Smart Home Appliances Market Growth and Industry Forecast

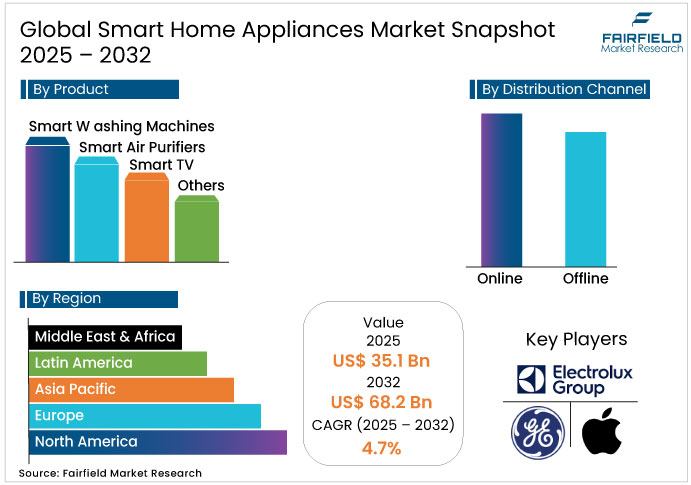

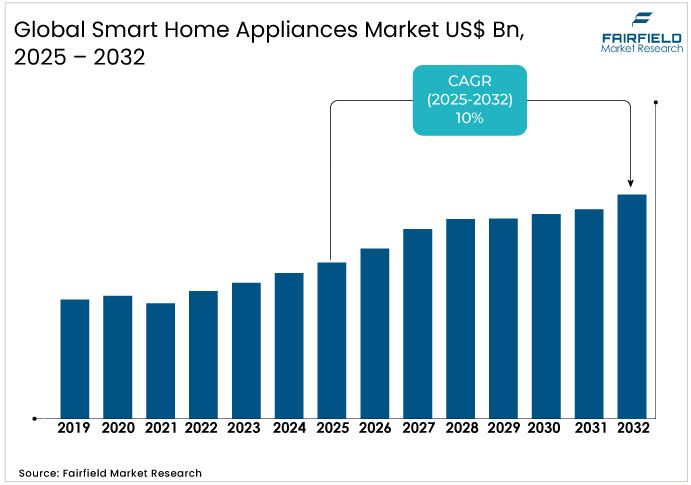

- The global smart home appliances market is projected to be valued at US$35.1 Bn in 2025.

- It is expected to reach US$68.2 Bn by 2032, growing at a CAGR of 10% between 2025 and 2032.

Smart Home Appliances Market Summary: Key Insights & Trends

- Smart washing machines lead the product segment with over 35% share in 2024, driven by energy optimization and voice-assistant integration.

- Smart air purifiers are the fastest-growing product segment, projected at 8% CAGR through 2032 due to health awareness and urban pollution.

- Wireless technologies dominate protocols with 62% share in 2025, reducing installation costs by 40% and enabling seamless multi-device connectivity.

- Wired protocols grow fastest at 9% CAGR, offering enhanced security and stability for energy-intensive appliances.

- Offline distribution holds 65% share in 2024, while online channels expand at 15% CAGR with AR-enabled shopping and fast delivery.

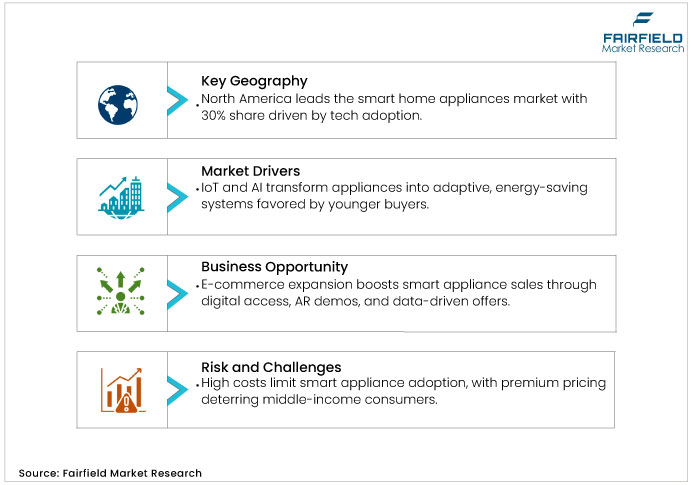

- IoT and AI integration drives growth by enabling seamless connectivity, automation, and personalized user experiences.

- Health and wellness-focused appliances present a major opportunity, with the segment forecast to grow at a 12% CAGR through advanced features and partnerships.

- Asia Pacific emerges as the fastest-growing region, expected to capture a 35% share by 2032 with a 14.5% CAGR led by China, India, and Japan.

A Look Back and a Look Forward - Comparative Analysis

The smart home appliances market witnessed notable fluctuations between 2019 and 2024, largely shaped by the COVID-19 pandemic, which accelerated digital adoption and altered consumer priorities. Valued at around US$ 22 Bn in 2019, the market expanded at nearly 8% CAGR on the back of early IoT integrations and growing smart home awareness. The pandemic in 2020 caused a temporary setback, with supply chain disruptions in manufacturing hubs such as China leading to a 5–7% decline in shipments. By 2021, recovery was swift as the market reached US$27 Bn, driven by surging online sales up more than 50% in the U.S. and Europe as consumers invested in smart air purifiers for health and smart TVs for entertainment. From 2022 to 2024, growth stabilized, with the market achieving US$32 Bn by 2024, supported by post-pandemic recovery, stronger cybersecurity measures, and European incentives for energy-efficient appliances. Despite progress, high upfront costs limited adoption in developing economies.

Looking forward, the smart home appliances market is expected to witness a strong expansion through the forecast period, maintaining a steady growth rate of around 10% annually. Growth is underpinned by AI-driven personalization, 5G connectivity, and sustainable technologies. Wireless protocols will dominate, with smart washing machines and air purifiers leading adoption. Asia Pacific is poised to be the fastest-growing region, with China and India driving urban demand and potentially accounting for 40% of global share by 2030. Opportunities lie in predictive maintenance, eco-friendly designs, and e-commerce expansion, though challenges around data security and interoperability remain.

Key Growth Drivers

- Increasing Adoption of IoT and AI Technologies in the Smart Home Appliances Market

The integration of IoT and AI has become a vital growth driver, turning appliances into intelligent systems that adapt to user preferences and automate tasks. For instance, smart washing machines use AI to optimize wash cycles by fabric and load, lowering energy consumption by 15–25%. This innovation appeals to millennials and Gen Z, who represent over half of new buyers, while supporting sustainability goals. According to the International Energy Agency's Net Zero Scenario, the average appliance in use will consume about 25% less energy by 2030 compared with 2020. Voice assistants improve accessibility, while 5G enables predictive maintenance and extended lifespans.

- Rising Consumer Demand for Energy Efficiency and Sustainability in the Smart Home Appliances

Energy efficiency has become a central growth driver as consumers prioritize eco-friendly solutions in response to rising energy costs and climate pressures. Devices such as smart air purifiers and TVs now use sensors to optimize power, reducing bills by up to 25% - 30% compared to traditional models, according to the U.S. Department of Energy. A 2024 survey found 65% of buyers factor sustainability into decisions, with Europe leading adoption under strict energy labeling rules. Sales of low-emission appliances such as wireless refrigerators rose, supported by incentives in the U.S. and Germany. In the smart home appliances market, manufacturers are increasingly adopting recyclable materials and partnering with energy firms, such as Samsung’s solar-integrated solutions, aligning with renewable energy goals and enabling premium pricing.

Key Growth Restraints

- High Upfront Costs Limiting Adoption and Accessibility Across Global Households

High upfront costs continue to act as a major restraint, limiting adoption among middle-income and rural households. Advanced features such as AI-enabled washing machines and wireless air purifiers are priced 30–50% higher than traditional models, making them less accessible. In cost-sensitive regions such as Southeast Asia, adoption remains below 20% due to low household incomes, while additional expenses such as Wi-Fi upgrades deter nearly 40% of potential buyers. Although premium categories perform well, offline retailers face challenges convincing budget-conscious shoppers. In the smart home appliances market, the absence of affordable entry-level models restricts penetration in developing economies and slows broader expansion.

- Cybersecurity Risks and Privacy Concerns Threaten Connected Device Consumer Trust

Cybersecurity and privacy concerns significantly hinder adoption, as smart devices remain vulnerable to hacking and data breaches. The 2023 Mirai botnet attack on IoT appliances highlighted risks, causing 10–15% purchase hesitation. Cloud-stored data in devices such as smart TVs raises surveillance fears, especially in the EU under GDPR, where non-compliance fines deter manufacturers. Limited standardization worsens interoperability issues, exposing users to unauthorized access. Recent polls show 25% of owners express privacy worries, slowing adoption in smart home appliances market. Without robust encryption and stronger regulatory frameworks, these risks will continue to restrict momentum, particularly in regions where consumers are highly privacy-conscious.

Smart Home Appliances Market Trends and Opportunities

- Rising E-Commerce and Online Channels Unlock Growth in Connected Devices

The rapid growth of e-commerce offers a major opportunity as digital platforms make connected appliances more accessible. Online retail is projected to expand at 15% CAGR through 2030, with channels expected to secure 40% share by 2028. Benefits such as convenience, virtual demos, and personalized recommendations are driving conversion rates up by 25%. Post-COVID, platforms such as Amazon have introduced AR previews for appliances, lowering return rates and improving engagement. In Asia Pacific, where smartphone penetration exceeds 70%, affordable data plans are enabling impulse purchases of wireless-enabled devices. Manufacturers are also leveraging data analytics for targeted promotions, such as bundling smart washing machines with adapters to encourage upselling. With scalability supporting flash sales and subscription-based maintenance, online channels are unlocking new revenue streams. Partnerships with leading tech companies will further accelerate adoption, turning digital distribution into a key growth driver.

- Health and Wellness Integrations Create Premium Opportunities for Smart Devices

Advancements in health-focused features are creating strong opportunities, closely tied to post-pandemic wellness trends. Demand for smart air purifiers with HEPA filters and real-time monitoring has surged by 20%, appealing to allergy sufferers and aging populations. Beyond purifiers, biometric sensors in TVs for posture alerts or hypoallergenic washing machine cycles support premium pricing. The wellness-focused segment is expected to grow at 12% CAGR, further validated by regulatory support such as U.S. FDA approvals for health-tracking technologies. AI-driven personalization, such as app-based air quality adjustments, enhances retention and user experience. Significant B2B potential also exists in elderly care, where integrated systems enable remote health monitoring, potentially unlocking billions in niche revenues. Partnerships with telemedicine platforms and fitness apps are set to expand these opportunities, positioning connected appliances as holistic wellness enablers and fostering inclusive growth across diverse demographics.

Segment-wise Trends & Analysis

- Smart Washing Machines Lead While Air Purifiers Emerge as Fastest Growing in Smart Home Appliances Market

Smart washing machines lead the product segment with over 35% share in 2024, driven by their essential role, app-based customization, and energy optimization. Their appeal to busy consumers is further boosted by voice assistant integration, supporting steady growth. Smart air purifiers are the fastest-growing sub-segment, projected at 13.8% CAGR through 2032, fueled by post-COVID health awareness and rising urban pollution in cities such as Delhi and Beijing. Equipped with IoT sensors for real-time adjustments and wireless portability, they see rising demand in homes and businesses. Smart TVs sustain 8–9% growth through entertainment ecosystems, while refrigerators and other appliances add diversity. Together, leading and fast-growing categories ensure stability and innovation, driving expansion.

- Wireless Technologies Dominate as Wired Protocols Show Niche Growth Potential

Wireless technologies lead connectivity with about 62% share in 2025, powered by Wi-Fi and Bluetooth that enable flexibility, remote access, and reduced installation costs. Adoption has risen 25% annually, reinforced by 5G rollout, enabling low-latency performance across devices. This dominance reflects consumer preference for seamless ecosystems and convenience. Meanwhile, wired protocols, though smaller in scale, are the fastest-growing niche at 9% CAGR. They provide stable data transfer for energy-intensive tasks such as smart washing machines, offering enhanced security and reliability valued in enterprise and premium segments. Wired options also reduce latency in congested networks, appealing to around 15% of high-end buyers. The future lies in hybrid models that merge wireless convenience with wired stability, driving interoperability and supporting long-term expansion of connected solutions.

- Offline Stores Maintain Lead While Online Distribution Surges with E-Commerce

Offline channels dominate distribution with a 65% share in 2024, as consumers prefer in-store demonstrations of appliances such as smart washing machines and air purifiers. Retailers such as Best Buy and hypermarkets build trust through expert guidance and immediate availability, supporting growth. However, online platforms are expanding fastest at 15% CAGR, boosted by post-COVID digital adoption and a 50% sales surge from 2020 to 2022. E-commerce giants such as Amazon drive growth with AR previews, rapid delivery, and promotions, resonating with millennials who value convenience and reviews. In emerging economies, rising smartphone use and digital payments are expected to lift online penetration to 35% by 2030. This dual-channel approach combines offline reliability with online scalability, ensuring broad accessibility and sustaining overall market expansion at a robust pace.

Regional Trends & Analysis

- North America Leads Adoption with Strong Infrastructure and Energy-Efficient Demand

North America dominates the smart home appliances market with over 30% global share in 2025, driven by advanced infrastructure and high-tech adoption. The U.S. Market, valued at US$8 Bn, exhibits trends such as widespread 5G integration and AI enhancements in smart washing machines, with a 11.6% CAGR fueled by consumer spending on energy-efficient devices amid rising electricity costs. Key drivers include government incentives such as the Inflation Reduction Act rebates and a tech-savvy population, where 55% of households own at least one smart appliance, per Statista. Urban trends in cities such as New York emphasize health-focused air purifiers, while expansions in smart TV ecosystems via partnerships with streaming services boost entertainment segments.

- Europe Strengthens Growth Through Energy Regulations and Sustainability Initiatives

Europe holds a 25% share in the smart home appliances market, with leading countries Germany, UK, and France driving growth through stringent energy regulations and innovation hubs. Germany's Market leads with US$2 Bn in 2025, propelled by EU Green Deal subsidies for wireless appliances, achieving a 9% CAGR via sustainable manufacturing. The UK focuses on post-Brexit smart home incentives, emphasizing cybersecurity in protocols, while France's trends highlight smart air purifiers amid urban pollution. Drivers include high internet penetration (90%) and eco-conscious consumers, fostering M&A for localized production.

- Asia Pacific Emerges Fastest Growing Region Driven by Urbanization and IoT

Asia Pacific is the fastest-growing region in the smart home appliances market at 14.5% CAGR, capturing 35% share by 2032, led by China, India, and Japan. China's Market in 2025 is driven by state-backed IoT initiatives and manufacturing prowess, with smart TVs booming via e-commerce giants such as Alibaba. India's growth stems from urbanization and affordable wireless devices, while Japan's aging population boosts health appliances such as air purifiers. Rising middle-class incomes (US$10 Tn economy boost) and 5G rollout, enabling seamless protocol adoption.

Competitive Landscape Analysis

The smart home appliances market features intense competition among global giants focusing on innovation, partnerships, and sustainability. Key players such as Samsung Electronics and LG Electronics focus on AI-integrated ecosystems, with Samsung's SmartThings platform unifying devices for 20% market penetration. Whirlpool emphasizes sustainability via energy-efficient lines, while Haier pursues M&A for localized production. Xiaomi targets affordability in emerging markets with budget wireless appliances, capturing 15% APAC share.

Key Companies

- Apple Inc.

- BSH Hausgeräte / Robert Bosch GmbH

- Electrolux Group (Electrolux AB)

- GE Appliances (General Electric Co.)

- Godrej Appliances

- Haier Group (Haier Smart Home Co. Ltd.)

- LG Electronics Inc.

- Midea Group Co. Ltd.

- Miele & Cie. KG

- Mitsubishi Electric Corp.

- Panasonic Corporation

- Philips (Koninklijke Philips N.V.)

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Whirlpool Corporation

- Xiaomi Corporation

Recent Developments:

- January 2025, Samsung expanded its Bespoke AI laundry portfolio in India, releasing new AI washers with predictive cleaning features that use machine learning to optimize wash cycles. Samsung offers Bespoke AI washers in the US market, but the January 2025 announcement specified the India expansion.

- In July 2024, LG acquired an 80% stake in Netherlands-based smart home company Athom to enhance protocol interoperability and advance its AI-enabled smart home ecosystem. There is no information connecting this acquisition to a specific 15% increase in smart TV sales.

- In March 2025, Haier Group announced a factory expansion in India, investing in new facilities at its Greater Noida plant. The focus of this investment is primarily on increasing the production of air conditioners and establishing a new plant for printed circuit boards (PCBs) for various home appliances, not specifically affordable air purifiers.

Global Smart Home Appliances Market Segmentation-

By Product

- Smart Washing Machines

- Smart Air Purifiers

- Smart TV

- Others

By Protocol

- Wired

- Wireless

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Smart Home Appliances Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Smart Home Appliances Market Outlook, 2019 - 2032

3.1. Global Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

3.1.1. Smart Washing Machines

3.1.2. Smart Air Purifiers

3.1.3. Smart TV

3.1.4. Others

3.2. Global Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

3.2.1. Wired

3.2.2. Wireless

3.3. Global Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

3.3.1. Online

3.3.2. Offline

3.4. Global Smart Home Appliances Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Smart Home Appliances Market Outlook, 2019 - 2032

4.1. North America Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

4.1.1. Smart Washing Machines

4.1.2. Smart Air Purifiers

4.1.3. Smart TV

4.1.4. Others

4.2. North America Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

4.2.1. Wired

4.2.2. Wireless

4.3. North America Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

4.3.1. Online

4.3.2. Offline

4.4. North America Smart Home Appliances Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.4.1. U.S. Smart Home Appliances Market Outlook, by Product, 2019-2032

4.4.2. U.S. Smart Home Appliances Market Outlook, by Protocol, 2019-2032

4.4.3. U.S. Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

4.4.4. Canada Smart Home Appliances Market Outlook, by Product, 2019-2032

4.4.5. Canada Smart Home Appliances Market Outlook, by Protocol, 2019-2032

4.4.6. Canada Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Smart Home Appliances Market Outlook, 2019 - 2032

5.1. Europe Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

5.1.1. Smart Washing Machines

5.1.2. Smart Air Purifiers

5.1.3. Smart TV

5.1.4. Others

5.2. Europe Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

5.2.1. Wired

5.2.2. Wireless

5.3. Europe Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

5.3.1. Online

5.3.2. Offline

5.4. Europe Smart Home Appliances Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.4.1. Germany Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.2. Germany Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.3. Germany Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.4. Italy Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.5. Italy Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.6. Italy Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.7. France Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.8. France Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.9. France Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.10. U.K. Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.11. U.K. Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.12. U.K. Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.13. Spain Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.14. Spain Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.15. Spain Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.16. Russia Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.17. Russia Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.18. Russia Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.4.19. Rest of Europe Smart Home Appliances Market Outlook, by Product, 2019-2032

5.4.20. Rest of Europe Smart Home Appliances Market Outlook, by Protocol, 2019-2032

5.4.21. Rest of Europe Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Smart Home Appliances Market Outlook, 2019 - 2032

6.1. Asia Pacific Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

6.1.1. Smart Washing Machines

6.1.2. Smart Air Purifiers

6.1.3. Smart TV

6.1.4. Others

6.2. Asia Pacific Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

6.2.1. Wired

6.2.2. Wireless

6.3. Asia Pacific Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

6.3.1. Online

6.3.2. Offline

6.4. Asia Pacific Smart Home Appliances Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.4.1. China Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.2. China Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.3. China Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.4.4. Japan Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.5. Japan Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.6. Japan Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.4.7. South Korea Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.8. South Korea Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.9. South Korea Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.4.10. India Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.11. India Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.12. India Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.4.13. Southeast Asia Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.14. Southeast Asia Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.15. Southeast Asia Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.4.16. Rest of SAO Smart Home Appliances Market Outlook, by Product, 2019-2032

6.4.17. Rest of SAO Smart Home Appliances Market Outlook, by Protocol, 2019-2032

6.4.18. Rest of SAO Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Smart Home Appliances Market Outlook, 2019 - 2032

7.1. Latin America Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

7.1.1. Smart Washing Machines

7.1.2. Smart Air Purifiers

7.1.3. Smart TV

7.1.4. Others

7.2. Latin America Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

7.2.1. Wired

7.2.2. Wireless

7.3. Latin America Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

7.3.1. Online

7.3.2. Offline

7.4. Latin America Smart Home Appliances Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.4.1. Brazil Smart Home Appliances Market Outlook, by Product, 2019-2032

7.4.2. Brazil Smart Home Appliances Market Outlook, by Protocol, 2019-2032

7.4.3. Brazil Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

7.4.4. Mexico Smart Home Appliances Market Outlook, by Product, 2019-2032

7.4.5. Mexico Smart Home Appliances Market Outlook, by Protocol, 2019-2032

7.4.6. Mexico Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

7.4.7. Argentina Smart Home Appliances Market Outlook, by Product, 2019-2032

7.4.8. Argentina Smart Home Appliances Market Outlook, by Protocol, 2019-2032

7.4.9. Argentina Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

7.4.10. Rest of LATAM Smart Home Appliances Market Outlook, by Product, 2019-2032

7.4.11. Rest of LATAM Smart Home Appliances Market Outlook, by Protocol, 2019-2032

7.4.12. Rest of LATAM Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Smart Home Appliances Market Outlook, 2019 - 2032

8.1. Middle East & Africa Smart Home Appliances Market Outlook, by Product, Value (US$ Bn), 2019-2032

8.1.1. Smart Washing Machines

8.1.2. Smart Air Purifiers

8.1.3. Smart TV

8.1.4. Others

8.2. Middle East & Africa Smart Home Appliances Market Outlook, by Protocol, Value (US$ Bn), 2019-2032

8.2.1. Wired

8.2.2. Wireless

8.3. Middle East & Africa Smart Home Appliances Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2032

8.3.1. Online

8.3.2. Offline

8.4. Middle East & Africa Smart Home Appliances Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.4.1. GCC Smart Home Appliances Market Outlook, by Product, 2019-2032

8.4.2. GCC Smart Home Appliances Market Outlook, by Protocol, 2019-2032

8.4.3. GCC Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

8.4.4. South Africa Smart Home Appliances Market Outlook, by Product, 2019-2032

8.4.5. South Africa Smart Home Appliances Market Outlook, by Protocol, 2019-2032

8.4.6. South Africa Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

8.4.7. Egypt Smart Home Appliances Market Outlook, by Product, 2019-2032

8.4.8. Egypt Smart Home Appliances Market Outlook, by Protocol, 2019-2032

8.4.9. Egypt Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

8.4.10. Nigeria Smart Home Appliances Market Outlook, by Product, 2019-2032

8.4.11. Nigeria Smart Home Appliances Market Outlook, by Protocol, 2019-2032

8.4.12. Nigeria Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

8.4.13. Rest of Middle East Smart Home Appliances Market Outlook, by Product, 2019-2032

8.4.14. Rest of Middle East Smart Home Appliances Market Outlook, by Protocol, 2019-2032

8.4.15. Rest of Middle East Smart Home Appliances Market Outlook, by Distribution Channel, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Apple Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. BSH Hausgeräte / Robert Bosch GmbH

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Electrolux Group (Electrolux AB)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. GE Appliances (General Electric Co.)

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Godrej Appliances

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Haier Group (Haier Smart Home Co. Ltd.)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. LG Electronics Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Midea Group Co. Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Miele & Cie. KG

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Mitsubishi Electric Corp.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Protocol Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |