Global Polyethylene Wax Market Forecast

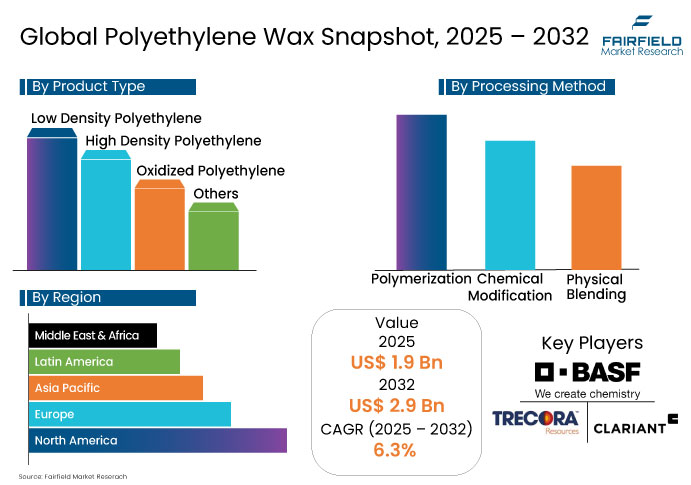

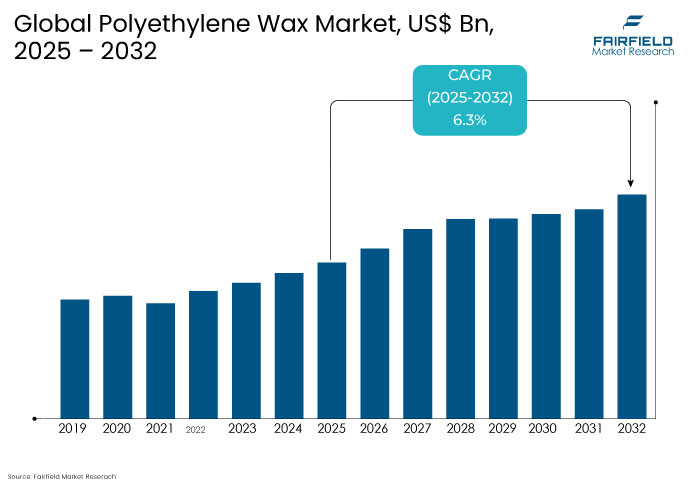

- The global Polyethylene Wax market is projected to grow from US$ 1.9 Bn in 2025 to US$ 2.9 Bn by 2032 with a staggering CAGR of 6.3% during this period.

- Rising demand for polyethylene wax in coatings, adhesives, and plastic processing industries is driving market growth due to its superior lubrication, dispersion, and thermal stability properties.

Polyethylene Wax Market Insights

- Increasing use of polyethylene wax as a processing aid in plastics and rubber industries is a primary market driver.

- Surging demand from hot melt adhesives and coating applications is fueling global polyethylene wax consumption.

- Expansion of packaging and textile industries in emerging economies presents lucrative growth opportunities.

- Adoption of polyethylene wax in pharmaceutical and cosmetic formulations opens new application avenues.

- Rising preference for oxidized polyethylene wax in printing inks and polish formulations is a notable market trend.

- Growing inclination toward bio-based and modified polyethylene waxes is shaping product innovation trends.

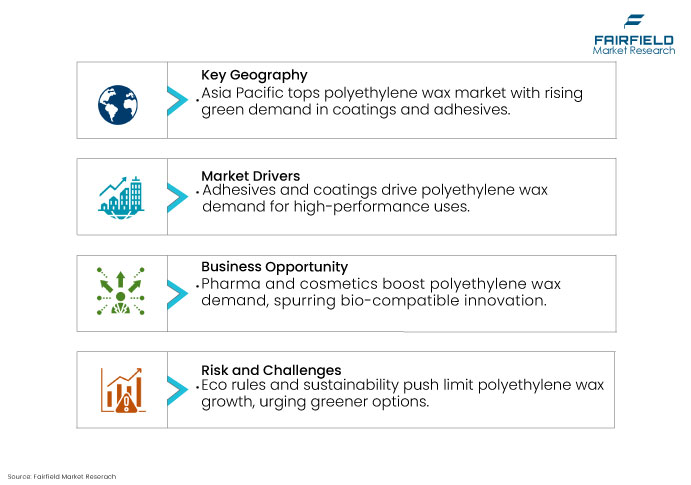

- Asia Pacific dominates the polyethylene wax market, driven by strong industrial growth in China and India.

- North America shows steady demand due to established plastics and coatings sectors with ongoing R&D initiatives.

- Europe is experiencing moderate growth, supported by eco-friendly product developments and industrial applications.

A Look Back and a Look Forward- Comparative Analysis

The market for polyethylene wax grew steadily between 2019 and 2024 at a rate of about 4%, helped by rising demand in the adhesive, coatings, and plastics processing industries. Asia Pacific and North America led consumption, while COVID-19 disruptions impacted supply chains and raw material pricing. Preference shifted gradually toward oxidized and high-density variants, with regulatory pressure encouraging exploration of bio-based alternatives.

The market is anticipated to grow at a 6.3% compound annual growth rate (CAGR) between now and 2032 as applications in high-performance coatings, cosmetics, and medicines increase. Innovation in low-VOC formulations and polymer modification will drive product advancement. Asia Pacific, particularly India and Southeast Asia, is set to emerge as a high-growth zone. Sustainability mandates and vertical integration are expected to redefine supply chains and support margin expansion.

Key Growth Determinants

Surging Demand from the Adhesives and Coatings Sector Drives Polyethylene Wax Market Growth

The growing demand from the adhesives and coatings sector, especially for hot melt adhesives (HMAs), is one of the main factors driving the polyethylene wax market. These waxes enhance performance characteristics such as viscosity control, thermal stability, and surface gloss, making them essential in industrial and consumer-grade applications. Polyethylene wax plays a critical role in improving the workability, bonding strength, and setting speed of adhesives, especially in packaging, automotive, construction, and furniture sectors. Additionally, its use in coatings enables smoother surfaces, scratch resistance, and improved pigment dispersion. The ongoing industrial shift toward high-performance materials has significantly amplified the demand for wax-based functional additives. The rising need for enhanced material properties, especially in high-growth economies, is expected to sustain and further intensify polyethylene wax consumption over the coming years

Key Growth Barriers

Environmental and Regulatory Pressures Pose Challenges to Polyethylene Wax Market Expansion

The growing regulatory and environmental scrutiny of synthetic polymer-based materials is a significant barrier to the market's growth trajectory for polyethylene wax. Since most polyethylene waxes are derived from petrochemical processes, concerns over microplastic pollution, ecological toxicity, and long-term non-biodegradability have drawn attention from environmental agencies and regulatory bodies. This has led to tighter controls on production practices, emissions, and disposal methods—especially in regions like the European Union and North America. Manufacturers now face mounting pressure to shift toward greener alternatives, which demands extensive R&D and reconfiguration of existing production lines.

These environmental regulations are not only increasing compliance costs but also delaying product approvals and commercial rollout of certain polyethylene wax formulations, thereby limiting market flexibility and slowing expansion in certain regions.

Polyethylene Wax Market Trends and Opportunities

Expanding Applications in Pharmaceuticals and Cosmetics Offer Lucrative Market Opportunity

The growing adoption of polyethylene wax in the pharmaceutical and cosmetics sectors presents a highly promising opportunity for market expansion. In these applications, polyethylene wax is valued for its emollient, binding, and viscosity-enhancing properties. It is increasingly being incorporated into skin creams, lipsticks, ointments, and tablet coatings due to its non-reactive nature and smooth texture. As consumer demand for premium personal care products and dermatological solutions continues to rise especially in Asia and the Middle East manufacturers are recognizing polyethylene wax as a stable, efficient formulation agent compatible with various active ingredients.

This trend is being further reinforced by the clean-label and multifunctionality preferences among end users, encouraging innovation in bio-compatible and hybrid wax blends, which can unlock untapped demand across both emerging and developed markets.

Rising Shift Toward Bio-Based and Modified Polyethylene Waxes Reshapes Product Development

The increasing tendency toward chemically modified and bio-based polyethylene waxes is one of the most prominent trends reshaping the polyethylene wax market. With heightened awareness of sustainability and stricter environmental regulations, manufacturers are actively exploring renewable feedstocks and safer chemical processing techniques. Bio-based polyethylene waxes, derived from plant oils or recycled plastics, offer a lower environmental impact while maintaining comparable performance properties. Additionally, chemically modified variants, such as oxidized or functionalized waxes, provide enhanced dispersion, adhesion, and compatibility across a wider range of applications, making them attractive in coatings, inks, and cosmetics.

This trend is expected to accelerate innovation and differentiation within the market, enabling suppliers to tap into high-value niche applications while aligning with evolving ESG (Environmental, Social, and Governance) expectations.

Leading Segment Overview

Plastics & Polymers Lead the Polyethylene Wax Market as Demand for Processing Aids Rises Across Industries

Plastics and polymers have emerged as the leading application category in the polyethylene wax market, accounting for the largest share of global consumption. Polyethylene wax is widely used as a processing aid in polymer compounding, extrusion, and molding due to its ability to enhance melt flow, reduce torque, and improve dispersion of fillers and pigments. Its compatibility with a wide range of thermoplastics include PVC, PE, and PP, makes it indispensable in the production of pipes, films, wires, cables, and masterbatches.

Rapid growth in the plastic manufacturing sector, especially in Asia Pacific and Latin America, is a key factor supporting this segment’s dominance. Increasing demand for lightweight, durable plastic components in automotive, consumer goods, and construction applications continues to drive adoption. Polyethylene wax also contributes to surface finish, release properties, and dimensional stability of plastic products, making it a preferred additive across high-volume and specialty processing lines.

Other significant application segments include coatings, hot melt adhesives, candles, rubber, cosmetics & pharmaceuticals. Hot melt adhesives are experiencing strong growth due to demand from the packaging and hygiene industries, while coatings maintain relevance in protective and decorative finishes. The cosmetics and pharmaceutical sectors, though niche, are steadily growing due to consumer preferences for premium, non-reactive formulation agents.

In March 2023, Honeywell International Inc. expanded its A-C® Performance Additives portfolio by launching a new polyethylene wax tailored for high-speed plastic processing. This move underscores the company's strategic commitment to innovation and sustainability, supporting evolving market demands across packaging, industrial goods, and specialty plastic applications.

Regional Analysis

- Asia Pacific Leads Polyethylene Wax Market with Robust Industrial Growth and Sustainability Trends

Asia Pacific (APAC) dominates the global polyethylene wax market, accounting for the largest share in both production and consumption. The region's rapid industrialization, especially in countries such as China, India, and Southeast Asia, has significantly increased the demand for polyethylene wax in applications such as coatings, plastics, and adhesives. Key sectors driving growth include automotive, packaging, and construction, where the demand for high-performance coatings and polymer additives is rising. The availability of raw materials, coupled with growing manufacturing hubs, strengthens APAC’s position as a market leader, particularly in the hot melt adhesive and rubber sectors.

In addition to the manufacturing boom, increasing infrastructure development and urbanization in Asia Pacific are further pushing the demand for coatings and adhesives, which is expected to sustain growth through 2032. Furthermore, innovations in bio-based polyethylene waxes and eco-friendly alternatives are gaining traction in the region, particularly in China and India, where environmental concerns are encouraging more sustainable product solutions. This trend aligns with both local regulatory policies and global demands for green and eco-conscious products.

- North America Drives Innovation and Steady Demand in the Polyethylene Wax Market with Sustainable Solutions

North America, particularly the United States and Canada, maintains a strong and steady demand for polyethylene wax, driven by advanced industries such as automotive, coatings, plastics, and adhesives. The region's robust manufacturing and R&D capabilities contribute to its position as a significant consumer of high-performance wax additives. The growth of end-use applications, including hot melt adhesives in packaging and plastics processing in automotive components, is particularly notable. Additionally, North American manufacturers are increasingly focusing on the development of bio-based polyethylene waxes, aligning with growing environmental and sustainability trends that are becoming central to the industry.

Innovation in polyethylene wax formulations is another driving factor in North America. The region’s shift towards green chemistry and low-VOC products aligns with stricter environmental regulations and sustainability initiatives. As a result, companies are investing heavily in developing eco-friendly polyethylene wax variants for a range of applications. The presence of major players, including Dow Chemical and ExxonMobil, also bolsters North America's leadership in the polyethylene wax market, ensuring continued growth and innovation.

- Europe Sees Steady Growth in Polyethylene Wax Market with a Focus on Sustainability and Eco-Friendly Solutions

Europe is witnessing consistent growth in the polyethylene wax market, driven by strong demand from the automotive, coatings, and plastics industries. Countries such as Germany, France, and the United Kingdom play pivotal roles in driving the market, with these nations focusing on advanced manufacturing processes and high-quality product standards. The region’s emphasis on sustainability and eco-friendly product formulations has also accelerated the adoption of bio-based polyethylene waxes and low-VOC solutions. The automotive sector, in particular, has contributed to growth owing to increased demand for high-performance coatings and polymers for exterior and interior applications in vehicles.

As European regulations tighten regarding environmental standards and carbon emissions, the focus on sustainable and green polyethylene wax alternatives has intensified. Innovations in the cosmetics and pharmaceuticals sectors, where polyethylene wax serves as an effective base material, are also contributing to market expansion. Moreover, the region’s strong regulatory frameworks and market-driven demand for cleaner, high-performance additives are likely to continue shaping the growth of the polyethylene wax market through 2032, ensuring Europe remains a significant player.

Competitive Landscape

The polyethylene wax market is highly competitive, with global leaders such as Dow Chemical, ExxonMobil, SABIC, and Honeywell International, along with regional players, battling for market share. Competition is driven by innovation, especially in the development of bio-based and sustainable polyethylene wax alternatives. Companies focus on maintaining high product quality and meeting regional regulatory standards, especially as eco-friendly products become more sought after.

To maintain competitiveness, companies are investing in R&D, enhancing production efficiency, and expanding globally. They are also increasing focus on low-VOC and environmentally friendly products, which align with the growing demand for sustainable solutions. Additionally, strategic partnerships and mergers & acquisitions are critical for market expansion, improving supply chain management, and boosting product offerings.

Growth opportunities include rising demand for polyethylene wax in key sectors like automotive, packaging, and cosmetics, with a focus on bio-based and functionalized waxes. The hot melt adhesive market, particularly in packaging, presents a major growth area. As environmental concerns drive demand for sustainable alternatives, market players can tap into emerging markets in Asia Pacific and Latin America.

The polyethylene wax market will continue evolving, driven by new product launches and strategic acquisitions. Companies like Honeywell and Dow Chemical are pushing innovation in bio-based polyethylene waxes, which will define future competition and shape the market's growth trajectory.

- In May 2024, Clariant AG launched Licolub PED 1316, an oxidized high-density poyethylene (HDPE) wax designed to enhance processing and surface properties in PVC applications. This product targets both internal and external PVC processing needs, particularly for extrusion in moldings, window frames, and non-potable pipes.

- In December 2024, Sasol launched a bio-based oxidized polyethylene wax, reducing reliance on petroleum-based materials for sustainable packaging solutions. This move aligns with the growing demand for eco-friendly alternatives in the industry.

- In April 2024, BASF SE introduced a new oxidized polyethylene wax for industrial coatings, improving durability and scratch resistance for automotive and construction applications. This development caters to the increasing demand for high-performance coatings in various industries.

Key Market Companies

- BASF SE

- Clariant AG

- Trecora Resources

- Honeywell International Inc.

- Lubrizol Corporation

- Westlake Chemical Corporation

- Mitsui Chemicals Inc.

- EUROCERAS

- Qingdao Haihao Chemical Co., Ltd.

- Yimei New Material Technology Co.,

- Michelman, Inc.

- Hase Petroleum Wax Co.

- Sasol Limited

- Evonik Industries

Expert Opinion

- The polyethylene wax market is increasingly driven by the demand for sustainable solutions. Innovations in bio-based polyethylene waxes and low-VOC products are gaining traction, especially in regions with stringent environmental regulations such as Europe and North America. Companies are leveraging advancements in green chemistry to align with global sustainability goals, which is positioning them for future market growth.

- Polyethylene wax is widely used across various sectors, including automotive, packaging, coatings, and cosmetics, making the market versatile and resilient. The rising adoption of polyethylene wax in hot melt adhesives and plastic processing particularly in automotive and construction industries is propelling market demand. This diversification of application areas ensures steady growth and mitigates risks from reliance on a single sector.

- The competitive intensity in the polyethylene wax market is increasing with key players such as Dow Chemical, ExxonMobil, and Honeywell focusing on strengthening their market positions through strategic mergers, acquisitions, and joint ventures. Collaborations, such as those seen between Shamrock Technologies and South Carolina Polymer Group, enhance production capabilities and allow companies to innovate efficiently, keeping pace with the evolving market dynamics.

- The polyethylene wax market is experiencing significant growth in Asia Pacific and Latin America, driven by industrialization, urbanization, and the expanding manufacturing sector. The growing demand for polyethylene wax in plastic processing, coating industries, and packaging in these regions offers lucrative opportunities for market players. As disposable income rises in these regions, the demand for high-performance, sustainable products is expected to increase, further fueling market expansion.

Global Polyethylene Wax Market Segmentation Include

By Product Type

- Low Density Polyethylene

- High Density Polyethylene

- Oxidized Polyethylene

- Others

By Processing Method

- Polymerization

- Chemical Modification

- Physical Blending

By Application

- Coating

- Plastics & Polymer

- Hot Melt Adhesive

- Candles

- Rubber

- Cosmetics & Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Polyethylene Wax Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Polyethylene Wax Market Outlook, 2019 - 2032

3.1. Global Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

3.1.1. Low Density Polyethylene

3.1.2. High Density Polyethylene

3.1.3. Oxidized Polyethylene

3.1.4. Others

3.2. Global Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

3.2.1. Polymerization

3.2.2. Chemical Modification

3.2.3. Physical Blending

3.3. Global Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

3.3.1. Coating

3.3.2. Plastics & Polymer

3.3.3. Hot Melt Adhesive

3.3.4. Candles

3.3.5. Rubber

3.3.6. Cosmetics & Pharmaceuticals

3.3.7. Others

3.4. Global Polyethylene Wax Market Outlook, by Region, Value (US$ Bn) & Volume (Tons), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Polyethylene Wax Market Outlook, 2019 - 2032

4.1. North America Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

4.1.1. Low Density Polyethylene

4.1.2. High Density Polyethylene

4.1.3. Oxidized Polyethylene

4.1.4. Others

4.2. North America Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

4.2.1. Polymerization

4.2.2. Chemical Modification

4.2.3. Physical Blending

4.3. North America Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

4.3.1. Coating

4.3.2. Plastics & Polymer

4.3.3. Hot Melt Adhesive

4.3.4. Candles

4.3.5. Rubber

4.3.6. Cosmetics & Pharmaceuticals

4.3.7. Others

4.4. North America Polyethylene Wax Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

4.4.1. U.S. Polyethylene Wax Market Outlook, by Product Type, 2019-2032

4.4.2. U.S. Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

4.4.3. U.S. Polyethylene Wax Market Outlook, by Application, 2019-2032

4.4.4. Canada Polyethylene Wax Market Outlook, by Product Type, 2019-2032

4.4.5. Canada Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

4.4.6. Canada Polyethylene Wax Market Outlook, by Application, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Polyethylene Wax Market Outlook, 2019 - 2032

5.1. Europe Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

5.1.1. Low Density Polyethylene

5.1.2. High Density Polyethylene

5.1.3. Oxidized Polyethylene

5.1.4. Others

5.2. Europe Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

5.2.1. Polymerization

5.2.2. Chemical Modification

5.2.3. Physical Blending

5.3. Europe Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

5.3.1. Coating

5.3.2. Plastics & Polymer

5.3.3. Hot Melt Adhesive

5.3.4. Candles

5.3.5. Rubber

5.3.6. Cosmetics & Pharmaceuticals

5.3.7. Others

5.4. Europe Polyethylene Wax Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

5.4.1. Germany Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.2. Germany Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.3. Germany Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.4. Italy Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.5. Italy Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.6. Italy Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.7. France Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.8. France Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.9. France Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.10. U.K. Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.11. U.K. Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.12. U.K. Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.13. Spain Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.14. Spain Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.15. Spain Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.16. Russia Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.17. Russia Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.18. Russia Polyethylene Wax Market Outlook, by Application, 2019-2032

5.4.19. Rest of Europe Polyethylene Wax Market Outlook, by Product Type, 2019-2032

5.4.20. Rest of Europe Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

5.4.21. Rest of Europe Polyethylene Wax Market Outlook, by Application, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Polyethylene Wax Market Outlook, 2019 - 2032

6.1. Asia Pacific Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

6.1.1. Low Density Polyethylene

6.1.2. High Density Polyethylene

6.1.3. Oxidized Polyethylene

6.1.4. Others

6.2. Asia Pacific Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

6.2.1. Polymerization

6.2.2. Chemical Modification

6.2.3. Physical Blending

6.3. Asia Pacific Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

6.3.1. Coating

6.3.2. Plastics & Polymer

6.3.3. Hot Melt Adhesive

6.3.4. Candles

6.3.5. Rubber

6.3.6. Cosmetics & Pharmaceuticals

6.3.7. Others

6.4. Asia Pacific Polyethylene Wax Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

6.4.1. China Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.2. China Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.3. China Polyethylene Wax Market Outlook, by Application, 2019-2032

6.4.4. Japan Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.5. Japan Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.6. Japan Polyethylene Wax Market Outlook, by Application, 2019-2032

6.4.7. South Korea Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.8. South Korea Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.9. South Korea Polyethylene Wax Market Outlook, by Application, 2019-2032

6.4.10. India Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.11. India Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.12. India Polyethylene Wax Market Outlook, by Application, 2019-2032

6.4.13. Southeast Asia Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.14. Southeast Asia Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.15. Southeast Asia Polyethylene Wax Market Outlook, by Application, 2019-2032

6.4.16. Rest of SAO Polyethylene Wax Market Outlook, by Product Type, 2019-2032

6.4.17. Rest of SAO Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

6.4.18. Rest of SAO Polyethylene Wax Market Outlook, by Application, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Polyethylene Wax Market Outlook, 2019 - 2032

7.1. Latin America Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

7.1.1. Low Density Polyethylene

7.1.2. High Density Polyethylene

7.1.3. Oxidized Polyethylene

7.1.4. Others

7.2. Latin America Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

7.2.1. Polymerization

7.2.2. Chemical Modification

7.2.3. Physical Blending

7.3. Latin America Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

7.3.1. Coating

7.3.2. Plastics & Polymer

7.3.3. Hot Melt Adhesive

7.3.4. Candles

7.3.5. Rubber

7.3.6. Cosmetics & Pharmaceuticals

7.3.7. Others

7.4. Latin America Polyethylene Wax Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

7.4.1. Brazil Polyethylene Wax Market Outlook, by Product Type, 2019-2032

7.4.2. Brazil Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

7.4.3. Brazil Polyethylene Wax Market Outlook, by Application, 2019-2032

7.4.4. Mexico Polyethylene Wax Market Outlook, by Product Type, 2019-2032

7.4.5. Mexico Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

7.4.6. Mexico Polyethylene Wax Market Outlook, by Application, 2019-2032

7.4.7. Argentina Polyethylene Wax Market Outlook, by Product Type, 2019-2032

7.4.8. Argentina Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

7.4.9. Argentina Polyethylene Wax Market Outlook, by Application, 2019-2032

7.4.10. Rest of LATAM Polyethylene Wax Market Outlook, by Product Type, 2019-2032

7.4.11. Rest of LATAM Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

7.4.12. Rest of LATAM Polyethylene Wax Market Outlook, by Application, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Polyethylene Wax Market Outlook, 2019 - 2032

8.1. Middle East & Africa Polyethylene Wax Market Outlook, by Product Type, Value (US$ Bn) & Volume (Tons), 2019-2032

8.1.1. Low Density Polyethylene

8.1.2. High Density Polyethylene

8.1.3. Oxidized Polyethylene

8.1.4. Others

8.2. Middle East & Africa Polyethylene Wax Market Outlook, by Processing Method, Value (US$ Bn) & Volume (Tons), 2019-2032

8.2.1. Polymerization

8.2.2. Chemical Modification

8.2.3. Physical Blending

8.3. Middle East & Africa Polyethylene Wax Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

8.3.1. Coating

8.3.2. Plastics & Polymer

8.3.3. Hot Melt Adhesive

8.3.4. Candles

8.3.5. Rubber

8.3.6. Cosmetics & Pharmaceuticals

8.3.7. Others

8.4. Middle East & Africa Polyethylene Wax Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

8.4.1. GCC Polyethylene Wax Market Outlook, by Product Type, 2019-2032

8.4.2. GCC Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

8.4.3. GCC Polyethylene Wax Market Outlook, by Application, 2019-2032

8.4.4. South Africa Polyethylene Wax Market Outlook, by Product Type, 2019-2032

8.4.5. South Africa Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

8.4.6. South Africa Polyethylene Wax Market Outlook, by Application, 2019-2032

8.4.7. Egypt Polyethylene Wax Market Outlook, by Product Type, 2019-2032

8.4.8. Egypt Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

8.4.9. Egypt Polyethylene Wax Market Outlook, by Application, 2019-2032

8.4.10. Nigeria Polyethylene Wax Market Outlook, by Product Type, 2019-2032

8.4.11. Nigeria Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

8.4.12. Nigeria Polyethylene Wax Market Outlook, by Application, 2019-2032

8.4.13. Rest of Middle East Polyethylene Wax Market Outlook, by Product Type, 2019-2032

8.4.14. Rest of Middle East Polyethylene Wax Market Outlook, by Processing Method, 2019-2032

8.4.15. Rest of Middle East Polyethylene Wax Market Outlook, by Application, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. BASF SE

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Clariant AG

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Trecora Resources

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Honeywell International Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Lubrizol Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Westlake Chemical Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Mitsui Chemicals Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. EUROCERAS

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Qingdao Haihao Chemical Co., Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Yimei New Material Technology Co.,

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Michelman, Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. Hase Petroleum Wax Co.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. Sasol Limited

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Evonik Industries

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type |

|

|

Processing Method |

|

|

Application |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |