Global Precision Fermentation Market Forecast

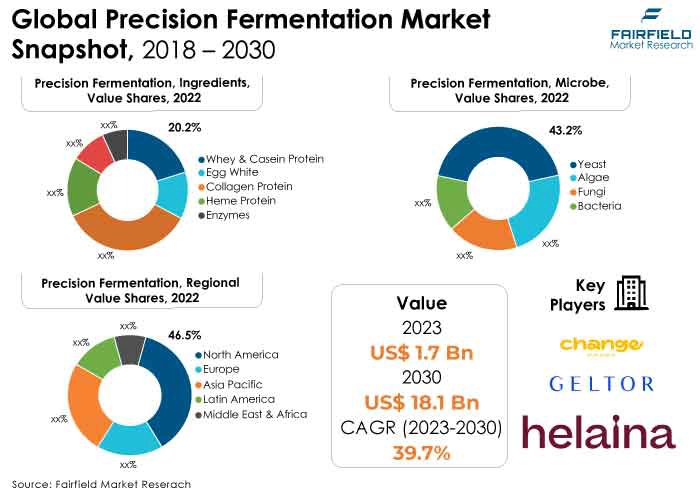

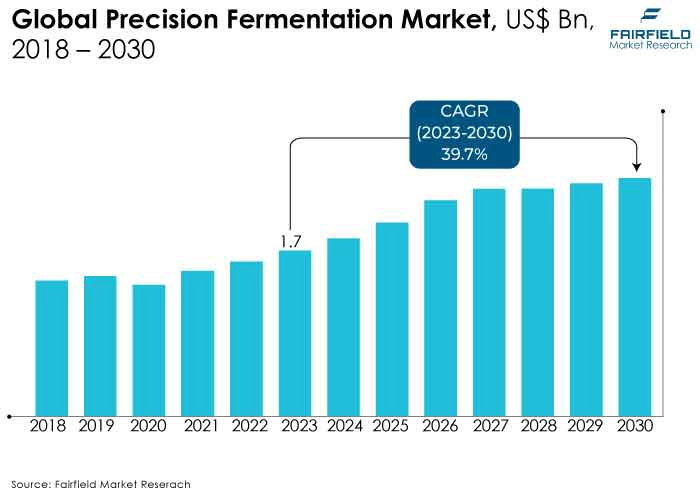

- Precision fermentation market size likely to reach US$18.1 Bn in 2030, up from US$1.7 Bn attained in 2022

- Global market for precision fermentation anticipated to expand at a CAGR of 39.7% during 2023 - 2030

Quick Report Digest

- In the food and beverage business, precision fermentation is seeing a shift toward sustainable production practices. Precision fermentation makes it possible to produce substitute proteins and components, which helps to create a more environmentally friendly and sustainable supply chain as businesses work to lessen their impact on the environment.

- The market is expanding significantly as a result of ongoing biotechnology breakthroughs. Precision fermentation is becoming more efficient and scalable thanks to advancements in bioprocessing technologies, microbial engineering, and fermentation techniques. This trend is driving increased adoption as businesses look to maximise production and more successfully market new items.

- In the precision fermentation industry, collagen protein is clearly the leading category. Its rise is linked to the rising popularity of functional meals and drinks among consumers, as well as the use of collagen in cosmetics. Precision-derived collagen's adaptability makes it popular across a range of industries, which propels the market's expansion as a whole.

- The market for precise fermentation is dominated by yeast because of its adaptability in creating a wide range of bio-based goods. The market is growing rapidly because of its scalability, flexibility with different applications, and rapid fermentation rates.

- The growing need for sustainable and alternative protein sources is driving the meat and seafood category to dominate the precision fermentation market. The dominance of this market is driven by consumer preferences for options that are ethical and environmentally beneficial.

- The precision fermentation market is expanding at the quickest rate in the Asia-Pacific area. Precision fermentation technologies are in high demand in the region because of factors like population expansion, shifting dietary choices, and increased awareness of sustainable practices.

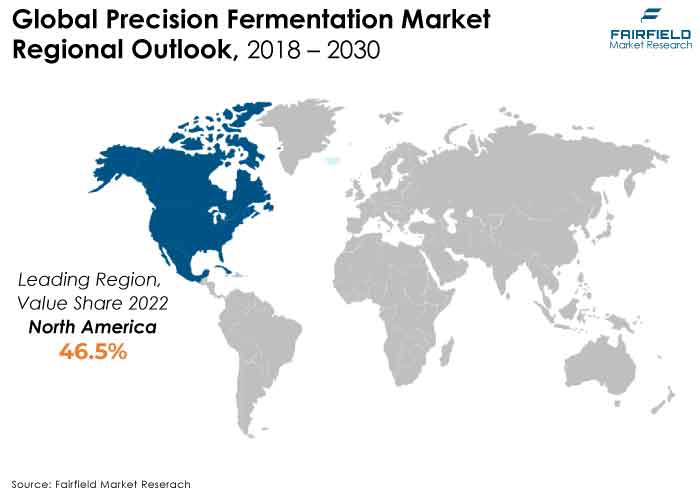

- The precision fermentation market is concentrated in North America. The region's market domination is a result of significant investments in research and development as well as the strong presence of important industry players. The firmly established biotech and food industries support expansion even more.

- In the precision fermentation market, Europe is currently the second-largest geographical area. The significant market share is a result of strict laws encouraging sustainable practices as well as a rising trend toward plant-based and alternative protein sources. The region's advanced technology and well-developed infrastructure are also essential to the growth of the market.

A Look Back and a Look Forward - Comparative Analysis

Increasing customer awareness of sustainability and a move toward plant-based and alternative proteins are driving the precision fermentation market's present rapid expansion. Important markets that are dominating indicating changing customer tastes, are collagen proteins and yeast microorganisms. The fastest-growing area is Asia Pacific, driven by both population growth and shifting nutritional preferences.

Precision fermentation has developed over time from a specialised idea to a major player in the biotech and food sectors. Historical patterns indicate a slow shift toward sustainable practices, with the market being shaped by developments in microbial engineering and biotechnology. The growing range of applications-from dairy to meat substitutes-emphasizes how dynamic the field of precision fermentation is.

Precision fermentation looks to have a bright future ahead of it, with a predicted boom in new product development and market expansion. The creation of novel ingredients and improvements in bioprocessing technologies will probably fuel growth. Precision fermentation is going to be a major participant in the future of food and biotechnology because the market is positioned to play a critical role in addressing global concerns, including environmental sustainability and food security.

Key Growth Determinants

- Sustainable Food Production Paradigm

A major factor driving the precision fermentation industry is the movement in global food production paradigms towards sustainable practices. Precision fermentation appears to be a game-changer as the globe struggles with environmental issues, climate change, and the requirement for resource-efficient procedures.

Precision fermentation, which uses microbial processes to produce nutrients and proteins, offers a more sustainable method of farming than traditional methods that are linked to excessive use of water and land. By minimising environmental impact, decreasing reliance on arable land, and lessening the negative effects of livestock production, this approach helps to create a more sustainable and ecologically balanced food chain. Precision fermentation is expanding in response to customer demand for ethically and environmentally sourced products and growing awareness of the need for a more sustainable future.

- Technological Advancements in Bioprocessing

The precision fermentation market is expected to increase at a significant rate due to the ongoing development of bioprocessing technologies. Precision fermentation techniques are becoming more scalable and efficient due to advances in microbial engineering and ongoing research and development. The capacity to serve a wide range of applications, cost-effectiveness, and quicker production cycles are all facilitated by these technical advancements.

The potential of the market is increased by the ability to create proteins and other biomolecules, as well as ingredients that are specifically tailored, through more accurate manipulation of microbial cultures. Precision fermentation technologies are becoming increasingly complex and flexible, allowing businesses to stay competitive in a constantly changing market and react to changing consumer tastes and product innovation.

- Increasing Demand for Alternative Proteins

The growing need for alternative proteins is one of the main factors propelling the precision fermentation market's expansion. There has been a trend towards plant-based and alternative protein sources due to factors such as the growing global population, worries about food security, and growing awareness of the environmental impact of conventional animal agriculture.

By offering a scalable and sustainable way to produce proteins like whey, collagen, and enzymes without using conventional farming methods, precision fermentation presents a workable option. This supports the growing trend of vegetarian, vegan, and flexitarian diets, which is propelling the market's growth.

Precision fermentation's ability to provide versatile substitutes for proteins found in meat, dairy, and eggs makes it an essential tool in satisfying consumer demand for high-protein, ethical, and sustainable food items. This, in turn, drives significant industry growth.

Major Growth Barriers

- Regulatory Challenges, and Uncertainties

The market for precision fermentation is severely constrained by the murky regulatory environment and the difficulties in getting goods approved and put on the market. The novelty of precision fermentation technologies frequently causes regulatory frameworks to become unclear, which hinders the market's expansion.

Achieving an equilibrium between promoting innovation and guaranteeing consumer safety presents difficulties for regulatory agencies as well as business participants. Market growth can be impeded by delays in approvals and regulatory barriers, which might affect the prompt release of products developed from precision fermentation.

- Cost and Economic Viability Challenges

One major obstacle to the broad use of precision fermentation methods is their economic sustainability. Even with advances in technology, precise fermentation facilities can require a sizable initial expenditure. For startups and smaller businesses, high capital costs, as well as the requirement for highly qualified employees and advanced equipment, present challenges.

Furthermore, reaching cost parity with traditional production techniques is still difficult, which affects how competitive the market is. Reaching the full potential of the market and guaranteeing wider industrial acceptability will depend on overcoming these financial obstacles and improving the precision fermentation processes' cost efficiency.

Key Trends and Opportunities to Look at

- Expanding Applications in Pharmaceutical Production

The pharmaceutical industry offers a substantial possibility for growth through precision fermentation. The technology's capacity to precisely create complex proteins, enzymes, and medicinal compounds is in line with the expanding market for biopharmaceuticals.

Precision fermentation is a cost-effective and regulated approach to pharmaceutical compound synthesis that guarantees constant quality and lower manufacturing costs. This creates opportunities for pharmaceutical businesses and biotechnology to work together, promoting innovation in biomanufacturing and medication development.

- Rocketing Sales of Nutraceuticals, and Functional Ingredients

The need for functional ingredients and nutraceuticals is being driven by the growing interest in health and well-being, which is creating a profitable opportunity for the precision fermentation market. Bioactive molecules, vitamins, and specialty components with improved nutritional profiles can be produced with precision fermentation.

The trend toward functional foods and tailored nutrition further increases the market's potential. Businesses can take advantage of consumers' increasing knowledge of preventative healthcare by using precision fermentation to produce tailored nutritional supplements and biofortified products. This will allow them to carve out a position for themselves in the booming nutraceutical sector.

- Collaborations, and Partnerships for Innovation

Partnerships and collaborations both inside and outside the food and biotech sectors present a strategic chance for precision fermentation innovation. Precision fermentation technology can evolve more quickly when cross-industry alliances, such as those between biotech companies, food producers, and research institutes, share resources and knowledge.

Joint ventures have the potential to promote the creation of innovative products and increase market reach by facilitating information sharing, common infrastructure, and access to a variety of microbial strains. By using complementary strengths and working together to handle regulatory barriers, strategic alliances enable companies to position themselves for sustained success in the ever-changing precision fermentation landscape.

How Does the Regulatory Scenario Shape this Industry?

In the precision fermentation business, regulations differ from place to place and are changing as a result of the technology's unique nature. The industry is being closely examined for environmental impact, safety, and labeling. Regulatory agencies evaluate the safety of products developed by precision fermentation, guaranteeing adherence to set standards for food safety.

The unique features of the technology present difficulties; thus, industry players and regulators must work together to create clear regulations. Regulatory frameworks will be essential in determining how innovation is balanced with consumer safety and environmental sustainability as precision fermentation develops and in determining the market's future course.

Fairfield’s Ranking Board

Top Segments

- Collagen Protein Continues to Dominate over Heme Protein

In 2022, the precision fermentation market is dominated by collagen protein, which is primarily attributed to its extensive utilisation in the food, beverage, and cosmetic sectors. Collagen's dominance in the market is largely due to the combination of rising consumer demand for functional and health-enhancing products and collagen's adaptability in formulations.

Precision fermentation makes it possible to produce collagen without using conventional animal sources, which is in line with consumers' growing need for components that are cruelty-free and sustainable.

The market for precision fermentation is expanding at the quickest rate in the heme protein category due to the increased demand for plant-based meat substitutes.

Heme proteins, which are essential for simulating the flavour and texture of meat, are produced more easily by precision fermentation. The utilisation of precision fermentation in the production of plant-based heme proteins places the market at the forefront of its explosive growth, coinciding with the growing demand for ethical and sustainable food options.

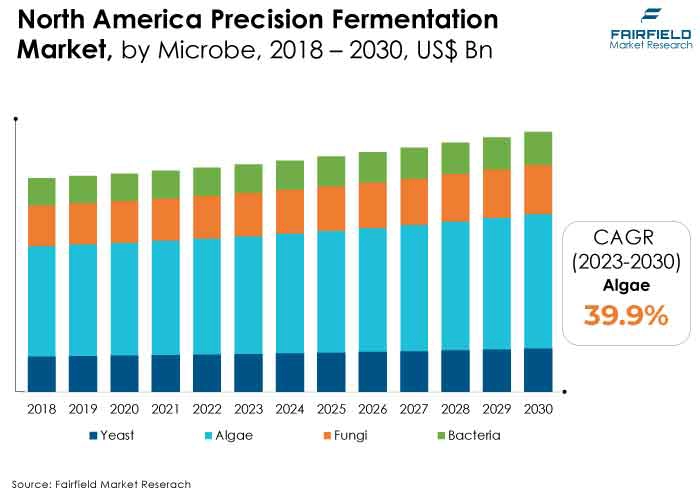

- Yeast Wins Preference with Versatility, Algae to Emerge Lucrative

Yeast arises as the prominent sector in the precise fermentation market in 2022, owing to its versatility, and widespread application in a variety of industries. Precision fermentation using yeast is prized for its ability to yield a variety of compounds, such as tastes, proteins, and enzymes. Yeast dominates the market because it can adapt to various fermentation methods and has a long history of use in industrial applications. Furthermore, items made from yeast meet consumers' growing desire for plant-based and sustainable substitutes.

The algae segment is the fastest expanding in the precision fermentation market, owing to algae's unique properties in creating a wide range of bio-based molecules. Because it can grow quickly and survive in a variety of conditions, algae is a useful microbe for precise fermentation.

The rapid expansion of this market can be attributed to the increased interest in sustainable practices as well as the potential of algae to produce nutritional supplements, biofuels, and specialty chemicals. This makes algae an important participant in the expanding field of precision fermentation.

- Sustainable Choices Drive Dominance of the Meat and Seafood Category

The meat and seafood category dominates precision fermentation as consumer preferences move toward plant-based and sustainable protein sources. The manufacturing of substitute meat and fish products is made possible by precision fermentation, which addresses environmental issues related to conventional animal husbandry.

This market is expanding due to consumer desire for cruelty-free and environmentally friendly products; precision fermentation is essential to producing viable and long-lasting substitutes for traditional meat and fish items.

The market for precision fermentation is expanding at the quickest rate in the dairy alternatives category due to the increased demand for plant-based and lactose-free products worldwide. The process of precision fermentation makes it easier to produce dairy substitutes with improved sensory qualities and nutritional profiles.

With consumers looking for more ethical and sustainable options, precision fermentation's ability to create dairy alternatives sets up this market for explosive growth. The growing market share of dairy substitutes in precision fermentation can be attributed to the capacity to produce goods that closely resemble dairy in terms of texture and flavour without using conventional agricultural methods.

Regional Frontrunners

North America Retains Leadership Position, Heavy R&D Investments Drive Growth

In 2022, North America’s dominant position in the precision fermentation market can be attributed to several factors, including robust investments in research and development, established biotechnology and food sectors, and a proactive stance toward embracing innovative technologies.

The consumer base in the region is showing more inclination toward alternative and sustainable food sources, which is consistent with precision fermentation's potential. North America's supremacy is further bolstered by the presence of major industry players, and a supportive legislative framework, as businesses use precision fermentation to address the need for creative, ethical, and environmentally friendly food and beverage products.

Asia Pacific to Gain from a Growing Consumer Tendency to Pick Sustainable Choices

The precision fermentation market is expanding at the quickest rate in the Asia Pacific area during the coming years due to factors such as changing food habits, population growth, and increased emphasis on sustainable practices. Precision fermentation technologies are in more demand due to the region's strong economic growth, and growing public awareness of environmental and health issues.

Consequently, to address the changing demands of a vibrant and populated market, businesses in the Asia Pacific region are making investments in R&D, stimulating innovation, and propelling the implementation of precision fermentation.

Fairfield’s Competitive Landscape Analysis

The market for precision fermentation is characterised by a dynamic competitive landscape with prominent players such as biotech companies, food producers, and technology providers. To stay ahead of the competition, businesses collaborate strategically, develop new products, and spend money on research and development. The food, pharmaceutical, and cosmetic industries' increasing need for sustainable and alternative solutions continues to be the primary emphasis.

Who are the Leaders in the Global Precision Fermentation Space?

- Change Foods

- Geltor

- Helania Inc.

- Formo

- Eden Brew

- Impossible Foods Inc.

- Melt & Marble

- Motif Foodworks, Inc.

- Mycorena

- Nourish Ingredients

- Perfect Day Inc.

Significant Company Developments

Product Launch

- September 2023: Formo will introduce a "New Class of Products" with precision-fermented eggs. In preparation for the debut of what it calls a "new class of products," Formo, in collaboration with Singapore Management University, undertook a peer-reviewed study that revealed a significant demand for precision fermenting eggs.

- February 2023: Precision Fermentation Alliance is a new trade group that was formed by nine food tech entrepreneurs, ranging from companies that make meaty flavours for meat substitutes to those that make dairy products without using any animals.

Funding

- January 2023: Precision Fermentation Raises $6 Million for Internet of Things Technology. The company's BrewIQ system uses IoT technology to deliver personalised warnings and data, facilitating trend analysis and well-informed decision-making. The technology can be used in other fermentation-related businesses, including dairy, kombucha, distilled spirits, and bio-ethanol, in addition to the beer industry.

- October 2023: Bio, a Berkeley-based firm that aims to enable a continuous process and transform the economics of precision fermentation, raised $9.5 million in a series A financing headed by Re: Food and Thia Ventures.

- May 2023: Next year, as part of its Horizon Europe program, the European Union will invest €50 million in startups specialising in precision fermentation and algae-based food production; applications will be accepted commencing. This marks the legislative body's first funding commitment made expressly for precision fermentation, which it acknowledges as a means of enhancing the food supply's sustainability and health benefits.

An Expert’s Eye

Demand and Future Growth

A number of variables are expected to propel the precision fermentation market's demand for expansion. Precision fermentation technologies are in high demand due to growing consumer awareness of sustainability and preference for plant-based and alternative products. Analysts predict a spike in applications in a variety of sectors, including cosmetics, food, and medicine.

Continuing technical developments, strategic alliances, and a global movement toward eco-friendly and cruelty-free business practices also support future market expansion. Analysts predict that precision fermentation will have a bright future because it can provide sustainable and creative solutions to satisfy the changing needs of a conscious customer base.

Supply Side of the Market

The precision fermentation market is characterised by an expanding network of suppliers that serve the varied requirements of sectors that are embracing this groundbreaking technology. Suppliers include biotech companies that specialise in microbial engineering, equipment manufacturers that supply cutting-edge fermentation technologies, and ingredient producers that create goods that are precisely produced from fermentation.

Growing emphasis on R&D distinguishes the supply chain to improve process effectiveness, lower expenses, and broaden product offers. In order to meet market demands, promote scientific breakthroughs, and guarantee a consistent and varied supply of precision fermentation solutions for a range of applications, suppliers are essential as demand rises.

Global Precision Fermentation Market is Segmented as Below:

By Ingredients:

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Miscellaneous

By Microbe:

- Yeast

- Algae

- Fungi

- Bacteria

By Application:

- Meat & Seafood

- Dairy Alternatives

- Egg Alternatives

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Precision Fermentation Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Precision Fermentation Market Outlook, 2018 - 2030

3.1. Global Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Whey & Casein Protein

3.1.1.2. Egg White

3.1.1.3. Collagen Protein

3.1.1.4. Heme Protein

3.1.1.5. Enzymes

3.1.1.6. Miscellaneous

3.2. Global Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Yeast

3.2.1.2. Algae

3.2.1.3. Fungi

3.2.1.4. Bacteria

3.3. Global Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Meat & Seafood

3.3.1.2. Dairy Alternatives

3.3.1.3. Egg Alternatives

3.3.1.4. Miscellaneous

3.4. Global Precision Fermentation Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Precision Fermentation Market Outlook, 2018 - 2030

4.1. North America Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Whey & Casein Protein

4.1.1.2. Egg White

4.1.1.3. Collagen Protein

4.1.1.4. Heme Protein

4.1.1.5. Enzymes

4.1.1.6. Miscellaneous

4.2. North America Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Yeast

4.2.1.2. Algae

4.2.1.3. Fungi

4.2.1.4. Bacteria

4.3. North America Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Meat & Seafood

4.3.1.2. Dairy Alternatives

4.3.1.3. Egg Alternatives

4.3.1.4. Miscellaneous

4.4. North America Precision Fermentation Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Precision Fermentation Market Outlook, 2018 - 2030

5.1. Europe Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Whey & Casein Protein

5.1.1.2. Egg White

5.1.1.3. Collagen Protein

5.1.1.4. Heme Protein

5.1.1.5. Enzymes

5.1.1.6. Miscellaneous

5.2. Europe Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Yeast

5.2.1.2. Algae

5.2.1.3. Fungi

5.2.1.4. Bacteria

5.3. Europe Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Meat & Seafood

5.3.1.2. Dairy Alternatives

5.3.1.3. Egg Alternatives

5.3.1.4. Miscellaneous

5.4. Europe Precision Fermentation Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Precision Fermentation Market Outlook, 2018 - 2030

6.1. Asia Pacific Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Whey & Casein Protein

6.1.1.2. Egg White

6.1.1.3. Collagen Protein

6.1.1.4. Heme Protein

6.1.1.5. Enzymes

6.1.1.6. Miscellaneous

6.2. Asia Pacific Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Yeast

6.2.1.2. Algae

6.2.1.3. Fungi

6.2.1.4. Bacteria

6.3. Asia Pacific Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Meat & Seafood

6.3.1.2. Dairy Alternatives

6.3.1.3. Egg Alternatives

6.3.1.4. Miscellaneous

6.4. Asia Pacific Precision Fermentation Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Precision Fermentation Market Outlook, 2018 - 2030

7.1. Latin America Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Whey & Casein Protein

7.1.1.2. Egg White

7.1.1.3. Collagen Protein

7.1.1.4. Heme Protein

7.1.1.5. Enzymes

7.1.1.6. Miscellaneous

7.2. Latin America Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Yeast

7.2.1.2. Algae

7.2.1.3. Fungi

7.2.1.4. Bacteria

7.3. Latin America Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Meat & Seafood

7.3.1.2. Dairy Alternatives

7.3.1.3. Egg Alternatives

7.3.1.4. Miscellaneous

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Precision Fermentation Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Precision Fermentation Market Outlook, 2018 - 2030

8.1. Middle East & Africa Precision Fermentation Market Outlook, by Ingredients, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Whey & Casein Protein

8.1.1.2. Egg White

8.1.1.3. Collagen Protein

8.1.1.4. Heme Protein

8.1.1.5. Enzymes

8.1.1.6. Miscellaneous

8.2. Middle East & Africa Precision Fermentation Market Outlook, by Microbe, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Yeast

8.2.1.2. Algae

8.2.1.3. Fungi

8.2.1.4. Bacteria

8.3. Middle East & Africa Precision Fermentation Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Meat & Seafood

8.3.1.2. Dairy Alternatives

8.3.1.3. Egg Alternatives

8.3.1.4. Miscellaneous

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Precision Fermentation Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Precision Fermentation Market by Ingredients, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Precision Fermentation Market Microbe, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Precision Fermentation Market Application, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Change Foods

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Geltor, Helania Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Formo.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Eden Brew.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Impossible Foods Inc..

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Melt & Marble

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Motif Foodworks, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Mycorena

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Nourish Ingredients

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Perfect Day Inc

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Ingredient Coverage |

|

|

Microbe Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |