Global Skincare Oil Market: Comprehensive Strategic Analysis

Executive Summary & Key Highlights

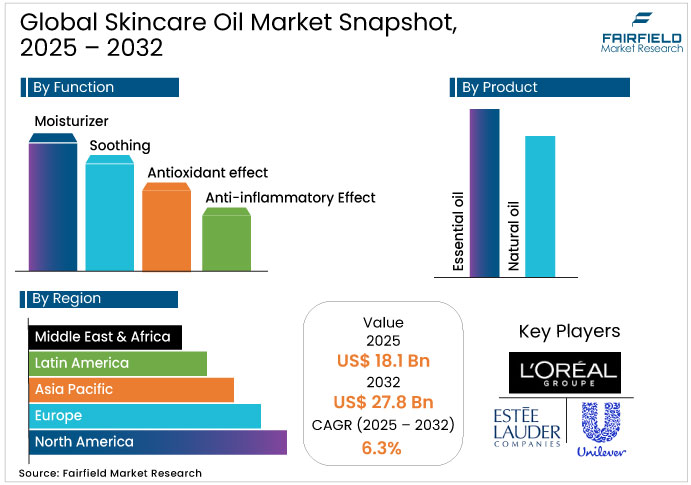

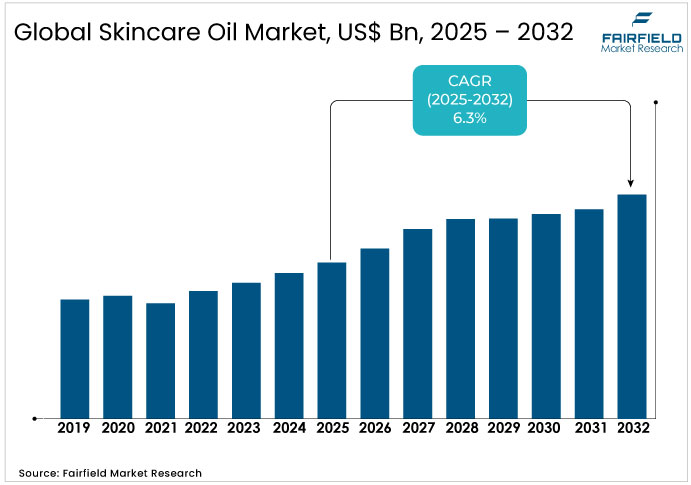

- The global Skincare Oil Market reached US$18.1 billion in 2025 and is projected to expand to US$27.8 billion by 2032, representing a CAGR of 6.3%.

- North America holds approximately 25% of the global skincare oil market, driven by premium, natural, and multifunctional formulations emphasising clean beauty and sustainability.

- Asia Pacific accounts for nearly 40% of the market, with China leading clean beauty growth through high digital adoption and venture-backed domestic brands.

- Natural oils dominate the market with a 60% share, led by coconut, jojoba, rosehip, almond, and argan oils, widely accepted across mass and premium channels.

- Essential oils are the fastest-growing segment, driven by aromatherapy-linked skincare, professional aesthetic applications, and therapeutic formulations.

- Moisturising applications lead with a 35% share, while the soothing segment is the fastest-growing, reflecting demand for barrier-supportive and anti-inflammatory oils.

Market Dynamics: Drivers, Restraints, and Opportunities Analysis

Market Drivers

- Consumer Demand for Natural and Organic Skincare Formulations

Consumer preference for plant-based and naturally derived ingredients remains a primary factor influencing the Skincare Oil Market. Botanical oils such as coconut, jojoba, almond, and argan are widely recognised for their efficacy and safety, fostering strong confidence among consumers.

The market reflects heightened attention to ingredient transparency and clean formulations, supported by certifications such as MADE SAFE® and ISO 16128 compliance, as seen in U.S. product launches like Sacred Rituel’s Sacred Serum™ and P2 Science’s CitroComplex® Nourish. These initiatives drive adoption in premium and speciality retail, reinforcing brand differentiation, consumer trust, and adherence to environmental and regulatory standards across the industry.

- Digital Commerce Infrastructure and Omnichannel Distribution Networks

Digital and e-commerce channels now constitute a significant avenue for Skincare Oil Market distribution, providing brands with direct engagement, detailed product information, and consumer feedback integration.

In Europe, e-commerce contributed 9.3% to the U.K.’s GDP in 2023, while cross-border online sales accounted for 80% of retail e-commerce in Luxembourg and 68.6% in Ireland, highlighting the efficiency of digital retail in connecting manufacturers with consumers.

In the Asia Pacific, China’s live-streaming commerce facilitates real-time interaction and purchase decisions for niche and premium skincare oils. Investment in digital infrastructure and regulatory harmonisation across borders continues to influence market reach, consumer accessibility, and competitive positioning.

Market Restraints

- Regulatory Compliance Complexity and Regional Variation

Skincare oil manufacturers face fragmented regulatory systems across key regions, creating compliance challenges and entry barriers. The EU mandates strict ingredient disclosure, safety documentation, and manufacturing standards, while Japan, South Korea, and India enforce region-specific frameworks that cannot be standardised globally.

This regulatory heterogeneity limits cross-regional product alignment and restricts smaller players from entering the market. Industry data shows compliance costs account for 8–12% of operating expenses, suppressing growth by 1–2 percentage points annually, giving established manufacturers with strong regulatory infrastructure a clear competitive advantage.

- Supply Chain Volatility and Raw Material Cost Exposure

Skincare oil products rely heavily on botanical ingredients that are exposed to climate variability, agricultural shifts, and commodity price fluctuations. Key oils such as argan, jojoba, rosehip, and coconut show inherent price volatility tied to agricultural output and global skincare oil market conditions.

Climate-driven supply disruptions in major producing regions trigger margin pressure or force retail price increases that affect demand. Companies with diversified sourcing and vertical integration gain stronger supply resilience, while those dependent on single-source or geographically concentrated procurement face heightened risk of supply interruptions and margin compression.

Market Opportunities

- Multifunctional Product Formulations and Segmentation Expansion

The Skincare Oil Market is increasingly shaped by multifunctional formulations that combine moisturising, antioxidant, and soothing properties, catering to consumer demand for simplified yet effective routines. Products targeting specific concerns such as sensitive, combination, or ageing skin enable brands to differentiate and command higher positioning in both premium and professional channels.

Evidence from launches like Sacred Rituel’s SPF 10 face oil and Omnisens’ soothing botanical oils highlights the appeal of oils that integrate multiple benefits, reinforcing consumer trust, supporting clinical credibility, and enhancing the potential for higher-value product segments.

- Sustainability and Eco-Conscious Packaging Innovation

Sustainability in packaging and ingredient sourcing continues to influence consumer preference in the Skincare Oil Market. Brands incorporating refillable bottles, biodegradable or compostable materials, and clear sustainability communication attract environmentally conscious buyers, particularly in mature markets such as North America and Europe.

The adoption of eco-focused practices strengthens brand reputation, allows for premium pricing, and creates competitive barriers for companies that neglect sustainability. Consumer research and market trends demonstrate that transparent environmental initiatives increasingly inform purchasing decisions in both physical and digital retail channels.

Regional Market Assessment: Strategic Geography Analysis

- North America: Mature Market with Premium Positioning

North America holds about 25% of the global skincare oil market, supported by affluent consumers with a preference for premium, sustainably sourced products. Growth is driven by natural and multifunctional oils, with clean beauty and high-performance formulations gaining traction. In October 2025, P2 Science launched CitroComplex® Nourish, combining U.S.-sourced meadowfoam seed oil and daikon radish seed extract to deliver a 99% natural, vegan-compliant ingredient for enhanced hydration and skin feel. Sacred Rituel’s July 2025 Sacred Serum™, the first broad-spectrum SPF 10 face oil made from raw, organic botanicals and MADE SAFE® certified, highlights demand for multifunctional and eco-conscious products.

Stringent U.S. regulations support ingredient safety and sustainability, promoting innovation. Key growth drivers include clean beauty certifications, multifunctional formulations, and premium segment expansion, while opportunities exist for brands offering certified, high-quality natural oils.

- Europe: Regulatory Harmonization and Sustainability Leadership

Europe holds around 16% of the global skincare oil market, driven by a mature retail and e-commerce ecosystem. In 2023, European e-commerce generated US$631.9 billion, with rapid digital adoption increasing access to premium natural oils.

Key markets like the U.K., Germany, and France show high per capita consumption and 60–70% online penetration. Consumer demand favours sustainable, plant-based formulations that comply with EU cosmetic regulations. Growth is supported by multinational and domestic players investing in R&D, multifunctional products, and clean, ingredient-focused oils, with e-commerce and premiumization offering strong investment opportunities.

- Asia Pacific: Differential Growth and Market Consolidation

Asia Pacific accounts for nearly 40% of the global skincare oil market, reflecting rapid consumer adoption of premium and natural skincare products. China, in particular, has become a key growth driver, with the clean beauty segment expanding significantly from 2023 to 2024. L’Oréal’s November 2025 investment in Lan, a Chinese clean-beauty brand, strengthens the natural oil segment by leveraging molecular oil extraction and botanical healing. Lan ranked number one in China’s facial oil sales volume during 2023–2024, with 100% independent R&D emphasising natural ingredients. Rising disposable incomes, urbanisation, and digital retail penetration, including e-commerce adoption, fuel demand for premium natural oils across the region.

Government support for sustainability and innovation, along with regulations encouraging safe and effective cosmetic products, further reinforces growth. Key growth drivers include increased consumer preference for clean, natural formulations, digital retail expansion, and interest in traditional botanical and multifunctional ingredients. Investment trends indicate rising venture capital and corporate backing for domestic clean beauty startups, creating opportunities for innovative natural oil products in skincare formulations.

Segmentation Analysis: Category-Wise Strategic Assessment

- By Product Type: Natural Oil vs. Essential Oil

Natural oils dominate the skincare oil market, holding approximately 60% of the global market share in 2025, driven by strong consumer familiarity, perceived efficacy, and ingredient transparency across demographic segments. This category includes coconut, jojoba, rosehip, almond, and argan oils, benefiting from established supply chains, regulatory acceptance, and broad distribution across both mass-market and premium retail channels.

Recent innovations highlight this dominance, with Palmer's Brazilian Coco Firming Oil showing firmer skin in 96% of users after eight weeks, while Omnisens' Reflets de Néroli leveraged 97% natural-origin ingredients, including camellia and sweet almond oils, to enhance sensorial wellness. The segment’s leadership underscores sustained demand for transparent, plant-based formulations that deliver tangible skincare benefits.

Essential oils are the fastest-growing segment, expanding at rates exceeding overall market growth, driven by rising use in aromatherapy-linked skincare, professional aesthetic treatments, and research-backed therapeutic applications, supporting premium positioning and specialised formulations.

- By Function: Moisturising Applications vs. Soothing and Therapeutic Functions

Moisturising applications lead the skincare oil market with a 35% share in 2025, driven by strong consumer awareness of hydration and barrier-repair benefits. Products like Oilixia’s vitamin-rich facial oil and Palmer’s deep-hydration cocoa butter oils reinforce demand for high-performance moisturising blends, with vitamins A, C, E, and omegas supporting long-term skin nourishment.

Everyday usage across skin types, climates, and demographics sustains the segment’s dominance, while dermatology-backed innovations such as CosMedical’s Complexion Renewal Oil strengthen clinical trust and category retention. Wide retail distribution and brand loyalty ensure stable volume in both premium and mass markets.

The soothing segment is the fastest-growing, fueled by rising sensitive skin concerns, inflammation, and demand for barrier-supportive formulations. Products like Omnisens’ Reflets de Néroli and Myra Veda’s Ayurvedic-infused oils highlight the consumer shift toward comfort-driven, restorative blends, with preference for natural, non-reactive ingredients accelerating segment growth.

- By Distribution Channel: Retail Consolidation vs. Digital and Professional Growth

Supermarkets and hypermarkets dominate the skincare oil distribution landscape with a 33% share in 2025, driven by wide product assortments, strong shelf visibility, and extensive access to mass and affordable natural oils. Palmer’s nationwide presence across these retail formats highlights the importance of physical stores for high-volume sales, where consumers value in-store comparisons and trust established chains.

Strategic shelf placements, loyalty programs, and competitive pricing further reinforce their leadership across North America, Europe, and Asia. Meanwhile, online channels are the fastest-growing segment, fueled by expanding digital adoption, convenience, and access to premium or niche skincare oils. Brands like Oilixia and CosMedical leverage expert-led marketing, detailed product information, and customer reviews to enhance discovery and conversion, supporting the rapid growth of e-commerce in the natural oil segment.

Competitive Landscape: Market Structure and Strategic Positioning

The competitive landscape of the global skincare oil market is moderately consolidated, leaning toward an oligopolistic structure where a handful of multinational companies exert significant control over distribution, branding, and R&D. L’Oréal Group, Unilever PLC, The Estée Lauder Companies Inc., Shiseido Company, Ltd., Procter & Gamble Co., and Beiersdorf AG are among the leading companies shaping market direction through heavy marketing, global supply chains, and broad retail reach.

These large companies compete on product innovation formulation, natural/clean-label positioning, and sustainable packaging, which raises barriers for smaller players. Niche and indie brands remain important, capturing consumer interest with specialised botanicals and direct-to-consumer models, but they struggle to match the scale and shelf presence of the majors.

Pricing pressure is intense at mass channels, while premium and prestige segments retain margin resilience for established companies. Ongoing consolidation through acquisitions and strategic partnerships is likely as incumbents seek rapid entry into trending niches and regional markets.

Key Players

- L’Oréal Group

- Unilever PLC

- The Estée Lauder Companies Inc.

- Shiseido Company, Ltd.

- Procter & Gamble Co.

- Beiersdorf AG

- Avon Products, Inc.

- Amway Corporation

- Chanel S.A.

- Johnson & Johnson

- Kao Corporation

- Henkel AG & Co. KGaA

- Edgewell Personal Care Company

- Mary Kay Inc.

- Coty Inc.

Recent Developments

- September 12, 2025 – Clean Food Group announced regulatory approval for its sustainable CLEAN Oil™ 25 to be used as a cosmetic ingredient across the United Kingdom, Europe, and the United States. Developed in collaboration with THG LABS and Croda, this milestone enables large-scale commercial application of biotech-derived oils in skincare formulations. The approval advances Clean Food Group’s CLEAN OilCell™ technology platform and opens opportunities for high-performance, sustainable skincare oils, reinforcing the growing shift toward biotech-driven innovation in the global cosmetics market.

- November 8, 2025 – Anatomy Naturals launched its new Plant Poetry Face Oils collection, introducing a handcrafted line of luxury natural face oils aimed at glowing skin, anti-aging benefits, and deep hydration. The range is formulated with high-performance botanical oils such as jojoba, rosehip, sacha inchi, meadowfoam, and sea buckthorn, catering to women aged 30+ seeking plant-based, dermatologist-recommended skincare. The launch strengthens the company's presence in the premium natural skincare oil segment by offering small-batch, sensory-rich formulations that align with rising demand for clean, results-driven face oils.

- November 12, 2024 – Finally All Natural announced the launch of its new line of natural skincare products, featuring its scientifically validated Finally All Natural Face Oil as the flagship innovation. The face oil enhances filaggrin levels in the skin, strengthening the moisture barrier and improving hydration, resilience, and overall skin health. The company also introduced complementary products including a Scalp Oil and Beard Oil, expanding its presence in the natural skincare oil segment with formulations made from premium U.S. and U.K.–sourced ingredients.

Global Skincare Oil Market Segmentation-

By Product

- Essential oil

- Natural oil

By Function

- Moisturizer

- Soothing

- Antioxidant effect

- Anti-inflammatory Effect

- Others

By Distribution channel

- Supermarkets & Hypermarkets

- Pharmacies & drug stores

- Specialty Stores

- Online

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Skincare Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Skincare Oil Market Outlook, 2019 - 2032

3.1. Global Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

3.1.1. Essential oil

3.1.2. Natural oil

3.2. Global Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

3.2.1. Moisturizer

3.2.2. Soothing

3.2.3. Antioxidant effect

3.2.4. Anti-inflammatory Effect

3.2.5. Others

3.3. Global Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

3.3.1. Supermarkets & Hypermarkets

3.3.2. Pharmacies & drug stores

3.3.3. Specialty Stores

3.3.4. Online

3.3.5. Others

3.4. Global Skincare Oil Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Skincare Oil Market Outlook, 2019 - 2032

4.1. North America Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

4.1.1. Essential oil

4.1.2. Natural oil

4.2. North America Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

4.2.1. Moisturizer

4.2.2. Soothing

4.2.3. Antioxidant effect

4.2.4. Anti-inflammatory Effect

4.2.5. Others

4.3. North America Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

4.3.1. Supermarkets & Hypermarkets

4.3.2. Pharmacies & drug stores

4.3.3. Specialty Stores

4.3.4. Online

4.3.5. Others

4.4. North America Skincare Oil Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.4.1. U.S. Skincare Oil Market Outlook, by Product, 2019-2032

4.4.2. U.S. Skincare Oil Market Outlook, by Function, 2019-2032

4.4.3. U.S. Skincare Oil Market Outlook, by Distribution channel, 2019-2032

4.4.4. Canada Skincare Oil Market Outlook, by Product, 2019-2032

4.4.5. Canada Skincare Oil Market Outlook, by Function, 2019-2032

4.4.6. Canada Skincare Oil Market Outlook, by Distribution channel, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Skincare Oil Market Outlook, 2019 - 2032

5.1. Europe Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

5.1.1. Essential oil

5.1.2. Natural oil

5.2. Europe Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

5.2.1. Moisturizer

5.2.2. Soothing

5.2.3. Antioxidant effect

5.2.4. Anti-inflammatory Effect

5.2.5. Others

5.3. Europe Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

5.3.1. Supermarkets & Hypermarkets

5.3.2. Pharmacies & drug stores

5.3.3. Specialty Stores

5.3.4. Online

5.3.5. Others

5.4. Europe Skincare Oil Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.4.1. Germany Skincare Oil Market Outlook, by Product, 2019-2032

5.4.2. Germany Skincare Oil Market Outlook, by Function, 2019-2032

5.4.3. Germany Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.4. Italy Skincare Oil Market Outlook, by Product, 2019-2032

5.4.5. Italy Skincare Oil Market Outlook, by Function, 2019-2032

5.4.6. Italy Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.7. France Skincare Oil Market Outlook, by Product, 2019-2032

5.4.8. France Skincare Oil Market Outlook, by Function, 2019-2032

5.4.9. France Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.10. U.K. Skincare Oil Market Outlook, by Product, 2019-2032

5.4.11. U.K. Skincare Oil Market Outlook, by Function, 2019-2032

5.4.12. U.K. Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.13. Spain Skincare Oil Market Outlook, by Product, 2019-2032

5.4.14. Spain Skincare Oil Market Outlook, by Function, 2019-2032

5.4.15. Spain Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.16. Russia Skincare Oil Market Outlook, by Product, 2019-2032

5.4.17. Russia Skincare Oil Market Outlook, by Function, 2019-2032

5.4.18. Russia Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.4.19. Rest of Europe Skincare Oil Market Outlook, by Product, 2019-2032

5.4.20. Rest of Europe Skincare Oil Market Outlook, by Function, 2019-2032

5.4.21. Rest of Europe Skincare Oil Market Outlook, by Distribution channel, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Skincare Oil Market Outlook, 2019 - 2032

6.1. Asia Pacific Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

6.1.1. Essential oil

6.1.2. Natural oil

6.2. Asia Pacific Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

6.2.1. Moisturizer

6.2.2. Soothing

6.2.3. Antioxidant effect

6.2.4. Anti-inflammatory Effect

6.2.5. Others

6.3. Asia Pacific Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

6.3.1. Supermarkets & Hypermarkets

6.3.2. Pharmacies & drug stores

6.3.3. Specialty Stores

6.3.4. Online

6.3.5. Others

6.4. Asia Pacific Skincare Oil Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.4.1. China Skincare Oil Market Outlook, by Product, 2019-2032

6.4.2. China Skincare Oil Market Outlook, by Function, 2019-2032

6.4.3. China Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.4.4. Japan Skincare Oil Market Outlook, by Product, 2019-2032

6.4.5. Japan Skincare Oil Market Outlook, by Function, 2019-2032

6.4.6. Japan Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.4.7. South Korea Skincare Oil Market Outlook, by Product, 2019-2032

6.4.8. South Korea Skincare Oil Market Outlook, by Function, 2019-2032

6.4.9. South Korea Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.4.10. India Skincare Oil Market Outlook, by Product, 2019-2032

6.4.11. India Skincare Oil Market Outlook, by Function, 2019-2032

6.4.12. India Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.4.13. Southeast Asia Skincare Oil Market Outlook, by Product, 2019-2032

6.4.14. Southeast Asia Skincare Oil Market Outlook, by Function, 2019-2032

6.4.15. Southeast Asia Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.4.16. Rest of SAO Skincare Oil Market Outlook, by Product, 2019-2032

6.4.17. Rest of SAO Skincare Oil Market Outlook, by Function, 2019-2032

6.4.18. Rest of SAO Skincare Oil Market Outlook, by Distribution channel, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Skincare Oil Market Outlook, 2019 - 2032

7.1. Latin America Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

7.1.1. Essential oil

7.1.2. Natural oil

7.2. Latin America Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

7.2.1. Moisturizer

7.2.2. Soothing

7.2.3. Antioxidant effect

7.2.4. Anti-inflammatory Effect

7.2.5. Others

7.3. Latin America Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

7.3.1. Supermarkets & Hypermarkets

7.3.2. Pharmacies & drug stores

7.3.3. Specialty Stores

7.3.4. Online

7.3.5. Others

7.4. Latin America Skincare Oil Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.4.1. Brazil Skincare Oil Market Outlook, by Product, 2019-2032

7.4.2. Brazil Skincare Oil Market Outlook, by Function, 2019-2032

7.4.3. Brazil Skincare Oil Market Outlook, by Distribution channel, 2019-2032

7.4.4. Mexico Skincare Oil Market Outlook, by Product, 2019-2032

7.4.5. Mexico Skincare Oil Market Outlook, by Function, 2019-2032

7.4.6. Mexico Skincare Oil Market Outlook, by Distribution channel, 2019-2032

7.4.7. Argentina Skincare Oil Market Outlook, by Product, 2019-2032

7.4.8. Argentina Skincare Oil Market Outlook, by Function, 2019-2032

7.4.9. Argentina Skincare Oil Market Outlook, by Distribution channel, 2019-2032

7.4.10. Rest of LATAM Skincare Oil Market Outlook, by Product, 2019-2032

7.4.11. Rest of LATAM Skincare Oil Market Outlook, by Function, 2019-2032

7.4.12. Rest of LATAM Skincare Oil Market Outlook, by Distribution channel, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Skincare Oil Market Outlook, 2019 - 2032

8.1. Middle East & Africa Skincare Oil Market Outlook, by Product, Value (US$ Bn), 2019-2032

8.1.1. Essential oil

8.1.2. Natural oil

8.2. Middle East & Africa Skincare Oil Market Outlook, by Function, Value (US$ Bn), 2019-2032

8.2.1. Moisturizer

8.2.2. Soothing

8.2.3. Antioxidant effect

8.2.4. Anti-inflammatory Effect

8.2.5. Others

8.3. Middle East & Africa Skincare Oil Market Outlook, by Distribution channel, Value (US$ Bn), 2019-2032

8.3.1. Supermarkets & Hypermarkets

8.3.2. Pharmacies & drug stores

8.3.3. Specialty Stores

8.3.4. Online

8.3.5. Others

8.4. Middle East & Africa Skincare Oil Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.4.1. GCC Skincare Oil Market Outlook, by Product, 2019-2032

8.4.2. GCC Skincare Oil Market Outlook, by Function, 2019-2032

8.4.3. GCC Skincare Oil Market Outlook, by Distribution channel, 2019-2032

8.4.4. South Africa Skincare Oil Market Outlook, by Product, 2019-2032

8.4.5. South Africa Skincare Oil Market Outlook, by Function, 2019-2032

8.4.6. South Africa Skincare Oil Market Outlook, by Distribution channel, 2019-2032

8.4.7. Egypt Skincare Oil Market Outlook, by Product, 2019-2032

8.4.8. Egypt Skincare Oil Market Outlook, by Function, 2019-2032

8.4.9. Egypt Skincare Oil Market Outlook, by Distribution channel, 2019-2032

8.4.10. Nigeria Skincare Oil Market Outlook, by Product, 2019-2032

8.4.11. Nigeria Skincare Oil Market Outlook, by Function, 2019-2032

8.4.12. Nigeria Skincare Oil Market Outlook, by Distribution channel, 2019-2032

8.4.13. Rest of Middle East Skincare Oil Market Outlook, by Product, 2019-2032

8.4.14. Rest of Middle East Skincare Oil Market Outlook, by Function, 2019-2032

8.4.15. Rest of Middle East Skincare Oil Market Outlook, by Distribution channel, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. L’Oréal Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Unilever PLC

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. The Estée Lauder Companies Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Shiseido Company, Ltd.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Procter & Gamble Co.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Beiersdorf AG

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Avon Products, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Amway Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Chanel S.A.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Johnson & Johnson

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Product Coverage |

|

|

By Function Coverage |

|

|

By Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |