Global Refurbished and Used Mobile Phones Market Forecast

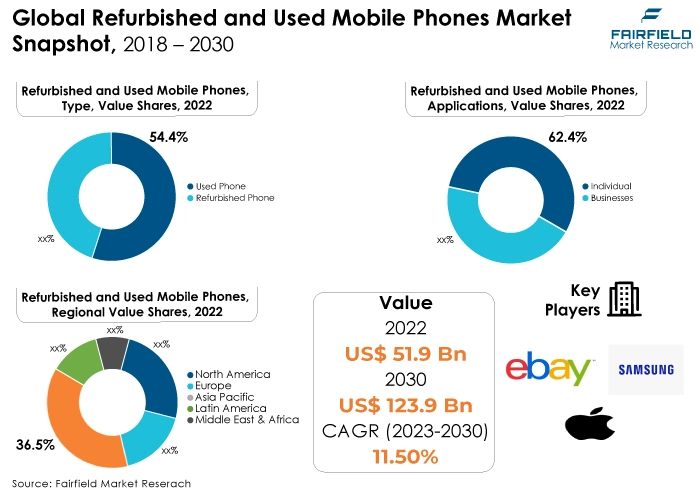

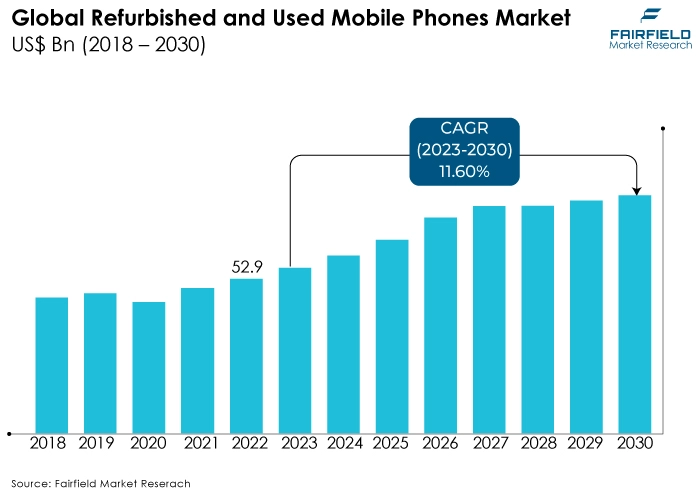

- Refurbieshed and used mobile phones market size likely to take a leap from US$51.9 Bn in 2022 to US$123.9 Bn in 2030

- Market valuation to expand at a CAGR of 11.5% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the global refurbished and used mobile phones market growth is the increasing popularity of used smartphones.

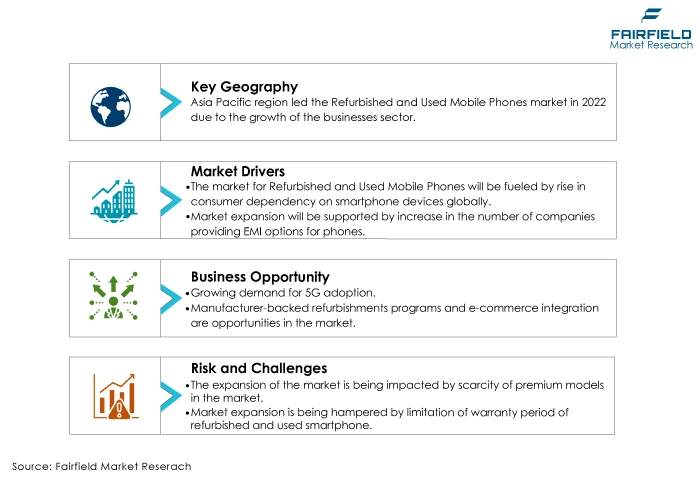

- The global rise in consumer dependency on smartphones is driving the market due to their essential role in communication, work, entertainment, and productivity. As smartphones become indispensable, consumers increasingly seek cost-effective options, spurring demand for refurbished and used devices.

- Used phones have captured the largest market share in the refurbished & used mobile phones market due to their lower cost, accessibility, and broad appeal to budget-conscious consumers. This affordability and availability make them the preferred choice for many buyers, driving their dominance in the market.

- Mid Price ($200 to $500) dominate the refurbished and used mobile phones market due to their broad consumer appeal. They offer affordability, catering to a wide range of budget-conscious buyers, making them the most accessible and sought-after segment in the market.

- Individual applications have secured the largest market share in the refurbished & used mobile phones market because they cater to diverse personal needs, making them the most versatile and widely adopted segment. This includes personal use, communication, entertainment, and productivity, making them the dominant choice among consumers.

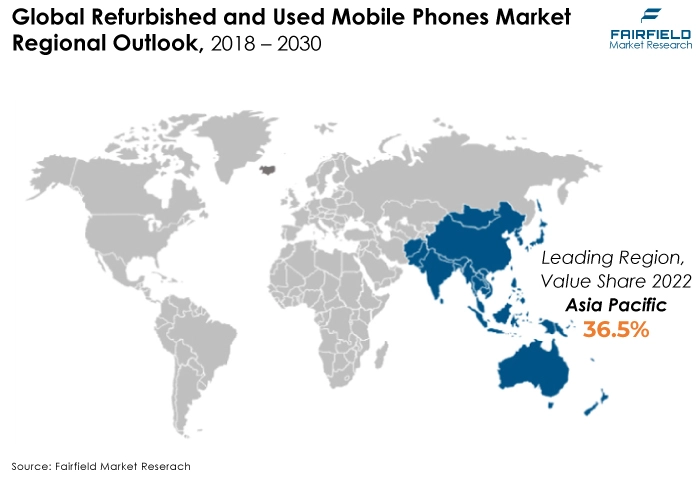

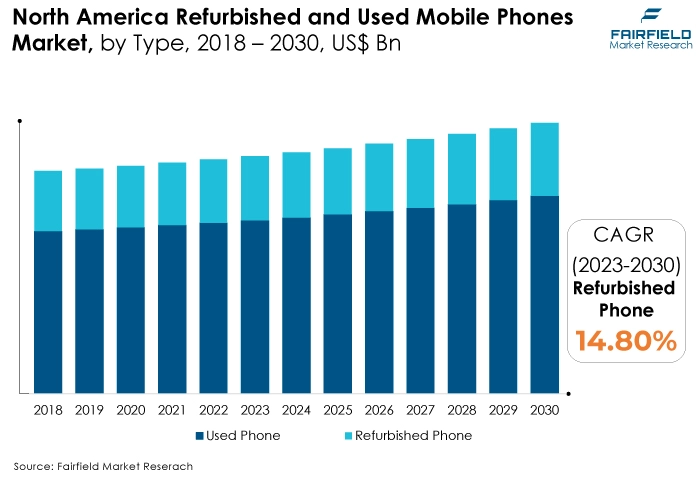

- North America was the largest market in the refurbished & used mobile phones market due to its tech-savvy population, strong demand for the latest technology, and the presence of established refurbishment programs and trusted resale channels, contributing to its market dominance.

- Asia Pacific is experiencing the fastest CAGR in the refurbished and used mobile phones market due to its large and diverse consumer base, increasing digital penetration, and growing environmental awareness, driving demand for cost-effective and sustainable mobile solutions.

- The limitation in the warranty period of refurbished and used smartphones poses a challenge as it can deter potential buyers concerned about device reliability. Offering longer warranties or transparently communicating conditions can help build consumer trust and overcome this challenge.

A Look Back and a Look Forward - Comparative Analysis

The refurbished & used mobile phone market is growing due to several factors, including consumers' increasing awareness of cost savings, environmental concerns, and the availability of certified, high-quality, pre-owned devices.

Additionally, advancements in smartphone technology have slowed, making slightly older models more appealing. E-commerce platforms and manufacturer-backed refurbishment programs have also contributed to the market's expansion, offering reliable options for consumers seeking budget-friendly alternatives.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors, such as individuals and businesses. In the refurbished & used mobile phone market, companies can capitalize on opportunities by offering certified refurbishment services, building online marketplaces, or participating in trade-in programs. They can also target sustainability-conscious consumers and explore partnerships with manufacturers for supply chain integration, enhancing profit margins and sustainability credentials.

The future of the refurbished and used mobile phones market appears promising. It's expected to continue growing due to increasing consumer demand for cost-effective and environmentally friendly options. Advancements in phone durability and reliability, coupled with expanded trade-in and refurbishment programs, will likely drive growth. Additionally, as 5G technology becomes more prevalent, older 4G devices will flood the secondary market, offering a wider range of affordable choices for consumers.

Key Growth Determinants

- Rise in Consumer Dependency on Smartphone Devices

The rise in consumer dependency on smartphone devices globally is a significant driver of the refurbished and used mobile phones market. Smartphones have become indispensable tools for communication, work, entertainment, and more.

As consumers increasingly rely on these devices, they seek cost-effective alternatives to upgrade or replace their current smartphones. Refurbished and used phones offer a budget-friendly option without compromising functionality.

Moreover, growing environmental awareness has spurred interest in recycling and reusing electronics, aligning with the sustainability goals of both consumers and manufacturers. This, coupled with the fact that smartphones are designed to last longer, creates a thriving market for refurbished and used mobile phones, providing accessible choices for consumers and reducing electronic waste.

- Increasing EMI/Finance Options on Phones

The increase in the number of companies offering EMI options for phones is driving the refurbished and used mobile phones market by making these devices more affordable and accessible to a wider consumer base.

EMI options help mitigate the upfront cost barrier associated with purchasing smartphones, encouraging consumers to opt for refurbished or used models. This trend fosters greater adoption, fuels demand, and stimulates the growth of the refurbished and used mobile phone market, especially among budget-conscious buyers seeking flexible payment solutions.

- Growing Inclination Toward Online Shopping

The increasing adoption of e-commerce platforms by both buyers and sellers is a significant driver of the refurbished and used mobile phone market. Online marketplaces provide a convenient and transparent way for consumers to browse, compare, and purchase pre-owned devices.

For sellers, e-commerce platforms offer a vast and global reach to showcase their refurbished products. This digital shift has expanded the market's reach, improved accessibility, and fostered trust, accelerating the demand of the refurbished & used mobile phones market as a reliable and cost-effective alternative for tech-savvy consumers.

Major Growth Barriers

- Scarcity of Top Models in Refurbished Markets

The scarcity of top models in the refurbished market presents a challenge to the refurbished and used mobile phones market. High-demand flagship models may not be readily available in refurbished condition, limiting consumer choices. This can lead to potential buyers opting for new devices instead, impacting the growth of the refurbished market.

To overcome this challenge, sellers and refurbishers must source and refurbish top models more effectively to meet consumer demands and maintain the market's competitiveness.

- Limitation in Warranty Period

The limitation in the warranty period of refurbished and used smartphones poses a challenge to the refurbished and used mobile phones market.

Reduced warranty durations could discourage prospective customers who prioritize post-purchase assistance and the reliability of the product. To address this challenge, market players must offer extended warranty options or improve the transparency of product conditions to build consumer trust and confidence.

Ensuring longer warranty coverage can mitigate this challenge and encourage more consumers to consider refurbished and used smartphones as viable alternatives to new ones.

Key Trends and Opportunities to Look at

- 5G Adoption

The adoption of 5G technology in the refurbished and used mobile phones market is a significant trend. As newer 5G-capable smartphones become mainstream, older 4G models are increasingly available in the refurbished need.

The shift provides consumers with access to more affordable 4G devices while driving demand for 5G models in the primary market. It also highlights the importance of offering a diverse range of refurbished options to cater to different consumer preferences.

- Manufacturer-backed Refurbishment Programs

Manufacturer-backed refurbishment programs are gaining prominence in the refurbished and used mobile phones market. Leading smartphone manufacturers establish these programs to refurbish and certify their own devices, ensuring quality, reliability, and post-sales support.

This particular trend boosts consumer confidence in refurbished products, drives brand loyalty, and expands the availability of high-quality used smartphones, shaping the market's growth and consumer trust.

- E-commerce Integration

E-commerce integration is transforming the refurbished and used mobile phones market. Online marketplaces and platforms have become central to buying and selling pre-owned smartphones. This trend offers consumers a convenient and transparent way to access a wide range of refurbished devices while sellers benefit from global reach and efficient sales channels.

E-commerce integration is expanding the market's accessibility and reshaping the way consumers engage with refurbished and used mobile phones.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario significantly shapes the refurbished and used mobile phone market by influencing consumer confidence, environmental sustainability, and fair business practices. Consumer protection laws are critical in ensuring that buyers are well-informed about the condition and warranty of refurbished devices, protecting them from deceptive practices. These regulations enhance trust in the market, fostering a more vibrant ecosystem for used mobile phones.

Furthermore, e-waste management regulations are pivotal for promoting responsible disposal and recycling of electronic devices. These regulations compel businesses to adopt eco-friendly practices, reducing the environmental footprint of discarded electronics and contributing to sustainability.

Data privacy laws also have a profound impact, as they necessitate stringent data erasure procedures to safeguard the personal information of previous device owners. Compliance is a aspect of building trust among consumers who may have concerns about their data security when purchasing refurbished devices.

Altogether, the regulatory framework in the refurbished and used mobile phones market is instrumental in ensuring ethical practices, environmental responsibility, and consumer protection, thus shaping the industry's future.

Fairfield’s Ranking Board

Top Segments

- Used Phones Category Dominant

Used phones have captured the largest market share in the refurbished & used mobile phones market due to their affordability and accessibility. Many consumers prioritize cost savings, and buying a "used" device often comes at a lower price point compared to certified refurbished models.

Additionally, used phones are readily available in the secondary market, offering a wide range of options, including popular older models. This affordability and variety make used phones a preferred choice for budget-conscious buyers, driving their dominance in the market.

Refurbished phones are experiencing the highest CAGR in the refurbished and used mobile phones market due to several factors. Firstly, they offer consumers a like-new experience as these devices undergo comprehensive testing, repairs, and quality assurance, ensuring high performance and reliability.

Growing environmental awareness encourages consumers to choose more sustainable options, and certified refurbished phones align with this ethos. Lastly, manufacturer-backed refurbishment programs are gaining trust, as they provide warranty support and peace of mind, fueling the growth of the refurbished segment with a reputation for quality and reliability.

- Mid Price Phones ($200 to $500) Remain Sought-after

Mid price phones ($200 to $500) have captured the largest market share in the refurbished and used mobile phones market due to their affordability and broad consumer appeal. These products cater to a diverse customer base, encompassing budget-conscious consumers in emerging markets and those seeking cost-effective alternatives.

Mid-price refurbished and used phones offer a more affordable option compared to brand new devices. This affordability is appealing to consumers who are budget-conscious and looking to save money.

Premium refurbished and used mobile phones priced above $500 are experiencing the fastest CAGR due to several factors. Firstly, consumers seeking flagship features and performance at a reduced cost are attracted to premium refurbished models.

Moreover, as flagship models age and enter the secondary market, they become more accessible to budget-conscious buyers. Manufacturer-backed programs ensure the quality and reliability of premium refurbished devices, boosting consumer confidence and driving growth in this segment as users seek high-end features without the new flagship price tag.

- Individual Application Segment Surges Ahead

Individual application segment have captured the largest market share in the refurbished & used mobile phones market due to their widespread appeal and versatility. These devices cater to the diverse needs of individual consumers, including personal use, communication, entertainment, and productivity.

The vast consumer base includes those looking for budget-friendly options, second devices, or specific features, making individual use the dominant driver of demand. Additionally, the availability of a wide range of models and price points within this category further reinforces its prominence in the market.

Business application on the other side are also likely to gain popularity in the years to come. Businesses are increasingly adopting cost-effective strategies, and purchasing refurbished devices in bulk can lead to substantial savings on mobile technology investments.

The availability of reliable, certified refurbished phones with warranty support makes them a viable option for corporate fleets. Lastly, the growth in remote work and the need for affordable yet capable mobile devices have fueled the demand for business-oriented refurbished smartphones.

Regional Frontrunners

North America Stands the Largest

The North American region has captured the largest market share in the refurbished and used mobile phones market for several reasons. Firstly, North American consumers have a strong appetite for the latest technology, leading to the frequent replacement of smartphones. This, in turn, supplies a steady stream of used devices to the market.

There is a growing awareness of environmental impact of electronic waste, driving interest in refurbished and used phones as more sustainable choices. Additionally, the presence of major smartphone manufacturers and retailers in North America has facilitated the development of robust refurbishment programs and the establishment of trusted channels for the resale of pre-owned devices.

Moreover, consumer preferences for premium models, even in the used segment, have further boosted market growth. Overall, these factors contribute to North America's dominant position in the refurbished & used mobile phones market.

Asia Pacific Likely to Witness Significant Growth in Sales During Forecast Period

Asia Pacific has a large and diverse consumer base that prioritises affordable mobile solutions, driving demand for used and refurbished devices. Expanding e-commerce infrastructure, and digital penetration make it easier for consumers to access these devices online. Rising environmental awareness also aligns with the sustainability benefits of buying refurbished.

The availability of a wide number of brands and models caters to diverse consumer preferences. These factors collectively contribute to the rapid demand of the refurbished & used mobile phones market in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The global refurbished and used mobile phones market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Refurbished and Used Mobile Phones Market space?

- Apple

- Samsung

- Amazon Renewed

- Gazelle

- Best Buy

- Decluttr

- Back Market

- Swappa

- Glyde

- BuyBack World

- GameStop

- uSell

- eBay

- GreenBuyback

- Quick Mobile Fix

Significant Company Developments

New Product Launches

- May 2022: Phixman has collaborated with Detel to offer refurbished premium smartphones at an affordable cost, complete with a warranty and all accompanying accessories. Moreover, it delivers cost-effective services across all its PAN India centers.

- April 2022: Samsung's Renewed online store now includes the Galaxy S21 series in its pre-owned selection, allowing customers to purchase these previously owned and refurbished devices. The Renewed store features attractive offers on relatively recent Samsung products. This initiative provides an opportunity for users who initially found the S21 range's high prices prohibitive to acquire these devices at a more budget-friendly cost, with Samsung offering them at just US$225.

Distribution Agreement

- March 2022: Apple has recently added the iPhone 12 and iPhone 12 Pro models to its official Certified Refurbished store. When you buy from Apple's Certified Refurbished store, you'll receive a brand-new battery, a fresh outer shell, and, if required, authentic Apple parts replacements. Additionally, these devices come with a comprehensive one-year warranty for added peace of mind.

From the Analyst's Perspective

Demand and Future Growth

As per Fairfield’s Analysis, the market demand for refurbished and used mobile phones continues to rise as consumers seek cost-effective and sustainable alternatives. With growing environmental awareness and the increasing lifespan of smartphones, this market is poised for significant future growth.

Advancements in refurbishment technologies, manufacturer-backed programs, and e-commerce integration are further driving this trend. As consumers prioritize affordability and reduced electronic waste, the refurbished and used mobile phones market is anticipated to expand, offering accessible options while contributing to a more sustainable tech ecosystem.

Supply Side of the Market

The leading regions/countries in the Refurbished and Used Mobile Phones Market include North America, particularly the United States, due to its robust demand for pre-owned devices and established refurbishment programs. The Asia Pacific region, including countries like India and China, is experiencing significant growth driven by a large and price-conscious consumer base.

Europe, with countries like the UK, Germany, and France, also plays an important role in the market, driven by sustainability initiatives and a growing preference for cost-effective mobile options. These regions/countries collectively shape the global refurbished and used mobile phone market.

The raw materials required in the Refurbished and Used Mobile Phones Market include components such as batteries, screens, casings, circuit boards, and connectors. These are sourced from a variety of suppliers, including electronic component manufacturers, recycling companies, and suppliers of refurbished phone parts.

Major suppliers in this industry may include companies like Samsung SDI, LG Chem, Panasonic, and various specialized suppliers that provide high-quality components for refurbishment processes. The supply chain for these materials is vital in ensuring the quality of refurbished devices in the market.

Global Refurbished and Used Mobile Phones Market is Segmented as Below:

By Type:

- Refurbished Phone

- Used Phone

By Price Range:

- Low Price (Below $200)

- Mid Price ($200 to $500)

- Premium (Above $500)

By Application:

- Individual

- Businesses

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Refurbished and Used Mobile Phones Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

3.1. Global Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Refurbished Phone

3.1.1.2. Used Phone

3.2. Global Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Low Price (Below $200)

3.2.1.2. Mid Price ($200 to $500)

3.2.1.3. Premium (Above $500)

3.3. Global Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Individual

3.3.1.2. Businesses

3.4. Global Refurbished and Used Mobile Phones Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

4.1. North America Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Refurbished Phone

4.1.1.2. Used Phone

4.2. North America Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Low Price (Below $200)

4.2.1.2. Mid Price ($200 to $500)

4.2.1.3. Premium (Above $500)

4.3. North America Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Individual

4.3.1.2. Businesses

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Refurbished and Used Mobile Phones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Refurbished and Used Mobile Phones Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Refurbished and Used Mobile Phones Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

5.1. Europe Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Refurbished Phone

5.1.1.2. Used Phone

5.2. Europe Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Low Price (Below $200)

5.2.1.2. Mid Price ($200 to $500)

5.2.1.3. Premium (Above $500)

5.3. Europe Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Individual

5.3.1.2. Businesses

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Refurbished and Used Mobile Phones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

6.1. Asia Pacific Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Refurbished Phone

6.1.1.2. Used Phone

6.2. Asia Pacific Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Low Price (Below $200)

6.2.1.2. Mid Price ($200 to $500)

6.2.1.3. Premium (Above $500)

6.3. Asia Pacific Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Individual

6.3.1.2. Businesses

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Refurbished and Used Mobile Phones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

7.1. Latin America Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Refurbished Phone

7.1.1.2. Used Phone

7.2. Latin America Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Low Price (Below $200)

7.2.1.2. Mid Price ($200 to $500)

7.2.1.3. Premium (Above $500)

7.3. Latin America Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Individual

7.3.1.2. Businesses

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Refurbished and Used Mobile Phones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Refurbished and Used Mobile Phones Market Outlook, 2018 - 2030

8.1. Middle East & Africa Refurbished and Used Mobile Phones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Refurbished Phone

8.1.1.2. Used Phone

8.2. Middle East & Africa Refurbished and Used Mobile Phones Market Outlook, by Price Range, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Low Price (Below $200)

8.2.1.2. Mid Price ($200 to $500)

8.2.1.3. Premium (Above $500)

8.3. Middle East & Africa Refurbished and Used Mobile Phones Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Individual

8.3.1.2. Businesses

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Refurbished and Used Mobile Phones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Refurbished and Used Mobile Phones Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Refurbished and Used Mobile Phones Market Price Range, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Refurbished and Used Mobile Phones Market Application, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Price Range Heatmap

9.2. Manufacturer vs Price Range Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Apple

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Samsung

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Amazon Renewed

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Gazelle

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Best Buy

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Decluttr

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Back Market

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Swappa

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Glyde

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. BuyBackWorld

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. GameStop

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. uSell

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. eBay

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. GreenBuyback

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Quick Mobile Fix

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Price Range Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |