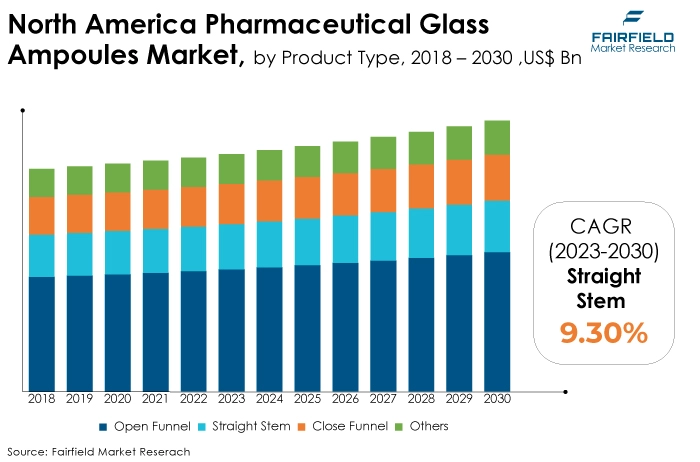

The straight stem product type is experiencing the fastest CAGR in the pharmaceutical glass ampoules market due to its suitability for modern pharmaceutical trends.

Straight stem ampoules offer enhanced compatibility with automated filling and sealing processes, increasing production efficiency. They are well-suited for aseptic packaging, reducing the risk of contamination.

Additionally, their robust design ensures secure containment of sensitive drug formulations. As pharmaceutical manufacturing becomes more automated and demands high precision, straight-stem ampoules align with these industry requirements, driving their rapid adoption and growth in the market.

- 3ml-5ml Capacity More Preferred

The 3 ml - 5 ml capacity range has secured the largest market share in the pharmaceutical glass ampoules market due to its versatility and widespread use. This capacity range is ideal for packaging a wide range of pharmaceutical formulations, including vaccines, injectable medications, and diagnostics.

It strikes a balance between accommodating an adequate volume of medicine while remaining compact and easy to handle. This adaptability to various drug types and applications has made 3 ml - 5 ml ampoules a preferred choice for pharmaceutical manufacturers, leading to their dominant market share.

The 6 ml - 8 ml capacity segment is experiencing the fastest CAGR in the pharmaceutical glass ampoules Market due to its increasing demand for specialised drug formulations. This capacity range is well-suited for packaging biologics, complex medications, and vaccines that require slightly larger volumes.

As the pharmaceutical industry advances, there's a growing need for precision dosing and specialised treatments, which aligns with the 6 ml - 8 ml ampoules. Their ability to accommodate these advanced drug formulations has fuelled their rapid growth, making them a prominent choice in the market.

Regional Frontrunners

North America Secures the Leadership Position

North America has secured the largest market share in the pharmaceutical glass ampoules market due to several key factors. First and foremost, the region boasts a well-established pharmaceutical industry known for its robust research and development activities, leading to a consistent demand for high-quality glass ampoules for drug packaging.

Additionally, North America has stringent regulatory standards and quality requirements for pharmaceutical packaging, which drive the adoption of premium glass ampoules.

Furthermore, the region's advanced healthcare infrastructure, including a vast network of hospitals and healthcare facilities, sustains a substantial need for pharmaceutical products packaged in glass ampoules.

The presence of major pharmaceutical companies and contract manufacturing organisations in North America also contributes to the market growth.

Moreover, North America's proactive approach to sustainability and environmental concerns aligns with the recyclable and eco-friendly nature of glass packaging, further boosting its popularity. These factors combined make North America a dominant player in the pharmaceutical glass ampoules market.

Asia Pacific

The pharmaceutical glass ampoules market is expanding at the quickest rate in the Asia Pacific region for several reasons. Pharmaceutical production and consumption have increased because of growing populations, improved healthcare access in nations like China, and India and rising demand for vaccination and freeze-dried formulations.

The heightened pharmaceutical production necessitates a significant demand for glass ampoules for drug packaging.

Additionally, the region's expanding middle-class population, coupled with a growing awareness of healthcare and safety standards, is driving the preference for high-quality glass packaging.

Furthermore, the cost-effective manufacturing capabilities in Asia Pacific make it an attractive destination for pharmaceutical companies, further fuelling market growth.

Fairfield’s Competitive Landscape Analysis

The global pharmaceutical glass ampoules market is consolidated, with several players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Pharmaceutical Glass Ampoules Space?

- Schott AG

- Gerresheimer AG

- SGD Pharma

- Nipro Corporation

- Bormioli Pharma

- Nippon Electric Glass Co., Ltd.

- Triveni Polymers Pvt. Ltd.

- Corning Incorporated

- Borosil Glass Works Ltd.

- APG Pharma Packaging

- RadiciGroup

- Tubi Glass, Inc.

- Pacific Vial Manufacturing, Inc.

- Pampac Machines Pvt. Ltd.

- Toray Industries, Inc.

Significant Company Developments

New Product Launches

- May 2022: Gerresheimer expanded its global production capabilities by establishing cutting-edge facilities in India. Through this expansion in India, Gerresheimer aims to guarantee a steady supply for essential pharmaceutical and healthcare institutions, meeting the growing demand for packaging and bolstering public health efforts.

- January 2022: In the spring of 2022, Schott AG scheduled to open a new manufacturing facility in Germany dedicated to producing high-quality, pre-fillable polymer syringes. Simultaneously, the company is expanding its global production network, which currently consists of 16 plants worldwide. In China, Schott AG has commenced construction on an additional module that is expected to triple its production capacity. The project is slated for completion by the close of 2022.

Distribution Agreement

- July 2022: Nipro, a Japanese company, has made a significant investment of KN 100 million (equivalent to US$14 Mn) to establish a state-of-the-art glass packaging facility in Croatia specifically designed for the pharmaceutical sector. This newly inaugurated factory, located in the suburbs of Zagreb, Sesvete, falls under the purview of Nipro's division known as Nipro PharmaPackaging. Its primary focus will be the production of glass ampoules, and vials intended for packaging life-saving medications.

An Expert’s Eye

Demand and Future Growth

The pharmaceutical glass ampoules market is poised for robust future growth due to increasing market demand. Factors such as a rising global pharmaceutical industry, growing demand for biologics and specialty drugs, stringent quality and regulatory standards, and an emphasis on patient safety are driving the need for high-quality glass ampoules.

Additionally, innovations in packaging and serialisation technologies to combat counterfeiting and ensure supply chain transparency are expected to boost the market's growth in the coming years.

Supply Side of the Market

The production of pharmaceutical glass ampoules requires specialised raw materials, primarily high-quality borosilicate glass tubing. This Glass is resistant to thermal shock and chemical reactions, making it suitable for drug storage.

Major suppliers of raw materials for pharmaceutical glass ampoules include companies like SCHOTT AG, Corning Incorporated, and Gerresheimer AG. SCHOTT especially is a leading global manufacturer of high-quality glass tubing used in pharmaceutical packaging. They play a pivotal role in ensuring the integrity and safety of medications stored in glass ampoules for the pharmaceutical industry.

The leading suppliers in the pharmaceutical glass ampoules market vary by region and country. In Europe, companies like SCHOTT AG, and Gerresheimer AG are prominent players, offering a wide range of high-quality glass ampoules for pharmaceutical packaging.

In the United States, Owens-Illinois, Inc., and West Pharmaceutical Services, Inc. are key suppliers catering to the pharmaceutical industry's needs. In Asia, Shandong Pharmaceutical Glass Co., Ltd., and Nipro Corporation play significant roles in supplying pharmaceutical glass ampoules to meet the growing demand in the region. These companies specialise in providing essential packaging solutions to the pharmaceutical industry.

Global Pharmaceutical Glass Ampoules Market is Segmented as Below:

By Product Type:

- Straight Stem

- Open Funnel

- Close Funnel

- Others

By Capacity:

- Up to 2 ml

- 3 ml - 5 ml

- 6 ml - 8 ml

- Above 8 ml

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Pharmaceutical Glass Ampoules Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

3.1. Global Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Straight Stem

3.1.1.2. Open Funnel

3.1.1.3. Close Funnel

3.1.1.4. Others

3.2. Global Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Up to 2 ml

3.2.1.2. 3 ml - 5 ml

3.2.1.3. 6 ml - 8 ml

3.2.1.4. Above 8 ml

3.3. Global Pharmaceutical Glass Ampoules Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

4.1. North America Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Straight Stem

4.1.1.2. Open Funnel

4.1.1.3. Close Funnel

4.1.1.4. Others

4.2. North America Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Up to 2 ml

4.2.1.2. 3 ml - 5 ml

4.2.1.3. 6 ml - 8 ml

4.2.1.4. Above 8 ml

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Pharmaceutical Glass Ampoules Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

5.1. Europe Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Straight Stem

5.1.1.2. Open Funnel

5.1.1.3. Close Funnel

5.1.1.4. Others

5.2. Europe Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Up to 2 ml

5.2.1.2. 3 ml - 5 ml

5.2.1.3. 6 ml - 8 ml

5.2.1.4. Above 8 ml

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Pharmaceutical Glass Ampoules Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

6.1. Asia Pacific Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Straight Stem

6.1.1.2. Open Funnel

6.1.1.3. Close Funnel

6.1.1.4. Others

6.2. Asia Pacific Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Up to 2 ml

6.2.1.2. 3 ml - 5 ml

6.2.1.3. 6 ml - 8 ml

6.2.1.4. Above 8 ml

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Pharmaceutical Glass Ampoules Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Pharmaceutical Glass Ampoules Market by Capacity, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

7.1. Latin America Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Straight Stem

7.1.1.2. Open Funnel

7.1.1.3. Close Funnel

7.1.1.4. Others

7.2. Latin America Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Up to 2 ml

7.2.1.2. 3 ml - 5 ml

7.2.1.3. 6 ml - 8 ml

7.2.1.4. Above 8 ml

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Pharmaceutical Glass Ampoules Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pharmaceutical Glass Ampoules Market Outlook, 2018 - 2030

8.1. Middle East & Africa Pharmaceutical Glass Ampoules Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Straight Stem

8.1.1.2. Open Funnel

8.1.1.3. Close Funnel

8.1.1.4. Others

8.2. Middle East & Africa Pharmaceutical Glass Ampoules Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Up to 2 ml

8.2.1.2. 3 ml - 5 ml

8.2.1.3. 6 ml - 8 ml

8.2.1.4. Above 8 ml

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Pharmaceutical Glass Ampoules Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Pharmaceutical Glass Ampoules Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Pharmaceutical Glass Ampoules Market Capacity, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Schott AG

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Gerresheimer AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. SGD Pharma

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Nipro Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Stevanato Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Bormioli Pharma

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Nippon Electric Glass Co., Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Triveni Polymers Pvt. Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Corning Incorporated

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Borosil Glass Works Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. RadiciGroup

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. APG Pharma Packaging

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Tubi Glass, Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Pacific Vial Manufacturing, Inc.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Pampac Machines Pvt. Ltd.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Capacity Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |