Global Serum Free Media Market Forecast

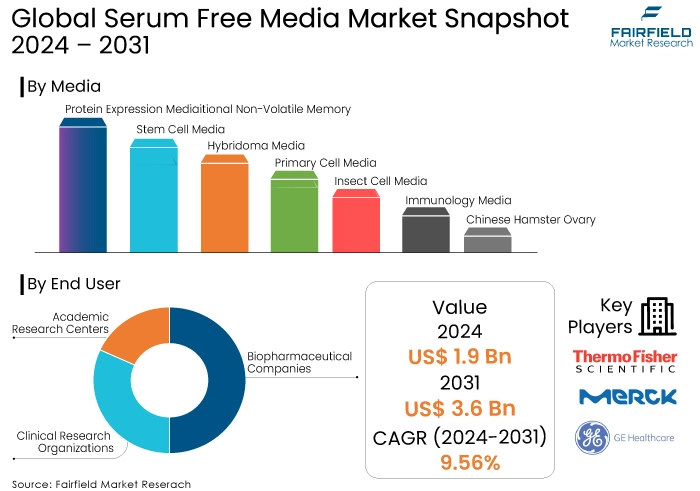

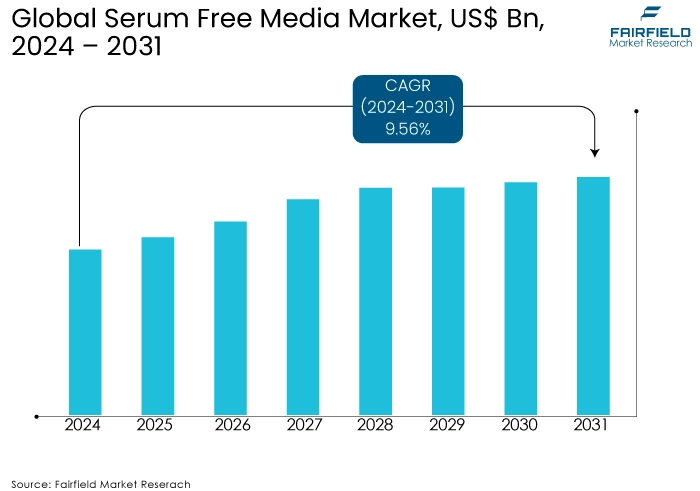

- Global serum free media market size to reach US$3.6 Bn in 2031, up from US$1.9 Bn estimated by the end of 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 9.56% during 2024 - 2031

Quick Report Digest

- Serum-free media offer advantages over traditional media, such as improved consistency, and reduced contamination risk.

- Major growth drivers include biopharmaceutical advancements, regulatory compliance requirements, and cost-effectiveness.

- Significant growth barriers include cost constraints, formulation complexity, and regulatory hurdles.

- Customised formulations present opportunities for tailored solutions in specific applications.

- Emerging markets in Asia Pacific, and Latin America offer growth potential due to increasing R&D activities.

- Regulatory environments significantly impact market dynamics, favouring regions with stringent regulations.

- Key segments driving demand include biopharmaceuticals, stem cell research, and diagnostic applications.

- Regional frontrunners in the global serum free media industry include North America, Europe, and Asia Pacific.

A Look Back and a Look Forward - Comparative Analysis

The serum free media market witnessed significant growth between 2019 and 2023, driven by factors like rising demand for cell-based therapies and increasing government funding for life science research. This growth was further fuelled by the advantages of serum-free media over traditional serum-containing media, such as improved consistency, reduced risk of contamination, and better defined cell culture conditions.

A comparative analysis for this period would reveal a steady rise in market size, potentially with a surge in recent years due to the COVID-19 pandemic and its focus on vaccine development and viral research. Looking ahead, the forecast for 2024-2031 remains optimistic due to several factors. The growing adoption of personalised medicine and the continued development of novel therapeutics are expected to propel market demand. Additionally, technological advancements in media formulations and bioreactor design are likely to enhance product efficacy and broaden application areas, creating further opportunities for market expansion.

Key Growth Determinants

- Biopharmaceutical Advancements

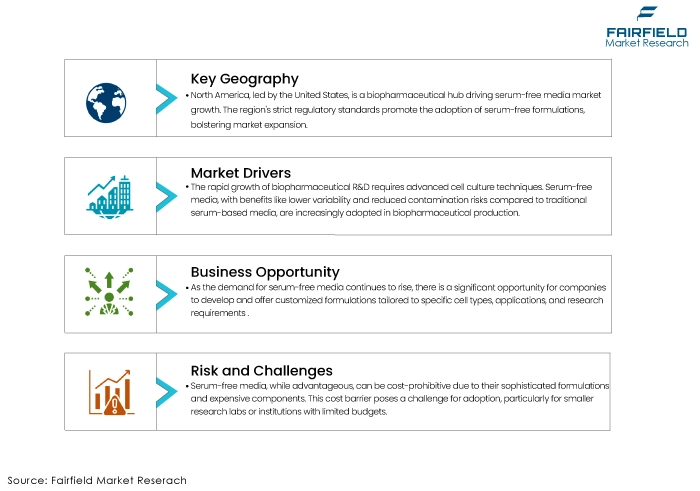

The rapid expansion of biopharmaceutical research and development necessitates sophisticated cell culture techniques. Serum-free media offer advantages such as reduced batch-to-batch variability and elimination of potential contaminants compared to traditional serum-based media, thus driving its adoption in biopharmaceutical production processes.

- Regulatory Compliance

Stringent regulations governing the safety, and quality of pharmaceutical products encourage the use of serum-free media in cell culture applications. As regulatory agencies increasingly emphasize the need for defined and animal-origin-free components in biopharmaceutical manufacturing, the demand for serum-free media continues to rise, especially in regions with strict regulatory frameworks like North America, and Europe.

- Cost Effectiveness, and Scalability

Serum-free media offer cost savings by reducing the need for expensive serum supplements and minimising downstream processing steps required for serum removal. Additionally, serum-free media formulations are often more scalable and reproducible, allowing for streamlined production processes and enhanced manufacturing efficiency. This cost-effectiveness and scalability drive the adoption of serum-free media across academic research institutions, contract research organisations, and biopharmaceutical companies, fostering market growth.

Major Growth Barriers

- Cost Constraints

Serum-free media often require more sophisticated formulations and expensive components compared to traditional serum-containing media. This increased cost can be a significant restraint for adoption, especially for smaller research laboratories or institutions with limited budgets.

- Complexity of Formulation

Developing serum-free media with comparable or superior performance to serum-containing media can be challenging due to the intricate balance of nutrients, growth factors, and supplements required for cell culture. The complexity of formulating such media may deter some researchers from transitioning away from serum-based protocols.

- Regulatory Challenges

Serum-free media development and usage may face regulatory hurdles, particularly in industries such as pharmaceuticals, where stringent regulations govern the use of cell culture systems for drug development and production. Compliance with regulatory requirements adds time and cost to the development and validation process, potentially slowing down market growth.

Key Trends and Opportunities to Look at –

- Increasing Demand for Customised Formulations

As the demand for serum-free media continues to rise, there is a significant opportunity for companies to develop and offer customised formulations tailored to specific cell types, applications, and research requirements. Customised media formulations can enhance cell growth, viability, and productivity, leading to improved research outcomes and higher yields in bioproduction processes. By leveraging advanced cell culture technologies and bioinformatics tools, companies can collaborate with research institutions and biopharmaceutical companies to design bespoke media solutions that address their unique needs and challenges.

- Expansion of CMOs in Developing Regions

The adoption of serum-free media is not limited to developed regions but is also gaining traction in emerging markets where biopharmaceutical R&D activities are expanding rapidly. Companies can capitalise on this opportunity by establishing strategic partnerships, distribution networks, and manufacturing facilities in key emerging markets such as Asia Pacific, and Latin America. By catering to the growing needs of biotechnology companies, academic research institutes, and contract manufacturing organisations in these regions, serum-free media suppliers can gain a competitive edge and strengthen their presence in the global market.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the serum-free media (SFM) market. Regions with well-defined regulations for biopharmaceutical manufacturing, especially biologics, tend to see a surge in SFM adoption. Clear guidelines ensure consistent and safe production, making SFM's defined components and reduced variability more attractive. Conversely, limited regulatory frameworks, like those in parts of Latin America, can hinder SFM uptake due to lower biopharmaceutical production activity.

Furthermore, regulatory policies that encourage research and development (R&D) spending in biopharmaceuticals and academia can fuel SFM growth. As research dives deeper into cell cultures and biologics, the need for more defined and controllable growth environments, like those provided by SFM, increases. In essence, regulations act as a guiding force. Supportive regulatory environments foster biopharmaceutical production, driving SFM demand. Conversely, stricter regulations or those limiting biopharmaceutical development can impede SFM market growth.

Fairfield’s Ranking Board

Top Segments

- Biopharmaceuticals Sector Represents the Key Segment

Biopharmaceuticals, including monoclonal antibodies, recombinant proteins, and vaccines, represent a key segment driving SFM demand. The shift towards biologics in pharmaceutical development fuels the need for specialised culture media devoid of animal-derived components. The market for SFM in biopharmaceuticals is characterised by continuous innovation, with manufacturers focusing on developing chemically defined media formulations tailored to specific cell types, and applications.

- Stem Cell Research Emerges as the Leading Application Area in Line with Commercialisation of Stem Cell Therapy

The stem cell research segment demonstrates significant growth within the SFM market due to the rising interest in regenerative medicine, and cell-based therapies. SFM provides an ideal environment for the expansion and maintenance of various stem cell types, offering reproducibility, and scalability crucial for research and clinical applications. As stem cell therapies advance toward commercialisation, the demand for SFM is expected to surge, driven by the need for standardised culture systems that ensure the safety and efficacy of therapeutic products.

- Leadership of Diagnostic Applications Prevails

The use of SFM in diagnostic applications is gaining momentum, driven by advancements in cell culture techniques and the growing emphasis on precision medicine. SFM facilitates the cultivation of primary cells and cell lines essential for in vitro diagnostics, including disease modelling, drug screening, and biomarker discovery. The adoption of SFM in diagnostic laboratories is propelled by its ability to support the growth of diverse cell types while maintaining physiological relevance, thus enabling accurate disease modelling and therapeutic efficacy assessment.

Regional Frontrunners

North America Dominant, Pioneers Biopharmaceutical Hub

In North America, especially the US, experiences significant growth driven by the region's pioneering position as a biopharmaceutical hub. The US boasts a robust biopharmaceutical sector supported by substantial research and development investments.

Moreover, the stringent regulatory environment in North America encourages the adoption of serum-free media formulations due to concerns regarding the safety and consistency of traditional serum-containing media. This regulatory push, coupled with the emphasis on innovation and quality in the biopharmaceutical industry, fosters the rapid expansion of the serum-free media market in the region.

Stringent Regulations Propel Adoption in Europe

Europe stands out as another prominent market for serum-free media, propelled by stringent regulations governing the use of animal-derived components in biopharmaceutical production. With a strong presence of biopharmaceutical companies and research institutions, Europe prioritises the adoption of serum-free alternatives to ensure compliance with regulatory standards while maintaining high product quality and safety.

This regulatory-driven demand, combined with the region's commitment to advancing biotechnology and pharmaceutical research, further boosts the adoption of serum-free media formulations.

Rapid Industrialisation Spurs Demand in Asia Pacific

In the Asia Pacific region, rapid industrialisation and increasing investments in healthcare infrastructure drive the demand for serum-free media in emerging biopharmaceutical markets. Countries such as China, India, and Japan witness a surge in biotechnology and pharmaceutical research activities, supported by government initiatives and growing private sector investments.

As these nations prioritise the development of their biopharmaceutical sectors, there is a growing need for advanced cell culture technologies, including serum-free media, to meet the demands of the expanding biopharmaceutical market. This rising focus on biotechnology and pharmaceutical research, coupled with the region's dynamic industrial landscape, positions the Asia Pacific region as a lucrative market for serum-free media, poised for significant growth in the coming years.

Fairfield’s Competitive Landscape Analysis

The serum free media market is characterised by intense competition driven by the rising demand for cell culture technologies across various industries such as biopharmaceuticals, biotechnology, and research institutions. Leading players in this landscape include Thermo Fisher Scientific, Merck KGaA, GE Healthcare, Lonza Group, and Corning Incorporated.

These companies employ various growth strategies to maintain their competitive edge, including mergers and acquisitions, strategic collaborations, product launches, and geographical expansions. Mergers and acquisitions enable companies to enhance their product portfolios and expand their market presence, while collaborations facilitate the development of innovative solutions and access to new markets.

Who are the Leaders in the Serum Free Media Market Space?

- Thermo Fisher Scientific Inc.

- Merck KGaA

- GE Healthcare

- Lonza

- Corning Incorporated

- Irvine Scientific

- STEMCELL Technologies

- PAN Biotech

- MP Biomedicals, LLC

- PromoCell GmbH

- Sartorius AG

Significant Company Developments

- February 2024: Bio-Tech Innovations unveiled a groundbreaking serum-free media product, SerumXpert™, designed to support the expansion and maintenance of various cell types in biopharmaceutical production. SerumXpert™ boasts enhanced nutrient formulations and superior cell viability, revolutionising cell culture workflows.

- March 2024: Witnessed the debut of CellGrowth Labs' novel serum-free media solution, CulturaPlus™. This advanced formulation provides optimal conditions for cell growth and productivity, catering to the evolving demands of bioprocessing applications with improved performance and scalability.

- April 2024: Biotech Supplies Inc. secured a strategic distribution agreement with GlobalBio Solutions, expanding the reach of its acclaimed serum-free media products across international markets. This collaboration aims to streamline access to high-quality cell culture solutions, empowering researchers and biopharmaceutical manufacturers worldwide.

- April 2024: RegenTech signed a distribution agreement with BioLabs Distributors, facilitating the widespread availability of its innovative serum-free media formulations. This partnership reinforces RegenTech's commitment to delivering cutting-edge solutions for cell culture applications, driving advancements in biotechnology research and production.

An Expert’s Eye

- Increasing Demand for Biopharmaceuticals

Both analysts agree that the rising demand for biopharmaceuticals, driven by factors like an aging population and the prevalence of chronic diseases, will fuel the growth of the serum-free media market. Serum-free media are essential for the cultivation of various cell types used in biopharmaceutical production, making them indispensable in the industry.

- Technological Advancements

The experts highlight ongoing technological advancements in cell culture techniques and media formulations. These advancements are leading to the development of more efficient and specialised serum-free media formulations, catering to the diverse needs of biopharmaceutical research and production. Such innovations are expected to attract investment and drive market growth.

- Regulatory Pressures, and Safety Concerns

Additionally, both analysts recognise the increasing regulatory pressures regarding the safety and consistency of biopharmaceutical products. Serum-free media offer advantages in terms of reducing the risk of contamination and variability compared to serum-containing media, aligning with regulatory requirements and addressing safety concerns.

The Global Serum Free Media Market is Segmented as Below:

By Media:

- Protein Expression Media

- Stem Cell Media

- Hybridoma Media

- Primary Cell Media

- Insect Cell Media

- Immunology Media

- Chinese Hamster Ovary (CHO) Cell Culture Media

By End User:

- Biopharmaceutical Companies

- Clinical Research Organisations

- Academic Research Centres

By Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East and Africa (MEA)

1. Executive Summary

1.1. Global Serum Free Media Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Serum Free Media Market Outlook, 2019 - 2031

3.1. Global Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Protein Expression Media

3.1.1.2. Stem Cell Media

3.1.1.3. Hybridoma Media

3.1.1.4. Primary Cell Media

3.1.1.5. Insect Cell Media

3.1.1.6. Immunology Media

3.1.1.7. CHO Cell Media

3.1.1.8. Chemically Defined Media

3.2. Global Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Biopharmaceutical Companies

3.2.1.2. Clinical Research Organizations

3.2.1.3. Academic Research Centers

3.3. Global Serum Free Media Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Serum Free Media Market Outlook, 2019 - 2031

4.1. North America Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Protein Expression Media

4.1.1.2. Stem Cell Media

4.1.1.3. Hybridoma Media

4.1.1.4. Primary Cell Media

4.1.1.5. Insect Cell Media

4.1.1.6. Immunology Media

4.1.1.7. CHO Cell Media

4.1.1.8. Chemically Defined Media

4.2. North America Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Biopharmaceutical Companies

4.2.1.2. Clinical Research Organizations

4.2.1.3. Academic Research Centers

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Serum Free Media Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Serum Free Media Market Outlook, 2019 - 2031

5.1. Europe Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Protein Expression Media

5.1.1.2. Stem Cell Media

5.1.1.3. Hybridoma Media

5.1.1.4. Primary Cell Media

5.1.1.5. Insect Cell Media

5.1.1.6. Immunology Media

5.1.1.7. CHO Cell Media

5.1.1.8. Chemically Defined Media

5.2. Europe Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Biopharmaceutical Companies

5.2.1.2. Clinical Research Organizations

5.2.1.3. Academic Research Centers

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Serum Free Media Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Serum Free Media Market Outlook, 2019 - 2031

6.1. Asia Pacific Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Protein Expression Media

6.1.1.2. Stem Cell Media

6.1.1.3. Hybridoma Media

6.1.1.4. Primary Cell Media

6.1.1.5. Insect Cell Media

6.1.1.6. Immunology Media

6.1.1.7. CHO Cell Media

6.1.1.8. Chemically Defined Media

6.2. Asia Pacific Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Biopharmaceutical Companies

6.2.1.2. Clinical Research Organizations

6.2.1.3. Academic Research Centers

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Serum Free Media Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Serum Free Media Market Outlook, 2019 - 2031

7.1. Latin America Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Protein Expression Media

7.1.1.2. Stem Cell Media

7.1.1.3. Hybridoma Media

7.1.1.4. Primary Cell Media

7.1.1.5. Insect Cell Media

7.1.1.6. Immunology Media

7.1.1.7. CHO Cell Media

7.1.1.8. Chemically Defined Media

7.2. Latin America Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Biopharmaceutical Companies

7.2.1.2. Clinical Research Organizations

7.2.1.3. Academic Research Centers

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Serum Free Media Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Serum Free Media Market Outlook, 2019 - 2031

8.1. Middle East & Africa Serum Free Media Market Outlook, by Media, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Protein Expression Media

8.1.1.2. Stem Cell Media

8.1.1.3. Hybridoma Media

8.1.1.4. Primary Cell Media

8.1.1.5. Insect Cell Media

8.1.1.6. Immunology Media

8.1.1.7. CHO Cell Media

8.1.1.8. Chemically Defined Media

8.2. Middle East & Africa Serum Free Media Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Biopharmaceutical Companies

8.2.1.2. Clinical Research Organizations

8.2.1.3. Academic Research Centers

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Serum Free Media Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Serum Free Media Market by Media, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Serum Free Media Market by End User, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End User Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Thermo Fisher Scientific Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Merck KGaA

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. GE Healthcare

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Lonza

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Corning Incorporated

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Irvine Scientific

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. STEMCELL Technologies

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. PAN Biotech

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. MP Biomedicals, LLC

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. PromoCell GmbH

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Sartorius AG

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Media Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |